Professional Documents

Culture Documents

Clearpar - Distressed Loan Trade Settlement

Uploaded by

Ayaz AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Clearpar - Distressed Loan Trade Settlement

Uploaded by

Ayaz AhmedCopyright:

Available Formats

ClearPar | Distressed Loan Trade Settlement

Transforming distressed loan settlement

Settling trades of distressed assets in the syndicated loan market is a manually intensive,

expensive and risky process. Unlike the par loan market, distressed includes additional

requirements for inventory management, due diligence and documentation, all of which are

largely managed offline by operations and legal professionals.

New distressed functionality now available on the ClearPar platform, provides a front-to-back

solution for LSTA distressed loan trade settlement. Used by buyers and sellers of distressed

loans, as well as their legal counsel, our platform provides tools for trade counterparties to

transform the way they manage distressed loan trades.

ClearPar now brings automation to each aspect of the distressed settlement process, much as it

has done for par for well over a decade. Leverage the power of our existing data and network for:

Document generation Upstream review

‒‒ Reduce manual drafting risks and avoid documentation ‒‒ Automate data comparison and highlight areas that

bottlenecks require attention or action

‒‒ LSTA Purchase and Sale Agreements for Distressed ‒‒ Upstream data from past trades creates a cycle of

Trades (PSA) are automatically generated and require continuous improvement and drives automated upstream

minimal manual intervention asset checks

‒‒ Regardless of the number of allocations, all documents ‒‒ Results of those checks that do not adhere to a standard

are immediately available to facilitate operational and rule set are presented as exceptions for the parties to

legal workflows remediate prior to closing

Inventory management Audit tools

‒‒ Track and manage all relevant data related to inventory in ‒‒ Manage risk through automated records of events and

real time actions impacting trades and inventory

‒‒ ClearPar tracks trade upstreams and downstreams, ‒‒ Changes to PSAs and inventory are tracked and presented

creating a single record of current inventory and facilitating in an accessible, easy to read interface

decision making for the settlement of future trades.

‒‒ ClearPar’s loan servicing data ensures that current

available amounts reflect all ongoing facility ledger events

(e.g. paydowns) and trading activity.

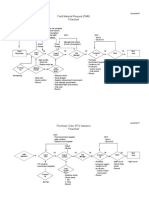

ClearPar Distressed Loan Trade Settlement

ClearPar brings automation to each aspect of the distressed settlement process, just as it does for par.

Allocate Inventory PSA Review Agent

Funds approval

New distressed automation

New distressed automation

Existing par-like workflow

Existing par-like workflow

‒‒ Track ‒‒ Generate ‒‒ Automated

Circulate PSA upstream

inventory Agent

trade confirm review

‒‒ Finalize data execution

and AA ‒‒ Assign points ‒‒ Easy access

upstreams to upstream

‒‒ Circulate for

‒‒ Permission documents

review and

documents signature ‒‒ Audit of legal

review and Review and

Approve to buyers

approvals sign pricing

Settlement letter

For more information, visit ihsmarkit.com/distressedloans

Contact Us About IHS Markit

E sales@ihsmarkit.com IHS Markit delivers information, analytics and solutions to customers in capital markets and the

major industries that promote well-informed, confident decision making, operational efficiency and

AMERICAS +1 212 931 4900

risk management. In syndicated loans, we address vital workflow needs across the entire life cycle of

EMEA +44 20 760 2000 a syndicated loan, and serve virtually every type of participant in the global syndicated loan market

– arrangers and dealers, investors, borrowers/sponsors and third-party servicers. Our data, indexes,

APAC +65 6922 4200

ClearPar, WSO and Debtdomain solutions support valuation, credit research, investment analysis,

trade settlement, portfolio administration, and secure data rooms and connectivity.

Copyright © 2019 IHS Markit. All Rights Reserved 385323480-1019-VL

You might also like

- Doing Business 2016: Measuring Regulatory Quality and EfficiencyFrom EverandDoing Business 2016: Measuring Regulatory Quality and EfficiencyNo ratings yet

- Related Parties ISA 550 Audit CAF 9 (ARM+AMK)Document11 pagesRelated Parties ISA 550 Audit CAF 9 (ARM+AMK)Abdul WahabNo ratings yet

- Make-to-Order (Process Industry) ( 910 )Document4 pagesMake-to-Order (Process Industry) ( 910 )Mosbah MohamedNo ratings yet

- Purchase Process Map Version 1.1Document1 pagePurchase Process Map Version 1.1ajayNo ratings yet

- OpenSAP Byd6 Week 2 All SlidesDocument70 pagesOpenSAP Byd6 Week 2 All Slidesraj uniqueNo ratings yet

- OpenSAP Byd6 Week 2 Unit 1 OCO PresentationDocument22 pagesOpenSAP Byd6 Week 2 Unit 1 OCO PresentationGaurab BanerjiNo ratings yet

- What Is The Answer?: Designed and Built by SAM Professionals For SAM ProfessionalsDocument2 pagesWhat Is The Answer?: Designed and Built by SAM Professionals For SAM ProfessionalsVikash SonarNo ratings yet

- Edge 360 BrochureDocument1 pageEdge 360 Brochurekc wardhaNo ratings yet

- Process Flow - Investment & Deposits: Start Accounting - Post TheDocument1 pageProcess Flow - Investment & Deposits: Start Accounting - Post TheFharook SyedNo ratings yet

- Order-to-Cash (Sell-from-Stock) : Scenario OverviewDocument23 pagesOrder-to-Cash (Sell-from-Stock) : Scenario OverviewYuri SeredaNo ratings yet

- Workday SOD Matrix 030116Document43 pagesWorkday SOD Matrix 030116Rafael Brito100% (1)

- Procurement of ServicesDocument10 pagesProcurement of ServicesBryant AdhitiaNo ratings yet

- Inventory Inventory IDR Control NoDocument23 pagesInventory Inventory IDR Control NoCA Rahul GuptaNo ratings yet

- Financial Supply Chain Management: Vikas SainiDocument15 pagesFinancial Supply Chain Management: Vikas SainiVikas SainiNo ratings yet

- Fixed-Assets Tutorials PDFDocument6 pagesFixed-Assets Tutorials PDFSarvjeet BhayanaNo ratings yet

- Fixed Assets PDFDocument6 pagesFixed Assets PDFMika Abucay ReyesNo ratings yet

- Business Process Flowchart Fixed Assets: Packet DescriptionDocument6 pagesBusiness Process Flowchart Fixed Assets: Packet DescriptionRupesh NiralaNo ratings yet

- Tut Fixed-Assets V1.0 PDFDocument6 pagesTut Fixed-Assets V1.0 PDFSarvjeet BhayanaNo ratings yet

- Business Process Flowchart Fixed Assets: Packet DescriptionDocument6 pagesBusiness Process Flowchart Fixed Assets: Packet DescriptionsksNo ratings yet

- Flow Chart Progress Claim 2Document2 pagesFlow Chart Progress Claim 2Marshall BoazyunusNo ratings yet

- Validation Test Plan: Archive Module: Receivables (AR)Document3 pagesValidation Test Plan: Archive Module: Receivables (AR)Suman GopanolaNo ratings yet

- Turtle Diagram of Cash Flow PDFDocument1 pageTurtle Diagram of Cash Flow PDFherikNo ratings yet

- SR - SC.H Goods In-Transit Clearance ProcessDocument2 pagesSR - SC.H Goods In-Transit Clearance Processmirzamohsinjaved000No ratings yet

- E-Payables Manager: Business Overview Datamatics' Solution Data To IntelligenceDocument2 pagesE-Payables Manager: Business Overview Datamatics' Solution Data To IntelligenceRobinNo ratings yet

- Risk Assessment TemplateDocument1 pageRisk Assessment TemplateYến Hoàng HảiNo ratings yet

- CPA AUD Summary NotesDocument28 pagesCPA AUD Summary Notesgovind raghavanNo ratings yet

- 30 Minute High Level Overview of R2RDocument24 pages30 Minute High Level Overview of R2Rdaluan2No ratings yet

- Ais ReportDocument5 pagesAis ReportAngela MacailaoNo ratings yet

- PR Approval ControlDocument3 pagesPR Approval ControlRey AlfonsoNo ratings yet

- Flowchart PPC & ProcDocument6 pagesFlowchart PPC & ProcImran AmamiNo ratings yet

- Lecture 5 - Qualitative Process Analysis: MTAT.03.231 Business Process ManagementDocument41 pagesLecture 5 - Qualitative Process Analysis: MTAT.03.231 Business Process ManagementRafia SultanaNo ratings yet

- 06.1 - Qaracter Training - CDUFDocument25 pages06.1 - Qaracter Training - CDUFJames BestNo ratings yet

- 03fulfillment CostingDocument22 pages03fulfillment Costingsujit nayakNo ratings yet

- Matriz de Conflictos SOD Funcional - Administración de Activos ASSDocument2 pagesMatriz de Conflictos SOD Funcional - Administración de Activos ASSGianmanco JorgeelcuriosoNo ratings yet

- Order-to-Cash (Standardized Services) : Scenario OverviewDocument20 pagesOrder-to-Cash (Standardized Services) : Scenario OverviewYuri SeredaNo ratings yet

- Manage Customer Engagements (Corporate)Document1 pageManage Customer Engagements (Corporate)Ram Mohan MishraNo ratings yet

- Change SummaryDocument21 pagesChange SummaryNguyễn LucyNo ratings yet

- Unit 2: Effective Supplier Management and Collaboration: Week 2: From Today To TomorrowDocument5 pagesUnit 2: Effective Supplier Management and Collaboration: Week 2: From Today To TomorrowTUHIN GHOSALNo ratings yet

- Lecture3 ProcessModeling1Document48 pagesLecture3 ProcessModeling1Zohaib Ali BhattiNo ratings yet

- Norikkon APay Suite 2009 W Esker OCR - ScanDocument4 pagesNorikkon APay Suite 2009 W Esker OCR - Scanjmcn6410No ratings yet

- Online Permitting ProcedureDocument17 pagesOnline Permitting ProcedureEs SyNo ratings yet

- 4.a Audit Program - Capex - RRRRRDocument14 pages4.a Audit Program - Capex - RRRRRashishhpandey99No ratings yet

- Blue Bank Story MappingDocument1 pageBlue Bank Story MappingVikin Jain100% (1)

- Order To Cash (Standardized Services) ENDocument20 pagesOrder To Cash (Standardized Services) ENomar khaledNo ratings yet

- In-House CashDocument5 pagesIn-House Cashdgz5qm8kcwNo ratings yet

- 07 BatchDocument12 pages07 BatchTrilochan SahooNo ratings yet

- Approved SuppliersDocument824 pagesApproved SuppliersJay SpNo ratings yet

- Supply Chain Cycle Sub Process: Ordering and InvoicingDocument1 pageSupply Chain Cycle Sub Process: Ordering and InvoicingSachin PanpatilNo ratings yet

- Emco Industries LimitedDocument36 pagesEmco Industries LimitedArslan AftabNo ratings yet

- (BPM) Lecture 3&4 - Business Process Modelling PDFDocument63 pages(BPM) Lecture 3&4 - Business Process Modelling PDFAna Florea100% (1)

- The Tube Map Status: An Example of A Process Flow and Its StepsDocument1 pageThe Tube Map Status: An Example of A Process Flow and Its StepsNomoNo ratings yet

- The Tube Map Status: An Example of A Process Flow and Its StepsDocument1 pageThe Tube Map Status: An Example of A Process Flow and Its StepsNomoNo ratings yet

- Supply Chain Collaboration Center of Excellence OverviewDocument74 pagesSupply Chain Collaboration Center of Excellence OverviewAlexandraNo ratings yet

- Fixed Asset Management Throughout Its LifecycleDocument2 pagesFixed Asset Management Throughout Its LifecycleSujal BackupNo ratings yet

- Procure-to-Pay (Stock) : Scenario OverviewDocument23 pagesProcure-to-Pay (Stock) : Scenario OverviewYuri SeredaNo ratings yet

- Newspaper Process FlowDocument1 pageNewspaper Process FlowManish BaptistNo ratings yet

- HAS Infographic July2018 v2Document5 pagesHAS Infographic July2018 v2Dickyard Mini PuckyNo ratings yet

- Kuali Financial System Workflow From A Functional PerspectiveDocument36 pagesKuali Financial System Workflow From A Functional PerspectiveBala Naga KiranNo ratings yet

- Fdocuments - in Mgt101 Papers and Quizzes Solved Mega FileDocument429 pagesFdocuments - in Mgt101 Papers and Quizzes Solved Mega Fileitz ZaynNo ratings yet

- Uwa SopDocument1 pageUwa SopMonjurul HassanNo ratings yet

- Cfa Level 1 BrochureDocument4 pagesCfa Level 1 Brochureaditya24292No ratings yet

- Income Taxes - AssessmentDocument5 pagesIncome Taxes - Assessmentglobeth berbanoNo ratings yet

- MCR3U Introduction To MortgagesDocument2 pagesMCR3U Introduction To Mortgagesapi-25935812No ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document21 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- Credit Creation Theory of BankingDocument10 pagesCredit Creation Theory of BankingNominee PareekNo ratings yet

- S Ep JFX 3 Wa El Al GS2Document8 pagesS Ep JFX 3 Wa El Al GS2Danda RavindraNo ratings yet

- Calpers Annual Investment Report - Fees 2004-2008Document8 pagesCalpers Annual Investment Report - Fees 2004-2008SpotUsNo ratings yet

- Discontinued OperationsDocument15 pagesDiscontinued OperationsMohammed AslamNo ratings yet

- Print Queue Inquiry: Menu Show Memo Pad CCY ConverterDocument11 pagesPrint Queue Inquiry: Menu Show Memo Pad CCY ConverterNarendra AtreNo ratings yet

- PWC Report-StartupsDocument17 pagesPWC Report-StartupsDhirendra TripathiNo ratings yet

- Networth Certificate: Sl. No. Source of Funds Indian Currency (INR) Foreign Currency (CAD) ReferenceDocument3 pagesNetworth Certificate: Sl. No. Source of Funds Indian Currency (INR) Foreign Currency (CAD) Referencesamraju1No ratings yet

- What Are The Costs and Benefits of Inflation Targeting? Should The Fed Adopt An Inflation Targeting Monetary Policy Regime?Document12 pagesWhat Are The Costs and Benefits of Inflation Targeting? Should The Fed Adopt An Inflation Targeting Monetary Policy Regime?Tyson KhagaiNo ratings yet

- The Transactions Completed by Dancin Music During April 2008 WerDocument2 pagesThe Transactions Completed by Dancin Music During April 2008 WerAmit PandeyNo ratings yet

- Financial Accounting: Daksh Gautam 22/834 Topic: Accounting ProcessDocument13 pagesFinancial Accounting: Daksh Gautam 22/834 Topic: Accounting ProcessDaksh GautamNo ratings yet

- The CFO Program PackageDocument232 pagesThe CFO Program PackageamatyaadibeshNo ratings yet

- Customer No.: 23558690 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument3 pagesCustomer No.: 23558690 IFSC Code: DBSS0IN0811 MICR Code: Branch Addresschandan naiduNo ratings yet

- Wells Fargo Wiring InstructionsDocument2 pagesWells Fargo Wiring InstructionsHosein Kerdar100% (2)

- Red Flags in Financial AnalysisDocument15 pagesRed Flags in Financial AnalysisHedayatullah PashteenNo ratings yet

- CH 09Document17 pagesCH 09AA BB MMNo ratings yet

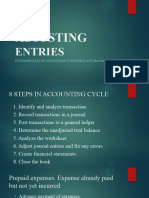

- ADJUSTING ENTRIES PPT Examples and ActivityDocument14 pagesADJUSTING ENTRIES PPT Examples and Activitytamorromeo908No ratings yet

- NGO (Grameen Bank)Document14 pagesNGO (Grameen Bank)aulad999No ratings yet

- Cibil - Report (P - SANJEEV KAMAL - 12 - 05 - 2023 14 - 49 - 45)Document7 pagesCibil - Report (P - SANJEEV KAMAL - 12 - 05 - 2023 14 - 49 - 45)Miss PallaviNo ratings yet

- TCG March Report 2023 1681756740Document17 pagesTCG March Report 2023 1681756740Dan CyglerNo ratings yet

- Edelweiss Financial Services LTDDocument7 pagesEdelweiss Financial Services LTDMukesh SharmaNo ratings yet

- Statement of Account: Summary of Charges and CreditsDocument3 pagesStatement of Account: Summary of Charges and CreditsRonnel TattaoNo ratings yet

- NEGOTIABLE INSTRUMENT-Written Compliance - 20170201215-GACUTANDocument27 pagesNEGOTIABLE INSTRUMENT-Written Compliance - 20170201215-GACUTANAnneNo ratings yet

- Integrated Accounting 8th Edition Klooster Solutions ManualDocument24 pagesIntegrated Accounting 8th Edition Klooster Solutions Manualmagdalavicemanocgp100% (28)

- Gabriel Steve GarciaDocument1 pageGabriel Steve GarciaJim ShortNo ratings yet