Professional Documents

Culture Documents

Lecture: 20 and 21: Expected Returns (R)

Uploaded by

Ammar UbaidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture: 20 and 21: Expected Returns (R)

Uploaded by

Ammar UbaidCopyright:

Available Formats

Lecture: 20 and 21

TRACING THE EFFICIENT FRONTIER OF MARKOWITZ

These notes give answer to : What combination to buy? That was Question 2 raised in the very first class.

Investors have more or less funds to invest but feel baffled and disoriented and confused about deciding which

shares to buy and which shares not to buy. Those shares they decide to be buy, what percentage of the OE be

invested in each of those share? Or equal amounts be invested in all chosen shares? Should some shares be

short sold, if yes, which ones; and what percentage of OE be the amount by which a share be shorted such as

UBL shorted 3% of OE, resulting in - 0.03 X UBL . All these question are answered in a precise and quantitative

manner by the Markowtiz MPT (Modern Portfolio Theory). These notes are the heart of MPT, and you are

advised to pay great attention to this material and learn it 100%.

According to Markowitz theory an investor should chose one efficient portfolio as her optimal portfolio from the

efficient set of portfolios. The job of portfolio manager is to build that portfolio of client’s desired risk and return

combination. To do so portfolio manager has to find weights (Xi) of stocks included in that efficient portfolio, that

is, percentage of investors OE invested in those shares that are included in that portfolio which the customer has

selected as her optimal portfolio of desired level of total risk and expected return. The following procedure is one

method of finding weights of an efficient portfolio.

Suppose there are only 3 risky stocks in the country i.e. Lever, ICI, PTCL. Expected returns (Ri) of these risky stocks

and their respective total risk ( SDi) have been estimated by your staff of security analysts. Your staff has also

estimated correlations between the returns of these risky stocks using past data of returns. These estimates are

given below.

Expected

Stocks returns (Ri) SDi

Lever 14.0% 6.0%

ICI 8.0% 3.0%

PTCL 20.0% 15.0%

Correlation of RORs of 3 stocks

Lever ICI PTCL

Lever 1

ICI 0.5 1

PTCL 0.2 0.4 1

You might also like

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Mini Case On Risk Return 1-SolutionDocument27 pagesMini Case On Risk Return 1-Solutionjagrutic_09No ratings yet

- Digital Booklet - The Barefoot InvesDocument17 pagesDigital Booklet - The Barefoot InvesCol. O'Neill83% (6)

- Sample Investment ContractDocument5 pagesSample Investment ContractDenDen Gaurana66% (58)

- OBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Document2 pagesOBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Nate TobikNo ratings yet

- Return On InvestmentDocument15 pagesReturn On InvestmentMarivic DianoNo ratings yet

- Investors DatabaseDocument4 pagesInvestors DatabaseRakesh Kumar Singh100% (1)

- Capital Asset Pricing Model (CAPM)Document5 pagesCapital Asset Pricing Model (CAPM)fatemaNo ratings yet

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadFrom EverandAdaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadRating: 5 out of 5 stars5/5 (2)

- Unit 3 Study GuideDocument3 pagesUnit 3 Study Guide高瑞韩No ratings yet

- Dela Investment ContractDocument3 pagesDela Investment ContractTin GomezNo ratings yet

- Assignment For Week #7 - FA17 - 9572Document4 pagesAssignment For Week #7 - FA17 - 9572Nicolas BattyNo ratings yet

- Assignment 1 - Investment AnalysisDocument5 pagesAssignment 1 - Investment Analysisphillimon zuluNo ratings yet

- Assignment 1 - Investment AnalysisDocument5 pagesAssignment 1 - Investment Analysisphillimon zuluNo ratings yet

- ps3 2010Document6 pagesps3 2010Ives LeeNo ratings yet

- Agile PortfolioDocument9 pagesAgile PortfolioquantextNo ratings yet

- Financial Risk Management Course OutlineDocument3 pagesFinancial Risk Management Course Outlineaon aliNo ratings yet

- Assignment Coversheet: Student Registration Number: 1 9 0 2 1 3 3 8 1Document10 pagesAssignment Coversheet: Student Registration Number: 1 9 0 2 1 3 3 8 1Stephanus Kukuh DewantoNo ratings yet

- Investment Appraisal QampaDocument62 pagesInvestment Appraisal QampaKamil SanifNo ratings yet

- Portfolio Optimization Analysis With Markowitz Quadratic Mean-Variance ModelDocument7 pagesPortfolio Optimization Analysis With Markowitz Quadratic Mean-Variance ModelKrishna JoshiNo ratings yet

- Diversification, Beta and The CapmDocument24 pagesDiversification, Beta and The Capmyee05No ratings yet

- Reading 37 Measuring and Managing Market Risk - AnswersDocument11 pagesReading 37 Measuring and Managing Market Risk - Answerstristan.riolsNo ratings yet

- 3017 Tutorial 6 SolutionsDocument3 pages3017 Tutorial 6 SolutionsNguyễn HảiNo ratings yet

- Least-Squares Monte Carlo Simulation For TimeDocument13 pagesLeast-Squares Monte Carlo Simulation For TimeLapaPereiraNo ratings yet

- Risk and ReturnDocument80 pagesRisk and ReturnMaira DogarNo ratings yet

- Capmandaptmodels 2215Document37 pagesCapmandaptmodels 2215rohin gargNo ratings yet

- FinQuiz - Item-Set Questions, Study Session 2, Reading 4 PDFDocument30 pagesFinQuiz - Item-Set Questions, Study Session 2, Reading 4 PDFAriyaNo ratings yet

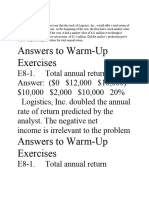

- Warm Up Chapter 8Document5 pagesWarm Up Chapter 8abdulraufdghaybeejNo ratings yet

- 18-06-2021-1624020528-7-Ijfm-3. Ijfm (Foc - Dec 2020) - Selective Diversification Does The Capital Asset Pricing Model Capture EffectsDocument6 pages18-06-2021-1624020528-7-Ijfm-3. Ijfm (Foc - Dec 2020) - Selective Diversification Does The Capital Asset Pricing Model Capture Effectsiaset123No ratings yet

- SSRN Id2242028Document41 pagesSSRN Id2242028Anishish SharanNo ratings yet

- 2011 - 1st ExamDocument10 pages2011 - 1st ExamcataNo ratings yet

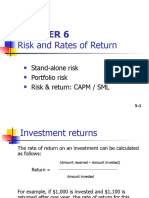

- CH 06Document65 pagesCH 06MrAschedNo ratings yet

- BFIN300 Chapter 8Document42 pagesBFIN300 Chapter 8Omar SerhalNo ratings yet

- ADocument2 pagesAPrincess BanquilNo ratings yet

- Sample 2012 Practice L1.T1 - 57-61 - v3 - 0119Document5 pagesSample 2012 Practice L1.T1 - 57-61 - v3 - 0119Doc MashalNo ratings yet

- Risk & Return: Page 1 of 5Document5 pagesRisk & Return: Page 1 of 5Saqib AliNo ratings yet

- Wiley CPAexcel - BEC - Assessment Review - 7 PDFDocument30 pagesWiley CPAexcel - BEC - Assessment Review - 7 PDFABCNo ratings yet

- Assignment1 2020 PDFDocument8 pagesAssignment1 2020 PDFmonalNo ratings yet

- Screenshot 2022-10-11 at 6.54.55 PMDocument4 pagesScreenshot 2022-10-11 at 6.54.55 PMdesi mundaNo ratings yet

- Final Exam Questions Portfolio ManagementDocument9 pagesFinal Exam Questions Portfolio ManagementThảo Như Trần NgọcNo ratings yet

- FM 8th Edition Chapter 12 - Risk and ReturnDocument20 pagesFM 8th Edition Chapter 12 - Risk and ReturnKa Io ChaoNo ratings yet

- Tugas 4 Tpai - Kelompok 1Document21 pagesTugas 4 Tpai - Kelompok 1Fungsional PenilaiNo ratings yet

- Factors That Change The SMLDocument6 pagesFactors That Change The SMLWawex DavisNo ratings yet

- 2826295699001Document4 pages2826295699001Yen TsangNo ratings yet

- MIT15 401F08 Lec15 PDFDocument29 pagesMIT15 401F08 Lec15 PDFfranciisNo ratings yet

- Revision For Exams NBDocument15 pagesRevision For Exams NBDan Saul KnightNo ratings yet

- TEME 6 Engl 2022Document50 pagesTEME 6 Engl 2022ihor.rudyk.mmeba.2022No ratings yet

- In The Next Three Chapters, We Will Examine Different Aspects of Capital Market Theory, IncludingDocument62 pagesIn The Next Three Chapters, We Will Examine Different Aspects of Capital Market Theory, IncludingRahmat M JayaatmadjaNo ratings yet

- Example 1: You Are Interested in Applying What You Have Just Learned in Class About The CAPM. Picking TwoDocument4 pagesExample 1: You Are Interested in Applying What You Have Just Learned in Class About The CAPM. Picking TwobrahmosNo ratings yet

- Risk and Return - Capital Marketing TheoryDocument19 pagesRisk and Return - Capital Marketing TheoryKEZIAH REVE B. RODRIGUEZNo ratings yet

- William Arrata - ESSEC FINM31261 - Exercises 6 7 8 9 10 11Document3 pagesWilliam Arrata - ESSEC FINM31261 - Exercises 6 7 8 9 10 11Bietto 10No ratings yet

- Risk and ReturnDocument36 pagesRisk and ReturnirniNo ratings yet

- IAPM Practical MannualDocument7 pagesIAPM Practical MannualArya KrishnanNo ratings yet

- Invest in This Smallcase HereDocument1 pageInvest in This Smallcase HereMalavShahNo ratings yet

- 07 AnsDocument5 pages07 AnsAnonymous 8ooQmMoNs10% (1)

- Critique of An Article On Machine Learning in The Detection of Accounting FraudDocument10 pagesCritique of An Article On Machine Learning in The Detection of Accounting Fraudsalmameirani1No ratings yet

- Chapter 7 Prospective Analysis: Valuation Theory and ConceptsDocument9 pagesChapter 7 Prospective Analysis: Valuation Theory and ConceptsWalm KetyNo ratings yet

- Zephyr Concepts - Black-LittermanDocument4 pagesZephyr Concepts - Black-LittermanGautam PraveenNo ratings yet

- Investment Theory QuestionDocument2 pagesInvestment Theory Questionmahin rayhanNo ratings yet

- Risk ManagementDocument60 pagesRisk ManagementEvans GazyNo ratings yet

- FIN300 Homework 3Document4 pagesFIN300 Homework 3JohnNo ratings yet

- R 30% Inflation Rate 15% R (1+R) - 1 (1+I)Document23 pagesR 30% Inflation Rate 15% R (1+R) - 1 (1+I)Adi SadiNo ratings yet

- Risks and Rate of Return PresentationDocument65 pagesRisks and Rate of Return PresentationMira Monica D. VillacastinNo ratings yet

- Lecture 10 Risk - Return 03102022 112616pmDocument63 pagesLecture 10 Risk - Return 03102022 112616pmtabassum manzoorshahNo ratings yet

- 1 19Document8 pages1 19Yilei RenNo ratings yet

- Brand Positioning Model For Nestle and Local Juice CornerDocument3 pagesBrand Positioning Model For Nestle and Local Juice CornerAmmar UbaidNo ratings yet

- Starbucks AsgDocument1 pageStarbucks AsgAmmar UbaidNo ratings yet

- Inside Job SummaryDocument2 pagesInside Job SummaryAmmar UbaidNo ratings yet

- Solution To Portfolio Problem: COV Corr SD SDDocument2 pagesSolution To Portfolio Problem: COV Corr SD SDAmmar UbaidNo ratings yet

- Objective Function Maximize Excess Portfolio Return Per Unit of Total RiskDocument2 pagesObjective Function Maximize Excess Portfolio Return Per Unit of Total RiskAmmar UbaidNo ratings yet

- The Rise Is Run Is:: Return of Tangency Portfolio - RF andDocument2 pagesThe Rise Is Run Is:: Return of Tangency Portfolio - RF andAmmar UbaidNo ratings yet

- Investor Profile QuestionnaireDocument4 pagesInvestor Profile QuestionnaireVNo ratings yet

- The Investable BlueprintDocument5 pagesThe Investable BlueprintDiana KilelNo ratings yet

- 7 Mistakes People Make When Choosing A Financial AdvisorDocument1 page7 Mistakes People Make When Choosing A Financial AdvisorSulemanNo ratings yet

- Indranil-Total BusinessDocument2 pagesIndranil-Total BusinessIndranilGhoshNo ratings yet

- Lcture 3 and 4 Risk and ReturnDocument8 pagesLcture 3 and 4 Risk and Returnmuhammad hasanNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Chapter 2 - Simple InterestDocument10 pagesChapter 2 - Simple InterestIzny KamaliyahNo ratings yet

- Fact Sheet - Investment IsaDocument4 pagesFact Sheet - Investment IsaXisefNo ratings yet

- Wiley - The Small-Cap Investor - Secrets To Winning Big With Small-Cap Stocks - 978-0-470-53572-1Document2 pagesWiley - The Small-Cap Investor - Secrets To Winning Big With Small-Cap Stocks - 978-0-470-53572-1Gv VlachoNo ratings yet

- 15 Must Read Books On Investing, Stock Markets, & Trading - GrowwDocument9 pages15 Must Read Books On Investing, Stock Markets, & Trading - GrowwsumonNo ratings yet

- A Assuming That Investments A and B Are Equally RiskyDocument2 pagesA Assuming That Investments A and B Are Equally RiskyAmit PandeyNo ratings yet

- MN2134 Online Exam Questions - 2020-2021Document3 pagesMN2134 Online Exam Questions - 2020-2021Shoaib AhmedNo ratings yet

- Top 6 Tips To Choose Best Debt Mutual Funds To Invest - FincashDocument8 pagesTop 6 Tips To Choose Best Debt Mutual Funds To Invest - FincashsumonNo ratings yet

- Portfolio Return & RiskDocument25 pagesPortfolio Return & RiskSohag KhanNo ratings yet

- Returns and VolatilityDocument35 pagesReturns and VolatilitymonikatatteNo ratings yet

- Activity Sheet Q2 - Week - 5 - and - 6Document8 pagesActivity Sheet Q2 - Week - 5 - and - 6Kierstin Kyle RiegoNo ratings yet

- Suppose You Won The Florida Lottery and Were Offered ADocument1 pageSuppose You Won The Florida Lottery and Were Offered AAmit Pandey0% (1)

- Systematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market TimingDocument4 pagesSystematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market Timingtilak kumar vadapalliNo ratings yet

- IREF V 6 Pager Brochure - X UnitsDocument6 pagesIREF V 6 Pager Brochure - X UnitsPushpa DeviNo ratings yet

- FINA340 6 Risk Aversion and Capital Allocation - Full VersionDocument15 pagesFINA340 6 Risk Aversion and Capital Allocation - Full VersionSteven ColeyNo ratings yet

- Investment PortfolioDocument3 pagesInvestment Portfolioapi-391913193No ratings yet

- Nebula Venture Business PresentationDocument18 pagesNebula Venture Business PresentationSunil Singh100% (1)

- Lee Diedericks OTM Buccleuch Mandate LetterDocument2 pagesLee Diedericks OTM Buccleuch Mandate LetterKEITH KINGNo ratings yet

- Conch Capital - Your Investment AdvisorDocument7 pagesConch Capital - Your Investment AdvisorDemo NOW100% (1)

- Best Unit Trust Investment Plans in Malaysia - Compare & ApplyDocument5 pagesBest Unit Trust Investment Plans in Malaysia - Compare & Applysara finaNo ratings yet