Professional Documents

Culture Documents

Infosys Accounting Policies

Uploaded by

Nawazish KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Infosys Accounting Policies

Uploaded by

Nawazish KhanCopyright:

Available Formats

FINA/007

IBS Center for Management Research

Infosys' Accounting Policies

This case was written by Pallavi A, IBS Center for Management Research. It was compiled from published sources, and is

intended to be used as a basis for class discussion rather than to illustrate either effective or ineffective handling of a

management situation.

© 2003, IBS Center for Management Research. All rights reserved.

To order copies, call +91-08417-236667/68 or write to IBS Center for Management Research (ICMR), IFHE Campus, Donthanapally,

Sankarapally Road, Hyderabad 501 504, Andhra Pradesh, India or email: info@icmrindia.org

www.icmrindia.org

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

FINA/007

Infosys' Accounting Policies

There is an increased interest in offshore outsourcing as global corporations realize its benefits.

Business opportunities continue to grow. However, the pricing environment remains challenging.

- Nandan Nilekani, CEO, President and Managing Director, Infosys. 1

Increased efficiency and optimization of expenses have helped us maintain our margins despite the

increase in salary cost.

- T.V. Mohandas Pai, CFO, Infosys.

Introduction

Infosys Technologies (Infosys), one of India’s best-known computer software companies, provided

consulting and IT services to clients globally. With over 19,000 employees worldwide, Infosys

was the second largest exporter of software from India, after Tata Consultancy Services (TCS).

Based in Bangalore, India's "Silicon City", Infosys offered a range of customized software services

including development, maintenance, reengineering, and consulting. The company had also set up

several dedicated offshore software development centers for large clients. Infosys was widely

considered to be one of India’s most respected and admired companies. The company was well

known for its excellent governance and financial reporting practices.

Infosys had been one of the first companies in India to issue stock options (ESOP) to its

employees. In recent times, accounting for stock options had become a controversial subject in the

US. With its ADRs listed on the NASDAQ, Infosys was not insulated from the debate in the US.

By 2003, the debate on expensing stock options in the income statements had become intense.

Analysts speculated that the main regulatory body in the US, Securities and Exchange Commission

(SEC) might make it mandatory for tech companies to expense stock options. In India, the

Securities & Exchange Board of India (SEBI) had also issued accounting guidelines for stock

options.

Exhibit: I

Infosys: Corporate Profile

Company Type Public (NASDAQ:

INFY [ADR]

Fiscal Year-End March

2003 Sales (mil.) $753.8

1-Year Sales Growth 38.3%

2003 Net Income (mil.) $194.9

1-Year Net Income Growth 18.5%

2003 Employees 15,940

1-Year Employee Growth 48.4%

Source: Hoovers Online.

1

The Hindu Business Line, 11th July 2003.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

1

Infosys' Accounting Policies

Background Note

After receiving a master’s degree in electrical engineering from one of India's highly regarded

Institutes of Technology (IIT - Kanpur) in the 1960s, Narayana Murthy (Murthy) left for France to

develop software for the air traffic control system at Paris' Charles de Gaulle airport.

During college, Murthy had believed that communism was the answer to his country's problems of

poverty and corruption. This belief was strengthened during his time spent with Paris leftists in the

1970s. But while hitchhiking back to India in 1974, Murthy's Marxist sympathies eroded quickly

after he was jailed in Hungary for allegedly disclosing state secrets while talking with Austrian

tourists on a train. The event triggered Murthy’s entrepreneurial move. In 1981, Murthy convinced

six fellow software engineers to join him. Infosys was founded that year with $250 in capital

(mostly borrowed from their wives).

From the beginning, Infosys looked for business outside India. But a lack of reputation and

government regulations made things difficult for Infosys during the 1980s. It took nine months just

to get the company's first telephone line, and three years to import new computers. The company

slowly expanded and opened its first US office in 1987.

Many of the government regulations that had kept India's economy stagnant were lifted when

economic reforms swept the country in 1991. Infosys began earnest efforts to capitalize on the new

opportunities which had opened up.

Exhibit: II

Infosys: Key milestones

Year of Incorporation: 1981

Became a public limited company in India: 1992

ISO 9001/TickIT Certification: 1993

Attained SEI-CMM Level 4: 1997

Listed on NASDAQ: 1999

Crossed $100 million in annual revenues: 1999

Attained SEI-CMM Level 5: 1999

Crossed $400 million in revenues: 2001

Crossed $ half a billion in revenues: 2002

Source: www.infy.com

In 1995, Infosys lost its biggest customer, General Electric, which accounted for more than 20% of

sales. Infosys decided it would not let one client or product drive more than 10% of its business.

The company diversified its customer base by finalizing deals with Xerox, Levi Strauss, and

Nynex.

Infosys grew so rapidly in the mid-1990s by signing short-term pilot projects that it was able to

move into more extensive contracts for managing mainframe upgrades, designing custom

software, and implementing e-commerce systems.

In 1998, Infosys established offices in Canada, Japan, and the US to strengthen its marketing

efforts. In 1999, Infosys became the first Indian company to list its shares on NASDAQ, an

offering timed perfectly to capitalize on the surge in demand for technology stocks. Infosys'

market cap ballooned to more than $17 billion in 2000.

Infosys got into a long-term pact with Microsoft to dedicate more than 1,200 engineers to build e-

commerce, financial services, and customer relationship management applications for the software

giant in 2000. In 2002, Murthy stepped down from the day-to-day management of the company.

The much younger co-founder Nandan Nilekani (Nilekani) took over as CEO. Murthy, who

remained chairman, adopted the new title, chief mentor.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

2

Infosys' Accounting Policies

In 2003, Infosys had offices in Argentina, Australia, Belgium, Canada, China, France, Germany,

Hong Kong, India, Japan, Mauritius, Sweden, the United Arab Emirates, the UK, and the US. Its

ambitions of becoming a global player in the software industry seemed to be stronger than ever. In

this context, the ability to attract and retain good people, using stock options, remained a key

concern for the top management.

Exhibit: III

Infosys: Summary Financials

For the financial year ending March 31, 2003

US GAAP

Revenues: $ 753.8 million

Net Income after taxes: $ 194.9 million

Earnings per ADS: $ 1.47 (diluted)

Total assets: $ 704.3 million

Cash and cash equivalents: $ 354.3 million

Indian GAAP

Total Income: Rs. 3,622.69 crore

Net profit after taxes: Rs. 957.93 crore

Earning per share (Rs. 5): Rs. 143.37 (diluted)

Total assets: Rs. 2,860.65 crore

Cash and cash equivalents: Rs. 1,638.51 crore

Source: www.infy.com

Significant Accounting Policies

Infosys prepared its financial statements in accordance with Indian Generally Accepted

Accounting Principles (GAAP) under the historical cost convention and applicable accounting

standards issued by the Institute of Chartered Accountants of India (ICAI) and the relevant

provisions of the Companies Act, 1956. The consolidated financial statements included accounts

of the company and its subsidiary undertakings.

Revenue Recognition

Revenue from software development on fixed-price, fixed-time frame contracts was recognized

according to the proportionate-completion method. This method of accounting recognized revenue

in the statement of profit and loss proportionately with the degree of completion of services under

the contract. On time-and-materials contracts2, revenue was recognized on the basis of software

developed and billable in accordance with the terms of the contracts with clients.

Annual Technical Services revenue and revenue from fixed-price maintenance contracts were

recognized proportionately over the period in which services were rendered. Revenue from the sale

of user licenses for software applications was recognized on transfer of the title in the user license,

except in multiple arrangement contracts, where revenue was recognized as per the proportionate-

completion method.

2

A hybrid type of contractual agreement that deals with both the aspects of cost reimbursable contract and

fixed price contract. A cost reimbursable contract involves payment to the seller for its actual costs (direct

and indirect costs), plus a fee representing a seller’s profit. In a fixed price contract, the amount to be paid

is fixed for a specified amount of work or specified deliverables. The performing contractor is legally

obligated to finish the job, no matter how much it costs to complete. T&M contracts resemble cost-type

arrangements in that they are open-ended. The full value of the arrangement is not defined at the time of

award and thus can grow in contract value as if they are cost-reimbursable type. Alternatively, they may

also resemble fixed-type arrangements, say, when the unit rates are preset by the buyer and the seller as

and when both parties agree on the rates for the resources/material.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

3

Infosys' Accounting Policies

Interest was recognized using the time-proportion method, based on rates implicit in the

transaction. Interest accrued was determined by the amount outstanding and the rate applicable.

Usually, discount or premium on debt securities held was treated as though it were accruing over

the period to maturity.

Expenditure

The cost of software purchased for use in software development was charged to cost of revenues in

the year of acquisition. Charges relating to non-cancelable, long-term operating leases were

computed on the basis of the lease rentals, payable as per the relevant lease agreements. Provisions

were made for all known losses and liabilities. Provisions for any estimated losses on incomplete

contracts were recorded in the period in which such losses became probable, based on current

contract estimates.

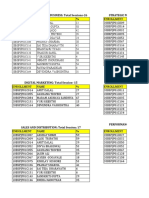

Exhibit: IV

Infosys: Expenditure

In Crores Rs.

Year ended March 31 2003 2002

Income from software services and products 3,622.69 2,603.59

Software development expenses 1,813.30 1,224.82

Gross profit 1,809.39 1,378.77

Selling and marketing expenses 266.98 129.79

General and administration expenses 270.37 211.35

Total operating expenses 2,350.65 1,565.96

Operating profit 1,272.04 1,037.63

Interest - -

Depreciation 188.95 160.65

Operating profit after interest and depreciation 1,083.09 876.98

Other income 99.61 66.41

Provision for investments 23.77 -

Profit before tax and extraordinary item 1,158.93 943.39

Provision for tax 201 135.43

Net profit after tax 957.93 807.96

Source: Annual Report 2003.

Fixed Assets, Intangible Assets and Capital Work-in-progress

Fixed assets were accounted at cost, less accumulated depreciation. Direct costs were capitalized

until fixed assets were ready for use. Capital work-in progress consisted of the advances paid to

acquire fixed assets, and the cost of fixed assets that were not yet ready for their intended use

before the balance sheet date. Intangible assets were recorded at the consideration paid for the

acquisition.

Depreciation and Amortization

Depreciation was allocated so as to charge a fair proportion of the depreciable amount in each

accounting period during the expected useful life of the asset. Depreciation included amortisation

of assets whose useful life was predetermined. Depreciation on fixed assets was applied on a

straight-line basis as per the useful lives of assets estimated by the management.

Depreciation for assets purchased / sold during a period was proportionately charged. Individual

low cost assets (acquired for less than Rs. 5,000/-) were entirely depreciated in the year of

acquisition.

Intangible assets were amortized over their estimated useful lives on a straight-line basis,

commencing from the date the asset was available to the company for its use.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

4

Infosys' Accounting Policies

Exhibit: V

Infosys: Fixed Assets and Depreciation & amortization

In Crores Rs. Depreciation and Net book

Original cost value

amortization

Cost as at Cost as at March As at April 1, As at March As at March

April1, 2002 31, 2003 2002 31, 2003 31, 2003

Land - free –hold 15.85 15.87 - - 15.87

Land - lease-hold 27.84 31.41 - - 31.41

Buildings 285.33 385.53 27.89 51.11 334.42

Plant and machinery 183.87 227.36 77.84 113.68 113.68

Computer equipment 287.89 367.4 216.63 299.88 67.52

Furniture and fixtures 159.46 208.99 70.51 102.27 106.72

Vehicles 0.35 0.35 0.16 0.22 0.13

Intangible assets - - - - -

Intellectual property - 42.13 - 11.38 30.75

rights

960.59 1,279.04 393.03 578.54 700.5

Source: Annual Report 2003.

Exhibit: VI

Infosys: Estimated Useful Lives of Various Fixed Assets

Building 15 years

Plant and Machinery 5 years

Computer equipment 2-5 years

Furniture and fixtures 5 years

Vehicles 5 years

Intellectual Property Rights 1-5 years

Source: Annual Report 2003.

Retirement Benefits to Employees

Retirement benefit plans were arrangements to provide provident fund, superannuation or pension,

gratuity, or other benefits to employees on leaving service or retiring or, after an employee’s death,

to his or her dependants. Retirement benefit plans were normally significant elements of an

employer’s remuneration package for employees.

Gratuity

Infosys provided a defined benefit3 retirement plan (the Gratuity Plan) covering eligible

employees, in accordance with the Payment of Gratuity Act, 1972. Alternatively, a trust fund could

be created, or an arrangement could be negotiated with an insurer so that the annual contributions,

calculated actuarially, could be made each year. Benefits to employees on entitlement would in

such a case be paid by the trust fund or by the insurer.

The employees, who had rendered continuous service for at least five years, were eligible for 15

days pay for each completed year of service. The gratuity benefit was payable on termination of

employment (either by resignation, death, retirement or termination etc), by taking the last drawn

basic salary as the basis for the calculation.

3

Retirement benefit plans under which amounts to be paid as retirement benefits are determinable usually

by reference to employee’s earnings and/or years of service.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

5

Infosys' Accounting Policies

Liabilities with regard to the Gratuity Plan were determined by actuarial valuation4, based on

which, the company fully contributed all the ascertained liabilities to the Infosys Technologies

Limited Employees’ Gratuity Fund Trust (the Trust). Trustees administered the contributions made

to the Trust and invested in specific designated securities (as mandated by law), which generally

comprised central and state government bonds and debt instruments of government-owned

corporations.

Superannuation

Some Infosys employees were also participants of a defined contribution plan5. Here, the employer

typically made a contribution once a year towards a separately created trust fund or to a plan

administered by an insurer. These contributions earned interest and the accumulated balance of

contributions and interest were used to pay the retirement benefit to the employee.

Superannuation available under a defined contribution plan was relevant only to the total of

accumulated contributions and interest and bore no relationship, with the final salary or number of

years of service put in by an employee. The defined contribution plan for superannuation/pension

was, in most respects, similar to the provident fund, so far as the accounting treatment was

concerned. It also presupposed payment of contributions every year, either once in a year or more

frequently. The company made monthly contributions under the superannuation plan (the Plan) to

the Infosys Technologies Limited Employees Superannuation Fund Trust based on a specified

percentage of each covered employee’s salary. The company had no further obligations to the Plan

beyond its monthly contributions.

Provident Fund

Infosys contributed a part of the contributions to the Infosys Technologies Limited Employees’

Provident Fund Trust. Eligible employees received benefits from a provident fund, which was a

defined contribution plan. Both the employee and the company made monthly contributions to the

provident fund plan equal to a specified percentage of the covered employee’s salary.

Provident fund benefit normally involved either the creation of a separate trust to which

contributions of both employees and employer were made periodically or remittance of such

contributions to the employees’ provident fund, administered by the Central Government. The

remaining contributions were made to a Government administered provident fund. The company

had no further obligations under the provident fund plan beyond its monthly contributions.

Provident fund plans, were generally contributory schemes from the point of view of employees.

Gratuity plans were non-contributory while superannuation plans, could be contributory or non-

contributory.

Foreign Currency Transactions

Revenue from overseas clients and collections deposited in foreign currency bank accounts was

recorded at the exchange rate as on the date of the respective transactions. Expenditure in foreign

currency was accounted at the exchange rate prevalent when such expenditure was incurred.

Disbursements made out of foreign currency bank accounts were reported at a rate that

approximated the actual monthly average rate. Exchange differences were recorded when the

amount actually received on sales or actually paid when the expenditure was incurred, was

converted into Indian Rupees.

4

Process used by an actuary to estimate the present value of benefits to be paid under a retirement benefit

plan and the present values of the plan assets and, sometimes, of future contributions.

5

Plans under which amounts to be paid as retirement benefits are determined by contributions to a fund

together with earnings.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

6

Infosys' Accounting Policies

The exchange differences arising on foreign currency transactions were recognized as income or

expense in the period in which they arose. Fixed assets purchased in overseas offices were

recorded at cost, based on the exchange rate as on the date of purchase. The charge for

depreciation was determined as per the company’s accounting policy. Monetary current assets and

current liabilities that were denominated in foreign currency were translated at the exchange rate

prevalent on the date of the balance sheet. The resulting difference was also recorded in the profit

and loss account. In the case of forward contracts, the difference between the forward rate and the

exchange rate on the date of the transaction was recognized as income or expense over the life of

the contract.

Income Tax

Infosys followed Accounting Standard 22, for computed Income taxes using the tax effect

accounting method. Taxes were accrued in the same period, the related revenue and expenses

arose. A provision was made for income tax annually based on the tax liability computed, after

considering tax allowances and exemptions. Provisions were recorded when it was estimated that a

liability due to disallowances or other matters was probable. The differences that resulted between

the profit offered for income taxes and the profit as per the financial statements were identified,

and subsequently a deferred tax was recorded.

Exhibit: VII

Infosys: Income Tax

In Crores Rs.

Income Taxes Paid during the Year 2003 2002

Charge as per the Profit and Loss Account 201 135.43

Add: Increase in advance income taxes 53.74 112.51

Less: Increase / (Decrease) in income tax provision (35.24) (116.67)

219.5 131.27

Source: Annual Report 2003.

Deferred taxation was the tax attributable to timing differences6 or a liability that resulted from

income already earned and recognized for accounting purposes, but not for tax purposes, that was

recorded on the balance sheet. Deferred tax assets7 and liabilities8 were recognized for all timing

differences subject to consideration of prudence in respect of deferred tax assets. The tax effect

was calculated on the accumulated timing differences at the end of an accounting period based on

the prevailing enacted or substantially enacted regulations. The accumulated deferred tax liability

at the beginning of the year was recognized with a corresponding charge to the general reserve, in

the year of transition. Deferred tax assets were recognized only if there was reasonable certainty

that they would be realized and were reviewed for the correctness of their respective carrying

values on each balance sheet date.

Investments

Investments were either classified as current or long-term based on the management’s intention at

the time of purchase. Current investment by nature was readily realisable and was intended to be

held for not more than one year. Current investments were carried at the lower of cost and fair

value. Cost for overseas investments comprised the Indian Rupee value of the consideration paid

for the investment.

6

Differences between profits or losses as computed for tax purposes and results as stated in financial

statements, which arise from the inclusion of items of income and expenditure in tax computation in

periods different from those in which they are dealt within the financial statements.

7

Deferred tax assets are prepaid income taxes and meet the definition of assets.

8

Amounts of income taxes payable in future periods in respect of taxable temporary differences.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

7

Infosys' Accounting Policies

Long-term investments were carried at cost and provisions recorded to recognize any decline,

other than temporary, in the carrying value of each investment. Any dividends were recorded as

income in the profit and loss account.

During the year ended 31st March 2003, Infosys invested Rs. 0.27 crores in M-Commerce Ventures

Pte Limited, Singapore (“M-Commerce”) for 10 ordinary shares of face value Singapore $ (“S$”)

1 each, fully paid at par and 90 redeemable preference shares of face value S$ 1 each, fully paid

for a premium of S$ 1,110. Accordingly, the aggregate investment in M-Commerce as on 31st

March 2003, amounted to Rs. 2.11 crores. Current liabilities included an amount of Rs. 2.94 crores

received from Workadia Inc., towards recovery of investment that was pending clearance from

regulatory authorities for setting off against the investment.

Stock Options Plans

Infosys’ stock option plan was established in 1994, prior to the SEBI guidelines on stock options.

By 2003, Infosys had three stock options plans, the options issued to employees in 1994, 1998 and

again in 1999.

Employee Stock Option plan (1994 plan)

In 1994, Infosys had the distinction of being the first software company in India to introduce an

Employee Stock Option Plan (ESOP). Under the 1994 plan, warrants9 were transferred to

employees deemed eligible by the Advisory Board constituted for the purpose. Accordingly,

60,00,000 warrants (as adjusted for the 1:1 bonus issue in October 1997 and March 1999, and 2-

for-1 stock split in February 2000) were issued by the company to the Infosys Technologies

Limited Employees Welfare Trust, to be held in trust and transferred to selected employees from

time to time. Warrants were issued at Rs. 0.50 each and entitled the holder to apply for and be

issued, one equity share of par value of Rs. 5 each at a price of Rs. 50, after a period of five years

from the date of issue. The warrants and the shares to be issued were subject to a lock-in period of

five years from the date of issue. The warrants expired on September 1999, and were convertible

before their expiration. All warrants were converted into shares.

Under the ESOP scheme, the warrant holders were entitled to convert the warrants before any

bonus or rights issue. Infosys had issued bonus shares in the ratio of 1:1 during October 1997 and

March 1999. The warrant holders, including the Trust and the employees, were given an option to

convert their warrants, and all warrants were converted into shares.

Infosys effected a stock-split (i.e. a subdivision of every equity share of par value of Rs. 10 each

into two equity shares of par value of Rs. 5 each) in February 2000. By January 2003, the lock-in

period ended in respect of 4,45,000 shares of par value of Rs. 5 each, held by 312 employees for

warrants issued in January 1998. Employees held 7,12,000 shares of par value of Rs. 5 each

subject to lock-in and 3,18,200 rights to shares of par value of Rs. 5 each, as on 31 st March 2003.

957 employees held shares under the 1994 Stock Option Plan. As on 31st March 2003, 504

employees held rights to 3,18,200 shares of par value of Rs. 5 each, which were subject to a lock-

in of 1-2 years. In the event of an employee leaving Infosys before the vesting period10, the shares

under lock-in were transferred to the Infosys Technologies Ltd. (ITL) Employees Welfare Trust.

As on 31st March 2003, the ITL Employees Welfare Trust held 3,42,000 shares of par value of Rs.

5 each.

9

A security entitling the holder to buy a proportionate amount of stock at some specified future date at a

specified price, usually one higher than current market. This "warrant" is then traded as a security, the

price of which reflects the value of the underlying stock.

10

The period of time before an option cannot be exercised.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

8

Infosys' Accounting Policies

Employee Stock Option plan (1998 plan)

Infosys had put in place an ADS-linked stock option plan termed as the “1998 Stock Option Plan”.

The Government of India (GoI) had approved the 1998 plan, subject to a limit of 14,70,000 equity

shares of par value of Rs. 5 each representing 29,40,000 ADSs to be issued under the plan. The

plan was effective for a period of 10 years from the date of its adoption by the Board. The

Compensation committee of the Board determined the exercise price for the ADS-linked stock

option, which would not be less than 90% of the fair market value on the date of grant. During

2003, 89,540 options issued under the 1998 plan were exercised and the remaining ADS options

unexercised and outstanding as on 31st March 2003, were 25,03,406.

Exhibit: VIII

Infosys: Stock Options under 1998 Plan

Source: Annual Report 2003.

Employee Stock Option plan (1999 plan)

The shareholders approved the 1999 plan in June 1999. The 1999 plan provided for the issue of

66,00,000 equity shares to employees, adjusted for the stock split. Under the 1999 plan, options

were issued to employees at an exercise price not less than the fair market value. Fair market value

was the closing price of the company’s shares on the stock exchange where there was the highest

trading volume on the date of grant and if the shares were not traded on that day, the closing price

on the next trading day. Under the 1999 plan, options were also granted to the employees at

exercise prices that were less than the fair market value only if specifically approved by the Board

in a general meeting.

Under the 1999 plan, 18,200 employees were given options during 2003. Of these, 12,178 options

were exercised and the remaining options unexercised /outstanding as on 31st March 2003, were

50,61,171.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

9

Infosys' Accounting Policies

Exhibit: IX

Infosys: Stock Options under 1999 Plan

Source: Annual Report 2003.

Infosys’ BPO subsidiary Progeon’s11 2002 Plan provided for the grant of stock options to

employees of the company and was approved by the board of directors and stockholders in June

2002. All options under the 2002 plan were exercisable for equity shares. The 2002 plan was

administered by a Compensation committee comprising three members, all of whom were

directors of Progeon. The plan provided for the issue of 52,50,000 equity shares to employees, at

an exercise price, which was not less than the fair market value. The options issued under the 2002

plan vested in periods ranging between four to seven years. All options granted, were accounted

for as a fixed plan.

Employee Stock Option Plan under SEBI guidelines

The Securities and Exchange Board of India (SEBI) had earlier issued the (Employee Stock Option

Scheme and Employee Stock Purchase Scheme) Guidelines, 1999, which was effective for all

stock option schemes established after 19th June 1999. In accordance with these guidelines, the

excess of the market price of the underlying equity shares as of the date of the grant of the option

over the exercise price of the option was to be recognized and amortized on a straight line basis

over the vesting period. The company’s 1994 stock option plan was established prior to SEBI

guidelines on stock options. All options under the 1998 and 1999 stock option plans were issued at

fair market value. Hence there were no compensation costs.

11

Infosys established Progeon Limited as a majority owned and controlled subsidiary on April 2002, to

provide business process management and transaction services.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

10

Infosys' Accounting Policies

Exhibit: X

Infosys: Stock Option Expensing under SEBI guidelines

Year ended March 31 2003 2002

Net profit: As 957.93 807.96

reported

Adjusted 934.76 784.18

profoma

Basic earnings per share: As 144.68 122.12

reported

Adjusted 141.18 118.52

profoma

Source: Annual Report 2003.

Employee Stock Compensation under SFAS 123

Infosys also submitted its financial statements in US GAAP as it was listed on the NASDAQ.

Statement of Financial Accounting Standards 123, Accounting for Stock Based Compensation

under US GAAP, required the proforma disclosure of the impact of the fair value method of

accounting for employee stock valuation in the financial statements. The fair value of a stock

option was determined using an option-pricing model that took into account the stock price at the

grant date, the exercise price, the expected life of the option, the volatility of the underlying stock

and the expected dividends on it, and the risk-free interest rate over the expected life of the option.

In compliance with this requirement, Infosys had charged to revenue under US GAAP an amount

of Rs. 23.20 crore and Rs. 23.92 crore for the year ended 31st March 2003 and 2002 respectively,

as deferred stock compensation.

Exhibit: XI

Infosys: Stock Option Expensing Under US GAAP

Year ended March 31 2003 2002

Net profit: As reported 957.93 807.96

Adjusted profoma 679.22 524.87

Basic earnings per share: As reported 144.68 122.12

Adjusted profoma 102.58 79.33

Source: Annual Report 2003.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

11

Infosys' Accounting Policies

Bibliography

1. Stephen Bernhut, “Interview: N.R. Narayana Murthy, CEO, Infosys Technologies,” Ivey

Business Journal, September /October 2001, Vol. 66, Issue 1, p-52.

2. “Infosys Technologies Announces 24% Rise in Net Profits,” Emerging Markets Economy,

10th January 2002.

3. Sudhakar Kosaraju, Siliconindia, “BPO: Will It Yield the Next Infosys?” September 2002,

Vol. 6 Issue 9, p-44.

4. “The SAND Infosys Increases Full-Year Guidance After Q3 Revenue Surge,”

Computergram Weekly, 13th January 2003, Issue 4582, p-5.

5. K. Giriprakash “SEC mulls `expensing stock options' mandatory — Infy, Wipro bottomline

may take a hit,” Business Line, 5th February 2003.

6. “Compendium of Accounting Standards,” The Institute of Chartered Accounts of India, 1st

July 2003.

7. CMIE: Prowess Database.

8. CMIE: Industry Analysis Service.

9. Infosys Annual Reports, 2003.

10. www.infosys.com.

11. www.investopedia.com.

12. www.hoovers.com.

Licensed to use for IBS Campuses only.

Sem I, Class of 2020-2022.

12

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Red Hat: When To Apply The Red Hat? Summary of Red HatDocument2 pagesRed Hat: When To Apply The Red Hat? Summary of Red HatNawazish KhanNo ratings yet

- RPG Group employee training to boost sales and customer relationshipsDocument3 pagesRPG Group employee training to boost sales and customer relationshipsNawazish KhanNo ratings yet

- RPG Group employee training to boost sales and customer relationshipsDocument3 pagesRPG Group employee training to boost sales and customer relationshipsNawazish KhanNo ratings yet

- Motivation vs Inspiration - What's the DifferenceDocument4 pagesMotivation vs Inspiration - What's the DifferenceNawazish KhanNo ratings yet

- Didn't Provide Enough Information About Its Testing On Innocent AnimalsDocument1 pageDidn't Provide Enough Information About Its Testing On Innocent AnimalsNawazish KhanNo ratings yet

- Ravi Rao MinicaseDocument7 pagesRavi Rao MinicaseNawazish KhanNo ratings yet

- CH #5Document9 pagesCH #5Abdul wahabNo ratings yet

- HR Analytics in Todays Business.: Made By: Mohd. Nawazish Khan Astha SinhaDocument6 pagesHR Analytics in Todays Business.: Made By: Mohd. Nawazish Khan Astha SinhaNawazish KhanNo ratings yet

- Time Value of Money SumsDocument13 pagesTime Value of Money SumsrahulNo ratings yet

- Attendance Below 60% - MBA Semester-IIIDocument6 pagesAttendance Below 60% - MBA Semester-IIINawazish KhanNo ratings yet

- RTFDocument17 pagesRTFNawazish KhanNo ratings yet

- 372 - Sentence Completion Advanced Level Test Quiz Online Exercise With Answers 4Document5 pages372 - Sentence Completion Advanced Level Test Quiz Online Exercise With Answers 4Nawazish KhanNo ratings yet

- S.No. Name of The Hostel Contact Details' Contact Person Contact No. RemarksDocument2 pagesS.No. Name of The Hostel Contact Details' Contact Person Contact No. RemarksNawazish KhanNo ratings yet

- Pawan Paradkar ResumeDocument2 pagesPawan Paradkar ResumeNawazish KhanNo ratings yet

- Mettur Salem 29112018Document46 pagesMettur Salem 29112018Ar Kethees WaranNo ratings yet

- Hawthorne StudiesDocument7 pagesHawthorne StudiesNawazish KhanNo ratings yet

- ManEco Assignment Disruptive TechsDocument2 pagesManEco Assignment Disruptive TechsNawazish KhanNo ratings yet

- Accessing criminal justice resource filesDocument65 pagesAccessing criminal justice resource filesNawazish KhanNo ratings yet

- Demand ForecastDocument16 pagesDemand ForecastPoonam SatapathyNo ratings yet

- Motivation: Concepts & TheoriesDocument56 pagesMotivation: Concepts & TheoriesNawazish KhanNo ratings yet

- Infosys Accounting PoliciesDocument13 pagesInfosys Accounting PoliciesNawazish KhanNo ratings yet

- Placement Preparation Record - 11-04-2021 To 22-05-2021Document1 pagePlacement Preparation Record - 11-04-2021 To 22-05-2021Nawazish KhanNo ratings yet

- Honda Motorcycle Labor Unrest in 2009Document5 pagesHonda Motorcycle Labor Unrest in 2009Nawazish KhanNo ratings yet

- Organizational Behaviour Session - 1Document45 pagesOrganizational Behaviour Session - 1Nawazish KhanNo ratings yet

- Demand ForecastDocument16 pagesDemand ForecastPoonam SatapathyNo ratings yet

- Demand for Money Function Stability in IndiaDocument29 pagesDemand for Money Function Stability in IndiaNawazish KhanNo ratings yet

- Green FashionDocument1 pageGreen FashionNawazish KhanNo ratings yet

- Manikanta Doki 1486 - IRDocument50 pagesManikanta Doki 1486 - IRNawazish KhanNo ratings yet

- 17.mengistu Zeleke PDFDocument78 pages17.mengistu Zeleke PDFWedi FitwiNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Print - Udyam Registration CertificateDocument1 pagePrint - Udyam Registration CertificatelalitpooniaNo ratings yet

- CP Shipping Desk 2018Document18 pagesCP Shipping Desk 2018Farid OMARINo ratings yet

- Subject - An Application For The Post of JR - Executive (Merchandising)Document4 pagesSubject - An Application For The Post of JR - Executive (Merchandising)aman shovonNo ratings yet

- Mca Project Report Guidelines and FormatsDocument11 pagesMca Project Report Guidelines and Formatsvikram AjmeraNo ratings yet

- MY Price List With CSV SBDocument6 pagesMY Price List With CSV SBNini Syaheera Binti JasniNo ratings yet

- Autocratic Leadership Style of Henry Ford 1.1. DefinitionDocument3 pagesAutocratic Leadership Style of Henry Ford 1.1. DefinitionThảo Ngọc100% (2)

- Licence Conditions and Codes of PracticeDocument80 pagesLicence Conditions and Codes of PracticeEric GarciaNo ratings yet

- Note On House Rent AllowanceDocument5 pagesNote On House Rent AllowanceAbhisek SarkarNo ratings yet

- Vitamin B12 order invoiceDocument1 pageVitamin B12 order invoiceDanielVasquezNo ratings yet

- BIR Ruling 415-93Document2 pagesBIR Ruling 415-93Russell PageNo ratings yet

- Group 7 - ABFRL in Ethnic ApparelDocument66 pagesGroup 7 - ABFRL in Ethnic ApparelSWETANJALI MEHER Jaipuria JaipurNo ratings yet

- FluidLab-PA MPS-PA 3 0 Manual EN PDFDocument90 pagesFluidLab-PA MPS-PA 3 0 Manual EN PDFAngelica May BangayanNo ratings yet

- Itp For All MaterialsDocument59 pagesItp For All MaterialsTauqueerAhmad100% (1)

- Financial Analysis of HDFC BankDocument58 pagesFinancial Analysis of HDFC BankInderdeepSingh50% (2)

- Kuis Akun No 1Document10 pagesKuis Akun No 1Daveli NatanaelNo ratings yet

- Ces Report in BusinessDocument54 pagesCes Report in Businessnicole alcantaraNo ratings yet

- The Signal Report 2022 - FINAL PDFDocument28 pagesThe Signal Report 2022 - FINAL PDFANURADHA JAYAWARDANANo ratings yet

- Beyond Marketing: Customer Relationship Management (CRM)Document49 pagesBeyond Marketing: Customer Relationship Management (CRM)Diamond MC TaiNo ratings yet

- Customer Satisfaction and Brand Loyalty in Big BasketDocument73 pagesCustomer Satisfaction and Brand Loyalty in Big BasketUpadhayayAnkurNo ratings yet

- Maruti Suzuki Internship ReportDocument19 pagesMaruti Suzuki Internship ReportShashikant kumar 21ME15No ratings yet

- Indian Coffee House: History and Growth of a Popular Cafe ChainDocument47 pagesIndian Coffee House: History and Growth of a Popular Cafe ChainSalman RazaNo ratings yet

- Purchase Order Lines - 637912274292216749Document110 pagesPurchase Order Lines - 637912274292216749Anoop PurohitNo ratings yet

- Soal Toeic Bab 1Document5 pagesSoal Toeic Bab 1Rizal BastianNo ratings yet

- Types of Failure and ACID Property (Basics Transaction) by Aditi WaghelaDocument5 pagesTypes of Failure and ACID Property (Basics Transaction) by Aditi Waghelaapi-27570914100% (2)

- Bobble.AI Internship Offer LetterDocument3 pagesBobble.AI Internship Offer LetterNilesh Sukhdeve IINo ratings yet

- Assignment 01 - FMDocument2 pagesAssignment 01 - FMGAME OVERNo ratings yet

- Chapter 5 The Nineteenth Century Philippine Economy Society and The Chinese MestizosDocument27 pagesChapter 5 The Nineteenth Century Philippine Economy Society and The Chinese MestizosJuMakMat Mac50% (2)

- Scan To Scribd With CcscanDocument13 pagesScan To Scribd With CcscanclarkcclNo ratings yet

- Jurnal Analogi Hukum Prosedur Dan Akibat PKPUDocument5 pagesJurnal Analogi Hukum Prosedur Dan Akibat PKPUanindita putriNo ratings yet

- MKT 222222222Document21 pagesMKT 222222222Faisal AhmedNo ratings yet