Professional Documents

Culture Documents

Oliveros-Discussion-Audit of Statement of Cash Flow

Uploaded by

Jessalyn Dane0 ratings0% found this document useful (0 votes)

8 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesOliveros-Discussion-Audit of Statement of Cash Flow

Uploaded by

Jessalyn DaneCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

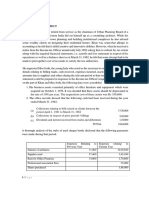

Oliveros, Mark M.

ACTCY32S1 – 3rd Year Accountancy

Auditing & Assurance: Concepts and Applications II

1. Describe the statement of cash flows and enumerate the three

classifications

A cash flow statement is a financial statement that provides aggregate

data regarding all cash inflows a company receives from its ongoing

operations and external investment sources. It also includes all cash

outflows that pay for business activities and investments during a given

period. The statement of cash flows is part of the complete set of financial

statement and entities are required to prepare these financial statements

with conformity with PFRS. This type of statement shows the cash flows

analysis of changes in cash and cash equivalents during the period. There

are three classification of statement of cash flow namely: operating cash

flows, investing cash flows, and financing cash flows

Operating cash flows:

Cash flows from operating activities is a section of a

company's cash flow statement that explains the

sources and uses of cash from ongoing regular

business activities in a given period. This typically

includes net income from the income statement,

adjustments to net income, and changes in working

capital.

Investing cash flows:

Cash flow from investing activities is a section of the

cash flow statement that shows the cash generated or

spent relating to investment activities. Investing

activities include purchases of physical assets,

investments in securities, or the sale of securities or

assets.

Financing cash flows:

The financing activity in the cash flow statement

focuses on how a firm raises capital and pays it back

to investors through capital markets. These activities

also include paying cash dividends, adding or

changing loans, or issuing and selling more stock

2. Explain the component of method of presentation of operating cash flows,

investing cash flows and financing cash flows

Operating cash flows:

The operating activities on the CFS include any sources and

uses of cash from business activities. In other words, it reflects how

much cash is generated from a company's products or services.

There are two methods of calculating cash flow: the direct

method and the indirect method.

o Indirect Method - whereby the profit or loss is

adjusted for the effects of non-cash

transaction.

o Direct Method - whereby the sources of cash

receipts and expenses are disclosed.

Investing cash flows:

Investing activities include any sources and uses of cash

from a company's investments. A purchase or sale of an asset,

loans made to vendors or received from customers, or any

payments related to a merger or acquisition is included in this

category. In short, changes in equipment, assets, or investments

relate to cash from investing. Usually, cash changes from

investing are a "cash out" item, because cash is used to buy new

equipment, buildings, or short-term assets such as marketable

securities. However, when a company divests an asset, the

transaction is considered "cash in" for calculating cash from

investing.

Financing cash flows:

Cash from financing activities includes the sources of cash

from investors or banks, as well as the uses of cash paid to

shareholders. Payment of dividends, payments for stock

repurchases, and the repayment of debt principal (loans) are

included in this category.

Changes in cash from financing are "cash in" when capital is

raised, and they're "cash out" when dividends are paid. Thus, if a

company issues a bond to the public, the company receives cash

financing; however, when interest is paid to bondholders, the

company is reducing its cash.

You might also like

- Cash FlowDocument28 pagesCash Flowleen mercado100% (1)

- Cash Flow StatementsDocument48 pagesCash Flow StatementsApollo Institute of Hospital Administration60% (5)

- 000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AMónica M. RodríguezNo ratings yet

- Financial Management Module 6Document17 pagesFinancial Management Module 6Armand Robles100% (1)

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- ARE144 Core ReviewDocument50 pagesARE144 Core Reviewshanmuga8950% (2)

- Recruitment of A StarDocument8 pagesRecruitment of A StarAshok Kumar VishnoiNo ratings yet

- Latif Khan PDFDocument2 pagesLatif Khan PDFGaurav AroraNo ratings yet

- FMA Cash Flow StatementsDocument19 pagesFMA Cash Flow Statementskanha PanigrahyNo ratings yet

- Coca Cola Research PaperDocument30 pagesCoca Cola Research PaperUmarNo ratings yet

- SAMALA - DISCUSSION 6 (Audit of Statement of Cash Flow)Document2 pagesSAMALA - DISCUSSION 6 (Audit of Statement of Cash Flow)Jessalyn DaneNo ratings yet

- De Guzman, C. - Statement of Cash Flow DiscussionDocument2 pagesDe Guzman, C. - Statement of Cash Flow DiscussionJessalyn DaneNo ratings yet

- Malinab Aira Bsba FM 2-2 Activity 5Document13 pagesMalinab Aira Bsba FM 2-2 Activity 5Aira MalinabNo ratings yet

- Act02 Cbactg01Document1 pageAct02 Cbactg01John Rick TambasacanNo ratings yet

- Unit Ii Accounting PDFDocument11 pagesUnit Ii Accounting PDFMo ToNo ratings yet

- Cash Flow Statement: Meaning and DefinitionDocument4 pagesCash Flow Statement: Meaning and DefinitionSuman ChaudharyNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsHershey Celine LaguaNo ratings yet

- Cash Flow StatementDocument31 pagesCash Flow StatementRajeevNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsCatriona Cassandra SantosNo ratings yet

- Chapter 1 NotesDocument9 pagesChapter 1 Notesaccswc21No ratings yet

- Cash Flow StatementDocument41 pagesCash Flow StatementPratyush SainiNo ratings yet

- ICCT Colleges Foundation, Inc. Conceptual Framework & Accounting Standard - CBACTG01Document1 pageICCT Colleges Foundation, Inc. Conceptual Framework & Accounting Standard - CBACTG01Damayan XeroxanNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementAnanyaNo ratings yet

- Chapter 6Document46 pagesChapter 6Aditya GuptaNo ratings yet

- Participant Guide C Cash FlowDocument45 pagesParticipant Guide C Cash FlowMohamed Ahmed100% (1)

- Cash Flow Statement (Anggi)Document4 pagesCash Flow Statement (Anggi)Fayya RFHNo ratings yet

- Albrecht CH 13 SM FinalDocument49 pagesAlbrecht CH 13 SM FinalJessie jorgeNo ratings yet

- CFS PDFDocument50 pagesCFS PDFSubbu ..No ratings yet

- Group 4 (Statement of Cash Flow)Document25 pagesGroup 4 (Statement of Cash Flow)Gerald CalimlimNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsIVONNE RUBIO BLANCASNo ratings yet

- Mcarthur Highway, Barangay Bulihan, City of Malolos, Bulacan 3000Document7 pagesMcarthur Highway, Barangay Bulihan, City of Malolos, Bulacan 3000Angela Dela PeñaNo ratings yet

- Cash Flow Statement - NCERTDocument54 pagesCash Flow Statement - NCERTHJ ManviNo ratings yet

- Cash Flow Statement PDFDocument48 pagesCash Flow Statement PDFsukriti dhauniNo ratings yet

- Cash Flow StatemementsDocument31 pagesCash Flow StatemementsTasim Ishraque100% (1)

- Saint Joseph College of Sindangan Incorporated College of AccountancyDocument18 pagesSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- International Accounting Standard 7 Statement of Cash FlowsDocument8 pagesInternational Accounting Standard 7 Statement of Cash Flowsইবনুল মাইজভাণ্ডারীNo ratings yet

- Peruvian University Wings Professional School of Accounting and Financial Sciences Course: EnglishDocument6 pagesPeruvian University Wings Professional School of Accounting and Financial Sciences Course: EnglishHassel Jesus Martinez MedinaNo ratings yet

- Cash Flow Statement: Vishesh SinghDocument20 pagesCash Flow Statement: Vishesh SinghVishesh SinghNo ratings yet

- Cash Flow StatementDocument20 pagesCash Flow StatementYASH SARDANo ratings yet

- MN Arora CashflowDocument36 pagesMN Arora CashflowJiavidhi SharmaNo ratings yet

- Module 3 Analysis of Financial StatementsDocument24 pagesModule 3 Analysis of Financial StatementsErick Mequiso100% (1)

- Statement of CashflowDocument2 pagesStatement of CashflowAeron Jay TamangNo ratings yet

- CH-5 Cash FlowDocument10 pagesCH-5 Cash FlowmotibtNo ratings yet

- CA. Praveen Tawania The Only Book That Balance Your Books: Inflows OutflowsDocument4 pagesCA. Praveen Tawania The Only Book That Balance Your Books: Inflows OutflowsABHISHEKNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementSwapnil ManeNo ratings yet

- Leac 206Document46 pagesLeac 206Akash KamathNo ratings yet

- Cash Flow and BudgetingDocument3 pagesCash Flow and BudgetingAdil MehmoodNo ratings yet

- Lecture 1Document8 pagesLecture 1ABDUL HADI KHANNo ratings yet

- Module 018 Week006-Finacct3 Notes To The Financial StatementsDocument5 pagesModule 018 Week006-Finacct3 Notes To The Financial Statementsman ibeNo ratings yet

- Fund Flow StatementDocument3 pagesFund Flow StatementManas MohapatraNo ratings yet

- Chapter 3Document22 pagesChapter 3Đông JustNo ratings yet

- TM Handout 2303Document8 pagesTM Handout 2303Kate F NocumNo ratings yet

- Cash FlowDocument50 pagesCash FlowAnant AJNo ratings yet

- Operating Activities:: What Are The Classification of Cash Flow?Document5 pagesOperating Activities:: What Are The Classification of Cash Flow?samm yuuNo ratings yet

- Cash Flow Statement Fund Flow Statement: Operating Activities Are The Main RevenueDocument3 pagesCash Flow Statement Fund Flow Statement: Operating Activities Are The Main RevenueHaripriya RajanNo ratings yet

- What Is A Statement of Cash Flow?Document3 pagesWhat Is A Statement of Cash Flow?Bea Marella CapundanNo ratings yet

- Week 4 Module 4 Chapter 4 Statement of Cash Flows With Practice Set 2Document9 pagesWeek 4 Module 4 Chapter 4 Statement of Cash Flows With Practice Set 2Joyce TanNo ratings yet

- Cash Flow Statement Full TheoryDocument3 pagesCash Flow Statement Full TheoryShubham BhaiNo ratings yet

- Chapter-I: Cash Flow AnalysisDocument47 pagesChapter-I: Cash Flow AnalysisMichael WellsNo ratings yet

- Cash Flow Erfeewer EreeDocument47 pagesCash Flow Erfeewer EreeMichael WellsNo ratings yet

- Zhaksylyk NazgulDocument12 pagesZhaksylyk NazgulNurt TurdNo ratings yet

- T9 Cash FlowDocument16 pagesT9 Cash FlowHD DNo ratings yet

- Satish FinalDocument79 pagesSatish FinalAnonymous MhCdtwxQINo ratings yet

- (Ana) Slide 1: What Is A Cash Flow Statement?Document4 pages(Ana) Slide 1: What Is A Cash Flow Statement?ketiNo ratings yet

- Advance Reading AnalysisDocument3 pagesAdvance Reading AnalysisJessalyn DaneNo ratings yet

- Assignment 1 AuditingDocument2 pagesAssignment 1 AuditingJessalyn DaneNo ratings yet

- Week 4 AssignmentDocument1 pageWeek 4 AssignmentJessalyn DaneNo ratings yet

- Accounting Is LifeDocument1 pageAccounting Is LifeJessalyn DaneNo ratings yet

- Assignment 5: Case StudyDocument1 pageAssignment 5: Case StudyJessalyn DaneNo ratings yet

- Accounting ReviewDocument1 pageAccounting ReviewJessalyn DaneNo ratings yet

- Jose Rizal'S Initial Biography, Family Background, Academic Background and Travel AbroadDocument3 pagesJose Rizal'S Initial Biography, Family Background, Academic Background and Travel AbroadJessalyn DaneNo ratings yet

- Wasting Asset AnswerDocument3 pagesWasting Asset AnswerJessalyn DaneNo ratings yet

- Final Reviewer Final Na FinalDocument14 pagesFinal Reviewer Final Na FinalJessalyn DaneNo ratings yet

- Culture and Belief AnswerDocument2 pagesCulture and Belief AnswerJessalyn DaneNo ratings yet

- True or False Semi QuizDocument1 pageTrue or False Semi QuizJessalyn DaneNo ratings yet

- Developing Career OpportunitiesDocument2 pagesDeveloping Career OpportunitiesJessalyn DaneNo ratings yet

- Running A Business Tips EssayDocument1 pageRunning A Business Tips EssayJessalyn DaneNo ratings yet

- Assignment Audit of Stockholders EquityDocument3 pagesAssignment Audit of Stockholders EquityJessalyn DaneNo ratings yet

- Educational and Life of RizalDocument3 pagesEducational and Life of RizalJessalyn DaneNo ratings yet

- 2 JorqueDocument1 page2 JorqueJessalyn DaneNo ratings yet

- Group 7: Senate Budget Hearing For Denr For 2021 Fiscal YearDocument5 pagesGroup 7: Senate Budget Hearing For Denr For 2021 Fiscal YearJessalyn DaneNo ratings yet

- Date Title ScoreDocument5 pagesDate Title ScoreJessalyn DaneNo ratings yet

- En Special Series On Covid 19 Budgeting in A Crisis Guidance On Preparing The 2021 BudgetDocument10 pagesEn Special Series On Covid 19 Budgeting in A Crisis Guidance On Preparing The 2021 BudgetJessalyn DaneNo ratings yet

- Introduction To Environmental ScienceDocument16 pagesIntroduction To Environmental ScienceJessalyn DaneNo ratings yet

- De Guzman, Chritsian Dayne M. ACTCY32S1 - 3 Year ACCTG 025 - Module 5 DiscussionDocument1 pageDe Guzman, Chritsian Dayne M. ACTCY32S1 - 3 Year ACCTG 025 - Module 5 DiscussionJessalyn DaneNo ratings yet

- Oliveros, Mark M. ACTCY32S1 - 3 Year Accountancy Auditing & Assurance: Concepts and Applications IIDocument1 pageOliveros, Mark M. ACTCY32S1 - 3 Year Accountancy Auditing & Assurance: Concepts and Applications IIJessalyn DaneNo ratings yet

- Julia Robinson Was A Prominent Twentieth Century American MathematicianDocument2 pagesJulia Robinson Was A Prominent Twentieth Century American MathematicianJessalyn DaneNo ratings yet

- Mendoza, Cedrick C. ACTCY32S1Document1 pageMendoza, Cedrick C. ACTCY32S1Jessalyn DaneNo ratings yet

- Group 7: Senate Budget Hearing For Denr For 2021 Fiscal YearDocument2 pagesGroup 7: Senate Budget Hearing For Denr For 2021 Fiscal YearJessalyn DaneNo ratings yet

- English Quiz: Crisandro James D. Nozaleda Grade 6 - Love Mrs - Rowena ReyesDocument2 pagesEnglish Quiz: Crisandro James D. Nozaleda Grade 6 - Love Mrs - Rowena ReyesJessalyn DaneNo ratings yet

- Group 7: Senate Budget Hearing For Denr For 2021 Fiscal YearDocument2 pagesGroup 7: Senate Budget Hearing For Denr For 2021 Fiscal YearJessalyn DaneNo ratings yet

- Phase 2 - 420 & 445Document60 pagesPhase 2 - 420 & 445SNo ratings yet

- Maidens, Meal and Money Capitalism and The Domestic Community (Claude Meillassoux) PDFDocument213 pagesMaidens, Meal and Money Capitalism and The Domestic Community (Claude Meillassoux) PDFjacoNo ratings yet

- Fast Retailing Sustainability Report 2019Document20 pagesFast Retailing Sustainability Report 2019Mahmudul HaqueNo ratings yet

- Jal Kal Vibhag, AgraDocument1 pageJal Kal Vibhag, AgraNeeraj gargNo ratings yet

- Cash Journal: Manage A Company S Cash TransactionDocument9 pagesCash Journal: Manage A Company S Cash TransactionSachin SinghNo ratings yet

- Roll No MBA05006039 (Priyanka Revale)Document83 pagesRoll No MBA05006039 (Priyanka Revale)Veeresh NaikarNo ratings yet

- Tejas UCLEntrepreneurshipDocument4 pagesTejas UCLEntrepreneurshiprahul jainNo ratings yet

- Universal Life Loans and SurrendersDocument12 pagesUniversal Life Loans and SurrendersZaher RedaNo ratings yet

- Case Study - DaburDocument1 pageCase Study - DaburMonica PandeyNo ratings yet

- Cameo Sports Agencies Pvt. LTDDocument4 pagesCameo Sports Agencies Pvt. LTDBhupender TakshakNo ratings yet

- 17 Business StandardDocument28 pages17 Business StandardMAJNU Bhai100% (1)

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- US Economic Indicators: Corporate Profits in GDP: Yardeni Research, IncDocument16 pagesUS Economic Indicators: Corporate Profits in GDP: Yardeni Research, IncJames HeartfieldNo ratings yet

- Gold Mastercard Titanium Mastercard Platinum MastercardDocument3 pagesGold Mastercard Titanium Mastercard Platinum MastercardRoseyy GalitNo ratings yet

- Post IndustrializationDocument3 pagesPost IndustrializationgdhssjjssjNo ratings yet

- BPP F3 KitDocument7 pagesBPP F3 KitMuhammad Ubaid UllahNo ratings yet

- A Study of Impact of Macroeconomic Variables On Performance of NiftyDocument3 pagesA Study of Impact of Macroeconomic Variables On Performance of NiftyMamta GroverNo ratings yet

- Foreign Exchange TranscationDocument7 pagesForeign Exchange TranscationBooth NathNo ratings yet

- Maybank Market Strategy For InvestmentsDocument9 pagesMaybank Market Strategy For InvestmentsjasbonNo ratings yet

- The Abercrombie Supply Company Reported The Following Information For 2014Document1 pageThe Abercrombie Supply Company Reported The Following Information For 2014Amit PandeyNo ratings yet

- Dreamforce 2019 - Justifying Your Salesforce InvestmentDocument21 pagesDreamforce 2019 - Justifying Your Salesforce InvestmentPattyNo ratings yet

- What Is Talent ManagementDocument8 pagesWhat Is Talent ManagementarturoceledonNo ratings yet

- Assignment Strategic ManagementDocument9 pagesAssignment Strategic ManagementHarpal PanesarNo ratings yet

- Name: Mrunmayee Mirlekar Roll No: 3812 Div: C Paper: Microeconomics Paper Code: RUAECO501 Topic: Game Theory Analysis of US-China Trade WarDocument17 pagesName: Mrunmayee Mirlekar Roll No: 3812 Div: C Paper: Microeconomics Paper Code: RUAECO501 Topic: Game Theory Analysis of US-China Trade WarMrunmayee MirlekarNo ratings yet

- Franchise AccountingDocument17 pagesFranchise AccountingCha EsguerraNo ratings yet