Professional Documents

Culture Documents

Cereno - Summary - Vat Exempt Sales 20 Discount

Uploaded by

Dianne Lontac0 ratings0% found this document useful (0 votes)

12 views1 pageThis document outlines VAT-exempt items and a 20% minimum discount for senior citizens and persons with disabilities (PWDs) in the Philippines. It lists qualifying medical services, transportation, lodging, entertainment, and funeral/burial services that are VAT-exempt and eligible for the 20% discount for seniors and PWDs. The discounts are intended to help offset costs for medicines, medical treatments, travel, and end-of-life expenses.

Original Description:

l>,MN

Original Title

CERENO_SUMMARY_VAT-EXEMPT-SALES-20-DISCOUNT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines VAT-exempt items and a 20% minimum discount for senior citizens and persons with disabilities (PWDs) in the Philippines. It lists qualifying medical services, transportation, lodging, entertainment, and funeral/burial services that are VAT-exempt and eligible for the 20% discount for seniors and PWDs. The discounts are intended to help offset costs for medicines, medical treatments, travel, and end-of-life expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageCereno - Summary - Vat Exempt Sales 20 Discount

Uploaded by

Dianne LontacThis document outlines VAT-exempt items and a 20% minimum discount for senior citizens and persons with disabilities (PWDs) in the Philippines. It lists qualifying medical services, transportation, lodging, entertainment, and funeral/burial services that are VAT-exempt and eligible for the 20% discount for seniors and PWDs. The discounts are intended to help offset costs for medicines, medical treatments, travel, and end-of-life expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

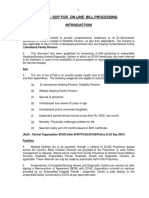

SUMMARY

VAT Exempt Sales and 20% Discount to

Senior Citizens and PWDs (CERENO, MAE CHAREZ A.)

The following items sold to a senior citizen or PWD are vat-exempt and will

entitle the SC/PWD to a minimum discount of 20%:

SENIOR CITIZENS (RR 7-2010) PWDs (RR 5-2017)

Medicine and Drug Purchases On the utilization of services in hotels

Professional fees of attending and similar lodging establishments,

physicians and licensed health restaurants, recreation centers.

workers in all private hospitals, On admission fees charged by

medical facilities, outpatient clinics theaters, cinema houses and concert

and home health care services. halls, circuses, carnivals and other

Medical and dental services, similar places of culture, leisure and

diagnostic and laboratory fees. amusement.

On actual fare for land transportation On the purchase of medicines in all

travel, domestic air transport and sea drugstores.

shipping vessels and the like. On medical and dental services

(Note: Toll fees are not the same as including diagnostic and laboratory

“fares”) fees in all government facilities,

On the utilization of services in hotels private hospitals and medical

and similar lodging establishments, facilities, subject to the guidelines to

restaurants, recreation centers. be issued by the DOH in coordination

On admission fees charged by with the PhilHealth.

theaters, cinema houses and concert On fare for domestic air and sea

halls, circuses, carnivals and other travel.

similar places of culture, leisure and On actual fare for land transportation

amusement. travel.

On funeral and burial services of On funeral and burial services for the

senior citizens. death of the PWD: Provided that the

beneficiary or any person who shall

shoulder the funeral and burial

expenses of the deceased PWD shall

claim the discount under this rule for

the deceased PWD upon

presentation of the death certificate.

(Note: It excludes obituary publication

and the cost of memorial lot)

You might also like

- Socio-Économie de la Santé: Présentation GraphiqueFrom EverandSocio-Économie de la Santé: Présentation GraphiqueRating: 5 out of 5 stars5/5 (2)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument5 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEunice Grace DemaclidNo ratings yet

- PWDDocument20 pagesPWDaya5monteroNo ratings yet

- Know Your Rights! Empowering Persons With DisabilitiesDocument20 pagesKnow Your Rights! Empowering Persons With Disabilitiesaya5monteroNo ratings yet

- DOT Memorandum Circular No. 2011-04Document2 pagesDOT Memorandum Circular No. 2011-04VERA FilesNo ratings yet

- VAT-Related Privileges For Senior CitizensDocument7 pagesVAT-Related Privileges For Senior CitizensMi-young SunNo ratings yet

- Senior Citizen LawDocument11 pagesSenior Citizen Lawacctg2012No ratings yet

- Senior ActDocument16 pagesSenior ActGohan SayanNo ratings yet

- Benefits of Senior CitizenDocument7 pagesBenefits of Senior CitizenShotaro HidariNo ratings yet

- Expanded Senior Citizen Act of 2010Document8 pagesExpanded Senior Citizen Act of 2010Mayvel VerzosaNo ratings yet

- Ethico Legal Considerations SUMMARRYDocument12 pagesEthico Legal Considerations SUMMARRYcj.ljndrn624No ratings yet

- RMC 45 2010Document1 pageRMC 45 2010Dia Mia BondiNo ratings yet

- RA 10754 - An Act Expanding The Benefits and Priviledges of Persons With Disability (PWD)Document6 pagesRA 10754 - An Act Expanding The Benefits and Priviledges of Persons With Disability (PWD)Therese Angelie CamacheNo ratings yet

- Magna Carta For Disabled PersonsDocument4 pagesMagna Carta For Disabled Personsacctg2012No ratings yet

- Comparative Matrix of The Privileges of The Senior CitizensDocument4 pagesComparative Matrix of The Privileges of The Senior CitizensHuemer UyNo ratings yet

- FINAL Benefits, Rights & Privileges of SC & PWD 2019Document26 pagesFINAL Benefits, Rights & Privileges of SC & PWD 2019Hazelle BondocNo ratings yet

- Benefits of Senior CitizensDocument5 pagesBenefits of Senior CitizensJoseph Gedeoni ValenciaNo ratings yet

- Expanded Senior Citizen ActDocument19 pagesExpanded Senior Citizen ActRegalario VincentNo ratings yet

- Global Health Secure - BrochureDocument4 pagesGlobal Health Secure - BrochureSaurabhChaturvediNo ratings yet

- Magna Carta For Persons With DisabilityDocument12 pagesMagna Carta For Persons With DisabilityJemarie AlamonNo ratings yet

- Senior Citizen or Elderly - Any Filipino Citizen Who Is A Resident of The Philippines Who Is 60 Y/o or AboveDocument3 pagesSenior Citizen or Elderly - Any Filipino Citizen Who Is A Resident of The Philippines Who Is 60 Y/o or AboveAlliah SomidoNo ratings yet

- Complimentary-COVID19 Coverage-Terms&Conditions-V2Document8 pagesComplimentary-COVID19 Coverage-Terms&Conditions-V2aasishNo ratings yet

- Matrix of 3 Senior Citizens ActDocument17 pagesMatrix of 3 Senior Citizens ActAisabai AbdulaNo ratings yet

- Blue Royale PlanDocument8 pagesBlue Royale PlanMikele Molina BetervoNo ratings yet

- Insurance Web DocumentDocument13 pagesInsurance Web DocumentOmkar DaveNo ratings yet

- Senior Citizen Act (R.A. 7432) Expanded Citizen Act of 2003 (R.A. 9257) Expanded Citizen Act of 2010 (R.A. 9994)Document2 pagesSenior Citizen Act (R.A. 7432) Expanded Citizen Act of 2003 (R.A. 9257) Expanded Citizen Act of 2010 (R.A. 9994)Reylan San PascualNo ratings yet

- Blue Royale 66 100 BrochureDocument2 pagesBlue Royale 66 100 BrochureAna Patricia SanchezNo ratings yet

- Certificate Study N Travel Elite, 10.20.10Document1 pageCertificate Study N Travel Elite, 10.20.10Intercambio Combr ErickNo ratings yet

- Senior Citizen Act AmendedDocument30 pagesSenior Citizen Act AmendedMaica ManzanoNo ratings yet

- 5 - Legal Med Buzzwords Oct 2023 Jamaiyah H. Serad - Hadji OsopDocument10 pages5 - Legal Med Buzzwords Oct 2023 Jamaiyah H. Serad - Hadji OsopmikzhiNo ratings yet

- VI - Members Guide (January 2022)Document22 pagesVI - Members Guide (January 2022)SalomeeNo ratings yet

- Certificate Study Travel Comfort, 10.20.10Document1 pageCertificate Study Travel Comfort, 10.20.10Intercambio Combr ErickNo ratings yet

- FAQs of RA 9994Document5 pagesFAQs of RA 9994angelosilva1981No ratings yet

- Summary of RA 9994 and IRR of 9994Document4 pagesSummary of RA 9994 and IRR of 9994LavernaNo ratings yet

- Sub172 PDFDocument2 pagesSub172 PDFmaiNo ratings yet

- RA 9994. Expanded Senior Citizen ActDocument24 pagesRA 9994. Expanded Senior Citizen ActArbie LlesisNo ratings yet

- TakafulEmarat Silver AUHDocument6 pagesTakafulEmarat Silver AUHMuruga AnanthNo ratings yet

- Medical Freedom-Stop Medical TyrannyDocument2 pagesMedical Freedom-Stop Medical TyrannyJamie WhiteNo ratings yet

- Medical Attendance Rules 2016Document6 pagesMedical Attendance Rules 2016moss4uNo ratings yet

- Obp PDFDocument39 pagesObp PDFBalhansNo ratings yet

- Federally Qualified Health Center: F Q H C (FQHC)Document4 pagesFederally Qualified Health Center: F Q H C (FQHC)sdardaNo ratings yet

- Brought Dead Protocol - RefDocument2 pagesBrought Dead Protocol - Refjesvin prathapNo ratings yet

- Ra 9994Document23 pagesRa 9994Sandy Marie DavidNo ratings yet

- Expanded Senior Citizens Act of 2010Document3 pagesExpanded Senior Citizens Act of 2010Christopher Jan DotimasNo ratings yet

- Magna Carta For Disabled PersonsDocument7 pagesMagna Carta For Disabled PersonsWayanz BuenaventuraNo ratings yet

- Guidance For Doctors Completing Medical Certificates Mar 22Document16 pagesGuidance For Doctors Completing Medical Certificates Mar 22mohammadsayfooNo ratings yet

- Mission Ballroom - Permitted Items and General RulesDocument1 pageMission Ballroom - Permitted Items and General RulesLogan NovakNo ratings yet

- Laws Affecting Senior CitizensDocument6 pagesLaws Affecting Senior CitizensKenneth UbaldeNo ratings yet

- Policy AnalysisDocument27 pagesPolicy AnalysisAdonis CorowanNo ratings yet

- Statement On Controlled Organ Donation After Circulatory DeathDocument10 pagesStatement On Controlled Organ Donation After Circulatory DeathHeidi ReyesNo ratings yet

- Kaiser Basic Care 2011Document2 pagesKaiser Basic Care 2011Jaime AntunezNo ratings yet

- Medcert July 2010Document15 pagesMedcert July 2010ranggadrNo ratings yet

- TST Les 4Document6 pagesTST Les 4leomartinqtNo ratings yet

- ElderlyDocument12 pagesElderlydNo ratings yet

- Group Health Insurance - Policy Overview.Document14 pagesGroup Health Insurance - Policy Overview.Sai SandeepNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument73 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledAngel JuanNo ratings yet

- WACHS G PATS GuideForPatientsAndCarersDocument16 pagesWACHS G PATS GuideForPatientsAndCarersboldeloubiaNo ratings yet

- Compiled by LifesourceDocument4 pagesCompiled by LifesourceNd HerbNo ratings yet

- PWDsDocument34 pagesPWDsmaria carmela pullantes100% (1)

- MAGO, KEISHA B. BSA-2B Business Taxation VAT Exempt Sales K & LDocument1 pageMAGO, KEISHA B. BSA-2B Business Taxation VAT Exempt Sales K & LDianne LontacNo ratings yet

- Gonzales Vat Exempt AbDocument3 pagesGonzales Vat Exempt AbDianne LontacNo ratings yet

- VAT (Chapter 8 Compilation of Summary)Document36 pagesVAT (Chapter 8 Compilation of Summary)Dianne LontacNo ratings yet

- Computation of Vat Payable and Actual SaleDocument2 pagesComputation of Vat Payable and Actual SaleDianne LontacNo ratings yet

- Camarines Norte State College: Republic of The PhilippinesDocument3 pagesCamarines Norte State College: Republic of The PhilippinesDianne LontacNo ratings yet

- Total Sales 1,120 Less: 20% Discount (224) Total Sales Net of Discount 896Document2 pagesTotal Sales 1,120 Less: 20% Discount (224) Total Sales Net of Discount 896Dianne LontacNo ratings yet

- Policarpio Jaymark BSA2B BayanihanAndSelfEmployedDocument2 pagesPolicarpio Jaymark BSA2B BayanihanAndSelfEmployedDianne LontacNo ratings yet

- CNSC Vision, Mission, Goals and Objectives and Quality PolicyDocument1 pageCNSC Vision, Mission, Goals and Objectives and Quality PolicyDianne LontacNo ratings yet

- Importation - Although Importation Is Not A Transaction Arising From The OrdinaryDocument2 pagesImportation - Although Importation Is Not A Transaction Arising From The OrdinaryDianne LontacNo ratings yet

- Vat Exempt Sales CD GumamelaDocument1 pageVat Exempt Sales CD GumamelaDianne LontacNo ratings yet

- Value Added Tax: Andrade, Celwyn Bonn S. Bsa 2BDocument1 pageValue Added Tax: Andrade, Celwyn Bonn S. Bsa 2BDianne LontacNo ratings yet

- Article 1519Document2 pagesArticle 1519Dianne LontacNo ratings yet

- Camarines Norte State College: FM 100 - LM 2Document2 pagesCamarines Norte State College: FM 100 - LM 2Dianne LontacNo ratings yet

- Handout For General Principles of TaxationDocument44 pagesHandout For General Principles of TaxationDianne LontacNo ratings yet

- Amended Bsa Handout For Gross Income Part 1Document40 pagesAmended Bsa Handout For Gross Income Part 1Dianne Lontac100% (1)

- Conceptual Activity 1 Journal FinalDocument2 pagesConceptual Activity 1 Journal FinalDianne LontacNo ratings yet

- Caregiving NC II - CBCDocument126 pagesCaregiving NC II - CBCDarwin Dionisio ClementeNo ratings yet

- Flowchart For Drug Surrender: Pnp/PdeaDocument2 pagesFlowchart For Drug Surrender: Pnp/PdeaLuppo PcaduNo ratings yet

- The ADHD ToolkitDocument161 pagesThe ADHD Toolkitrachisan95% (62)

- Algoritmo IctericiaDocument18 pagesAlgoritmo IctericiaDiego RodriguezNo ratings yet

- Hitachi Solutions - ETIQA - Application Form (Signed)Document1 pageHitachi Solutions - ETIQA - Application Form (Signed)Bernard CasimiroNo ratings yet

- AO No. 2016-0003Document13 pagesAO No. 2016-0003Are Pee EtcNo ratings yet

- HIV - LancetDocument13 pagesHIV - LancetcristhianldsNo ratings yet

- 1E - Group E - Anquilo-Boter-Deraco-Magno-Parame-Sitoy-WhelessDocument10 pages1E - Group E - Anquilo-Boter-Deraco-Magno-Parame-Sitoy-WhelessAdrea DeracoNo ratings yet

- Materi Dokter Bayu TGL 9 Juli 2020Document53 pagesMateri Dokter Bayu TGL 9 Juli 2020humaira noorNo ratings yet

- RA For Installation & Dismantling of Loading Platform A69Document8 pagesRA For Installation & Dismantling of Loading Platform A69Sajid ShahNo ratings yet

- PASSMED MRCP MCQs-DERMATOLOGY PDFDocument53 pagesPASSMED MRCP MCQs-DERMATOLOGY PDFFatima Ema100% (5)

- MATRIX - Health and Safety Guidelines - Travel and ToursDocument8 pagesMATRIX - Health and Safety Guidelines - Travel and ToursEdwin Rueras SibugalNo ratings yet

- Prenatal AssignmentDocument5 pagesPrenatal Assignmentkudzai madziwaNo ratings yet

- CPS Family Staff Letter Jan 31Document7 pagesCPS Family Staff Letter Jan 31CrainsChicagoBusinessNo ratings yet

- Heart Failure (Congestive Heart Failure) FINALDocument6 pagesHeart Failure (Congestive Heart Failure) FINALKristian Karl Bautista Kiw-isNo ratings yet

- Presidential Leadership, Illness, and Decision Making PDFDocument346 pagesPresidential Leadership, Illness, and Decision Making PDFepure_cosminaNo ratings yet

- Diploma in Anaesthesia (Da) : Page 1 of 5Document5 pagesDiploma in Anaesthesia (Da) : Page 1 of 5krishnaNo ratings yet

- The Integration LadderDocument7 pagesThe Integration LadderTahir QaziNo ratings yet

- Protecting and Supporting Vulnerable Groups Through The Covid-19 CrisisDocument28 pagesProtecting and Supporting Vulnerable Groups Through The Covid-19 CrisisPacuto Ngos SolomonNo ratings yet

- UNIT 5 Food and Beverage Operations ManagementDocument5 pagesUNIT 5 Food and Beverage Operations Managementchandni0810No ratings yet

- Pharmacotherapy Update in Heart Failure: Siti Elkana Nauli Tangerang District HospitalDocument45 pagesPharmacotherapy Update in Heart Failure: Siti Elkana Nauli Tangerang District HospitalFadly AminNo ratings yet

- Physical Examination ScoliosisDocument7 pagesPhysical Examination Scoliosisyosua_edwinNo ratings yet

- Rickets of Vitamin D DeficiencyDocument70 pagesRickets of Vitamin D Deficiencyapi-19916399No ratings yet

- 1 s2.0 S0196655316001693 MainDocument3 pages1 s2.0 S0196655316001693 MainSandu AlexandraNo ratings yet

- VIVA PresentationDocument26 pagesVIVA PresentationWgr SampathNo ratings yet

- rd-15 Bartholin Cyst and Abscess 10-12 PDFDocument2 pagesrd-15 Bartholin Cyst and Abscess 10-12 PDFdevidanthonyNo ratings yet

- Community Health Nursing Approach: Mrs - Neethu Vincent Asst Professor KVM College of NursingDocument21 pagesCommunity Health Nursing Approach: Mrs - Neethu Vincent Asst Professor KVM College of NursingNeethu VincentNo ratings yet

- Memorandum: Philippine National Police Training Institute Regional Training Center 8Document2 pagesMemorandum: Philippine National Police Training Institute Regional Training Center 8DUN SAMMUEL LAURENTENo ratings yet

- Sex Differences in Brain Anatomy - National Institutes of Health (NIH)Document4 pagesSex Differences in Brain Anatomy - National Institutes of Health (NIH)Ryan BurtonNo ratings yet

- INFOSAN User Guide FinalDocument17 pagesINFOSAN User Guide FinalJorge Gregorio SeguraNo ratings yet