Professional Documents

Culture Documents

FIN620 Formulas

Uploaded by

Pinkera -Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN620 Formulas

Uploaded by

Pinkera -Copyright:

Available Formats

Chapter 11

Expected Return Prob. * Return

Portfolio (Ra*Wa)+(Rb*Wb)

Variance 1/n (Ra-E(R))2 + (Rb-E(R))2

Portfolio (Wa*σa)2 +(Wb*σb)2+2*(Wa*σa)*(Wb*σb)ρab p from -1.0 to +1.0 If p = +1.0, no risk reduction is possible

If p = –1.0, complete risk reduction is possible

Covariance (Ra-E(R)) * Prob. from -∞ to +∞ negative is better

Correlation Cov (a,b) / σa*σb from -1 to +1 negative is better

Return (R ) R+U

Regression Model Ri = αi + βiRm+ ei

Retrun on Market (Rm) Rf + Market Risk Premium(Rm-Rf)

Beta Cov (Ri, Rm) / σ2m >1 more voitaile e.g.: technology

>1 less voiltaile e.g.: food

CAPM Rf + βi(Rm-Rf)

Chapter 13

Cost of Equity/Expected Return Rf + βi(Rm-Rf)

Company's βi σ i,m / σ2m

Market Risk Premium - DDM (D1/p) + g

βAssets (D/ D+E * βDebt) + (E/ D+E * βEquity) F. Leverage increases βEquity compared to βAssets

Cost of Debt Interest rate/yeild to maturity adjusted for tax

Cost of Preferred Stocks RP = C / PV Not tax deductible

RWACC (S/(B+P+S))RS + (P/(B+P+S))RP + (B/(B+P+S))RD(1-TC)

New cost of a project Amount Raised = Necessary Proceeds / (1-% flotation cost)

fo (E/V)* fE + (D/V)* fD

1.Use Rwacc to get PVs, then initial NPV

To calculate the NPV for a project 2.Calculate fo, then total costs

considering floating costs 3.Calculate new NPV

Chapter 14

Abnormal Return (AR) R - RM

Chapter 16

MM Proposition I VL = VU W/o taxes

VL = VU + T *B T * B replace the PV of interst tax sheild w/ taxes

VU = EBIT * (1-T) / R0

RWACC (leveraged firm) (S/(B+S))RS + (B/(B+P+S))RD Share price when debt to be used to repurchase and we have 2 plans

MM Proposition II Rs=R0 + B/S × (R0 -RB) W/o taxes

Rs=R0 + B/S * (1-T)* (R0 -RB) w/ taxes

RWACC (leveraged firm) (S/(B+S))RS + (B/(B+S))RD*(1-tax)

Interest Tax Sheild T * RB * B

Chapter 19

Common Stocks no. of shares * par value

Surplus Account old surplus + increase in no. of shares * (price-par)

Retained Earnings Old RE - change in common stocks - change in surplus account

You might also like

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- CFA Level II Cheat Sheet: Equity Fixed IncomeDocument1 pageCFA Level II Cheat Sheet: Equity Fixed Incomeapi-19918095No ratings yet

- Equations From DamodaranDocument6 pagesEquations From DamodaranhimaggNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Physics RulesDocument19 pagesPhysics RulesAhmed GhanamNo ratings yet

- Exam 2 EquationsDocument1 pageExam 2 EquationsFatma SulaimanNo ratings yet

- Finance 2 Formula Sheet FinalDocument2 pagesFinance 2 Formula Sheet Final9bpj6qfyhwNo ratings yet

- Formula Sheet Mid-Term BUSI 3500Document2 pagesFormula Sheet Mid-Term BUSI 3500Michael RahmeNo ratings yet

- Cash Flow PV R CF PV RG: FCF NPV Initial T RDocument2 pagesCash Flow PV R CF PV RG: FCF NPV Initial T RMindaugas PinčiukovasNo ratings yet

- 26 - Summary of MafaDocument3 pages26 - Summary of Mafahina1234No ratings yet

- Formulas and ConceptsDocument7 pagesFormulas and Conceptscolen.anneNo ratings yet

- Risk and ReturnDocument19 pagesRisk and ReturnRaju SainiNo ratings yet

- Cost of Capital Calculation: Parameters SourceDocument1 pageCost of Capital Calculation: Parameters SourcearunsjainNo ratings yet

- Formula Sheet FMDocument3 pagesFormula Sheet FMAbdullah ShahNo ratings yet

- Cost of Capital TemplateDocument1 pageCost of Capital TemplatearunsjainNo ratings yet

- Wacc Calculation: Parameters SourceDocument1 pageWacc Calculation: Parameters SourcearunsjainNo ratings yet

- L 3 Formulasheetjune 2016 SampleDocument6 pagesL 3 Formulasheetjune 2016 Samplepier AcostaNo ratings yet

- RSM 333 Fall 2019 Formula SheetDocument2 pagesRSM 333 Fall 2019 Formula SheetJoe BobNo ratings yet

- FandI SubjACiD 200004 ExamreportDocument13 pagesFandI SubjACiD 200004 Examreportdickson phiriNo ratings yet

- Input: Frozen Foods Products: Cost of CapitalDocument12 pagesInput: Frozen Foods Products: Cost of CapitalSurya G.C.No ratings yet

- Formulae sheet: σ r a) 1 (r a r Document1 pageFormulae sheet: σ r a) 1 (r a r Linh NguyễnNo ratings yet

- Formula For Financial Market TheoryDocument6 pagesFormula For Financial Market TheoryHansNo ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- Job Information: Engineer Checked ApprovedDocument23 pagesJob Information: Engineer Checked ApprovedJaydeep PatelNo ratings yet

- Formula For Financial Market Theory AMENDEDDocument7 pagesFormula For Financial Market Theory AMENDEDHansNo ratings yet

- Formula SheetDocument2 pagesFormula SheetAnarghyaNo ratings yet

- Formula Sheet: Corporate Valuation Formula NoteDocument3 pagesFormula Sheet: Corporate Valuation Formula NoteYUDHA BASUKI 1506798831No ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Ross Formula - Card SheetDocument3 pagesRoss Formula - Card SheetkazadiratiNo ratings yet

- Analog Electronics: Op-Amp Circuits and Active FiltersDocument43 pagesAnalog Electronics: Op-Amp Circuits and Active FiltersSin SideNo ratings yet

- Formulae Sheet - 2017Document1 pageFormulae Sheet - 2017Kien HoangNo ratings yet

- Chapter - 9 - Op-Amp Basic CircuitDocument17 pagesChapter - 9 - Op-Amp Basic CircuitLiked my comments INo ratings yet

- Formula Sheet FinanceDocument2 pagesFormula Sheet Financemostafa daherNo ratings yet

- CFFM Formula Sheet 2017Document1 pageCFFM Formula Sheet 2017Thibault MHNo ratings yet

- Cse 7Document22 pagesCse 7jezreel gamboaNo ratings yet

- 24 Top Financial FormulasDocument1 page24 Top Financial FormulasNgọc Linh NguyễnNo ratings yet

- Exam Formula SheetDocument2 pagesExam Formula SheetYeji KimNo ratings yet

- L2-Formula SheetDocument4 pagesL2-Formula SheetShumaila FurqanNo ratings yet

- FormulaDocument2 pagesFormulamarwin73No ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- TMV Practice ProblemsDocument3 pagesTMV Practice ProblemsPrometheus SmithNo ratings yet

- Financial Market Analysis (Fmax) : "Asset Allocation and Diversification"Document52 pagesFinancial Market Analysis (Fmax) : "Asset Allocation and Diversification"Beka GurgenidzeNo ratings yet

- BFC5935 - Final Exam Information PDFDocument2 pagesBFC5935 - Final Exam Information PDFXue XuNo ratings yet

- FM Formula Sheet - Not GivenDocument4 pagesFM Formula Sheet - Not GivenSophie ChopraNo ratings yet

- GICE Govt Purchase IPIRATED IncomeDocument3 pagesGICE Govt Purchase IPIRATED IncomeChristy Boyd TurnerNo ratings yet

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Engineering Reference - Equations: Voltage Reflection Coefficient VSWR To RSLDocument5 pagesEngineering Reference - Equations: Voltage Reflection Coefficient VSWR To RSLanne_lizeNo ratings yet

- Formula SheetDocument7 pagesFormula SheetAbraham RodriguezNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- Appendix A: Formula Sheet: The Following Are Useful Formulae 1. Simple Interest FormulaDocument53 pagesAppendix A: Formula Sheet: The Following Are Useful Formulae 1. Simple Interest FormulasilentNo ratings yet

- FormulasDocument3 pagesFormulasДля ФігніNo ratings yet

- Financial Market AnalysisDocument52 pagesFinancial Market AnalysisSuad AbdulmajedNo ratings yet

- CF 12Document45 pagesCF 12pgdmhrm23sreyabNo ratings yet

- CF P R: Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate FinanceDocument4 pagesCF P R: Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate FinanceJoana MouraNo ratings yet

- FM Quick ReferencerDocument8 pagesFM Quick ReferencerDeep PatelNo ratings yet

- FormulasDocument20 pagesFormulasWilliam ZeNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasadssdasdsadNo ratings yet

- Reflective Reading 1 - Turning Crisis Into OpportunityDocument10 pagesReflective Reading 1 - Turning Crisis Into OpportunityyashitaNo ratings yet

- Assignments Topics SYBA A Indian EconomyDocument3 pagesAssignments Topics SYBA A Indian EconomyMohil DaveraNo ratings yet

- Quiz Paper Part A Mcqs (Answer Any 18)Document14 pagesQuiz Paper Part A Mcqs (Answer Any 18)Gobinda SubediNo ratings yet

- FIN221 Chapter 3Document45 pagesFIN221 Chapter 3jojojoNo ratings yet

- Contract To Sell Mr. AguilarDocument2 pagesContract To Sell Mr. AguilarMinnie VillafuerteNo ratings yet

- Akmpr7229l Partb 2022-23Document3 pagesAkmpr7229l Partb 2022-23BB StudioNo ratings yet

- Boon or BaneDocument2 pagesBoon or BaneLucifer RoxxNo ratings yet

- Compoun Interest New - 412310955Document21 pagesCompoun Interest New - 412310955Kathryn Santos50% (2)

- PV Grid-Tied Project MGMT & Economics PDFDocument79 pagesPV Grid-Tied Project MGMT & Economics PDFMohammed EL-bendaryNo ratings yet

- BGG Hansa Rule enDocument12 pagesBGG Hansa Rule enRafael Iglesias de la RochaNo ratings yet

- Nielsen India FMCG Snapshot - Q2'20 - DeckDocument23 pagesNielsen India FMCG Snapshot - Q2'20 - DeckAshish GandhiNo ratings yet

- What Is NS 5Tx5T?: Investment Universe, Process & StrategyDocument2 pagesWhat Is NS 5Tx5T?: Investment Universe, Process & StrategyBina ShahNo ratings yet

- Chapter 1 IntroductionDocument8 pagesChapter 1 IntroductionSachin MohalNo ratings yet

- BBYB - Annual Report - 2018Document271 pagesBBYB - Annual Report - 2018sofyanNo ratings yet

- Oil India LTD (OINL IN) - BBG AdjustedDocument16 pagesOil India LTD (OINL IN) - BBG AdjustedBhawna YadavNo ratings yet

- Good OutlineDocument76 pagesGood OutlineLizzy McEntire100% (1)

- Score:: Points %Document3 pagesScore:: Points %Ketan KulkarniNo ratings yet

- Spatial Access To Pedestrians and Retail Sales in Seoul, KoreaDocument11 pagesSpatial Access To Pedestrians and Retail Sales in Seoul, KoreaParth PasheklNo ratings yet

- Ba 623 Case AnalysisDocument8 pagesBa 623 Case AnalysisSarah Jane OrillosaNo ratings yet

- Lendingkart Review Top400Document81 pagesLendingkart Review Top400jituhero007No ratings yet

- Chapter 11Document25 pagesChapter 11Oliver TalipNo ratings yet

- Modeling Business DecisionDocument3 pagesModeling Business Decision7xdbbnnhqmNo ratings yet

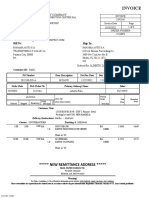

- Invoice: Hydraulic Supply CompanyDocument3 pagesInvoice: Hydraulic Supply CompanyIsaías GarcíaNo ratings yet

- Valucon M1-M2 Ppt-ReviewerDocument137 pagesValucon M1-M2 Ppt-ReviewerEarl De LeonNo ratings yet

- RPPT FinalDocument8 pagesRPPT FinalArpann DekaNo ratings yet

- Buckwold Tax Power Point Chapter 14Document24 pagesBuckwold Tax Power Point Chapter 14Tylor KimNo ratings yet

- Republic of Austria Investor Information PDFDocument48 pagesRepublic of Austria Investor Information PDFMi JpNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- 1539-Article Text-3127-2-10-20180430Document17 pages1539-Article Text-3127-2-10-20180430Juliany Helen Das GraçasNo ratings yet