Professional Documents

Culture Documents

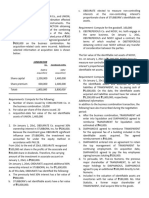

(Before Acquisition) (After Acquisition) : Conjunction Co. Combined Entity

Uploaded by

ellieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Before Acquisition) (After Acquisition) : Conjunction Co. Combined Entity

Uploaded by

ellieCopyright:

Available Formats

1. On January 1, 20x1, CONJUNCTION Co., and UNION, Inc.

entered into a business combination

effected through exchange of equity instruments. The combination resulted to CONJUNCTION

obtaining 100% interest in UNION. Both of the combining entities are publicly listed. As of this

date, CONJUNCTION’s shares have a quoted price of ₱200 per share. CONJUNCTION Co.

recognized goodwill of ₱600,000 on the business combination. No acquisition-related costs were

incurred. Additional selected information at acquisition date is shown below:

CONJUNCTION Co. Combined entity

(before acquisition) (after acquisition)

Share capital 1,200,000 1,400,000

Share premium 600,000 2,400,000

Totals 1,800,000 3,800,000

Requirements: Compute for the following:

a. Number of shares issued by CONJUNCTION Co. in the business combination.

b. Par value per share of the shares issued.

c. Acquisition-date fair value of the net identifiable assets of UNION.

2. On January 1, 20x1, OBDURATE Co. acquired 30% ownership interest in STUBBORN, Inc. for

₱200,000. Because the investment gave OBDURATE significant influence over STUBBORN, the

investment was accounted for under the equity method in accordance with PAS 28.

From 20x1 to the end of 20x3, OBDURATE recognized ₱100,000 net share in the profits of the

associate and ₱20,000 share in dividends. Therefore, the carrying amount of the investment in

associate account on January 1, 20x3, is ₱280,000.

On January 1, 20x4, OBDURATE acquired additional 60% ownership interest in STUBBORN, Inc. for

₱1,600,000. As of this date, OBDURATE has identified the following:

a. The previously held 30% interest has a fair value of ₱360,000.

b. STUBBORN’s net identifiable assets have a fair value of ₱2,000,000.

c. OBDURATE elected to measure non-controlling interests at the non-controlling interest’s

proportionate share of STUBBORN’s identifiable net assets.

Requirement: Compute for the goodwill.

3. OBSTREPEROUS Co. and NOISY, Inc. both engage in the same business. On January 1, 20x1,

OBSTREPEROUS and NOISY signed a contract, the terms of which resulted in OBSTREPEROUS

obtaining control over NOISY without any transfer of consideration between the parties.

The fair value of the identifiable net assets of NOISY, Inc. on January 1, 20x1 is ₱2,000,000. NOISY

chose to measure non-controlling interest at the non-controlling interest’s proportionate share of the

acquiree’s identifiable net assets.

Requirement: Compute for the goodwill.

4. On January 1, 20x1, DIAPHANOUS Co. acquired all of the identifiable assets and assumed all of

the liabilities of TRANSPARENT, Inc. by paying cash of ₱2,000,000. On this date, the identifiable

assets acquired and liabilities assumed have fair values of ₱3,200,000 and ₱1,800,000,

respectively.

Additional information:

In addition to the business combination transaction, the following have also transcribed during the

negotiation period:

a. After the business combination, TRANSPARENT will enter into liquidation and DIAPHANOUS

agreed to reimburse TRANSPARENT for liquidation costs estimated at ₱40,000.

b. DIAPHANOUS agreed to reimburse TRANSPARENT for the appraisal fee of a building

included in the identifiable assets acquired. The agreed reimbursement is ₱20,000.

c. DIAPHANOUS entered into an agreement to retain the top management of TRANSPARENT for

continuing employment. On acquisition date, DIAPHANOUS agreed to pay the key employees

signing bonuses totaling ₱200,000.

d. To persuade, Mr. Five-six Numerix, the previous major shareholder of TRANSPARENT, to sell

his major holdings to DIAPHANOUS, DIAPHANOUS agreed to pay an additional ₱100,000

directly to Mr. Numerix.

e. Included in the valuation of identifiable assets are inventories with fair value of ₱180,000. Ms.

Vital Statistix, a former major shareholder of TRANSPARENT, shall acquire title to the goods.

Requirement: Compute for the goodwill (gain on bargain purchase).

You might also like

- Partnership Dissolution ProblemsDocument2 pagesPartnership Dissolution ProblemsAilene MendozaNo ratings yet

- Leases (PART I)Document28 pagesLeases (PART I)Carl Adrian Valdez100% (1)

- This Study Resource Was: SolutionDocument6 pagesThis Study Resource Was: SolutionChris Jay LatibanNo ratings yet

- Absorption vs Variable Costing CalculationsDocument6 pagesAbsorption vs Variable Costing CalculationsVexana NecromancerNo ratings yet

- Activity 6 - EthicsDocument2 pagesActivity 6 - EthicsGwy HipolitoNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- CH 15Document20 pagesCH 15grace guiuanNo ratings yet

- Intermediate Accounting 2.0 InvestmentsDocument6 pagesIntermediate Accounting 2.0 InvestmentsKaren Joy Jacinto ElloNo ratings yet

- Personality AndvaluesDocument29 pagesPersonality AndvaluesJagmohan Pattnaik100% (1)

- Entity A Issues Convertible Bonds With Face Amount ofDocument1 pageEntity A Issues Convertible Bonds With Face Amount ofNicole AguinaldoNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Chapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDocument5 pagesChapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosNo ratings yet

- Quiz 7Document8 pagesQuiz 7shivnilNo ratings yet

- AVERAGEDocument4 pagesAVERAGEClyde RamosNo ratings yet

- Jawaban Soal No.1Document2 pagesJawaban Soal No.1Enci UnsriyaniNo ratings yet

- Chapter 21 - Teacher's Manual - Far Part 1BDocument19 pagesChapter 21 - Teacher's Manual - Far Part 1BPacifico HernandezNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Chapter 03Document30 pagesChapter 03ajbalcitaNo ratings yet

- 2.6. Retained EarningsDocument5 pages2.6. Retained EarningsKPoPNyx Edits100% (1)

- Partnership Dissolution: National College of Business and ArtsDocument5 pagesPartnership Dissolution: National College of Business and ArtsKate Jezel SantoniaNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Management Science Assessment 2Document2 pagesManagement Science Assessment 2Cath KatNo ratings yet

- Midterm 138 - BDocument6 pagesMidterm 138 - BJoyce Anne IgotNo ratings yet

- CAE01Document1 pageCAE01joanna supresenciaNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Chapter 7: What Is GAAP?Document4 pagesChapter 7: What Is GAAP?Lysss EpssssNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- Dhis Special Transactions 2019 by Millan Solman PDFDocument158 pagesDhis Special Transactions 2019 by Millan Solman PDFQueeny Mae Cantre ReutaNo ratings yet

- Requirements:: Intermediate Accounting 3Document7 pagesRequirements:: Intermediate Accounting 3happy240823No ratings yet

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- 11 Just in Time Backflush CostingDocument3 pages11 Just in Time Backflush CostingIrish Gracielle Dela CruzNo ratings yet

- Amortization of Intangible AssetsDocument2 pagesAmortization of Intangible Assetsemman neriNo ratings yet

- Torres, John Renson (Exercises in Governance)Document2 pagesTorres, John Renson (Exercises in Governance)Renson TorresNo ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- 16 - Innovative Inventory and Production Management TechniquesDocument52 pages16 - Innovative Inventory and Production Management Techniquesmehul3685No ratings yet

- Chapter 6Document5 pagesChapter 6Angelita Dela cruzNo ratings yet

- Lobarbio, Fitz Clark T - FM1Document3 pagesLobarbio, Fitz Clark T - FM1Fitz Clark LobarbioNo ratings yet

- Solman ch21 DayagDocument6 pagesSolman ch21 DayagMayeth BotinNo ratings yet

- D15Document12 pagesD15neo14No ratings yet

- Repair Cost Probabilit yDocument2 pagesRepair Cost Probabilit yNicole AguinaldoNo ratings yet

- Intermediate Accounting 1A Chapter 7 InventoriesDocument25 pagesIntermediate Accounting 1A Chapter 7 InventoriesAna Leah DelfinNo ratings yet

- Quiz On Partnership FormationDocument2 pagesQuiz On Partnership FormationVher Christopher DucayNo ratings yet

- ACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Document21 pagesACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Elizalen MacarilayNo ratings yet

- Business Combinations CalculationsDocument1 pageBusiness Combinations CalculationsMel paloma0% (1)

- 12 Business Combination Pt2 PDFDocument1 page12 Business Combination Pt2 PDFRiselle Ann SanchezNo ratings yet

- M ABC 5 CopiesDocument6 pagesM ABC 5 CopiesChloe CataluñaNo ratings yet

- Quiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Document2 pagesQuiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Andrew wigginNo ratings yet

- ABC - Homework 02 - JaguinesDocument5 pagesABC - Homework 02 - JaguinesHannah Mae JaguinesNo ratings yet

- Pre Final Round ReviewDocument14 pagesPre Final Round ReviewCheska JaplosNo ratings yet

- Acc AssignmentDocument5 pagesAcc AssignmentBlen tesfayeNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- (Before Acquisition) (After Acquisition) : Conjunction Co. Combined EntityDocument2 pages(Before Acquisition) (After Acquisition) : Conjunction Co. Combined Entityellie100% (1)

- Acquiring IMMATURE Inc earnings valuationDocument1 pageAcquiring IMMATURE Inc earnings valuationellieNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument3 pagesXYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsellieNo ratings yet

- Busscom - RecognitionDocument2 pagesBusscom - RecognitionellieNo ratings yet

- Conso Prob (Part 1)Document1 pageConso Prob (Part 1)Donna Marie BaluyutNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Acquiring IMMATURE Inc earnings valuationDocument1 pageAcquiring IMMATURE Inc earnings valuationellieNo ratings yet

- Consolidated Ending Inventory 1,615,000Document4 pagesConsolidated Ending Inventory 1,615,000ellieNo ratings yet

- Acquiring IMMATURE Inc earnings valuationDocument1 pageAcquiring IMMATURE Inc earnings valuationellieNo ratings yet

- Business Combinations Accounting QuestionsDocument5 pagesBusiness Combinations Accounting QuestionsAndy LaluNo ratings yet

- Chapter 12 - Assurance & Other Related ServicesDocument5 pagesChapter 12 - Assurance & Other Related ServicesellieNo ratings yet

- Long-Term CostructionDocument3 pagesLong-Term CostructionellieNo ratings yet

- January 22Document1 pageJanuary 22ellieNo ratings yet

- Risk Based Audit PlanDocument1 pageRisk Based Audit PlanellieNo ratings yet

- Chapter 4 - The Audit Process - Accepting An EngagementDocument2 pagesChapter 4 - The Audit Process - Accepting An EngagementMichelleNo ratings yet

- HANDOUTS AUDITORs ResponsibilityDocument3 pagesHANDOUTS AUDITORs ResponsibilityKathleeneNo ratings yet

- Indemnity Bailment Pledge GuaranteeDocument47 pagesIndemnity Bailment Pledge GuaranteeBhairav CharantimathNo ratings yet

- Project Report - Garden PipesDocument21 pagesProject Report - Garden PipesShreyans Tejpal ShahNo ratings yet

- Monetary Authority of SingaporeDocument29 pagesMonetary Authority of Singaporerahulchoudhury32No ratings yet

- Essential Documents for New ClientsDocument22 pagesEssential Documents for New ClientsChaitanya NandaNo ratings yet

- Reaction Paper - Cost CapitalDocument1 pageReaction Paper - Cost CapitalMerrylyn VargasNo ratings yet

- RMO No. 27-2016Document5 pagesRMO No. 27-2016Romer LesondatoNo ratings yet

- Business Organization TypesDocument36 pagesBusiness Organization TypesNatalie Tremblay100% (1)

- CEI Fund at EBRD Supports Transition CountriesDocument72 pagesCEI Fund at EBRD Supports Transition CountriesSlaviša VračarNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentFarhan TyeballyNo ratings yet

- Chapter 6 Partnership Liquidation (Lump-Sum)Document1 pageChapter 6 Partnership Liquidation (Lump-Sum)John Louie Dungca100% (1)

- Solution Manual Finance For Executives Managing For Value Creation 4th Edition by Gabriel Hawawini SLC1085Document17 pagesSolution Manual Finance For Executives Managing For Value Creation 4th Edition by Gabriel Hawawini SLC1085thar adelei33% (3)

- Internship Report On Loan & Deposit Policy of HBLDocument52 pagesInternship Report On Loan & Deposit Policy of HBLLochan Khanal100% (3)

- CHECK - P2 Quiz 1 GradedDocument3 pagesCHECK - P2 Quiz 1 GradedARNEL CALUBAGNo ratings yet

- Chapter 2Document4 pagesChapter 2Phương Anh NguyễnNo ratings yet

- Report of Summit Power Ltd.Document64 pagesReport of Summit Power Ltd.Shaheen Mahmud50% (2)

- Working Capital Management OptionsDocument2 pagesWorking Capital Management OptionsDiana TuckerNo ratings yet

- Board's Unethical Decision to Loan CEO $400MDocument1 pageBoard's Unethical Decision to Loan CEO $400MRachel VoonNo ratings yet

- WhatsApp Chat With SPACE MUSICDocument114 pagesWhatsApp Chat With SPACE MUSIC10k subscribers without any Videos ChallengeNo ratings yet

- Himanshu Lohia: Curriculum VitaeDocument4 pagesHimanshu Lohia: Curriculum Vitaehimanshulohia85No ratings yet

- WEF Balancing Financial Stability, Innovation, and Economic GrowthDocument20 pagesWEF Balancing Financial Stability, Innovation, and Economic GrowthKonstantin S. TrusevichNo ratings yet

- PDFDocument10 pagesPDFAmit RoyNo ratings yet

- Currency Option Pricing GuideDocument17 pagesCurrency Option Pricing GuideMed MesNo ratings yet

- Key Investor Information: Class A Accumulation Units The HL Multi-Manager Balanced Managed Trust ("The Fund")Document2 pagesKey Investor Information: Class A Accumulation Units The HL Multi-Manager Balanced Managed Trust ("The Fund")Merabharat BharatNo ratings yet

- Group 2 Cw2Document10 pagesGroup 2 Cw2Worlanyo Philip AmevuvorNo ratings yet

- Cash and Cash Equivalents Reconciliation ProblemsDocument50 pagesCash and Cash Equivalents Reconciliation ProblemsAnne EstrellaNo ratings yet

- gm11 Businessmath Annuity Part1withpetaDocument38 pagesgm11 Businessmath Annuity Part1withpetaEmer John Dela CruzNo ratings yet

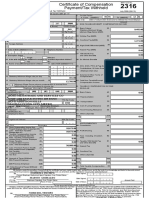

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- 90,95,2000 Macro Multiple ChoiceDocument37 pages90,95,2000 Macro Multiple ChoiceAaron TagueNo ratings yet

- CIDB L5 LP04 Finance and Business PlanningDocument86 pagesCIDB L5 LP04 Finance and Business PlanningMohd Zailani Mohamad Jamal0% (1)

- XXXX Mining Limited: 2nd Mireku Street, Building #B18, Dunkwa-On-Offin. Central Region, GhanaDocument8 pagesXXXX Mining Limited: 2nd Mireku Street, Building #B18, Dunkwa-On-Offin. Central Region, GhanaEvangelineNo ratings yet