Professional Documents

Culture Documents

Tan Application Form Form-49b 1-3-19

Tan Application Form Form-49b 1-3-19

Uploaded by

phani raja kumar0 ratings0% found this document useful (0 votes)

108 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

108 views5 pagesTan Application Form Form-49b 1-3-19

Tan Application Form Form-49b 1-3-19

Uploaded by

phani raja kumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

Form No, 498

[S00 soction 208A and ral 1148)

Form of application for allotment ot Tax Deduction and Collection Account Number

* under Section 203A of the Income Tax Act, 1961

‘Assessing Officer (TDS/TCS)

‘Assessing Officer Code (TDS/TCS)

‘roa code.

AO Type,

Range Code

720 Numbor

Whereas “ie ‘anare liable to “deduccolet or dedut tax ad coe ax n acordance wih Chapter XVI! under the heading “B.~ Deduction

{soure’ or BB, -Colecton a soured ofthe Icometax Act, 964

‘and whores no Tax Deduction Account NumborTax Colecton Account Number or Tax Deduction Account Numb and Tax Colecion Account

amber has boon ated to mals

‘We gio below te necessary paras:

{Please refer to nstictons bere tng up the form ]

1 Name = (Fil oly ono ofthe columns ‘toy, whichever is applicable)

(0) Conta / State Government

“Tek th anpropratsonty Contrat Goverment] State Govenmont[—] Local Auhorty (Catal Govt) [-—]

Local Autorty (State Govt) ]

Name of Office

a

a

Namo of Department

Name of Ministry [ ]

Designation of the person responsibie 2

for* making payment / collecting tax

(©) Statutory / Autonomous Bodies

“Tick the appropiate entry Statutory Body[——] __Atonemnous Body [—]

Name of Oca

Designation ofthe person responsible

for* making payment / collecting tax

{€) Company (See Note 1):

“Tick the appropriate erty

“ie is) [ek appa)

Name of Company

Designation ofthe person responsible

for * making payment /cofecting tax

() BranctyDivision of a Company:

“ick the appropriate entry

Tite 4s) [tik it appeabe)

Name of Company

Name of Dlvsion

NamelLocation of Sranch

Designation ofthe person responsible

for* making payment / collecting tax

(6) Individual / Hindu Undivided Family (Karta) - (See Note 2):

Tick the appropriate entry

Tite (bok the appropriate entry for indivi)

Last Name F Suiname

First Name

Midele Name

Government CompanyiCorporation [—] Government Company/Gorpraton [—] other [—]

‘established by a Cental Act cstabishod by a Stato Act Company

CLTTTTTT Tr rr rrr rrr rrr rr ir)

CLTTTTT TT rrr rrr rrr rrr rrr)

CLTTTTTT Tr rr rrr rrr rrr rr ir)

CLTTTTT TT rrr rrr rrr rrr rrr)

‘Government Company/Corporaion [] Government CompanyiCorporaion Other [—]

‘established by a Conal Act cstabishod by a State Act company

CITTTTTT TTT rr rr rrrrrrrriry

Incividual [——] Hindu Undivided Famity [——]

(9 Branch of individual Business (Sole proprietorship concerny/ Hindu Undivided Family (Karta)

Tick the appropriate erty

Individual Hindu Undivided Famiy (Kari)

Branch of Icha business [——] Branch of Hines Undivided Famiy [——]

“Tie (ck the appropriate eniry for incvidual) shi 27] sm] Kumari J

Last Name F Suiname

First Name

idole Name

NameiLocation of branch

{g) Firm / Association of Persons / Associa

Name

ton of Persons (Trusts) / Body of Individuals / Arificial Juridical Person (See Note 3):

[ ]

(b) Branch of Firm / Association of Persons / Association of Persons (Trusts) / Body of Incividuale / Arificial Juridical Person:

Name of Fim / Assocation of Persons / Association of Persons (Trusts) / Body of Individuals / Attica

Juridical Person:

2 ness

‘Area Locality | Talika / Sub-Diision

Town / Cty / Distict

Stato / Union Teritory CLTTTITPTIT TT rrr rrr rrr rr rrr

PIN code [ ]

ema IDs a)

»

23. Nationaty of Deductor (Tek the appropriate entry)

Ingan C4

Foreign cq

4. Permanent Account Number (PAN) = (spect wharever applicable)

5 Existing Tax Deduction Account Number (i ry)

CLTTTTTT Tt r rir rir

6 Existing Tax Collection Account Number (i ary)

CITTTTTT rrr rrr iry

7 Date (OD-MM-YYYY)

CO-OL-CLITT)

‘Signed (Applicant)

Verification

“We, in my/our capact

to the best of my/our knowledge and belie

Vertied today the [T]-L1]-CLLLI

adomm yyyy

do hereby declare that what is stated above is true

at (Signature/Lett Thumb Impression of Applicant)

Notes

1 This column is applicable only ia single TAN is applied for the whole company. If separate TANs are applied for different

divisions/branches, please fill details in (4)

2 For branch of Individual business/Hindu Undivided Family, please fil details in (0.

3 For branch of firm/Association Of Persons/Association Of Persons (Trusl) / Body Of Individuals/Artilicial Juridical Person,

please fil details in (h).

4 * Delete whichever is inapplicable,

@

i)

©

©

fe

o

©

co)

Instructions for filling up Form 498

Form is wo be filled leibly in ENGLISH in BLOCK LETTERS and in BLACK INK nly.

Each box, wherever provided, shovld contin oly one charter (lphabevnamberfpunctution mark leaving «blank box ater each word

‘Thumb impression, if used, shouldbe aested by a Magistrate ora Notary Public or « Gazetted Otficer, under oficial sel end tan,

Desietrs are required to provide details of Astetting Officer (TDS TCS) in the application. These details cam be obtained rom the Income Tax Office

The deductrfcllector mos fill up Area Code, AO Type, Range Code and AO Number. fhe applicants unable to determine the details, TIN Feiittion

Cente CFIN-FC) may assist in ding so

Form shuld be filled up completely

“Designation of te person responsile foe making paymentcollecting tax’ field is mandatory to fl up, wherever splisable.

The aldess of applicant shouldbe an Taian Adds only

[tem No] Item Detalle ldclines or filing up the forme

1

‘Nue ‘Deductor/Colector sal ill he deals ofits mame depending on its category in anyone ofthe Belds 1 (2) 0

1) specified inthe form. If deductoncolletr fils tails in more than one category the application form

will be reece

14) | Name - Cental ‘Cena / State Governen Local Autboritydeductrfeoletor wil ill up he nse in this field. Name of

‘State Goverment Otice is mandatory: Name of Organisation Departmen Ministry may be filled with relevant details

For example if Directorate of Income Tax (stems) in Income Tax Department i applying fora TAN, i

sv fil the Name eld

Name of Office DIRECTORATE OF INCOME TAX (SYSTEMS)

[Name of Organisation INCOME. TAX DEPARTMENT.

Name of Department DEPARTMENT OF REVENUE

[Name of Ministry MINISTRY OF FINANCE,

Centraltate GovernmenLocal Aubority Deductor/Collector ~ wll select it appropeat etry by

ticking in the elevant box for Central Government a Sate Government or Local Avtkoiy (Cente Gov) oe

Local Authority (State Govt),

106) | Name — Saamory/ ‘Name of Office ie Mandatory.

‘Autonomous Bodies Relevant Rox far Statutory Body or Autonomous Bad i tobe ticked by the deductorfealiector.

For example if Bandra office of Brihanmumbai Monicipal Corporation is applying for a TAN, i wil ill

the Name fede a

Name of Office [BRIFTANMUMBAT MUNICTPAL CORPORATION, BANDRA,

Name of Organisation 2 BRIHANMUMBAI MUNICIPAL CORPORATION

Statuory/Autonomous Bodies will selec its appropiate entry by ticking inthe relevent box.

1@ | Name — Company The dedvetofcollstor i company fg 4 Bank) this pointe applicable. Is mandatory to fl he Name

of Company

“This category Ito be filled by the company iit is applying TAN for the company as whole. In cae company

wants o apply diferent TANS for diferent ivsionsfranches pot Id) shod he filed

Name should be provided without any abveviations. Diferent vasatons of “Private Limited? viz. Pvt Lid

Deva Li, Pt Timited, Pid, PL, Tad are not allowed. Ht should be “Private Limited! o Limited” only

For example,

Name of Company ABC PRIVATE. LIMITED

Cuegory of compans~ DeductrCollectr wil sec its appropiate cory by dking inthe relevant box.

100 | Branch oF a company 1 BrancuDivision of a Compan is applying forts separte TAN, it wll metion the Name and Location of

the Branch (in whose rame TAN i sought) in this Feld. Different Branches of a company applying for

separate TANs wil fil this eld

For example, Cement Division of ABC Private Limited located at Andheri wil fil as

Name of Company ABC PRIVATE. LIMITED

[Name of Division 1 CEMENT DIVISION

[Name/Location of Branch ANDHERI BRANCH

on,

ABC Bank of India — Nariman Point Branch, Mumbai will be writen as

Name of Company [ABC BANK OF INDIA

[Name of Division

Name/Location of Branch NARIMAN POINT BRANCH, MUMBAT

CCuegory of a company — Deductr/Caletor wil selec its appropiate entry by icing inthe relevant box

160) | Name tnavidoatnda ist Name is Mandatory Name ofthe deductncollector sould

‘writen in fll and not in abbreviated or.

Undivided Family (Kara) ‘As an exception, very large Middle names may be abbreviated. Name should not be prefixed with Shi, St

‘Mis, Kumasi, Late, Major, Dr, et. Incase name is profited with Tile, aplication may be rejected,

Individuals! HUFs (Kara) must state thee ull expanded name and fl inthe appropriate feds for Last, Middle

oc Fst Nate

For example, Dinesh Kumar Garg wil be writen as

Last NamefSarname First Name Middle Name

GARG DINESH KUMAR,

, if mide name isnot there, it wil be lft blank. Fr example, Gunjan Bansal wil be writen as

Last Name/Sarmame First Name Middle Name

BANSAL GUNIAN

a Sole Propretor/HUF wants to cbain a single TAN in hither name for all businesses ran by hime

‘her hehe shal ll ame inthis eld

DesctoriColector wil sels ts appropiate erry ie, Invi! / Hindu Undivided Family) hy tcking inthe

sclevan box

Invi shal select ts spropriate nity by Hiking in he rlevan box for ‘Shi, “Sm “Koran UP wil

leave the mentioned fields Hank

10] Branch of tnd This fied wil be filled nly if TAN is being applied for Wench of Individual Business (Sale Froprictership

BasinsxSole Propistarship | Concer/Hindy Undivided Fail

concern Hine Undivided (Other Tie (De. Lats, Sm et.) relate roles given in Hem No, Ke) wil be applicable here also

Family (HUF) In case an IndviduaTUF wants to obtain separate TANs fr diferent businesses being run by hint, this

‘aegory willbe applicable, Henee, the name of the concern wil be filled inthe field for Name/Lacation of

‘Branch Name of Branch shouldbe entered athe relevat fel.

For example,

Last Name/Surname First Name Middle Name

KOHLI BHUWAN

[Name/Location of Branch WELLWORTH BOOK HOUSE.

DeditolColetor wil select

fn relevant box for Indvigel oF

sopra category (ve. Indvide indy Undivided Family) by

Undivided Family

1g) | FrnvAssciation of peony | The Name ofthe Fin/Assocation of posons/Assocaton af pesons (TrstsVBody of Inavidual/Artiicial

Associaton of persons (Truss) | sural Person will be writen in fll a the fila provided.

Body of Indvidoas Artificial

Juice Peron,

Tihy | Branch of FinAssocation of — | IFalifree barshes of fiem are applying for separate TANG, his category is applicable. The Name of Fim

PersoastAssociaion of Persons | AOPIete. wil inclnde the desertion ofthe Branch. Name of Branch should be entered in the relevant Fe

(rwssyBody of Individuals?” | For example,

Artificial Juridical Person Name of Fi SHAH & COMPANY

[NamesLocation of Branch FORT BRANCH

2 Adress ‘Dedactr/CoMestor shall mention the address of he location where the tax is being deducted. Its compal-

sory forthe deductoreolecter to mention atleast two details out of four ie PlavDoorBlock No.. Name of

PromisesBulding/Vilage, Road/SuectLanefPoxt Ofice ac Atea/Locality/TalukalSub Division). Tow/Ciy!

Distiet, State, Union Testory and PIN Code ate mandatory. The applicant should nat mention 2 foreign

sates

2 | Telephone Number and (Ie Telepnone Number ix mentioned, STD Code ix manson,

‘email ID (2) Incase of mobile number, county code should be mentioned ax STD Code

STD Code ‘Telephone No.

CCOETTT) COTE T rrr rrr)

‘Where ‘1 the country cade of Indl

(G) lismandatory fr applicants o mention either thei telephone number orn e-mail iso tat they can be

‘contacted incase of any diezepancy inthe eplicsion form,

(Applicants may provide thir vali e-mnil IDs fr receiving intimation about the ats of thei ppiction

trough e-mail

3 | Nationality of DeductontColestor_| This fed ie mandatory for ll categories of deductofcollestor

4 | Permanent Account Number | DeductovCalletor will mention the existing i0-

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GST Audit Cannot Be Conducted After Winding Up of BusinessDocument3 pagesGST Audit Cannot Be Conducted After Winding Up of Businessphani raja kumarNo ratings yet

- Whats NewDocument3 pagesWhats Newphani raja kumarNo ratings yet

- ACT Invoice FOR JANDocument2 pagesACT Invoice FOR JANphani raja kumarNo ratings yet

- Addition For Cash Deposited in Bank Out of Business Receipts - Draft SubmissionDocument69 pagesAddition For Cash Deposited in Bank Out of Business Receipts - Draft Submissionphani raja kumarNo ratings yet

- Leelavati Service Tax ReturnDocument6 pagesLeelavati Service Tax Returnphani raja kumarNo ratings yet

- Vat 112Document2 pagesVat 112phani raja kumarNo ratings yet

- Test AttachmentDocument1 pageTest Attachmentphani raja kumarNo ratings yet

- Taxation of Income Earned From Selling SharesDocument5 pagesTaxation of Income Earned From Selling Sharesphani raja kumarNo ratings yet

- I Disabled HiberfilDocument3 pagesI Disabled Hiberfilphani raja kumarNo ratings yet

- Socieity Registration Required DetailsDocument1 pageSocieity Registration Required Detailsphani raja kumarNo ratings yet

- Affidavit For Society Registration For Own House Amma PremashramDocument1 pageAffidavit For Society Registration For Own House Amma Premashramphani raja kumarNo ratings yet

- Stampduty For Firm ReconstitutionDocument2 pagesStampduty For Firm Reconstitutionphani raja kumarNo ratings yet

- Some Important Aspects of HUF Under Income Tax, 1961Document16 pagesSome Important Aspects of HUF Under Income Tax, 1961phani raja kumarNo ratings yet

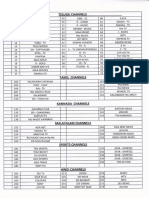

- Channels ListDocument2 pagesChannels Listphani raja kumarNo ratings yet

- Income Tax Scrutiny NormsDocument6 pagesIncome Tax Scrutiny Normsphani raja kumarNo ratings yet

- Acception of Cforms After Issuing of Assessment Order Godrej Agrovet CaseDocument1 pageAcception of Cforms After Issuing of Assessment Order Godrej Agrovet Casephani raja kumarNo ratings yet

- Capital Gain Compensation Recd From Central GovernmentDocument45 pagesCapital Gain Compensation Recd From Central Governmentphani raja kumarNo ratings yet

- Digital Signature Certificate Subscription FormDocument1 pageDigital Signature Certificate Subscription Formphani raja kumarNo ratings yet

- 2 of 2008 8 % To 10 % Duty ChangeDocument3 pages2 of 2008 8 % To 10 % Duty Changephani raja kumarNo ratings yet

- BALAJI SOFTTECK DIGITAL SIGNATURE APPLICATION TCS - Class 2 IndividualDocument2 pagesBALAJI SOFTTECK DIGITAL SIGNATURE APPLICATION TCS - Class 2 Individualphani raja kumarNo ratings yet