Professional Documents

Culture Documents

Adjusting Entries - Activity

Uploaded by

James Adam Vecino0 ratings0% found this document useful (0 votes)

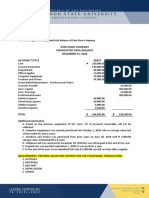

36 views1 pageThe document is an unadjusted trial balance for Bob Uy, Inc. as of December 31, 2019. It lists assets, liabilities, capital, revenues and expenses. Requirements are to journalize adjustments for annual depreciation, collection of accounts receivable, payment of accounts payable, future income tax payment, and prepaid rent. Then prepare a 10-column worksheet with the unadjusted trial balance, adjusting entries, adjusted trial balance, income statement and balance sheet.

Original Description:

Activity for adjusting entry

Original Title

ADJUSTING ENTRIES - ACTIVITY

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an unadjusted trial balance for Bob Uy, Inc. as of December 31, 2019. It lists assets, liabilities, capital, revenues and expenses. Requirements are to journalize adjustments for annual depreciation, collection of accounts receivable, payment of accounts payable, future income tax payment, and prepaid rent. Then prepare a 10-column worksheet with the unadjusted trial balance, adjusting entries, adjusted trial balance, income statement and balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views1 pageAdjusting Entries - Activity

Uploaded by

James Adam VecinoThe document is an unadjusted trial balance for Bob Uy, Inc. as of December 31, 2019. It lists assets, liabilities, capital, revenues and expenses. Requirements are to journalize adjustments for annual depreciation, collection of accounts receivable, payment of accounts payable, future income tax payment, and prepaid rent. Then prepare a 10-column worksheet with the unadjusted trial balance, adjusting entries, adjusted trial balance, income statement and balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

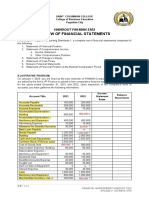

ABM 2 – Fundamentals of Accountancy, Business and Management 1

Bob Uy, INC.

Unadjusted Trial Balance

December 31, 2019

Particulars Debit Credit

Cash in Bank P 1,314,500.00

Accounts Receivable 232,500.00

Machineries and Equipment 405,000.00

Furniture and Fixtures 340,200.00

Transportation Equipment 1,486,500.00

Accounts Payable P 239,700.00

Bob Patrick, Capital 2,450,000.00

Bob Patrick, Drawing 150,000.00

Sales 4,130,000.00

Cost of Goods Sold 500,000.00

Rent Expense 60,000.00

Supplies and Materials 1,438,000.00

Salaries and Wages 600,000.00

Utilities Expense 245,000.00

Tax, Duties and Licenses 48,000.00

TOTAL P 6,819,700.00 P 6,819,700.00

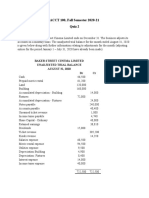

Requirements:

1. Journalize the following adjustments:

A. Annual depreciation for the following fixed assets with certain useful life:

Machineries and Equipment = 10 years useful life with acquisition cost of Php 155,000.00

Furniture and Fixtures = 10 years useful life with acquisition cost of Php 155,000.00

Transportation Equipment = 10 years useful life with acquisition cost of Php 250,000.00

B. Collected accounts receivable amounting Php 100,000.00. The amount was deposited in Bob Uy’s bank

account.

C. Paid accounts payable from a partner company amounting Php 110,000.00 cash in bank.

D. The income tax for the year 201B will be paid on January 2, 201C – Php 200,500.00.

E. Paid rent in advance for the month of January 2020 worth Php 5,000.00.

2. Prepare a 10-columnar worksheet.

A. Unadjusted Trial Balance

B. Adjusting Entries

C. Adjusted Trial Balance

D. Income Statement

E. Balance Sheet

You might also like

- 21414-3 Valves and Unit Injectors, AdjustDocument11 pages21414-3 Valves and Unit Injectors, AdjustTeguh Imam Adri100% (1)

- Ch10-Slope Stability ExamplesDocument19 pagesCh10-Slope Stability ExamplesRafi Sulaiman100% (1)

- CA No. 2 - Business FinanceDocument43 pagesCA No. 2 - Business FinanceArthurLeonard MalijanNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Lesson 3 - Stocks and Its ClassificationDocument40 pagesLesson 3 - Stocks and Its ClassificationJames Adam VecinoNo ratings yet

- Partnership - Chapter 1 Test BankDocument8 pagesPartnership - Chapter 1 Test BankCaile SalcedoNo ratings yet

- Adjusting - Merchandising BusinessDocument3 pagesAdjusting - Merchandising BusinessJekoe25% (4)

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Wartsila O E RT Flex68 D MIM Part 1.Document379 pagesWartsila O E RT Flex68 D MIM Part 1.Uhrin Imre100% (1)

- Basic Acctg PracticalDocument3 pagesBasic Acctg PracticalPatricia Camille Austria50% (2)

- SGLG For BarangayDocument15 pagesSGLG For BarangayMike GuerzonNo ratings yet

- Manual - NQDI - Database StructureDocument240 pagesManual - NQDI - Database StructureÜmit Karadayi100% (1)

- Dunning Objects ListsDocument1 pageDunning Objects ListsSachin SinghNo ratings yet

- Artigo - Doll e Torkzadeh 1988 - The Mesurement of End-User Computing SatisfactionDocument17 pagesArtigo - Doll e Torkzadeh 1988 - The Mesurement of End-User Computing Satisfactiondtdesouza100% (1)

- 1.1.2.a Assignment - Partnership Formation and OperationDocument14 pages1.1.2.a Assignment - Partnership Formation and OperationGiselle MartinezNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- P AND S Corporation ProblemDocument10 pagesP AND S Corporation ProblemRose Medina BarondaNo ratings yet

- Correcting The Trial Balance 2022Document3 pagesCorrecting The Trial Balance 2022Charlemagne Jared RobielosNo ratings yet

- Ajusted TB PDFDocument2 pagesAjusted TB PDFmEOW SNo ratings yet

- Ga ParcorDocument3 pagesGa ParcorSky RamirezNo ratings yet

- Bus Com 7Document5 pagesBus Com 7Chabelita MijaresNo ratings yet

- Consolidated FS May 2023Document2 pagesConsolidated FS May 2023Palma, Arrabela M.No ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Afar Drill 3Document7 pagesAfar Drill 3ROMAR A. PIGANo ratings yet

- Equipment ### Accounts Payable ### P120,000 / 30 + P4,000 A MonthDocument10 pagesEquipment ### Accounts Payable ### P120,000 / 30 + P4,000 A MonthShaina AragonNo ratings yet

- Ansay, Allyson Charissa T - Activity 3Document9 pagesAnsay, Allyson Charissa T - Activity 3カイ みゆきNo ratings yet

- EXERCISES FABM q2 QuizDocument2 pagesEXERCISES FABM q2 QuizGenesa Buen A. PolintanNo ratings yet

- Master BudgetDocument2 pagesMaster BudgetAli SwizzleNo ratings yet

- Basic Financial Accounting - Adjusting Entry ProblemDocument1 pageBasic Financial Accounting - Adjusting Entry ProblemTreesh Marie MenorNo ratings yet

- Basic Acctg PracticalDocument3 pagesBasic Acctg PracticalPatricia Camille AustriaNo ratings yet

- PARTNERSHIP Formation and OperationDocument6 pagesPARTNERSHIP Formation and OperationDaniela ParreñoNo ratings yet

- Audit Report SampleDocument44 pagesAudit Report SampleJun Guerzon PaneloNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Accounting Notes Chapter 6Document10 pagesAccounting Notes Chapter 6Mikaela LacabaNo ratings yet

- Final BASIC AcctgDocument3 pagesFinal BASIC AcctgFiona Concepcion100% (1)

- ABRERA Activity 2 - Transaction AnalysisDocument2 pagesABRERA Activity 2 - Transaction AnalysisZoram AbreraNo ratings yet

- Unit 1 ActvitiesDocument6 pagesUnit 1 ActvitiesLeslie Mae Vargas ZafeNo ratings yet

- ACCT 100 Quiz 2aDocument2 pagesACCT 100 Quiz 2aAli Zain ParharNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Partnership Formation and OperationDocument4 pagesPartnership Formation and Operationkat kaleNo ratings yet

- Final Accounting Part 1Document1 pageFinal Accounting Part 1Joaquin Jeanne Marie B.0% (2)

- Multiple ChoiceDocument10 pagesMultiple ChoiceStefanie FerminNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- I - Identify The Following Accounts As A. Assets, Liabilities, Capital, Revenue, Expense, Other Income B. Debit or Credit C. Nominal or Real AccountDocument2 pagesI - Identify The Following Accounts As A. Assets, Liabilities, Capital, Revenue, Expense, Other Income B. Debit or Credit C. Nominal or Real AccountAries KeiffNo ratings yet

- Module 4 - Problem 5Document1 pageModule 4 - Problem 5Lycksele RodulfaNo ratings yet

- Principles of Accounting Problem 12Document5 pagesPrinciples of Accounting Problem 12Carlo AbrinaNo ratings yet

- Module 5 - Far - Activity-Answer KEYDocument2 pagesModule 5 - Far - Activity-Answer KEYRhadzmae OmalNo ratings yet

- Handout Fin Man 2302Document2 pagesHandout Fin Man 2302Ranz Nikko N PaetNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- SegmentsDocument5 pagesSegmentsehpubguc1No ratings yet

- 1st QTR PETA - 2021 - New 1Document12 pages1st QTR PETA - 2021 - New 1FranceeNo ratings yet

- BTS Accounting Firm Trial Balance December 31, 2014Document4 pagesBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNo ratings yet

- University of Luzo4Document1 pageUniversity of Luzo4Mariphie OsianNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- BFC 3175 Financial Accounting II - 4Document6 pagesBFC 3175 Financial Accounting II - 4karashinokov siwoNo ratings yet

- AdVacc Q1Document5 pagesAdVacc Q1Red Yu100% (1)

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- Solution AssignmentDocument6 pagesSolution AssignmentRaven SiaNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- P Company Acquires 80Document5 pagesP Company Acquires 80hus wodgyNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Assignment 1.1Document14 pagesAssignment 1.1Tricia Nicole DimaanoNo ratings yet

- For 18 - 25: Deficiency of Liquid Assets. On July 1, 2020, The Following Information Was AvailableDocument3 pagesFor 18 - 25: Deficiency of Liquid Assets. On July 1, 2020, The Following Information Was AvailableExzyl Vixien Iexsha LoxinthNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- Summer School AdamDocument3 pagesSummer School AdamJames Adam VecinoNo ratings yet

- He Textin These R Usod Wol ( 11 : SnakeDocument6 pagesHe Textin These R Usod Wol ( 11 : SnakeJames Adam VecinoNo ratings yet

- 134 Why Does Water SplashDocument5 pages134 Why Does Water SplashJames Adam VecinoNo ratings yet

- Lesson 2 - The Financial MarketDocument32 pagesLesson 2 - The Financial MarketJames Adam VecinoNo ratings yet

- Summer School Adam FinalDocument3 pagesSummer School Adam FinalJames Adam VecinoNo ratings yet

- Entrep - Nutrimount - C1Document5 pagesEntrep - Nutrimount - C1James Adam VecinoNo ratings yet

- Catch A Cup-C1-C6Document57 pagesCatch A Cup-C1-C6James Adam VecinoNo ratings yet

- CSC Project OutlineDocument19 pagesCSC Project OutlinesyazaNo ratings yet

- Mackenzie Marr Marketing ReportDocument13 pagesMackenzie Marr Marketing Reportapi-250686425100% (2)

- BPW Brake Cylinders: For Disc and Drum Brake AxlesDocument14 pagesBPW Brake Cylinders: For Disc and Drum Brake AxlesSteven FryeNo ratings yet

- Local Government Marketing ModelDocument160 pagesLocal Government Marketing ModeladiNo ratings yet

- Open Hole Wireline LoggingDocument32 pagesOpen Hole Wireline Loggingsanjeet giriNo ratings yet

- Lubetool ManualDocument10 pagesLubetool ManualdragosNo ratings yet

- PFP Tutorial 8Document2 pagesPFP Tutorial 8stellaNo ratings yet

- Shampoo ComponentsDocument4 pagesShampoo Componentsmohamedelshrpeni0No ratings yet

- BS BuzzDocument8 pagesBS BuzzBS Central, Inc. "The Buzz"No ratings yet

- Module 1 Chapter 3 Week 3 Fundamentals of Surveying LectureDocument12 pagesModule 1 Chapter 3 Week 3 Fundamentals of Surveying LecturePrincess Erika CanlasNo ratings yet

- PNG 8 Directory Health Language v1 m56577569830506654Document28 pagesPNG 8 Directory Health Language v1 m56577569830506654Alex Efkarpidis100% (1)

- Registration Certificate of Vehicle: Issuing Authority: Kanpur Nagar, Uttar PradeshDocument1 pageRegistration Certificate of Vehicle: Issuing Authority: Kanpur Nagar, Uttar PradeshgauravashNo ratings yet

- Roff Master Fix Adhesive Mfa Tds DownloadDocument5 pagesRoff Master Fix Adhesive Mfa Tds DownloadsanjayNo ratings yet

- Record A FaceTime CallDocument3 pagesRecord A FaceTime Calltsultim bhutiaNo ratings yet

- My Heart Will Go On 1Document11 pagesMy Heart Will Go On 1JumioWaeNo ratings yet

- 1701075261076Document18 pages1701075261076rahulpavn01No ratings yet

- BSNL Project MbaDocument92 pagesBSNL Project MbaSathish Ssathish100% (1)

- 08 VLAN Principles and ConfigurationDocument46 pages08 VLAN Principles and Configurationdembi86No ratings yet

- EDPS - (Guidelines) On Processing PI in Whistleblowing Procedure A 17-12-19Document16 pagesEDPS - (Guidelines) On Processing PI in Whistleblowing Procedure A 17-12-19Mario Gomez100% (1)

- A Comparative Study On Customers Satisfaction Towards Android Operating System and Iphone Operating System in Moblie PhoneDocument8 pagesA Comparative Study On Customers Satisfaction Towards Android Operating System and Iphone Operating System in Moblie PhoneGUNALSIVA VNo ratings yet

- Catalog Tranzistori NPN de PutereDocument4 pagesCatalog Tranzistori NPN de PutereSmigun CorneliuNo ratings yet

- Legal System KuwaitDocument9 pagesLegal System KuwaitAhmed MareeNo ratings yet

- Load Case CombinationsDocument5 pagesLoad Case CombinationsFrancisco UgarteNo ratings yet