Professional Documents

Culture Documents

Caso 2 Royal Mail

Uploaded by

juanito perezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caso 2 Royal Mail

Uploaded by

juanito perezCopyright:

Available Formats

This spreadsheet supports STUDENT analysis of the case “Royal Mail plc: Cost of Capital” (UVA-F-1774).

This spreadsheet was prepared by Professor Michael J. Shill. Copyright © 2017 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved.

For customer service inquiries, send an e-mail tosales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, posted to the

Internet, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of the Darden School Foundation.

Our goal is to publish materials of the highest quality, so please submit any errata to editorial@dardenbusinesspublishing.com.

Rev. Apr. 3, 2017

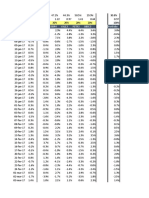

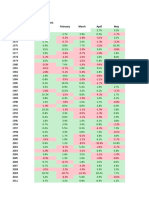

Exhibit 2

Royal Mail plc: Cost of Capital

Cumulative Weekly Total Stock Returns--Royal Mail and FTSE100 Index

35%

30%

Royal Mail

FTSE100

25% Index

20%

Cumulative returns

15%

10%

5%

0%

-5%

-10%

Oct-13 Mar-14 Aug-14 Jan-15 Jun-15

*** Monthly Return *** *** Cumulative Return ***

FTSE100 Index Royal Mail FTSE100 Index Royal Mail

Oct-13 0% 0%

Oct-13 2% 10% 2% 10%

Oct-13 1% 10% 4% 21%

Oct-13 0% 3% 4% 24%

Nov-13 0% -1% 3% 23%

Nov-13 0% -2% 3% 22%

Nov-13 0% -4% 3% 18%

Nov-13 0% 3% 3% 21%

Dec-13 -1% 7% 1% 28%

Dec-13 -2% -1% -1% 27%

Dec-13 3% 0% 2% 28%

Dec-13 2% -2% 4% 26%

Dec-13 0% 0% 4% 26%

Jan-14 0% 1% 4% 26%

Jan-14 1% 4% 5% 30%

Jan-14 -2% -5% 3% 25%

Jan-14 -2% 4% 1% 29%

Feb-14 1% -2% 1% 28%

Feb-14 1% 1% 3% 29%

Feb-14 3% 1% 5% 29%

Feb-14 0% 0% 5% 29%

Mar-14 -1% -2% 4% 27%

Mar-14 -3% -4% 1% 24%

Mar-14 0% 3% 1% 26%

Mar-14 1% -3% 2% 23%

Mar-14 1% -3% 3% 21%

Apr-14 -2% -10% 1% 11%

Apr-14 1% 3% 2% 14%

Apr-14 1% 2% 3% 16%

Apr-14 2% 4% 5% 20%

May-14 0% 3% 5% 23%

May-14 1% 3% 6% 25%

May-14 -1% -8% 5% 17%

May-14 0% -3% 6% 15%

Jun-14 0% -3% 6% 12%

Jun-14 -1% 0% 5% 12%

Jun-14 1% -3% 5% 9%

Jun-14 -1% 3% 4% 13%

Jun-14 2% -2% 6% 11%

Jul-14 -3% 0% 3% 11%

Jul-14 1% -1% 4% 10%

Jul-14 1% -6% 5% 3%

Jul-14 -2% -3% 3% 0%

Aug-14 -2% 0% 2% 0%

Aug-14 2% 2% 4% 2%

Aug-14 1% 3% 5% 5%

Aug-14 1% -1% 5% 4%

Sep-14 1% -5% 6% 0%

Sep-14 -1% -1% 5% -1%

Sep-14 0% 3% 6% 2%

Sep-14 -3% -8% 3% -6%

Sep-14 -2% -1% 1% -7%

Oct-14 -3% 1% -2% -6%

Oct-14 0% 8% -2% 2%

Oct-14 1% 6% -1% 8%

Oct-14 2% -4% 2% 4%

Nov-14 0% 5% 2% 9%

Nov-14 1% 1% 3% 10%

Nov-14 1% -8% 5% 2%

Nov-14 0% -1% 4% 1%

Dec-14 0% -3% 4% -2%

Dec-14 -7% -3% -2% -5%

Dec-14 4% 5% 2% 0%

Dec-14 1% 2% 3% 2%

Dec-14 -1% 0% 2% 3%

Jan-15 -1% -1% 1% 2%

Jan-15 1% 2% 2% 4%

Jan-15 4% 2% 6% 7%

Jan-15 -1% -1% 5% 5%

Feb-15 2% 5% 7% 10%

Feb-15 0% -2% 7% 8%

Feb-15 1% -5% 7% 3%

Feb-15 0% -1% 8% 2%

Mar-15 -1% 1% 7% 3%

Mar-15 -2% 1% 5% 4%

Mar-15 4% 4% 9% 8%

Mar-15 -2% -1% 7% 7%

Mar-15 0% 0% 6% 7%

Apr-15 4% 2% 10% 9%

Apr-15 -1% -1% 9% 8%

Apr-15 1% -1% 10% 7%

Apr-15 -1% 6% 9% 13%

May-15 1% 2% 10% 16%

May-15 -1% 1% 8% 17%

May-15 1% 4% 9% 21%

May-15 -1% 4% 9% 25%

Jun-15 -3% -6% 6% 19%

Jun-15 0% 3% 6% 22%

Jun-15 -1% -1% 5% 21%

Jun-15 1% 4% 5% 25%

Jun-15 -2% -1% 3% 24%

Jul-15 1% 2% 4% 26%

Jul-15 2% -1% 6% 25%

Jul-15 -3% 0% 3% 25%

Source: Investing.com

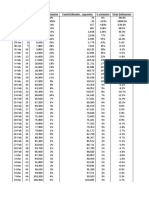

Exhibit 3

Royal Mail plc: Cost of Capital

Royal Mail Unit Volume History (Millions of units, period ending March 31)

2012 2013 2014 2015

Letters

Addressed letters 15,147 13,869 13,342 13,009

Unaddressed letters 3,077 3,258 3,143 3,157

Total 18,224 17,127 16,485 16,166

Growth rate -6.0% -3.7% -1.9%

Parcels

Royal Mail core network 950 994 991 1,015

Parcelforce Worldwide 66 70 77 86

Total 1,016 1,064 1,068 1,101

Growth rate 4.7% 0.4% 3.1%

Source: Company Annual Reports

Exhibit 4

Royal Mail plc: Cost of Capital

Royal Mail Consolidated Income Statement

(Reported as of the end of March in millions of GBP)

2014 2015

Revenue 9,357 9,328

People costs 5,209 5,230

Distribution and conveyance costs 1,796 1,764

Infrastructure costs 1,047 1,019

Other operating costs 578 575

Transformation costs 241 145

Earnings before interest and tax 486 595

Finance costs 71 30

Finance income 4 4

Profit before tax 419 569

Tax 110 138

Profit for the period 309 431

Earnings per share 30.6p 42.8p

Source: Royal Mail Annual Report 2015

Exhibit 5

Royal Mail plc: Cost of Capital

Royal Mail Consolidated Balance Sheet

(Reported as of the end of March in millions of GBP)

2014 2015

Non-current assets

Property, plant and equipment 1,989 1,933

Goodwill and intangible assets 392 482

Retirement benefit asset 1,723 3,179

Other non-current assets 55 80

4,159 5,674

Current assets

Inventories 22 20

Trade and other receivables 926 949

Cash and current financial assets 369 348

1,317 1,317

Total assets 5,476 6,991

Current liabilities

Trade and other payables 1,652 1,668

Financial loans and borrowing 286 290

1,938 1,958

Non-current liabilities

Financial loans and borrowings 860 559

Deferred tax liabilities 151 474

Other liabilities 126 154

1,137 1,187

Total equity

Share capital 10 10

Retained earnings 2,332 3,843

Other equity 59 -7

2,401 3,846

Source: Royal Mail Annual Report 2015

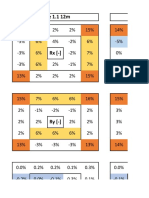

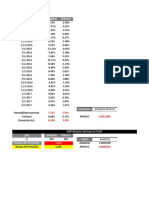

Exhibit 6

Royal Mail plc: Cost of Capital

Kyle Brooks' Cost of Capital Analysis

WACC for Royal Mail

Capital Sources Book Values Percentage

Current Debt 290 6%

Non-current Debt 559 12%

Equity 3,846 82%

Cost of Debt

Current Debt 0.900% Bono triple A

Non-current Debt 4.375%

Weighted Average 3.188%

Cost of Equity

Dividend per share 21

Price per share 511

Dividend Yield 4.110%

Risk-free Rate 1.551%

Beta 0.65

Market Risk Premium 5.8%

CAPM Cost of Equity 5.321%

Weighted Average Cost of Capital

Tax Rate 20.0%

WACC 3.828%

WACC for Comparable Companies

Severn United

National Grid Trent Tesco Utilities Vodafone

Debt / Value 45% 47% 41% 50% 29%

Cost of Debt 3.188% 3.188% 3.188% 3.188% 3.188%

Cost of Equity 4.912% 3.653% 7.500% 4.000% 6.957%

WACC 3.853% 3.136% 5.475% 3.281% 5.660%

Source: Case Writer Analysis

Exhibit 7

Royal Mail plc: Cost of Capital

One Month Interbank Lending Rate and Government Bond Yields (%)

1 Month 5 Year Bond 10 Year Bond

Jan-14 0.47 1.78 2.71

Feb-14 0.47 1.80 2.72

Mar-14 0.47 1.87 2.74

Apr-14 0.47 1.86 2.67

May-14 0.48 1.80 2.57

Jun-14 0.48 1.99 2.67

Jul-14 0.47 1.98 0.62

Aug-14 0.47 1.70 2.37

Sep-14 0.47 1.78 2.43

Oct-14 0.47 1.56 2.25

Nov-14 0.47 1.30 1.93

Dec-14 0.47 1.20 1.76

Jan-15 0.48 0.91 1.34

Feb-15 0.48 1.28 1.79

Mar-15 0.48 1.09 1.58

Apr-15 0.48 1.30 1.84

May-15 0.48 1.26 1.80

Jun-15 0.51 1.46 2.03

Source: Bank of England

Exhibit 8

Royal Mail plc: Cost of Capital

U.K. Corporate Benchmark Bond Yields for 10 year Maturity in GBP (July 14, 2015)

Credit Rating Yield

AAA 2.503

AA 2.839

A 3.356

BBB 3.776

BB 4.773

B 5.883

Source: Thomson Reuters and case writer estimates

Exhibit 9

ROYAL MAIL

Financial Data for Comparables (Market Data as of July 14, 2015, Other Data is Most Recent Available)

Company Industry

National Grid Electricity and gas utility

Severn Trent Water Utility

Tesco Food Retailer

United Utilities Water Utility

Vodafone Telecommunications

National Severn United

Grid Trent Tesco Utilities Vodafone

Price per Share (Pence) 855 2,190 200 900 230

Dividend per Share (Pence) 42 80 15 36 16

Shares Outstanding (Millions) 3,730 239 8,096 682 26,440

Market Capitalisation (Millions) 31,892 5,234 16,192 6,138 60,812

Book Equity (Millions) 11,911 1,078 14,715 2,216 70,802

Book Debt (Millions) 25,950 4,622 11,213 6,042 25,362

Beta 0.60 0.79 0.87 0.67 0.86

Credit Rating BBB- BBB+ BB+ BBB+ BBB+

Source: Financial Times

You might also like

- Case 13 Royal Mail F1774XDocument12 pagesCase 13 Royal Mail F1774XAndy NamNo ratings yet

- N AtivosDocument25 pagesN AtivosCarlos RostonNo ratings yet

- Same Store SalesDocument2 pagesSame Store SalesSahil IqbalNo ratings yet

- Same Store SalesDocument2 pagesSame Store SalesPhương HoàngNo ratings yet

- Data Jumlah Pasien - BOR Agustus 2018Document6 pagesData Jumlah Pasien - BOR Agustus 2018Novia Cahya Sari HarahapNo ratings yet

- SLR LL Bi-Weekly Variance TrendDocument7 pagesSLR LL Bi-Weekly Variance Trendali haiderNo ratings yet

- Design of PortfoliosDocument12 pagesDesign of PortfoliosAvik SarkarNo ratings yet

- Ampliacion de concentradora Toquepala a 60,000 TMPD resumen por faseDocument15 pagesAmpliacion de concentradora Toquepala a 60,000 TMPD resumen por faseArturo Saenz ArteagaNo ratings yet

- National Consumer Spending Trends Data - ENDocument17 pagesNational Consumer Spending Trends Data - ENNormelNo ratings yet

- Thuc hanh 1 khanhDocument4 pagesThuc hanh 1 khanhphamthicamvy10a2No ratings yet

- Bharat Barometer - Nov'23 - HSIE-202311151202284972889Document11 pagesBharat Barometer - Nov'23 - HSIE-202311151202284972889adityazade03No ratings yet

- Data Jumlah Pasien - BOR Juli 2018Document6 pagesData Jumlah Pasien - BOR Juli 2018Novia Cahya Sari HarahapNo ratings yet

- Curva SDocument1 pageCurva SMabe Pa HerNo ratings yet

- Nuevas Muertes (Abs) PM (5d) (%)Document13 pagesNuevas Muertes (Abs) PM (5d) (%)gamallofNo ratings yet

- Meat Production Demand ReportDocument21 pagesMeat Production Demand ReportFernanda HurtadoNo ratings yet

- Distribuicao Retornos ExemploDocument61 pagesDistribuicao Retornos ExemploCarlos RostonNo ratings yet

- Monthly S CurveDocument2 pagesMonthly S CurveGiridhar KrishnaNo ratings yet

- Digital Metrics Dashboard TemplateDocument20 pagesDigital Metrics Dashboard TemplateZao ZulNo ratings yet

- Stress Test 032020Document4 pagesStress Test 032020Nayro RodriguesNo ratings yet

- Anexo Proyecto Información La Granja de Juan 2018-2Document33 pagesAnexo Proyecto Información La Granja de Juan 2018-2Fernanda HurtadoNo ratings yet

- Factor de Ocupación La MacarenaDocument7 pagesFactor de Ocupación La MacarenabrayanNo ratings yet

- 12 - Planilha TUDO +Document120 pages12 - Planilha TUDO +Bruno TeixeiraNo ratings yet

- Portfolio Optimization, FROCA (Solución)Document38 pagesPortfolio Optimization, FROCA (Solución)Fabián Cajas100% (1)

- Company AnalysisDocument10 pagesCompany AnalysisPoorvi VermaNo ratings yet

- Banks & Treasury function-IIM LucknowDocument44 pagesBanks & Treasury function-IIM LucknowWhysok M.No ratings yet

- Beta PortfolioDocument74 pagesBeta PortfolioCarlos RostonNo ratings yet

- Proyecto Gerencia Financiera FinalDocument109 pagesProyecto Gerencia Financiera FinalDante DornanNo ratings yet

- Reporte de Recaudacion y Recuperacion Al 08.06Document2,650 pagesReporte de Recaudacion y Recuperacion Al 08.06Piero RVNo ratings yet

- Retention Rates by CategoryDocument118 pagesRetention Rates by CategoryMariaIsabelRodriguesNo ratings yet

- Indikator KaberDocument46 pagesIndikator KaberRatnaNo ratings yet

- Bus-Loader-Ger PerformanceDocument10 pagesBus-Loader-Ger PerformanceMahmoud TaherNo ratings yet

- Res ChartDocument20 pagesRes ChartSaurav GhimireNo ratings yet

- Res ChartDocument20 pagesRes ChartSaurav GhimireNo ratings yet

- Systematic Investment Plan: June 2022Document16 pagesSystematic Investment Plan: June 2022Vinayak ChennuriNo ratings yet

- Nuevo Hoja de Cálculo de Microsoft ExcelDocument14 pagesNuevo Hoja de Cálculo de Microsoft ExcelMarcelo SalasNo ratings yet

- Bijlage 4Document143 pagesBijlage 4CharlotteNo ratings yet

- Tabla Contratos Día SemanaDocument1 pageTabla Contratos Día SemanaANGEL ROZAS ESPAÑOLNo ratings yet

- Pivot Tables2 12 March 2021Document103 pagesPivot Tables2 12 March 2021Naresh KumarNo ratings yet

- Pivot Tables2 Crypto Forecasting 16 MarchDocument332 pagesPivot Tables2 Crypto Forecasting 16 MarchNaresh KumarNo ratings yet

- BCG India Economic Monitor Jan 2021Document33 pagesBCG India Economic Monitor Jan 2021akashNo ratings yet

- LA Economic Vitals Dec Jan 2021Document5 pagesLA Economic Vitals Dec Jan 2021ChrisMNo ratings yet

- Form Tabulasi DianDocument1 pageForm Tabulasi DiandianNo ratings yet

- Retail Performance Pulse: Year-Over-Year Report September 2015Document6 pagesRetail Performance Pulse: Year-Over-Year Report September 2015ML YanNo ratings yet

- By Larry Souza, MD, Charles Schwab Investment Management: Commercial Real Estate: Economic Cycle AnalysisDocument8 pagesBy Larry Souza, MD, Charles Schwab Investment Management: Commercial Real Estate: Economic Cycle Analysisfad2030No ratings yet

- Acid ReportDocument21 pagesAcid Reportsyahirah shamsudinNo ratings yet

- Casos Excel - EncajeDocument24 pagesCasos Excel - EncajeSebastian Ramirez MoranNo ratings yet

- SIP Recommendation December 2021Document16 pagesSIP Recommendation December 2021hitakeyinfosysNo ratings yet

- Portfolio Optimization, FROCA (Solución)Document16 pagesPortfolio Optimization, FROCA (Solución)Esteban BustamanteNo ratings yet

- Global salmon production trendsDocument27 pagesGlobal salmon production trendsRobertas KupstasNo ratings yet

- Angel Salazar EF FIDocument5 pagesAngel Salazar EF FIYuriika Quenta ChinoNo ratings yet

- Book 1Document85 pagesBook 1vandanaNo ratings yet

- TARETELAENÇDocument132 pagesTARETELAENÇMariaIsabelRodriguesNo ratings yet

- IE255 Tables BookletDocument107 pagesIE255 Tables BookletMuhammad AdilNo ratings yet

- MCRSDocument9 pagesMCRSMercedes Isla VertizNo ratings yet

- Commercial Planning V02.1Document35 pagesCommercial Planning V02.1nishant.mishraNo ratings yet

- 6-15-13-SBK No DB Killa-W-Zbomb-13Document2 pages6-15-13-SBK No DB Killa-W-Zbomb-13hay.moradiNo ratings yet

- Schedule chart and S curve for construction projectDocument5 pagesSchedule chart and S curve for construction projectNaufal Fauzan HafizhNo ratings yet

- Fase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoDocument26 pagesFase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoArturo Saenz ArteagaNo ratings yet

- Case Krakatau Steel A Report - Syndicate 11Document10 pagesCase Krakatau Steel A Report - Syndicate 11Philip AnugrahRaskitaNo ratings yet

- BBM 301 Advanced Accounting Chapter 1, Section 2Document6 pagesBBM 301 Advanced Accounting Chapter 1, Section 2lil telNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- FAR610 - Consolidated Financial StatementsDocument3 pagesFAR610 - Consolidated Financial StatementsAmirul AimanNo ratings yet

- Financial Statement Modeling Course Manual - 647883d6d91e8Document121 pagesFinancial Statement Modeling Course Manual - 647883d6d91e8brandkNo ratings yet

- Batavia Prosperindo 2018Document164 pagesBatavia Prosperindo 2018Shafira ArtaNo ratings yet

- Intersale AnswerDocument2 pagesIntersale AnswerJJ JaumNo ratings yet

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- Short-Term Finance and Planning: Mcgraw-Hill/IrwinDocument25 pagesShort-Term Finance and Planning: Mcgraw-Hill/IrwinMhmood Al-saadNo ratings yet

- SOB - Financial Accounting and Reporting 1Document87 pagesSOB - Financial Accounting and Reporting 1Miccccch50% (2)

- Horngrens Accounting 11th Edition Miller Nobles Solutions ManualDocument26 pagesHorngrens Accounting 11th Edition Miller Nobles Solutions ManualColleenWeberkgsq100% (52)

- PT Mustika Ratu TBK Dan Entitas Anak / and Its SubsidiariesDocument79 pagesPT Mustika Ratu TBK Dan Entitas Anak / and Its SubsidiariesDina sofianaNo ratings yet

- Financial Reporting Error CorrectionDocument14 pagesFinancial Reporting Error CorrectionSel AtenionNo ratings yet

- Dummy Financial ModelDocument17 pagesDummy Financial ModelarhawnnNo ratings yet

- PFRS UPDATES ON ACCOUNTING CHANGES AND ERRORSDocument11 pagesPFRS UPDATES ON ACCOUNTING CHANGES AND ERRORSMark GerwinNo ratings yet

- Financial Statement Analysis ExamDocument21 pagesFinancial Statement Analysis ExamKheang Sophal100% (2)

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- CHAPTER 13 Solved Problems PDFDocument8 pagesCHAPTER 13 Solved Problems PDF7100507100% (2)

- Chapter 18 Consolidated Financial Statements ProblemsDocument61 pagesChapter 18 Consolidated Financial Statements Problemsxxxxxxxxx100% (3)

- LinkedIn ValuationDocument13 pagesLinkedIn ValuationSunil Acharya100% (1)

- Keac 210Document65 pagesKeac 210vichmegaNo ratings yet

- Consolidation (Study Hub)Document4 pagesConsolidation (Study Hub)HammadNo ratings yet

- Audit Prob ReceivablesDocument30 pagesAudit Prob ReceivablesMagnana Kaw81% (21)

- Finman Bobadilla PDFDocument49 pagesFinman Bobadilla PDFChristopher Vicente100% (1)

- Firm Valuation (2) : Class 7 Financial Management, 15.414Document19 pagesFirm Valuation (2) : Class 7 Financial Management, 15.414Marino Brnic100% (4)

- Financial Statement AnalysisDocument8 pagesFinancial Statement AnalysisRochelle Joyce CosmeNo ratings yet

- Page 1 of 10Document10 pagesPage 1 of 10Mercado JessicaNo ratings yet

- Balance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMDocument43 pagesBalance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- The Elements Directly Related To The Measurement of Financial Position AreDocument8 pagesThe Elements Directly Related To The Measurement of Financial Position AreKim Patrice NavarraNo ratings yet

- Business Finance: Financial Statement Preparation, Analysis, and InterpretationDocument7 pagesBusiness Finance: Financial Statement Preparation, Analysis, and InterpretationRosalyn Mauricio VelascoNo ratings yet

- Vertical Analysis FinalDocument8 pagesVertical Analysis FinalLiya JahanNo ratings yet

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- Streetsmart Financial Basics for Nonprofit Managers: 4th EditionFrom EverandStreetsmart Financial Basics for Nonprofit Managers: 4th EditionRating: 3.5 out of 5 stars3.5/5 (3)

- Other People's Money: The Real Business of FinanceFrom EverandOther People's Money: The Real Business of FinanceRating: 4 out of 5 stars4/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- The Leadership Capital Index: Realizing the Market Value of LeadershipFrom EverandThe Leadership Capital Index: Realizing the Market Value of LeadershipRating: 5 out of 5 stars5/5 (2)

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet