Professional Documents

Culture Documents

Revision of CST Assessments for 2005-06 and 2006-07

Uploaded by

phani raja kumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision of CST Assessments for 2005-06 and 2006-07

Uploaded by

phani raja kumarCopyright:

Available Formats

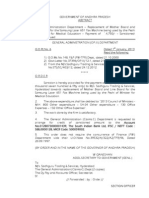

GOVERNMENT OF ANDHRA PRADESH

COMMECIAL TAXES DEPARTMENT

Office of the Commissioner of Commercial Taxes,

Andhra Pradesh, Hyderabad.

CCT’s Ref. AIII (1)/10/2012 Dt. 26.01.2012

Sri Suresh Chanda, I.A.S., Commissioner of Commercial Taxes, A.P., Hyderabad

***

Sub: Request to order revision of assessment for the year 2005-06 and 2006-07

under Rule 12(7) under CST Act, 1956 – Regarding.

Ref: From M/s Siflon Polymers Pvt. Ltd., representation Dt. 21/01/2012.

***

The attention of the Commercial Tax Officer, Madhapur is invited to the

reference cited.

In the reference cited, M/s Siflon Polymers Pvt. Ltd., Hyderabad requested to

accept the Statutory Forms filed under CST Act and pass assessment orders in accordance

with the provisions of the Central Sales Tax Act.

In this regard, it is informed that as per the decision of the A.P. High Court in

case of M/s Godrej Agrovet Ltd., Vs CTO, Eluru (41 APSTJ 92), the assessing authority has

to accept the Forms, filed even subsequent to the date of finalization of the assessments

and pass appropriate orders again.

In view of the settled case-law, the Commercial Tax Officer, Madhapur Circle,

Hyderabad (Rural) Division is hereby instructed to accept the Statutory Forms filed under

CST Act and pass assessment orders again in accordance with the provisions of the Central

Sales Tax Act for the assessment years 2005-06 and 2006-07.

Sd/. Suresh Chanda

Commissioner of Commercial Taxes

To

The Commercial Tax Officer, Madhapur Circle.

Copy to

The Deputy Commissioner (CT), Hyderabad Rural Division

M/s Siflon Polymers Pvt. Ltd., Chamber No.303, III floor, Jamuna Towers, Malakpet,

Hyderabad.

Copy to all DCs in the State for information

Copy to Portal and FAPCI Hyderabad.

//f.b.o//

Sd/. G. Lakshmi Prasad

Additional Commissioner (CT) (Policy)

You might also like

- Public Notice 04 - 2022-23 MSME TFCDocument2 pagesPublic Notice 04 - 2022-23 MSME TFCBhadrachalam GST RangeNo ratings yet

- Form No. S0B92E9 VAT DeclarationDocument1 pageForm No. S0B92E9 VAT DeclarationDssp StmpNo ratings yet

- Navin Danger MMRDocument1 pageNavin Danger MMRmahesh.sanjotmaxlifeNo ratings yet

- 2013gad RT6Document1 page2013gad RT6malledipNo ratings yet

- Umesh 011Document23 pagesUmesh 011Yogesh KumarNo ratings yet

- The Jurisdiction of Customs Commissionerate, AhmedabadDocument2 pagesThe Jurisdiction of Customs Commissionerate, Ahmedabadsanjiiva8531No ratings yet

- Application of Babar & SonsDocument3 pagesApplication of Babar & SonsAbdul RehmanNo ratings yet

- GST authority rejects cement maker's application for advance ruling on tax appropriation and refundDocument5 pagesGST authority rejects cement maker's application for advance ruling on tax appropriation and refundTushar SuriNo ratings yet

- 2023transco - MS 9Document1 page2023transco - MS 9Raajesh VinukondaNo ratings yet

- Malhotra Rajiv & Co Chartered Accountant: Turnover CertificateDocument3 pagesMalhotra Rajiv & Co Chartered Accountant: Turnover Certificateamit22505No ratings yet

- 100 CR DeclarationDocument2 pages100 CR DeclarationOmkar VichareNo ratings yet

- 500 CR Declaration HRLDocument2 pages500 CR Declaration HRLOmkar VichareNo ratings yet

- FCI E-Tender for Mandi Transport ContractorsDocument2 pagesFCI E-Tender for Mandi Transport ContractorsRahul RawatNo ratings yet

- TD - Outsourcing PDFDocument17 pagesTD - Outsourcing PDFrajaNo ratings yet

- PT CalanDocument1 pagePT CalanMichael OwenNo ratings yet

- Malak Tender NoticeDocument73 pagesMalak Tender Noticemohammedjafar2508No ratings yet

- Government of Andhra Pradesh: G.O.Ms - No. 427 Dated: 07.07.2009 Read The FollowingDocument1 pageGovernment of Andhra Pradesh: G.O.Ms - No. 427 Dated: 07.07.2009 Read The Followingvarma2011No ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- ClsaDocument15 pagesClsaV RNo ratings yet

- GHMC tender construction retaining wallDocument6 pagesGHMC tender construction retaining wallAbu MariamNo ratings yet

- WR Cleaning ContractDocument9 pagesWR Cleaning Contractabhimanyutiwari1234No ratings yet

- FX Gains Part of Profits for TP, Only Tax-Free Investments Count for 14ADocument4 pagesFX Gains Part of Profits for TP, Only Tax-Free Investments Count for 14ADayavanti Nilesh RanaNo ratings yet

- 23 PFDocument2 pages23 PFSunil PatelNo ratings yet

- 71995chess TournamentDocument1 page71995chess Tournamentkumar101kumarNo ratings yet

- Signature Not Verified PODocument3 pagesSignature Not Verified POAbhishek DahiyaNo ratings yet

- EMD RefundDocument1 pageEMD RefundRavi UpadhyayNo ratings yet

- CNF Tender Document JPR 02-04-19 56736downloaded 0219beDocument86 pagesCNF Tender Document JPR 02-04-19 56736downloaded 0219beManoj KumarNo ratings yet

- Expenses Claim Form: QF/FIN/005/01/00Document2 pagesExpenses Claim Form: QF/FIN/005/01/00rahmanNo ratings yet

- Tender Documents For Gas Seperation Dehydration Etc by Oil PDFDocument71 pagesTender Documents For Gas Seperation Dehydration Etc by Oil PDFuss1957No ratings yet

- DocumentDocument2 pagesDocumentSubrata HalderNo ratings yet

- Letter To Builder For VATDocument5 pagesLetter To Builder For VATPrasadNo ratings yet

- 42 KV, 10 Ka Metal OxideDocument2 pages42 KV, 10 Ka Metal OxideSSE TRD JabalpurNo ratings yet

- Pwrjm13062-Emergency Escape SetDocument60 pagesPwrjm13062-Emergency Escape Setsuman_94103No ratings yet

- Purchase OrderDocument6 pagesPurchase OrderMANGAL MUNSHINo ratings yet

- 110 GSECL 17 08 13 BLTPSETender-Notice51Document4 pages110 GSECL 17 08 13 BLTPSETender-Notice51thedevdaasNo ratings yet

- 2013maud RT2Document2 pages2013maud RT2malledipNo ratings yet

- Presidential Order 5Document1 pagePresidential Order 5acaudit VJA.INo ratings yet

- DT Income CertificateDocument2 pagesDT Income CertificateLavan58No ratings yet

- Labour Law Case Summary (Half-Yearly Update) Part 2Document13 pagesLabour Law Case Summary (Half-Yearly Update) Part 2Rishi PandeyNo ratings yet

- OutsourcingDocument12 pagesOutsourcingMuralidhar MogalicherlaNo ratings yet

- View Tender DetailsDocument6 pagesView Tender DetailsAbu MariamNo ratings yet

- Satisfaction of Addl Cit MP HCDocument3 pagesSatisfaction of Addl Cit MP HCNeena BatlaNo ratings yet

- KRNTK 12.18 DT 29.06.18 UCLDocument2 pagesKRNTK 12.18 DT 29.06.18 UCLPradeep PNo ratings yet

- GO Ms No 725 Rev DeptDocument3 pagesGO Ms No 725 Rev DeptjaganmpNo ratings yet

- 1047 To The EE, Toll Fee Notification On 08.12.2018Document1 page1047 To The EE, Toll Fee Notification On 08.12.2018patil banduNo ratings yet

- Civil Aviation Authority (Recruitment Test For The Post of AD HR) Civil Aviation Authority (Recruitment Test For The Post of AD HR)Document1 pageCivil Aviation Authority (Recruitment Test For The Post of AD HR) Civil Aviation Authority (Recruitment Test For The Post of AD HR)Ethane YneNo ratings yet

- Office of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001Document4 pagesOffice of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001jitendraktNo ratings yet

- E-Tender Document FOR Hiring of Vehicles On Monthly & Casual BasisDocument34 pagesE-Tender Document FOR Hiring of Vehicles On Monthly & Casual BasisSanjay parmarNo ratings yet

- 3rd Call-Vehicle Hire Bid MoRTH RO Hyd Bid Doc-13-07-2022 PDFDocument12 pages3rd Call-Vehicle Hire Bid MoRTH RO Hyd Bid Doc-13-07-2022 PDFI KanthNo ratings yet

- Pre Deep Jang AmDocument4 pagesPre Deep Jang AmRakesh RavalNo ratings yet

- Aarnav AmalgamationDocument135 pagesAarnav AmalgamationMuneeshNo ratings yet

- 1.class III Civil CertificateDocument2 pages1.class III Civil CertificateTULAMAN SOFTWARENo ratings yet

- 17375advt Retailers Hyd 2014Document12 pages17375advt Retailers Hyd 2014SANDEEPNo ratings yet

- Master List of CSD Cars Updated 29 Jul 2011Document31 pagesMaster List of CSD Cars Updated 29 Jul 2011Ashish Kumar RoyNo ratings yet

- Kun Motor CompanyDocument12 pagesKun Motor CompanyLatest Laws TeamNo ratings yet

- Without Prejudice The Chairman,: GMR Hyderabad International Airport LimitedDocument89 pagesWithout Prejudice The Chairman,: GMR Hyderabad International Airport Limited丨么S H Ã D Ø W么丨No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Check Email Settings in Saral TDSDocument1 pageCheck Email Settings in Saral TDSphani raja kumarNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document3 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Shihb100% (1)

- Compendium of MSMEDocument65 pagesCompendium of MSMEChaitra KatragaddaNo ratings yet

- Leelavati Service Tax ReturnDocument6 pagesLeelavati Service Tax Returnphani raja kumarNo ratings yet

- Practical Aspects of Availing Credit in Respect of Invoices Not Appearing in Form GSTR 2A or GSTR 2BDocument6 pagesPractical Aspects of Availing Credit in Respect of Invoices Not Appearing in Form GSTR 2A or GSTR 2Bphani raja kumarNo ratings yet

- Taxation of Gains From Share Sales: A Guide to Capital Gains Tax RulesDocument5 pagesTaxation of Gains From Share Sales: A Guide to Capital Gains Tax Rulesphani raja kumarNo ratings yet

- New FVU Changes and Enhancements in SaralTDS v15.07Document3 pagesNew FVU Changes and Enhancements in SaralTDS v15.07phani raja kumarNo ratings yet

- ACT Invoice FOR JANDocument2 pagesACT Invoice FOR JANphani raja kumarNo ratings yet

- Socieity Registration Required DetailsDocument1 pageSocieity Registration Required Detailsphani raja kumarNo ratings yet

- Affidavit Declaring Free Rent for Society LocationDocument1 pageAffidavit Declaring Free Rent for Society Locationphani raja kumarNo ratings yet

- Vat 112Document2 pagesVat 112phani raja kumarNo ratings yet

- ICSI E-Bulletin MAY - JUNE 2014Document59 pagesICSI E-Bulletin MAY - JUNE 2014phani raja kumarNo ratings yet

- I Disabled HiberfilDocument3 pagesI Disabled Hiberfilphani raja kumarNo ratings yet

- Incorporation of CompanyDocument4 pagesIncorporation of Companyphani raja kumarNo ratings yet

- Stampduty For Firm ReconstitutionDocument2 pagesStampduty For Firm Reconstitutionphani raja kumarNo ratings yet

- Income Tax Scrutiny NormsDocument6 pagesIncome Tax Scrutiny Normsphani raja kumarNo ratings yet

- GOODS SOLD ON MRP BASIS IS EXEMPTED FROM SERVICE TAX Circular No.173 - 8 - 2013 - ST, Dated 07-10-2013Document1 pageGOODS SOLD ON MRP BASIS IS EXEMPTED FROM SERVICE TAX Circular No.173 - 8 - 2013 - ST, Dated 07-10-2013phani raja kumarNo ratings yet

- Compensation Under RR Act and Vijayawada Rural DetailsDocument2 pagesCompensation Under RR Act and Vijayawada Rural Detailsphani raja kumarNo ratings yet

- APPT RegistrationDocument2 pagesAPPT Registrationphani raja kumarNo ratings yet

- Q1. Whether HUF can do business in its own nameDocument16 pagesQ1. Whether HUF can do business in its own namephani raja kumarNo ratings yet

- Impact of Non Submission of Export Intimation Within The Prescribed Time in Case of ct-3Document6 pagesImpact of Non Submission of Export Intimation Within The Prescribed Time in Case of ct-3phani raja kumarNo ratings yet

- How To Claim Income Tax Refund of TDS For Last Six YearsDocument1 pageHow To Claim Income Tax Refund of TDS For Last Six Yearsphani raja kumarNo ratings yet

- Channels ListDocument2 pagesChannels Listphani raja kumarNo ratings yet

- Verification of Applicant in Case of Form DIN-1 As Per Annexure I of The DIN RulesDocument1 pageVerification of Applicant in Case of Form DIN-1 As Per Annexure I of The DIN Rulesphani raja kumarNo ratings yet

- Cost Inflation Index Notified by Indian Government 1981-2012Document1 pageCost Inflation Index Notified by Indian Government 1981-2012Ritesh AgarwalNo ratings yet

- Chapter 61 Central ExciseDocument1 pageChapter 61 Central Excisephani raja kumarNo ratings yet

- Central Excise Duty Rates Chapter Wise Changes in Budget 2015-16Document34 pagesCentral Excise Duty Rates Chapter Wise Changes in Budget 2015-16phani raja kumarNo ratings yet

- Central Excise Job Work RulesDocument3 pagesCentral Excise Job Work RulesSameer HusainNo ratings yet

- Rectification ManualDocument25 pagesRectification Manualwww.TdsTaxIndia.comNo ratings yet