Professional Documents

Culture Documents

Internal and External Audit

Uploaded by

ËvaBless ÇhicaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal and External Audit

Uploaded by

ËvaBless ÇhicaCopyright:

Available Formats

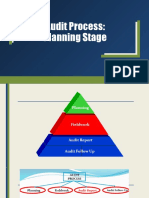

Steps of internal Auditing

1. Planning: The audit process begins with planning the audit. First you Notify everyone

about the audit, Organize a pre-audit meeting, Personnel from the department should be

interviewed, Check out the policies and procedures, Recognize and Document Business

Processes, Conduct a risk assessment, Prepare a thorough audit plan, Prepare a budget for

the audit (in hours) and Choose the items that will be audited (samples, not 100 percent ).

2. Fieldwork: is the second phase of the audit. During this phase, the audit team will be

doing the audit on-site at the audit client's location. The processes listed below are some

of the most common ones used during fieldwork. They are Examine supporting

documentation and conduct interviews with department staff, Identify the Outliers,

Identify Improvement Recommendations, Prepare audit comments in writing (i.e.,

findings) and for the findings, the department provides a written response and a

corrective action plan.

3. Reporting: The audit's third phase is reporting. During this phase, the lead auditor will

write an audit report that summarizes and conveys the audit findings. In this Phase you

Prepare a draft report, consult with the unit's management about the prepared report,

Publish the final report, the report is accurate, brief, and written in a suitable tone,

distribution of the report: President, Vice President, Executive, Auditors from outside the

company, Managing Director of Finance, Controller, Subcommittee on Audit, Vice

President of Divisions or Senior Vice President of Divisions and Head of Department.

Steps of External Auditing

Preparing an Audit plan: The auditor examines the information included in the papers

and maps out how the audit will be conducted in the first stage of an external audit. A

workshop could be held to identify potential future issues. After then, a plan for auditing

was created.

Obtaining an Understanding of the Client: The Auditor must gain a thorough

understanding of a company in order to assess the risk of substantial misstatement on

financial statements and to plan the nature, timing, and scope of additional audit

processes. Inquiries of management and others within the entity, analytical techniques,

observation and inspection, and other procedures are among the risk assessment

processes utilized here.

Assessing the risk of Misstatement: When gaining a better understanding of the client,

the auditor should use the information gathered And its surroundings to identify

transaction classifications, account balances, and disclosures that may be materially

incorrect. Risk assessment, on the other hand, supplies auditors with proof of potential

material misstatement risks. For relevant claims, the risks of substantial misrepresentation

are made up of inherent and control risks. Inherent risk refers to a relevant assertion's

vulnerability to material falsification in the absence of corresponding controls.

Performing tests of Controls: are used to assess whether important controls are

correctly designed and running. Consider the control activity in which the accounting

department records the serial sequence of all shipping papers prior to producing the

associated journal entries. This check is important because it ensures that each shipment

of product is properly recorded in the accounting records.

Completing the Audit: In addition, the audit was completed, and some procedures were

re-performed to guarantee their validity. Final decisions on financial statement

disclosures are made at this point. Senior management will meet with the auditor to

discuss the results.

Audit Report: When the examination and the results are satisfactory, a standard

unqualified audit report is provided. As the audit examination deviates from typical, this

report is likewise amended.

You might also like

- Open World First B2 Students BookDocument257 pagesOpen World First B2 Students BookTuan Anh Bui88% (8)

- Gerry Mulligan DiscographyDocument491 pagesGerry Mulligan DiscographyIan SinclairNo ratings yet

- Case Study 6Document6 pagesCase Study 6Shaikh BilalNo ratings yet

- Audit Planning and Risk Assessment New SlidesDocument38 pagesAudit Planning and Risk Assessment New SlidesAdeel AhmadNo ratings yet

- RAB PLTS Hybrid 1kWp-ScheneiderDocument4 pagesRAB PLTS Hybrid 1kWp-ScheneiderilhamNo ratings yet

- AAE Migration GuideDocument29 pagesAAE Migration GuideNguyen Hung0% (1)

- FD72 Technical Manual 28.10.09Document74 pagesFD72 Technical Manual 28.10.09cavgsi16vNo ratings yet

- 7 Major Phases On AuditDocument4 pages7 Major Phases On AuditvinceNo ratings yet

- Chap.3 Audit Plannng, Working Paper and Internal Control-1Document10 pagesChap.3 Audit Plannng, Working Paper and Internal Control-1Himanshu MoreNo ratings yet

- Audit PlanningDocument29 pagesAudit PlanningTaimur ShahidNo ratings yet

- Chapter-6: in An Effective Manner. Planning Consists of A Number of Elements. However, They Could Be Summarized AsDocument10 pagesChapter-6: in An Effective Manner. Planning Consists of A Number of Elements. However, They Could Be Summarized AsNasir RifatNo ratings yet

- Audit PlanningDocument26 pagesAudit PlanningDev PipilNo ratings yet

- Chapter 6 070804Document14 pagesChapter 6 070804Shahid Nasir MalikNo ratings yet

- Audit Process: Planning StageDocument25 pagesAudit Process: Planning StageNelsie Grace PinedaNo ratings yet

- Audting Chapter4Document12 pagesAudting Chapter4Getachew JoriyeNo ratings yet

- Audit Plan Essay - Fatima Ortiz 3biDocument6 pagesAudit Plan Essay - Fatima Ortiz 3biFatima Ortiz BalandránNo ratings yet

- Essay On AuditingDocument7 pagesEssay On AuditingAndy Rdz0% (1)

- Difficulties, If There Are Concerns With Compliance, It Implies There Are ProblemsDocument4 pagesDifficulties, If There Are Concerns With Compliance, It Implies There Are ProblemsBrian GoNo ratings yet

- Alan Fernandes (AUDIT EVIDENCE TO AUDIT REPORTING)Document28 pagesAlan Fernandes (AUDIT EVIDENCE TO AUDIT REPORTING)Alan FernandesNo ratings yet

- Lecture 3 Audit Planning and Internal ControlDocument20 pagesLecture 3 Audit Planning and Internal ControlKaran RawatNo ratings yet

- Audit Process: Here Click HereDocument3 pagesAudit Process: Here Click HereShailesh Gosai100% (1)

- Key Planning ActivitiesDocument3 pagesKey Planning ActivitiesTasha MarieNo ratings yet

- Unit 2 Audit ProcessDocument5 pagesUnit 2 Audit ProcessGokul.S 20BCP0010No ratings yet

- Audit PlanningDocument9 pagesAudit PlanninggumiNo ratings yet

- Auditing 1 Final Chapter 10Document7 pagesAuditing 1 Final Chapter 10PaupauNo ratings yet

- Chapter 3 AuditingDocument81 pagesChapter 3 Auditingmaryumarshad2No ratings yet

- AudTheo Compilation Chap9 14Document130 pagesAudTheo Compilation Chap9 14Chris tine Mae MendozaNo ratings yet

- Fish Bone DiagramDocument4 pagesFish Bone DiagramPatrice Elaine PillaNo ratings yet

- Unit IV Audit PlanningDocument24 pagesUnit IV Audit PlanningMark GerwinNo ratings yet

- Audit ProcessDocument2 pagesAudit Processrajahmati_28No ratings yet

- Operational AuditDocument2 pagesOperational Auditayansane635100% (1)

- Audit Planning and Risk AssessmentDocument41 pagesAudit Planning and Risk AssessmentMan ChengNo ratings yet

- Audit Planning TechniquesDocument12 pagesAudit Planning TechniquesRahul KadamNo ratings yet

- Audit PlanningDocument5 pagesAudit PlanningDeopito BarrettNo ratings yet

- 10.1 What Is An Audit?Document16 pages10.1 What Is An Audit?Martina MartinaNo ratings yet

- Overview of Risk-Based AuditDocument8 pagesOverview of Risk-Based AuditMay Grethel Joy PeranteNo ratings yet

- Auditing Planning Chapt 3Document8 pagesAuditing Planning Chapt 3bhumika aggarwalNo ratings yet

- Chapter 8 Discussion QuestionsDocument3 pagesChapter 8 Discussion QuestionsJuliana ChengNo ratings yet

- Acca F 8 L3Document20 pagesAcca F 8 L3Fahmi AbdullaNo ratings yet

- Auditing ReportDocument47 pagesAuditing ReportNoj WerdnaNo ratings yet

- Are There Different Types of Audits? Yes, There Are Five Basic Types of Audits As WellDocument5 pagesAre There Different Types of Audits? Yes, There Are Five Basic Types of Audits As WellSatya SharmaNo ratings yet

- Cpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Document5 pagesCpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Ma Yra YmataNo ratings yet

- Auditing Book EditedDocument72 pagesAuditing Book EditedJE SingianNo ratings yet

- TOPIC 3 2021 B RevisedDocument40 pagesTOPIC 3 2021 B Revisedkitderoger_391648570No ratings yet

- The Audit Process How We Work With You2Document17 pagesThe Audit Process How We Work With You2Rich R. PontesorNo ratings yet

- Informe InglesDocument9 pagesInforme InglesGERALDINE IVONNE GARCIA CARRIZALESNo ratings yet

- Reviewer Sa AuditDocument6 pagesReviewer Sa Auditprincess manlangitNo ratings yet

- ACCT3043 Unit 3 For PostingDocument9 pagesACCT3043 Unit 3 For PostingKatrina EustaceNo ratings yet

- Interactive Training On Overall Audit Process and DocumentationDocument19 pagesInteractive Training On Overall Audit Process and DocumentationAmenu AdagneNo ratings yet

- Uploaded in Moodle As A Guide To Complete Your Assignment Apart From Your Other Sources.)Document6 pagesUploaded in Moodle As A Guide To Complete Your Assignment Apart From Your Other Sources.)Derek GawiNo ratings yet

- Module 1 Overview of The Audit Process and Audit PlanningDocument8 pagesModule 1 Overview of The Audit Process and Audit PlanningChristine CariñoNo ratings yet

- PPT. Chapter 2 AuditingDocument21 pagesPPT. Chapter 2 AuditingJerlmilline Serrano Jose100% (1)

- CombinepdfDocument39 pagesCombinepdfLeamay LajotNo ratings yet

- Chapter 21: Evaluation of Audit Evidence and Completion of The AuditDocument12 pagesChapter 21: Evaluation of Audit Evidence and Completion of The AuditIrine A. Pedregosa100% (1)

- Internal AuditDocument3 pagesInternal Auditm_saleem433No ratings yet

- The Risk Based AuditDocument6 pagesThe Risk Based AuditHana AlmiraNo ratings yet

- How To Prepare An Audit PlanDocument8 pagesHow To Prepare An Audit PlanJay Ann100% (1)

- Classnotes Important!!Document35 pagesClassnotes Important!!mansi patelNo ratings yet

- AU-00314 Auditing A Business Risk ApproachDocument43 pagesAU-00314 Auditing A Business Risk Approachredearth2929No ratings yet

- Audit ObjectionDocument15 pagesAudit ObjectionShuaib Rahujo100% (1)

- Activity 4Document12 pagesActivity 4Beatrice Ella DomingoNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Audit Engagement Strategy (Driving Audit Value, Vol. III): The Best Practice Strategy Guide for Maximising the Added Value of the Internal Audit EngagementsFrom EverandAudit Engagement Strategy (Driving Audit Value, Vol. III): The Best Practice Strategy Guide for Maximising the Added Value of the Internal Audit EngagementsNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Anglian Fraternity: Theme: Seeking Perennial Wisdom Yet Everyone ChangesDocument6 pagesAnglian Fraternity: Theme: Seeking Perennial Wisdom Yet Everyone ChangesËvaBless ÇhicaNo ratings yet

- ApprochesDocument1 pageApprochesËvaBless ÇhicaNo ratings yet

- Anglian Fraternity: Theme: Seeking Perennial Wisdom Yet Everyone ChangesDocument6 pagesAnglian Fraternity: Theme: Seeking Perennial Wisdom Yet Everyone ChangesËvaBless ÇhicaNo ratings yet

- Internal ControlDocument1 pageInternal ControlËvaBless ÇhicaNo ratings yet

- Directorate of Pension, Provident Fund & Group Insurance: WWW - Wbepension.gov - inDocument37 pagesDirectorate of Pension, Provident Fund & Group Insurance: WWW - Wbepension.gov - inSandipan RoyNo ratings yet

- BIGDATA LAB MANUALDocument27 pagesBIGDATA LAB MANUALjohn wickNo ratings yet

- Questionnaire On Teaching Learning 1Document4 pagesQuestionnaire On Teaching Learning 1Sonia Agustin100% (1)

- Package Suppdists': R Topics DocumentedDocument26 pagesPackage Suppdists': R Topics DocumentedHector Alejandro Cabezas CasanuevaNo ratings yet

- PIRCHLDocument227 pagesPIRCHLapi-3703916No ratings yet

- Training SCLDocument60 pagesTraining SCLAlu menzikenNo ratings yet

- Scib RC PipesDocument4 pagesScib RC PipesterrylimNo ratings yet

- Well Control - Pore PressureDocument31 pagesWell Control - Pore PressureMiguel Pinto PonceNo ratings yet

- 2003 Wiley Periodicals, Inc.: Max VisserDocument10 pages2003 Wiley Periodicals, Inc.: Max VisserMariano DomanicoNo ratings yet

- "Assessing The Effect of Work Overload On Employees Job Satisfaction" Case of Commercial Bank of Ethiopia Nekemte Town BranchesDocument1 page"Assessing The Effect of Work Overload On Employees Job Satisfaction" Case of Commercial Bank of Ethiopia Nekemte Town Branchesmikiyas zerihunNo ratings yet

- Ac-Ppt On Crystal OscillatorDocument10 pagesAc-Ppt On Crystal OscillatorRitika SahuNo ratings yet

- AdinaDocument542 pagesAdinaSafia SoufiNo ratings yet

- Impromptu SpeechDocument44 pagesImpromptu SpeechRhea Mae TorresNo ratings yet

- MarpleDocument10 pagesMarpleC.Auguste DupinNo ratings yet

- AWS Abbreviations Oxyfuel Cutting - OFC Oxyacetylene Cutting - OFC-A Oxyfuel Cutting - Process and Fuel GasesDocument8 pagesAWS Abbreviations Oxyfuel Cutting - OFC Oxyacetylene Cutting - OFC-A Oxyfuel Cutting - Process and Fuel GasesahmedNo ratings yet

- Literature Review Topics RadiographyDocument8 pagesLiterature Review Topics Radiographyea7w32b0100% (1)

- OfficeServ 7200 Service Manual - Ed.0Document351 pagesOfficeServ 7200 Service Manual - Ed.0Richard WybornNo ratings yet

- 1 MergedDocument81 pages1 MergedCHEN XIAN YANG MoeNo ratings yet

- Agrasar Lecture and Demonstration Programme On Water, Food and Climate ChangeDocument20 pagesAgrasar Lecture and Demonstration Programme On Water, Food and Climate ChangeMinatiBindhaniNo ratings yet

- 14.victorian Era Inventions and Changes Pupils PDFDocument1 page14.victorian Era Inventions and Changes Pupils PDFSam FairireNo ratings yet

- W01-Introduction To Materials Modeling and SimulationDocument30 pagesW01-Introduction To Materials Modeling and SimulationMuco İboNo ratings yet

- FAME - Teachers' Material TDocument6 pagesFAME - Teachers' Material TBenny PalmieriNo ratings yet

- Cuadernillo de Ingles Grado 4 PrimariaDocument37 pagesCuadernillo de Ingles Grado 4 PrimariaMariaNo ratings yet