Professional Documents

Culture Documents

Cash Flow Statement: Meaning and Definition

Uploaded by

Suman Chaudhary0 ratings0% found this document useful (0 votes)

15 views4 pagesThe document discusses cash flow statements, including their meaning, importance, and preparation. It provides the following key points:

- Cash flow statements show the inflows and outflows of cash from operating, investing, and financing activities over an accounting period. They indicate reasons for increases or decreases in cash.

- Cash flow statements are important for identifying sources of cash inflows, how cash was used, planning cash flows, and assessing capital investment programs.

- Cash flow statements are prepared by classifying cash flows into the three categories of operating, investing, and financing activities. Operating activities include cash from sales and payments for expenses. Investing activities involve cash from the sale and purchase of long-term assets. Fin

Original Description:

note

Original Title

cash flow statement

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses cash flow statements, including their meaning, importance, and preparation. It provides the following key points:

- Cash flow statements show the inflows and outflows of cash from operating, investing, and financing activities over an accounting period. They indicate reasons for increases or decreases in cash.

- Cash flow statements are important for identifying sources of cash inflows, how cash was used, planning cash flows, and assessing capital investment programs.

- Cash flow statements are prepared by classifying cash flows into the three categories of operating, investing, and financing activities. Operating activities include cash from sales and payments for expenses. Investing activities involve cash from the sale and purchase of long-term assets. Fin

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesCash Flow Statement: Meaning and Definition

Uploaded by

Suman ChaudharyThe document discusses cash flow statements, including their meaning, importance, and preparation. It provides the following key points:

- Cash flow statements show the inflows and outflows of cash from operating, investing, and financing activities over an accounting period. They indicate reasons for increases or decreases in cash.

- Cash flow statements are important for identifying sources of cash inflows, how cash was used, planning cash flows, and assessing capital investment programs.

- Cash flow statements are prepared by classifying cash flows into the three categories of operating, investing, and financing activities. Operating activities include cash from sales and payments for expenses. Investing activities involve cash from the sale and purchase of long-term assets. Fin

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Cash Flow Statement

MEANING AND DEFINITION

Financial statements of an enterprise include income statement, which shows the

operating result and balance sheet, which shows the financial position. For

betterment of decision making additional statement are prepared to analyse the

change in financial position of the enterprise over the accounting period. These

statements of change in financial position includes funds flow statement, cash flow

statement and ratio analysis etc. Cash is the blood of a business. Without sufficient

cash business cannot run properly.

Cash flow is the flow of cash in an accounting year or over two dates of balance

sheet. Cash flow statements shows the inflows and outflows of cash from different

business activities like operating, investing and financing activities. It is the indicator

of the amount of cash receipt and amount of cash payment or disbursement during

an accounting period in different activities of an organization. It shows the causes of

increase or decrease in cash and net change in cash position during a particular

period.

Cash flow is one of the compulsory financial statements that should be prepared with

the other financial statements. As per company act,2063, in case of public limited

company, the cash flow statement must be prepared annually 30 days prior to

annual general meeting but in case of private limited company, it should be prepared

within 60 days from the end of the accounting period.

IMORTANCE OF CASH FLOW STATEMENT

The statement of cash flow statement provides information regarding inflows and

outflows of cash of a firm for a period of one year. Therefore, cash flow statement is

important on the following grounds.

To identify the sources from where cash inflows have risen within in a

particular period.

To show the various activities where in the cash was utilized.

To plan cash in systematic method and maintain a proper matching between

cash inflows. and outflows.

To show the efficiency of the firm in generating cash inflows from its regular

operations.

To reports the amount of cash used during the period in various long term

investing activities such as purchase of fixed assets.

To reports the amount of cash received during the period through various

financing activities such as issue of shares, debentures and raising long-term

loan.

To helps for appraisal of various capital investment programmes to determine

their profitability and viability.

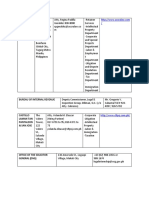

DIFFERENCES BETWEEN CASH FLOW STATEMENT AND FUNDS FLOW

STATEMENT

CASH FLOW STATEMENT FUNDS FLOW STATEMENT

It is based on the changes in working capital,

Cash flow statement is based on narrow concept which considers both the changes in cash as

of funds, which considers changes in cash. well as other components of current assets

and current liabilities.

It is prepared on cash basis. It is prepared in accrual basis.

It does not require use of changes in net working

It requires using of a separate statement of

capital because all the changes in assets and

changes in net working capital.

liabilities are summarized in cash flow statement.

The preparation of cash flow statement considers The preparationof funds flow statement

only those transactions that are linked with flow of considers those transactions that are linked

cash. with flow of funds along with actual cash.

This statement is more useful in short-term This is more useful in long-term analysis of

analysis and cash planning. financial planning.

PREPARATION OF CASH FLOW STATEMENT

The cash flow statement is prepared by showing inflows and outflows of cash from

major activities of a firm. The activities that result in cash inflows are referred to as

source of cash and the activities that results into cash flow outflow are referred to as

uses of cash. The firm’s activities are classified into 3 categories. They are:

1. Cash flows from operating activities

2. Cash flows from investing activities

3. Cash flow from financing activities

Cash flow from operating activities

Operating activities refer to the day-to-day revenue generating activities of a firm.

These activities are considered to be the major sources of internally generated cash.

Cash inflows form operating activities include the cash from sales and collection from

debtors. Cash outflows for operating activities include cash purchase, payment of

suppliers, payment for other operating expenses, payment for interest and taxes thus

consist of all cash revenue expenses.

Cash flows from operating activities could be determined by using two methods.

Direct and indirect method

1. Cash flow from operating activities under direct method

Under direct method only those items from income statement are selected that result

into actual flow of cash. So, non-cash expenses such as depreciation and amortized

amount appeared in income statement are ignored. The change in some

components of current assets and current liabilities except cash balance are also

incorporated that result into cash inflows and outflows.

A. Cash sales and collection from debtors

It includes cash from sales and cash inflows or outflows resulted from change

in debtors and bills receivable.

B. Cash purchases and payment to suppliers

It includes cash inflow resulted from purchase of raw materials or cost of

goods sold. The changes in creditors and bills payables of two balance sheet

dates are adjusted to the amount of purchase of raw materials or cost of

goods sold.

C. Payment to employees and other operating expenses

It includes cash outflow resulted from payment of wages, salaries,

manufacturing expenses, administrative expenses, selling and distribution

expenses, including insurance and other operating expenses.

D. Payment for interest and taxes

It includes the cash outflow occurring out of payment of interest and taxes.

The change in outstanding interest and taxes are also included.

E. Cash from extra-ordinary activities

It includes all the cash inflows and outflows arising on account of short-term

investment and short-term financing such as short-term bank loan, bank

overdraft, and marketable securities.

2. Cash flows from operating activities under indirect method

Under indirect method first the funds from operation is ascertain by adjusting the net

income by non-cash expenses and non-operating incomes and expenses included in

the income statement. The funds from operation so ascertained are again adjusted

by the changes in current assets and the changes in current liabilities to determine

cash flows from operating activities.

To apply this method all the amount of non-operating and non-cash expenses are

added to the net income and then the amount of non-operating incomes are

deducted. The resulting figure is known as funds from operation. The changes in

current assets, other than cash and the changes in current liabilities are adjusted to

funds from operation so that the resulting figure is known as cash from operating

activities.

Cash flow from investing activities

Investing activities refer to those activities, which are concerned with acquisition or

sales of long-term assets or investment. Cash inflows from investing activities

include the cash received from sales of fixed assets as well as investment and cash

outflows include cash paid for the purchase of fixed assets and investment made.

Cash flow from financing activities

Financing activities are concerned with cash collection by issuing shares and

debentures, raising long-term loan and so on. It also involves cash outflows in terms

of redemption of debentures and preference shares, repurchase of shares,

repayment of long-term loan and payment of cash dividend.

You might also like

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- SAMALA - DISCUSSION 6 (Audit of Statement of Cash Flow)Document2 pagesSAMALA - DISCUSSION 6 (Audit of Statement of Cash Flow)Jessalyn DaneNo ratings yet

- What Is A Statement of Cash Flow?Document3 pagesWhat Is A Statement of Cash Flow?Bea Marella CapundanNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDr. Shoaib MohammedNo ratings yet

- International Accounting Standard 7 Statement of Cash FlowsDocument8 pagesInternational Accounting Standard 7 Statement of Cash Flowsইবনুল মাইজভাণ্ডারীNo ratings yet

- AFM Unit 4 CASH FLOW TheoryDocument5 pagesAFM Unit 4 CASH FLOW TheoryMr. N. KARTHIKEYAN Asst Prof MBANo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementHemant kumar JhaNo ratings yet

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- Unit 4Document25 pagesUnit 4venkyNo ratings yet

- Brindha Csash Flow StatementDocument32 pagesBrindha Csash Flow Statementgkvimal nathan100% (1)

- FMA Cash Flow StatementsDocument19 pagesFMA Cash Flow Statementskanha PanigrahyNo ratings yet

- Unit Ii Accounting PDFDocument11 pagesUnit Ii Accounting PDFMo ToNo ratings yet

- Fundflow and Cashflow DifferenceDocument4 pagesFundflow and Cashflow DifferencerakeshkchouhanNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementSwapnil ManeNo ratings yet

- Prepare The Statement of Cash Flows Using The Indirect MethodDocument4 pagesPrepare The Statement of Cash Flows Using The Indirect MethodcindywNo ratings yet

- Chapter: - 8Document16 pagesChapter: - 8Kanu SubramanianNo ratings yet

- Cash Flow Statement PDFDocument18 pagesCash Flow Statement PDFPrithikaNo ratings yet

- Cash FlowsDocument24 pagesCash Flowst4fgmwcb2kNo ratings yet

- Microsoft Word - Cash Flow StatementDocument13 pagesMicrosoft Word - Cash Flow StatementAshishNo ratings yet

- IAS 7 Statement of Cash Flows: Technical SummaryDocument3 pagesIAS 7 Statement of Cash Flows: Technical SummaryIQBALNo ratings yet

- Cash Follow Statement (1) - 2Document17 pagesCash Follow Statement (1) - 2Gkgolam KibriaNo ratings yet

- Ias 3Document21 pagesIas 3JyotiNo ratings yet

- FFS and CFSDocument28 pagesFFS and CFSAnuj DhamaNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDeepalaxmi BhatNo ratings yet

- Accounting 3 Cash Flow Statement DiscussionDocument6 pagesAccounting 3 Cash Flow Statement DiscussionNoah HNo ratings yet

- BusFin NotesDocument10 pagesBusFin NotesJeremae EtiongNo ratings yet

- IAS 7, Statement of Cash Flows - A Closer Look: ArticleDocument10 pagesIAS 7, Statement of Cash Flows - A Closer Look: ArticlevcdsvcdsvsdfNo ratings yet

- Cash Flow and BudgetingDocument3 pagesCash Flow and BudgetingAdil MehmoodNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementAnonymous E0dOQEqIyNo ratings yet

- How To Use A Cash Flow StatementDocument2 pagesHow To Use A Cash Flow StatementSha RonNo ratings yet

- (Ana) Slide 1: What Is A Cash Flow Statement?Document4 pages(Ana) Slide 1: What Is A Cash Flow Statement?ketiNo ratings yet

- Oliveros-Discussion-Audit of Statement of Cash FlowDocument2 pagesOliveros-Discussion-Audit of Statement of Cash FlowJessalyn DaneNo ratings yet

- Cash Flow Statement AnalysisDocument29 pagesCash Flow Statement AnalysisCASAQUIT, IRA LORAINENo ratings yet

- Satish FinalDocument79 pagesSatish FinalAnonymous MhCdtwxQINo ratings yet

- Of Cash and Which Are Subject To An Insignificant Risk of Changes in ValueDocument2 pagesOf Cash and Which Are Subject To An Insignificant Risk of Changes in ValueJMClosedNo ratings yet

- 13 - Chapter 7 PDFDocument30 pages13 - Chapter 7 PDFLoveleena RodriguesNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementAnanyaNo ratings yet

- Chapter 6Document46 pagesChapter 6Aditya GuptaNo ratings yet

- Summer Training AnuragDocument11 pagesSummer Training Anuraganurag kumarNo ratings yet

- Fund Flow StatementDocument3 pagesFund Flow StatementManas MohapatraNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow Statementhitesh26881No ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementRojesh BasnetNo ratings yet

- Chapter 8 Cash Flow StatementDocument23 pagesChapter 8 Cash Flow StatementAnant AJNo ratings yet

- IAS 7 SummaryDocument3 pagesIAS 7 SummarymalickmustafaNo ratings yet

- Participant Guide C Cash FlowDocument45 pagesParticipant Guide C Cash FlowMohamed Ahmed100% (1)

- Advance AccountingDocument27 pagesAdvance AccountingHaris MalikNo ratings yet

- Funds Flow Statement - IntroductionDocument37 pagesFunds Flow Statement - Introductionjanishasanthi67% (6)

- Unit 4 Cash Flow StatementDocument26 pagesUnit 4 Cash Flow Statementjatin4verma-2No ratings yet

- IAS 7 Statement of Cash Flows PDFDocument3 pagesIAS 7 Statement of Cash Flows PDFAKNo ratings yet

- Malinab Aira Bsba FM 2-2 Activity 5Document13 pagesMalinab Aira Bsba FM 2-2 Activity 5Aira MalinabNo ratings yet

- Cash Flow Statements Bas 7Document12 pagesCash Flow Statements Bas 7Hasnain MahmoodNo ratings yet

- 400 - 605 CashFlowReview84Document9 pages400 - 605 CashFlowReview84Zenni T XinNo ratings yet

- Project On Cash Flow StatementDocument95 pagesProject On Cash Flow Statementravikumarreddyt58% (19)

- Cash FlowDocument50 pagesCash FlowAnant AJNo ratings yet

- REPORTING AND ANALYZING Cash FlowsDocument39 pagesREPORTING AND ANALYZING Cash FlowsmarieieiemNo ratings yet

- Statement of Cash Flows Chapter # 10Document22 pagesStatement of Cash Flows Chapter # 10Fahad BataviaNo ratings yet

- Cash Flow Statement PDFDocument48 pagesCash Flow Statement PDFsukriti dhauniNo ratings yet

- Cash Flow Statement - NCERTDocument54 pagesCash Flow Statement - NCERTHJ ManviNo ratings yet

- Economic Activities Text Annual 2076.77Document27 pagesEconomic Activities Text Annual 2076.77Suman ChaudharyNo ratings yet

- Current Macroeconomic Situation of Nepal (Based On The First Tmonths' Data of 2015 - 16)Document18 pagesCurrent Macroeconomic Situation of Nepal (Based On The First Tmonths' Data of 2015 - 16)Suman ChaudharyNo ratings yet

- Small Companies Can Change The WorldDocument3 pagesSmall Companies Can Change The WorldSuman ChaudharyNo ratings yet

- MFD Activities Brocher 20700219Document2 pagesMFD Activities Brocher 20700219Suman ChaudharyNo ratings yet

- (Affiliated To Kathmandu University) Hattiban, Lalitpur: Subject: HRM Year: BBA 3rd Year Time: 160 Min. Full Marks: 50Document1 page(Affiliated To Kathmandu University) Hattiban, Lalitpur: Subject: HRM Year: BBA 3rd Year Time: 160 Min. Full Marks: 50Suman ChaudharyNo ratings yet

- Function of WtoDocument12 pagesFunction of WtoSuman ChaudharyNo ratings yet

- Intaf Answari Section ADocument5 pagesIntaf Answari Section ASuman ChaudharyNo ratings yet

- Mas 310 - Operations ManagementDocument6 pagesMas 310 - Operations ManagementSuman ChaudharyNo ratings yet

- List of Business Presentation TopicsDocument6 pagesList of Business Presentation TopicsSuman ChaudharyNo ratings yet

- Management Information Systems Laudon 12th Edition Solutions ManualDocument4 pagesManagement Information Systems Laudon 12th Edition Solutions ManualSuman ChaudharyNo ratings yet

- 2017 End Sem 1Document3 pages2017 End Sem 1Suman ChaudharyNo ratings yet

- Literature Survey of An Entrepreneur: Rahul BajajDocument10 pagesLiterature Survey of An Entrepreneur: Rahul BajajSuman ChaudharyNo ratings yet

- 2012 Bookmatter InternationalBusinessDocument5 pages2012 Bookmatter InternationalBusinessSuman ChaudharyNo ratings yet

- Financial Goals:: 1. Profitability and RevenueDocument2 pagesFinancial Goals:: 1. Profitability and RevenueSuman ChaudharyNo ratings yet

- Little Angels' College of Management: Q. Long Question Answer: (25 X 4 100)Document3 pagesLittle Angels' College of Management: Q. Long Question Answer: (25 X 4 100)Suman ChaudharyNo ratings yet

- Week 7 Strategic International HRMDocument21 pagesWeek 7 Strategic International HRMSuman Chaudhary100% (1)

- Mis IndividualDocument5 pagesMis IndividualSuman ChaudharyNo ratings yet

- Minicase Week ThreeDocument2 pagesMinicase Week ThreeSuman ChaudharyNo ratings yet

- The Fundamental Freedom To Trade by Edward L. HudginsDocument9 pagesThe Fundamental Freedom To Trade by Edward L. HudginsmirunelutuNo ratings yet

- MA1 Kit BPP 2016-1Document170 pagesMA1 Kit BPP 2016-1Muhammad Hassan UddinNo ratings yet

- Imc (Flexi) ReportDocument14 pagesImc (Flexi) ReportShrinidhiBhat100% (1)

- Financial Budget PlanDocument11 pagesFinancial Budget PlanApril Dawn DaepNo ratings yet

- Income Tax Volume 1 With CorrectionsDocument554 pagesIncome Tax Volume 1 With CorrectionsSourabh NagurkarNo ratings yet

- The Case of ABSDocument3 pagesThe Case of ABSRizzy Jane PacitoNo ratings yet

- PTP - Annual Operations PlanningDocument56 pagesPTP - Annual Operations Planningsasikiran mNo ratings yet

- Yuqipeng-Cv Updated 11-10-2020Document3 pagesYuqipeng-Cv Updated 11-10-2020api-506780939No ratings yet

- Teaching ProfessionDocument2 pagesTeaching ProfessionKi KhaiiNo ratings yet

- Summary of John SidgmoreDocument3 pagesSummary of John Sidgmorefarah tasnimNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/22Ruchira Sanket KaleNo ratings yet

- Demand-Pull Inflation & Cost-Push InflationDocument4 pagesDemand-Pull Inflation & Cost-Push InflationAlec Hope BuenaventuraNo ratings yet

- MGMT 026 Connect Chapter 6 Learnsmart HQDocument71 pagesMGMT 026 Connect Chapter 6 Learnsmart HQRashid V Mohammed100% (2)

- Business Ethics ReviewerDocument8 pagesBusiness Ethics ReviewerKc BaroNo ratings yet

- Holland & Knight, 2020) : Advertising-And-Marketing-CampaignsDocument1 pageHolland & Knight, 2020) : Advertising-And-Marketing-CampaignsAriannejoy ValerosNo ratings yet

- Banking Law NotesDocument8 pagesBanking Law NotesGeetika DhamaNo ratings yet

- Office Fit-Out GuideDocument4 pagesOffice Fit-Out Guidebulsemberutu100% (1)

- Empowering Payments: Digital India On The Path of RevolutionDocument39 pagesEmpowering Payments: Digital India On The Path of RevolutionRonica DashNo ratings yet

- Reviewer in Business LaaaawDocument10 pagesReviewer in Business LaaaawMaria Regina Luisa CambaNo ratings yet

- Standard Costing and Variance AnalysisDocument45 pagesStandard Costing and Variance AnalysisPrecious Ijeoma PeterNo ratings yet

- Tle-Ia-Eim: Quarter 1 - Module 2: Environment and Market (EM)Document22 pagesTle-Ia-Eim: Quarter 1 - Module 2: Environment and Market (EM)Joejen polacasNo ratings yet

- Shrem InvIT Investor Data Sheet Nov 23 2023Document40 pagesShrem InvIT Investor Data Sheet Nov 23 2023Amber GuptaNo ratings yet

- PDF Chapter 3 Test Bankk Creativity and Innovation - CompressDocument10 pagesPDF Chapter 3 Test Bankk Creativity and Innovation - CompressZNo ratings yet

- Internship ChoicesDocument8 pagesInternship Choicesannarosemel cruzNo ratings yet

- 081994GST 8-8-2018 PDFDocument18 pages081994GST 8-8-2018 PDFAKHILESH YADAVNo ratings yet

- 09 Economic History of India 1857 1947 30.7.2015Document4 pages09 Economic History of India 1857 1947 30.7.2015Rakesh GujralNo ratings yet

- ActivityDocument1 pageActivityNicole Kyle AsisNo ratings yet

- Global Optical CaseletDocument1 pageGlobal Optical Caseletchandan tiwariNo ratings yet

- Entrep Quiz No. 01Document2 pagesEntrep Quiz No. 01Roxan Binarao-BayotNo ratings yet