Professional Documents

Culture Documents

Request For Waiver of Penalty For Failure To File And/or Pay Electronically

Uploaded by

Sai BodduOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Request For Waiver of Penalty For Failure To File And/or Pay Electronically

Uploaded by

Sai BodduCopyright:

Available Formats

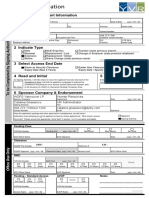

89-225

(7-15) *8922500W071501*

PRINT FORM RESET FORM

*8922500W071501*

* 8 9 2 2 5 0 0 W 0 7 1 5 0 1 *

Request for Waiver of Penalty for

Failure to File and/or Pay Electronically You have certain rights under Chapters 552 and 559, Government Code,

to review, request and correct information we have on file about you.

Contact us at the address or phone number listed on this form.

Taxpayer Information

a. Taxpayer name b. Texas 11-digit taxpayer number

Electronic Reporting Penalty Waiver (If you have more than one request, be sure to list each request separately.)

a. b. e.

Ending date for

Tax Type Year

each waiver request

Select Tax Type Select Ending Date Year

Select Tax Type Select Ending Date Year

Select Tax Type Select Ending Date Year

Electronic Penalty Waiver Reason

Briefly explain why the fee for failing to file or pay electronically should be waived.

Contact Information

Preferred contact method (Check one.)

Email Mail

Company/requestor’s name (if different from the taxpayer) Date

Sep. 9, 2019; 11:59 am

First and last name Job title

Email Phone (Area code and number)

Address City State ZIP code

Send your completed request by mail, email or FAX.

Comptroller of Public Accounts eft.waivers@cpa.texas.gov

Attn: Electronic Reporting Section SEND WAIVER REQUEST BY EMAIL

111 E. 17th St.

Austin, TX 78774-0100 FAX:512-936-0008

If you need additional information about requesting a waiver, call us at 1-800-531-5441, extension 33630.

All waivers are worked in the order they are received. Allow 28 days for us to contact you.

You might also like

- Georgia State Board of Workers' Compensation: EmployeeDocument1 pageGeorgia State Board of Workers' Compensation: EmployeejeffdandelNo ratings yet

- 2023 Winter Storm Penalty WaiverDocument2 pages2023 Winter Storm Penalty WaiverFOX54 News HuntsvilleNo ratings yet

- Disbur Form Series 100-500, 800 & 801Document12 pagesDisbur Form Series 100-500, 800 & 801Geno GottschallNo ratings yet

- Loan Modification Package Empire MSDocument14 pagesLoan Modification Package Empire MSjeff499No ratings yet

- 1341241234Document3 pages1341241234Jam GarciaNo ratings yet

- Pastor MarlenDocument8 pagesPastor Marlenjessem01No ratings yet

- Ryan M Scharetg TMobile BillDocument3 pagesRyan M Scharetg TMobile BillJonathan Seagull LivingstonNo ratings yet

- Georgia State Board of Workers' Compensation: Attorney Withdrawal / LienDocument1 pageGeorgia State Board of Workers' Compensation: Attorney Withdrawal / LienjeffdandelNo ratings yet

- Software Products Billing Information: Product AmountDocument2 pagesSoftware Products Billing Information: Product AmountindiaNo ratings yet

- Jefferson Township OPRA Request FormDocument4 pagesJefferson Township OPRA Request FormThe Citizens CampaignNo ratings yet

- AMY PALINGCOD DOBSON TMobile BillDocument3 pagesAMY PALINGCOD DOBSON TMobile BillJonathan Seagull Livingston100% (1)

- Three Easy Ways To Apply For Your Experian® Credit ReportDocument2 pagesThree Easy Ways To Apply For Your Experian® Credit ReportrushyanthNo ratings yet

- NEW Preapproval LA Package NC 2022Document5 pagesNEW Preapproval LA Package NC 2022PamelaNo ratings yet

- Application For Handling RefrigerantsDocument3 pagesApplication For Handling RefrigerantsAhmed AzadNo ratings yet

- John P Mauro TMobile BillDocument2 pagesJohn P Mauro TMobile BillAlex NeziNo ratings yet

- Motor Claim FormDocument4 pagesMotor Claim FormYash SharmaNo ratings yet

- Commercial Tenant Information FormDocument8 pagesCommercial Tenant Information FormYangee PeñaflorNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument11 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJazella IlejayNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument10 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJordan Raji JrLcNo ratings yet

- Liebherr USA Customer ApplicationDocument5 pagesLiebherr USA Customer ApplicationAngel CruzNo ratings yet

- Part 1 - Application For Duplicate Utah TitleDocument1 pagePart 1 - Application For Duplicate Utah TitleLaura FrekiNo ratings yet

- Same-Day Worksheet 1010Document2 pagesSame-Day Worksheet 1010Hans GadamerNo ratings yet

- REV105 - Rebate-Refund Form - Fillable - 0Document1 pageREV105 - Rebate-Refund Form - Fillable - 0Alexander DaltonNo ratings yet

- Contract Proposal UD Single SiteDocument2 pagesContract Proposal UD Single SiteChughtai AshrafNo ratings yet

- Sample Lease AbstractsDocument18 pagesSample Lease Abstractsrc0191000No ratings yet

- Order ACT Test Information Release FormDocument1 pageOrder ACT Test Information Release FormSusan WerbNo ratings yet

- Service Terms: Transaction DetailsDocument1 pageService Terms: Transaction DetailsČårl-Ünløćkēr EdouardNo ratings yet

- Roselle, NJ OPRA Request FormDocument2 pagesRoselle, NJ OPRA Request FormVeritas155No ratings yet

- ApplicationDocument2 pagesApplicationFabian SandovalNo ratings yet

- Amend/Lienholder Maintenance/ Duplicate Title Application: Service TypeDocument2 pagesAmend/Lienholder Maintenance/ Duplicate Title Application: Service TypeAlexander DaltonNo ratings yet

- a-YVR RAIC Extension - CGDocument1 pagea-YVR RAIC Extension - CGRobin NgNo ratings yet

- Rental Application CA SafeRentDocument2 pagesRental Application CA SafeRentMichael SnyderNo ratings yet

- Property InformationDocument8 pagesProperty Informationapi-25314129No ratings yet

- 02 - HomesteadExemption-WilliamsonCo-2010Document2 pages02 - HomesteadExemption-WilliamsonCo-2010Jairo GrovesNo ratings yet

- Notice of Failure To Present Certificate of Title - Vessel or WatercraftDocument1 pageNotice of Failure To Present Certificate of Title - Vessel or WatercraftJesse GibsonNo ratings yet

- Request SC Tax Return CopyDocument2 pagesRequest SC Tax Return CopyAsjsjsjsNo ratings yet

- 60 Sycamore ST Rental ApplicationDocument2 pages60 Sycamore ST Rental ApplicationSasha PerigoNo ratings yet

- TSD Partnership Tax Return 700 2018Document5 pagesTSD Partnership Tax Return 700 2018Anonymous 7xLWMndehNo ratings yet

- Form 03 App MCD Minor DebtDocument7 pagesForm 03 App MCD Minor DebtJohn StokesNo ratings yet

- C Ujeniuc 2Document17 pagesC Ujeniuc 2cujeniucYAHOO.COMNo ratings yet

- Refunds: What Type of Refund Are You Applying For?Document2 pagesRefunds: What Type of Refund Are You Applying For?Vinamra GuptaNo ratings yet

- Undertaking To File An Income Tax Return by A Non-ResidentDocument2 pagesUndertaking To File An Income Tax Return by A Non-ResidentjessiechowemailNo ratings yet

- Residential GeothermalDocument2 pagesResidential GeothermalsandyolkowskiNo ratings yet

- US Internal Revenue Service: f8878 - 2002Document2 pagesUS Internal Revenue Service: f8878 - 2002IRSNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument9 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeAdrián Vázquez SolísNo ratings yet

- Downloadable Rental Ledger TemplateDocument4 pagesDownloadable Rental Ledger TemplatemaroNo ratings yet

- Utility Application PDFDocument1 pageUtility Application PDFTravis JohansenNo ratings yet

- Holder Refund and Reimbursement Request Form: Indemnification and Affidavit of OfficerDocument1 pageHolder Refund and Reimbursement Request Form: Indemnification and Affidavit of OfficerPhyliss RobinsonNo ratings yet

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Document2 pagesPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgNo ratings yet

- Claim For Refund and Request For Abatement: See Separate InstructionsDocument1 pageClaim For Refund and Request For Abatement: See Separate InstructionsYang JeanNo ratings yet

- Formulario HoneywellDocument1 pageFormulario HoneywellTomas PorrecaNo ratings yet

- PDF 0093 Annual Report Request FormDocument1 pagePDF 0093 Annual Report Request FormAdolfo Montero TerretoNo ratings yet

- Labour FormsDocument59 pagesLabour FormsUnited Conservative Party CaucusNo ratings yet

- dr841 FillableDocument2 pagesdr841 FillableAsjsjsjsNo ratings yet

- DownloadDocument1 pageDownloadGeeta shaghasiNo ratings yet

- GeorgiPetrov Past BillsDocument2 pagesGeorgiPetrov Past Billsgeorgi.georgiev.petrovNo ratings yet

- Request For A Copy of Exempt or Political Organization IRS FormDocument1 pageRequest For A Copy of Exempt or Political Organization IRS FormMike SiscoNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Everthing You Need To Know To Start An Auto DealershipFrom EverandEverthing You Need To Know To Start An Auto DealershipRating: 5 out of 5 stars5/5 (1)

- How To Model A Gateway Service Based On CDS View For ABAP Using SADLDocument3 pagesHow To Model A Gateway Service Based On CDS View For ABAP Using SADLSai BodduNo ratings yet

- Select Case When Then When Then When Then Else End From OrderbyDocument21 pagesSelect Case When Then When Then When Then Else End From OrderbySai BodduNo ratings yet

- Consonant Tongue Twisters Exercise Twisters With "T" and "TH"Document9 pagesConsonant Tongue Twisters Exercise Twisters With "T" and "TH"Sai BodduNo ratings yet

- Notes HereDocument1 pageNotes HereSai BodduNo ratings yet

- BW CLassDocument2 pagesBW CLassSai BodduNo ratings yet

- Validation INPUTDocument1 pageValidation INPUTSai BodduNo ratings yet

- Source SQL or Hana or BW Ms Acess DB (Motors)Document2 pagesSource SQL or Hana or BW Ms Acess DB (Motors)Sai BodduNo ratings yet

- Phonics Rules and Spelling RulesDocument6 pagesPhonics Rules and Spelling RulesZakir UllahNo ratings yet

- AnteDocument1 pageAnteRoshan DalanjaNo ratings yet

- List of Suffixes and Their Influence On Word Stress: Suffix - Ade - Aire - Ee - Eer - Ese - Ette - Oo - Que - Sce - OonDocument4 pagesList of Suffixes and Their Influence On Word Stress: Suffix - Ade - Aire - Ee - Eer - Ese - Ette - Oo - Que - Sce - OongaladrielinNo ratings yet

- Deepen Your Voice in Days with Proven ExercisesDocument1 pageDeepen Your Voice in Days with Proven ExercisesSai BodduNo ratings yet

- Vocal Cord Strengthening Exercises: X26029 (05/11) ©AHC VoiceDocument1 pageVocal Cord Strengthening Exercises: X26029 (05/11) ©AHC VoiceSai BodduNo ratings yet

- Complete Slides For Module 10 PDFDocument35 pagesComplete Slides For Module 10 PDFhiryanizamNo ratings yet

- Consonant Tongue Twisters Exercise Twisters With "T" and "TH"Document9 pagesConsonant Tongue Twisters Exercise Twisters With "T" and "TH"Sai BodduNo ratings yet

- Soundz Tongue TwistersDocument27 pagesSoundz Tongue TwistersSai BodduNo ratings yet

- Eng WordsDocument91 pagesEng WordsSai Boddu100% (1)

- One Syllable: Stressed: PAY Drive GoodDocument4 pagesOne Syllable: Stressed: PAY Drive GoodboddulNo ratings yet

- Voice Projection ExercisesDocument10 pagesVoice Projection ExercisesSai BodduNo ratings yet

- Articulation Exercises (AKA - Tongue Twisters)Document52 pagesArticulation Exercises (AKA - Tongue Twisters)Sai BodduNo ratings yet

- AnteDocument1 pageAnteRoshan DalanjaNo ratings yet

- Soundz Tongue TwistersDocument27 pagesSoundz Tongue TwistersSai BodduNo ratings yet

- !!!!!!!pronunciationDocument54 pages!!!!!!!pronunciationSai BodduNo ratings yet

- 1617 Robertson ShariDocument10 pages1617 Robertson ShariSai BodduNo ratings yet

- "A Person's A Person, No Matter How Small": 10 Dr. Seuss Quotes To Frame Your Online Marketing StrategyDocument12 pages"A Person's A Person, No Matter How Small": 10 Dr. Seuss Quotes To Frame Your Online Marketing StrategyboddulNo ratings yet

- Raushanah N. Butler, MBA, MPMDocument12 pagesRaushanah N. Butler, MBA, MPMSai BodduNo ratings yet

- 22 SongsDocument14 pages22 SongsSai BodduNo ratings yet

- Voice Projection ExercisesDocument10 pagesVoice Projection ExercisesSai BodduNo ratings yet

- Tongue Twister, Students' Pronunciation Ability, and Learning StylesDocument20 pagesTongue Twister, Students' Pronunciation Ability, and Learning StylesSai BodduNo ratings yet

- ABAP Chapter 3: Open SQL Internal TableDocument101 pagesABAP Chapter 3: Open SQL Internal TableArun Varshney (MULAYAM)No ratings yet

- 8 Unique Ways To Practice EnglDocument6 pages8 Unique Ways To Practice EnglSai BodduNo ratings yet

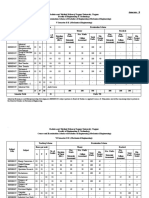

- Auditing Case 3Document12 pagesAuditing Case 3Kenny Mulvenna100% (6)

- Affidavit Defends Wife's InnocenceDocument6 pagesAffidavit Defends Wife's InnocenceGreggy LawNo ratings yet

- Azbil - SS2 DEO412 0010 02Document12 pagesAzbil - SS2 DEO412 0010 02Magoroku D. YudhoNo ratings yet

- Toshiba X-Ray Tube Product InfoDocument10 pagesToshiba X-Ray Tube Product InfoJairo ManzanedaNo ratings yet

- Acquisition of SharesDocument3 pagesAcquisition of SharesChaudhary Mohsin RazaNo ratings yet

- Tax2win's Growth Strategy Through Comprehensive Tax SolutionsDocument6 pagesTax2win's Growth Strategy Through Comprehensive Tax SolutionsAhmar AyubNo ratings yet

- Anand FDocument76 pagesAnand FSunil BharadwajNo ratings yet

- Bomani Barton vs. Kyu An and City of Austin For Alleged Excessive Use of ForceDocument16 pagesBomani Barton vs. Kyu An and City of Austin For Alleged Excessive Use of ForceAnonymous Pb39klJNo ratings yet

- Title Page - Super King Air C90CGTi FusionDocument2 pagesTitle Page - Super King Air C90CGTi Fusionsergio0% (1)

- Internship Report On: "Training and Development of Bengal Group of Industries."Document47 pagesInternship Report On: "Training and Development of Bengal Group of Industries."Lucy NguyenNo ratings yet

- AOC AW INSP 010 Rev04 AOC Base Inspection ChecklistDocument6 pagesAOC AW INSP 010 Rev04 AOC Base Inspection ChecklistAddisuNo ratings yet

- Indian Standard: Methods For Sampling of Clay Building BricksDocument9 pagesIndian Standard: Methods For Sampling of Clay Building BricksAnonymous i6zgzUvNo ratings yet

- Lista 04-09-19Document6 pagesLista 04-09-19comunik1977No ratings yet

- Nasrullah March23Document11 pagesNasrullah March23Angellin JoiceNo ratings yet

- Lucsuhin National High School Daily Lesson Plan on Accounting ConceptsDocument6 pagesLucsuhin National High School Daily Lesson Plan on Accounting ConceptsALMA ACUNANo ratings yet

- Mechanical Engineering Semester SchemeDocument35 pagesMechanical Engineering Semester Schemesantvan jagtapNo ratings yet

- Oatey2021 CommercialCat LCS1146B 022421 WEB LR 1Document204 pagesOatey2021 CommercialCat LCS1146B 022421 WEB LR 1Pablo CINo ratings yet

- Order From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedDocument9 pagesOrder From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedBeau YarbroughNo ratings yet

- PMDC Renewal FormDocument3 pagesPMDC Renewal FormAmjad Ali100% (1)

- Sample PresentationDocument26 pagesSample PresentationMitali MishraNo ratings yet

- Fazaia College of Education For WomenDocument10 pagesFazaia College of Education For WomenZahra TahirNo ratings yet

- J-19-16-III - Bengali - FDocument24 pagesJ-19-16-III - Bengali - FDebayanbasu.juNo ratings yet

- KEB GM 2014 3 - enDocument109 pagesKEB GM 2014 3 - envankarpNo ratings yet

- Dee ChuanDocument4 pagesDee ChuanBurn-Cindy AbadNo ratings yet

- Automatic Transaxle and Transfer Workshop Manual Aw6A-El Aw6Ax-ElDocument212 pagesAutomatic Transaxle and Transfer Workshop Manual Aw6A-El Aw6Ax-ElVIDAL ALEJANDRO GARCIAVARGASNo ratings yet

- Designing An AirshipDocument100 pagesDesigning An AirshipFrik van der Merwe100% (2)

- SolidWorks Motion Tutorial 2010Document31 pagesSolidWorks Motion Tutorial 2010Hector Adan Lopez GarciaNo ratings yet

- Geotextile Its Application To Civil Engineering ODocument7 pagesGeotextile Its Application To Civil Engineering OezequilNo ratings yet

- Lb-Xp12-350-Pd-En-V1.3-201912 - EquivalenteDocument2 pagesLb-Xp12-350-Pd-En-V1.3-201912 - EquivalenteDaniel Oliveira Freitas RochaNo ratings yet

- Kirkpatricks ModelDocument2 pagesKirkpatricks Modelnazia_ahmed_10No ratings yet