Professional Documents

Culture Documents

Truth in Lending Act

Uploaded by

Kriztel Cuñado0 ratings0% found this document useful (0 votes)

222 views2 pagesOriginal Title

TRUTH-IN-LENDING-ACT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

222 views2 pagesTruth in Lending Act

Uploaded by

Kriztel CuñadoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

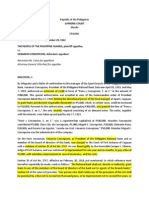

TRUTH IN LENDING ACT

Republic Act No. 3765 or known as the “Truth in Lending Act”

What is the policy behind the Truth in Lending Act?

The declared policy behind the law is to protect the people from lack of awareness of the true

cost of credit by assuring full disclosure of such cost, with a view of preventing the uninformed

use of credit to the detriment of the national economy.

Who are covered under the Truth in Lending Act?

The law covers any creditor, which is defined as any person engaged in the business of extending

credit (including any person who as a regular business practice make loans or sells or rents

property or services on a time, credit, or installment basis, either as principal or as agent) who

requires as an incident to the extension of credit, the payment of a finance charge.

In that definition, what is meant by “credit”?

It means any loan, mortgage, deed of trust, advance, or discount; any conditional sales contract;

any contract to sell, or sale or contract of sale of property or services, either for present or future

delivery, under which part or all of the price is payable subsequent to the making of such sale or

contract; any rental-purchase contract; any contract or arrangement for the hire, bailment, or

leasing of property; any option, demand, lien, pledge, or other claim against, or for of 40the

delivery of, property or money; any purchase, or other acquisition of, or any credit upon the

security of, any obligation of claim arising out of any of the foregoing; and any transaction or

series of transactions having a similar purpose or effect.

In the same definition, what is meant by a “finance charge”?

A finance charge includes interest, fees, service charges, discounts, and such other charges

incident to the extension of credit as may be prescribed by the Monetary Board of the Bangko

Sentral ng Pilipinas through regulations.

What are the information required to be furnished to the debtor or borrower?

The creditor or lender is required to inform the debtor or borrower of the following facts:

(1) the cash price or delivered price of the property or service to be acquired;

(2) the amounts, if any, to be credited as down payment and/or trade-in;

(3) the difference between the amounts set forth under clauses (1) and (2);

(4) the charges, individually itemized, which are paid or to be paid by such person in

connection with the transaction but which are not incident to the extension of credit;

(5) the total amount to be financed;

(6) the finance charge expressed in terms of pesos and centavos; and

(7) the percentage that the finance bears to the total amount to be financed expressed as a

simple annual rate on the outstanding unpaid balance of the obligation.

When and how should this information be furnished to the debtor or borrower?

The information enumerated above must be disclosed to the debtor or borrower prior to the

consummation of the transaction. The information must be clearly stated in writing.

What is the effect on the obligation in case of violations to the Truth in Lending Act?

The contract or transaction remains valid or enforceable, subject to the penalties discussed

below.

What are the penalties in case of violation?

1. Any creditor who violates the law is liable in the amount of P100 or in an amount equal

to twice the finance charged required by such creditor in connection with such

transaction, whichever is the greater, except that such liability shall not exceed P2,000 on

any credit transaction. The action must be brought within one year from the date of the

occurrence of the violation.

2. The creditor is also liable for reasonable attorney’s fees and court costs as determined by

the court.

3. Any person who willfully violates any provision of this law or any regulation issued

thereunder shall be fined by not less than P1,00 or more than P5,000 or imprisonment of

not less than 6 months, nor more than one year or both.

However, no punishment or penalty under this law shall apply to the Philippine Government or

any agency or any political subdivision thereof.

References: R. A. No. 3765; https://pnl-law.com/blog/truth-in-lending-act-explained/.

You might also like

- Powers of Bangko Sentral and Requirements of Truth in Lending ActDocument20 pagesPowers of Bangko Sentral and Requirements of Truth in Lending ActErika Potian100% (1)

- Truth in Lending ActDocument2 pagesTruth in Lending ActShyrine EjemNo ratings yet

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActArjay MolinaNo ratings yet

- The Truth in Lending Act ExplainedDocument24 pagesThe Truth in Lending Act ExplainedGrace Angelie C. Asio-Salih100% (3)

- Special Comml Laws - Tila and AmlaDocument20 pagesSpecial Comml Laws - Tila and AmlaJoseph John Santos RonquilloNo ratings yet

- TRUTH IN LENDING ACT KEY TERMSDocument23 pagesTRUTH IN LENDING ACT KEY TERMSShyrine EjemNo ratings yet

- Truth in Lending ActDocument31 pagesTruth in Lending ActArann Pilande100% (1)

- Truth in Lending Act (Notes)Document2 pagesTruth in Lending Act (Notes)Vernie Anne100% (2)

- RA 3765 Truth in Lending ActDocument2 pagesRA 3765 Truth in Lending ActEmil BautistaNo ratings yet

- Truth in Lending ActDocument12 pagesTruth in Lending ActCoreine Imee ValledorNo ratings yet

- NOTES ON TILA - Truth in Lending Act (RA 3765)Document8 pagesNOTES ON TILA - Truth in Lending Act (RA 3765)edrianclydeNo ratings yet

- PPT - Truth in Lending ActDocument23 pagesPPT - Truth in Lending ActGigiRuizTicar100% (1)

- Truth in Lending Act ReviewerDocument1 pageTruth in Lending Act ReviewerJoanna Paula CañaresNo ratings yet

- RFBT.09 - Lecture Notes (Truth in Lending Act)Document3 pagesRFBT.09 - Lecture Notes (Truth in Lending Act)Monica GarciaNo ratings yet

- TILADocument1 pageTILACJ IbaleNo ratings yet

- The Truth in Lending ActDocument3 pagesThe Truth in Lending ActBOEN YATORNo ratings yet

- Republic Act No. 3765 Truth in Lending ActDocument6 pagesRepublic Act No. 3765 Truth in Lending ActMarc Geoffrey HababNo ratings yet

- Truth in Lending Act (Ayn Ruth Notes)Document3 pagesTruth in Lending Act (Ayn Ruth Notes)Ayn Ruth Zambrano TolentinoNo ratings yet

- Truth in Lending ActDocument30 pagesTruth in Lending ActAlyanna Chang86% (7)

- Becoming Your own Infinity Banker: A Successful Strategy for Creating a Billion DollarsFrom EverandBecoming Your own Infinity Banker: A Successful Strategy for Creating a Billion DollarsNo ratings yet

- Truth in Lending Act ErikaDocument42 pagesTruth in Lending Act ErikaErika PotianNo ratings yet

- Truth in Lending ActDocument20 pagesTruth in Lending ActAbel Francis50% (2)

- REPUBLIC ACT No 3765 - Truth and Lending ActDocument2 pagesREPUBLIC ACT No 3765 - Truth and Lending ActJoey Ann Tutor KholipzNo ratings yet

- Violation of The Truth Lending Act, Sample ComplaintDocument12 pagesViolation of The Truth Lending Act, Sample ComplaintShan KhingNo ratings yet

- Truth in Lending Chapters 1 and 2Document93 pagesTruth in Lending Chapters 1 and 2CarrieonicNo ratings yet

- What is the Truth in Lending Act? (TILADocument9 pagesWhat is the Truth in Lending Act? (TILARenee FisherNo ratings yet

- Truth in Lending Act Case LawDocument5 pagesTruth in Lending Act Case Lawdbush2778100% (1)

- Sample FDCPA Debt Verification LetterDocument2 pagesSample FDCPA Debt Verification LetterwicholacayoNo ratings yet

- Title Iv. - Consumer Credit TransactionDocument24 pagesTitle Iv. - Consumer Credit TransactionALIAHDAYNE POLIDARIONo ratings yet

- TILA Shared PDFDocument8 pagesTILA Shared PDFGretchen Alunday SuarezNo ratings yet

- Truth-In-Lending-Act-HandoutDocument6 pagesTruth-In-Lending-Act-HandoutHazel Anne QuilosNo ratings yet

- U.S. Code Requirements for Open-End Credit PlansDocument28 pagesU.S. Code Requirements for Open-End Credit PlansSamuel100% (1)

- Case Digests For The Truth in Lending ActDocument2 pagesCase Digests For The Truth in Lending ActslumbaNo ratings yet

- RemittanceDocument3 pagesRemittanceSalman Abrar100% (2)

- Republic Act No. 9510Document9 pagesRepublic Act No. 9510Simeon SuanNo ratings yet

- Rescissible ContractsDocument4 pagesRescissible ContractsMhoe BaladhayNo ratings yet

- Understanding the Purpose and Requirements of the Truth in Lending Act (TILADocument9 pagesUnderstanding the Purpose and Requirements of the Truth in Lending Act (TILAJenevieve Muya Sobredilla100% (1)

- Stamp Duty CalculatorDocument2 pagesStamp Duty Calculatorjmathew_984887No ratings yet

- 5.discharge of ContractsDocument9 pages5.discharge of Contractsnatsu lolNo ratings yet

- Truth in Lending ActDocument30 pagesTruth in Lending ActjayrenielNo ratings yet

- Negotiable instruments characteristics requisites roles partiesDocument4 pagesNegotiable instruments characteristics requisites roles partiesAndrolf CaparasNo ratings yet

- Sample Rescission Letter: Investor InvestorDocument1 pageSample Rescission Letter: Investor Investortizes2759No ratings yet

- For UploadDocument6 pagesFor UploadDino AbieraNo ratings yet

- The Features of Long Term DebtsDocument56 pagesThe Features of Long Term DebtsMicah Ramayka100% (3)

- Truth in Lending ActDocument22 pagesTruth in Lending Actmark matalino100% (1)

- Tila LawDocument2 pagesTila LawMichael RitaNo ratings yet

- Consumer Protection ActDocument10 pagesConsumer Protection ActShubham SethiNo ratings yet

- Validation of Debt Disbute LetterDocument2 pagesValidation of Debt Disbute Lettercolemanbe07No ratings yet

- Collection agency demand for disclosuresDocument2 pagesCollection agency demand for disclosuresMichael Rispoli100% (1)

- The Negotiable Instruments Law in a NutshellDocument78 pagesThe Negotiable Instruments Law in a NutshelljaneNo ratings yet

- Demand For Arbitration Before JAMSDocument4 pagesDemand For Arbitration Before JAMSspork77No ratings yet

- Truth in Lending - Act PDF BookDocument91 pagesTruth in Lending - Act PDF BookBOSSKING DESIGNS100% (2)

- Negotiable Instruments: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments: Legal Aspects of BusinessArun Sharma100% (2)

- Truth in Lending Complaint SampleDocument3 pagesTruth in Lending Complaint SampleCarrieonic100% (3)

- Section 1637 - Open End Consumer Credit PlansDocument19 pagesSection 1637 - Open End Consumer Credit PlansSamuel75% (4)

- Notice of Default Discharge of Obligation Demand For Reconveyance To Donna Carpenter For First American Title Interlachen LNDocument5 pagesNotice of Default Discharge of Obligation Demand For Reconveyance To Donna Carpenter For First American Title Interlachen LNArmond TrakarianNo ratings yet

- 3 Day Notice To ReportDocument1 page3 Day Notice To ReportMarsha MainesNo ratings yet

- Credit Transaction (Full Cases)Document217 pagesCredit Transaction (Full Cases)RowenaSajoniaArengaNo ratings yet

- Surety 2Document10 pagesSurety 2ramilflecoNo ratings yet

- Bank Secrecy LawDocument2 pagesBank Secrecy LawKriztel CuñadoNo ratings yet

- Family InteractionDocument1 pageFamily InteractionKriztel CuñadoNo ratings yet

- PM ReportDocument3 pagesPM ReportKriztel CuñadoNo ratings yet

- What Is Porter's Five Model? Explain and Elaborate The Use of This ModelDocument4 pagesWhat Is Porter's Five Model? Explain and Elaborate The Use of This ModelKriztel CuñadoNo ratings yet

- Project Management (HRMA 40023) : Office of The Vice President For Academic Affairs College of Business AdministrationDocument13 pagesProject Management (HRMA 40023) : Office of The Vice President For Academic Affairs College of Business AdministrationKriztel CuñadoNo ratings yet

- Project Management (HRMA 40023) : Office of The Vice President For Academic Affairs College of Business AdministrationDocument13 pagesProject Management (HRMA 40023) : Office of The Vice President For Academic Affairs College of Business AdministrationKriztel CuñadoNo ratings yet

- Family InteractionDocument1 pageFamily InteractionKriztel CuñadoNo ratings yet

- Anti-Money Laundering ActDocument8 pagesAnti-Money Laundering ActKriztel CuñadoNo ratings yet

- Bank Secrecy LawDocument2 pagesBank Secrecy LawKriztel CuñadoNo ratings yet

- Pdic LawDocument3 pagesPdic LawKriztel CuñadoNo ratings yet

- PM ReportDocument3 pagesPM ReportKriztel CuñadoNo ratings yet

- What Is Porter's Five Model? Explain and Elaborate The Use of This ModelDocument4 pagesWhat Is Porter's Five Model? Explain and Elaborate The Use of This ModelKriztel CuñadoNo ratings yet

- Anti-Money Laundering ActDocument8 pagesAnti-Money Laundering ActKriztel CuñadoNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActKriztel CuñadoNo ratings yet

- Nasty Gal Best PracticesDocument16 pagesNasty Gal Best PracticesKriztel CuñadoNo ratings yet

- The Construction of The SelfDocument2 pagesThe Construction of The SelfKriztel CuñadoNo ratings yet

- Nasty GalDocument16 pagesNasty GalKriztel CuñadoNo ratings yet

- 02 Chapter 2Document60 pages02 Chapter 2swapnshriNo ratings yet

- CRM Final PresentationDocument9 pagesCRM Final PresentationKriztel CuñadoNo ratings yet

- Tho29503 Case Analysis CA1 CA12Document12 pagesTho29503 Case Analysis CA1 CA12Kisilu MbathaNo ratings yet

- CRM Final PresentationDocument9 pagesCRM Final PresentationKriztel CuñadoNo ratings yet

- CRM Final PresentationDocument9 pagesCRM Final PresentationKriztel CuñadoNo ratings yet

- Financial Intermediaries Simplify Fund TransfersDocument44 pagesFinancial Intermediaries Simplify Fund TransfersKriztel CuñadoNo ratings yet

- Application For Student Driver'S Permit / Driver'S License / Conductor'S License (Apl)Document2 pagesApplication For Student Driver'S Permit / Driver'S License / Conductor'S License (Apl)Jac Polido90% (10)

- K to 12 ABM Fundamentals of Accountancy, Business and ManagementDocument7 pagesK to 12 ABM Fundamentals of Accountancy, Business and ManagementMica SaeronNo ratings yet

- ISO 9001:2015 Internal Audit Checklist: WWW - Iso9001help - Co.ukDocument2 pagesISO 9001:2015 Internal Audit Checklist: WWW - Iso9001help - Co.ukSwetha Rao0% (1)

- ACCT 101 QUIZ 11 Section ReviewDocument5 pagesACCT 101 QUIZ 11 Section ReviewhappystoneNo ratings yet

- NR ResumeDocument4 pagesNR ResumeNAMBIRAJAN GNo ratings yet

- Examining the Diploma Disease Theory in Developing NationsDocument6 pagesExamining the Diploma Disease Theory in Developing NationsMdd ZxlNo ratings yet

- First Time Buyer Guide Int PDFDocument18 pagesFirst Time Buyer Guide Int PDFTausifNo ratings yet

- 1.4 Leading Change Through Innovative MindsetDocument20 pages1.4 Leading Change Through Innovative MindsetShewegen WaltengusNo ratings yet

- Manufacturing P&L and Balance SheetDocument2 pagesManufacturing P&L and Balance SheetcalebNo ratings yet

- SMU Law Corporate Law Reading List W11Document4 pagesSMU Law Corporate Law Reading List W11gohweixueNo ratings yet

- Fodder Production & Trading Company Business PlanDocument18 pagesFodder Production & Trading Company Business PlanBrave King100% (2)

- Chapter 2-Marketing Strategy and Market EnvironmentDocument20 pagesChapter 2-Marketing Strategy and Market EnvironmentMohd AnwarshahNo ratings yet

- Social Studies ReviewerDocument2 pagesSocial Studies ReviewerVaughn Siegfried FuertezNo ratings yet

- Cherry Capital Communications Proposal To Benzie CountyDocument12 pagesCherry Capital Communications Proposal To Benzie CountyColin MerryNo ratings yet

- Akshay Finance PRJCTDocument38 pagesAkshay Finance PRJCTsamarthadhkariNo ratings yet

- Addis Ababa University-1Document18 pagesAddis Ababa University-1ASMINO MULUGETA100% (1)

- Project Report On Starting A New Business.... (Comfort Jeans)Document30 pagesProject Report On Starting A New Business.... (Comfort Jeans)lalitsingh76% (72)

- Background of Digital Services ActDocument13 pagesBackground of Digital Services Actadelemahe137No ratings yet

- How To Start A Manufacturing BusinessDocument2 pagesHow To Start A Manufacturing BusinessVin SNo ratings yet

- President Rodrigo Duterte: December 19, 2017Document7 pagesPresident Rodrigo Duterte: December 19, 2017Chelsy SantosNo ratings yet

- Dream Job Placement ReceiptDocument1 pageDream Job Placement Receiptnaamm757No ratings yet

- Survey On Garment Workers in Karnataka - 2015Document21 pagesSurvey On Garment Workers in Karnataka - 2015ShreeDN67% (3)

- Service Delivery Manager IT in NYC Resume Vasudeva SameeraDocument4 pagesService Delivery Manager IT in NYC Resume Vasudeva SameeraVasudevaSameeraNo ratings yet

- Nezone FinalDocument61 pagesNezone Finalvictor saikiaNo ratings yet

- Principles of Scientific ManagementDocument5 pagesPrinciples of Scientific Managementshadrick kasubaNo ratings yet

- Assurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonDocument21 pagesAssurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonmerantidownloaderNo ratings yet

- Piggery Business Plan MDP To Self HelpDocument23 pagesPiggery Business Plan MDP To Self Helpj mountain100% (2)

- Economic Bubbles British English TeacherDocument10 pagesEconomic Bubbles British English TeacherHarry RadcliffeNo ratings yet

- 1991-2019 Bqa Labor Law Sample Pages PDFDocument47 pages1991-2019 Bqa Labor Law Sample Pages PDFJaja NullaNo ratings yet

- Financial Accounting Module Investment AnalysisDocument6 pagesFinancial Accounting Module Investment AnalysisDanny ToligiNo ratings yet

- HR Internship Report: Learning Practical HR ConceptsDocument25 pagesHR Internship Report: Learning Practical HR ConceptsIndhu RamachandranNo ratings yet