Professional Documents

Culture Documents

A Guide To Our HMRC Tax Calculation & Tax Year Overview Requirements

A Guide To Our HMRC Tax Calculation & Tax Year Overview Requirements

Uploaded by

bswaminaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Guide To Our HMRC Tax Calculation & Tax Year Overview Requirements

A Guide To Our HMRC Tax Calculation & Tax Year Overview Requirements

Uploaded by

bswaminaCopyright:

Available Formats

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

Online HMRC Tax Calculation

1 If you need to provide any additional

LOGO information to help progress your case,

2 Ms A N Other’s tax return: 2018-19 IN PROGRESS

4 Your tax return is 100% complete please upload a separate document or

Unique Taxpayer Reference (UTR): 1234567890 3 call us on 0800 30 20 11

1 The GOV.UK logo must be shown, unless the

6. View your calculation

Tax calculation

applicant is using commercial software to

obtain their tax calculation.

This section provides you with a breakdown of your full calculation. If it says your tax return is 100% complete then you have

submitted your return and this is a copy of the information held on your official online Self assessment tax account with HM These are acceptable but will not include

Revenue and Customs.

the GOV.UK logo.

Pay from employments £33,254.00

Pay from all employments £33,254.00 2 The customer’s name and tax year must

5

Profit from all self-employment

Interest received from UK banks and building societies

£46,800.00

£249.00

be shown.

UK pensions and state benefits £5,004.00

Total income received £85,307.00 3 The Unique Tax Reference number must

minus be shown.

Payments into a retirement annuity contract etc. £3.00

Personal Allowance

Total £11,853.00

£11,850.00 4 Progress bar must show ‘your tax return

is 100% complete’ & state “This section

Total income on which tax is due £73,454.00

provides you with a breakdown of your

How we have worked out your income tax

Your basic rate limit has been increased by £1.00 to £37,500.00 for pension payments etc. full calculation. If it says your tax return is

This reduces the amount of income charged to higher rates of tax.

______________________________________________ 100% complete then you have submitted

Amount Percentage Total

______________________________________________ this return and this is a copy of information

Pay, pensions, profit etc £34,500.00 @ 20% £6,900.00

£38,705.00 @ 40% £15,482.00

held on your official online SA tax account

with HMRC”.

Interest received from bank of building society etc. £249.00 @ 0% £0.00

NB – If the customer uses Commercial

software then this wording may not appear.

Total income on which tax has been charged

Income Tax charged

£73,454.00

£22,382.00

The document would still be acceptable.

plus Class 4 National Insurance contributions

5 Income from the relevant income stream to

£37,926.00 @ 9% £3,413.34

£450.00 @ 2% £9.00 be taken from here.

Total Class 4 National Insurance contributions due £3,422.34

6 All pages must be received.

plus High Income Child Benefit Charge £1,788.80

plus State Pension lump sum payment £1.00 @ 40% £0.40 For self-employed applicants who

self-assess online, you must obtain

6

the corresponding two years’ tax year

overviews in addition to the latest two

1 of 2 01/05/2019 14:03

years’ Tax Calculations. Applicants who

submit their return by post will not receive

a Tax Year Overview.

All figures used are for illustrative purposes only For example, where tax calculations for

2017/18 and 2018/19 are provided, you also

Without supplying all requested proofs your case can’t progress to now need the tax year overviews for the tax

Case Assessment stage.

years ending 05 April 2018 and 2019.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

Commercial Software Tax Calculation – This can only be accepted

in conjunction with the HMRC Online Tax Year overview

If you need to provide any additional

Self Assessment - Tax Calculation

information to help progress your case,

Name XXX

Address XXX

2 Tax Reference

12345 67890

1 please upload a separate document or

call us on 0800 30 20 11

1 The Unique Tax Reference number must

Tax Calculation for 2018 - 19 (year ended 5 April 2019) 3

be shown.

2 The customer’s name must be shown.

Income received (before tax taken off)

Pay from all employments £19,458.00

Profit from partnerships £2,142.00 4

Interest received from UK banks and building societies £50.00 3 The tax year must be shown.

Dividends £4,876.00

Total Income received £26,526.00

4 Income from the relevant income stream to

minus Personal allowance £11,850.00

be taken from here.

Total income on which tax is due £14,676.00

5 All pages must be received.

How I worked out your Income Tax

Pay, pensions, profit etc £9,750.00 @ 20% £1,950.00

For self-employed applicants who

self-assess online, you must obtain

Interest received from bank of building society etc.

£50.00 @ 0% £0.00 the corresponding two years’ tax year

Dividends from companies etc. £4,876.00 @ 7.5% £365.70

overviews in addition to the latest two

____________

£14,676.00 years’ Tax Calculations. Applicants who

Income Tax charged £2,315.70 submit their return by post will not receive

minus

Tax deducted

From all employments, UK pensions and state benefits £1,300.00

a Tax Year Overview.

Total tax deducted £1,300.00

For example, where tax calculations for

Total Income Tax due £1,015.70

plus Capital Gains Tax

2017/18 and 2018/19 are provided, you

Taxable capital gain £30,000.00 also need the tax year overviews for the tax

£19,874.00 @ 18% £3,577.32

__________ £10,126.00 @ 28% £2,835.28 years ending 05 April 2018 and 2019.

£6,412.60

Capital Gains Tax due £6,412.60 NB – Commercial Software Tax Calculations

don’t show the GOV.UK logo and may also

Income and Capital Gains Tax due £7,428.30

be referred to as tax computations.

1 of 2 01/05/2019 14:02

This is an example of a

commercial software tax

5

calculation. There are several

other versions, but they must

include the same information.

All figures used are for illustrative purposes only

Without supplying all requested proofs your case can’t progress to

Case Assessment stage.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

Online HMRC Tax Year overview

If you need to provide any additional

LOGO Home Cymraeg 1

Contact HMRC Help

information to help progress your case,

Sign out please upload a separate document or

Information as at 01 May 2019

Ms A N Other

call us on 0800 30 20 11

2

Unique Taxpayer Reference (UTR): 1234567890 1 The GOV.UK logo must be shown.

Tax years 2 The Unique Tax Reference and customer’s

Tax year overview name must be shown.

Please select the appropriate tax year you wish to view a summary for from the drop-down menu and click ‘Go’.

3 The statement ‘This is a copy of the

Tax year ending: 05 Apr 2019 Go

information held on your official online

You can also view tax returns due/received by following Tax return options.

self-assessment tax account with HMRC’

Tax year ending 05 Apr 2019.

3 This is a copy of the information held on your official online Self Assessment tax account with HM Revenue and Customs.

must be visible.

Print your tax year overview 4 How much tax is due and has been paid

Please note: To view a breakdown of an amount, follow the appropriate link in the ‘Description’ column.

for the tax year must be shown.

5 All pages must be received.

Description Amount (£)

Tax 16,140.60 4 For self-employed applicants who

Surcharges

Interest

0.00

0.00

self-assess online, you must obtain

Penalties 0.00 the corresponding two years’ tax year

Sub total 16,140.60

overviews in addition to the latest two

Less payments for this year 15,059.40

Less other adjustments 0.00 years’ Tax Calculations. Applicants who

Total 1,081.20 submit their return by post will not receive

a Tax Year Overview.

For example, where tax calculations for

2017/18 and 2018/19 are provided, you also

now need the tax year overviews for the tax

years ending 05 April 2018 and 2019.

1 of 2 01/05/2019 14:02

All figures used are for illustrative purposes only

Without supplying all requested proofs your case can’t progress to

Case Assessment stage.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

HMRC postal SA302 Self Assessment Tax Calculation

If you need to provide any additional

LOGO 1

Self Assessment: Tax Calculation

information to help progress your case,

please upload a separate document or

2

call us on 0800 30 20 11

205077:000000000001:001 UTR 12345 67890

MRA SOMEONE

1 ANYTOWN ROAD 4

NNO

Date

AA112233A

01 May 2019 1 The HMRC logo must be shown.

ANYTOWN Issued by:

ANYWHERE

AN1 9GG

HM REVENUE & CUSTOMS

ANY OFFICE

2 The Unique Tax Reference number must

ANYTOWN be shown.

ANYWHERE

AN1 3YY

3 The tax year must be shown.

Telephone 12345 67890

Issue No: 2019/001 4 The customer’s name and address must

3

be shown.

Tax Calculation for 2018/19 (year ended 5 April 2019)

Thank you for your tax return. 5 The customer may not always receive a page

We enclose our tax calculation based on the amounts shown in your tax return. 2, but will always receive pages 1 and 3.

Our calculation shows the tax due under Self Assessment for 2018/19 is £15,065.78, payable in three amounts:

1st payment on account £6,298.22 due by 31 January 2020 6 The form must show SA302 on it.

2nd payment on account £6,928.22 due by 31 July 2020

Balancing payment £2,469.34 due by 31 January 2021

We also calculate the payments on account towards your tax bill for 2019/20 are:

Applicants who submit their return by post

1st payment on account

2nd payment on account

£7,532.89 due by 31 January 2021

£7,532.89 due by 31 July 2021

will not receive a Tax Year Overview.

If your income for 2019/20 has gone down you can ask to reduce these payments on account.

Find form SA303 Self Assessment claim to reduce your payments on account at

gov.uk/understand-self-assessment-statement/change-your-payments-on-account

Please note the total amount due by 31 January 2020 is £10,002.23. We will add this amount to your SA300

Self Assessment Statement.

The above figures do not take into account any payments you may have made towards amounts due on these dates,

or any other amounts which may be outstanding or becoming due.

You will receive an SA300 Self Assessment Statement nearer the due date telling you how much to pay.

Please note we charge interest and penalties on payments made after a due date.

You can find out how to pay us at gov.uk/pay-self-assessment-tax-bill

If you are registered for Self Assessment Online, log in at online.hmrc.gov.uk and use the ‘View account’

pages to see what you owe.

This tax calculation is based on figures in your tax return, before it has been checked. It is not our confirmation that

your return is complete or correct. If, at a later date, your return is found to be incorrect, your tax calculation will be amended

accordingly.

The amount of Student Loan repayments included in this calculation will be reported to Student Loans Company

and credited to your Student Loan account.

We have sent a copy of this notice and calculation to your agent. We will write to you and your agent again if we have any

questions about your tax return. Please let us know if there is anything you do not agree with or do not understand in our

calculation. Our telephone number is shown above.

6 5

SA302 Page 1 HMRC 06/13

All figures used are for illustrative purposes only

Without supplying all requested proofs your case can’t progress to

Case Assessment stage.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

HMRC postal SA302 Self Assessment Tax Calculation

If you need to provide any additional

Self Assessment: Tax Calculation

information to help progress your case,

205077:0000000001:001 UTR 12345 67890

MR A SOMEONE NNO AA112233A please upload a separate document or

Date 01 May 2019

call us on 0800 30 20 11

Tax Calculation for 2018-19 (year ended 5 April 2019)

Income received (before tax taken off) 1

1 Income from the relevant income stream to

Pay from all employments £33,254 be taken from here.

Profit from self-employment £46,800

Interest received from UK banks and building societies £2,464

Total Income received

minus Personal allowance

£82,518.00

£11,850.00

2 The customer may not always receive a page

2, but will always receive pages 1 and 3.

Total income on which tax is due £70,668.00

How I worked out your Income Tax Applicants who submit their return by post

Pay, pensions, profit etc £34,500.00

£33,704.00

@ 20% =

@ 40% =

£6,900.00

£13,481.60

will not receive a Tax Year Overview.

Interest received from bank of building society etc. £500.00 @ 0% = £0.00

-----------------

£1,964.00 @ 40% = £785.60

Total income on which tax has been charged £70,688.00

Income Tax charged £21,167.20

plus Class 4 National Insurance contributions

£37,926.00 @ 9% = £3,413.34

£450.00 @ 2% = £9.00

Total Class 4 National Insurance contributions due £3,422.34

plus High Income Child Benefit Charge £1,788.80

Income Tax and Class 4 National Insurance contributions £26,378.34

minus Tax deducted

From all employments, UK pensions and state benefits £4,250.80

CIS vouchers and profits £9,360.00

Total tax deducted £13,610.80

Income Tax and Class 4 National Insurance contributions due £12,767.54

2

Page 3

All figures used are for illustrative purposes only

Without supplying all requested proofs your case can’t progress to

Case Assessment stage.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

HMRC Contact Centre SA302

Self Assessment Tax Calculation

If you need to provide any additional

LOGO 1

information to help progress your case,

Ref: 9230176036 2

4 Year: 2019 please upload a separate document or

OUID: 240601

3 Name: Ms A N Other

_______________________________________________________________________________________________ call us on 0800 30 20 11

Tax Calculation for 2018-19 (year ended 5 April 2019) 1 The GOV.UK logo must be shown.

Income received (before tax taken off)

Pay from UK Land and property £ 4,376.60 2 The Unique Tax Reference number must

Interest received from UK banks and building societies £

£

48.00

950.00

5 be shown.

Dividends from UK companies (plus 10% tax credits)

UK pensions and state benefits

Total Income received

£ 46,376.60

£ £51,751.20

3 The customer’s name must be shown.

£ £11,850.00

4 The tax year must be shown.

minus Personal allowance

Total income on which tax is due £ £39,901.20

How I have worked out your Income Tax 5 Income from the relevant income stream to

£ XX,XXX.XX £ XX,XXX.XX

Pay, pensions, profit etc.

£ XX,XXX.XX

@ 20% =

@ 40% = £ XX,XXX.XX be taken from here.

Interest received from a bank or building society etc.

£

£

XX,XXX.XX

XX,XXX.XX

@ 10% =

@ 20% =

£

£

XX,XXX.XX

XX,XXX.XX

6 The form must show SA302 on it.

£ XX,XXX.XX @ 40% = £ XX,XXX.XX

Dividends from companies etc. £ XX,XXX.XX @ 10% = £ XX,XXX.XX For self-employed applicants who

Pay, pensions, profit etc. £

£

XX,XXX.XX

XX,XXX.XX

@ 32.6% = £ XX,XXX.XX

self-assess online, you must obtain

Total Income on which tax has been charged.

Income Tax charged £ XX,XXX.XX

the corresponding two years’ tax year

minus 10% tax credits on dividends from UK companies (not repayable) £ XX,XXX.XX overviews in addition to the latest two

Income Tax due after dividend tax credits £ XX,XXX.XX

years’ Tax Calculations. Applicants who

minus Tax deducted

From all employments, UK pensions and state benefits £ XX,XXX.XX submit their return by post will not receive

a Tax Year Overview.

Interest received from UK banks and building societies £ XX,XXX.XX

Total tax deducted £ XX,XXX.XX

Total Income Tax due £ XX,XXX.XX For example, where tax calculations for

2017/18 and 2018/19 are provided, you also

now need the tax year overviews for the tax

years ending 05 April 2018 and 2019.

6 SA302 Page 1 of 1 Printed 01/05/2019

All figures used are for illustrative purposes only

Without supplying all requested proofs your case can’t progress to

Case Assessment stage.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

FOR INTERMEDIARY USE ONLY

A guide to our HMRC Tax Calculation

& Tax Year Overview requirements

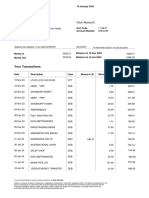

Tax Year Overview

If you need to provide any additional

LOGO 1 Help Close

information to help progress your case,

Information as at 01 May 2019

Ms A N Other 3 please upload a separate document or

2 Unique Taxpayer Reference (UTR): 12345 67890

call us on 0800 30 20 11

1 The GOV.UK logo must be shown.

Tax years

Self Assessment

Select taxpayer

Tax year overview 2 The Unique Tax Reference number must

At a glance

Please select the appropriate tax year you wish to view a summary for from the drop-down menu be shown.

and click ‘Go’.

About you

Ask a question

Tax year ending: 05 Apr 2019 Go

3 The customer’s name must be shown.

▼ View account You can also view tax returns due/received by following Tax return options. 4 The statement ‘This is a copy of the

● Tax years

Tax year ending 05 Apr 2019. 4 information held on your official online

● Surcharges This is a copy of the information held on your official online Self Assessment tax account with HM

● Interest Revenue and Customs. If you want to print this information for your records, use the print facility

self-assessment tax account with HM

● Penalties on your browser.

Please note: To view a breakdown of an amount, follow the appropriate link in the ‘Description’

Revenue & Customs’ must be visible.

Payments/Credits received

How much tax is due and has been paid

●

column. 5

● Repayments

Tax return options

Description Amount (£) for the tax year.

Reduce payments on

account

Request a repayment

Tax

Surcharges

16,140.60

0.00

6 The form must show SA302 on it.

Interest 0.00

View statement

Penalties 0.00

5 For self-employed applicants who

FAQs

Business help and

Sub total 16,140.60 self-assess online, you must obtain

Less payments for this year 15,059.40

educationemails Less other adjustments 0.00 the corresponding two years’ tax year

Total 1,081.20 overviews in addition to the latest two

years’ Tax Calculations. Applicants who

submit their return by post will not receive

a Tax Year Overview.

For example, where tax calculations for

2017/18 and 2018/19 are provided, you also

now need the tax year overviews for the tax

years ending 05 April 2018 and 2019.

6 SA302 Page 1 of 1 Printed 01/05/2019

All figures used are for illustrative purposes only

Without supplying all requested proofs your case can’t progress to

Case Assessment stage.

For more information about our evidence requirements, visit: nationwide-intermediary.co.uk/hmrc

Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print.

F1062 (November 2019)

You might also like

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- Sa302 2021-22Document2 pagesSa302 2021-22Viktoria VasevaNo ratings yet

- FitNote - 3Document1 pageFitNote - 3Arindella AllenNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- My Payslips 2022-11-07Document16 pagesMy Payslips 2022-11-07Ildikó Pető-Jánosi0% (1)

- Paysliper Template Grid1Document1 pagePaysliper Template Grid1Leonard PaduaNo ratings yet

- Taxation Chapter 5 - 8Document117 pagesTaxation Chapter 5 - 8Hồng Hạnh NguyễnNo ratings yet

- CT600 2021 Version 3 04 22Document11 pagesCT600 2021 Version 3 04 22Antoon Lorents0% (1)

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Statement PDFDocument7 pagesStatement PDFSamir GhimireNo ratings yet

- Collections 101Document0 pagesCollections 101pacopepe7750% (2)

- Alan Seymour's Sports Arbitrage Professional IntroductionDocument26 pagesAlan Seymour's Sports Arbitrage Professional IntroductionAlan Seymour100% (2)

- Administrative Officer Duties and ResponsibilitiesDocument5 pagesAdministrative Officer Duties and Responsibilitieselvispranil100% (2)

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- PayslipDocument1 pagePayslipmoriyambugam1No ratings yet

- Goods Documents Required Customs Prescriptions Remarks: IrelandDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: IrelandKelz YouknowmynameNo ratings yet

- Payslip EPay 20231026Document1 pagePayslip EPay 20231026jacksparrow2023mayNo ratings yet

- 135 PayslipDocument1 page135 PayslipSkerdi KumriaNo ratings yet

- DD Form - Watford Council TaxDocument1 pageDD Form - Watford Council TaxAfzal ShaikhNo ratings yet

- Virgin Media BillDocument2 pagesVirgin Media BillmktxouNo ratings yet

- Re: Summons (The Bear™ Holdings Ltd. vs. Iamnero vs. Her Majesty The Queen)Document1 pageRe: Summons (The Bear™ Holdings Ltd. vs. Iamnero vs. Her Majesty The Queen)ethan8572No ratings yet

- Sky BillDocument1 pageSky Billfrancis.berginNo ratings yet

- NinoDocument1 pageNinoSavage GuyNo ratings yet

- 1 2023 Calendar Month - 31-MAR-23 - 10112851-2 - 1.Document1 page1 2023 Calendar Month - 31-MAR-23 - 10112851-2 - 1.Caitlin HeaNo ratings yet

- Council TaxDocument1 pageCouncil Taxsteve.hartNo ratings yet

- United Kingdom Utility Gas StatementDocument2 pagesUnited Kingdom Utility Gas StatementAyilaran EmmanuelNo ratings yet

- Statement 517014 78338832 22 Dec 2023Document5 pagesStatement 517014 78338832 22 Dec 2023cressidafunkeadedareNo ratings yet

- IndianDocument1 pageIndianxfzm99mr8rNo ratings yet

- UntitledDocument1 pageUntitledIleana MateiNo ratings yet

- Information About Invoices Received RegardingDocument2 pagesInformation About Invoices Received RegardingMatthew HeritageNo ratings yet

- AST Tenancy Agreement - TDS - Landlord RentDocument42 pagesAST Tenancy Agreement - TDS - Landlord RentGareth McKnightNo ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- Statement 25-NOV-22 AC 43388212 27104301Document4 pagesStatement 25-NOV-22 AC 43388212 27104301cecilia mwangiNo ratings yet

- Statement 2020 03 10Document3 pagesStatement 2020 03 10BrendaNo ratings yet

- Monzo Bank Statement 2022 10 01-2022 10 06 703Document3 pagesMonzo Bank Statement 2022 10 01-2022 10 06 703Monila PunNo ratings yet

- 2022 12 23 YourTalkTalkBill-2-2-2Document2 pages2022 12 23 YourTalkTalkBill-2-2-2apple3215522No ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- customs: CorporationDocument2 pagescustoms: Corporationbilal sarfrazNo ratings yet

- Confirming Your Eligibility For Tax ReliefDocument4 pagesConfirming Your Eligibility For Tax ReliefNurullah GuzelNo ratings yet

- Halifax Statement Jan19Document1 pageHalifax Statement Jan19alexpicary79No ratings yet

- Inspired Sisters LTD Online) AUDocument3 pagesInspired Sisters LTD Online) AUthankksNo ratings yet

- Statement of Benefits 30 04 2020Document10 pagesStatement of Benefits 30 04 2020Chris MillsNo ratings yet

- SS033790C 52 Ionela Claudia Insuratelu 30-03-2023Document1 pageSS033790C 52 Ionela Claudia Insuratelu 30-03-2023Ionela InsurateluNo ratings yet

- Tax Invoice: New ChargesDocument3 pagesTax Invoice: New ChargesSMART DESIGNSNo ratings yet

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- Uk PayslipDocument1 pageUk PayslipEsidor PalushiNo ratings yet

- Silver Account 06 December 2021 To 06 June 2022: Abuzeid Huda AliDocument2 pagesSilver Account 06 December 2021 To 06 June 2022: Abuzeid Huda Alimohamed elmakhzniNo ratings yet

- Statement 25-MAY-22 AC 43388212 28153934Document7 pagesStatement 25-MAY-22 AC 43388212 28153934cecilia mwangiNo ratings yet

- SkyBill - 2022 05 05Document1 pageSkyBill - 2022 05 05Madalina GrNo ratings yet

- Payslip - Payslip-SOMIGLI212-20230228Document1 pagePayslip - Payslip-SOMIGLI212-20230228Luca SomigliNo ratings yet

- Edited - 519896510 Statement 104644 1753353Document2 pagesEdited - 519896510 Statement 104644 1753353contability121.ukNo ratings yet

- Ita34 1058123249Document3 pagesIta34 1058123249Bahlakoana NtsasaNo ratings yet

- Factory April BillDocument3 pagesFactory April BillSumit AgarwalNo ratings yet

- Private & Confidential: (No Pay Point)Document1 pagePrivate & Confidential: (No Pay Point)Michalina WróblewskaNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- CorrespondenceDocument5 pagesCorrespondenceUsakikamiNo ratings yet

- Atr Waste Carrier Licence Valid To 25.09.2026Document1 pageAtr Waste Carrier Licence Valid To 25.09.2026Anytime Recycling AccountsNo ratings yet

- Statement 2023 OctDocument2 pagesStatement 2023 Octbabyshark9030No ratings yet

- Filling in Your VAT ReturnDocument28 pagesFilling in Your VAT ReturnkbassignmentNo ratings yet

- Renata Balogh - Payslip For 12.04.21Document1 pageRenata Balogh - Payslip For 12.04.21Renáta BaloghNo ratings yet

- Business Account StatementDocument2 pagesBusiness Account StatementRamesh NatarajanNo ratings yet

- invoice (с)Document1 pageinvoice (с)OlgaNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- Bloomberg ManualDocument84 pagesBloomberg ManualDavid ReaNo ratings yet

- Us Aers Tone at The Top Sept 2014Document8 pagesUs Aers Tone at The Top Sept 2014Nicole Romero EspínolaNo ratings yet

- Fact Sheet On Foreign Direct Investment (Fdi)Document10 pagesFact Sheet On Foreign Direct Investment (Fdi)SusilPandaNo ratings yet

- QUESTION 1 - Multiple Choice (15 Marks)Document24 pagesQUESTION 1 - Multiple Choice (15 Marks)Juanita AddinallNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- Niveshi - Invest Like The ExpertsDocument20 pagesNiveshi - Invest Like The ExpertsRachana RamchandNo ratings yet

- Unit 5: Income From House PropertyDocument11 pagesUnit 5: Income From House PropertySiddhant PowleNo ratings yet

- Banking Law RDDocument3 pagesBanking Law RDAditi VatsaNo ratings yet

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- Grissom Vs Dealer Services Corporation 5th Amended Complaint If YouDocument9 pagesGrissom Vs Dealer Services Corporation 5th Amended Complaint If YouCalifornia AutoDealers100% (1)

- A Joint Venture Between Indian Bank, Sompo Japan Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument3 pagesA Joint Venture Between Indian Bank, Sompo Japan Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsanshiNo ratings yet

- Reinforcement Activity 1 Processing and Reporting Departmental Accounting DataDocument14 pagesReinforcement Activity 1 Processing and Reporting Departmental Accounting Datalana.ballard2004No ratings yet

- Technical Analysis of Stocks Commodities 2018 No 09Document64 pagesTechnical Analysis of Stocks Commodities 2018 No 09s9298100% (1)

- Marginal CostingDocument63 pagesMarginal Costingprachi aroraNo ratings yet

- 595unit 4 Insurance Underwriting and Claims SettlementsDocument40 pages595unit 4 Insurance Underwriting and Claims SettlementsBajra VinayaNo ratings yet

- MBD SS Q. Bank ACC - G12 - Ch01Document26 pagesMBD SS Q. Bank ACC - G12 - Ch01Muskan KheraNo ratings yet

- Local Budget Memorandum No 78 PDFDocument42 pagesLocal Budget Memorandum No 78 PDFgulamskyNo ratings yet

- Supertech+EV+II +Provisional+List+of+PRAs+ (Reissued)Document2 pagesSupertech+EV+II +Provisional+List+of+PRAs+ (Reissued)Abhishek TomarNo ratings yet

- IPSAS 1 For 2022 SeptDocument5 pagesIPSAS 1 For 2022 SeptWilson Mugenyi KasendwaNo ratings yet

- IcpoDocument2 pagesIcpobogoreh.djamaNo ratings yet

- Prati BhaDocument4 pagesPrati BhaABHIJEET RATHODNo ratings yet

- Statement: February 2023Document5 pagesStatement: February 2023Nayelly PichardoNo ratings yet

- Terms and ConditionsDocument3 pagesTerms and ConditionsRAJUsssNo ratings yet

- Trial Balance: JM Accounting Service Trial Balance Dember 31,2011 Account NameDocument19 pagesTrial Balance: JM Accounting Service Trial Balance Dember 31,2011 Account NameJeremy LunsodNo ratings yet

- Construction Schedule of Values Template LevelsetDocument3 pagesConstruction Schedule of Values Template Levelsetjarellano08No ratings yet

- Press ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECDocument4 pagesPress ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECKweku ZurekNo ratings yet