Professional Documents

Culture Documents

Dremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With Book

Uploaded by

Louiza Kyla AridaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With Book

Uploaded by

Louiza Kyla AridaCopyright:

Available Formats

Dividend to Class 7:

$410,000 ÷ $640,000 = 64.1%

c. Unsecured portion of notes payable and

interest $380,000

Dividend on unsecured amount 64.1%

Amount received on unsecured portion $243,580

Proceeds from receivables and inventory 150,000

Total Received $393,580

Dividend to note holders: $393,580 ÷ $530,000 = 74.3%

DIF: D OBJ: 21-3

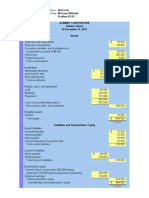

Dremer Corporation: On June 1, 20X5, the books of Dremer Corporation show assets with book

values and realizable values as follows:

Assets

Realizable

Book Value Value

Cash $ 1,850 $ 1,850

Accounts Receivable (net) 21,200 17,000

Note Receivable 15,000 15,000

Inventory 41,000 20,000

Investment in Calandir Stock 5,800 15,000

Land and Building (net) 98,500 92,800

Equipment (net) 43,000 8,000

Totals $226,350 $169,650

Dremer's books show the following liabilities:

Liabilities

Book Value

Accounts payable (50,000 secured by inventory

and equipment) $ 90,625

Wages payable (eligible for priority) 3,775

Other Accrued Liabilities 10,000

Accrued interest on notes payable 375

Accrued interest on mortgage payable 600

Notes payable (secured by Investment in Calandir Stock) 10,000

Mortgage payable (secured by land and building) 70,000

Total $185,375

21-1

You might also like

- Book Value Realizable ValueDocument4 pagesBook Value Realizable ValueGennia Mae Martinez100% (1)

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- Fischer10e Ch21 TBDocument2 pagesFischer10e Ch21 TBLouiza Kyla AridaNo ratings yet

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Marco Company Bankruptcy Statement of Affairs and Estimated RecoveryDocument4 pagesMarco Company Bankruptcy Statement of Affairs and Estimated Recoveryarif budi hermansahNo ratings yet

- Tender - BQ Ecd Construction of ClassroomsDocument64 pagesTender - BQ Ecd Construction of ClassroomsMutai KiprotichNo ratings yet

- Problem A - SFP For UploadDocument3 pagesProblem A - SFP For UploadLuisa Janelle Boquiren50% (2)

- NGO Fundraising MethodsDocument62 pagesNGO Fundraising MethodsNishant Kataria67% (3)

- 1Document4 pages1NURHAM SUMLAYNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Advanced Financial Accounting QuizDocument53 pagesAdvanced Financial Accounting Quizanon nimusNo ratings yet

- Assignment #1 BADM 1050 Emily KiaraDocument5 pagesAssignment #1 BADM 1050 Emily Kiaraemilynelson1429No ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Chapter 3 - Excel SolutionsDocument8 pagesChapter 3 - Excel SolutionsHalt DougNo ratings yet

- Financial Statement AdjustmentsDocument5 pagesFinancial Statement AdjustmentsHasan NajiNo ratings yet

- QuestionsDocument1 pageQuestionsjesicaNo ratings yet

- Assets Book Value Estimated Realizable ValuesDocument3 pagesAssets Book Value Estimated Realizable ValuesEllyza SerranoNo ratings yet

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanNo ratings yet

- Jawaban Excersice Advance Chpt3Document3 pagesJawaban Excersice Advance Chpt3teamjkt48merchNo ratings yet

- 3.2 Acco 2100 Milagros MelecioDocument11 pages3.2 Acco 2100 Milagros MelecioDorisNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Balance Sheet SolutionsDocument3 pagesBalance Sheet SolutionsAbhishekKumarNo ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- DAGUPLO - Tour 131 WFX - Modules 2-3 - ExercisesDocument4 pagesDAGUPLO - Tour 131 WFX - Modules 2-3 - ExercisesAlexis B. DaguploNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Drill Corporate LiquidationDocument3 pagesDrill Corporate LiquidationElizabeth DumawalNo ratings yet

- AC213 Ch03 ExerciseSolutionsDocument24 pagesAC213 Ch03 ExerciseSolutionsJoshua Miguel R. SevillaNo ratings yet

- Kaladkaren Corporation Bankruptcy Liquidation StatementsDocument51 pagesKaladkaren Corporation Bankruptcy Liquidation StatementsrenoNo ratings yet

- Book Value Assets Total Unsecured Realizable ValueDocument9 pagesBook Value Assets Total Unsecured Realizable ValueJPNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Tania Maharani - C1C019071 - Tugas AKL 3Document5 pagesTania Maharani - C1C019071 - Tugas AKL 3Tania MaharaniNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (28)

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- Mastering Corporate Accounting ConsolidationsDocument7 pagesMastering Corporate Accounting ConsolidationsArmaghan Ali MalikNo ratings yet

- FABM 2 Peer TutorialDocument3 pagesFABM 2 Peer TutorialIrish LudoviceNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Example Corp balance sheet liabilitiesDocument1 pageExample Corp balance sheet liabilitiesCasañas, Gillian DrakeNo ratings yet

- Chapter 12 Exercises Indirect Method Cash Flow StatementsDocument2 pagesChapter 12 Exercises Indirect Method Cash Flow StatementsAreeba QureshiNo ratings yet

- Corporate Liquidation FinancialsDocument11 pagesCorporate Liquidation FinancialsJenny LelisNo ratings yet

- Special Transaction ACtivityDocument4 pagesSpecial Transaction ACtivityPrincessNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Final accounts for year ending 1992Document50 pagesFinal accounts for year ending 1992kalyanikamineniNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Accounting for margin of safety, break-even pointDocument5 pagesAccounting for margin of safety, break-even pointRheu ReyesNo ratings yet

- TPBALANCESHEET DeloyDocument1 pageTPBALANCESHEET DeloyJen DeloyNo ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- BUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Document2 pagesBUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Y KNo ratings yet

- Activity-4-CLDocument2 pagesActivity-4-CLfrancesdimplesabio06No ratings yet

- Problem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksDocument2 pagesProblem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksArtisanNo ratings yet

- Comprehensive Business Combination Problem Journal EntriesDocument3 pagesComprehensive Business Combination Problem Journal EntrieskathNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationkathNo ratings yet

- Please Refer To Table 4-1 For The Following Questions. Table 4-1Document1 pagePlease Refer To Table 4-1 For The Following Questions. Table 4-1Megana PunithNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument2 pagesNon-Current Assets Held For Sale and Discontinued OperationsLouiza Kyla AridaNo ratings yet

- Chapter 3 - Page 6 Financial Statement Analysis Answer: D Diff: M NDocument2 pagesChapter 3 - Page 6 Financial Statement Analysis Answer: D Diff: M NpompomNo ratings yet

- Quiz No. 2 FSA Oral Recits Quiz1Document1 pageQuiz No. 2 FSA Oral Recits Quiz1Louiza Kyla AridaNo ratings yet

- Impairment Loss Machinery - Held For Sale Accumulated Depreciation MachineryDocument2 pagesImpairment Loss Machinery - Held For Sale Accumulated Depreciation MachineryLouiza Kyla AridaNo ratings yet

- Quiz No. 2 FSA Oral Recits Quiz3Document1 pageQuiz No. 2 FSA Oral Recits Quiz3Louiza Kyla AridaNo ratings yet

- Solution:: Estimated Stand-Alone Selling Prices Allocation As Allocated 33 17 50Document2 pagesSolution:: Estimated Stand-Alone Selling Prices Allocation As Allocated 33 17 50Louiza Kyla AridaNo ratings yet

- Dremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With BookDocument1 pageDremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With BookLouiza Kyla AridaNo ratings yet

- Contracts 1Document2 pagesContracts 1Louiza Kyla AridaNo ratings yet

- Case B: Solution: (100 Shares Per Week X 52 Weeks X 20) 104,000 SolutionsDocument2 pagesCase B: Solution: (100 Shares Per Week X 52 Weeks X 20) 104,000 SolutionsLouiza Kyla AridaNo ratings yet

- Chapter 21-Debt Restructuring, Corporate ReorDocument2 pagesChapter 21-Debt Restructuring, Corporate ReorLouiza Kyla AridaNo ratings yet

- Problem 39-5: ComputationalDocument2 pagesProblem 39-5: ComputationalLouiza Kyla AridaNo ratings yet

- Impairment Loss Machinery - Held For Sale Accumulated Depreciation MachineryDocument2 pagesImpairment Loss Machinery - Held For Sale Accumulated Depreciation MachineryLouiza Kyla AridaNo ratings yet

- Fischer10f Ch21 TBDocument3 pagesFischer10f Ch21 TBLouiza Kyla AridaNo ratings yet

- Refer To Dremer Corporation Prepare An Accounting Statement of Affairs Including The Computation of The Dividend To Class 7 Unsecured Creditors. AnsDocument2 pagesRefer To Dremer Corporation Prepare An Accounting Statement of Affairs Including The Computation of The Dividend To Class 7 Unsecured Creditors. AnsLouiza Kyla AridaNo ratings yet

- Fischer10d Ch21 TBDocument2 pagesFischer10d Ch21 TBLouiza Kyla AridaNo ratings yet

- Fischer10b Ch21 TBDocument2 pagesFischer10b Ch21 TBLouiza Kyla AridaNo ratings yet

- Dividend Statement LiquidationDocument2 pagesDividend Statement LiquidationLouiza Kyla AridaNo ratings yet

- Fischer10g Ch21 TBDocument2 pagesFischer10g Ch21 TBLouiza Kyla AridaNo ratings yet

- Fischer10a Ch21 TBDocument1 pageFischer10a Ch21 TBLouiza Kyla AridaNo ratings yet

- Chapter 21-Debt: Figure 21-ADocument2 pagesChapter 21-Debt: Figure 21-ALouiza Kyla AridaNo ratings yet

- TB 6Document2 pagesTB 6Louiza Kyla AridaNo ratings yet

- Fischer10h Ch21 TBDocument2 pagesFischer10h Ch21 TBLouiza Kyla AridaNo ratings yet

- TB 4Document1 pageTB 4Louiza Kyla AridaNo ratings yet

- TB 7Document2 pagesTB 7Louiza Kyla AridaNo ratings yet

- TB 8Document1 pageTB 8Louiza Kyla AridaNo ratings yet

- TB 2Document1 pageTB 2Louiza Kyla AridaNo ratings yet

- TB 9Document2 pagesTB 9Louiza Kyla AridaNo ratings yet

- TB 3Document1 pageTB 3Louiza Kyla AridaNo ratings yet

- TB 5Document2 pagesTB 5Louiza Kyla AridaNo ratings yet

- Problem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsDocument3 pagesProblem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsandreamrieNo ratings yet

- External Forces of Organizational ChangeDocument6 pagesExternal Forces of Organizational ChangeyousufNo ratings yet

- Time Impact Analysis - Window AnalysisDocument10 pagesTime Impact Analysis - Window AnalysisJeezan AzikNo ratings yet

- ToR For Solar ConsultantDocument7 pagesToR For Solar ConsultantJustice WinsNo ratings yet

- Introduction to Business Muslim Idol Datuk Haji IbrahimDocument10 pagesIntroduction to Business Muslim Idol Datuk Haji IbrahimhisyamstarkNo ratings yet

- ResearchGate - Find and Share ResearchDocument3 pagesResearchGate - Find and Share Researchakdo.zumNo ratings yet

- Activity Based Costing CH 11Document32 pagesActivity Based Costing CH 11shiellaNo ratings yet

- ACCT 100-Principles of Financial Accounting - Omair HaroonDocument7 pagesACCT 100-Principles of Financial Accounting - Omair HaroonUmar FarooqNo ratings yet

- 3 Special Conditions of Contract (ICB) - ABCDocument1 page3 Special Conditions of Contract (ICB) - ABCJayantha SampathNo ratings yet

- How Natural Environment Influences Business DecisionsDocument60 pagesHow Natural Environment Influences Business DecisionsNihalNo ratings yet

- Abhishek Raj CVDocument4 pagesAbhishek Raj CVSairam VundavilliNo ratings yet

- UrbanClap Case StudyDocument7 pagesUrbanClap Case StudyAniket SanyalNo ratings yet

- 947 WarehouseInventoryAdjustment 0410Document11 pages947 WarehouseInventoryAdjustment 0410babu_midasNo ratings yet

- Question Papers Sample Papers CMAT General Awareness Sample Question PaperDocument7 pagesQuestion Papers Sample Papers CMAT General Awareness Sample Question Paperjoshi.isha.ecNo ratings yet

- CII IGBC Dossier On 5 Billion SQ - FT of Green Building Footprint PDFDocument52 pagesCII IGBC Dossier On 5 Billion SQ - FT of Green Building Footprint PDFRamaiah KumarNo ratings yet

- Cesc Lesson 12Document1 pageCesc Lesson 12Christian BaldoviaNo ratings yet

- Types of Price DiscountsDocument53 pagesTypes of Price DiscountsAmit RajNo ratings yet

- What Jobs Can You Do With An Electrical Engineering DegreeDocument3 pagesWhat Jobs Can You Do With An Electrical Engineering DegreeImam d'SmartanNo ratings yet

- Project Report Industrial Visit AKS UniversityDocument18 pagesProject Report Industrial Visit AKS UniversityShivansh SinghNo ratings yet

- SharesDocument26 pagesSharesnaineshmuthaNo ratings yet

- SM chapter 3 Key Words.pdf_d2d58481-904a-4025-a00e-4a0636dd1351Document48 pagesSM chapter 3 Key Words.pdf_d2d58481-904a-4025-a00e-4a0636dd1351VikramNo ratings yet

- SAP IRPA Estimation PDFDocument1 pageSAP IRPA Estimation PDFJMNo ratings yet

- 403 - 1 - Business Vocabulary in Use Elementary To Pre-Intermediate - 2010 - 176p - 13-14Document2 pages403 - 1 - Business Vocabulary in Use Elementary To Pre-Intermediate - 2010 - 176p - 13-14Анна ГончароваNo ratings yet

- Airport Terminal Planning RFQDocument18 pagesAirport Terminal Planning RFQAndrew TanNo ratings yet

- Baring Brothers Short Version April 2009Document4 pagesBaring Brothers Short Version April 2009Daniel IsacNo ratings yet

- User Story For Purchase Inventory ManagementDocument3 pagesUser Story For Purchase Inventory ManagementAkash SinghNo ratings yet

- MidtermsDocument8 pagesMidtermsRhea BadanaNo ratings yet

- Accountant UPDATEDocument1 pageAccountant UPDATEyuyukikijulyNo ratings yet