Professional Documents

Culture Documents

Exercise 7.6: Mowbray LTD: Budgeted Income Statement

Exercise 7.6: Mowbray LTD: Budgeted Income Statement

Uploaded by

doriaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 7.6: Mowbray LTD: Budgeted Income Statement

Exercise 7.6: Mowbray LTD: Budgeted Income Statement

Uploaded by

doriaCopyright:

Available Formats

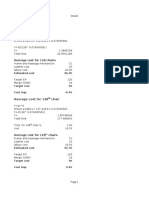

Exercise 7.

6: Mowbray Ltd

Budgeted Income Statement

less

Sales 24000 (1200*20)

Expenses

Materials 9000 (3600*2,5)

Labour 2700 (300*9)

Fixed overheads 4320 (1200*3,6)

16020

PROFIT: 7980

Actual Income Statement

less

Sales 18000

Expenses

Materials 7400

Labour 2300

Fixed overheds 4100

13800

PROFIT: 4200

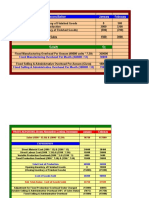

Reconcilation

Budgeted profit 7980

ADD Favorable variances

Material quantity variance 2000

Labour efficency v. 405

Fixed overheads 220 (4320-

4100)

2625

LESS Unfavorable variances -

Matrial price variance 400

Labour rate variance 5

Sales price variance 6000

-6405

ACTUAL PROFIT: 4200

Standard 1 unit Standard 1200 units Actual 1200 units

qty/hr price/rate AMOUNT qty/hr price/rat AMOUNT qty/hr price/rat AMOUNT

e e

3 2,5 7,5 3600 2,5 9000 2800 2,64 7400 material

0,25 9 2,25 300 9 2700 255 9,02 2300 labour

1 20 20 1200 20 24000 1200 15 18000 sales

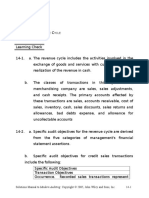

Material price variance: 400 unfavorable Material quantity variance: 2000 favorable

(standard price-actual price)*actual quantity (stand q.-act.q)*standard price

(2,5-2.64)*2800 (3600-2800)*2.5

Labor rate variance: 5 unfavorable Labor efficiency variance: 405 favorable

(standard rate-actual rate)*actual hours (standard hrs-actual hrs)*standard rate

(9-9,02)*255 (300-255)*9

Sales price varaince: 6000 unfavorable

(standard price - actual price)*actual

quantity

(20-15)*1200

You might also like

- JW SPORT SuppliesDocument5 pagesJW SPORT SuppliesVishvesh Soni100% (4)

- MKT243 Marketing Portfolio ReportDocument17 pagesMKT243 Marketing Portfolio ReportIzlyn IzlyanaNo ratings yet

- Fly Ash Brick Project - Feasibility Study Using CVP AnalysisDocument6 pagesFly Ash Brick Project - Feasibility Study Using CVP AnalysisAshish PatwardhanNo ratings yet

- Q1. Following Details Pertain To Amkit India LTD For Sale Volume of 240,000 Units: Balance Sheet As On 31 March 2020 Income Statement For 2019-20Document6 pagesQ1. Following Details Pertain To Amkit India LTD For Sale Volume of 240,000 Units: Balance Sheet As On 31 March 2020 Income Statement For 2019-20Rohan SahiniNo ratings yet

- Solutions Manual: Elements of CostsDocument6 pagesSolutions Manual: Elements of CostsNed Neddy NeddieNo ratings yet

- Chapter 10 Tute Solutions PDFDocument7 pagesChapter 10 Tute Solutions PDFAi Tien TranNo ratings yet

- DucatiDocument3 pagesDucatidipesh341267% (3)

- Cost Sheet SumsDocument2 pagesCost Sheet SumsRoshni MoryeNo ratings yet

- Narsee Monjee Institute of Management StudiesDocument8 pagesNarsee Monjee Institute of Management StudiesSHIVANGI AGRAWALNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Sno Description Cost in Rs Cost in RsDocument8 pagesSno Description Cost in Rs Cost in RsCH NAIRNo ratings yet

- Learning Curve: Average Cost For 128 ChairsDocument5 pagesLearning Curve: Average Cost For 128 ChairsFarman ShaikhNo ratings yet

- Bedco Question Actual Output STD Usage Bedsheets 120000 2 Pillowcases 180000 0.5Document3 pagesBedco Question Actual Output STD Usage Bedsheets 120000 2 Pillowcases 180000 0.5israNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Acc Assignment Sem 2Document23 pagesAcc Assignment Sem 2Luqman HaqimNo ratings yet

- Assignment: Table of ContentDocument9 pagesAssignment: Table of ContentAhsanur HossainNo ratings yet

- Cost AccountingDocument53 pagesCost Accountingpritika mishraNo ratings yet

- Standard Costing and Manufacturing Methods Answer To End of Chapter ExercisesDocument5 pagesStandard Costing and Manufacturing Methods Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Mumbai University - TYBCOM - Sem 5 - Cost AccountingDocument19 pagesMumbai University - TYBCOM - Sem 5 - Cost Accountingpritika mishraNo ratings yet

- Break EvenDocument5 pagesBreak EvenENS SunNo ratings yet

- Variances in ExcelDocument5 pagesVariances in Excelbiasab123No ratings yet

- Budgeted Statement ExamDocument11 pagesBudgeted Statement ExamNelz KhoNo ratings yet

- 10.2 Clearwater CaseDocument1 page10.2 Clearwater CaseKatelynNo ratings yet

- CS 7Document1 pageCS 7Dhruv Ratan DeyNo ratings yet

- MFRD Budget NeededDocument2 pagesMFRD Budget NeededHijaz AhamedNo ratings yet

- WCM QuestionsDocument5 pagesWCM QuestionsBhavin BaxiNo ratings yet

- Acc Assign Sem 2Document7 pagesAcc Assign Sem 2xuanylimNo ratings yet

- RAT/AC/2018/F/0008: Budgeted Profit StatementDocument8 pagesRAT/AC/2018/F/0008: Budgeted Profit StatementumeshNo ratings yet

- Problem Set 1 (Problem No-3) : Inventories As On 1.4.2012Document1 pageProblem Set 1 (Problem No-3) : Inventories As On 1.4.2012ankitaNo ratings yet

- Ac417 Solution R174903ZDocument5 pagesAc417 Solution R174903ZPresident MusukiNo ratings yet

- Forecasts - The TestDocument3 pagesForecasts - The TestPatrykNo ratings yet

- Intensive VariancesDocument11 pagesIntensive VariancesZainab SyedaNo ratings yet

- MFRD BudgetDocument2 pagesMFRD BudgetHijaz AhamedNo ratings yet

- Tutorial 5 - B - G2Document26 pagesTutorial 5 - B - G2mohd reiNo ratings yet

- Variances Working Sheet CDocument12 pagesVariances Working Sheet CHitesh YadavNo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceNurul InsyirahNo ratings yet

- BudgetsDocument8 pagesBudgetsBarack MikeNo ratings yet

- CVP Relevant CostDocument15 pagesCVP Relevant CostSoumya Ranjan PandaNo ratings yet

- CM Unit 3Document6 pagesCM Unit 3shanthala mNo ratings yet

- MANAC Pre MidDocument9 pagesMANAC Pre MidAbhay KaseraNo ratings yet

- Finalcosting NiyazDocument29 pagesFinalcosting Niyazakramshaikh87No ratings yet

- Chapter 1 SolutionDocument3 pagesChapter 1 SolutionabeeraNo ratings yet

- Mock Exam QuestionDocument11 pagesMock Exam QuestionSubmission PortalNo ratings yet

- 30 Process CostingDocument2 pages30 Process CostingJAY PRAKASH HINDOCHA-BBANo ratings yet

- Cost Sheet Proforma Details Total Cost Per Unit Rs Rs Rs Add Less Less Less 75000Document10 pagesCost Sheet Proforma Details Total Cost Per Unit Rs Rs Rs Add Less Less Less 75000amolNo ratings yet

- Chapter 11 - Standard CostingDocument3 pagesChapter 11 - Standard CostingAlexsandra GarciaNo ratings yet

- Session#15Document5 pagesSession#15Saurabh Kumar BJ22041No ratings yet

- Cma 1 GeneralDocument10 pagesCma 1 GeneralMax MarckNo ratings yet

- Job CostingDocument18 pagesJob CostingPaula ChicoNo ratings yet

- Assignment 2 - CMADocument9 pagesAssignment 2 - CMAVivek SharanNo ratings yet

- Standard Costing and Overhead Analysis: (Company Name)Document11 pagesStandard Costing and Overhead Analysis: (Company Name)Faraz BakhshNo ratings yet

- Suggested Answers Final Examination - Winter 2014: Management AccounitngDocument5 pagesSuggested Answers Final Examination - Winter 2014: Management AccounitngAbdulAzeemNo ratings yet

- 4 2 Sma 2017Document5 pages4 2 Sma 2017Nawoda SamarasingheNo ratings yet

- Worksheet Campar IndustriesDocument11 pagesWorksheet Campar IndustriesRUPIKA R GNo ratings yet

- Bbca2053 202201F1165 20220501073204Document9 pagesBbca2053 202201F1165 20220501073204Tron TrxNo ratings yet

- Q1 Fixed Overhead Cost Total Variable Cost Per Unit Revenue Per Unit Contribution Margin Break Even QuantityDocument7 pagesQ1 Fixed Overhead Cost Total Variable Cost Per Unit Revenue Per Unit Contribution Margin Break Even Quantityगौरव जैनNo ratings yet

- Chapter 7, 8, 9: Answers Cost Accounting ACCT3395Document11 pagesChapter 7, 8, 9: Answers Cost Accounting ACCT3395Quynhu Smiley Nguyen50% (10)

- Cost SheetDocument4 pagesCost Sheetpravinmore1589No ratings yet

- Importance of Industry AnalysisDocument15 pagesImportance of Industry AnalysisAbhin BhatNo ratings yet

- BA7013 Services MarketingDocument5 pagesBA7013 Services MarketingArunEshNo ratings yet

- Financial AnalysisDocument8 pagesFinancial Analysisneron hasaniNo ratings yet

- Apalit - List of Registered Business EstablishmentsDocument191 pagesApalit - List of Registered Business EstablishmentsEJ LacapNo ratings yet

- Accounting For Manufctuirng - PQ)Document6 pagesAccounting For Manufctuirng - PQ)usama sarwerNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/32gibbamanjexNo ratings yet

- Gap Analysis Model AssignmentDocument10 pagesGap Analysis Model Assignmentsamia suktaNo ratings yet

- Summary GASB 34Document2 pagesSummary GASB 34disisjenNo ratings yet

- 46712bosfnd p4 Part2 Cp6Document26 pages46712bosfnd p4 Part2 Cp6RushikeshNo ratings yet

- Bank of America - Analyst GIB PitchbookDocument2 pagesBank of America - Analyst GIB PitchbookJigar PitrodaNo ratings yet

- Lecture# 12: Creative Strategy (Evaluation of Electronic Media)Document19 pagesLecture# 12: Creative Strategy (Evaluation of Electronic Media)Mehak SinghNo ratings yet

- Boynton SM CH 14Document52 pagesBoynton SM CH 14kevin earlNo ratings yet

- Law MCQDocument260 pagesLaw MCQPooja ThakurNo ratings yet

- Nileshkpatel NkproteinsDocument1 pageNileshkpatel NkproteinsEshita SrivastavaNo ratings yet

- Updates On Buy Back Offer (Company Update)Document55 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Osp - Presentation-1Document12 pagesOsp - Presentation-1priyanka srivastavaNo ratings yet

- RRSDocument3 pagesRRSDead WalkerNo ratings yet

- SummarizeDocument9 pagesSummarizePhú Đỗ ThiênNo ratings yet

- 11 17 AnswersDocument9 pages11 17 AnswersRizalito SisonNo ratings yet

- Journal Entry at The Step of TransactionDocument4 pagesJournal Entry at The Step of Transactionadmin finishyourtaskNo ratings yet

- Customer-Based Equity and Brand PositioningDocument39 pagesCustomer-Based Equity and Brand PositioningLalit TankNo ratings yet

- Certificate Course in Full Stack Digital MarketingDocument22 pagesCertificate Course in Full Stack Digital MarketingDaniel IsaacNo ratings yet

- Walmart VRIODocument6 pagesWalmart VRIOgouravNo ratings yet

- Financial Ratios (Word Scramble)Document3 pagesFinancial Ratios (Word Scramble)MoniqueNo ratings yet

- Chapter - 3 - Departmental AccountsDocument22 pagesChapter - 3 - Departmental Accountsshubham yadavNo ratings yet

- Lecture 2 Operational Gearing ExampleDocument5 pagesLecture 2 Operational Gearing ExampleQi ZhuNo ratings yet

- Financial Accounting Tools For Business Decision Making Canadian 7Th Edition Kimmel Solutions Manual Full Chapter PDFDocument67 pagesFinancial Accounting Tools For Business Decision Making Canadian 7Th Edition Kimmel Solutions Manual Full Chapter PDFphongtuanfhep4u100% (11)

- Baldwin Bicycle Case MBA Case StudyDocument24 pagesBaldwin Bicycle Case MBA Case StudyRobin L. M. Cheung100% (9)