Professional Documents

Culture Documents

Consumer Study Buying Bahaviors

Consumer Study Buying Bahaviors

Uploaded by

vishal sinhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Study Buying Bahaviors

Consumer Study Buying Bahaviors

Uploaded by

vishal sinhaCopyright:

Available Formats

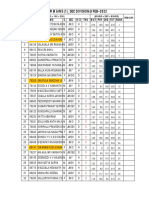

CONSUMER STUDY SOURCE: Marketplace Insights

Buying Behaviors

To better understand the buying habits of today’s tire customer, we offer the results

55%

of a study conducted by Marketplace Insights titled, Consumer Study: Buying Behaviors. In

this section, we provide data related to what factors influence the consumers’ tire purchase

decision process as a means to know how to better communicate and engage with them.

This national study was drawn from more than 10,000 interviews with recent tire and

service buyers in 26 metro markets across the U.S.

For more information about Marketplace Insights or their other research offerings,

of respondents

contact Steve Schroeder at steve@mpinsights.com or at 440.365.5872, ext. 3. TR were women

Income Age of consumer

Less than $20,000 11% 18-29..................40%

$20,000 but less than $40,000 20% 30-49.................... 27%

$40,000 but less than $60,000 20% 50-64.................... 22%

$60,000 but less than $75,000 17% 65 or older........... 11%

$75,000 but less than $100,000 18%

$100,000 or more 13%

Preferred not to answer 1% Most important

40%

factors in last tire Price

92%

purchase

Price....................40%

33%

Brand.................... 33%

of respondents 27%

Store..................... 27%

own their vehicle

Actions before making a purchase

Researched on the internet......................................55%

Visited tire retailers........................................................37%

Talked to an auto service professional..........................33%

Talked to friends, relatives or coworkers.......................31%

Called tire retailers.........................................................30%

Read ads (newspaper, TV, radio, magazines or mail)....28%

Used Facebook or Twitter..............................................23%

Read reviews in magazines (i.e. Consumer Reports).....17%

Looked in the yellow pages...........................................11%

No research....................................................................11%

34 TIREREVIEW.COM • AUGUST 2019

CONSUMER STUDY SOURCE: Marketplace Insights

Why did you purchase tires where you did?

Price, sale, discount, rebate.....................................52%

Convenient location.......................................................42%

Good past experience...................................................38%

Good selection of tire brands........................................37%

Fast, quick service..........................................................36%

Availability of tires .........................................................35%

Good reputation............................................................33%

Friendly, trustworthy personnel.....................................33%

Free tire rotation or lifetime tire rotation......................26%

Mileage warranties.........................................................20%

Convenient hours...........................................................18%

Recommended by a friend or relative...........................17%

Retailer had many locations...........................................14%

Recommended by mechanic, or retailer.......................13%

Credit availability...........................................................11%

Advertising in newspaper, television, radio or mail......10%

Other warranties..............................................................8%

Car was already there for service....................................7%

Members of rewards program

89%

68%

of respondents are more likely 32%

to shop with retailers who offer

a rewards program Yes No

Likelihood of using an emailed coupon

Very likely...........60%

39%

Likely.................... 24% of respondents used a

Somewhat likely... 13% retailer coupon at their

Not at all likely....... 3% last auto service visit.

36 TIREREVIEW.COM • AUGUST 2019

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Havanna FosterDocument1 pageHavanna Fosterapi-359632806No ratings yet

- Lus Cp31 Vel DWG Ar 00024Document1 pageLus Cp31 Vel DWG Ar 00024AjmeerNo ratings yet

- Unity For Human BeingsDocument354 pagesUnity For Human BeingsChiragNo ratings yet

- Life of People in SlumsDocument51 pagesLife of People in SlumsPrabhdeep Kaur80% (5)

- Singapore Mathematical Olympiads 2011 (By Tay Seng Et Al)Document64 pagesSingapore Mathematical Olympiads 2011 (By Tay Seng Et Al)saulpantojaNo ratings yet

- On NewspaperDocument25 pagesOn Newspapervishal sinhaNo ratings yet

- All JDDocument90 pagesAll JDvishal sinhaNo ratings yet

- Steel SuppliersDocument11 pagesSteel Suppliersvishal sinhaNo ratings yet

- Job Description Assignmnet 1 Student Info: Profile Related To Which SectorDocument31 pagesJob Description Assignmnet 1 Student Info: Profile Related To Which Sectorvishal sinhaNo ratings yet

- Analyzing Newspaper Buying Behavior: Prashant Sharma, Prateek Jain Preeti Ravi Pushker Prasad Raghav KaliaDocument10 pagesAnalyzing Newspaper Buying Behavior: Prashant Sharma, Prateek Jain Preeti Ravi Pushker Prasad Raghav Kaliavishal sinhaNo ratings yet

- Consumer BehaviourDocument10 pagesConsumer Behaviourvishal sinhaNo ratings yet

- BMC Colg WorkDocument3 pagesBMC Colg Workvishal sinhaNo ratings yet

- HUL Finacial RatiosDocument12 pagesHUL Finacial Ratiosvishal sinhaNo ratings yet

- BMC Colg WorkDocument3 pagesBMC Colg Workvishal sinhaNo ratings yet

- HR Practices During Covid and Usage of TechnologyDocument10 pagesHR Practices During Covid and Usage of Technologyvishal sinhaNo ratings yet

- BMC Colg WorkDocument3 pagesBMC Colg Workvishal sinhaNo ratings yet

- BMC Colg WorkDocument3 pagesBMC Colg Workvishal sinhaNo ratings yet

- Based On Structure: M ID C A P F U N DDocument19 pagesBased On Structure: M ID C A P F U N Dvishal sinhaNo ratings yet

- Assignment 3 Organisation Structure - 5 - 6 - 92020070480000Document18 pagesAssignment 3 Organisation Structure - 5 - 6 - 92020070480000vishal sinhaNo ratings yet

- 02 - Summary - Scientific Approach To Research in Physical and Management SciencesDocument1 page02 - Summary - Scientific Approach To Research in Physical and Management Sciencesvishal sinha0% (1)

- Intercom Service ProviderDocument12 pagesIntercom Service Providervishal sinhaNo ratings yet

- Assignment No 2 - 5 - 6 - 920200724100000Document1 pageAssignment No 2 - 5 - 6 - 920200724100000vishal sinhaNo ratings yet

- 01 - FAQ's - MEANING AND TYPES OF RESEARCHDocument7 pages01 - FAQ's - MEANING AND TYPES OF RESEARCHvishal sinhaNo ratings yet

- 02 - Script - Scientific Approach To Research in Physical and Management SciencesDocument9 pages02 - Script - Scientific Approach To Research in Physical and Management Sciencesvishal sinhaNo ratings yet

- Group Project Report MaricoDocument21 pagesGroup Project Report Maricovishal sinhaNo ratings yet

- Pune Institute of Business ManagementDocument15 pagesPune Institute of Business Managementvishal sinhaNo ratings yet

- Assignment 2 Treasure Hunt - 5 - 6 - 920200609110000Document21 pagesAssignment 2 Treasure Hunt - 5 - 6 - 920200609110000vishal sinhaNo ratings yet

- FTM Business Template - Margin AnalysisDocument9 pagesFTM Business Template - Margin AnalysisSofTools LimitedNo ratings yet

- PadedeDocument5 pagesPadedeEstri AmaliyaNo ratings yet

- Fugitive - Post IsandhlwanaDocument14 pagesFugitive - Post IsandhlwanajpNo ratings yet

- BD TTM Neuro Brochure Update Feb 2020 - v1Document2 pagesBD TTM Neuro Brochure Update Feb 2020 - v1Hanh NguyenNo ratings yet

- History of Growth of Hyderabad Chaper IIDocument101 pagesHistory of Growth of Hyderabad Chaper IIMl AgarwalNo ratings yet

- Berger PaintsDocument27 pagesBerger PaintsGyanendra Sharma100% (1)

- DR Abbas Batkhela 02-02-2024Document3 pagesDR Abbas Batkhela 02-02-2024Smart ProNo ratings yet

- Case Study Perception of A Teenager On PDocument42 pagesCase Study Perception of A Teenager On PRome Sapico PaleroNo ratings yet

- AngkongDocument3 pagesAngkongEiginber BelarminoNo ratings yet

- Corrpro CanadaDocument2 pagesCorrpro Canadaosama.shuaibNo ratings yet

- Week: 3 Class / Subject Time Topic/Theme Focus Skill Content Standard Learning Standard Learning ObjectivesDocument9 pagesWeek: 3 Class / Subject Time Topic/Theme Focus Skill Content Standard Learning Standard Learning ObjectivesAlya FarhanaNo ratings yet

- Problem of Polimer PDFDocument33 pagesProblem of Polimer PDFGreggy Praisvito RomadhoniNo ratings yet

- High School Admissions Training PresentationDocument58 pagesHigh School Admissions Training PresentationchimamandaokwuuwaNo ratings yet

- Ulangan Harian Bab 3Document4 pagesUlangan Harian Bab 3Anniza WinandaryNo ratings yet

- Supplementary Specifications and Detail Drawings PDFDocument170 pagesSupplementary Specifications and Detail Drawings PDFSrujan GuptaNo ratings yet

- JR Mains (1) - Sec Division@feb-202Document16 pagesJR Mains (1) - Sec Division@feb-202TIRUMALA IIT AND MEDICAL ACADEMYNo ratings yet

- Mrunal 12 Ethics Case Studies For UPSC With Sample AnswersDocument10 pagesMrunal 12 Ethics Case Studies For UPSC With Sample Answersmuhammedsinask sinasNo ratings yet

- Article IV CITIZENSHIPDocument3 pagesArticle IV CITIZENSHIPItsClarenceNo ratings yet

- BBG Anglais LV2Document11 pagesBBG Anglais LV2Anonymous QhB2OHxB0% (1)

- Dot Matrix 23 XXDocument204 pagesDot Matrix 23 XXhatchett927No ratings yet

- Response To Letter From Danny Alfonso On Unjust Terminations 12-23-16Document2 pagesResponse To Letter From Danny Alfonso On Unjust Terminations 12-23-16Walter E Headley FopNo ratings yet

- May 2 - 9, 2012 Sports ReporterDocument8 pagesMay 2 - 9, 2012 Sports ReporterSportsReporterNo ratings yet

- Topic Personal DevelopmentDocument7 pagesTopic Personal DevelopmentSteffNo ratings yet

- Consti Memory AidDocument2 pagesConsti Memory AidArwella GregorioNo ratings yet

- Cse MP&MC SyllabusDocument5 pagesCse MP&MC SyllabusSenthilraja BNo ratings yet