Professional Documents

Culture Documents

Contoh Soal PV

Uploaded by

KSW Fantasy0 ratings0% found this document useful (0 votes)

18 views2 pagesOriginal Title

contoh soal PV

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesContoh Soal PV

Uploaded by

KSW FantasyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Penerimaan

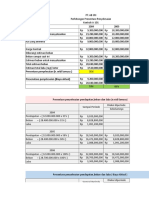

3a. Tahun Biaya Tunai Cash Inflow

Tunai

1

650,000,000 500,000,000 150,000,000

2

650,000,000 500,000,000 150,000,000

3

650,000,000 500,000,000 150,000,000

4

650,000,000 500,000,000 150,000,000

5

650,000,000 500,000,000 150,000,000

Karena arus kas setiap tahun sama, maka

Payback period = Investasi Awal x 1 tahun

Arus Kas

= x 1 tahun

600,000,000

150,000,000

= 4 x 1 tahun

= 4 tahun

3b. Depresiasi = investasi awal / usai ekonomis

600,000,000 /

=

5

=

120,000,000

ARR = (Rata-rata Cash in flow - depresiasi)

Investasi awal

150,000,000 -

=

120,000,000

600,000,000

= 30,000,000

600,000,000

= 5.00%

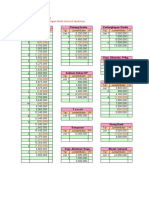

3c. NPV = (Ct x PVIFA (r)(t)) – C0

= (C5 x PVIFA (10%)(5)) – 600,000,000

= (150,000,000 x 3.7908) – 600,000,000

= 568,620,000 – 600,000,000

= -31,380,000

3d. NPV dengan PVIFA 10%

NPV = (Ct x PVIFA (r)(t)) – C0

= (C5 x PVIFA (10%)(5)) – 600,000,000

= (150,000,000 x 3.7908) – 600,000,000

= 568,620,000 – 600,000,000

= -31,380,000

NPV dengan PVIFA 7%

NPV = (Ct x PVIFA (r)(t)) – C0

= (C5 x PVIFA (7%)(5)) – 600,000,000

= (150,000,000 x 4.1002) – 600,000,000

= 615,030,000 – 600,000,000

= 15,030,000

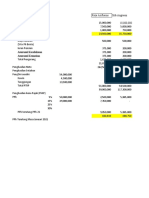

Selisih Selisih PV dengan

Selisih PV

Bunga Investasi Awal

7%

615,030,000 615,030,000

10%

568,620,000 600,000,000

3%

46,410,000 15,030,000

IRR = 7% + (15,030,000 / 46,410,000) * 3%

= 10,97%

You might also like

- Salon NadiaDocument1 pageSalon Nadianaisya rahma57% (7)

- UTS MNJ FINANSIAL - Hermawan - 172310004Document7 pagesUTS MNJ FINANSIAL - Hermawan - 172310004Dany KusumaNo ratings yet

- Adbi4335 MuharlanDocument2 pagesAdbi4335 MuharlanalfanfhNo ratings yet

- AmortizacionDocument10 pagesAmortizacionPaola CastilloNo ratings yet

- Maria Petra Angelina Br. Sihaloho Tugas 2 Praktek Audit AC4Document16 pagesMaria Petra Angelina Br. Sihaloho Tugas 2 Praktek Audit AC4Maria Petra Angelina Br. Sihaloho 20510043No ratings yet

- Forum12 - Erfan Satria Perdana - 55121110133Document4 pagesForum12 - Erfan Satria Perdana - 55121110133Erfan SatriaNo ratings yet

- Adm PajakDocument2 pagesAdm Pajakeka elmi hikmawatiNo ratings yet

- Angela Apriliany Abdullah (614419065) PDFDocument10 pagesAngela Apriliany Abdullah (614419065) PDFInthan LasenaNo ratings yet

- 20-Nano Romansyah-23401020312Document1 page20-Nano Romansyah-23401020312Nano MansyahNo ratings yet

- Praktek Audit Piutang Usaha (Tiori Kesia)Document4 pagesPraktek Audit Piutang Usaha (Tiori Kesia)novisinagaa.5233351032No ratings yet

- Neraca Lajur Ibu BungaDocument2 pagesNeraca Lajur Ibu BungaGeraldy AmricoNo ratings yet

- Jawaban SoalDocument3 pagesJawaban SoalDina RahayuNo ratings yet

- Du PontDocument1 pageDu Pontw_fibNo ratings yet

- No. 5 Akun PerbankanDocument2 pagesNo. 5 Akun PerbankanWachidatul Ayu FitriNo ratings yet

- Tugas VingkanDocument3 pagesTugas VingkanMlcheezNo ratings yet

- Contoh Tabel RencanaDocument2 pagesContoh Tabel RencanaUmi Laila SariNo ratings yet

- Akuntansi Lanjut 1Document3 pagesAkuntansi Lanjut 1Roni febrianNo ratings yet

- Perhitungan AlokasiDocument1 pagePerhitungan AlokasiTarsono OyeNo ratings yet

- Kertas Kerja Capital BudgetingDocument2 pagesKertas Kerja Capital BudgetingFauzan AhmadNo ratings yet

- Uts Akl 2 DesyDocument15 pagesUts Akl 2 DesyEmailkuhh Secondemail100% (1)

- Akd1 SoalDocument8 pagesAkd1 Soalrivaldo putraNo ratings yet

- Rosa Aulia Nurhaini (201622018252975) - Tugas Lap Keu KonsolidasiDocument13 pagesRosa Aulia Nurhaini (201622018252975) - Tugas Lap Keu KonsolidasiKOPERASIBMT MALANGNo ratings yet

- Penyelesaian Soal Aspek Keuangan SKBDocument5 pagesPenyelesaian Soal Aspek Keuangan SKBOlof MeisterNo ratings yet

- Aset Keterangan Kas Aset Tetap Persediaan Kendaraan Bangunan Peralatan Kantor/mesinDocument2 pagesAset Keterangan Kas Aset Tetap Persediaan Kendaraan Bangunan Peralatan Kantor/mesinDede FirmansahNo ratings yet

- TugasDocument11 pagesTugasPuji Desta AnandaNo ratings yet

- Soal EkonomiDocument6 pagesSoal EkonomiPutri RahayuNo ratings yet

- KK UAS JesDocument8 pagesKK UAS Jesabdulsihite backup1No ratings yet

- Kunci Jawaban Kasus PT - Ab SriDocument22 pagesKunci Jawaban Kasus PT - Ab SriAyu Ismayanti0% (2)

- TUGAS Akt 1Document4 pagesTUGAS Akt 1Anonymous 52aubwOZNo ratings yet

- Guntur Bastian HerlanggaDocument8 pagesGuntur Bastian HerlanggaGuntur bastian HerlanggaNo ratings yet

- Excel Sabat Nathanniel - KuisDocument3 pagesExcel Sabat Nathanniel - KuisExcel Sabat NathannielNo ratings yet

- Berikut Transaksi Bengkel Purnomo Selama Bulan Mei 2018Document2 pagesBerikut Transaksi Bengkel Purnomo Selama Bulan Mei 2018M Rizky BryNo ratings yet

- FINALDocument9 pagesFINALRismayanti HamzahNo ratings yet

- AKL 1 Rissa (Sesi 7)Document2 pagesAKL 1 Rissa (Sesi 7)Clarissa HalimNo ratings yet

- Tugas AkuntansiDocument6 pagesTugas AkuntansiAlvin Krisna BudimanNo ratings yet

- 25 - Atmiraldo Agung Nugroho - (Soal 2 Ju) - DikonversiDocument4 pages25 - Atmiraldo Agung Nugroho - (Soal 2 Ju) - DikonversiEva ChasandraNo ratings yet

- Biro Jasa HenryDocument16 pagesBiro Jasa HenryFenny KhoNo ratings yet

- Jawaban Uas Lab Ak BiayaDocument2 pagesJawaban Uas Lab Ak BiayaaglamNo ratings yet

- Tugas - J U R N A L21 (Jawaban 1)Document2 pagesTugas - J U R N A L21 (Jawaban 1)krisnayusufmaulanaNo ratings yet

- ALK PERT.3 (Nikmatul Ula Wila - 22102)Document5 pagesALK PERT.3 (Nikmatul Ula Wila - 22102)Nikmatul Ula wilaNo ratings yet

- Brosur BPUDocument2 pagesBrosur BPUkemalamcNo ratings yet

- Jurnal Umum Perusahaan JasaDocument1 pageJurnal Umum Perusahaan JasaKouyou Sammy BudimanNo ratings yet

- Jawaban Review UAS 22Document7 pagesJawaban Review UAS 22Antony HermawanNo ratings yet

- Jumlah RP 37,500,000 RP 37,500,000Document9 pagesJumlah RP 37,500,000 RP 37,500,000Rismayanti HamzahNo ratings yet

- Ikhtisar Mutasi Piutang Usaha DepiDocument4 pagesIkhtisar Mutasi Piutang Usaha Depinovisinagaa.5233351032No ratings yet

- Manajemen Keuangan Dan Akuntansi Rumah SakitDocument2 pagesManajemen Keuangan Dan Akuntansi Rumah Sakityusak tapakedingNo ratings yet

- Penjualan AngsuranDocument8 pagesPenjualan AngsuranSusaksi RahayuNo ratings yet

- Uas Anggaran PerusahaanDocument4 pagesUas Anggaran PerusahaanAmalia Ramadhani MentariNo ratings yet

- NERACADocument7 pagesNERACASiti Marisa Nasywa HalizaNo ratings yet

- Latihan Cash BudgetDocument3 pagesLatihan Cash Budgetdevina utamiNo ratings yet

- Perpajakan Excell - Fitri Ruhimah - 081021011Document2 pagesPerpajakan Excell - Fitri Ruhimah - 081021011rhmh fitNo ratings yet

- Persamaan Akuntansi-2Document10 pagesPersamaan Akuntansi-2Nabila MaudianaNo ratings yet

- Neraca Saldo PT Angkasa Perkasa MultigunaDocument1 pageNeraca Saldo PT Angkasa Perkasa MultigunaAlvica Dian100% (2)

- Neraca Lajur (Aster Indah)Document6 pagesNeraca Lajur (Aster Indah)Wahyu SajugoNo ratings yet

- BilaDocument2 pagesBilaUlfa MuniraNo ratings yet

- AKL I-4-1, Latihan AfiliasiDocument35 pagesAKL I-4-1, Latihan AfiliasiburgerkickNo ratings yet

- Tugas 2 Cashflow - Alfi NikmatikaDocument16 pagesTugas 2 Cashflow - Alfi Nikmatikaalfi nikmatika syifaNo ratings yet

- Tabel Bunga Flat - Efektif - AnuitasDocument4 pagesTabel Bunga Flat - Efektif - AnuitasaditnakkpcNo ratings yet

- Akuntansi TabelDocument2 pagesAkuntansi TabelNURDIANA TANDI PARENo ratings yet