Professional Documents

Culture Documents

1stPB Taxsol

1stPB Taxsol

Uploaded by

Emey Calbay0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

1stPB_taxsol

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pages1stPB Taxsol

1stPB Taxsol

Uploaded by

Emey CalbayCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

ReSA

The Review School of

Accountancy

TAXATION

First Pre-Board Examination

MULTIPLE CHOICE

February 10,

11:45 AM to 2:45 P.M.

Tel. No. 735-9807 & 734-3989

2019 (Sunday)

FREGRUGHIONS: Select

Nark only one answer

ded.

The GOEEGCL answer for each of the fellowing questions

ding the box corresponding to the

STRICTLY NO ERASURES ARE ALLOWED.

D €

x So) ee

7. BF Tk 27. c a

Sova te ee. “aa 3 €

Sera ear aoane 25: x pal

(aoe 20.5 30 meal B

Bonus item

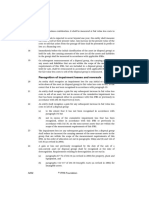

SUPPORTING COMPUTATIONS

sae

“Sasic statutory siniaum wage —[Er7s 600

‘Gvertine pay = 40,006

Night-shift differentaal iss a0¢

[wetaz a ipea0--008

4.8

woe eales/receipts z a B2,500,00¢

Tax rate 18.

Amusement tax

HSO;006

8D

Geos compensation income = PL; 200,00

Add: Paxable 13” month pay and other benefits (120,000 —

| 90,000) = 30,001

Taxable compensation income [Binza0.006

19. ¢ ~

Actual Funeral expenses (30,050 + 50,000) F280,000

init (54 x 10,000,000) = 2500, 000

Allowed (Lower) (maximum) a 2250.00

20. 5 a

Funeral expenses

‘Actus 200,000

Timi (2,700,000 x 58) P135,000 | P 135,006

Gisine against insolvent person 50,006

Transfer to National Government 100,000

Other deductions 7,000,000.

Total = a? BL.2ns 000

29.0 ti

( Gcses estate (real and pexsonal PFOBETEY) 2,700,000)

Het eiats borore apeaial deductions {ae toe

|ues8: Standard deduction "1,000,006

ie net estate Eats ‘000

ReSA: The Review School of Accountancy

39. 8 ie ie

eco of Tend, aaneased valve (higher)

rice)

Te

[motel gross gifte

i

Page 2 of 3

[#1,000,000"]

760-000 _| |

200,000,

{Birs00.000 |

| ehere =

| | administrative purpose.

cig te Tansey Too non-profit woligious organization is an exempe transfer’ | |

transfer £0 2 non Pree part of the gross gifts for verification By the

EBere af hot more than 308 of the donation shall be used by the donee for

[civés tos Ror profit religious organization (200,000 + 700,000) | # 3097000 |

ae pe Bose)

[Groeo gifts ae 75,500,000

| [feet Sesscetone 390-500

[Taxable not eifts 3 ¥ 1,000,000

42.

[Taxable net gifts = ee 1,000,000 |

‘Tax rate ia a z is 30%

([Doner's tax 7 - z =—00-000 |

aac eee ao _ z

Grose gifts Fi, 900,000

Less Deductions 300,000,

Sees : = FE000-008

Donor’s tax due 250,000 Txeape

750,000 x 6 75,000 | 25,000 }

a7. 7

Gcis zeceipts, lease of residential waits (onthly xental is

or 3,500,000

Tale of Cour (a) eesidential Tots ot F1,500,000 each to leanne!

four (4) individual buyers 6,000,000

VAT-exempt gross anount =a Be, 500,000

ag, co i

[Gross receipts, trucking business 755,800,000}

Gross receipts, practice of accountancy [1,000,000 |

‘Sale of three (3) parking spaces at P500,000 ea: : 1,500,000

Hvatable gross anount = eae

57. D

‘The input tax shall be Claimed outright. The amortization

VAT shall only be allowed until December 31, 2021

taxpayers with unutilized y

amput VAT on capital goods purchased or

imported shall be allowed to apply the same as scheduled until fully

of the input

after which

[utilized

58.6 2

Paras pizza.

P980.00 |

[piengoreaste 180.00

Total VAT-exeapt sales ano

oes! vad sockuded Sn ie VAE-eweapt sais 000,00 = az7mIa) | “18.81

ates PB 946.43

| | s9.¢

VaT=exempt sale a

Bales discount wate 96.8

sae er ccount to senior citizen a

60. B

6

83)

66

69.

70

ReSA: The Review Sch

ool of Accountancy

Total calos (WA inclusive)

Tose’ Sales discount aon

Vat included on VAT-exempt sale

Net sales

Ada; Serviee chat

|

‘Total sales (VAT inclusive

Less: VE (2,260.00

otal sales before VAT

[Hess: Sales discount to

Net sales

Servies charge rate

#3,000,000_|

ae

30,000

[orcas veceipts,

Franch:

¥3, 500,000

Tan ate - a

aii Te ago.na0

‘Gross reeipte, cele of water pe :

ares P3, 500,000 |

Gross receipts, rent of office spaces == SSE

otal arses recenpes See ee Se oe

VAT at 308

: aoe

Bis pot “ssbjest_te epusanont taxes

abe ee

(Gross selling price (100,000 shares x Fi a a

[oseeea (100,00 “= Piz) PY, 200,000

Stock transactions tax a a

Ratio = 00,000 —

3 ; = 08]

[Gress sailing price (100,000 shares = Pia)

ie r Pr, 400,000

Stock transactions tax. Dae aa

Ee a00

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FAR Final Preboard-5Document1 pageFAR Final Preboard-5Emey CalbayNo ratings yet

- FAR Final Preboard-11Document1 pageFAR Final Preboard-11Emey CalbayNo ratings yet

- FAR Final Preboard-10Document1 pageFAR Final Preboard-10Emey CalbayNo ratings yet

- CH 19Document29 pagesCH 19Emey CalbayNo ratings yet

- 1stPB MasolDocument1 page1stPB MasolEmey CalbayNo ratings yet

- Appendix A Defined Terms: Ifrs 5Document1 pageAppendix A Defined Terms: Ifrs 5Emey CalbayNo ratings yet

- Transitional Provisions: Ifrs 5Document1 pageTransitional Provisions: Ifrs 5Emey CalbayNo ratings yet

- FAR Final Preboard-9Document1 pageFAR Final Preboard-9Emey CalbayNo ratings yet

- Gains or Losses Relating To Continuing Operations: Ifrs 5Document1 pageGains or Losses Relating To Continuing Operations: Ifrs 5Emey CalbayNo ratings yet

- Ifrs5 1Document1 pageIfrs5 1Emey CalbayNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- Recognition of Impairment Losses and Reversals: Ifrs 5Document1 pageRecognition of Impairment Losses and Reversals: Ifrs 5Emey CalbayNo ratings yet

- Ifrs5 20Document1 pageIfrs5 20Emey CalbayNo ratings yet

- Ifrs5 12Document1 pageIfrs5 12Emey CalbayNo ratings yet

- Appendix B Application Supplement: Extension of The Period Required To Complete A SaleDocument1 pageAppendix B Application Supplement: Extension of The Period Required To Complete A SaleEmey CalbayNo ratings yet

- International Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsDocument1 pageInternational Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsEmey CalbayNo ratings yet

- Ifrs 5: Presentation and DisclosureDocument1 pageIfrs 5: Presentation and DisclosureEmey CalbayNo ratings yet

- Chapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashDocument35 pagesChapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashEmey CalbayNo ratings yet

- Changes To A Plan of Sale or To A Plan of Distribution To OwnersDocument1 pageChanges To A Plan of Sale or To A Plan of Distribution To OwnersEmey CalbayNo ratings yet

- Ifrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersDocument1 pageIfrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersEmey CalbayNo ratings yet

- Ifrs5 6Document1 pageIfrs5 6Emey CalbayNo ratings yet

- Account Title Dr. CRDocument6 pagesAccount Title Dr. CREmey CalbayNo ratings yet

- Chapter 15 Inventories and Construction Contracts: 1. ObjectivesDocument20 pagesChapter 15 Inventories and Construction Contracts: 1. ObjectivesEmey CalbayNo ratings yet

- This Study Resource Was: None of TheseDocument1 pageThis Study Resource Was: None of TheseEmey CalbayNo ratings yet

- Fav2chp4 9Document122 pagesFav2chp4 9Emey CalbayNo ratings yet

- This Study Resource WasDocument6 pagesThis Study Resource WasEmey CalbayNo ratings yet