Professional Documents

Culture Documents

CLEAR WATER VOLUME VARIANCE AND BUDGET ANALYSIS

Uploaded by

KatelynOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CLEAR WATER VOLUME VARIANCE AND BUDGET ANALYSIS

Uploaded by

KatelynCopyright:

Available Formats

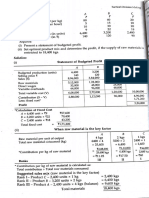

CLEAR WATER

Actual Variance Flexible budget Volume Variance Static budget

Units 72,000 72,000 8,000 64,000 Volume variance because actual output exceeded static budget is 8,000 units

Sales revenue 1,152,000 - 36,000 1,188,000 132,000 1,056,000

Variable costs

DM 216,000 14,400 201,600 22,400 179,200

DL 360,000 - 72,000 432,000 48,000 384,000

VMO 57,600 - 18,000 75,600 8,400 67,200

Other costs 242,000 - 57,520 299,520 33,520 266,000 per unit 4.16

- -

Total Vc 875,600 - 133,120 1,008,720 112,320 896,400

CM 276,400 97,120 179,280 19,680 159,600

- -

Fixed Manufacturing C 75,000 3,000 72,000 - 72,000

Operating income 201,400 94,120 107,280 19,680 87,600

Direct material variance

DM price variance (Actual quantity of Kg used @ budgeted standard price)-(Actual quantity of Kg used @ Actual price)

AQ (SP-AP)

Var =(1.40-1.00)*(72,000units*3kg/unit)

86,400 Favorable Actual price was lower than budgeted std price

Direct Material efficiency variance

(Direct Material standard allowed for actual output - Direct Material s used for actual output) Standard price

SP(SQ-AQ)

Var ={(72,000 units * 2kg/unit)-(72,000*3kg/unit)} *1.40

- 100,800 Unfavorable used more materials for actual output than was allowed by standard

B)

Calculate the following 4 variances

Direct Labour Rate (price) variance

Direct Labour Efficiency variance

Variable manufacturing Overhead rate variance

Variable manufacturing Overhead efficiency variance

Fixed Manufacturing overhead variance= Actual - Static budget= 75000-72000=3000

You might also like

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- CF 3B Revision QDocument4 pagesCF 3B Revision Qnoel25509542No ratings yet

- Abysse FrameworkDocument7 pagesAbysse Frameworkyimin liuNo ratings yet

- Group 6 - Boston CreameryDocument7 pagesGroup 6 - Boston CreameryYAKSH DODIANo ratings yet

- Stylistic FurnitureDocument6 pagesStylistic FurnitureJaideep ChauhanNo ratings yet

- FAMA '22 SolutionDocument4 pagesFAMA '22 SolutionRushil JoshiNo ratings yet

- Join Cost and By-Products ExerciseDocument2 pagesJoin Cost and By-Products ExerciseVixen Aaron EnriquezNo ratings yet

- Q1 Fixed Overhead Cost Total Variable Cost Per Unit Revenue Per Unit Contribution Margin Break Even QuantityDocument7 pagesQ1 Fixed Overhead Cost Total Variable Cost Per Unit Revenue Per Unit Contribution Margin Break Even Quantityगौरव जैनNo ratings yet

- Joint Cost AllocationDocument16 pagesJoint Cost AllocationCharish AbayonNo ratings yet

- Mandy LTDDocument4 pagesMandy LTDMohammed TawfiqNo ratings yet

- Dahon CompanyDocument2 pagesDahon CompanyPrankyJellyNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- Chapter 7, 8, 9: Answers Cost Accounting ACCT3395Document11 pagesChapter 7, 8, 9: Answers Cost Accounting ACCT3395Quynhu Smiley Nguyen50% (10)

- Mandy LTDDocument5 pagesMandy LTDMohammed TawfiqNo ratings yet

- CMA Exercises 1Document9 pagesCMA Exercises 1Ariel VenturaNo ratings yet

- CVP, AVC, BudgetingDocument8 pagesCVP, AVC, BudgetingLeoreyn Faye MedinaNo ratings yet

- Agarbatti DPRDocument8 pagesAgarbatti DPRsansiNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- IndexDocument29 pagesIndexBình QuốcNo ratings yet

- Month Sale VC Sales in Amount: High Value Low Value DifferenceDocument4 pagesMonth Sale VC Sales in Amount: High Value Low Value DifferenceRani Malik Rani MalikNo ratings yet

- Corporation Tax - Suggested AnswerDocument5 pagesCorporation Tax - Suggested AnswerQasimNo ratings yet

- Cash Flow EstimationDocument6 pagesCash Flow EstimationFazul RehmanNo ratings yet

- Product Cost Controlling in SAP - Master DataDocument3 pagesProduct Cost Controlling in SAP - Master DatalymacsauokNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Cost and Management Assignment AnalysisDocument9 pagesCost and Management Assignment AnalysisTakudzwa BenjaminNo ratings yet

- Day 4 - Class ExerciseDocument10 pagesDay 4 - Class Exerciseum23328No ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- Marginal Costing Values Inventory at The Total Variable Production Cost of A UnitDocument3 pagesMarginal Costing Values Inventory at The Total Variable Production Cost of A UnitNiomi GolraiNo ratings yet

- Fixed Overhead Incurred (REAL)Document5 pagesFixed Overhead Incurred (REAL)Anny ChainNo ratings yet

- Modul 7Document9 pagesModul 7Sebastian T.MNo ratings yet

- Project Cost EstimateDocument4 pagesProject Cost EstimateVinay MalpaniNo ratings yet

- Budgeted Statement ExamDocument11 pagesBudgeted Statement ExamNelz KhoNo ratings yet

- Activity Based-WPS OfficeDocument6 pagesActivity Based-WPS OfficeTakudzwa BenjaminNo ratings yet

- Day8 (My)Document9 pagesDay8 (My)Jhilmil JeswaniNo ratings yet

- Miller Toy Company Manufactures A Plastic Swimming PoolDocument10 pagesMiller Toy Company Manufactures A Plastic Swimming Poollaale dijaanNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Initial Cash Flows Terminal Cash FlowsDocument5 pagesInitial Cash Flows Terminal Cash FlowshannahNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- ME CIA3 BepDocument4 pagesME CIA3 BepSanjana A 1910217No ratings yet

- 220Document18 pages220Angel PulvinarNo ratings yet

- Case Study: Danshui Plant No2Document3 pagesCase Study: Danshui Plant No2Abdelhamid JenzriNo ratings yet

- 2020 Manufacturing Cost Estimates and Income Statement Analysis Using Traditional and Activity-Based CostingDocument6 pages2020 Manufacturing Cost Estimates and Income Statement Analysis Using Traditional and Activity-Based CostingBornyNo ratings yet

- Monthly Sales and Cost AnalysisDocument3 pagesMonthly Sales and Cost AnalysisGautam D50% (2)

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- Standard Costing I SolutionDocument7 pagesStandard Costing I SolutionDheeraj DoliyaNo ratings yet

- Absorption Costing vs ABC Costing for Overhead AllocationDocument3 pagesAbsorption Costing vs ABC Costing for Overhead AllocationsactenNo ratings yet

- Unit 2-3 ADM TYBBADocument24 pagesUnit 2-3 ADM TYBBAVohra AimanNo ratings yet

- 1 Quantity Sold Per Month Unit Sales Price Total Revenue Per Month Changes in Total RevenueDocument15 pages1 Quantity Sold Per Month Unit Sales Price Total Revenue Per Month Changes in Total RevenueGillu BilluNo ratings yet

- Mystic SportsDocument6 pagesMystic SportsBatista Firangi100% (2)

- SPK GENAP - Silfina WasrilDocument16 pagesSPK GENAP - Silfina WasrilnanaNo ratings yet

- Segment Reporting - Regal Cycle Manufacturing 2Document2 pagesSegment Reporting - Regal Cycle Manufacturing 2IshanNo ratings yet

- AccountingDocument4 pagesAccountingFerrNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisAlaa AlsultanNo ratings yet

- Danshui CaseDocument9 pagesDanshui CaseNIKHIL CHAVANNo ratings yet

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Bollfilter India Private LimitedDocument3 pagesBollfilter India Private LimitedsoorajssNo ratings yet

- ESI Previous Year 2019Document42 pagesESI Previous Year 2019Prajwal PatelNo ratings yet

- ICAP Advanced Auditing Final Exam Risk IdentificationDocument1 pageICAP Advanced Auditing Final Exam Risk IdentificationAhmad MalikNo ratings yet

- Atlas Battery Limited: Group Project By: Aqsa A. Khan Rounaq QaiserDocument21 pagesAtlas Battery Limited: Group Project By: Aqsa A. Khan Rounaq QaiserROUNAQ 11952No ratings yet

- Calculating Interest Rates and Loan PaymentsDocument13 pagesCalculating Interest Rates and Loan Paymentsdavid austriaNo ratings yet

- (DISS 3) MARXISM Students'Document1 page(DISS 3) MARXISM Students'AndreiNo ratings yet

- Paraphrasing ActivitiesDocument3 pagesParaphrasing ActivitiesGabit KaldarbekNo ratings yet

- Statement of Account - 12 - 38 - 53Document7 pagesStatement of Account - 12 - 38 - 53varaprasadNo ratings yet

- Setting The Rules Dean BakerDocument11 pagesSetting The Rules Dean BakerOccupyEconomicsNo ratings yet

- Money IdiomsDocument4 pagesMoney IdiomsMónica GonzálezNo ratings yet

- Textile Internship at OCM India LTDDocument73 pagesTextile Internship at OCM India LTDHaqiqat Ali100% (4)

- WORKING CAPITAL MANAGEMENTDocument5 pagesWORKING CAPITAL MANAGEMENTAdliana ColinNo ratings yet

- Survey of Economics 10th Edition Tucker Solutions ManualDocument7 pagesSurvey of Economics 10th Edition Tucker Solutions Manuallindsaycoopergiabxnfmqs100% (12)

- Chapter 6. Interest Rates and Bond ValuationDocument2 pagesChapter 6. Interest Rates and Bond ValuationMir Salman AjabNo ratings yet

- EU Commission raises no objections to State aid casesDocument16 pagesEU Commission raises no objections to State aid casesjaimeNo ratings yet

- 005 02 GlobalEconomic v1Document31 pages005 02 GlobalEconomic v1Ayinde Taofeeq OlusolaNo ratings yet

- Napier - Identifying Market Inflection Points CFADocument9 pagesNapier - Identifying Market Inflection Points CFAAndyNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- Crypto Pearls 2021Document34 pagesCrypto Pearls 2021Crypto Atlas100% (4)

- Concept of Corporate Governance DefinedDocument8 pagesConcept of Corporate Governance DefinedPrashant singhNo ratings yet

- Greenlam 2021 DP CompressedDocument143 pagesGreenlam 2021 DP CompressedTanu GuptaNo ratings yet

- Lecture 4 Agriculture SectorDocument25 pagesLecture 4 Agriculture SectorYumna HasnainNo ratings yet

- Malaysia As Attraction of International Foreign WorkersDocument8 pagesMalaysia As Attraction of International Foreign WorkersAnyelir17No ratings yet

- Factura - Ad 245676 - Sempo Trans S.R.L.Document2 pagesFactura - Ad 245676 - Sempo Trans S.R.L.serban popescuNo ratings yet

- PutraResidence E-BrochureDocument16 pagesPutraResidence E-BrochureHoover RynnNo ratings yet

- Tema 3 Strategia de Internationalizare A Companiei Wizz Air: Duval Alexandru, Grupa 948 ADocument3 pagesTema 3 Strategia de Internationalizare A Companiei Wizz Air: Duval Alexandru, Grupa 948 AAlexandruNo ratings yet

- Central Investigation & Security Services LTD.: Info@cissindia - Co.in WWW - Cissindia.co - inDocument7 pagesCentral Investigation & Security Services LTD.: Info@cissindia - Co.in WWW - Cissindia.co - inFiroze Zia HussainNo ratings yet

- Articles of Incorporation of A Stock CorporationDocument5 pagesArticles of Incorporation of A Stock CorporationSheryl VelascoNo ratings yet

- Crypto Currency Bit CoinDocument35 pagesCrypto Currency Bit CoinJohnNo ratings yet

- List of Status Holders As On 13.10.2014Document9 pagesList of Status Holders As On 13.10.2014santosh kumar100% (1)