Professional Documents

Culture Documents

Seller Declaration

Uploaded by

sumitOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seller Declaration

Uploaded by

sumitCopyright:

Available Formats

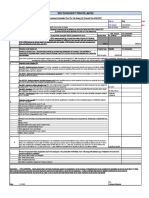

NoidaOffice: Ph.No.

9871173550,

B-191andOldno.B-

40,NewAshokNagar,Delhi,Ea

S AND A Ph.No.9473062202

stDelhi,Delhi110096

ENTERPRISES

ElectricalsEngineers&Contractors

To,

Sharika Enterprises Limited

B-124, Sector-67 Noida

Pin Code- 201301 India

Sub: Declaration / information for deduction of tax at source u/s 194Q of the Act.

Dear Sir,

This is with reference to your letter dated requiring our declaration / information in regard to

deduction of tax at source u/s 194Q of the Act. The information is being provided hereunder:

1. Since your company is liable to deduct tax u/s 194Q of the Act, you may deduct the tax

@0.1 % of sale consideration paid / credited by your company to us on the amount

exceeding Rs.50 lacs during the current financial year. We also confirm that we will not take

any action to collect tax at source under section 206C(1H) of the Act w.e.f. 01.07.2021.

2. Permanent Account Number of our company is ADYFS0292D . Further, we have duly filed

our returns of income for Assessment Years 2019-20 and 2020-21 as per the information

given hereunder:

Assessment year Acknowledgement No. Filing Date

AY 2019-20 NA NA

AY 2020-21 203415790120121 12/01/2021

3. Our PAN and AADHAR is linked. This is applicable only in case of Individual.

Please take note of the above information and confirmation and deduct tax at the appropriate

rate-taking cognizance of the above information.

Thanks,

For S and A Enterprises

Authorized Signatory

You might also like

- EDit 2Document2 pagesEDit 2Nrs KhalidNo ratings yet

- Peachtree Comprehensive Group ProjectDocument7 pagesPeachtree Comprehensive Group ProjectrabbirraabullooNo ratings yet

- Aiss Full Profile.Document15 pagesAiss Full Profile.Sukul UchadadiaNo ratings yet

- Tax Proof Forms PDFDocument1 pageTax Proof Forms PDFAnushyantan NicholasNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Company Scrip Code: 533033Document17 pagesCompany Scrip Code: 533033Lazy SoldierNo ratings yet

- Legal Notice - Continental IndustriesDocument11 pagesLegal Notice - Continental Industriesshweta uppal100% (1)

- 3660incom From BusinessDocument19 pages3660incom From BusinessWaqar AhmadNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- S.No Party Name Month Amount ReceivedDocument3 pagesS.No Party Name Month Amount Receivedgautambajaj007No ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- IN30267933627262Document2 pagesIN30267933627262CLANCY GAMING COMUNITYNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not VerifiedMostafa GaziNo ratings yet

- Tax Invoice: Mudass Ir Syed ZaidiDocument2 pagesTax Invoice: Mudass Ir Syed ZaidiRohit ChhabraNo ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- PGDTP ParnaDocument73 pagesPGDTP ParnaRi ChNo ratings yet

- 4100 C Dea 268912Document1 page4100 C Dea 268912Rabi Sen100% (1)

- TDS Presentation Taxguru - inDocument35 pagesTDS Presentation Taxguru - inBj Thivagar0% (2)

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- Statement of Account: Summary of Charges and CreditsDocument3 pagesStatement of Account: Summary of Charges and CreditsRonnel TattaoNo ratings yet

- Ak Collectionreceipt 35156714Document1 pageAk Collectionreceipt 35156714Shubham KumarNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- It Pays To Pay Your Taxes.. It Pays To Pay Your Taxes.Document1 pageIt Pays To Pay Your Taxes.. It Pays To Pay Your Taxes.kufre elijahNo ratings yet

- Interest On Housing Loan Provisional Certificate 2020 21Document1 pageInterest On Housing Loan Provisional Certificate 2020 21tabrez khanNo ratings yet

- Hawwa NaseeraDocument2 pagesHawwa Naseerahawwa naseeraNo ratings yet

- SGS Philippines Client Info Sheet 082019Document3 pagesSGS Philippines Client Info Sheet 082019Mayette Rose SarrozaNo ratings yet

- A9Rfcwz1g A682zt AqwDocument46 pagesA9Rfcwz1g A682zt AqwSANJAY DUMBRENo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sona mishraNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Inv Ipl 23-24 D 1462Document1 pageInv Ipl 23-24 D 1462Vishnu DwivediNo ratings yet

- Acct 470 Pre Quiz Chapter 4,5,9-12Document28 pagesAcct 470 Pre Quiz Chapter 4,5,9-12karissa.jqasm.0No ratings yet

- ST 000131731320 2022 12Document2 pagesST 000131731320 2022 12Abdul WaheedNo ratings yet

- RA Small Business SNSWDocument3 pagesRA Small Business SNSWMike GibsonNo ratings yet

- Mithu Offer LetterDocument2 pagesMithu Offer LetterShivam Singh100% (1)

- Report - 2024-03-01T112624.349Document1 pageReport - 2024-03-01T112624.349Kevin MasagaNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Byjus - Offer Letter - TNL71885888 - 21 Jan 2022 - EncryptedDocument1 pageByjus - Offer Letter - TNL71885888 - 21 Jan 2022 - EncryptedpraveenNo ratings yet

- Ghosh & Khanna & Co - MayDocument1 pageGhosh & Khanna & Co - MayPankaj AzadNo ratings yet

- Dynemic: SymbolDocument5 pagesDynemic: Symbolravi.youNo ratings yet

- Computation 1Document2 pagesComputation 1Gaurav SinsinbarNo ratings yet

- ZomatoResultssignedfinal 08022024150540Document11 pagesZomatoResultssignedfinal 08022024150540Lucky PatilNo ratings yet

- Form PDF 846262881191220Document80 pagesForm PDF 846262881191220Ravi KumarNo ratings yet

- Navneet Kumar: Account StatementDocument5 pagesNavneet Kumar: Account StatementNavneet Kumar VermaNo ratings yet

- Bill 1 1537699319 1 86790957Document4 pagesBill 1 1537699319 1 86790957Bens ReceivablesNo ratings yet

- RE: Settlement Quotation On Account Number: 70699090001: WWW - Mfc.co - ZaDocument1 pageRE: Settlement Quotation On Account Number: 70699090001: WWW - Mfc.co - ZaDexter Van AvondaleNo ratings yet

- Idfc Loan StatmentDocument13 pagesIdfc Loan StatmentAarti ParmarNo ratings yet

- Lipc C222668767Document1 pageLipc C222668767Bahirkhand SchoolNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- Aleena Textile Reply After Appeal OrderDocument2 pagesAleena Textile Reply After Appeal OrderAsif IqbalNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- FAR Vol 2 Chapter 16 18Document14 pagesFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Document2 pagesSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadNo ratings yet

- Accm4200 Online A Week 9 - Danica GarciaDocument4 pagesAccm4200 Online A Week 9 - Danica Garciaddga2003No ratings yet

- Airconsystems (I) : PVT - LTDDocument1 pageAirconsystems (I) : PVT - LTDDinesh VallechaNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet