Professional Documents

Culture Documents

Quiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000

Uploaded by

Andrew wigginOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000

Uploaded by

Andrew wigginCopyright:

Available Formats

QUIZ 1:

Part II

1. On January 1, 20x1, SMUTTY acquired all of the identifiable assets and assumed all of the

liabilities of OBSCENE, Inc. On this date, the identifiable assets acquired and liabilities

assumed have fair values of ₱3,200,000 and ₱1,800,000, respectively.

SMUTTY incurred the following acquisition-related costs: legal fees, ₱20,000, due

diligence costs, ₱200,000, and general administrative costs of maintaining an internal

acquisitions department, ₱40,000.

Case #1: As consideration for the business combination, SMUTTY Co. transferred 8,000

of its own equity instruments with par value per share of ₱200 and fair value per share

of ₱250 to OBSCENE’s former owners. Costs of registering the shares amounted to

₱80,000.

(1) How much is the goodwill (gain on bargain purchase) on the business

combination?

Case #2: As consideration for the business combination, SMUTTY Co. issued bonds

with face amount and fair value of ₱2,000,000. Transaction costs incurred in issuing

the bonds amounted to ₱100,000.

(2) How much is the goodwill (gain on bargain purchase) on the business

combination?

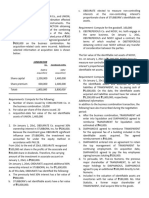

2. On January 1, 20x1, CONJUNCTION Co., and UNION, Inc. entered into a business

combination effected through exchange of equity instruments. The combination resulted

to CONJUNCTION obtaining 100% interest in UNION. Both of the combining entities are

publicly listed. As of this date, CONJUNCTION’s shares have a quoted price of ₱200 per

share. CONJUNCTION Co. recognized goodwill of ₱600,000 on the business combination.

No acquisition-related costs were incurred. Additional selected information at acquisition

date is shown below:

CONJUNCTION Co. Combined entity

(before acquisition) (after acquisition)

Share capital 1,200,000 1,400,000

Share premium 600,000 2,400,000

Totals 1,800,000 3,800,000

Requirements: Compute for the following:

(3) Number of shares issued by CONJUNCTION Co. in the business combination.

(4) Par value per share of the shares issued.

(5) Acquisition-date fair value of the net identifiable assets of UNION.

3. UNFLEDGED Co. is contemplating on acquiring IMMATURE, Inc. The following

information was gathered through a diligence audit:

• The actual earnings of IMMATURE, Inc. for the past 5 years are shown below:

Year Earnings

20x1 2,400,000

20x2 2,600,000

20x3 2,700,000

20x4 2,500,000

20x5 3,600,000

Total 13,800,000

• Earnings in 20x5 included an expropriation gain of ₱800,000.

• The fair value of IMMATURE’s net assets as of the end of 20x5 is ₱20,000,000.

• The industry average rate of return is 12%.

• Probable duration of “excess earnings” is 5 years.

Requirements:

(6) How much is the estimated goodwill under the multiples of average excess earnings

method?

(7) How much is the estimated goodwill under the capitalization of average excess

earnings method? Use a capitalization rate of 25%.

(8) How much is the estimated goodwill under the capitalization of average earnings

method? Use a capitalization rate of 12.5%.

(9) How much is the estimated goodwill under the present value of average excess

earnings method? Use a discount rate of 10%.

You might also like

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- (Before Acquisition) (After Acquisition) : Conjunction Co. Combined EntityDocument2 pages(Before Acquisition) (After Acquisition) : Conjunction Co. Combined Entityellie100% (1)

- M ABC 5 CopiesDocument6 pagesM ABC 5 CopiesChloe CataluñaNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- Consolidation QuestionsDocument16 pagesConsolidation QuestionsUmmar FarooqNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Mendoza, Keije Lawrence M.Document10 pagesMendoza, Keije Lawrence M.21-39693No ratings yet

- Accounting for Business Combinations Final ExamDocument3 pagesAccounting for Business Combinations Final ExamMay P. HuitNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- 12 Business Combination Pt2 PDFDocument1 page12 Business Combination Pt2 PDFRiselle Ann SanchezNo ratings yet

- Business Combinations CalculationsDocument1 pageBusiness Combinations CalculationsMel paloma0% (1)

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- ACCTG-202-A-MIDTERM-QUIZ-1-WITH-SOLUTIONDocument6 pagesACCTG-202-A-MIDTERM-QUIZ-1-WITH-SOLUTIONMeryjoy NoroNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- Midterm ExamDocument14 pagesMidterm ExamDrew BanlutaNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument156 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- ABC - Homework 02 - JaguinesDocument5 pagesABC - Homework 02 - JaguinesHannah Mae JaguinesNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- Quiz Number 2 BuscombDocument12 pagesQuiz Number 2 BuscombRyan CapistranoNo ratings yet

- Business Combinations Accounting QuestionsDocument5 pagesBusiness Combinations Accounting QuestionsAndy LaluNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- CH 13Document80 pagesCH 13ddNo ratings yet

- Midterm Long Quiz - Part 2Document6 pagesMidterm Long Quiz - Part 2Chrismae Monteverde SantosNo ratings yet

- AUDIT-INVESTMENTS-REPORTSDocument2 pagesAUDIT-INVESTMENTS-REPORTSSabel FordNo ratings yet

- TTM 12 - InvestmentDocument81 pagesTTM 12 - Investmentjoki ekonomiNo ratings yet

- Aac M 2 Cash Flow Prob Answer 1 5Document11 pagesAac M 2 Cash Flow Prob Answer 1 5Micah Danielle S. TORMON0% (1)

- Accounting for Business CombinationsDocument12 pagesAccounting for Business CombinationsSteffany RoqueNo ratings yet

- Plant Asset Natural ResourcesDocument21 pagesPlant Asset Natural ResourcesMarco LawinataNo ratings yet

- Analyzing Financial StatementsDocument12 pagesAnalyzing Financial StatementsRHIAN B.No ratings yet

- Module 5.3 Advanced Financial ReportingDocument31 pagesModule 5.3 Advanced Financial ReportingRonaly Nario DagohoyNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- CE Principles of Accounts 2000 PaperDocument7 pagesCE Principles of Accounts 2000 Paperapi-3747191100% (1)

- L4 Graded TestDocument5 pagesL4 Graded TestGarp BarrocaNo ratings yet

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- ACCTGREV1 - 009.1 Statement of Cash Flows Part 1Document1 pageACCTGREV1 - 009.1 Statement of Cash Flows Part 1Jeremiah David0% (1)

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Chapter 2Document13 pagesChapter 2Robin LiNo ratings yet

- White Lightning Inc. Reported Income From Continuing Operations Before Income Taxes of $626,000Document9 pagesWhite Lightning Inc. Reported Income From Continuing Operations Before Income Taxes of $626,000Almarie gilNo ratings yet

- MTP_11_1_QUESTIONS_1696062519Document6 pagesMTP_11_1_QUESTIONS_1696062519kabeeramitbarot96No ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- Intercompany Transfers of Services and Noncurrent Assets: AnswerDocument34 pagesIntercompany Transfers of Services and Noncurrent Assets: AnswerIzzy B100% (1)

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Business Combination AccountingDocument8 pagesBusiness Combination AccountingAljenika Moncada GupiteoNo ratings yet

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- Acquiring IMMATURE Inc earnings valuationDocument1 pageAcquiring IMMATURE Inc earnings valuationellieNo ratings yet

- Private Equity: Access for All: Investing in Private Equity through the Stock MarketsFrom EverandPrivate Equity: Access for All: Investing in Private Equity through the Stock MarketsNo ratings yet

- The Auditorx27s Responsibilitydocx PDF FreeDocument9 pagesThe Auditorx27s Responsibilitydocx PDF FreeGONZALES CamilleNo ratings yet

- Audit Engagement Letter SampleDocument3 pagesAudit Engagement Letter SampleTechnical UsamaNo ratings yet

- Quiz 1 Part II SolutionsDocument3 pagesQuiz 1 Part II SolutionsAndrew wigginNo ratings yet

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- Quiz 3 ABC 25 ITEMSDocument8 pagesQuiz 3 ABC 25 ITEMSAndrew wiggin0% (1)

- Accounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsDocument13 pagesAccounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsAndrew wigginNo ratings yet

- Problem 2: Multiple Choice - TheoryDocument4 pagesProblem 2: Multiple Choice - TheoryAndrew wigginNo ratings yet

- Cost Accounting Final Exam ReviewDocument11 pagesCost Accounting Final Exam ReviewAndrew wigginNo ratings yet

- Quiz 3 ABC 25 ITEMSDocument8 pagesQuiz 3 ABC 25 ITEMSAndrew wiggin0% (1)

- Quiz 2 ABC SolutionsDocument3 pagesQuiz 2 ABC SolutionsAndrew wigginNo ratings yet

- LTCC and Franchise Long Exam PDFDocument9 pagesLTCC and Franchise Long Exam PDFChristine Joy Original50% (2)

- Corporate Liquidation & Reorganization Chapter ExplainedDocument4 pagesCorporate Liquidation & Reorganization Chapter ExplainedJane GavinoNo ratings yet

- Benefits of recreational activitiesDocument2 pagesBenefits of recreational activitiesAndrew wigginNo ratings yet

- Quiz 1 Part II SolutionsDocument3 pagesQuiz 1 Part II SolutionsAndrew wigginNo ratings yet

- Aqc 2nd-Year Week-3Document5 pagesAqc 2nd-Year Week-3Andrew wigginNo ratings yet

- Week 2-Aqc (Oblicon)Document2 pagesWeek 2-Aqc (Oblicon)F U D G ENo ratings yet

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- PAS 27 and Equity Method for AssociatesDocument17 pagesPAS 27 and Equity Method for Associateslatte aeriNo ratings yet

- Going Concern Asset Based Valuation Analysis (GCABVADocument21 pagesGoing Concern Asset Based Valuation Analysis (GCABVAMae Angiela TansecoNo ratings yet

- Financial Planning and BudgetingDocument4 pagesFinancial Planning and BudgetingangelapearlrNo ratings yet

- Company Law test: Share Capital, Charges, Deposits, Debentures and MembershipDocument26 pagesCompany Law test: Share Capital, Charges, Deposits, Debentures and MembershipShrikant RathodNo ratings yet

- Strategic financial concepts for CA finalDocument75 pagesStrategic financial concepts for CA finalapurv12289No ratings yet

- 1 Soya Paneer: Project Profiles - MP Agros Global Agrisystem Pvt. Ltd. Your Partner in Agri-Business 1Document6 pages1 Soya Paneer: Project Profiles - MP Agros Global Agrisystem Pvt. Ltd. Your Partner in Agri-Business 1Sagar R. VakilNo ratings yet

- Principles of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsDocument3 pagesPrinciples of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsYumna TauqeerNo ratings yet

- Financial Accounting 1Document35 pagesFinancial Accounting 1Bunbun 221No ratings yet

- Advanced Accounting Beams 12th Edition Solutions ManualDocument24 pagesAdvanced Accounting Beams 12th Edition Solutions ManualMariaDaviesqrbg100% (48)

- DeltaDocument29 pagesDeltaIvánFernándezPuenteNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- Accounting For PartnershipDocument46 pagesAccounting For PartnershipRejean Dela Cruz100% (1)

- Financial Management: Krakatau Steel (A) & (B)Document13 pagesFinancial Management: Krakatau Steel (A) & (B)mochammad rifaiNo ratings yet

- Accy 517 Syllabus (Fall 2015)Document6 pagesAccy 517 Syllabus (Fall 2015)VerguishoNo ratings yet

- Mayes 8e CH01 Problem SetDocument12 pagesMayes 8e CH01 Problem SetRamez AhmedNo ratings yet

- Cooper Industries PresentationDocument7 pagesCooper Industries PresentationSupriya Gunthey RanadeNo ratings yet

- 5Document11 pages5shayn delapenaNo ratings yet

- CH02TBV7Document21 pagesCH02TBV7AAAMMMBBBNo ratings yet

- Ratio Analysis TheoryDocument22 pagesRatio Analysis TheoryTarun Sukhija100% (1)

- Decision Usefulness in Financial Reports Research Report No. 1Document20 pagesDecision Usefulness in Financial Reports Research Report No. 1Bayu Perdana PutraNo ratings yet

- Horizontal and Vertical Analysis of Financial StatementsDocument3 pagesHorizontal and Vertical Analysis of Financial StatementsJazzy CozyNo ratings yet

- FY 2022 Audited Financial Statements 1Document87 pagesFY 2022 Audited Financial Statements 1Amira OkashaNo ratings yet

- Audt3 - Applied Auditing Complete ModuleDocument232 pagesAudt3 - Applied Auditing Complete ModuleDominique Anne BenozaNo ratings yet

- Finmarket ReviewerDocument7 pagesFinmarket ReviewerRenalyn PascuaNo ratings yet

- Membership Interest Contribution AgreementDocument14 pagesMembership Interest Contribution AgreementMontserrat ViñalsNo ratings yet

- Blce 3Document4 pagesBlce 3Cri5tobalNo ratings yet

- 1Q18 Prudential Debt Investor UpdateDocument41 pages1Q18 Prudential Debt Investor UpdateohwowNo ratings yet

- YehDocument3 pagesYehDeneree Joi EscotoNo ratings yet

- UGBA 120AB Chapter 18 With Solutions Spring 2020Document109 pagesUGBA 120AB Chapter 18 With Solutions Spring 2020yadi lauNo ratings yet