Professional Documents

Culture Documents

Write Your Good-Form Solutions Below and Bolden Your Answer: Cash Received From Factoring 692,424.66 692,250.00

Uploaded by

Anne EstrellaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Write Your Good-Form Solutions Below and Bolden Your Answer: Cash Received From Factoring 692,424.66 692,250.00

Uploaded by

Anne EstrellaCopyright:

Available Formats

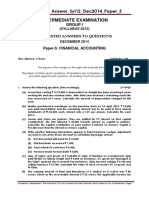

Taylor Company factored P750,000 of accounts receivable at year-end. Control was surrendered.

The factor

accepted the accounts receivable, subject to recourse for nonpayment.

The factor assessed a fee of 2% and retained a holdback equal to 4% of the accounts receivable.

In addition, the factor charged 12% interest computed on a maturity of fifty-one days. The fair value of the

recourse obligation is P15,000.

REQUIRED

a. What is the amount of cash initially received from the factoring?

b. Assuming all accounts receivable are collected, what is the cost of

factoring the accounts

receivable?

Write your good-form solutions below and bolden your answer

Accounts

receivable 750,000.00

Factor's holdback 30,000.00

Factoring fee 15,000.00

Interest on

factoring 12,575.34 or (750,000 x 12% x 51/360) = 12,750.00

Cash received from factoring 692,424.66 or 692,250.00

Factoring fee 15,000.00

Interest on

factoring 12,575.34 or (750,000 x 12% x 51/360) = 12,750.00

Total cost of factoring 27,575.34 or 27,750.00

You might also like

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- By Team: Wisdom Makers Submit To: Prof. Kirit ChauhanDocument19 pagesBy Team: Wisdom Makers Submit To: Prof. Kirit ChauhanTushar JethavaNo ratings yet

- Acctg Equation and Journal EntriesDocument3 pagesAcctg Equation and Journal EntriesNiño Dwayne TuboNo ratings yet

- Module 7 Loans Receivable and Impairment of ReceivablesDocument10 pagesModule 7 Loans Receivable and Impairment of Receivablesshaira doctorNo ratings yet

- Roe Net Income Ave. Ordinary Equity or Roe Return On Assets X Equity Multiplier 0.0924Document39 pagesRoe Net Income Ave. Ordinary Equity or Roe Return On Assets X Equity Multiplier 0.0924MPCINo ratings yet

- Chapter 11Document13 pagesChapter 11pau mejaresNo ratings yet

- INTACCDocument4 pagesINTACCApple RoncalNo ratings yet

- DBA401 - CS221051: Balance Sheet AssetsDocument10 pagesDBA401 - CS221051: Balance Sheet AssetsAian Kit Jasper SanchezNo ratings yet

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Pamela Company #11Document7 pagesPamela Company #11Yassi CurtisNo ratings yet

- Reviewer FOR Midterm Apr 25 2023Document6 pagesReviewer FOR Midterm Apr 25 2023Lorifel Antonette Laoreno TejeroNo ratings yet

- Reconciliation of Investment /conversion of Investment Account From Cost To Equity MethodDocument14 pagesReconciliation of Investment /conversion of Investment Account From Cost To Equity MethodLove FreddyNo ratings yet

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyNicole Anne Santiago Sibulo67% (3)

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyAngel ChuaNo ratings yet

- Activity 4-IntAcc1Document2 pagesActivity 4-IntAcc10322-1975No ratings yet

- Solution Manual Chapter 13 B MC Problems 1Document3 pagesSolution Manual Chapter 13 B MC Problems 1Mallet S. GacadNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Step AcquisitionDocument2 pagesStep AcquisitionJamaica DavidNo ratings yet

- Ac312, Assignment 1, Dela CruzDocument4 pagesAc312, Assignment 1, Dela CruzChelsea Dela CruzNo ratings yet

- 67229bos54127 Inter P8aDocument16 pages67229bos54127 Inter P8aSANDEEP MADANNo ratings yet

- Gross Working CapitalDocument14 pagesGross Working Capitalfizza amjadNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Team Criminal NuisanceDocument4 pagesTeam Criminal NuisanceShreya ShrivastavaNo ratings yet

- Accounting For Franchise Operation - FranchisorDocument4 pagesAccounting For Franchise Operation - FranchisorJanella Umieh De UngriaNo ratings yet

- AssignmentDocument40 pagesAssignmentnoeljrpajaresNo ratings yet

- TrailbalaDocument1 pageTrailbalaWAQAR FAYAZNo ratings yet

- P5-32 Hanifah Nabilah Ginting (7183220030) AKL-1Document13 pagesP5-32 Hanifah Nabilah Ginting (7183220030) AKL-1Hanifah NabilahNo ratings yet

- ANS KEY - QUIZ ON RECEIVABLE FINANCING 12 OctDocument4 pagesANS KEY - QUIZ ON RECEIVABLE FINANCING 12 OctAzzariah DeniseNo ratings yet

- SW Chapter9 BDocument4 pagesSW Chapter9 BAnonnNo ratings yet

- Group Activities in Receivable FinancingDocument2 pagesGroup Activities in Receivable FinancingTrisha VillegasNo ratings yet

- Assignment No. 1Document3 pagesAssignment No. 1ENo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Poa 2012 Jan p.2.q.1 1Document4 pagesPoa 2012 Jan p.2.q.1 1RealGenius (Carl)No ratings yet

- Entity Tax ExamDocument7 pagesEntity Tax ExamWesley JacksonNo ratings yet

- Final Bomb (Before Main Body)Document7 pagesFinal Bomb (Before Main Body)Mohammad helal uddin ChowdhuryNo ratings yet

- Suryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)Document2 pagesSuryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)BimalNo ratings yet

- CHPTR 7 TutoDocument5 pagesCHPTR 7 Tutotengku rilNo ratings yet

- v2 Assignment Due 26.3.2023Document24 pagesv2 Assignment Due 26.3.2023alisa rachelNo ratings yet

- Question 12.8 SolutionDocument1 pageQuestion 12.8 SolutionShareef MutabaziNo ratings yet

- 06 Liquidity & Leverage RatiosDocument4 pages06 Liquidity & Leverage RatiosAkansh NuwalNo ratings yet

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- Solution Receivable FinancingDocument3 pagesSolution Receivable FinancingAnonymous CuUAaRSNNo ratings yet

- 0206 - Soal Esai Teori AkuntansiDocument5 pages0206 - Soal Esai Teori AkuntansiLaela NovitaNo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- FR-Master Final Exam Solutions-JJ2023Document18 pagesFR-Master Final Exam Solutions-JJ2023panhapichhaiNo ratings yet

- 1. the required return on a stock = Rf+ β (Rm-Rf) = 6+2 (10-6) = 14% an expected return of 12 percent Rf= 6%, Rm= 10%Document2 pages1. the required return on a stock = Rf+ β (Rm-Rf) = 6+2 (10-6) = 14% an expected return of 12 percent Rf= 6%, Rm= 10%Help EssaysNo ratings yet

- Receivable FinancingDocument18 pagesReceivable FinancingGab IgnacioNo ratings yet

- Suggested Answer - Syl12 - Dec2014 - Paper - 5 Intermediate ExaminationDocument26 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 5 Intermediate ExaminationTRAILER HUBNo ratings yet

- Liabilities With Answer For StudentsDocument29 pagesLiabilities With Answer For StudentsDivine CuasayNo ratings yet

- Activity 2Document3 pagesActivity 2jonalyn arellanoNo ratings yet

- TrialBal (1) - 2Document1 pageTrialBal (1) - 2shreygautam12No ratings yet

- SO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioDocument231 pagesSO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioAnne EstrellaNo ratings yet

- Timeline of Activities: PlanningDocument18 pagesTimeline of Activities: PlanningAnne EstrellaNo ratings yet

- ProblemsDocument368 pagesProblemsAnne EstrellaNo ratings yet

- Machinery and Capitl ExpendituresDocument18 pagesMachinery and Capitl ExpendituresAnne Estrella0% (1)

- PRTC Olympiad Region 12: Page 1 of 16Document16 pagesPRTC Olympiad Region 12: Page 1 of 16Anne EstrellaNo ratings yet

- Retail Method: Problem 20-1 (AICPA Adapted)Document9 pagesRetail Method: Problem 20-1 (AICPA Adapted)Anne EstrellaNo ratings yet

- DepreciationDocument5 pagesDepreciationAnne EstrellaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument13 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAnne EstrellaNo ratings yet

- Cash and Cash EquivalentsDocument50 pagesCash and Cash EquivalentsAnne EstrellaNo ratings yet