Professional Documents

Culture Documents

KYLE de VERA BSA-3A (Auditing & Assurance in SPCL Industries MT Exam) Answers

KYLE de VERA BSA-3A (Auditing & Assurance in SPCL Industries MT Exam) Answers

Uploaded by

Kyree Vlade0 ratings0% found this document useful (0 votes)

17 views3 pagesOriginal Title

KYLE de VERA BSA-3A (Auditing & Assurance in Spcl Industries MT Exam) Answers

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views3 pagesKYLE de VERA BSA-3A (Auditing & Assurance in SPCL Industries MT Exam) Answers

KYLE de VERA BSA-3A (Auditing & Assurance in SPCL Industries MT Exam) Answers

Uploaded by

Kyree VladeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

NAME: KYLE C.

DE VERA

Course Year & Sec.: BSA-3A

Pamantasan ng Lungsod ng Pasig

Auditing & Assurance in Specialized Industries

Mid-Term Examinations

Test I - True or False

_TRUE_ 1. Construction auditing provides process improvement recommendation for project

management teams.

_TRUE_ 2. One of the reasons why construction auditing is important is it aids in cost recovery.

_FALSE 3. That the asset value in relation to losses of any type best safeguarded are quantitative

goals.

_TRUE_ 4. The economic calculation is of the greatest significance to the process of reaching a

decision.

_TRUE_ 5. The pre-project is worked upon with variants and the selection of best variants then

forms the basis of the investment decision.

_FALSE 6. Improvement suggestions arising from our experience and the identified defects are

qualitative goals

_TRUE_ 7. Rural banks and cooperative banks extend loans to farmers, fishermen, cooperatives

and merchant.

_TRUE_ 8. Commercial banks can engage in quasi banking function.

_FALSE 9. PSA 400 provides guidance as to the auditor’s consideration of the appropriateness

of

management use of the going concern assumption.

_FALSE 10. PSA 570 lists the assertions embodied in the financial statements as existence,

rights

and obligation, occurrence, completeness, etc.

Test II – Identification

DEADLINE PLANNING 1. It includes the scheduling of activities for planning, completion of

the project and the checks on construction’s progress.

CONSTRUCTIONS AUDITING 2. It includes all planning and construction services in

connection with the bidding activities of the company, in respect of administration.

PLANNING PHASE 3. It offers many levers to optimize the future project and the soft issues

point in the right direction for an optimal result.

FACILITY MANAGEMENT 4. It is comprised of the different task of building management.

FIDUCIARY RISK 5. The risk of loss arising from factors such as failure to maintain safe

custody

or negligence in the management of assets on behalf of other parties.

LIQUIDITY RISK 6. The risk of loss arising from the changes in the bank’s ability to sell or

dispose of an asset.

REPLACEMENT RISK 7. The risk of failure of a customer to perform the terms of the contract.

OBSERVATION 8. An audit procedure where the auditor remains alert to the possibility that

some

of the assets the bank holds may be held on behalf of third parties.

NAME: KYLE C. DE VERA

Course Year & Sec.: BSA-3A

BANGKO SENTRAL NG PILIPINAS 9. It was established in July 3, 1993 pursuant to the

provisions of the 1987 Philippine Constitution.

SOLVENCY RISK 10. The risk of loss arising from the possibility of the bank not having

sufficient funds to meet its obligations.

Test III – Enumeration

1–3 - What are the 3 areas where a construction audit focuses on

4–7 - Give the 4 procedures for a construction audit.

8 – 11 - Give at least 4 audit scope of construction auditing.

12 – 15 - What are the 4 goals to meet by organization of the project.

16 – 20 - Give the 5 audit process in banks

21 – 23 - What are the 3 components of audit risk

24 – 25 - What are the 2 major functions of bank

26 – 30 - Give the 5 non – interest revenues of bank.

TEST III – ANSWERS

What are the 3 areas where a construction audit focuses on

1. Validating contract compliance.

2. Assessing performance against key performance indicators, objectives, and requirements. 3.

Identifying improvement opportunities to better align construction practices with industry best

practices.

Give the 4 procedures for a construction audit.

4. Planning phase

5. Implementation phase

6. Usage phase

7. Follow-up checks

Give at least 4 audit scope of construction auditing.

8. Planning of construction projects and economic calculation.

9. Application and permission for project

10. Cost control, construction and credit settlement

11. Acceptance, warranty and liability

What are the 4 goals to meet by organization of the project.

12. Coordination of the service, deadline and cost-oriented planning.

13. Project planning.

14. Execution.

15. Start-up and completion of the project.

NAME: KYLE C. DE VERA

Course Year & Sec.: BSA-3A

Give the 5 audit process in banks

16. Accepting an engagement

17. Audit planning

18. Considering internal control

19. Performing substantive testing

20. Making opinion on audit

What are the 3 components of audit risk

21. inherent risk

22. control risk

23. detection risk

What are the 2 major functions of bank

24. Accepting deposits

25. Granting advances

Give the 5 non – interest revenues of bank.

26. Broker fees

27. Commissions and fees from products and services

28. Underwriting fees

29. Gain on sale of trading assets

30. Other customer fees (NSF fees, swipe fees, overdrawn fees)

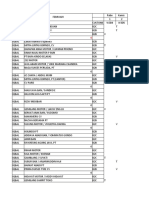

You might also like

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Course Title: Auditing and Assurance: Concepts and Applications 2 Course DescriptionDocument1 pageCourse Title: Auditing and Assurance: Concepts and Applications 2 Course DescriptionMichael Arevalo100% (1)

- Chapter 22 Auditing in A CIS Environment - pptx990626434Document25 pagesChapter 22 Auditing in A CIS Environment - pptx990626434Clar Aaron Bautista67% (3)

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (3)

- Quiz Group 1Document10 pagesQuiz Group 1Mubarrach MatabalaoNo ratings yet

- Prelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearDocument10 pagesPrelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearJeremae Ann Ceriaco100% (1)

- Chapter 25 - Substantive Test of LiabilitiesDocument10 pagesChapter 25 - Substantive Test of LiabilitiesQuijano GpokskieNo ratings yet

- Auditing Specialised IndustryDocument3 pagesAuditing Specialised IndustryAcheampong AnthonyNo ratings yet

- AUDITING PROBLEMS TEST BANK 2 With AnswersDocument14 pagesAUDITING PROBLEMS TEST BANK 2 With AnswersKimberly Milante100% (3)

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Group 8 Audit of Insurance Industry Including HMODocument16 pagesGroup 8 Audit of Insurance Industry Including HMOKyree VladeNo ratings yet

- Auditing in Specialized Industries (Notes)Document10 pagesAuditing in Specialized Industries (Notes)Jene LmNo ratings yet

- Midterm Specialized IndustriesDocument9 pagesMidterm Specialized IndustriesAmie Jane Miranda0% (1)

- Auditing and Assurance: Specialized Industries ACCO 30073: College of Accountancy and Finance Department of AccountancyDocument7 pagesAuditing and Assurance: Specialized Industries ACCO 30073: College of Accountancy and Finance Department of AccountancyLee Teuk100% (2)

- At.3001 Assurance Engagements Other Services of A PractitionerDocument4 pagesAt.3001 Assurance Engagements Other Services of A PractitionerSadAccountantNo ratings yet

- Auditing in The Cis Environment ReviewerDocument3 pagesAuditing in The Cis Environment ReviewerEvita Faith LeongNo ratings yet

- Test Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsDocument14 pagesTest Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsMarkie Grabillo100% (1)

- ACCT403: Auditing and Assurance: Specialized Industries Final ExaminationDocument4 pagesACCT403: Auditing and Assurance: Specialized Industries Final ExaminationMiles SantosNo ratings yet

- Audit of BanksDocument10 pagesAudit of BanksIra Grace De Castro100% (2)

- Quiz 12 - Subs Test - Audit of Investment (Q)Document3 pagesQuiz 12 - Subs Test - Audit of Investment (Q)Kenneth Christian WilburNo ratings yet

- Semi-Final Examination: Auditing Assurance in Specialized IndustriesDocument3 pagesSemi-Final Examination: Auditing Assurance in Specialized IndustriesNikky Bless LeonarNo ratings yet

- Audit of Insurance Industry Including Hmo: Specialized IndustriesDocument47 pagesAudit of Insurance Industry Including Hmo: Specialized IndustriesKyree VladeNo ratings yet

- Pre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesDocument2 pagesPre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesCristina ElizaldeNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- Preliminary Exam Reviewer1Document77 pagesPreliminary Exam Reviewer1Adam Smith0% (1)

- Aud Spec 101Document19 pagesAud Spec 101Yanyan GuadillaNo ratings yet

- Quiz 1 Specialized IndustriesDocument5 pagesQuiz 1 Specialized IndustriesLyca Mae CubangbangNo ratings yet

- Operational Auditing Chapter 5 (Hernan Murdock Chapter Questionnaire)Document6 pagesOperational Auditing Chapter 5 (Hernan Murdock Chapter Questionnaire)Renelle HabacNo ratings yet

- Internal Auditing 2015 Ed SolManDocument3 pagesInternal Auditing 2015 Ed SolManGiovannaNo ratings yet

- Quiz 2 Specialized IndustriesDocument5 pagesQuiz 2 Specialized IndustriesLyca Mae CubangbangNo ratings yet

- Specialized Industry Finals - With AnswerDocument16 pagesSpecialized Industry Finals - With AnswerXXXXXXXXXXXXXXXXXXNo ratings yet

- 1 Open Preboard Examination, Batch 3: Page Jabellar/Ajabinal/Aibay/Rbercasio/JmaglinaoDocument13 pages1 Open Preboard Examination, Batch 3: Page Jabellar/Ajabinal/Aibay/Rbercasio/JmaglinaoMerliza JusayanNo ratings yet

- Group-6-Auditing The Revenue CycleDocument57 pagesGroup-6-Auditing The Revenue CycleRia CruzNo ratings yet

- Audit On CIS EnvironmentDocument30 pagesAudit On CIS EnvironmentMiles SantosNo ratings yet

- PSA 700, 705, 706, 710, 720 ExercisesDocument11 pagesPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNo ratings yet

- Audit of Receivables Problem No. 1: Auditing ProblemsDocument6 pagesAudit of Receivables Problem No. 1: Auditing ProblemsCiarie Mae SalgadoNo ratings yet

- Ap Prob 8Document2 pagesAp Prob 8jhobsNo ratings yet

- Auditing and Assurance - Concepts and Applications - Preim ExamDocument8 pagesAuditing and Assurance - Concepts and Applications - Preim ExamMaricar San AntonioNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- BanksDocument58 pagesBanksgraceNo ratings yet

- Auditing and Assurance Concepts and Applications 2Document6 pagesAuditing and Assurance Concepts and Applications 2mhadzmp100% (1)

- 10.1. Cis Environment: Meaning of CIS AuditDocument13 pages10.1. Cis Environment: Meaning of CIS AuditShubham BhatiaNo ratings yet

- Important Points and Sample Questions On Audit of Specialized IndustriesDocument8 pagesImportant Points and Sample Questions On Audit of Specialized IndustriesIra Grace De CastroNo ratings yet

- Quiz 1 AuditingDocument1 pageQuiz 1 AuditingSashaNo ratings yet

- At Professional Responsibilities and Other Topics With AnswersDocument27 pagesAt Professional Responsibilities and Other Topics With AnswersShielle AzonNo ratings yet

- Auditing Theory Review Course Pre-Board Exam - FinalDocument11 pagesAuditing Theory Review Course Pre-Board Exam - FinalROMAR A. PIGANo ratings yet

- IT Audit 4ed SM Ch10Document45 pagesIT Audit 4ed SM Ch10randomlungs121223No ratings yet

- Answer KeyDocument6 pagesAnswer KeyClaide John OngNo ratings yet

- Aasi Group 1 QuizDocument4 pagesAasi Group 1 QuizNanase SenpaiNo ratings yet

- Audit of Liabilities. REVIEWDocument3 pagesAudit of Liabilities. REVIEWCattleyaNo ratings yet

- Quiz On Overview of Audit ProcessDocument14 pagesQuiz On Overview of Audit ProcessZtrick 1234No ratings yet

- Difficulties, If There Are Concerns With Compliance, It Implies There Are ProblemsDocument4 pagesDifficulties, If There Are Concerns With Compliance, It Implies There Are ProblemsBrian GoNo ratings yet

- Introduction To Specialize IndustriesDocument2 pagesIntroduction To Specialize IndustriesPaupauNo ratings yet

- Code of Ethics CPAR Manila ReviewerDocument14 pagesCode of Ethics CPAR Manila ReviewerJudith GabuteroNo ratings yet

- Audit Fot Liability Problem #8Document2 pagesAudit Fot Liability Problem #8Ma Teresa B. CerezoNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- Focus Notes Psa 530Document1 pageFocus Notes Psa 530Joyce Kay AzucenaNo ratings yet

- Audit Process - Performing Substantive TestDocument49 pagesAudit Process - Performing Substantive TestBooks and Stuffs100% (1)

- Chapter 9-Auditing The Revenue Cycle: True/FalseDocument23 pagesChapter 9-Auditing The Revenue Cycle: True/Falseahmed0% (1)

- Chapter 9 Cabrera Applied AuditingDocument5 pagesChapter 9 Cabrera Applied AuditingCristy Estrella50% (4)

- GEC Elect 2 Module 5Document15 pagesGEC Elect 2 Module 5Aira Mae Quinones OrendainNo ratings yet

- Test Result: B. Periodic Review of The Business Case Is Not Needed For A Multi-Phase ProjectDocument9 pagesTest Result: B. Periodic Review of The Business Case Is Not Needed For A Multi-Phase ProjectAris FrianantaNo ratings yet

- Question and Answer of Group 8 - Audit of Insurance Industry Including HMODocument32 pagesQuestion and Answer of Group 8 - Audit of Insurance Industry Including HMOKyree VladeNo ratings yet

- Chapter 4 Revenues and Other ReceiptsDocument10 pagesChapter 4 Revenues and Other ReceiptsKyree VladeNo ratings yet

- Pamantasan NG Lungsod NG Pasig: Test I - IdentificationDocument2 pagesPamantasan NG Lungsod NG Pasig: Test I - IdentificationKyree VladeNo ratings yet

- Overall Role and ResponsibilityDocument9 pagesOverall Role and ResponsibilityKyree VladeNo ratings yet

- Net 57,000 Date (5.II.e)Document11 pagesNet 57,000 Date (5.II.e)Kyree VladeNo ratings yet

- De Vera, Kyle (AP1 - Assign3 - Inventories)Document3 pagesDe Vera, Kyle (AP1 - Assign3 - Inventories)Kyree VladeNo ratings yet

- JowanDocument3 pagesJowanKyree VladeNo ratings yet

- Audit of Insurance Industry Including Hmo: Specialized IndustriesDocument47 pagesAudit of Insurance Industry Including Hmo: Specialized IndustriesKyree VladeNo ratings yet

- Dokumento Nang PagtitiponDocument3 pagesDokumento Nang PagtitiponKyree VladeNo ratings yet

- ShiftDocument2 pagesShiftKyree VladeNo ratings yet

- This Study Resource Was: The Expenditure CycleDocument2 pagesThis Study Resource Was: The Expenditure CycleKyree VladeNo ratings yet

- Group 8 Audit Plan of Insurance Company ManulifeDocument19 pagesGroup 8 Audit Plan of Insurance Company ManulifeKyree VladeNo ratings yet

- De Vera, Kyle (Activity - Pearson R)Document2 pagesDe Vera, Kyle (Activity - Pearson R)Kyree VladeNo ratings yet

- Principles of TeachingDocument2 pagesPrinciples of TeachingKyree VladeNo ratings yet

- De Vera, Kyle C. (StraMa - Webinar)Document3 pagesDe Vera, Kyle C. (StraMa - Webinar)Kyree VladeNo ratings yet

- Based On The Movie JOBS and On The Lessons Learned So Far, What Do You Think Is The Biggest Stumbling Block For APPLE?Document2 pagesBased On The Movie JOBS and On The Lessons Learned So Far, What Do You Think Is The Biggest Stumbling Block For APPLE?Kyree VladeNo ratings yet

- JOBS2013 - Movie Analysis (Kyle de Vera BSA-3A)Document2 pagesJOBS2013 - Movie Analysis (Kyle de Vera BSA-3A)Kyree VladeNo ratings yet

- Retrieved November 18, 2019 From: BibliographyDocument3 pagesRetrieved November 18, 2019 From: BibliographyKyree VladeNo ratings yet

- Kedir Awel KalilDocument29 pagesKedir Awel KalilKedir100% (3)

- Otd MCQSDocument18 pagesOtd MCQSAnasAhmed100% (1)

- Flowchart For SDM ProcessDocument5 pagesFlowchart For SDM ProcessSpencer BrianNo ratings yet

- Philips Versus MatsushitaDocument4 pagesPhilips Versus Matsushitaswati04sweetNo ratings yet

- New Signature Update FormDocument3 pagesNew Signature Update FormKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- Chapter Four OmDocument20 pagesChapter Four Omkassahungedefaye312No ratings yet

- b02084 - Chapter 4 - Goals and Governance of The FirmDocument12 pagesb02084 - Chapter 4 - Goals and Governance of The Firmhonguyenkimkhanh55No ratings yet

- Business Plan Proposal OF (Name of Business) EntrepreneurshipDocument10 pagesBusiness Plan Proposal OF (Name of Business) EntrepreneurshipMariel Jayloni VicenteNo ratings yet

- Solution Key of Quiz 3 Statistics - Mathematics For Management Spring - 2023 MBA 1A 22052023 021548pmDocument6 pagesSolution Key of Quiz 3 Statistics - Mathematics For Management Spring - 2023 MBA 1A 22052023 021548pmAimen ImranNo ratings yet

- APPC Inventory Operations SynopsisDocument5 pagesAPPC Inventory Operations Synopsisdev_thecoolboy0% (1)

- Building Condition Assessment A Comprehensive Approach in Energy and Facility ManagementDocument56 pagesBuilding Condition Assessment A Comprehensive Approach in Energy and Facility ManagementBilly TalaugonNo ratings yet

- Semi-Final Examination: Auditing Assurance in Specialized IndustriesDocument3 pagesSemi-Final Examination: Auditing Assurance in Specialized IndustriesNikky Bless LeonarNo ratings yet

- Competitive AdvantageDocument16 pagesCompetitive AdvantageakashNo ratings yet

- Analisis Peramalan Kebutuhan Persediaan Untuk Keunggulan Bersaing Pada Perusahaan OrcaDocument12 pagesAnalisis Peramalan Kebutuhan Persediaan Untuk Keunggulan Bersaing Pada Perusahaan OrcaMuhammad Hasanuddin taibienNo ratings yet

- Th-Catalogue 2016Document128 pagesTh-Catalogue 2016Sales AydinkayaNo ratings yet

- Microeconomics 11th Edition Michael Parkin Test BankDocument25 pagesMicroeconomics 11th Edition Michael Parkin Test BankRobertFordicwr100% (57)

- BSBPMG521 Manage Project Integration First Submission AIBL190470 Gurkirat Singh PDFDocument70 pagesBSBPMG521 Manage Project Integration First Submission AIBL190470 Gurkirat Singh PDFDuvan BermudezNo ratings yet

- Aligning CMMI & ITIL: Where Am I and Which Way Do I Go?Document27 pagesAligning CMMI & ITIL: Where Am I and Which Way Do I Go?Wewe SlmNo ratings yet

- The BUDGET MANUAL-report in Operation ManagementDocument42 pagesThe BUDGET MANUAL-report in Operation ManagementAzucenaNo ratings yet

- World Class MaintenanceDocument7 pagesWorld Class MaintenancebsrchandruNo ratings yet

- Required:: Chapter 13 Mini Case Massachusetts Restaurant AppliancesDocument4 pagesRequired:: Chapter 13 Mini Case Massachusetts Restaurant AppliancesSebastian MuñozNo ratings yet

- FINAL Global B2B 2023 SuperPower IndexDocument26 pagesFINAL Global B2B 2023 SuperPower IndexJosue VazquezNo ratings yet

- Makeni FootingDocument3 pagesMakeni FootingJack HaamboteNo ratings yet

- C5-Location Selection and Facility DesignDocument99 pagesC5-Location Selection and Facility DesignThảo ThảoNo ratings yet

- Auditing Notes B.com Part 2 Punjab UniversityDocument73 pagesAuditing Notes B.com Part 2 Punjab Universitykhursheed rasoolNo ratings yet

- What Makes A Brand Manager EffectiveDocument7 pagesWhat Makes A Brand Manager EffectiveSchiknider DarkNo ratings yet

- Escape The Matrix - Business Advice For Money Making SuccessDocument9 pagesEscape The Matrix - Business Advice For Money Making SuccessSaiskanda GunturyNo ratings yet

- Kejriwal Castings Limited (Testing Lab, DGP) : 1.0 PurposeDocument4 pagesKejriwal Castings Limited (Testing Lab, DGP) : 1.0 PurposeAniruddha ChatterjeeNo ratings yet

- Schedule-Q Marjan RedDocument78 pagesSchedule-Q Marjan RedVinu MadhavanNo ratings yet

- Iqbal Banjar Jadwal MaretDocument18 pagesIqbal Banjar Jadwal MaretIqbal ZulhamiNo ratings yet