Professional Documents

Culture Documents

Solutions: Case #1:: Quiz 1

Uploaded by

Andrew wigginOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions: Case #1:: Quiz 1

Uploaded by

Andrew wigginCopyright:

Available Formats

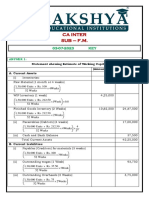

Quiz 1

Part II

1. Solutions:

Case #1:

(1) Consideration transferred (8,000 sh. x P250) 2,000,000

(2) Non-controlling interest in the acquiree -

(3) Previously held equity interest in the acquiree -

Total 2,000,000

Fair value of net identifiable assets acquired (1,400,000)

Goodwill 600,000

2. Case #2:

(1) Consideration transferred (fair value of bonds) 2,000,000

(2) Non-controlling interest in the acquiree -

(3) Previously held equity interest in the acquiree -

Total 2,000,000

Fair value of net identifiable assets acquired (1,400,000)

Goodwill 600,000

3. Solutions:

Requirement (a): Number of shares issued

CONJUNCTION Co. Combined entity Increase

Share capital 1,200,000 1,400,000 200,000

Share premium 600,000 2,400,000 1,800,000

Totals 1,800,000 3,800,000 2,000,000

The fair value of the shares transferred as consideration for the business combination is

P2,000,000.

The number of shares issued in the business combination is computed as follows:

Fair value of shares transferred 2,000,000

Divide by: CONJUNCTION’s fair value per share 200

Number of shares issued 10,000

4. Requirement (b): Par value per share

The par value per share of the shares issued is computed as follows:

Increase in share capital account (see table above) 200,000

Divide by: Number of shares issued 10,000

Par value per share 20

5. Requirement (c): Acquisition-date fair value of the net identifiable assets acquired

(1) Consideration transferred (see previous computation) 2,000,000

(2) Non-controlling interest in the acquiree -

(3) Previously held equity interest in the acquiree -

Total 2,000,000

Fair value of net identifiable assets acquired

(squeeze) (1,400,000)

Goodwill (given information) 600,000

6. Solutions:

Method #1: Multiples of average excess earnings

Average earnings (13.8M – .8M expropriation gain) ÷ 5 years 2,600,000

Normal earnings in the industry (20M x 12%) (2,400,000)

Excess earnings 200,000

Multiply by: Probable duration of excess earnings 5

Goodwill 1,000,000

7. Method #2: Capitalization of average excess earnings

Average earnings (13.8M – .8M expropriation gain) ÷ 5 years 2,600,000

Normal earnings in the industry (20M x 12%) (2,400,000)

Excess earnings 200,000

Divide by: Capitalization rate 25%

Goodwill 800,000

8. Method #3: Capitalization of average earnings

Average earnings (13.8M – .8M expropriation gain) ÷ 5 years 2,600,000

Divide by: Capitalization rate 12.5%

Estimated purchase price 20,800,000

Fair value of acquiree’s net assets (20,000,000)

Goodwill 800,000

9. Method #4: Present value of average excess earnings

Average earnings (13.8M – .8M expropriation gain) ÷ 5 years 2,600,000

Normal earnings in the industry (20M x 12%) (2,400,000)

Excess earnings 200,000

Multiply by: PV of an ordinary annuity @10%, n=5 3.79079

Goodwill 758,158

Answers:

1. ₱600,000

2. ₱600,000

3. 10,000

4. ₱20

5. ₱1,400,000

6. ₱1,000,000

7. ₱800,000

8. ₱800,000

9. ₱758,158

You might also like

- Non-Profit Organizations: Problem 16-1: Multiple ChoiceDocument7 pagesNon-Profit Organizations: Problem 16-1: Multiple ChoiceKyla Ramos Diamsay100% (1)

- Business Combi. Chapter 1 PROBLEM 3Document4 pagesBusiness Combi. Chapter 1 PROBLEM 3latte aeriNo ratings yet

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- Ratio Analysis - 10 Questions ExerciseDocument10 pagesRatio Analysis - 10 Questions ExerciseSaralita NairNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- BUSCOM Test Bank 2Document22 pagesBUSCOM Test Bank 2Liberty NovaNo ratings yet

- Wax Candle Manufacturing PlantDocument30 pagesWax Candle Manufacturing Plantbig john94% (18)

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- MCQ On Financial Management For UGC NET With AnswersDocument9 pagesMCQ On Financial Management For UGC NET With AnswersRajendra SinghNo ratings yet

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Ajay Summer Project Report at AU FINANCIERSDocument71 pagesAjay Summer Project Report at AU FINANCIERSAjay Motwani73% (15)

- Accounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Document52 pagesAccounting For Partnership and Corporation (3 Trimester - CY 2016-2017)machelle francisco80% (5)

- Financial Accounting December 2009 Exam PaperDocument10 pagesFinancial Accounting December 2009 Exam Paperkarlr9No ratings yet

- FINANCIAL REPORTING - Doc For IKEADocument47 pagesFINANCIAL REPORTING - Doc For IKEAanttheo100% (1)

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- Sol Man Chapter 2 Bus Com Part 2Document14 pagesSol Man Chapter 2 Bus Com Part 2Halt DougNo ratings yet

- ABC Chapter 1 Solman - 2020 Millan Abc ABC Chapter 1 Solman - 2020 Millan AbcDocument10 pagesABC Chapter 1 Solman - 2020 Millan Abc ABC Chapter 1 Solman - 2020 Millan AbcJessaNo ratings yet

- Profe03 Act#2Document2 pagesProfe03 Act#2Red MarieeNo ratings yet

- Chapter 1Document9 pagesChapter 1Rufina B VerdeNo ratings yet

- Business CombinationDocument2 pagesBusiness CombinationJezelle NanoNo ratings yet

- Abc Chapter 1 Solman 2020 Millan Abc - CompressDocument9 pagesAbc Chapter 1 Solman 2020 Millan Abc - CompressErna DavidNo ratings yet

- Bus. Com. Part 1Document10 pagesBus. Com. Part 1Jaycel BayronNo ratings yet

- Module 2Document5 pagesModule 2Alpha RamoranNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 1Document18 pages2076 - Varias, Aizel Ann B - Module 1Aizel Ann VariasNo ratings yet

- Valuation of GoodwillDocument3 pagesValuation of GoodwillAhiaanNo ratings yet

- QUIZ 2 (Part 2) SolutionsDocument3 pagesQUIZ 2 (Part 2) SolutionsCharizza Amor TejadaNo ratings yet

- ASSIGNMENT 2 Business CombinationDocument3 pagesASSIGNMENT 2 Business CombinationApril ManjaresNo ratings yet

- Profe03 - Chapter 2 Business Combinations Specific CasesDocument12 pagesProfe03 - Chapter 2 Business Combinations Specific CasesSteffany RoqueNo ratings yet

- Chapter 14 - Bus Com Part 1 - Afar Part 2-1Document4 pagesChapter 14 - Bus Com Part 1 - Afar Part 2-1Glennizze GalvezNo ratings yet

- Activity Chapter 3: (A) Average Annual Earnings 2,600,000Document2 pagesActivity Chapter 3: (A) Average Annual Earnings 2,600,000Randelle James FiestaNo ratings yet

- SHE (Part 2) - OvilloDocument13 pagesSHE (Part 2) - OvilloMaria AngelicaNo ratings yet

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoNo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- Chapter 11 Shareholders' 2Document13 pagesChapter 11 Shareholders' 2Thalia Rhine AberteNo ratings yet

- Activity Chapter 2Document2 pagesActivity Chapter 2Randelle James FiestaNo ratings yet

- Aep32 Prelim Exam AnswerDocument4 pagesAep32 Prelim Exam AnswerTan ToyNo ratings yet

- Module 1Document4 pagesModule 1Alpha RamoranNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Solutions Ch08Document19 pagesSolutions Ch08KyleNo ratings yet

- Profe03 Act3Document1 pageProfe03 Act3Red MarieeNo ratings yet

- Consolidation Q74Document4 pagesConsolidation Q74johny SahaNo ratings yet

- Quiz On Pension, Equity Investments - Answer KeyDocument3 pagesQuiz On Pension, Equity Investments - Answer KeyAlthea RubinNo ratings yet

- Answer Key Chapter 2 BCDocument18 pagesAnswer Key Chapter 2 BCMerel Rose FloresNo ratings yet

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocument5 pagesAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNo ratings yet

- Quiz Adv2 - Bryan LesmadiDocument9 pagesQuiz Adv2 - Bryan LesmadiBryan LesmadiNo ratings yet

- Ia2 Ka & SolDocument31 pagesIa2 Ka & SolCarlah Jeane BasinaNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- Advanced Part 2 Solman MillanDocument320 pagesAdvanced Part 2 Solman Millanlily janeNo ratings yet

- Fund Flow Statement-FR FSADocument27 pagesFund Flow Statement-FR FSADãrk LïghtNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- A1c019112 Jeremy Christ Manuel AklDocument21 pagesA1c019112 Jeremy Christ Manuel AklJeremy Christ ManuelNo ratings yet

- Buscom-Asset AcquisitionDocument7 pagesBuscom-Asset AcquisitionRenelyn DavidNo ratings yet

- CXC Principles of Accounts June 2013 AnswersDocument7 pagesCXC Principles of Accounts June 2013 AnswersNeran SinghNo ratings yet

- Ca Inter-F.m.03-07-2023-KeyDocument3 pagesCa Inter-F.m.03-07-2023-KeyChintuNo ratings yet

- BS1209 Midterm Test Example FA SolDocument4 pagesBS1209 Midterm Test Example FA SolGhazi Ben JaballahNo ratings yet

- Module 5Document11 pagesModule 5Jacqueline OrtegaNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Quiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Document2 pagesQuiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Andrew wigginNo ratings yet

- Quiz 3 ABC 25 ITEMSDocument8 pagesQuiz 3 ABC 25 ITEMSAndrew wiggin0% (1)

- Accounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsDocument13 pagesAccounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsAndrew wigginNo ratings yet

- Cost Accounting Final ExaminationDocument11 pagesCost Accounting Final ExaminationAndrew wigginNo ratings yet

- Problem 2: Multiple Choice - TheoryDocument4 pagesProblem 2: Multiple Choice - TheoryAndrew wigginNo ratings yet

- Quiz 2 ABC SolutionsDocument3 pagesQuiz 2 ABC SolutionsAndrew wigginNo ratings yet

- MODULE 4 RecreationalDocument2 pagesMODULE 4 RecreationalAndrew wigginNo ratings yet

- Balance Sheet and Profit and Loss Account - FinalDocument20 pagesBalance Sheet and Profit and Loss Account - FinalKartikey Mishra100% (1)

- r7 Mba Financial Accounting and Analysis Set1Document3 pagesr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNo ratings yet

- Microsoft Word - Unit 2 Understanding Statement of Financial PositionDocument17 pagesMicrosoft Word - Unit 2 Understanding Statement of Financial PositionKamille C. CerenoNo ratings yet

- Performance Analysis of Central Pharmaceuticals LTDDocument21 pagesPerformance Analysis of Central Pharmaceuticals LTDFahim RahmanNo ratings yet

- Mankeu Ross PDFDocument733 pagesMankeu Ross PDFYustina Lita SariNo ratings yet

- Esas Answer KeyDocument14 pagesEsas Answer KeyChela Nicole EchonNo ratings yet

- Accounting Assignment 1Document6 pagesAccounting Assignment 1Abbas KhanNo ratings yet

- Prospective Analysis 2Document7 pagesProspective Analysis 2MAYANK JAINNo ratings yet

- Pas 23 Pas 27Document12 pagesPas 23 Pas 27Jophet Banabana MagalonaNo ratings yet

- A Study On Capital Structure: Roll No. - 2K191014Document38 pagesA Study On Capital Structure: Roll No. - 2K191014Samrddhi GhatkarNo ratings yet

- Form A2 Purpose Codes April16Document6 pagesForm A2 Purpose Codes April16Basanta Kumar SahooNo ratings yet

- Advacc Final Exam Answer KeyDocument7 pagesAdvacc Final Exam Answer KeyRIZLE SOGRADIELNo ratings yet

- Mba Project On Economic Value Added11Document58 pagesMba Project On Economic Value Added11Avinash Bilagi50% (2)

- ACCT 1005 Worksheet 1 Selected Solutions 2016 Practice QuestionsDocument2 pagesACCT 1005 Worksheet 1 Selected Solutions 2016 Practice QuestionsChan SynergisticNo ratings yet

- FABM2-Chapter 2Document31 pagesFABM2-Chapter 2Marjon GarabelNo ratings yet

- Why Value Value?: An Excerpt From The Second Edition of Valuation: Measuring andDocument13 pagesWhy Value Value?: An Excerpt From The Second Edition of Valuation: Measuring andSathyanarayanan SridharNo ratings yet

- Uds Business Plan Presentation FinalDocument21 pagesUds Business Plan Presentation FinalAdams Yussif KwajaNo ratings yet

- Corporate Law - Unit 2Document17 pagesCorporate Law - Unit 2Shem W LyngdohNo ratings yet

- Unit 9 LeasingDocument21 pagesUnit 9 LeasingAnuska JayswalNo ratings yet

- Chapter 4 TofutatoDocument12 pagesChapter 4 TofutatoCrissaNo ratings yet

- Philips DF 2006Document244 pagesPhilips DF 2006JORGENo ratings yet

- Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009Document241 pagesSecurities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009samlobo31No ratings yet