Professional Documents

Culture Documents

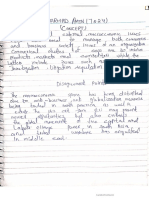

The General Tyre and Rubber Company of Pakistan Limited

Uploaded by

Sarmad AminCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The General Tyre and Rubber Company of Pakistan Limited

Uploaded by

Sarmad AminCopyright:

Available Formats

The total no. of share outstanding from FY 19 to FY -20 is same.

This shows that the company hasn’t

been increasing its no. of shareholders. However, the total amount of equity has shown a slight

decrease and it is because of the decrease in the value of reserves that the company has been

holding from the FY -19to FY 20. the equity portion is decreased as compare to the previous year’s

this is because the unappropriated profit is decreased because in the FY -20 company did not

reinvested its profit to expand the business and give dividends to its shareholders.Total long-term

liabilities of the company have decreased from the FY -19to FY-20. It seems like a nt having a good

strategy on the part of the company because the company has decreased its liabilities due to

adverse political and economic conditions in Pakistan and also due to COVID-19. The Current

liabilities of the company are less in FY-20 Rather Then of FY-19. The total sum of Liabilities and

Equity shows an downtrend because of the decrease in current liabilities from FY -19 to FY-20.Fixed

Assets of the company decrease in FY-20 rather then FY-19 However, the current assets have decreased

from FY-19 to FY -20 . This could be the counter effect of the decrease in the current liabilities. Total Assets

of the company also show an downtrend due to the increase in current assets.

the sales of the company sales have decreased in FY-20 to FY-19.The Sales have been decreased by the

19.25 percent due tyre smuggling as stated by general tyre officals and Huge implemenation of taxation

and also due to the increase in the value of dollar.COVID -19 has a huge impact on sales.The distribution

cost the company has been increased in FY-20 to FY-19. However, the Administrative expense has

shown fluctuations and it is showing a decreasing trend from FY -19 to FY-20. The Finance Cost of the

company has increased drastically from a FY-19 to a FY -20 and this drastic increase tells us that the

company has started to rely heavily on debts and it is giving out huge amount of interests on these

loans.The company has paid a huge taxes in FY-20 to FY-19. The Net income of the company is showing

a declining trend and it has incurred as loss in FY-20 as of FY-19.Sales had remained low during the

past year owing to the rapid spread of Covid19, however, the auto industry is now on a path of

recovery as it plans to launch a large number of new cars in the year with new new entrants

include M/s Kia Lucky Motors Pvt Ltd, M/s United Motors (Pvt) Ltd, M/s Regal Automobile

Industries Ltd, M/s Foton JW Auto Park (PVT) Ltd, M/s Master Motors Ltd and M/s Hyundai Nishat

Motor (Pvt) Ltd.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CFBC Maintenance CostDocument16 pagesCFBC Maintenance Costyogeshmangal1317100% (1)

- Lesson Plan On DVTDocument18 pagesLesson Plan On DVTAlma Susan100% (1)

- Rebirthing Philippine ForestsDocument50 pagesRebirthing Philippine Forestsfpe_scribdNo ratings yet

- BS en Iso 11125-6-1997 (2000) BS 7079-E11-1994 PDFDocument12 pagesBS en Iso 11125-6-1997 (2000) BS 7079-E11-1994 PDFShankar GurusamyNo ratings yet

- Science8 Q4 SLM4Document16 pagesScience8 Q4 SLM4Joel VillegasNo ratings yet

- Session 5Document3 pagesSession 5Sistine Rose Labajo100% (1)

- Standard Kessel Cat - Gral.Document40 pagesStandard Kessel Cat - Gral.Marcelo ResckNo ratings yet

- Haram and Mubah (Sarmad 7024)Document3 pagesHaram and Mubah (Sarmad 7024)Sarmad AminNo ratings yet

- Class Presentation: Submitted By: Muhammad Sarmad Amin Submitted To: Prof Ammanullah Khan CMS 28757Document3 pagesClass Presentation: Submitted By: Muhammad Sarmad Amin Submitted To: Prof Ammanullah Khan CMS 28757Sarmad AminNo ratings yet

- Case Study (Midtown Medical Centre)Document3 pagesCase Study (Midtown Medical Centre)Sarmad AminNo ratings yet

- B-Ethics Final Project (7024)Document15 pagesB-Ethics Final Project (7024)Sarmad AminNo ratings yet

- Case Study (Midtown Medical Centre)Document3 pagesCase Study (Midtown Medical Centre)Sarmad AminNo ratings yet

- CEOs (Business in Society) Sarmad Amin 7024Document2 pagesCEOs (Business in Society) Sarmad Amin 7024Sarmad AminNo ratings yet

- Sarmad Amin (7024) - BC-Term ProjectDocument8 pagesSarmad Amin (7024) - BC-Term ProjectSarmad AminNo ratings yet

- Sarmad Amin-7024-Busniess Law-Final PaperDocument8 pagesSarmad Amin-7024-Busniess Law-Final PaperSarmad AminNo ratings yet

- Husband-Wife Relationship in Islam - Sarmad Amin - 7024Document8 pagesHusband-Wife Relationship in Islam - Sarmad Amin - 7024Sarmad AminNo ratings yet

- Ribi in Islam - Group-7Document20 pagesRibi in Islam - Group-7Sarmad AminNo ratings yet

- Sarmad Amin Sap ID:7024 Sociology (Final Term Exam) : ExampleDocument4 pagesSarmad Amin Sap ID:7024 Sociology (Final Term Exam) : ExampleSarmad AminNo ratings yet

- Executive Order No. 459, S. 2005 - Official Gazette of The Republic of The PhilippinesDocument1 pageExecutive Order No. 459, S. 2005 - Official Gazette of The Republic of The PhilippinesCharlie AdonaNo ratings yet

- H) Questions.: Ion/.orr-'Crles Rf'aDocument2 pagesH) Questions.: Ion/.orr-'Crles Rf'aakshayNo ratings yet

- Unit 3 Eee2202Document19 pagesUnit 3 Eee2202Kishore RavichandranNo ratings yet

- Excel Property Management Invoice TemplateDocument10 pagesExcel Property Management Invoice Templatenull22838No ratings yet

- ZumbroShopper15 10 07Document12 pagesZumbroShopper15 10 07Kristina HicksNo ratings yet

- HSE L141 - 2005 - Whole-Body VibrationDocument56 pagesHSE L141 - 2005 - Whole-Body VibrationKris WilochNo ratings yet

- tv1 MagDocument6 pagestv1 MagKim SindahlNo ratings yet

- Fact Erp - NG: The Next Generation ERP SoftwareDocument20 pagesFact Erp - NG: The Next Generation ERP SoftwareAbhijit BarmanNo ratings yet

- 1MRK511261-UEN - en Engineering Manual 650 Series 1.2 IECDocument128 pages1MRK511261-UEN - en Engineering Manual 650 Series 1.2 IECsabah nooriNo ratings yet

- Renewable Energy Systems (Inter Disciplinary Elective - I)Document2 pagesRenewable Energy Systems (Inter Disciplinary Elective - I)vishallchhayaNo ratings yet

- BED-2912-0000922351 Backend Development Vijay Vishvkarma: Phase I - Qualifier Round 1Document1 pageBED-2912-0000922351 Backend Development Vijay Vishvkarma: Phase I - Qualifier Round 1vijayNo ratings yet

- A Simple Runge-Kutta 4 TH Order Python Algorithm: September 2020Document5 pagesA Simple Runge-Kutta 4 TH Order Python Algorithm: September 2020alaa khabthaniNo ratings yet

- Current & Saving Account Statement: Ajju Cotton Mill 321 2 Vettuvapalayam Mangalam Tiruppur TiruppurDocument2 pagesCurrent & Saving Account Statement: Ajju Cotton Mill 321 2 Vettuvapalayam Mangalam Tiruppur Tiruppurajju computersNo ratings yet

- Prosiding Faperta 2018 Fix PDFDocument676 pagesProsiding Faperta 2018 Fix PDFAgus Kaspun100% (1)

- Task 1 Identify Typical Sources of Harmonics in A Power SystemDocument12 pagesTask 1 Identify Typical Sources of Harmonics in A Power SystemSean Galvin100% (1)

- A8 HBR-01-WSX-MEC-DTS-0001 Rev B2Document12 pagesA8 HBR-01-WSX-MEC-DTS-0001 Rev B2ahmed.njahNo ratings yet

- Ict351 4 Logical FormulasDocument32 pagesIct351 4 Logical FormulastheoskatokaNo ratings yet

- Voltmeter and Ammeter Using PIC Microcontroller PDFDocument11 pagesVoltmeter and Ammeter Using PIC Microcontroller PDFMohd Waseem Ansari100% (1)

- Effect of Ambient Vibration On Solid Rocket Motor Grain and Propellant/liner Bonding InterfaceDocument7 pagesEffect of Ambient Vibration On Solid Rocket Motor Grain and Propellant/liner Bonding InterfaceZehra KabasakalNo ratings yet

- 22 CONSTANTIN Doru Teza 5oct - 2018 - Signed - Teza Doctorat Imbunatatire Comfort Sisteme TransportDocument137 pages22 CONSTANTIN Doru Teza 5oct - 2018 - Signed - Teza Doctorat Imbunatatire Comfort Sisteme TransportCășeriu BiancaNo ratings yet

- Edaphic FactorsDocument3 pagesEdaphic FactorsjamesNo ratings yet

- Almaz BaruDocument9 pagesAlmaz BaruHarry WSNo ratings yet

- 03 01 Straight LineDocument31 pages03 01 Straight LineSai Ganesh0% (1)