Professional Documents

Culture Documents

ORA Preview H121

Uploaded by

Bypass Icloudiphoneipad BypasshelloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ORA Preview H121

Uploaded by

Bypass Icloudiphoneipad BypasshelloCopyright:

Available Formats

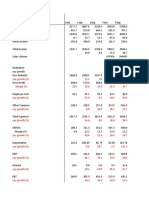

Detailed preview for H1 21 results

2 3 4 9 10 11 12 13 14 15 16 33 34 35 36 37 38 39 40 41 42 41 42

in m€ 2Q21 1H21 2021 2022 2023 2024 2025

var 21 / 20 var 21 / 20 var 21 / 20

# Estimates: 17 2Q21 2Q20 CB * 2Q20 A 1H21 1H20 CB * 1H20 A FY21 FY20 CB * FY20 A FY22e var 22/21 FY23e var 23/22 FY24e var 24/23 FY25e var 25/24

CB CB CB

1. Profit & Loss Account

Revenues Total Group 10,360 10,288 10,375 +0.7% 20,675 20,553 20,769 +0.6% 42,285 41,936 42,270 +0.8% 42,682 +0.9% 43,028 +0.8% 43,115 +0.2% 43,107 -0.0%

France 4,554 4,577 4,593 -0.5% 8,958 8,992 9,024 -0.4% 18,353 18,395 18,461 -0.2% 18,370 +0.1% 18,360 -0.1% 18,277 -0.4% 18,074 -1.1%

Europe 2,514 2,535 2,544 -0.8% 5,096 5,181 5,229 -1.6% 10,449 10,541 10,580 -0.9% 10,560 +1.1% 10,642 +0.8% 10,709 +0.6% 10,712 +0.0%

Spain 1,158 1,213 1,216 -4.5% 2,346 2,495 2,503 -6.0% 4,758 4,951 4,951 -3.9% 4,755 -0.1% 4,783 +0.6% 4,757 -0.5% 4,777 +0.4%

Poland 640 624 627 +2.5% 1,282 1,241 1,276 +3.3% 2,599 2,557 2,590 +1.6% 2,621 +0.8% 2,649 +1.1% 2,678 +1.1% 2,665 -0.5%

Belgium & Luxembourg 315 303 303 +3.9% 645 637 637 +1.3% 1,353 1,315 1,315 +2.9% 1,387 +2.5% 1,410 +1.7% 1,447 +2.6% 1,461 +1.0%

Central Europe 407 399 402 +2.0% 834 817 823 +2.0% 1,763 1,740 1,746 +1.4% 1,769 +0.3% 1,791 +1.2% 1,817 +1.5% 1,827 +0.6%

Eliminations intra-european (5) (4) (4) - (10) (10) (10) - (22) (22) (22) - (22) - (22) - (22) - (22) -

Africa & Middle East 1,471 1,359 1,401 +8.2% 2,959 2,748 2,845 +7.7% 6,098 5,685 5,834 +7.3% 6,376 +4.6% 6,683 +4.8% 6,945 +3.9% 7,173 +3.3%

Enterprise 1,921 1,889 1,925 +1.7% 3,828 3,789 3,859 +1.0% 7,776 7,659 7,807 +1.5% 7,829 +0.7% 7,831 +0.0% 7,884 +0.7% 7,943 +0.8%

International carriers & Shared services 355 355 355 -0.1% 719 729 728 -1.3% 1,430 1,453 1,450 -1.6% 1,413 -1.2% 1,408 -0.3% 1,413 +0.3% 1,393 -1.4%

Eliminations (445) (426) (441) - (875) (883) (915) - (1,861) (1,791) (1,855) - (1,879) - (1,884) - (1,878) - (1,872) -

0 0

EBITDAaL* - Total Group 3,259 3,286 3,312 -0.8% 5,824 5,859 5,914 -0.6% 12,596 12,607 12,680 -0.1% 12,924 +2.6% 13,140 +1.7% 13,330 +1.4% 13,517 +1.4%

EBITDAaL* - Telecom activities 3,293 3,326 3,350 -1.0% 5,886 5,933 5,985 -0.8% 12,715 12,771 12,839 -0.4% 12,993 +2.2% 13,159 +1.3% 13,272 +0.9% 13,455 +1.4%

France 3,207 3,252 3,301 -1.4% 7,001 7,070 7,163 -1.0% 7,089 +1.3% 7,157 +1.0% 7,112 -0.6% 7,126 +0.2%

Europe 1,367 1,444 1,457 -5.3% 2,823 2,918 2,932 -3.2% 2,884 +2.2% 2,946 +2.1% 3,014 +2.3% 3,042 +0.9%

Spain 631 728 728 -13.4% 1,292 1,433 1,433 -9.8% 1,307 +1.2% 1,340 +2.6% 1,360 +1.5% 1,361 +0.1%

Poland 320 310 319 +3.3% 636 623 632 +2.1% 647 +1.6% 657 +1.7% 670 +2.0% 677 +1.0%

Belgium & Luxembourg 152 148 148 +2.5% 331 323 323 +2.3% 344 +3.9% 354 +3.0% 365 +2.9% 373 +2.4%

Central Europe 262 257 261 +2.1% 552 538 544 +2.6% 560 +1.4% 566 +1.0% 567 +0.2% 572 +0.9%

Africa & Middle East 988 898 935 +10.0% 2,097 1,910 1,964 +9.8% 2,227 +6.2% 2,349 +5.5% 2,482 +5.6% 2,568 +3.5%

Enterprise 473 486 471 -2.8% 1,023 1,056 1,023 -3.1% 1,022 -0.1% 1,026 +0.3% 1,021 -0.5% 1,025 +0.5%

International carriers & Shared services (140) (148) (179) - (234) (183) (244) - (224) - (212) - (221) - (228) -

EBITDAaL - Orange Bank (61) (75) (72) - (125) (165) (160) - (75) - (50) - (25) - 20 -

EBITDAaL margin - Telecom activities 31.8% 32.3% 32.3% -0.5pt 28.5% 28.9% 28.8% -0.4pt 30.1% 30.4% 30.4% -0.4pt 30.4% +0.4pt 30.6% +0.1pt 30.8% +0.2pt 31.2% +0.4pt

France 35.8% 36.2% 36.6% -0.4pt 38.1% 38.4% 38.8% -0.3pt 38.6% +0.4pt 39.0% +0.4pt 38.9% -0.1pt 39.4% +0.5pt

Europe 26.8% 27.9% 27.9% -1.0pt 27.0% 27.7% 27.7% -0.7pt 27.3% +0.3pt 27.7% +0.4pt 28.1% +0.5pt 28.4% +0.3pt

Spain 26.9% 29.2% 29.1% -2.3pt 27.1% 28.9% 28.9% -1.8pt 27.5% +0.3pt 28.0% +0.5pt 28.6% +0.6pt 28.5% -0.1pt

Poland 25.0% 25.0% 25.0% -0.0pt 24.5% 24.4% 24.4% +0.1pt 24.7% +0.2pt 24.8% +0.1pt 25.0% +0.2pt 25.4% +0.4pt

Belgium & Luxembourg 23.6% 23.3% 23.3% +0.3pt 24.5% 24.6% 24.6% -0.1pt 24.8% +0.3pt 25.1% +0.3pt 25.2% +0.1pt 25.6% +0.4pt

Central Europe 31.5% 31.4% 31.7% +0.0pt 31.3% 30.9% 31.2% +0.4pt 31.7% +0.3pt 31.6% -0.1pt 31.2% -0.4pt 31.3% +0.1pt

Africa & Middle East 33.4% 32.7% 32.9% +0.7pt 34.4% 33.6% 33.7% +0.8pt 34.9% +0.5pt 35.2% +0.2pt 35.7% +0.6pt 35.8% +0.1pt

Entreprise 12.3% 12.8% 12.2% -0.5pt 13.2% 13.8% 13.1% -0.6pt 13.1% -0.1pt 13.1% +0.0pt 12.9% -0.2pt 12.9% -0.0pt

International carriers & Shared services -19.5% -20.2% -24.6% +0.7pt -16.4% -12.6% -16.9% -3.8pt -15.9% +0.5pt -15.1% +0.8pt -15.6% -0.5pt -16.4% -0.8pt

2. Operating cash-flow - - - -

eCAPEX - Total Group 1,855 1,565 1,576 +18.5% 3,615 3,131 3,156 +15.5% 7,630 7,092 7,132 +7.6% 7,297 -4.4% 6,813 -6.6% 6,594 -3.2% 6,531 -0.9%

eCAPEX - Telecom activities 1,844 1,556 1,567 +18.5% 3,598 3,115 3,142 +15.5% 7,600 7,059 7,102 +7.7% 7,271 -4.3% 6,785 -6.7% 6,582 -3.0% 6,499 -1.3%

France 1,971 1,647 1,635 +19.7% 4,125 3,788 3,748 +8.9% 3,845 -6.8% 3,468 -9.8% 3,215 -7.3% 3,129 -2.7%

Europe 870 755 761 +15.2% 1,879 1,841 1,847 +2.1% 1,829 -2.7% 1,726 -5.6% 1,670 -3.3% 1,685 +0.9%

Spain nc nc nc 443 392 392 nc

+12.9% 954 969 969 -1.5% 899 -5.8% 823 -8.5% 799 -2.9% 803 +0.6%

Poland 198 181 nc

186 nc

+9.7% 405 400 nc

405 +1.2% 398 -1.7% 397 -0.2% 399 +0.3% 397 -0.3%

Belgium & Luxembourg 90 65 65 +38.7% 203 178 178 +14.1% 207 +2.3% 197 -5.2% 190 -3.4% 195 +2.6%

Central Europe 125 117 118 +6.5% 295 294 295 +0.4% 288 -2.5% 282 -2.1% 278 -1.4% 277 -0.4%

Africa & Middle East 467 434 449 +7.7% 1,061 1,008 1,036 +5.3% 1,077 +1.5% 1,100 +2.1% 1,139 +3.6% 1,140 +0.1%

Enterprise 180 170 174 +5.8% 389 332 339 +17.0% 383 -1.6% 380 -0.7% 378 -0.6% 393 +4.1%

International carriers & Shared services 117 110 123 +7.2% 141 91 133 +55.8% 138 -2.1% 139 +0.9% 143 +2.4% 150 +5.2%

eCapex Telecom activities in % of revenues 17.8% 15.1% 15.1% +2.7pt 17.4% 15.2% 15.1% +2.2pt 18.0% 16.8% 16.8% +1.1pt 17.0% -0.9pt 15.8% -1.3pt 15.3% -0.5pt 15.1% -0.2pt

EBITDAaL - eCapex (Total Group) 1,404 1,721 1,737 -18.4% 2,209 2,727 2,758 -19.0% 4,966 5,515 5,548 -10.0% 5,627 +13.3% 6,328 +12.5% 6,736 +6.5% 6,986 +3.7%

EBITDAaL - eCapex (Telecom activities) 1,449 1,770 1,782 -18.1% 2,288 2,817 2,843 -18.8% 5,115 5,711 nc

5,736 -10.4% 5,721 +11.9% 6,374 +11.4% 6,690 +5.0% 6,956 +4.0%

3. Cash-flow statement (Telecom activities) - -

EBITDAaL - eCapex (Telecom activities) 2,288 2,843 5,115 5,736 5,721 606 6,374 653 6,690 316 6,956 266

Change in eCAPEX payables (200) (340) 45 307 13 (34) (33) (46) (20) 12 (20) (1)

Change in working capital requirement (300) (1,017) (100) (500) (70) 29 (56) 13 (60) (5) (60) (1)

Net interest paid (excluding interests paid on lease liabilities) (536) (559) (1,074) nc(1,127) (1,053) 20 (1,056) (4) (1,037) 18 (1,014) 22

Income paid tax (516) (527) (1,026) nc(1,085) (1,125) (100) (1,167) (43) (1,301) (135) (1,318) (18)

Other operational items. It excludes litigations since FY 2019. (150) (146) (696) (838) (655) 41 (532) 122 (369) 162 (318) 51

Organic cash flow (Telecom activities) 760 255 2,267 2,494 2,954 685 3,560 606 3,800 239 4,077 276

Telecommunication licenses paid (150) (134) (547) (351) (379) 167 (399) (21) (395) 3 (395) (1)

(Significant) litigations paid (and cashed) (34) (18) (200) 2,217 (314) (115) (295) 18 (296) (2) (297) (2)

Net of acquisitions and disposals (323) (18) (356) (89) - 355 - - - - - -

Subordinated notes issuances & coupons (163) (186) (292) (292) (292) (1) (292) (1) (286) 5 (286) (1)

Dividends to Orange shareholders (1,062) (532) (2,218) (1,595) (1,862) 355 (1,896) (35) (1,929) (34) (2,073) (146)

Minority shareholders remuneration in group subsidiaries (164) (164) (230) (225) (234) (5) (237) (4) (234) 2 (240) (7)

Other financial items (86) (157) (150) (183) (128) 22 (96) 31 (150) (56) (150) (1)

Net financial debt 24,664 26,420 24,832 23,489 24,855 22 23,872 (984) 22,917 (956) 21,906 (1,012)

4. Data per Share - - - -

Number of shares (in millions) 2,660 2,660 2,660 2,660 2,661 2,661

Dividend per share for fiscal year 0.45 0.70 0.72 0.74 0.74 0.79

*comparable basis: unaudited figures, subject to adjustments.

GROUP - comparable basis

revenues (1) EBITDAaL (1) eCAPEX (1) B/S (2)

in M€ Currency

egyptian egyptian egyptian egyptian

Total euros zloty pound other Total euros zloty pound other Total euros zloty pound other zloty pound

1Q20

actual per currency EUR 10,394 7,874 640 220 1,660 2,601 1,954 158 72 417 1,580 1,266 79 30 204

euro exchange rate applied in 1Q20 1.00 4.32 17.37 1.00 4.32 17.37 1.00 4.32 17.37 4.55 17.34

euro exchange rate applied in 1Q21 1.00 4.54 18.92 1.00 4.54 18.92 1.00 4.54 18.92 4.65 18.46

forex impact EUR (122) (31) (18) (73) (29) (7) (6) (16) (14) (4) (2) (8)

perimeter impact (3) EUR (6) (6) (0) 0 (4) 0 4 0 (0)

1Q20 comparable basis EUR 10,265 7,868 609 202 1,587 2,573 1,950 151 67 405 1,566 1,266 76 28 196

2Q20

actual per currency EUR 10,375 7,874 620 211 1,670 3,312 2,626 162 73 451 1,576 1,181 106 37 251

euro exchange rate applied in 2Q20 1.00 4.51 17.52 1.00 4.51 17.52 1.00 4.51 17.52 4.46 18.15

euro exchange rate applied in 2Q21 1.00 4.46 19.68 1.00 4.46 19.68 1.00 4.46 19.68 4.50 19.30

forex impact EUR (76) (3) (15) (57) (25) (2) (5) (18) (10) (1) (3) (6)

perimeter impact (3) EUR (12) (3) (9) (1) (5) (0) 3 0 (0)

2Q20 comparable basis EUR 10,288 7,871 617 196 1,604 3,286 2,622 160 67 437 1,565 1,181 105 35 245

1H20

actual per currency EUR 20,769 15,748 1,260 432 3,330 5,914 4,580 320 145 868 3,156 2,447 186 67 456

euro exchange rate applied in 1H20 1.00 4.41 17.44 1.00 4.41 17.44 1.00 4.41 17.44 4.46 18.15

euro exchange rate applied in 1H21 1.00 4.50 19.30 1.00 4.50 19.30 1.00 4.50 19.30 4.50 19.30

forex impact EUR (198) (34) (33) (130) (54) (9) (11) (34) (25) (5) (5) (14)

perimeter impact (3) EUR (18) (9) (9) (1) (8) 7 0 (0)

1H20 comparable basis EUR 20,553 15,738 1,225 398 3,191 5,859 4,572 311 134 842 3,131 2,447 181 62 441

3Q20

actual per currency EUR 10,584 8,047 620 222 1,695 3,584 2,879 167 83 455 1,730 1,366 87 41 235

euro exchange rate applied in 3Q20 1.00 4.44 18.60 1.00 4.44 18.60 1.00 4.44 18.60 4.55 18.48

euro exchange rate applied in 3Q21 1.00 4.50 19.30 1.00 4.50 19.30 1.00 4.50 19.30 4.50 19.30

forex impact EUR (77) 2 (16) (63) (12) 1 (6) (6) (10) 0 (3) (8)

perimeter impact (3) EUR (7) (8) 1 0 (4) 4 (0) 0

3Q20 comparable basis EUR 10,500 8,039 622 206 1,633 3,573 2,875 168 77 452 1,720 1,366 88 38 228

9m20

actual per currency EUR 31,353 23,794 1,880 654 5,025 9,498 7,460 487 228 1,323 4,886 3,813 273 109 691

euro exchange rate applied in 9m20 1.00 4.42 17.83 1.00 4.42 17.83 1.00 4.42 17.83 4.55 18.48 0

euro exchange rate applied in 9m21 1.00 4.50 19.30 1.00 4.50 19.30 1.00 4.50 19.30 4.50 19.30 0

forex impact EUR (275) (32) (50) (193) (65) (8) (17) (40) (35) (5) (8) (22)

perimeter impact (3) EUR (25) (17) (8) (1) (12) 11 0 (0)

9m20 comparable basis EUR 31,053 23,778 1,847 604 4,824 9,432 7,447 479 211 1,294 4,851 3,814 268 100 669

4Q20

actual per currency EUR 10,917 8,228 677 221 1,791 3,182 2,466 143 79 494 2,247 1,740 133 39 335

euro exchange rate applied in 4Q20 1.00 4.51 18.71 1.00 4.51 18.71 1.00 4.51 18.71 4.56 19.25

euro exchange rate applied in 4Q21 1.00 4.50 19.30 1.00 4.50 19.30 1.00 4.50 19.30 4.50 19.30

forex impact EUR (24) 0 (7) (17) (2) 0 (3) (0) (5) (0) (1) (4)

perimeter impact (3) EUR (10) 7 (18) (4) (5) 1 0 (0)

4Q20 comparable basis EUR 10,882 8,235 677 214 1,756 3,176 2,461 144 76 495 2,241 1,740 132 38 331

2H20

actual per currency EUR 21,501 16,275 1,297 443 3,486 6,767 5,346 310 162 949 3,977 3,107 220 80 570

euro exchange rate applied in 2H20 1.00 4.47 18.66 1.00 4.47 18.66 1.00 4.47 18.66 4.56 19.25

euro exchange rate applied in 2H21 1.00 4.50 19.30 1.00 4.50 19.30 1.00 4.50 19.30 4.50 19.30

forex impact EUR (101) 2 (23) (80) (14) 1 (8) (7) (16) (0) (4) (11)

perimeter impact (3) EUR (17) (0) (17) (4) (9) 5 0 (0)

2H20 comparable basis EUR 21,383 16,275 1,299 420 3,389 6,749 5,336 312 153 948 3,961 3,107 220 76 559

FY20

actual per currency EUR 42,270 32,022 2,556 875 6,817 12,680 9,926 630 307 1,817 7,132 5,554 405 147 1,026

euro exchange rate applied in FY20 1.00 4.44 18.05 1.00 4.44 18.05 1.00 4.44 18.05 4.56 19.25

euro exchange rate applied in FY21 1.00 4.50 19.30 1.00 4.50 19.30 1.00 4.50 19.30 4.50 19.30

forex impact EUR (299) (32) (57) (210) (68) (8) (20) (40) (40) (5) (10) (26)

perimeter impact (3) EUR (35) (9) (26) (5) (17) 12 0 (0)

FY20 comparable basis EUR 41,936 32,013 2,524 818 6,580 12,607 9,908 623 287 1,789 7,092 5,554 400 138 1,000

(0) 0 0 (0) (0) 0 0 0

(1) Average exchange rates over the period used to convert the P&L accounts of the group foreign subsidiaries from local currency to euros.

(2) End of period exchange rates used to convert the balance sheet accounts of the group foreign subsidiaries from local currency to euros.

(3) Comparable basis: unaudited figures, subject to adjustments.

You might also like

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- Axiata Data Financials 4Q21bDocument11 pagesAxiata Data Financials 4Q21bhimu_050918No ratings yet

- CorrelationDocument21 pagesCorrelationraviNo ratings yet

- Avis and Herz CarDocument11 pagesAvis and Herz CarSheikhFaizanUl-HaqueNo ratings yet

- Cell Referencing Hack FinishDocument10 pagesCell Referencing Hack FinishDivya DhakalNo ratings yet

- Performance ReportDocument24 pagesPerformance ReportJuan VegaNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- FSP Tuka CheckDocument25 pagesFSP Tuka CheckAlina Binte EjazNo ratings yet

- Aol Time WarnerDocument5 pagesAol Time WarnerIndrama PurbaNo ratings yet

- Nvidia DCFDocument28 pagesNvidia DCFibs56225No ratings yet

- Caso TeuerDocument46 pagesCaso Teuerjoaquin bullNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- CMG Postmortem 2018Document9 pagesCMG Postmortem 2018mweng407No ratings yet

- Facebook Penetration November UpdateDocument3 pagesFacebook Penetration November Updaterob170No ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- Wealth Sizing Model 2021Document1 pageWealth Sizing Model 2021Mufqi MuliaNo ratings yet

- Input: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020EDocument4 pagesInput: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020ERam persadNo ratings yet

- Budget Format V5 31-1-2017 DELDocument99 pagesBudget Format V5 31-1-2017 DELravindranath_kcNo ratings yet

- Z - M&A Data UKDocument21 pagesZ - M&A Data UKKhouseyn IslamovNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Computation of Taxable Income For The F.Y 01.04.13 To 31.03.14 of Mr. RDocument10 pagesComputation of Taxable Income For The F.Y 01.04.13 To 31.03.14 of Mr. RAshutosh SinghNo ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- DCF SBI TemplateDocument7 pagesDCF SBI Templatekeya.bitsembryoNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Datos 3Document8 pagesDatos 3andres felipe cuellar carreñoNo ratings yet

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNo ratings yet

- ACC Cement: Reference ModelDocument21 pagesACC Cement: Reference Modelsparsh jainNo ratings yet

- Raymond AnalysisDocument31 pagesRaymond Analysissanket mehtaNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- Financial Modelling and Analysis ITCDocument9 pagesFinancial Modelling and Analysis ITCPriyam SarangiNo ratings yet

- Cash FlowDocument6 pagesCash Flowahmedmostafaibrahim22No ratings yet

- Excel Shortcut Master KeyDocument15 pagesExcel Shortcut Master KeyBajazid NadžakNo ratings yet

- COVID-19 Weekly Trends by Country - WorldometerDocument1 pageCOVID-19 Weekly Trends by Country - WorldometerDmitry DakhnovskyNo ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Vertical & Horizontal AnalysisDocument11 pagesVertical & Horizontal Analysisstd25732No ratings yet

- Book 1Document32 pagesBook 1deniar fitri andiniNo ratings yet

- CAMPOFRIO RATIOSv1Document15 pagesCAMPOFRIO RATIOSv1Nacho MarijuanNo ratings yet

- PROFIT AND LOSS ACCOUNT (Horizontal Analysis) : P/L of Ambuja Cement Particulars 2017 2018 2019 IncomeDocument4 pagesPROFIT AND LOSS ACCOUNT (Horizontal Analysis) : P/L of Ambuja Cement Particulars 2017 2018 2019 IncomeEashaa SaraogiNo ratings yet

- D.statistical - Appendix (English-2020)Document98 pagesD.statistical - Appendix (English-2020)ArthurNo ratings yet

- NH Forecast 2024Document11 pagesNH Forecast 2024KellyNo ratings yet

- Y2020 Budget PL-NMDocument1 pageY2020 Budget PL-NMBảo AnNo ratings yet

- Forecasted Volume Sold Direct +0% Volume Sold Direct +1% Volume Sold Direct +2% Volume Sold Direct +3%Document5 pagesForecasted Volume Sold Direct +0% Volume Sold Direct +1% Volume Sold Direct +2% Volume Sold Direct +3%gatorcapital123No ratings yet

- Fsa 21311030Document12 pagesFsa 21311030Gangothri AsokNo ratings yet

- Roche Group Financial DataDocument43 pagesRoche Group Financial DataDryTvMusicNo ratings yet

- Dec 2021 enDocument21 pagesDec 2021 enMohammed ShbairNo ratings yet

- AmcDocument19 pagesAmcTimothy RenardusNo ratings yet

- Fashionbi - Loro-Piana FinancialsDocument7 pagesFashionbi - Loro-Piana FinancialsyerazoNo ratings yet

- MGM China BloombergDocument148 pagesMGM China BloombergDaniel HernàndezNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Document11 pagesNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- Sales Report 17th JuneDocument1 pageSales Report 17th JuneAsifNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- Sibanye Stillwater Q32020 Historical StatsDocument14 pagesSibanye Stillwater Q32020 Historical StatsMashudu MbulayeniNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Ford Case Study (LT 11) - Jerry's Edit v2Document31 pagesFord Case Study (LT 11) - Jerry's Edit v2JerryJoshuaDiazNo ratings yet

- Business Case Example 1.1Document15 pagesBusiness Case Example 1.1Sergei MoshenkovNo ratings yet

- Deed of Sale With Right To RepurchaseDocument1 pageDeed of Sale With Right To RepurchaseJeanetteNo ratings yet

- Exchange Rates: Proposed As A Task CourseDocument18 pagesExchange Rates: Proposed As A Task CourseFariz Phoenix Erdhinata100% (1)

- Shobhan Dey PDFDocument3 pagesShobhan Dey PDFPulkit KothariNo ratings yet

- Globalization and Trends in Management System End Chapter QuizzesDocument23 pagesGlobalization and Trends in Management System End Chapter Quizzeschanfa3851No ratings yet

- Mathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Document6 pagesMathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Kenneth NuñezNo ratings yet

- Financial Accounting - User Guide: Release R15.000Document66 pagesFinancial Accounting - User Guide: Release R15.000Yousra Hafid100% (1)

- Financial Markets and Institutions - PART1Document75 pagesFinancial Markets and Institutions - PART1shweta_46664100% (3)

- Exchange Rate Concepts: Dr. TinaikarDocument39 pagesExchange Rate Concepts: Dr. TinaikarMUKESH KUMARNo ratings yet

- Closing Case Caterpillar IncDocument3 pagesClosing Case Caterpillar InczaheerkhanafridiNo ratings yet

- Blue Ray Aviation Private Limited Begumpet - 306 - 27-11-2023Document1 pageBlue Ray Aviation Private Limited Begumpet - 306 - 27-11-2023anandNo ratings yet

- IBA, Main Campus: Regulations of Financial MarketsDocument50 pagesIBA, Main Campus: Regulations of Financial MarketsOmer CrestianiNo ratings yet

- LC RemittanceDocument3 pagesLC Remittancemuhammad shahid ullahNo ratings yet

- Forex - An Overview: Compiled By: CA Sapna JainDocument35 pagesForex - An Overview: Compiled By: CA Sapna JainbittunewNo ratings yet

- Forex Assassin Outside DayDocument19 pagesForex Assassin Outside DayDavidNo ratings yet

- Coinlend ReportDocument14 pagesCoinlend Reportlautaro oyuelaNo ratings yet

- Finacle 10 Commands PDFDocument49 pagesFinacle 10 Commands PDFSam JebaduraiNo ratings yet

- Project On Forex, Finance SpecializationDocument69 pagesProject On Forex, Finance SpecializationHritwik AryaNo ratings yet

- FMM Ch-2 Money - Exchange SystemDocument15 pagesFMM Ch-2 Money - Exchange SystemMeenal SinglaNo ratings yet

- Financial ManagementDocument44 pagesFinancial ManagementMadhurendra KumarNo ratings yet

- Summer Internship Project Report: On Market Mapping and Credit Card SourcingDocument35 pagesSummer Internship Project Report: On Market Mapping and Credit Card SourcingMRINALMILLAN ROUTRAYNo ratings yet

- Nadex Binary Option BookletDocument16 pagesNadex Binary Option BookletsimontaniousNo ratings yet

- Derivatives Case StudyDocument4 pagesDerivatives Case StudyPavnesh KumarNo ratings yet

- International Business 7th Edition Wild Test BankDocument40 pagesInternational Business 7th Edition Wild Test Banklegacycoupablemf2100% (30)

- Asset Liability ManagementDocument10 pagesAsset Liability ManagementAnonymous x5odvnNV50% (2)

- Concept Map-Investments (Singson, DM)Document11 pagesConcept Map-Investments (Singson, DM)Donna Mae SingsonNo ratings yet

- Bretton Wood SystemDocument12 pagesBretton Wood SystemKiara RuelaNo ratings yet

- Cracked Forex Tools - Clients Mirror Trader ManualDocument38 pagesCracked Forex Tools - Clients Mirror Trader ManualquackmNo ratings yet

- Asset Liability Management in YES Bank: A Final Project ReportDocument68 pagesAsset Liability Management in YES Bank: A Final Project ReportUjwal JaiswalNo ratings yet

- Complete Trading Guide On Trading Order Blocks Smart Money ConceptDocument5 pagesComplete Trading Guide On Trading Order Blocks Smart Money ConceptRobiyanto Wedha100% (2)

- Reliance Power Limited - ProspectusDocument379 pagesReliance Power Limited - ProspectusSampath Kumar100% (2)