Professional Documents

Culture Documents

1 - Laurent Pipitone

1 - Laurent Pipitone

Uploaded by

Ram KnowlesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 - Laurent Pipitone

1 - Laurent Pipitone

Uploaded by

Ram KnowlesCopyright:

Available Formats

Cocoa

supply & demand: what to expect in the

coming years?

London, 22 September 2015

Daily QKCc1 21/09/2005 - 29/08/2014 (NYC)

Value

VltyOHLC, QKCc1, Trade Price, 0.0, 10, 365.0 USc

05/01/2010, 22.93

Lbs

BarHL, QKCc1, Trade Price

290

05/01/2010, 142.70, 140.40, +2.45, (+1.79%)

BBand, QKCc1, Trade Price(Last), 20, Simple, 2.0 280

05/01/2010, 149.64, 142.35, 135.06 270

260

250

248.94

240

230

220

210

200

190

180

170

160

150

146.00

140

135.50

130

125.19

120

110

104.39

100

90

80

70

60

55.74

50

40

30

20

10

Auto

O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S OTue

N D05/01/2010

J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A SO N D J FM A M J J A S O N D J FM A M J J AS

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Laurent Pipitone - ICCO - laurent.pipitone@icco.org

International Cocoa Organization (ICCO) | September 2015

1

The “chocapocalypse 2020”

“No more chocolates by 2020!”

“Chocolate bars may get replaced by slabs of palm

oil and vegetable fats packed with raisins and nougat by 2020 ”

The Times of India – 13 April 2014

“Don’t panic, but we could be running

out of chocolate”

“By 2020, the world could see a chocolate deficit of 1m tonnes”

The Telegraph – 17 November 2014

“We'll run out of cocoa in just SEVEN years!”

“The world will officially run out on October 2, 2020”

Star Sunday – 6 October 2013

Enjoy today’s Easter eggs: they could

soon become a luxury

The Observer – 4 April 2015

“Manufacturers warn that the world may

soon run out of chocolate!”

The Week – 17 November 2014

International Cocoa Organization (ICCO) | September 2015

2

Trend in supply & demand

4,500

4,000

3,500

Thousand tonnes

3,000

Net Production

2,500

2,000

Grindings

1,500

1,000

Source: ICCO

International Cocoa Organization (ICCO) | September 2015

3

Development of cocoa prices,

in relation to cocoa availability

$15,000 160%

$14,000 18 July 1977: max 150%

US$18,000 per tonne

$13,000 140%

$12,000 130%

120%

$11,000

110%

$10,000

100%

$9,000

90%

$8,000

80%

$7,000

70%

$6,000 Today: over

60%

US$3,300 per tonne

$5,000

50%

$4,000

24 Nov 2000: min 40%

$3,000 US$1,000 per tonne

30%

$2,000 20%

$1,000 10%

$0 0%

Crop year (Oct-Sep)

Stocks-to-grindings ratio (right scale) ICCO daily price US$/tonne (current)

ICCO daily price US$/tonne (2013/14 terms)

International Cocoa Organization (ICCO) | September 2015

4

World cocoa production (gross)

2014/15 forecast: 4.192 million tonnes

Africa: 72% Asia & Oceania: 10%

(3.013 million tonnes) (435,000 tonnes)

Latin America: 18%

(744,000 tonnes)

International Cocoa Organization (ICCO) | September 2015

5

Source: ICCO

Regional cocoa production

(thousand tonnes)

3,500

3,000

2,500

Thousand tonnes

2,000

1,500

1,000

500

Africa America Asia

International Cocoa Organization (ICCO) | September 2015

6

Source: ICCO

2000

1800 1746 1760 Cocoa production: top 12

(thousand tonnes)

1600

1400 Estimates for 2013/14

Forecasts for 2014/15

1200

1000

897

800 720

600

375

400 350

234 250 230 248

228

230 211 210

200

76 78 70 70 51

49 36 42 30 30

0

Source: ICCO

International Cocoa Organization (ICCO) | September 2015

7

Main factors influencing cocoa production

and farm profitability

Business environment

• Ease of doing business

• Regulations and taxation

• Infrastructures

• Qualified labour availability and cost

• Policy support to the cocoa sector

Agronomic factors

• Farming system used (from agroforestry model to intensive, productivity-orientated

model, often without shade of any kind (full-sun),

• Level of farm crop diversity

• Variety of the cocoa used: yield, resistance to pests and diseases, quality traits

• Age of the trees

• Level of husbandry – Good Agricultural practices

• Use of inputs (labour, use of phytosanitary products and fertilizers)

• Weather condition

• Presence of pests and diseases

Economic factors

• Price of cocoa beans

• Cost of inputs

International Cocoa Organization (ICCO) | September 2015

8

World cocoa grindings

2014/15 forecast: 4.131 million tonnes

Europe and Russia: 38%

(1.571 million tonnes)

Asia & Oceania 20%

(831,000 tonnes)

Americas: 21%

(875,000 tonnes)

Africa: 21%

(855,000 tonnes)

International Cocoa Organization (ICCO) | September 2015

9

Regional cocoa grindings

(thousand tonnes)

1,800

1,600

1,400

1,200

1,000

Thousand tonnes

800

600

400

200

Europe Africa America Asia

International Cocoa Organization (ICCO) | September 2015

10

600

560

550 519

528

516 Cocoa processing: top 15

500

(thousand tonnes)

446

450

406 412 404

Estimates for 2013/14

400

Forecasts for 2014/15

350 322

312

300

259

250 240 234

220

200 200

200

150 135

126

98 96 91 94

100 88 91

73 78 79 77 75 71

50

Source: ICCO

International Cocoa Organization (ICCO) | September 2015

11

Production surpluses / deficits

4 500 500

4 200

400

thousand tonnes (Production/Grindings)

thousand tonnes (Surplus/Deficit)

3 900

300

3 600

200

3 300

3 000 100

2 700

0

2 400

-100

2 100

-200

1 800

1 500 -300

International Cocoa Organization (ICCO) | September 2015

12

Cocoa apparent consumption

Cocoa year 2008/09 Cocoa year 2013/14

Asia & Oceania

Asia & Oceania European

Union European

Union

15% 17%

Latin Latin

America 39% America 36%

9%

9%

23% 10%

24%

North America 4%

3% 10% North America

Other

Other

Africa Europe

Europe

Africa

Source: ICCO, Quarterly Bulletin of Cocoa Statistics

International Cocoa Organization (ICCO) | September 2015

13

Growth in cocoa consumption

4500 60%

4004

4000 + 51%

3536

50%

3500

3000 + 31%

40%

2614

thousand tonnes

2500 2444

30%

2000 + 23%

+ 28%

1501

1500 1390 1421 20%

+ 12%

1091

1000 + 10%

794 856

10%

435 445

500 362 359

288 117 152 229 257 + 8% 325

+7% + 6%

0 0%

Source: ICCO 2008/09 2013/14 % Increase

International Cocoa Organization (ICCO) | September 2015

14

What about China and India?

Retail Chocolate confectionery consumption Cocoa consumption

China & World China &

World % world % world

India Consumption India

(in thousand tonnes) (in thousand tonnes)

2012/13 6,946 314 4.5% 3,889 115 3.0%

2013/14 7,061 344 4.9% 4,089 138 3.4%

2014/15 7,177 375 5.2% 4,131 150 3.6%

2015/16 7,314 406 5.5% 4,218 162 3.8%

2016/17 7,465 437 5.9% 4,318 175 4.0%

2017/18 7,626 469 6.2% 4,437 188 4.2%

2018/19 7,796 502 6.4% 4,568 201 4.4%

Annual growth

2013/14 -

2018/19 2.0% 7.9% 2.2% 7.9%

Source: Euromonitor, ICCO

International Cocoa Organization (ICCO) | September 2015

15

ICCO Forecasts for cocoa supply and demand

5000

4800

4600

Thousand tonnes

4400

4200

4000

3800

3600

Production (net) Grindings

Note: These forecasts are the result of the ICCO econometric model on the World Cocoa Economy. The model is

Source: ICCO based on past information and does not take into account new policies set up to support the cocoa sector as well

as abnormal weather condition. The aim of the model is to provide a likely trend with a view to adapt government

policies and investments. Due caution should be used in using these forecasts.

International Cocoa Organization (ICCO) | September 2015

16

You might also like

- EC - Item 03 - World Cocoa EconomyDocument7 pagesEC - Item 03 - World Cocoa EconomyArnaud KUCZINANo ratings yet

- Conference On The Trends and Future Prospects - EC-Item 08Document2 pagesConference On The Trends and Future Prospects - EC-Item 08Ricardo Vera TorresNo ratings yet

- Market Update 020710Document2 pagesMarket Update 020710wsocNo ratings yet

- DeckDocument1 pageDeckKiki FadilahNo ratings yet

- UntitledDocument1 pageUntitledMeet JaniNo ratings yet

- Sci GeneralDocument1 pageSci Generalabbas.arch.ciNo ratings yet

- SCI GENERAL Plan Etage Courant 24-04-24Document1 pageSCI GENERAL Plan Etage Courant 24-04-24abbas.arch.ciNo ratings yet

- 27 37708 A Sheet Sunroof: 02.04.2020 01.04.2020 KURA KuraDocument1 page27 37708 A Sheet Sunroof: 02.04.2020 01.04.2020 KURA KuraAlfonso LópezNo ratings yet

- A3 Kolor 2Document1 pageA3 Kolor 2dami20022412No ratings yet

- ARBURG - Hydraulic AllroundersDocument16 pagesARBURG - Hydraulic AllroundersEnrique GamaNo ratings yet

- 10 - AHSS in Mercedes-Benz Passenger CarsDocument19 pages10 - AHSS in Mercedes-Benz Passenger CarsAbhishek KumarNo ratings yet

- AC-201 PLAN PARTER - ModifDocument1 pageAC-201 PLAN PARTER - Modiflupumihaicosmin89No ratings yet

- Sectiune Biserica: Master TMLCDocument1 pageSectiune Biserica: Master TMLCAlexandru ȚigănușNo ratings yet

- Claim AnalysisDocument54 pagesClaim AnalysisKATHIRVEL SNo ratings yet

- Claim AnalysisDocument54 pagesClaim AnalysisKATHIRVEL SNo ratings yet

- Carbon Dioxide: Pressure - Enthalpy Diagram: R 90 0 Sity 7 00 KG/MDocument1 pageCarbon Dioxide: Pressure - Enthalpy Diagram: R 90 0 Sity 7 00 KG/MJackNo ratings yet

- CZ LOKO Catalogue of Locomotives and Special Vehicles1Document32 pagesCZ LOKO Catalogue of Locomotives and Special Vehicles1frtanay12No ratings yet

- Blacl Swan Capital, Currency Currents 12.11.10Document11 pagesBlacl Swan Capital, Currency Currents 12.11.10jockxyzNo ratings yet

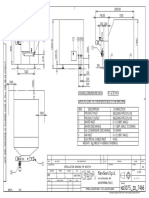

- Draft by Niswar: Coldbin Asphalt Drum/CementDocument1 pageDraft by Niswar: Coldbin Asphalt Drum/CementNiswar MiftahNo ratings yet

- Produk Diskon Membership / Membeship Discount ListDocument1 pageProduk Diskon Membership / Membeship Discount ListNithaNo ratings yet

- Diseño F-Tramo 02Document1 pageDiseño F-Tramo 02Euliseo TacnaNo ratings yet

- Chart of Thermodynamic & Transport Properties of CO2 - ManualDocument34 pagesChart of Thermodynamic & Transport Properties of CO2 - ManualAbdus Saboor KhalidNo ratings yet

- Ground Floor 3076 First Floor 3412 Stair 148 Total 6636 FTSQ With Out ElevationDocument2 pagesGround Floor 3076 First Floor 3412 Stair 148 Total 6636 FTSQ With Out ElevationMAN ENGINEERINGNo ratings yet

- PW 065 PW 120 PW 102: Extra Top BarsDocument1 pagePW 065 PW 120 PW 102: Extra Top BarsHossam AbdelazizNo ratings yet

- Stock Market ReactionDocument3 pagesStock Market ReactionDwitiya MukhopadhyayNo ratings yet

- Usi Corp N PDFDocument1 pageUsi Corp N PDFRaluca NicuNo ratings yet

- Plan View at Tos - El +104.000: Sheet 1 of 1Document1 pagePlan View at Tos - El +104.000: Sheet 1 of 1D7mey XNo ratings yet

- Bu Henny - Rencana Plafond Kamar Utama PDFDocument1 pageBu Henny - Rencana Plafond Kamar Utama PDFFackur MansyahNo ratings yet

- Return Sludge PumpDocument2 pagesReturn Sludge PumpAbu SuraisyNo ratings yet

- Long ProfileDocument1 pageLong ProfileHabib Husni HutagalungNo ratings yet

- Peta Sequence Elev 25-30Document1 pagePeta Sequence Elev 25-30haltimberdikariNo ratings yet

- CCDC Ubbm30 01Document4 pagesCCDC Ubbm30 01Luong LeNo ratings yet

- Pressed PDFDocument2 pagesPressed PDFFrankNo ratings yet

- HousingDocument1 pageHousingArief FibonacciNo ratings yet

- SP02-TA01-105: Detail A Scale 1: 5Document1 pageSP02-TA01-105: Detail A Scale 1: 5kartik spectomsNo ratings yet

- Osnova Prizemlja: Kotlara OstavaDocument1 pageOsnova Prizemlja: Kotlara OstavaEminaŠarkinovićNo ratings yet

- KOUROUSSA - Clinique - Vue en PlanDocument1 pageKOUROUSSA - Clinique - Vue en PlanSamuel YekoNo ratings yet

- BMWDocument1 pageBMWWawan R YusufNo ratings yet

- Second Floor Rev1Document1 pageSecond Floor Rev1Izzet BozkurtNo ratings yet

- Gfps System Specification PVC C Metric en PDFDocument24 pagesGfps System Specification PVC C Metric en PDFMohammed sabatinNo ratings yet

- Releveu CabinetDocument1 pageReleveu Cabinetnagib rihamNo ratings yet

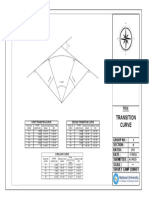

- Transition CurveDocument1 pageTransition CurveFaisal TehseenNo ratings yet

- Mapa de Comunidades NativasDocument1 pageMapa de Comunidades NativasLizeth Licas camposNo ratings yet

- Inferred Map of Landslide Hazard Zones - Sheet 55: Laggala-PallegamaDocument1 pageInferred Map of Landslide Hazard Zones - Sheet 55: Laggala-Pallegamabub12345678No ratings yet

- Bike StationDocument1 pageBike StationNajate BennaniNo ratings yet

- PWHEAMTUSDMDocument3 pagesPWHEAMTUSDMLinh TranNo ratings yet

- Denah UkuranDocument1 pageDenah UkuranJaka PranaNo ratings yet

- Jindal Steel and Power LTD: 1.1 Fundamentalanalysis (Company Analysis by Financial Ratio'S)Document3 pagesJindal Steel and Power LTD: 1.1 Fundamentalanalysis (Company Analysis by Financial Ratio'S)yash chauhanNo ratings yet

- Concrete Framed Structure DrawingsDocument52 pagesConcrete Framed Structure DrawingsZiningi Makha MnqayiNo ratings yet

- Plano NS3075 - ID - 7466Document1 pagePlano NS3075 - ID - 7466Christian CastilleroNo ratings yet

- Arburg Hydraulic Allrounders 680472 en GBDocument16 pagesArburg Hydraulic Allrounders 680472 en GBPurece EugenNo ratings yet

- Designing Silicon Carbide (Sic) Based DC Fast Charging System: Key Challenges, Design Considerations, and Building ValidationDocument31 pagesDesigning Silicon Carbide (Sic) Based DC Fast Charging System: Key Challenges, Design Considerations, and Building Validationtakaca40No ratings yet

- First FloorDocument1 pageFirst Floortadesse felekeNo ratings yet

- B01-SOP-HC-E-003 - HC-E Controller Basic Installation Instructions - ENGDocument2 pagesB01-SOP-HC-E-003 - HC-E Controller Basic Installation Instructions - ENGKien Nguyen TrungNo ratings yet

- Suzi's Weight and BMI ChartDocument1 pageSuzi's Weight and BMI ChartreimsmNo ratings yet

- MAP Student TrajectoriesDocument1 pageMAP Student TrajectoriesJulian A.No ratings yet

- PLANDocument1 pagePLANbasurah abdullNo ratings yet

- Star S2 St-Brochure March2019 WebDocument3 pagesStar S2 St-Brochure March2019 WebMandla RebirthNo ratings yet

- Cooker Hood: User ManualDocument124 pagesCooker Hood: User ManualRadu PopescuNo ratings yet

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- Store Check ReportDocument5 pagesStore Check ReportRam KnowlesNo ratings yet

- Morphology: Grasses Scientific Name English Name Habitat Life Cycle CharacteristicsDocument4 pagesMorphology: Grasses Scientific Name English Name Habitat Life Cycle CharacteristicsRam KnowlesNo ratings yet

- We Are Intechopen, The World'S Leading Publisher of Open Access Books Built by Scientists, For ScientistsDocument16 pagesWe Are Intechopen, The World'S Leading Publisher of Open Access Books Built by Scientists, For ScientistsRam KnowlesNo ratings yet

- Job CostingDocument24 pagesJob CostingRam KnowlesNo ratings yet

- Activity-Based Costing SampleDocument16 pagesActivity-Based Costing SampleRam KnowlesNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- Standard CostingDocument30 pagesStandard CostingRam KnowlesNo ratings yet

- Job CostingDocument24 pagesJob CostingRam KnowlesNo ratings yet

- Mr. Cooper Individual Notice - Proof - RedactedDocument4 pagesMr. Cooper Individual Notice - Proof - Redactedmichael.kanNo ratings yet

- 10 11648 J Jfa 20221001 17Document19 pages10 11648 J Jfa 20221001 17Bekele GetachewNo ratings yet

- Cement Industry Analysis 2022Document21 pagesCement Industry Analysis 2022babu chyNo ratings yet

- Revised As of January 2015Document4 pagesRevised As of January 2015Agustino Laoaguey MarceloNo ratings yet

- MEFA Unit-5Document22 pagesMEFA Unit-5Koppula veerendra nadhNo ratings yet

- 02 Quiz 2Document1 page02 Quiz 2Rosemarie AberosNo ratings yet

- Art Integration Project: Xii-B Ansh Patel Roll No: 06Document7 pagesArt Integration Project: Xii-B Ansh Patel Roll No: 06Ansh PatelNo ratings yet

- Final Delhi Metro RailDocument116 pagesFinal Delhi Metro RailDhruv Kalia100% (2)

- T M Thomas Isaac Kerala Elections, 1991 - Lessons and Non-LessonsDocument14 pagesT M Thomas Isaac Kerala Elections, 1991 - Lessons and Non-Lessonssudheesh k mNo ratings yet

- Write Up BossingDocument2 pagesWrite Up BossingRhomz OrtizNo ratings yet

- TN3323TS044301 EF1161 31-Dec-2022Document1 pageTN3323TS044301 EF1161 31-Dec-2022vragavhNo ratings yet

- Viva PrepDocument11 pagesViva PrepNayeema khanNo ratings yet

- City Bank Ltd. AuditDocument29 pagesCity Bank Ltd. AuditSameena AhmedNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Bank Reconciliation Statement Solved Example 2Document2 pagesBank Reconciliation Statement Solved Example 2TAFARA MUKARAKATENo ratings yet

- Integrated Provisioning Services: Airbus Material, Logistics and Suppliers, HamburgDocument12 pagesIntegrated Provisioning Services: Airbus Material, Logistics and Suppliers, HamburgEdwar ZulmiNo ratings yet

- Business Cycle Measurement (Chapter 3)Document48 pagesBusiness Cycle Measurement (Chapter 3)Teachers OnlineNo ratings yet

- How To Power Indonesias Solar PV Growth OpportunitiesDocument10 pagesHow To Power Indonesias Solar PV Growth OpportunitiesDilip79No ratings yet

- How To Design A Winning Business ModelDocument20 pagesHow To Design A Winning Business ModelIshita Gupta100% (2)

- Supply Chain Activities / Functions of A CompanyDocument6 pagesSupply Chain Activities / Functions of A CompanyAhmed Afridi Bin FerdousNo ratings yet

- Ratio Analysis - BBA ClassDocument27 pagesRatio Analysis - BBA ClassSophiya PrabinNo ratings yet

- Strategic Planning: Jo Balucanag-Bitonio CDA Dagupan Extension OfficeDocument46 pagesStrategic Planning: Jo Balucanag-Bitonio CDA Dagupan Extension OfficeJay C. LachicaNo ratings yet

- Acca Approved EmployersDocument2 pagesAcca Approved EmployersAsim Khalil100% (1)

- Fecha / Hora Mov. Concepto Importe ComentariosDocument8 pagesFecha / Hora Mov. Concepto Importe ComentariosPela JuanNo ratings yet

- 2021 02 09 SemiconductorsDocument15 pages2021 02 09 SemiconductorskakolakoNo ratings yet

- Traditional Licensing Review Mock Exam - v2023.05.08Document18 pagesTraditional Licensing Review Mock Exam - v2023.05.08valdezkristineanneNo ratings yet

- Familymart in China The Divorce of A 20Document7 pagesFamilymart in China The Divorce of A 20sonali mahajan 833No ratings yet

- MGTS 301 Syllabus UPDATE 2021 FinalDocument2 pagesMGTS 301 Syllabus UPDATE 2021 FinalUtsav PathakNo ratings yet

- Capital Recovery % Annual WorthDocument3 pagesCapital Recovery % Annual WorthTien-Thinh NguyenNo ratings yet

- Investment FD (1652)Document22 pagesInvestment FD (1652)Soumya SinhaNo ratings yet