Professional Documents

Culture Documents

Page 1 of 3 Islamic Naya Pakistan Certificates - February 2021

Uploaded by

MWBABAROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Page 1 of 3 Islamic Naya Pakistan Certificates - February 2021

Uploaded by

MWBABARCopyright:

Available Formats

MOST IMPORTANT DOCUMENT AND DEBIT AUTHORITY FORM

Islamic Naya Pakistan Certificates

Government of Pakistan (GOP) is the issuer and State Bank of Pakistan (SBP) is the primary custodian of Shariah

Compliant Islamic Naya Pakistan Certificates while Standard Chartered Bank (Pakistan) Limited (SCBPL) is only

acting as a distributor and sub custodian of these certificates in Pakistan.

I/We confirm that I/We have read and fully understood the information that is given below:

1. Islamic certificates are Shariah Compliant long-term and short-term profit bearing instruments with regular profit

payments and maturities as governed by SBP.

2. Government of Pakistan (GoP) Islamic Naya Pakistan Certificates have a fixed maturity date with a specified

tenor of Investment and have the following general characteristics:

Shariah Compliant Islamic Naya Pakistan Certificates are offered in FCY (Foreign

Product Currency) & LCY (Local Currency) denomination. These are securities issued by State

Bank of Pakistan on behalf of Government of Pakistan for Non-Resident Pakistanis.

3 months, 6 months, 12 months, 3 Years and 5 Years or any other tenor as notified by

Tenor

the regulator

EUR, GBP, USD and PKR or any other currency as notified by the regulator

EUR Certificates Min EUR 5,000 and EUR 1,000 multiples thereon

Currency of Issue GBP Certificates Min GBP 5,000 and GBP 1,000 multiples thereon

USD Certificates Min USD 5,000 and USD 1,000 multiples thereon

PKR Certificates Min PKR 100,000 and PKR 10,000 multiples thereon

As directed / announced by the regulator or governing body

Subject to Withholding tax of 10% currently and subject to change as per the regulator

Minimum 1 month holding period

Profit sharing ratio will be announced at the commencement of investment. Investors

share in the losses as well, if any. The following are the expected gross returns (before

deduction of tax). The rates below are only indicative in nature and actual returns are

dependent on performance of relevant currency pools.

Rate of Return

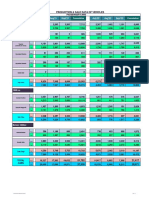

Tenor of EUR GBP USD PKR

Certificate Denominated Denominated Denominated Denominated

9.50% p.a.

3-Month 4.75% p.a. 5.25% p.a. 5.50% p.a.

10.00% p.a.

6-Month 5.00% p.a. 5.50% p.a. 6.00% p.a.

6.50% p.a.

10.50% p.a.

12-Month 5.25% p.a. 5.75% p.a.

Page 1 of 3 Islamic Naya Pakistan Certificates - February 2021

10.75% p.a.

3-Year 5.50% p.a. 6.25% p.a. 6.75% p.a.

11.00% p.a.

5-Year 5.75% p.a. 6.50% p.a. 7.00% p.a.

Encashment is allowed subject to rules laid down by the regulator. Request can be

placed online on the website.

Minimum holding period is one month. Encashment is allowed post this holding

period.

Encashment after one month & before three months Redeemed at a discounted

price by applying a discount on the announced profit rate for that category of

investor.

Encashment

After three months, profit rate of the nearest shorter tenor will be applied e.g. if a

thirty six month (3 year) INPC is prematurely encashed before 12 months, the

profit shall be calculated based on the weightages applicable to six month INPCs,

whereas the weightages applicable on 12 month INPCs shall be used if redeemed

after 12 months. The coupon payments earlier made based on the higher

weightages, shall be adjusted by applying appropriate discount on the repayment

price to ensure that the investor earn profit based on the weightages of the

nearest shorter completed period.

3. SCBPL shall not be held responsible in any manner including but not limited to, the customer(s), beneficiary or

any third party with respect to the returns/profit payment on the certificate. The performance of the investment is

ability to meet its financial obligations and the risk of an investment in a foreign currency

is likely to be higher due to currency movements. All currency risk will be borne by the customer.

4. Deal Confirmation / acknowledgement will be emailed by the bank generally within one week of the deal

settlement on the email address as per the account details.

5. I/We understand and agree that all decisions to purchase the Islamic Naya Pakistan Certificates are my/our own

and are based on my/our independent assessment of the risk associated with investing in these instruments,

including but not limited to issuer risk, sovereign risk and market risk. The decision to invest is in no way reliant on

any advice received from the Bank or any of its affiliates.

6. I/We confirm that the funds will be available in my/our account with Saadiq Standard Chartered Bank (Pakistan)

Limited at the time of investment (purchase) in Islamic Naya Pakistan Certificates.

7. The investment is subject to the deduction of Withholding Tax as per prevailing Tax Laws. SCBPL, as a

distribution agent, would have no responsibility to deduct / withhold tax as this responsibility lies with the profit

payer (in this case SBP) and the tax liability is of the profit receiver (in this case customer). O

SCBPL will provide the copy of the tax challan, if issued by SBP, in this regard.

Page 2 of 3 Naya Pakistan Islamic Certificates - February 2021

8. I Islamic Schedule of Charges

(SOC) along with any Government Charges / Levies from the encashment value / profit of the Naya Pakistan

Certificates or from my / our account.

9. Standard Chartered Bank Pakistan Limited has the right to approve or reject any deal without giving any reason

whatsoever.

10. I/We understand that any information, explanation or other communication by SCBPL shall not be construed

as an investment advice or recommendation to enter into that transaction and that no advisory or fiduciary

relationship exists between SCBPL and me/us.

11. Standard Chartered Bank Pakistan Limited will provide activity statements for my/our IPS account on monthly

basis on email.

12. Islamic Naya Pakistan Certificates are being offered by Saadiq Standard Chartered Bank Pakistan Limited for

investment purpose and an investor should make his/her own appraisal of the investment opportunity and consult

his/her own financial, legal, tax and other professional advisors prior to the investment decision.

13. The Bank reserves the right to share, at its discretion, any information it may have regarding my/our personal

details and/or banking history, with the State Bank of Pakistan or any authorized agency as per Pakistan law.

14. I/We understand that bank may share my/our personal and banking details with SCB Group member/office,

affiliates, agents etc within or outside Pakistan.

15. I/We confirm that I/We am/are not a US Person, do not reside in United States of America or hold a Green

Card.

16. I

as per any of my/our know your customer (KYC) documents.

17. I/We confirm that I/We am/are not a resident of the following countries in the European Economic Area (EEA),

Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France,

Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta,

Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the UK.

18. I/We confirm that I/We have read and understood the return mechanism as described by SBP.

19. In case of any grievances, queries or suggestions regarding the product, Kindly:

i. Call 111-002-002

ii. Visit www.sc.com/pk

iii. Email complaints.pakistan@sc.com

iv. Email rdasupport@sbp.org.pk

Page 3 of 3 Naya Pakistan Islamic Certificates - February 2021

February 2021

February 2021

February 2021

You might also like

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- Group Members:: Comparison Between Bank AL Habib & Habib Metro BankDocument13 pagesGroup Members:: Comparison Between Bank AL Habib & Habib Metro BankAbbas AliNo ratings yet

- Interest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresSumanyuSoodNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRajender Singh DeepakNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- Savings & fixed deposit rates at a glanceDocument3 pagesSavings & fixed deposit rates at a glancesaiaviNo ratings yet

- Individual Deposit MUDARABADocument6 pagesIndividual Deposit MUDARABASyed Sadiq HussainNo ratings yet

- Fixed Deposit Interest RatesDocument2 pagesFixed Deposit Interest Ratessasi 'sNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- PBC FaqDocument7 pagesPBC FaqMuhammad AsifNo ratings yet

- Money and Banking Project - Soneri BankDocument29 pagesMoney and Banking Project - Soneri Banklushcheese100% (8)

- Soneri Bank Managment ProjectDocument29 pagesSoneri Bank Managment ProjectAamir Raza100% (3)

- Faqs of Islamic Naya Pakistan Certificates (Inpcs)Document3 pagesFaqs of Islamic Naya Pakistan Certificates (Inpcs)Ajmal AfzalNo ratings yet

- Interest Rates For Recurring Deposits 2023 GDFCDocument1 pageInterest Rates For Recurring Deposits 2023 GDFCRakshith Rahul BNo ratings yet

- Commercial Banking Assignment: Analysis of Assets and Liabilities of A BankDocument15 pagesCommercial Banking Assignment: Analysis of Assets and Liabilities of A BankAyaz QaiserNo ratings yet

- PNB Housing: Harvest Great Returns, Assured and SafeDocument6 pagesPNB Housing: Harvest Great Returns, Assured and Safeshahid2opuNo ratings yet

- Interest Rates on Deposits & Advances at IDFC FIRST BankDocument4 pagesInterest Rates on Deposits & Advances at IDFC FIRST BankRavi KumarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- What Are FMPS??: Fixed Maturity Plans (FMPS) Are Back in VogueDocument2 pagesWhat Are FMPS??: Fixed Maturity Plans (FMPS) Are Back in VogueShravan KumarNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularPrashantGuptaNo ratings yet

- EOC08 UpdatedDocument25 pagesEOC08 Updatedtaha elbakkushNo ratings yet

- Faqs of Islamic Naya Pakistan Certificates (Inpcs)Document2 pagesFaqs of Islamic Naya Pakistan Certificates (Inpcs)Ahmed NiazNo ratings yet

- NBP Aitemaad - Islamic Banking Product Key Fact Statement: Profit / Linked AccountDocument2 pagesNBP Aitemaad - Islamic Banking Product Key Fact Statement: Profit / Linked AccountGhulam HabibNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailAlok GoyalNo ratings yet

- Interest rates on deposits and loansDocument4 pagesInterest rates on deposits and loansShanawaz KhanNo ratings yet

- Fee & InterestDocument1 pageFee & InterestAlex KimboiNo ratings yet

- EOC08 EdittedDocument12 pagesEOC08 EdittedFilip velico100% (1)

- FD Interest RatesDocument2 pagesFD Interest RatesHimanshu MilanNo ratings yet

- Fixed Deposit Plus Rates W e F May 2023Document1 pageFixed Deposit Plus Rates W e F May 2023saurav katarukaNo ratings yet

- PDS - Personal Financing-I (Eng)Document3 pagesPDS - Personal Financing-I (Eng)Muhammad TaqiyuddinNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- SC Eoc08Document25 pagesSC Eoc08vanessagreco17No ratings yet

- State Bank of India: Play On Economic Recovery Buy MaintainedDocument4 pagesState Bank of India: Play On Economic Recovery Buy MaintainedPaul GeorgeNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- RevisionInterestRates CircularDocument4 pagesRevisionInterestRates CircularNishantNo ratings yet

- Dubai Islamic BankDocument3 pagesDubai Islamic Bankumair20062010100% (1)

- Interest Rate RetailDocument4 pagesInterest Rate RetailManvith B YNo ratings yet

- Lecture 3 - Valuation of Fixed Income Securities (II)Document13 pagesLecture 3 - Valuation of Fixed Income Securities (II)Samad HussainNo ratings yet

- Screenshot 2023-07-02 at 11.14.42 PMDocument6 pagesScreenshot 2023-07-02 at 11.14.42 PMUttam JaiswalNo ratings yet

- Bank IslamiDocument2 pagesBank IslamiShayan AhmedNo ratings yet

- HDFC FD PDFDocument2 pagesHDFC FD PDFghesiaNo ratings yet

- Banking and Insurance of BangladeshDocument25 pagesBanking and Insurance of BangladeshAbul HasnatNo ratings yet

- Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesCard Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croressatyajit_manna_2No ratings yet

- Changes to interest rates on Fixed Deposits and Savings AccountsDocument5 pagesChanges to interest rates on Fixed Deposits and Savings AccountsK NkNo ratings yet

- Terms and Conditions for Trading Plans and Brokerage RatesDocument2 pagesTerms and Conditions for Trading Plans and Brokerage RatesHrishiNo ratings yet

- CIMB Islamic Sukuk Fund PerformanceDocument2 pagesCIMB Islamic Sukuk Fund PerformanceAbdul-Wahab Abdul-HamidNo ratings yet

- CFA Chapter 15 Problems SolutionsDocument5 pagesCFA Chapter 15 Problems SolutionsFagbola Oluwatobi OmolajaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsAkhilesh VijayaKumarNo ratings yet

- Bank PresentationDocument5 pagesBank Presentationujjawalapawar49No ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Understanding Variable Speed Drives: Basic VFD TheoryDocument7 pagesUnderstanding Variable Speed Drives: Basic VFD TheorynikecerreroNo ratings yet

- Report 2022-psx StocksDocument106 pagesReport 2022-psx StocksMWBABARNo ratings yet

- Production Sales September 2022Document4 pagesProduction Sales September 2022MWBABARNo ratings yet

- Production-Sales-Automobile PakistanDocument4 pagesProduction-Sales-Automobile PakistanMWBABARNo ratings yet

- PK Ips Terms Conditions SaadiqDocument1 pagePK Ips Terms Conditions SaadiqMWBABARNo ratings yet

- Category Control ValvesDocument1 pageCategory Control ValvesMWBABARNo ratings yet

- Securities and Exchange Commission of Pakistan: Form 45Document1 pageSecurities and Exchange Commission of Pakistan: Form 45MWBABARNo ratings yet

- Labor LawDocument93 pagesLabor LawYASIRNo ratings yet

- The Safety Lifecycle As A Risk Control LoopDocument1 pageThe Safety Lifecycle As A Risk Control LoopMWBABARNo ratings yet

- Production Wellsite Packages PL WebDocument4 pagesProduction Wellsite Packages PL WebMWBABARNo ratings yet

- Profit Rates July 2019Document3 pagesProfit Rates July 2019MWBABARNo ratings yet

- ATS OverlappingDocument4 pagesATS Overlappingcosmin75No ratings yet

- Grounding Separately Derived Alternating-Current Systems and 3 4 Pole SwitchingDocument16 pagesGrounding Separately Derived Alternating-Current Systems and 3 4 Pole SwitchingMWBABARNo ratings yet

- Planning and Designing GDSDocument7 pagesPlanning and Designing GDSMWBABARNo ratings yet

- Grounding Separately Derived Alternating-Current Systems and 3 4 Pole SwitchingDocument16 pagesGrounding Separately Derived Alternating-Current Systems and 3 4 Pole SwitchingMWBABARNo ratings yet

- Why You QuestionDocument1 pageWhy You QuestionMWBABARNo ratings yet

- AIS vs GIS Design Standards ComparisonDocument1 pageAIS vs GIS Design Standards ComparisonMWBABARNo ratings yet

- Field InstrumentationDocument85 pagesField InstrumentationSavana Prasanth100% (3)

- ATS OverviewDocument13 pagesATS OverviewPaul PkNo ratings yet

- Plant-Air Compressor PDFDocument20 pagesPlant-Air Compressor PDFGabriel Andres ValenciaNo ratings yet

- Calculation of Flow Rate From Differential Pressure Devices - Orifice PlatesDocument26 pagesCalculation of Flow Rate From Differential Pressure Devices - Orifice Platesamirreza_eng3411No ratings yet

- 1q07 Field Wiring PDFDocument8 pages1q07 Field Wiring PDFMWBABARNo ratings yet

- Article Ultrasonic Gas Leak Detection Your First Line of Defense en 1623540Document2 pagesArticle Ultrasonic Gas Leak Detection Your First Line of Defense en 1623540MWBABARNo ratings yet

- Actual Vs Installed KvarDocument3 pagesActual Vs Installed KvarMWBABARNo ratings yet

- Product Drawing: Customer Project Tag No. Unit Description of Service Location PID No./Line NumberDocument6 pagesProduct Drawing: Customer Project Tag No. Unit Description of Service Location PID No./Line NumberMWBABARNo ratings yet

- Actual Vs Installed KvarDocument3 pagesActual Vs Installed KvarMWBABARNo ratings yet

- Crystal Reports - Arc-Flash Look-Up TableDocument8 pagesCrystal Reports - Arc-Flash Look-Up TableMWBABARNo ratings yet

- ToolkitReport CalculationDocument1 pageToolkitReport CalculationMWBABARNo ratings yet

- Fisher Specification Manager User ManualDocument28 pagesFisher Specification Manager User Manualtareq.sefatNo ratings yet

- The Following Question Illustrates The Apt Imagine That There ADocument1 pageThe Following Question Illustrates The Apt Imagine That There AAmit PandeyNo ratings yet

- Currency PairsDocument9 pagesCurrency PairsyousufNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 8Document4 pagesAccountancy Notes PDF Class 11 Chapter 8Rishi ShibdatNo ratings yet

- The Pizza Theory of Business ValuationDocument3 pagesThe Pizza Theory of Business ValuationBharat SahniNo ratings yet

- Collection of Short Stories and Poems From The African WritersDocument46 pagesCollection of Short Stories and Poems From The African WritersLauraSantosNo ratings yet

- Condies Organisation Chart - June 2016 - Losing Nearly All Partners and Staff Within 6 YearsDocument1 pageCondies Organisation Chart - June 2016 - Losing Nearly All Partners and Staff Within 6 Yearstjacmg4qqs6gr6sbdvoNo ratings yet

- SAT exam instructions and questionsDocument11 pagesSAT exam instructions and questionskrishnaNo ratings yet

- Ethical Issues in Wells Fargo: Business EthicsDocument12 pagesEthical Issues in Wells Fargo: Business EthicsramneetNo ratings yet

- Aee Gs EnglishDocument64 pagesAee Gs EnglishNaveen Kumar Reddy YelugotiNo ratings yet

- Capital BudgetingDocument27 pagesCapital BudgetingDilu - SNo ratings yet

- In The Event of Coming Up With Edition of Principles & Practices of BANKING We Have Made Following Changes in The Edition BookDocument21 pagesIn The Event of Coming Up With Edition of Principles & Practices of BANKING We Have Made Following Changes in The Edition BookdhirajNo ratings yet

- Saatchi & Saatchi Case Study: How the Balanced Scorecard Drove StrategyDocument6 pagesSaatchi & Saatchi Case Study: How the Balanced Scorecard Drove StrategyVenkat KonakandlaNo ratings yet

- ENTREPRENEURSHIP FINALS - 2018-19.docx Version 1Document4 pagesENTREPRENEURSHIP FINALS - 2018-19.docx Version 1Gerby Godinez100% (1)

- Acc407 Quiz 1 Introduction To Accounting (Question)Document7 pagesAcc407 Quiz 1 Introduction To Accounting (Question)Tuan AinnurNo ratings yet

- Loan Loss ProvisionDocument8 pagesLoan Loss ProvisionbinuNo ratings yet

- NGANIEANGDER KÝ THUONG VI£T NAM Chihanb Braneh bEOTCB LAC LONG QUANDocument1 pageNGANIEANGDER KÝ THUONG VI£T NAM Chihanb Braneh bEOTCB LAC LONG QUANĐào Văn CườngNo ratings yet

- Merger of Narmada Cement LTD With Ultratech Cements LTDDocument10 pagesMerger of Narmada Cement LTD With Ultratech Cements LTDnhsurekaNo ratings yet

- Sample General Power of AttorneyDocument3 pagesSample General Power of AttorneyFLASHDRIVERNo ratings yet

- The 2014 Big Four Firms Performance Analysis Big4.Com Jan 2015Document34 pagesThe 2014 Big Four Firms Performance Analysis Big4.Com Jan 2015avinash_usa2003No ratings yet

- Business Partnership AgreementDocument6 pagesBusiness Partnership AgreementNigil josephNo ratings yet

- NM de 08102016Document16 pagesNM de 08102016Md Rasel Uddin ACMANo ratings yet

- Ckyc & Kra Kyc FormDocument27 pagesCkyc & Kra Kyc FormPerumal SNo ratings yet

- Types of CostingDocument20 pagesTypes of Costingavdhoot7100% (1)

- Evaluating Internal Audit PerformanceDocument92 pagesEvaluating Internal Audit Performancenisrina jaesaNo ratings yet

- CapstoneDocument29 pagesCapstonelajjo1230% (1)

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportDocument34 pagesIFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportWubneh AlemuNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Aimen AhmedNo ratings yet

- Question bank-BBA 208-Income Tax by Dr. Preeti JindalDocument2 pagesQuestion bank-BBA 208-Income Tax by Dr. Preeti JindalDrPreeti JindalNo ratings yet

- Personal Financial StatementDocument1 pagePersonal Financial StatementCenon Alipante Turiano Jr.No ratings yet