Professional Documents

Culture Documents

103 Commercial Banks Finance To Small Industries in India - An Overview

103 Commercial Banks Finance To Small Industries in India - An Overview

Uploaded by

PARAMASIVAN CHELLIAHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

103 Commercial Banks Finance To Small Industries in India - An Overview

103 Commercial Banks Finance To Small Industries in India - An Overview

Uploaded by

PARAMASIVAN CHELLIAHCopyright:

Available Formats

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-11, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

Commercial Banks Finance to Small

Industries in India – An Overview

Dr. C. Paramasivan, Ph.D.1 & Ms. A. Jainambu Gani2

1

Assistant Professor of Commerce & Research supervisor,

Periyar E.V.R. College (Autonomous), Tiruchirappalli – 23

2

Ph.D. Research Scholar –Part Time B Category, Department of Commerce

Research and Development Centre, Bharathiar University, Coimbatore

Abstract: Indian banking sectors play a vital role industrial output, 40 per cent of exports, 42 million

in the field of socio economic development through in employment, create one million jobs every year

its conventional as well as pioneering services in and produces more than 8000 quality products for

the modern periods with innovative banking models the Indian and international markets. The

like payments and small finance banks. The central Government of India enacted the Micro, Small and

bank granted in-principle approval to 11 payments Medium Enterprises Development Act 2006 to

banks and 10 small finance banks in FY 2015- provide a policy framework for the development of

16.RBI’s new measures may go a long way in the MSMEs. The Micro, Small and Medium

helping the restructuring of the domestic banking Enterprises Development Act 2006 groups MSME

industry. MSME needs liberal financial assistance firms into manufacturing enterprises and service

from commercial banks to establish and extent enterprises. A manufacturing firm with investment

their business operation to meet the global in plant and machinery not exceeding Rs. 25 lakhs

competition.RBI has formulated several policies is considered a micro enterprise. Firms with

regarding financing to priority sectors particularly investment in plant and machinery between Rs 25

in small industries in the country. lakhs and Rs 5 crores are considered a small

enterprise, and medium enterprises are those where

Key words: banking sectors, industrial the investment is in the range of Rs. 5 crores to Rs

development, public sector banks, MSME 10 crores . In the service group, for investment in

equipment of less than Rs 10 lakhs,the firm would

Introduction be in the micro category, if it is between Rs 10

Growth of industrial development in a lakhs to Rs 2 crores,then it would fall in the small

country depends on availability of infrastructural enterprise category; if investment in equipment is

facilities and credit facilities offered by the in the range of Rs 2 crores to Rs 5 crores, then it

financial institutions particularly commercial would fall in the medium enterprise category. As a

banks. The Indian banking system consists of 26 result, MSMEs are today exposed to greater

public sector banks, 25 private sector banks, 43 opportunities for expansion and diversification

foreign banks, 56 regional rural banks, 1,589 urban across the sectors. The Indian market is growing

cooperative banks and 93,550 rural cooperative rapidly and Indian industry is making remarkable

banks, in addition to cooperative credit institutions. progress in various Industries like Manufacturing,

Public-sector banks control nearly 80 percent of the Precision Engineering, Food Processing,

market, thereby leaving comparatively much Pharmaceuticals, Textile & Garments, Retail, IT,

smaller shares for its private peers. Banks are also Agro and Service sectors. SMEs are finding

encouraging their customers to manage their increasing opportunities to enhance their business

finances using mobile phones. The value of mobile activities in core sectors.

banking transactions in December 2015 increased Review of Literature

four times year-on-year and jumped by 46 per cent Sivasankar. P.R, and Ekambaram.K, K

over the previous month to Rs 49,029 crore (US$ (2005) concluded that commercial banks continue

7.34 billion), as per data from the RBI. to play an important role in financing small scale

MSME Sectors industrial sectors. The growth rate of bank credit

Micro, Small and Medium Enterprise has been low as compared to the growth rate of

(MSME’S) are recognized having enormous production from small scale industrial sector.

potential for employment generation and wealth Rajan Kumar and SubhashChander,

creation in any economy in addition other (2005) focused that most of the small scale

immeasurable virtues. Micro , Small and Medium industries in Punjab depended heavily on the

Enterprises play a vital role for the growth of owner’s capitals for financing fixed capital. They

Indian economy by contributing 45 per cent of the resorted to long – term borrowings under

Imperial Journal of Interdisciplinary Research (IJIR) Page 1512

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-11, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

compulsion and not as a matter of policy or headquarters to cater to the financial needs of small

convenience to take advantage of favourable entrepreneurs

financial leverage. Commercial banks are the most Basarkar.A(2006) said that banks did not

prominent institutions approached by the units for doubt technical capabilities of delivering on the

long – term borrowings followed by Punjab project. The bankers probably expect small

Financial Corporation, Punjab Small Industries enterprises to grow at only 20-25 percent and not

Development Corporation of India and more. His study indicates that, 32000 small and

DistrictIndustrialCenter. medium enterprises and 2,500 large corporate by

Sindhu Vijayakumar(2007), noted that rating agency, CRISIL, shows that small and

commercial banks sanction loans to industries but medium enterprises have lower access to bank

their focus is generally on large – scale units. They funding.

hesitate to provide large funds to small – scale units Parimalam. M(2006), concluded that

because of two reasons. First, small – scale units commercial banks performance towards small-scale

generally need small amount of finance. Second industries in Erode district is not satisfactory. They

creditworthiness of small – scale entrepreneurs is are confronted with so many problems. If they are

doubtful. So small scale entrepreneurs especially expected to play the role assigned to them

women entrepreneurs, largely depend on financial effectively, right type of climate and effective

institutions other than commercial banks. solutions of the problems has to be provided.

RamachandracRao. K.S, Abhiman Das Joseph AndrewKuzilwa (2005), viewed

and Aravind Kumar Singh, (2006) viewed that the that lack of access to credit has been identified as

definition and coverage of the small scale industrial one of the major constraints hindering the

sector is being revised from time to time by development of small business and the supply of

excluding more and more commodities from the entrepreneurial activities not only in Tanzania but

reserved small -scale industries list and also also in other developing countries. Commercial

through liberalizing the credit delivery mechanism banks have traditionally concentrated their lending

of the banking industry. Despite increase in the on large formal enterprises which possess collateral

coverage of the small-scale industrial sector, its and therefore, are deemed to be less risk from.

share in bank credit decreased and growth The Banking news (2006), Tamil Nadu

fluctuated. Merchant Bank limited has introduced a new loan

Thingalaya. N.K, (2006) described that product called small and medium enterprises credit

new generation banks are normally not interested in to cater to the exclusive needs of the small and

small amounts of credit. They have ventured in to medium enterprises sector. Under this scheme, an

this only after the upward revision is made in the individual can get a maximum loan of Rs. 2 crore

definition of small and medium sector, and with a and group borrowers up to Rs. 10 crore.

narrow base of advances made; their progress in Ruddar Datt and Sundharam. K.P.M

credit disbursements appears impressive. (2002), said that considering the vital role of small

Prasain.G.P. Nixon Singh. E. and Sharat industries within the Indian Industrial Economy,

Singh.N, (2006) concluded that there was a severe the total amount of loans granted to small industry

lack of capital as well as credit, largely because of forms a very small part of the total loans of Indian

low productivity in many branches of small scale industry. In March 1994, as against a total advance

industries. The commercial banks and financial of Rs. 80,492 crores to all industries from

agencies may establish more small scale industrial commercial banks, small industries received Rs.

specialized branches at least one in every district 22, 620 crores that is 28.1 percentages.

Performance of all Scheduled Commercial Banks

Table -1 All Scheduled Commercial Banks (Amount in ` Million)

Items Year

2008-09 2009-10 2010-11 2011-12 2012-13

No. of banks 80 81 81 87 89

No. of offices 67562 72906 78215 85262 92114

No. of employees 954684 955990 1001096 1048520 1096984

Business per employee 73.98 86.23 99.03 109.95 121.33

Profit per employee 0.55 0.60 0.70 0.78 0.83

Capital and Reserve & Surplus 3679473 4301613 5099192 6085618 7089300

Deposits 40632011 47469196 56158743 64535485 74295324

Imperial Journal of Interdisciplinary Research (IJIR) Page 1513

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-11, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

Investments 14495506 17290059 19236333 22339033 26132752

Advances 29999239 34967200 42974875 50735592 58797025

Interest Income 3884816 4151786 4913407 6552839 7636115

Other income 752204 792676 798501 863437 977866

Interest expended 2632232 2720836 2989248 4303557 5138027

Operating expenses 895814 1000279 1231403 1375720 1565855

Net Interest Margin 2.62 2.54 2.91 2.90 2.79

Cost of Funds (CoF) 5.99 5.10 4.75 5.90 6.12

Return on advances adjusted to COF 4.56 4.19 4.47 4.51 4.21

Wages as % to total expenses 13.60 14.85 17.22 13.73 13.02

Return on Equity 15.44 14.31 14.96 14.60 13.84

Return on Assets 1.13 1.05 1.10 1.08 1.03

CRAR 13.97 14.54 14.19 14.24 13.88

Net NPA ratio 1.05 1.12 0.97 1.28 1.68

Source: Banking statistics in India

The above table indicates that the 26132752 million, advances amounted to Rs.

performance of all scheduled commercial banks in 58797025 million and amounted to Rs. 58797025

India during the year 2008-09 to 2012-13. Numbers million.

of banks have been increased from 80 to 89 and As regards the earnings and expenditure of

also number of branches has been increased to All Scheduled Commercial Banks in 2012-13,

92114 in the year 2012-13. Number of employees Interest Income amounted to Rs. 7636115 million,

rose to 1096984 and Business per employee other income amounted to Rs. 977866 million,

recorded with 121.33. Interest expended amounted to Rs. 5138027 million

As regards the business performance, and Operating expenses amounted to Rs. 1565855

Capital and Reserve & Surplus amounted to Rs. million. Return on Equity is recorded with 13.84

7089300 million, deposits amounted to Rs. per cent , CRAR is 13.88 per cent and Net NPA

74295324 million, investment amounted to Rs. ratio is 1.68.

Region wise distribution of Scheduled Commercial Banks' Advances to MSME

Table -2

(Amount in Million)

S.No 2013 2014

Region No. of Accounts Amount No. of Amount

outstanding Accounts outstanding

1 Northern 1609506 1478297 1837097 1863009

2 North Eastern 235008 93215 255616 112901

3 Eastern 1702537 672408 1739204 848132

4 Central 1505533 749533 1779208 982233

5 Western 2021571 1642328 2191900 1983530

6 Southern 4008594 1767170 4648726 2211270

7 Total 11082749 6402954 12451751 8001075

Sources: Report of RBI

The above table reveals that Region wise 1779208 accounts with the outstanding amounted

distribution of Scheduled Commercial Banks' to Rs. 982233 million, In Western region, there are

Advances to MSME in the year 2013 and 2014. In 2191900 accounts with the outstanding amounted

northern region, there are 1837097 accounts with to Rs. 1983530 million and In southern region,

the outstanding amounted to Rs. 1863009 million, there are 4648726 accounts with the outstanding

In north eastern region, there are 255616 accounts amounted to Rs. 2211270 million. As on whole,

with the outstanding amounted to Rs. 112901 commercial banks outstanding amounted to Rs.

million, In eastern region, there are 1739204 8001075 million with 12451751 accounts in the

accounts with the outstanding amounted to Rs. year 2014.

848132 million, In central region, there are

Imperial Journal of Interdisciplinary Research (IJIR) Page 1514

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-11, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

Conclusion 8. Rajan Kumar, Subhashchander (2005),

The banking system occupies an important “Financing of fixed assets in Small scale

place in a nation’s economy. A banking institution industries”, Journal of Accounting and

is indispensable in a modern society. It plays a Finance, Vol 19: No.1, pp.186-188.

pivotal role in the economic development of a 9. Ram Chandra Rao.K.S, Abhiman Das,

country and forms the core of the money market in aravidn Kumar Singh. (2006),

an advance country. With the effects of the “Commercial bank lending to Small scale

globalisation, banking sectors become highly Industry”, Economic and Political weekly,

competitive and technology based with March 18, p.368.

multidimensional products to the customers and 10. Ruddar Datt and Sundharam. K.P.M

public. Commercial banks particularly public (2002), Indian Economy, ‘Policies and

sectors banks are extremely responsible to the Programmes to remove Disabilities’, S.

provides financial support to industrial sectors not Chand and Company Limited, New Delhi,

only for generate revenue but also for the p.362.

development of industries in a particular region 11. Sindhu Vijayakumar (2007), “Sources of

which the banks is located. MSME needs liberal finance for small scale units”, Facts for

financial assistance from commercial banks to you, p.28.

establish and extent their business operation to 12. Thingalaya.N.K (2006), “Who is financing

meet the global competition.RBI has formulated the SME segment” Industrial economist,

several policies regarding financing to priority 15-29 January, p.24.

sectors particularly in small industries in the

country.

References

1. Sivasankar.P.R, Ekambaram. K (2005),

“Role of public sector Banks in the

development of small scale sector in

India”, Journal of Banking finance, vol.

30, pp.3-5.

2. Banking News (2006), ‘Tamil Nadu

Merchant bank Limited launches credit

schemes for small and medium

enterprises,” Journal of banking and

finance, Vol. XIX No.9,p.23.

3. Basakar. A (2006), Survey of India’s

small and medium enterprises’, Business

Today, September 10, p.15.

4. Joseph Andrew Kuzilwa (2005), “The role

of credit for small business success., A

study of the national Entrepreneurship

Development Fund in Tanzania., The

Journal of Entrepreneurship, February

14,p.129.

5. Mary Jesselyn. Co (2004), ‘The formal

Institutional framework of

Entrepreneurship in the Philippines”, the

journal of Entrepreneurship, Vol.132,

p.13.

6. Parimalam. M (2006), “Commercial

Banks performance towards SSI sectors in

Erode District”, M.Phil dissertation,

Periyar University, p.108.

7. Prasain.G.P, Nixon singh.E.N, Sharat

Singh. N (2006), ‘Financing Pattern of

Small scale Industries’, The Indian Journal

of Commerce, Vol. 59, No.4,p.123.

Imperial Journal of Interdisciplinary Research (IJIR) Page 1515

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 13 Growth of E - Banking Challenges and Opportunities in IndiaDocument5 pages13 Growth of E - Banking Challenges and Opportunities in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- Western Home Elevator Design Guide 2011 PDFDocument21 pagesWestern Home Elevator Design Guide 2011 PDFTuấn NamNo ratings yet

- Types of FOB Contracts: Scinda Navigation Co LTD (1954) and They AreDocument3 pagesTypes of FOB Contracts: Scinda Navigation Co LTD (1954) and They AreRamchundar Karuna100% (1)

- The Smoking GunDocument6 pagesThe Smoking Guneduardo castro roblesNo ratings yet

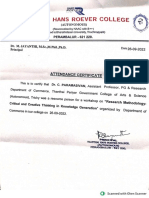

- Attentance CertificateDocument1 pageAttentance CertificatePARAMASIVAN CHELLIAHNo ratings yet

- Research Publication and PopularizationDocument55 pagesResearch Publication and PopularizationPARAMASIVAN CHELLIAHNo ratings yet

- Research Funding OppurtunitiesDocument69 pagesResearch Funding OppurtunitiesPARAMASIVAN CHELLIAHNo ratings yet

- A Study On Customer Perception Towards Business Innovation Practices in Tiruchirappalli DistrictDocument28 pagesA Study On Customer Perception Towards Business Innovation Practices in Tiruchirappalli DistrictPARAMASIVAN CHELLIAHNo ratings yet

- An Overview of Branches and Atms of Commercial Banks in IndiaDocument12 pagesAn Overview of Branches and Atms of Commercial Banks in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- Brief Resume With Recent Publication-October 2021Document3 pagesBrief Resume With Recent Publication-October 2021PARAMASIVAN CHELLIAHNo ratings yet

- Financial Performance of Commercial Banks in IndiaDocument11 pagesFinancial Performance of Commercial Banks in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- Cutting-Edge Research in BusinessDocument29 pagesCutting-Edge Research in BusinessPARAMASIVAN CHELLIAHNo ratings yet

- 14 A Study On Women Empowerment Through Self Help Groups in IndiaDocument6 pages14 A Study On Women Empowerment Through Self Help Groups in IndiaPARAMASIVAN CHELLIAH100% (1)

- 24 Public Sector Banks Finance To MsmeDocument7 pages24 Public Sector Banks Finance To MsmePARAMASIVAN CHELLIAHNo ratings yet

- Scopus Article 2021Document12 pagesScopus Article 2021PARAMASIVAN CHELLIAHNo ratings yet

- Sustainablity and Success of Msme in India: Dr.G.SrividhyaDocument5 pagesSustainablity and Success of Msme in India: Dr.G.SrividhyaPARAMASIVAN CHELLIAHNo ratings yet

- 14 E-Payment System in Rural India Issues and ChellengesDocument3 pages14 E-Payment System in Rural India Issues and ChellengesPARAMASIVAN CHELLIAHNo ratings yet

- 97 Structure and Demography of Prisons in Tamil NaduDocument5 pages97 Structure and Demography of Prisons in Tamil NaduPARAMASIVAN CHELLIAHNo ratings yet

- E-Governance: Reforming Government Through Technology in Tamil NaduDocument4 pagesE-Governance: Reforming Government Through Technology in Tamil NaduPARAMASIVAN CHELLIAHNo ratings yet

- 16 Institutional Assistance For Women Entrepreneurship in TamilnaduDocument6 pages16 Institutional Assistance For Women Entrepreneurship in TamilnaduPARAMASIVAN CHELLIAHNo ratings yet

- A Study On Students Satisfaction Towards Educational Loan From Canara Bank With Special Reference To Gurusamipalayam, Namakkal DistrictDocument9 pagesA Study On Students Satisfaction Towards Educational Loan From Canara Bank With Special Reference To Gurusamipalayam, Namakkal DistrictPARAMASIVAN CHELLIAHNo ratings yet

- 111 A Study On Growth and Performance of Indian Agro Based ExportsDocument5 pages111 A Study On Growth and Performance of Indian Agro Based ExportsPARAMASIVAN CHELLIAHNo ratings yet

- USMLE Step 2 CK 6 Months Study Plan For 240Document1 pageUSMLE Step 2 CK 6 Months Study Plan For 240DhritisdiaryNo ratings yet

- Primary Water SystemDocument15 pagesPrimary Water SystemSantoshkumar GuptaNo ratings yet

- Cultured Make Healthy Fermented Foods at Home EbookDocument182 pagesCultured Make Healthy Fermented Foods at Home EbookJose M Tous100% (2)

- All About Me Board Game - Ver - 4Document2 pagesAll About Me Board Game - Ver - 4Eng BenjellounNo ratings yet

- 1 Mechanical Behavior of MaterialsDocument7 pages1 Mechanical Behavior of MaterialsMohammed Rashik B CNo ratings yet

- Millennial Parents On Campus:: Reflecting On How To Discover Confluence With This ConstituencyDocument26 pagesMillennial Parents On Campus:: Reflecting On How To Discover Confluence With This ConstituencyLeon GuintoNo ratings yet

- Special EducationDocument44 pagesSpecial EducationNoman MasoodNo ratings yet

- Semiconductor PhysicsDocument54 pagesSemiconductor PhysicsGod KillerNo ratings yet

- Blossoms of The Savannah SummaryDocument34 pagesBlossoms of The Savannah SummaryMAGOMU DAN DAVIDNo ratings yet

- Introduction To Conditional Probability and Bayes Theorem For Data Science ProfessionalsDocument12 pagesIntroduction To Conditional Probability and Bayes Theorem For Data Science ProfessionalsNicholas Pindar DibalNo ratings yet

- Background Report For The National Dialogue On PaintDocument82 pagesBackground Report For The National Dialogue On PaintMSCT TrainingNo ratings yet

- WEEK 10 Aromatic HydrocarbonDocument26 pagesWEEK 10 Aromatic HydrocarbonChris Angelo De GuzmanNo ratings yet

- Enrolled Nurse Clinical Preceptor Feedback FormDocument3 pagesEnrolled Nurse Clinical Preceptor Feedback FormRegina PunNo ratings yet

- Battery Chargers and Charging MethodsDocument4 pagesBattery Chargers and Charging MethodsMary HarrisonNo ratings yet

- 1.3 - Social Identity and Changes - The ElderlyDocument4 pages1.3 - Social Identity and Changes - The ElderlySharik CheemaNo ratings yet

- Sexy Questions For Scientific ThinkersDocument13 pagesSexy Questions For Scientific ThinkersMohamed JaabirNo ratings yet

- Narayana GT 5 QPDocument17 pagesNarayana GT 5 QPGowri Shankar100% (1)

- Semistructured Key Informant Interview (KII) GuideDocument10 pagesSemistructured Key Informant Interview (KII) GuideEdy Syahputra HarahapNo ratings yet

- Laboratory Exercise 1Document7 pagesLaboratory Exercise 1jan ray aribuaboNo ratings yet

- Da Vinci S, Da Vinci Si Quick Reference Guide (Emergency Grip Release) (551979-05)Document2 pagesDa Vinci S, Da Vinci Si Quick Reference Guide (Emergency Grip Release) (551979-05)Juan RamirezNo ratings yet

- 9202Document80 pages9202leninks_1979No ratings yet

- StrabismusDocument14 pagesStrabismusAchmad HariyantoNo ratings yet

- Retirees Health Monitoring OCTOBERDocument3 pagesRetirees Health Monitoring OCTOBERBfp Caraga SisonfstnNo ratings yet

- Offre de Places Mobilité 4A 2022-23Document1 pageOffre de Places Mobilité 4A 2022-23Valérie PaulusNo ratings yet

- Appendix 2 - Application Checklist - ICH CTDDocument17 pagesAppendix 2 - Application Checklist - ICH CTDWilliam ChandraNo ratings yet

- Office of The Municipal Engineer Improvement of Multi-Purpose Hall/ Repair and RehabilitationDocument21 pagesOffice of The Municipal Engineer Improvement of Multi-Purpose Hall/ Repair and RehabilitationVicent John ParedesNo ratings yet

- Auto Loan: Application FormDocument10 pagesAuto Loan: Application Formabhijit majarkhedeNo ratings yet