Professional Documents

Culture Documents

Chapter - 7 Sources of Business Finance: Material Downloaded From SUPERCOP 1/7

Chapter - 7 Sources of Business Finance: Material Downloaded From SUPERCOP 1/7

Uploaded by

Aejaz MohamedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter - 7 Sources of Business Finance: Material Downloaded From SUPERCOP 1/7

Chapter - 7 Sources of Business Finance: Material Downloaded From SUPERCOP 1/7

Uploaded by

Aejaz MohamedCopyright:

Available Formats

CHAPTER - 7

SOURCES OF BUSINESS FINANCE

• Introduction: (14 Marks)

Business cannot be run without money. Funds required to carry out business is called

Business Finance. This chapter throws light on how the finances for the business can be

arranged, what are the sources of funding and what terms and conditions are governed

with each type of funding.

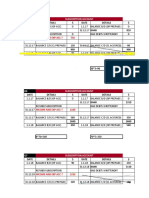

• Sources of Funds :

Material Downloaded From SUPERCOP 1/7

• Share: The amount of capital to be raised from public is divided into units of equal values.

These units are known as SHARE.

Equity (Ordinary) shares are those which do not carry any special or preferential rights.

Equity Share

Merits Demerits

1. Convenience 1. Low dividend

2. No charge on assets 2. Uncertain

3. No obligation 3. Unbalanced growth

4. Dependable 4. Misuse and Speculation

5. Growth and Expansion

Debenture: It constitutes the borrowed funds of the company. It is an acknowledgement of

debt. Debenture capital may be called DEBT CAPITAL.

Material Downloaded From SUPERCOP 2/7

Types Of Debentures

• Secured Unsecured

• Redeemable Irredeemable

• Convertible Non- Convertible

• Registered Bearer

Debentures

Merits Demerits

1. Regular return 1.Charge on assets

2. Safety of investment 2.No voting rights

3. Economic sources 3.Permanent burden of

4. Flexibility interests

5. Tax relief

• Differences between Shares and Debentures

BASIS SHARES DEBENTURES

1.Types of funds Owner's funds Borrowed funds

2.Return Flexible Fixed

3.Voting rights Available No voting rights

4.Status of holders Owners of the company Creditors of the company

5. Redemption Not redeemable Mostly Redeemable

6.Charge No charge on assets Charge on assets

7. Degree of risk for

High Low

holders

• Public deposits:

Material Downloaded From SUPERCOP 3/7

Refers to the unsecured deposits invited by companies from the public. It can invite for a

period of six months to 3 years. Public deposit cannot exceed 25% of its share capital &

resources.

MERITS DEMERITS

1. Simplicity 1. Uncertainty

2. Economical 2. Temporary finance

3. No charge on assets 3.Unsuitable for new

4. No loss on control company

• Lease financing: A lease is a contractual agreement where by the owner of an asset

grants rights to use the asset to other party for rent.

• Short term funds:

1. Trade credit: refers to the credit extended by one trader to another for purchasing

goods or service. Small and new firms are usually more dependent on trade credit.

2. Factoring: It has emerged as a popular source of short term finance. It is a financial

service where by the factor responsible for all credit control and debt collection from the

buyers and provides protection against any bad debt losses to the firm.

Two methods of Factoring

Recourse factoring Non- Recourse factoring

3. Commercial Paper (C.P.): It is an unsecured promissory note issued by firm to raise

funds for a short period says 90 days to 364 days. Only firms having good credit rating can

issue the C.P.

Material Downloaded From SUPERCOP 4/7

• Loans From Commercial Banks

Business can raise finance from commercial banks in the following ways

Term Loan: Cash Credit: Discount of bill: Overdraft:

For medium Interest is Banks provide Current Account

term charged on short term finance holders is allowed

the amount in exchange for to overdraw his

actually bill. A/c.

withdrawn.

• Loans from financial Institutions:

Institutional finance means finance arranged from financial institutions other than

commercial banks like IFCI, ICICI, IDBI, SFI etc.

• International Sources of Finance:

Financial institutions and investors in foreign countries can invest in the shares and

debentures of Indian companies. Two main instruments used by Indian companies to tap

international sources of finance are:

International Sources of Finance

ADR GDR

(American Depository Receipt) (Global Depository Receipt)

1. Rose from equity markets in USA. 1. Traded on a stock exchange

2. Funds from ADR are available in in Europe or US or both.

US Dollars.

3. No broker is needed. Issued only to 2. No voting right

American citizens

• Factors affecting choice of Source of Funds

Material Downloaded From SUPERCOP 5/7

Long term finance is raised through shares and

debentures.

1 TIME PERIOD

Short term finance is raised through trade credit,

commercial paper, etc.

There is least risk on Equity shares as the capital need not

2 RISK

be repaid. But in case of loan, interest has to be paid

Issue of equity shares may lead to dilution of control but

3 CONTROL

debt involves no dilution of control.

Stability of earnings are important because loan should be

4 EARNINGS

raised only when earning are sufficient.

Interest on debenture is tax deductible.

5 TASK IMPACT

Dividend is not tax deductible.

VSA (Very short Answer type questions ) (1mark)

1. What is commercial paper?

2. What is ADR?

3. What is meant by convertible debenture?

4. Explain the term ‘Factoring’?

SA (Short Answer type questions ) (3 or 4 marks)

1. Describe the various types of finance?

2. Explain three sources of owned funds.

3. Explain any two types of preference shares.

4. Explain the advantages of equity share.

LA (Long Answer type questions ) (5 or 6 marks)

1. Distinguish between Equity shares and Preference shares.

2. What are retained profits? Discuss their merits and demerits.

3. Explain the disadvantages of shares.

4. Explain the merits and demerits of public deposits.

HOTS

1. Name the capital invested in permanent assets.

2. What is self financing?

Material Downloaded From SUPERCOP 6/7

3. Name the agreement where by the owner of the asset grants another party

the right to use the asset in return for a periodic payment.

4. Name the funds needed for day to day operations of business.

• Gist of the Lesson:

Finance is the life blood of business.

Business finance is of three types – Long term, Medium term, Short term

There are two sources of business finance – Owned funds, Borrowed funds

Shares are of two types – Equity and Preference shares

Retained profits refer to the undistributed profits which are re-invested in

business.

Debentures are creditor ship security.

ADRS and GDRS are the main International sources of finance.

Material Downloaded From SUPERCOP 7/7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Bobcat Mower Zt7000 Operation and Maintenance Manual 4178816 2020Document23 pagesBobcat Mower Zt7000 Operation and Maintenance Manual 4178816 2020victorbooth231093jbg100% (66)

- 6 Day PPL Split For Strength and Hypertrophy PDFDocument7 pages6 Day PPL Split For Strength and Hypertrophy PDFAnkit Sharma100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsAejaz Mohamed81% (21)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Balance of Payments: Presented by Shamroze SajidDocument18 pagesBalance of Payments: Presented by Shamroze SajidAejaz MohamedNo ratings yet

- Commerce Revision Questions. PDF For FORM 4 and 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 and 5 2021Aejaz Mohamed100% (2)

- Balance of Payment & Balance of TradeDocument11 pagesBalance of Payment & Balance of TradeAejaz MohamedNo ratings yet

- Chapter - 10 International BusinessDocument7 pagesChapter - 10 International BusinessAejaz MohamedNo ratings yet

- Form 4 Paper 1 2020 Batch Term 3 19.3.21Document10 pagesForm 4 Paper 1 2020 Batch Term 3 19.3.21Aejaz MohamedNo ratings yet

- Term 1 - Commerce F4 SOW 2021-2022Document6 pagesTerm 1 - Commerce F4 SOW 2021-2022Aejaz MohamedNo ratings yet

- Commerce 3rd Term Exam Form 3 2020Document9 pagesCommerce 3rd Term Exam Form 3 2020Aejaz MohamedNo ratings yet

- Chapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipDocument10 pagesChapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipAejaz MohamedNo ratings yet

- Chapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Document10 pagesChapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Aejaz MohamedNo ratings yet

- Commerce Revision Questions. PDF For FORM 4 AND 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 AND 5 2021Aejaz MohamedNo ratings yet

- Commerce 3rd Term Exam 2020 Form 3 Answer KeyDocument9 pagesCommerce 3rd Term Exam 2020 Form 3 Answer KeyAejaz MohamedNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- Excel 2016 Basic Quick RefeDocument3 pagesExcel 2016 Basic Quick RefeAejaz MohamedNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- Clubs and Societies Questions 2020 BatchDocument13 pagesClubs and Societies Questions 2020 BatchAejaz MohamedNo ratings yet

- Chapter 6 Types of Leverages-1Document23 pagesChapter 6 Types of Leverages-1Aejaz MohamedNo ratings yet

- Irvin What Is Academic WritingDocument16 pagesIrvin What Is Academic WritingMariya MulrooneyNo ratings yet

- DDP Lab Manuals PhysicsDocument111 pagesDDP Lab Manuals PhysicsHamza RahimNo ratings yet

- Basketball Team Sport: Nba Jersey Sando Men'S Jersey Basketball Teens Size 150.00Document2 pagesBasketball Team Sport: Nba Jersey Sando Men'S Jersey Basketball Teens Size 150.00Bernadeth BaiganNo ratings yet

- Programming Games in Java 2 PDFDocument817 pagesProgramming Games in Java 2 PDFaisl_2No ratings yet

- 348 - 61275 - BA124 - 2018 - 4 - 2 - 1 - Solution Assignment 1-2 - Math2Document13 pages348 - 61275 - BA124 - 2018 - 4 - 2 - 1 - Solution Assignment 1-2 - Math2physics a2100% (1)

- Opportunities in Peru and LACDocument20 pagesOpportunities in Peru and LACOlivia JacksonNo ratings yet

- Mass Flow SiloDocument17 pagesMass Flow SiloBùi Hắc HảiNo ratings yet

- AMS Device Manager Product Data SheetDocument4 pagesAMS Device Manager Product Data Sheetfavi89No ratings yet

- Itp For Gasket - r1Document7 pagesItp For Gasket - r1Hamid Taghipour ArmakiNo ratings yet

- Soul Reaver HD Remaster ManualDocument20 pagesSoul Reaver HD Remaster ManualJose Wadson dos Santos SalesNo ratings yet

- Class Planning: Teacher: Natália Fiorotto Soares Unit: Level/Class: B1 - 1A/1B/1CDocument3 pagesClass Planning: Teacher: Natália Fiorotto Soares Unit: Level/Class: B1 - 1A/1B/1CFernanda English TeacherNo ratings yet

- Maximize: GE Energy-Efficient T5 Linear Fluorescent SystemsDocument16 pagesMaximize: GE Energy-Efficient T5 Linear Fluorescent SystemsabangudaNo ratings yet

- Chemistry TextbookDocument148 pagesChemistry TextbookOtuku DavidNo ratings yet

- Chart of NSM Semantic Primes v15 PDFDocument1 pageChart of NSM Semantic Primes v15 PDFStalyn MercedesNo ratings yet

- Design of Splice ConnectionDocument4 pagesDesign of Splice ConnectionJustinNo ratings yet

- Framing EffectsDocument21 pagesFraming EffectsSheza AksarNo ratings yet

- Drug StudyDocument24 pagesDrug Studyabulan100% (1)

- Sim Pack Part Programmer ManualDocument130 pagesSim Pack Part Programmer Manualfirepower117No ratings yet

- Setup and ConfigDocument2 pagesSetup and Configpradeep kumarNo ratings yet

- Rolling (Metalworking) : From Wikipedia, The Free EncyclopediaDocument12 pagesRolling (Metalworking) : From Wikipedia, The Free Encyclopediarhajtv100% (1)

- Construction Method Statement FOR RCC Boundry Wall With Precast Panel & ColumnDocument8 pagesConstruction Method Statement FOR RCC Boundry Wall With Precast Panel & Columnkhurshidoman123No ratings yet

- EVOLUTION of SHRM, Traditionmodern HRM, Barriers, Role of SHRMDocument27 pagesEVOLUTION of SHRM, Traditionmodern HRM, Barriers, Role of SHRMDr. DhanabagiyamNo ratings yet

- Capital Budget TemplateDocument1 pageCapital Budget TemplaterajvakNo ratings yet

- Intro Units 9-16 Practice Quiz: Unit 9-10 1. Complete The Sentences With A, An, Any, or SomeDocument6 pagesIntro Units 9-16 Practice Quiz: Unit 9-10 1. Complete The Sentences With A, An, Any, or SomeEsther GiannamoreNo ratings yet

- Vision & Strategic Plan NewDocument94 pagesVision & Strategic Plan Newjim lovehiowtNo ratings yet

- T2100 Treadmill: GE HealthcareDocument2 pagesT2100 Treadmill: GE Healthcareelektromedis RsRNo ratings yet

- Ncm113 Oxygenation Viral RhinitisDocument11 pagesNcm113 Oxygenation Viral RhinitisJaka Carina CalicaNo ratings yet

- Food SafetyDocument5 pagesFood Safetylynda abtoucheNo ratings yet