Professional Documents

Culture Documents

Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021

Uploaded by

ameer HamzaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021

Uploaded by

ameer HamzaCopyright:

Available Formats

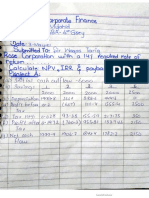

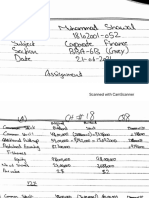

Ameer Hamza Butt 18102001-094 Submitted to: Ma’am Nimra Sohail

Osama Ahsan 18102001-087 Assignment # 1

Abubaker Shafique 18102001-129 08-04-2021

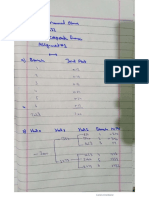

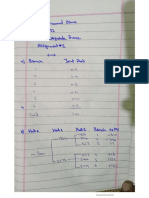

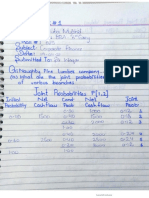

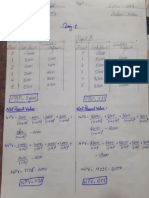

Vertical Analysis Horizontal Analysis

Analysis

2018 2017 2016 2018 2017 2016

51.2% 46.4% 58.6% 117.8% 107.5% 100%

0.02% - - - - -

5.53% 2.8% 3.9% 192% 97.3% 100%

0.04% 0.033% 0.056% 99% 82% 100%

0.03% 0.06% 0.05% 87% 155% 100%

57% 49.27% 62.6% 122.3% 107% 100%

3.41% 3.37% 4.3% 105% 104.6% 100%

23.5% 41.3% 28% 113% 200% 100%

4% 2.15% 0.9% 599% 328% 100%

0.73% 0.63% 1% 97.3% 85% 100%

0.2% 0.17% 0.08% 362% 299% 100%

8.3% 0.43% 0.6% 1945% 100.4 100%

1.35% 0.26% 0.22% 829% 162% 100%

0.53% 1.09% 0.13% 533% 1078% 100%

1% 1.35% 2% 68% 94.4% 100%

43% 50.72 37.3 155% 185% 100%

100% 100% 100% 135% 136% 100%

5.3% 5.25% 7.13% 100% 100% 100%

2.2% 2.15% 3% 100% 100% 100%

10.6% 10.5% 14.2% 100% 100% 100%

2.8% 3.56% 5.7% 68.3% 85.2% 100%

(0.028) % (0.022) % (0.03) % (133) % (103.5) % (100) %

16.2% 11.11% 15.9% 137.5% 95.1% 100%

31.8% 27.3% 39% 111% 96% 100%

22.2% 23.1% 23% 131% 137% 100%

3.77% 5.7% 9.1% 55.5% 85% 100%

26% 29% 32.1% 109% 122% 100%

14.8% 6.6% 12.3% 161.2% 73.2% 100%

0.6% 0.76% 0.7% 125% 154% 100%

20.4% 33.5% 10% 280% 461% 100%

0.054% 0.054% 0.06% 122.2% 123% 100%

6.32% 2.9% 6.3% 136% 63.2% 100%

42.16% 43.7% 29.1% 195% 204.3% 100%

100% 100% 100% 135% 136% 100%

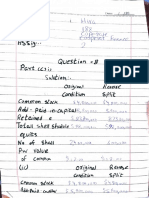

From vertical analysis of (2018), we can oversee that Similarly, From the vertical analysis of (2017,2016), with disastrous change, like trade amount doubled the base year and

the majorly part (57 %) of the whole assets (100%)is the situation of contribution of non-current assets 13% in the 2018. Their trade debts increase with 228% in 2017 and

contributed by the company’s non-current assets, and current assets with respect to whole asset is off 499% in 2018. Trade deposits also increases with 199%, and 262%

and in non-current assets about (90%) of the part is same nature, and the equity and liability section is with respective years. The receivables which are left to collected

contributed by the Al Noor mills property, plants and also similar to the (2018) balance sheet, all the increases with a margin of 1845% increase compared to base year in

equipment’s. And current assets hold about (43%) of entities and their nature of contribution is similar. 2018 and 0.4 increase in 2017. Similarly, income tax refund increase

the whole assets, furthermore in which stock in trade with 62 percent and 729 percent w.r.t base year. And income

contributes about (50%) of the current assets and Horizontal Analysis, horizontal analysis gives us the refundable (NOP) increase with 978% in 2017 and 433% w.r.t base

respectively (19.5%) by receivables and (9.2%) by trend of growth/decline with respect to base year, if year. And in the equity and liability section un appropriate profit

trade debts. In equity section capital reserves we compare the balance sheet, we come to know that decrease with a margin of 14.8% and 31.7 with 2017 and 2018. Their

contributes about (50%) of total share equity and Al Noor mills Property/equipment’s increases (7.5%in capital reserves decrease with 4.9 percent in 2017 and increase with

general reserves about 3rd half. In non- liabilities, long 2017, and 17.8% w.r.t Base year), it’s long term the margin of 37.5 percent. Long term financing also increases, but

term financing take part of (85%) and in current investment decreases with a lower margin of 2.7% in deferred liability decreased for about half compared to the base

liabilities. Majority part is taken by short term 2017, but increases with a margin of 92%. But if we year. Trade payable decreases in 2017 but increases in 2018. Accrued

borrowing (48%), then payables (35%) and then were to compare the whole non-current asset entity finance cost also increases in both years, short term borrowing also

current portion of financing (15%). then if increases with a margin of 7% in 2017 and increases in both years. Unclaimed dividend firstly decreases with a

22.3% in 2018. In current assets there are some assets margin of 36.8% but increases with 36% next year. Overall change

CONT w.r.t base year is increase in 36 percent in 2017 and 35% in 2018.

You might also like

- Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021Document3 pagesAmeer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021ameer HamzaNo ratings yet

- Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021Document1 pageAmeer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021ameer HamzaNo ratings yet

- Blackjack Excel Zen vs. Omega ComparisonDocument2 pagesBlackjack Excel Zen vs. Omega ComparisonKarthik S. IyerNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- Colombia Calendario Lunar: WWW - Vercalendario.infoDocument3 pagesColombia Calendario Lunar: WWW - Vercalendario.infoEduardo MarinoNo ratings yet

- Discount RatesDocument2 pagesDiscount RatesabeerNo ratings yet

- Porcentaje de ObraDocument3 pagesPorcentaje de ObraCesar E. RodriguezNo ratings yet

- 05 Granulometria PracticaDocument3 pages05 Granulometria Practicaanayeli alejandra robreño gonzalezNo ratings yet

- Y Frequency Cumulative % Y Frequency Cumulative %Document3 pagesY Frequency Cumulative % Y Frequency Cumulative %Boy MicroNo ratings yet

- Pencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Document1 pagePencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Johari AbdullahNo ratings yet

- Nutritional Status Report of Cabiao National High SchoolDocument4 pagesNutritional Status Report of Cabiao National High SchoolLorraine VenzonNo ratings yet

- Cmat AssignmentDocument7 pagesCmat AssignmentJulia FlorencioNo ratings yet

- hsc2011 Alevel Subjectwise PDFDocument3 pageshsc2011 Alevel Subjectwise PDFYuviraj PuttenNo ratings yet

- Pyq Jul 2022Document13 pagesPyq Jul 2022Nurdiana AzwaNo ratings yet

- 06 - Uas Pai - Ida Ayu Made Dwi PuspitaDocument7 pages06 - Uas Pai - Ida Ayu Made Dwi PuspitaGus TutNo ratings yet

- Rendimientos Diarios - Amazon (2023)Document1 pageRendimientos Diarios - Amazon (2023)Pro God1293No ratings yet

- Promkes: Grafik Capaian Program Ukm EsensialDocument21 pagesPromkes: Grafik Capaian Program Ukm Esensialeyun k firdausNo ratings yet

- IC Email Marketing Dashboard Template 8673Document7 pagesIC Email Marketing Dashboard Template 8673Haytham NasefNo ratings yet

- Stock Price: Dividend YieldDocument21 pagesStock Price: Dividend YieldEmre UzunogluNo ratings yet

- Anexo Tablas Asistente de Servicios Tabla de Variables: Cumplimiento Comercial Satisfacción ClienteDocument2 pagesAnexo Tablas Asistente de Servicios Tabla de Variables: Cumplimiento Comercial Satisfacción ClienteIsrael AguilarNo ratings yet

- Total 352 242 146 60.33% 140 2 70 0.85% 50.00%Document2 pagesTotal 352 242 146 60.33% 140 2 70 0.85% 50.00%Frank PietersenNo ratings yet

- m1 Safetystockminmax ExaDocument6 pagesm1 Safetystockminmax ExaAslam SoniNo ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- Red Line Mix ChartDocument1 pageRed Line Mix ChartOrlandoNo ratings yet

- Single Machine - Multi Part OEE TemplateDocument3 pagesSingle Machine - Multi Part OEE Templaterkhadke1No ratings yet

- Paretto Rac1Document2 pagesParetto Rac1aries danNo ratings yet

- Paretto Rac1Document2 pagesParetto Rac1aries danNo ratings yet

- Paretto Rac1Document2 pagesParetto Rac1aries danNo ratings yet

- Analysis BAB 1-6Document8 pagesAnalysis BAB 1-6Jeremi Ricardo100% (1)

- Analysis BAB 1-6Document8 pagesAnalysis BAB 1-6Jeremi RicardoNo ratings yet

- Item Preguntas Aciertos Promedio Incorrectas Porsentaje Suma de PorcentajesDocument2 pagesItem Preguntas Aciertos Promedio Incorrectas Porsentaje Suma de PorcentajesAnonymous CvOBouNo ratings yet

- Confiabilidad EjerciciosDocument10 pagesConfiabilidad EjerciciosGely CruzNo ratings yet

- (Reference) : OEE (NAT / Total NAT) A (NAT / Total NAT) P% (NOT / Total NOT)Document4 pages(Reference) : OEE (NAT / Total NAT) A (NAT / Total NAT) P% (NOT / Total NOT)oborda2769No ratings yet

- Truoc Thang 6 Tuoi 36 60Document1 pageTruoc Thang 6 Tuoi 36 60Phan Huy HoangNo ratings yet

- ColoradoCaseAges District Juvenile DelinquencyDocument1 pageColoradoCaseAges District Juvenile DelinquencyCircuit MediaNo ratings yet

- Summary StatisticsDocument3 pagesSummary StatisticsNguyenNo ratings yet

- F23 - OEE DashboardDocument10 pagesF23 - OEE DashboardAnand RNo ratings yet

- Simulation Statistics Simulation Statistics: Average STD Dev STD Err Max Min PercentilesDocument4 pagesSimulation Statistics Simulation Statistics: Average STD Dev STD Err Max Min PercentilesEdward WeaverNo ratings yet

- Calculation Saving Ipl 16.6.2017Document3 pagesCalculation Saving Ipl 16.6.2017Jal Ley HaaNo ratings yet

- Cortec CV Table 2.5 CageDocument1 pageCortec CV Table 2.5 CageFernando Ledesma SolaecheNo ratings yet

- Vix Hedges: Institute of Trading & Portfolio ManagementDocument9 pagesVix Hedges: Institute of Trading & Portfolio ManagementHakam DaoudNo ratings yet

- Informe de Situación Del País Al 2022 - CEPLANDocument46 pagesInforme de Situación Del País Al 2022 - CEPLANAlbert GamboaNo ratings yet

- Performance IndicatorDocument2 pagesPerformance IndicatorRolden Torres VallegaNo ratings yet

- Columna1 Columna2 Columna3 Tasa de Desempleo Tasa de InflacionDocument7 pagesColumna1 Columna2 Columna3 Tasa de Desempleo Tasa de Inflacionjorge eliecer ibarguen palaciosNo ratings yet

- Determinacion de Portafolio OptimoDocument8 pagesDeterminacion de Portafolio OptimoDanie RomaniNo ratings yet

- Variabel Pengetahuan Jumlah Kurang Cukup Baik N % Umur: B. Analia BivariatDocument6 pagesVariabel Pengetahuan Jumlah Kurang Cukup Baik N % Umur: B. Analia BivariatEvan SandersNo ratings yet

- INITIALDocument19 pagesINITIALEloisa EspadillaNo ratings yet

- Eje 4 EstadisticaDocument191 pagesEje 4 EstadisticaYesica PNo ratings yet

- Chart Title: Valor de KDocument9 pagesChart Title: Valor de KNatalia BordaNo ratings yet

- MCRSDocument9 pagesMCRSMercedes Isla VertizNo ratings yet

- Bengkel Kepimpinan Unit Beruniform KokurikulumDocument11 pagesBengkel Kepimpinan Unit Beruniform KokurikulumSyamimSohaniNo ratings yet

- Percentages AnswersDocument1 pagePercentages AnswersWho YouNo ratings yet

- Tugas AlkDocument7 pagesTugas AlkMuthia FadillaNo ratings yet

- Dia Fecha Peso Diario Avance (TN)Document8 pagesDia Fecha Peso Diario Avance (TN)Anonymous xI91T7GjSNo ratings yet

- PORCENTAJESDocument2 pagesPORCENTAJESmaresa45No ratings yet

- Department of Education Bureau of Learner Support Services School Health DivisionDocument2 pagesDepartment of Education Bureau of Learner Support Services School Health DivisionBadeth AblaoNo ratings yet

- ABC in ExcelDocument2 pagesABC in ExcelJigar DhuvadNo ratings yet

- Bitumen Extraction Test: Gradation of Aggregate of BC WT of SampleDocument6 pagesBitumen Extraction Test: Gradation of Aggregate of BC WT of Sampleamit singhNo ratings yet

- Frequencyabsolute Amplitude (A.U.)Document11 pagesFrequencyabsolute Amplitude (A.U.)shy_foeNo ratings yet

- Sufiyan Aslam 121 Sec B BBA Grey 8 Quiz RM Sir AmirDocument5 pagesSufiyan Aslam 121 Sec B BBA Grey 8 Quiz RM Sir Amirameer HamzaNo ratings yet

- Sufiyan Aslam 121 (Sec B BBA Grey 6) (Corporate Finance) Assignment 1 (Sir Waqas Tariq)Document2 pagesSufiyan Aslam 121 (Sec B BBA Grey 6) (Corporate Finance) Assignment 1 (Sir Waqas Tariq)ameer HamzaNo ratings yet

- Kinza 206 Bba 6th (B) Assignment 2 CFDocument4 pagesKinza 206 Bba 6th (B) Assignment 2 CFameer HamzaNo ratings yet

- Quiz 1Document5 pagesQuiz 1ameer HamzaNo ratings yet

- Jaweria 185 (FRM) QuizDocument3 pagesJaweria 185 (FRM) Quizameer HamzaNo ratings yet

- Corporate Finance Assignment (Abubakar-142)Document3 pagesCorporate Finance Assignment (Abubakar-142)ameer HamzaNo ratings yet

- Sufiyan Aslam 121 Sec B BBA Grey 6 Corporate Finance AssignmentDocument3 pagesSufiyan Aslam 121 Sec B BBA Grey 6 Corporate Finance Assignmentameer HamzaNo ratings yet

- Bilal FarooqDocument3 pagesBilal Farooqameer HamzaNo ratings yet

- Saim Imtiaz 186 Corporate Finance Assignment 1Document7 pagesSaim Imtiaz 186 Corporate Finance Assignment 1ameer HamzaNo ratings yet

- Coprate Finance Assignment No.2Document2 pagesCoprate Finance Assignment No.2ameer HamzaNo ratings yet

- Corporate Finance Assignment 1Document6 pagesCorporate Finance Assignment 1ameer HamzaNo ratings yet

- CF Quiz#1 Amna IqbalDocument4 pagesCF Quiz#1 Amna Iqbalameer HamzaNo ratings yet

- Kinza 206 BBA Grey Assignments 1 CFDocument3 pagesKinza 206 BBA Grey Assignments 1 CFameer HamzaNo ratings yet

- Sufiyan Aslam 121 BBA 6 Grey Sec B Quiz FinanceDocument4 pagesSufiyan Aslam 121 BBA 6 Grey Sec B Quiz Financeameer HamzaNo ratings yet

- Corporate Finance Assignment 1Document6 pagesCorporate Finance Assignment 1ameer HamzaNo ratings yet

- Maryam Rajpoot 059 (Yellow)Document5 pagesMaryam Rajpoot 059 (Yellow)ameer HamzaNo ratings yet

- Cooperate FinanceDocument3 pagesCooperate Financeameer HamzaNo ratings yet

- Ruba 025 Corporate Finance QuizDocument5 pagesRuba 025 Corporate Finance Quizameer HamzaNo ratings yet

- Shawal Corporate Finance AssignmentDocument4 pagesShawal Corporate Finance Assignmentameer HamzaNo ratings yet

- Saim Imtiaz (186) CF Assignment 2Document6 pagesSaim Imtiaz (186) CF Assignment 2ameer HamzaNo ratings yet

- CF - Assignment #01 HiraDocument2 pagesCF - Assignment #01 Hiraameer HamzaNo ratings yet

- Nimra 063 Assignment Corporate Finance BBA 6th GreyDocument6 pagesNimra 063 Assignment Corporate Finance BBA 6th Greyameer HamzaNo ratings yet

- M.osama 232 Assignment 1 Corporate FinanceDocument6 pagesM.osama 232 Assignment 1 Corporate Financeameer HamzaNo ratings yet

- Nimra 063 Corporate Finance BBA 6th GreyDocument3 pagesNimra 063 Corporate Finance BBA 6th Greyameer HamzaNo ratings yet

- Ruba 025 Corporate Finance AssignmentDocument3 pagesRuba 025 Corporate Finance Assignmentameer HamzaNo ratings yet

- Maryam Rajpoot 059 AssignmentDocument4 pagesMaryam Rajpoot 059 Assignmentameer HamzaNo ratings yet

- M. Hassan Sultan (213) CF Assignment 2Document3 pagesM. Hassan Sultan (213) CF Assignment 2ameer HamzaNo ratings yet

- M. Hassan Sultan (213) Corporate Finance Assignment 1Document9 pagesM. Hassan Sultan (213) Corporate Finance Assignment 1ameer HamzaNo ratings yet

- Maryam Rajpoot (059) Yellow QuizDocument2 pagesMaryam Rajpoot (059) Yellow Quizameer HamzaNo ratings yet

- 18102001-090 BBA 6th Book Review FSADocument9 pages18102001-090 BBA 6th Book Review FSAameer HamzaNo ratings yet

- BROKERDocument2 pagesBROKEROblivious lyNo ratings yet

- A Seminar Report CSRDocument85 pagesA Seminar Report CSRAmanat Talwar0% (1)

- How To Start Investing in Philippine Stock MarketDocument53 pagesHow To Start Investing in Philippine Stock MarketAlbert Aromin100% (1)

- Factors in Engineering Economy Excel FunctionsDocument12 pagesFactors in Engineering Economy Excel FunctionsHerliaa AliaNo ratings yet

- CTS Marketing Executive - CTS - NSQF-4Document40 pagesCTS Marketing Executive - CTS - NSQF-4H RakshitNo ratings yet

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Name: Xolisa Surname: Sikembula 65173104 UNIQUE NUMBER: 803495 Due Date: 28 AugustDocument2 pagesName: Xolisa Surname: Sikembula 65173104 UNIQUE NUMBER: 803495 Due Date: 28 AugustXolisaNo ratings yet

- 1 - MB Group Assignment I 21727Document2 pages1 - MB Group Assignment I 21727RoNo ratings yet

- The Other Face of Managerial AccountingDocument20 pagesThe Other Face of Managerial AccountingModar AlzaiemNo ratings yet

- Statement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionDocument43 pagesStatement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasNo ratings yet

- 5.2. Tax-Aggressiveness-In-Private-Family-Firms - An - 2014 - Journal-of-Family-Busine PDFDocument11 pages5.2. Tax-Aggressiveness-In-Private-Family-Firms - An - 2014 - Journal-of-Family-Busine PDFLiLyzLolaSLaluNo ratings yet

- Iv Report%2Document64 pagesIv Report%2yashNo ratings yet

- Frequently Asked Questions Regarding The BPS FY23 Budget DeficitDocument1 pageFrequently Asked Questions Regarding The BPS FY23 Budget DeficitFox Boston StaffNo ratings yet

- Hindustan Petroleum Corporation - FullDocument64 pagesHindustan Petroleum Corporation - FullSathyaPriya RamasamyNo ratings yet

- Emarketer Influencer Marketing in 2023 RoundupDocument15 pagesEmarketer Influencer Marketing in 2023 RoundupMyriam PerezNo ratings yet

- Skrill Terms of UseDocument17 pagesSkrill Terms of UseFahad SheikhNo ratings yet

- Capital RevenueDocument20 pagesCapital RevenueYatin SawantNo ratings yet

- This Study Resource Was: Agenda Item 11 Half Year 4Document2 pagesThis Study Resource Was: Agenda Item 11 Half Year 4akiyama madokaNo ratings yet

- 2008 IOMA Derivatives Market Survey - For WCDocument83 pages2008 IOMA Derivatives Market Survey - For WCrush2arthiNo ratings yet

- Management Consulting Firms - Finding The Right Growth StrategyDocument140 pagesManagement Consulting Firms - Finding The Right Growth Strategyer_manikaur2221No ratings yet

- Event Management & MarketingDocument20 pagesEvent Management & MarketingChithra KrishnanNo ratings yet

- Construction Sectors and Roles For Chartered Quantity SurveyorsDocument33 pagesConstruction Sectors and Roles For Chartered Quantity Surveyorspdkprabhath_66619207No ratings yet

- Demand Function and Regression ModelDocument14 pagesDemand Function and Regression ModelShahrul NizamNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- Sample - Global Air Conditioner Market (2021-2026) - Mordor Intelligence1623170907386Document53 pagesSample - Global Air Conditioner Market (2021-2026) - Mordor Intelligence1623170907386Vaibhav SinghNo ratings yet

- Rogue Trader Profit FactorDocument9 pagesRogue Trader Profit FactorMorkizgaNo ratings yet

- Study Notes On Cost AccountingDocument69 pagesStudy Notes On Cost AccountingPriyankaJainNo ratings yet

- FIN516 W6 Homework-4Document4 pagesFIN516 W6 Homework-4Roxanna Gisell RodriguezNo ratings yet

- Take Home Midterms Mix 30Document6 pagesTake Home Midterms Mix 30rizzelNo ratings yet

- Letter of CreditDocument3 pagesLetter of CreditNikita GadeNo ratings yet