Professional Documents

Culture Documents

Case Study: Tata Motors JLR - A Two-Edged Sword

Uploaded by

Dipanjan RayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study: Tata Motors JLR - A Two-Edged Sword

Uploaded by

Dipanjan RayCopyright:

Available Formats

Case Study: Tata Motors JLR - a two-edged sword.

History was made in March 2008 when one of India’s top corporate entities, Tata Motors

acquired luxury auto brands -- Jaguar and Land Rover (JLR) from Ford Motor for $2.3 billion,

imprinting their specialty as a takeover magnate.

Beating Mahindra and Mahindra for the prestigious brands, just a year after acquiring steel giant

Corus for $12.1 billion, the Tata signed the deal with Ford, which on its part chipped in with

$600 million towards JLR’s pension plan.

Acquisition of JLR by Tata was one of the rarest cases of an Indian Company acquiring luxury

brands. It was a very risky acquisition since JLR had been wobbling in the market and surviving

on the edge. Tata had to invest a lot in the brand to make it stand out once again. The biggest

reason behind Tata acquiring JLR was that it wanted to decrease their dependency on the Indian

market which accounted for more than 90 % of its sales.

Tata raised USD 3 billion (Rs 12000 crores) through bridge loans for 15 months from different

banks including JP Morgan and SBI as they were facing a cash crisis due to Corus deal and

heavy investments in TATA NANO Project back home.

What led to FORD selling off JLR?

Ford bought Jaguar from British Leyland Ltd. in 1989 for USD 2.5 billion and Land Rover for

USD 2.7 billion in May 2000. As market conditions toughened in the 90s and people stopped

buying luxury cars, they went through a rough phase. However, in 1999, Ford established a

PAG (Premier Automotive Group) which included Jaguar, Aston Martin and Lincoln. Volvo

soon entered this PAG. But they had to dismantle the PAG in 2006 and sell Aston Martin for

USD 931 million. JLR was next in the line and they showed all their intentions to put JLR on

the market.

Benefits to TATA

1. Less dependency on the Indian Market and an increased share in the Global Market.

2. Their range diversifying from India’s cheapest car to luxury brands.

3. Access to latest technology which came along with JLR.

4. Cost Competitive Advantage as Corus supplied steel to JLR as TATA had already clocked a

deal with them.

TATA- JLR deal--- Profit or Loss?

As per Morgan Stanley’s report, this deal was a loss for TATA. They had to put in extra USD 1

billion as capital expenditure in JLR to go with USD 2.3 billion they had already given. Since

they were investing a huge amount in TATA NANO project too, it was adding up to their costs

as well. Their worldwide car sales also took a hit and decreased by 5 %. TATA lost USD 517

million in their Indian operations in March 2009 and lost additional USD 510 million on JLR.

However, if TATA had not acquired JLR, they would not have been able to enter the luxury cars

segment and they would have lost on amazing technology of JLR too. Moreover, sooner or later,

global market would have risen from recession and value of JLR would have increased.

Current situation

Initially JLR has performed strongly after the merger and was slowly and steadily repaying

TATA’s immense faith in its name and reputation.

On June 15, 2020 JLR reported a drop in its sale figure for fourth quarter and financial year

ended March 31st, 2020 due to corona virus pandemic. The luxury carmaker said the pandemic

"significantly impacted" its projections for 2019-20, with fourth quarter retail sales down 30.9

per cent and full year sale lower 12.1 percent. Since year 2014-15, JLR is facing problems and

its sales is reducing throughout the globe.

Tata Motors suffered consolidated fourth quarter net loss of 98.94 billion rupees, as coronavirus

lockdown across its markets weakened sales, including at JLR. Its total sales of passenger

vehicles for financial year 2019-20 is 38% less than financial year 2018-19 and total sales of

commercial vehicles is 34% less in comparison to financial year 2018-19. Tata Motors’ losses

mount, with sluggish sales in China and Brexit adding to its woes.

Tata Motors is reviewing all its businesses, revising its investments and working capital and the

company has also launched inventory correction programme. During the time of corona virus

pandemic, company has laid off 1100 employees as it is focusing on cost cutting. JLR deal is not

proving to be very good for the company in year 2020. JLR is like two-edged sword for Tata

Motors. If JLR performs well, Tata Motors earn its profit nearer to 80% from JLR. When JLR

doesn’t perform well, in that situation most of the loss of Tata Motors is from JLR.

In the past, the company has launched few vehicles, but they did not perform well. Due to this

Tata Motor’s survival is getting difficult. The company is struggling for profits in the last few

years, in fact the company suffered huge losses of 28,826 crores in year 2019. Apart from losses,

the company has taken huge debt nearing one lakh crore. The situation of the company is grim in

2020.

Let’s foresee, what strong decisions Tata Motors would take in the next couple of years

especially related to JLR so that it stays strong.

Case Questions

Q1. Why did Ford Motors fail to keep JLR afloat?

Q2. How did acquisition of JLR provide TATA with cost competitive advantage?

Q3. Do you think Tata motors extended restructuring program, will lead to an improvement in

its performance?

You might also like

- What Led To FORD Selling Off JLR?Document2 pagesWhat Led To FORD Selling Off JLR?Nitish MishraNo ratings yet

- Tata JLR Acquisition - A Two-Edged SwordDocument13 pagesTata JLR Acquisition - A Two-Edged SwordNitish MishraNo ratings yet

- Case Study: Tata Motors JLR - A Two-Edged SwordDocument12 pagesCase Study: Tata Motors JLR - A Two-Edged SwordVidushi ThapliyalNo ratings yet

- Case Study on TATA Motors' Acquisition of Jaguar and Land RoverDocument8 pagesCase Study on TATA Motors' Acquisition of Jaguar and Land RoverChe Tanifor BanksNo ratings yet

- Tata Motors acquires Jaguar Land Rover from FordDocument12 pagesTata Motors acquires Jaguar Land Rover from Fordbhumikasem1No ratings yet

- Unit No. 1 - Case study-TATADocument3 pagesUnit No. 1 - Case study-TATAAdvait DalviNo ratings yet

- Case Study: Tata - JLR Deal (Jaguar Land Rover Acquisition by Tata Motors)Document25 pagesCase Study: Tata - JLR Deal (Jaguar Land Rover Acquisition by Tata Motors)Pratik Prakash BhosaleNo ratings yet

- Tata's Jaguar Deal Worries AnalystsDocument5 pagesTata's Jaguar Deal Worries AnalystsDeepak TiwariNo ratings yet

- Tata and Jagur MargerDocument4 pagesTata and Jagur Margertrilokrarotia7656No ratings yet

- Tata Group Case StudyDocument16 pagesTata Group Case StudyAshish DeoliNo ratings yet

- Amalgamation of Tata Motor With JaguarDocument8 pagesAmalgamation of Tata Motor With JaguarMohd sakib hasan qadriNo ratings yet

- TATA AcquisitionDocument4 pagesTATA AcquisitionAashima GuptaNo ratings yet

- Tata's Post-Merger Success With Jaguar Land RoverDocument19 pagesTata's Post-Merger Success With Jaguar Land Roversibubanerjee100% (3)

- Tata Motors' Acquisition of Jaguar and Land Rover: IntroductionDocument5 pagesTata Motors' Acquisition of Jaguar and Land Rover: IntroductionPallavi GuptaNo ratings yet

- DMUO - Teaching NotesDocument9 pagesDMUO - Teaching NotespankajsyalNo ratings yet

- Merger and Acquisition Ca2Document6 pagesMerger and Acquisition Ca2Uzumaki NarutoNo ratings yet

- Tata JLR Case StudyDocument11 pagesTata JLR Case Studytom george100% (1)

- Post Acquisition Scenario of Tata Motors An OverviewDocument20 pagesPost Acquisition Scenario of Tata Motors An OverviewArun SinghNo ratings yet

- Tata Motors' Acquisition of Iconic British Brands Jaguar and Land RoverDocument2 pagesTata Motors' Acquisition of Iconic British Brands Jaguar and Land Roverrhemrajani793960% (10)

- Group 4 - TATA JLR DealDocument22 pagesGroup 4 - TATA JLR DealXyz YxzNo ratings yet

- Case Study: Tata Motors JLR - A Two-Edged SwordDocument1 pageCase Study: Tata Motors JLR - A Two-Edged SwordNitish MishraNo ratings yet

- Case StudyDocument3 pagesCase StudyprateekkapNo ratings yet

- Tata - JLRDocument30 pagesTata - JLRpurval1611100% (3)

- Pre-Merger Due Diligence:: Tata-JLR DealDocument12 pagesPre-Merger Due Diligence:: Tata-JLR DealStephen JohnsonNo ratings yet

- 3 DR Seema Laddha PDFDocument5 pages3 DR Seema Laddha PDFBinaya PradhanNo ratings yet

- About Tata Motors: Reasons For AcquisitionDocument6 pagesAbout Tata Motors: Reasons For AcquisitionApurva GuptaNo ratings yet

- Tata JLR Case StudyDocument11 pagesTata JLR Case StudyRaviNo ratings yet

- TATA JLR DealDocument8 pagesTATA JLR DealUmang ThakerNo ratings yet

- Business Problem Related To Mergers and Acquisition: Case Study of Acquisition of Jaguar and Land Rover by Tata MotorsDocument7 pagesBusiness Problem Related To Mergers and Acquisition: Case Study of Acquisition of Jaguar and Land Rover by Tata MotorsDarshan DhawareNo ratings yet

- TATA Jaguar and LandRover AcquisitionDocument4 pagesTATA Jaguar and LandRover AcquisitionSubhangkar DasNo ratings yet

- Cross-Country Merger and Acquisition - Sell-Off - Jaguar and Land RoverDocument7 pagesCross-Country Merger and Acquisition - Sell-Off - Jaguar and Land RoverSatish ChauhanNo ratings yet

- TATA JLR Deal Group 4Document12 pagesTATA JLR Deal Group 4Xyz YxzNo ratings yet

- Tata Group Buys Jaguar Land RoverDocument17 pagesTata Group Buys Jaguar Land RoverShubh ShrivastavaNo ratings yet

- Tata Jaguar - Amit and AmritDocument22 pagesTata Jaguar - Amit and AmritTaruna JunejaNo ratings yet

- Merger of TLJDocument23 pagesMerger of TLJvijay2512No ratings yet

- Tata MotorsDocument3 pagesTata MotorsBasudev SubediNo ratings yet

- Tata Motors' Acquisition of Jaguar Land RoverDocument9 pagesTata Motors' Acquisition of Jaguar Land RoverziaeceNo ratings yet

- M&A PresentationDocument25 pagesM&A PresentationDaniel PedrosaNo ratings yet

- Tata MotorsDocument22 pagesTata Motorsnamangupta010904No ratings yet

- Tata Motors' Acquisition of Jaguar Land RoverDocument9 pagesTata Motors' Acquisition of Jaguar Land Roverajinkya8400No ratings yet

- Global auto consolidation and Tata Motors' expansionDocument10 pagesGlobal auto consolidation and Tata Motors' expansionzaffireNo ratings yet

- EntrepreneurshipDocument16 pagesEntrepreneurshipHyder HussainNo ratings yet

- News ArticlesDocument20 pagesNews ArticlesPriya GoyalNo ratings yet

- Bav 8Document22 pagesBav 8namangupta010904No ratings yet

- The Royal Bank of Scotland Takeover of ABNDocument76 pagesThe Royal Bank of Scotland Takeover of ABNMarmik SoniNo ratings yet

- SM PV-2Document13 pagesSM PV-2Marrapu VijayNo ratings yet

- Tata's $2.3 Billion Acquisition of Jaguar and Land Rover from FordDocument17 pagesTata's $2.3 Billion Acquisition of Jaguar and Land Rover from Fordsulabhsingh85No ratings yet

- Merger & Acquisition: Presented ByDocument21 pagesMerger & Acquisition: Presented ByHardik A SondagarNo ratings yet

- JLR Acquisition Structure and FinancingDocument34 pagesJLR Acquisition Structure and Financingpanchashil_dawareNo ratings yet

- Merger and Acquisition AssignmentDocument11 pagesMerger and Acquisition AssignmentKuumaar AayushNo ratings yet

- CASE STUDY: Tata Motors Acquisition of Jaguar and Land Rover in 2008Document7 pagesCASE STUDY: Tata Motors Acquisition of Jaguar and Land Rover in 2008VincentMBANo ratings yet

- Jaguar Report Case StudyDocument23 pagesJaguar Report Case StudyAkshay JoshiNo ratings yet

- Automobile Industry in IndiaDocument13 pagesAutomobile Industry in IndiaKarishma GuptaNo ratings yet

- Jewels in the Crown: How Tata of India Transformed Britain's Jaguar and Land RoverFrom EverandJewels in the Crown: How Tata of India Transformed Britain's Jaguar and Land RoverRating: 5 out of 5 stars5/5 (1)

- Comeback: The Fall & Rise of the American Automobile IndustryFrom EverandComeback: The Fall & Rise of the American Automobile IndustryRating: 4.5 out of 5 stars4.5/5 (4)

- My Years with General Motors (Review and Analysis of Sloan Jr.'s Book)From EverandMy Years with General Motors (Review and Analysis of Sloan Jr.'s Book)Rating: 5 out of 5 stars5/5 (1)

- How Toyota Became #1 (Review and Analysis of Magee's Book)From EverandHow Toyota Became #1 (Review and Analysis of Magee's Book)No ratings yet

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- FY20 NIKE Inc Impact Report2Document125 pagesFY20 NIKE Inc Impact Report2Dipanjan RayNo ratings yet

- Tableau DIY BDCSDocument12 pagesTableau DIY BDCSHARSHITANo ratings yet

- Sample Superstore Subset ExcelDocument1,100 pagesSample Superstore Subset Excelamer_wahNo ratings yet

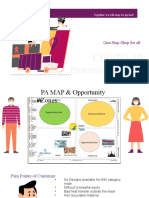

- Store Design FinalDocument14 pagesStore Design FinalDipanjan RayNo ratings yet

- Re Edited RM Group 2Document13 pagesRe Edited RM Group 2Dipanjan RayNo ratings yet

- Store Design FinalDocument14 pagesStore Design FinalDipanjan RayNo ratings yet

- MBM Prof - Joffi Thomas Course Outline PGPBL02Document6 pagesMBM Prof - Joffi Thomas Course Outline PGPBL02Dipanjan RayNo ratings yet

- MBM Project Exercise 2 - Understanding Value Proposition of A BM Offering To aTGDocument2 pagesMBM Project Exercise 2 - Understanding Value Proposition of A BM Offering To aTGDipanjan RayNo ratings yet

- DBST Project GuidelineDocument2 pagesDBST Project GuidelineDipanjan RayNo ratings yet

- ITC Complete AnalysisDocument58 pagesITC Complete AnalysisDipanjan RayNo ratings yet

- Paired T TestDocument2 pagesPaired T TestDipanjan RayNo ratings yet

- What Were The Challenges in Creating A New Online Vertical in Furniture?Document1 pageWhat Were The Challenges in Creating A New Online Vertical in Furniture?Dipanjan RayNo ratings yet

- Analysis of VarianceDocument2 pagesAnalysis of VarianceDipanjan RayNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- Audit ScheduleDocument3 pagesAudit ScheduleQuality ManNo ratings yet

- The Isis Engineering Company Operates A Job Order Costing System WhichDocument2 pagesThe Isis Engineering Company Operates A Job Order Costing System WhichAmit PandeyNo ratings yet

- ASE20091 April 2016 Examiner ReportDocument7 pagesASE20091 April 2016 Examiner ReportTin Zar ThweNo ratings yet

- Digital Marketing Campaign Plan For Lloyds BankDocument23 pagesDigital Marketing Campaign Plan For Lloyds BankOkikioluwa FajemirokunNo ratings yet

- A Study The Compatative of Income Tax For Partnership Firm With Reference To KDMC AreaDocument49 pagesA Study The Compatative of Income Tax For Partnership Firm With Reference To KDMC AreaTasmay EnterprisesNo ratings yet

- MCQ in Engineering Economics Part 2 ECE Board ExamDocument17 pagesMCQ in Engineering Economics Part 2 ECE Board ExamEj ParañalNo ratings yet

- E Verify FaqsDocument4 pagesE Verify FaqsMuhammad Aulia RahmanNo ratings yet

- Business Advantages and DisadvantagesDocument2 pagesBusiness Advantages and DisadvantagesTYA HERYANINo ratings yet

- Retention Strategies To Control Attrition Rate With Special Reference To BPO SectorDocument5 pagesRetention Strategies To Control Attrition Rate With Special Reference To BPO SectorInternational Journal in Management Research and Social ScienceNo ratings yet

- Deloitte NL Risk Sdgs From A Business PerspectiveDocument51 pagesDeloitte NL Risk Sdgs From A Business PerspectiveAshraf ChowdhuryNo ratings yet

- Multiple Choice Problems ChapterDocument1 pageMultiple Choice Problems ChapterJohn Carlos Doringo100% (1)

- Tata Motors Group Corporate Presentation 2023Document46 pagesTata Motors Group Corporate Presentation 2023Vikram KatariaNo ratings yet

- Quality Assurance ProcedureDocument6 pagesQuality Assurance ProcedureTrivesh Sharma100% (1)

- AUD 2 Audit of Cash and Cash EquivalentDocument14 pagesAUD 2 Audit of Cash and Cash EquivalentJayron NonguiNo ratings yet

- Internal Control and Control Risk HandoutsDocument38 pagesInternal Control and Control Risk Handoutsumar shahzadNo ratings yet

- Urban Ladder - Case StudyDocument31 pagesUrban Ladder - Case StudyUtkarsh Gupta100% (1)

- Loading AU Calculation Cards Using HCM Data LoaderDocument45 pagesLoading AU Calculation Cards Using HCM Data Loadersachanpreeti100% (1)

- GaGoBaTu Law Firm Partnership AgreementDocument4 pagesGaGoBaTu Law Firm Partnership AgreementHomer SimpsonNo ratings yet

- Assurance Certificate LevelDocument76 pagesAssurance Certificate Levelrubel khan100% (4)

- UAE-All Companies Addresses and Contact DetailsDocument9 pagesUAE-All Companies Addresses and Contact Detailswafaa al tawil100% (1)

- PD Mitra Account LedgersDocument8 pagesPD Mitra Account LedgersBirul KesNo ratings yet

- Game TheoryDocument16 pagesGame TheoryVivek Kumar Gupta100% (1)

- The End of Bureaucracy: How Haier is Building a New Management ModelDocument11 pagesThe End of Bureaucracy: How Haier is Building a New Management ModelWendel RharaelNo ratings yet

- 5S mottos and methods for workplace organizationDocument2 pages5S mottos and methods for workplace organizationJsham100% (1)

- Black & Veatch Pltu Tanjung Jati B Pltu Tanjung Jati B JeparaDocument1 pageBlack & Veatch Pltu Tanjung Jati B Pltu Tanjung Jati B Jeparabass_121085477No ratings yet

- Specific Factors and Income Distribution: © Pearson Education Limited 2015Document62 pagesSpecific Factors and Income Distribution: © Pearson Education Limited 2015Emre PakNo ratings yet

- There Are No Permanent Changes Because Change Itself Is Permanent. It Behooves The Industrialist To Research and The Investor To Be VigilantDocument10 pagesThere Are No Permanent Changes Because Change Itself Is Permanent. It Behooves The Industrialist To Research and The Investor To Be Vigilantagrvinit123No ratings yet

- 8 Myths of WMS - HighJumpDocument4 pages8 Myths of WMS - HighJumprichardmarvellNo ratings yet

- Specifications: Notes On The SpecificationsDocument2 pagesSpecifications: Notes On The SpecificationsSagar AcharyaNo ratings yet