Professional Documents

Culture Documents

Shivani Jain: Work Experience Skills

Uploaded by

The Cultural CommitteeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shivani Jain: Work Experience Skills

Uploaded by

The Cultural CommitteeCopyright:

Available Formats

SHIVANI JAIN

CHARTERED ACCOUNTANT

linkedin.com/in/shivani-jain-55727315

# +91 9711784891 _ shivanijain.sj93@gmail.com

b

97, Street No. 3, Mandoli Extn., Delhi-

+

110093

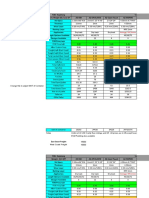

WORK EXPERIENCE SKILLS

Chartered Accountant Accounting Auditing Taxation

Ajay Kanjhlia & Associates

~ 01/2018 - Ongoing + Delhi

Meeting deadlines Decision- Making

Practicing Partnership Chartered Accountant Firm since 1987

Work Profile

Direct Taxation ACHIEVEMENTS

- Conduct of Tax Audit of partnership firms, individuals, joint venture,

companies duly complied with Income Tax Act, 1961 Exemption in 5 Practical Subjects

- Preparation and Filing of Income Tax Return of Individuals, HUF, P in CA Final Exam

Companies and Partnership Firms

(Financial Reporting & Strategic Financial

- Handled and engaged in Income Tax scrutiny cases including

Management, Indirect Tax, Direct Tax &

assessments under section 148 of the Income Tax Act, 1961

Advance Management Accounting)

- Preparation of submissions ad presentation before Income Tax

Authorities for Income Tax Case/Appeals

- Calculation of Income Tax Provision, Deferred Tax, Advance Tax & MAT Scored 95 % Marks in Financial

Provision Accounts in CA Intermediate

- Preparation and filing of TDS Return & related compliance like P Exam

download of TDS Certificates

(IPCE Cleared with 66.5 % marks in First

- Filing of Form 15CB & 15CA for Foreign Transaction

Attempt)

- Handling Tax Compliance assignment related to Direct Tax Laws

Audit & Assurance Services

- Conducting Statutory audit of Manufacturing Units, Real Estate EDUCATION

Companies, Service Sector, Trading entities duly complied with

Accounting Standards and Companies Act, 2013 Chartered Accountancy

- Finalization of Audit Report duly complied with Companies Act, 2013

Institute of Chartered Accountant of

India

Indirect Taxation

- Registration under GST and Finalization of GST Returns and

Reconciliations (GSTR 3B, GSTR 1) Bachelor of Commerce

- Handling of GST compliances of various domains including Real Estate Delhi University

Entities

- Handling and conducting GST Audit along with the preparation of GST

Annual Return of various entities

Senior Secondary

CBSE

Other Areas

- Finalization of Balance Sheet of Company duly complied with Matriculation

Accounting Standards CBSE

- Various Certification work including Tender Certificate, Certificates

under RERA

Associate & Article Assistant LANGUAGES

Ajay Kanjhlia & Associates

English

~ 07/2013 - 11/2017 + Delhi

Proficient

- Accounting, Tax Compliance's, preparation & filing of Income Tax

Return, Auditing, TDS Returns

Hindi

Proficient

www.enhancv.com Powered by

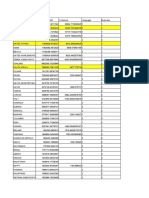

You might also like

- Wa0003.Document2 pagesWa0003.bhoomika rathodNo ratings yet

- Sunny Thakral: Address: 130/28A, Jyoti Park, Near Ashirwad Banquet Garden, Gurgaon-122001Document4 pagesSunny Thakral: Address: 130/28A, Jyoti Park, Near Ashirwad Banquet Garden, Gurgaon-122001The Cultural CommitteeNo ratings yet

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDocument3 pagesSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiNo ratings yet

- Amit Munka: Professional & Academic CredentialsDocument1 pageAmit Munka: Professional & Academic CredentialsAvinash ShelkeNo ratings yet

- Ankur TripathiDocument2 pagesAnkur TripathiThe Cultural CommitteeNo ratings yet

- Munawar Hussain - TufailDocument4 pagesMunawar Hussain - TufailRukhshindaNo ratings yet

- Resume - Sikander - Gupta - (Accounts and Finance)Document2 pagesResume - Sikander - Gupta - (Accounts and Finance)Phanindra GaddeNo ratings yet

- CV - Divya GoyalDocument1 pageCV - Divya GoyalGarima JainNo ratings yet

- Gagandeep Singh AjmaniDocument2 pagesGagandeep Singh AjmaniThe Cultural CommitteeNo ratings yet

- MD Sajjad AnsariDocument2 pagesMD Sajjad AnsariMd sajjad afzalNo ratings yet

- CA Akash Maheshwari's Tax Expertise and ExperienceDocument2 pagesCA Akash Maheshwari's Tax Expertise and ExperienceDivya NinaweNo ratings yet

- ANKIT SINGH RESUME-1Document2 pagesANKIT SINGH RESUME-1miteshvishwakarma92No ratings yet

- Fahad Ahmad CV - Fahad AhmadDocument3 pagesFahad Ahmad CV - Fahad AhmadFahim FerozNo ratings yet

- SagarTendulkar (9 0)Document2 pagesSagarTendulkar (9 0)Pankti PatelNo ratings yet

- Jitendra Prasad: Finance & Accounts ProfessionalDocument2 pagesJitendra Prasad: Finance & Accounts ProfessionalshannabyNo ratings yet

- Pritesh's ResumeDocument1 pagePritesh's Resumepriteshsolanki10761No ratings yet

- Abhijeet Sinha: Career ObjectiveDocument2 pagesAbhijeet Sinha: Career ObjectiveGaurav SharrmaNo ratings yet

- 1.sanish Resume Latest - FinalDocument4 pages1.sanish Resume Latest - FinalBos BosNo ratings yet

- Saurabh ChauhanDocument1 pageSaurabh ChauhanThe Cultural CommitteeNo ratings yet

- CA Rajat Jain: Career ObjectiveDocument3 pagesCA Rajat Jain: Career ObjectiveThe Cultural CommitteeNo ratings yet

- Profile Summary: Ca Vaibhav KumarDocument3 pagesProfile Summary: Ca Vaibhav KumarThe Cultural CommitteeNo ratings yet

- Resume CA Ummer Rashid - AFMDocument2 pagesResume CA Ummer Rashid - AFMVaibhav VermaNo ratings yet

- Resume Rishabh SinhaDocument1 pageResume Rishabh SinhayashikaNo ratings yet

- Ajay Ahuja - ResumeDocument3 pagesAjay Ahuja - ResumemcocatanaNo ratings yet

- CA Finalist's Expertise in Audit, Taxation and Financial ReportingDocument5 pagesCA Finalist's Expertise in Audit, Taxation and Financial ReportingkhurramNo ratings yet

- Fahad C.VDocument4 pagesFahad C.VMisbhasaeedaNo ratings yet

- SwathiBindu CA - Resume - Business FinanceDocument2 pagesSwathiBindu CA - Resume - Business Financetvishwap39No ratings yet

- Ahmad Hamid CVDocument2 pagesAhmad Hamid CVHekmat AsefiNo ratings yet

- Major NotesDocument32 pagesMajor NotesMolina, Beatrice Alessandra C.No ratings yet

- Dharmendra Singh CV For Internal Audit ProfileDocument2 pagesDharmendra Singh CV For Internal Audit ProfileDharmendra SinghNo ratings yet

- Kunal Kumar ResumeDocument3 pagesKunal Kumar Resumekunal kumarNo ratings yet

- Naukri GauravBahuguna (3y 0m)Document2 pagesNaukri GauravBahuguna (3y 0m)taxmanagerNo ratings yet

- Nisha ResumeDocument2 pagesNisha ResumePratik IngaleNo ratings yet

- Shweta Shahade: AddressDocument2 pagesShweta Shahade: AddressShweta TatheNo ratings yet

- Resume ShahabDocument2 pagesResume Shahabnasir elahiNo ratings yet

- CA Divanshu Jindal's ResumeDocument3 pagesCA Divanshu Jindal's Resumetul SanwalNo ratings yet

- CV - CA Nikhil TandonDocument2 pagesCV - CA Nikhil TandonRahul GoyalNo ratings yet

- Muhammad Tanzeel, Acma, Cgma, Uk: Accounting & Finance Professional With 10 Year of UAE, Oman and Pakistan ExperienceDocument3 pagesMuhammad Tanzeel, Acma, Cgma, Uk: Accounting & Finance Professional With 10 Year of UAE, Oman and Pakistan Experienceadnan ahmadNo ratings yet

- Curriculum Vitae: Career ObjectiveDocument2 pagesCurriculum Vitae: Career ObjectiveJItender SharmaNo ratings yet

- Garima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265Document3 pagesGarima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265The Cultural CommitteeNo ratings yet

- Accountant Cum AdminDocument1 pageAccountant Cum AdminNimil A SNo ratings yet

- Interim ReportDocument19 pagesInterim ReportKunvar MattewalNo ratings yet

- Experienced Taxation & Accounts ProfessionalDocument2 pagesExperienced Taxation & Accounts Professionalrajat guptaNo ratings yet

- Especia Associates Business ProfileDocument13 pagesEspecia Associates Business ProfileHarshil GoyalNo ratings yet

- Resume Kapil UpretiDocument2 pagesResume Kapil UpretipawanchatgptNo ratings yet

- Resume Ravi BansalDocument2 pagesResume Ravi Bansalaasthapoddar155No ratings yet

- 11th Commerce 3 MarksDocument5 pages11th Commerce 3 Marksts varshaNo ratings yet

- CV Ca Ankit MaheshwaryDocument2 pagesCV Ca Ankit MaheshwaryAman MathurNo ratings yet

- Mohammed Khan (SR Accountant) KSA Wup CCDocument21 pagesMohammed Khan (SR Accountant) KSA Wup CCftimum1No ratings yet

- Finance & Accounts Leader with 12+ Years of ExperienceDocument4 pagesFinance & Accounts Leader with 12+ Years of ExperienceNiveditha RajNo ratings yet

- Resume AbadDocument2 pagesResume AbadpiyushNo ratings yet

- Resume (Iqra Tanveer)Document2 pagesResume (Iqra Tanveer)ArslanNo ratings yet

- Template - 24 - 1655438656Document4 pagesTemplate - 24 - 1655438656Ranjit SinghNo ratings yet

- CFAS Module Week 1-2Document11 pagesCFAS Module Week 1-2Yamit, Angel Marie A.No ratings yet

- Younus Arif CVDocument2 pagesYounus Arif CVMisbhasaeedaNo ratings yet

- Akshita Vijay: Work Experience EducationDocument1 pageAkshita Vijay: Work Experience EducationRahul KarkhanisNo ratings yet

- Kunalmandot: Work Experience Technical and Soft SkillsDocument1 pageKunalmandot: Work Experience Technical and Soft SkillsMukul SuhalkaNo ratings yet

- Mukesh Rauniyar Semi CA For AppealDocument8 pagesMukesh Rauniyar Semi CA For AppealAnuj TiwariNo ratings yet

- Tax Accountant Professional With 13+ Years ExperienceDocument3 pagesTax Accountant Professional With 13+ Years ExperienceGreen Sustain EnergyNo ratings yet

- Panjiva US - Imports All Results - 10001 - To - 20000 - of - 1003630 2022 02 08 06 52Document13,606 pagesPanjiva US - Imports All Results - 10001 - To - 20000 - of - 1003630 2022 02 08 06 52The Cultural CommitteeNo ratings yet

- Panjiva US - Imports All Results - 110001 - To - 120000 - of - 1003630 2022 02 08 07 18Document13,681 pagesPanjiva US - Imports All Results - 110001 - To - 120000 - of - 1003630 2022 02 08 07 18The Cultural CommitteeNo ratings yet

- Vitenam Export To USA HSN 94 (Repaired)Document3,016 pagesVitenam Export To USA HSN 94 (Repaired)The Cultural CommitteeNo ratings yet

- Documents: What Are The Requirements For A Vietnam Business Visa?Document2 pagesDocuments: What Are The Requirements For A Vietnam Business Visa?The Cultural CommitteeNo ratings yet

- Panjiva US - Imports All Results - 100001 - To - 110000 - of - 1003630 2022 02 08 07 06Document13,683 pagesPanjiva US - Imports All Results - 100001 - To - 110000 - of - 1003630 2022 02 08 07 06The Cultural CommitteeNo ratings yet

- Panjiva US - Imports All Results - 1 - To - 10000 - of - 1003630 2022 02 08 07 24Document13,986 pagesPanjiva US - Imports All Results - 1 - To - 10000 - of - 1003630 2022 02 08 07 24The Cultural CommitteeNo ratings yet

- Panjiva US - Imports All Results - 70001 - To - 80000 - of - 1003630 2022 02 08 07 00Document13,678 pagesPanjiva US - Imports All Results - 70001 - To - 80000 - of - 1003630 2022 02 08 07 00The Cultural CommitteeNo ratings yet

- Panjiva US - Imports All Results - 90001 - To - 100000 - of - 1003630 2022 02 08 06 54Document13,787 pagesPanjiva US - Imports All Results - 90001 - To - 100000 - of - 1003630 2022 02 08 06 54The Cultural CommitteeNo ratings yet

- Panjiva US - Imports All Results - 50001 - To - 60000 - of - 1003630 2022 02 08 07 19Document13,666 pagesPanjiva US - Imports All Results - 50001 - To - 60000 - of - 1003630 2022 02 08 07 19The Cultural CommitteeNo ratings yet

- Risk Management and ALMDocument93 pagesRisk Management and ALMThe Cultural CommitteeNo ratings yet

- Marketing Interview Questions: Your Quick Guide ToDocument2 pagesMarketing Interview Questions: Your Quick Guide ToThe Cultural CommitteeNo ratings yet

- ICICI Bank - Case Study AnalysisDocument10 pagesICICI Bank - Case Study AnalysisThe Cultural CommitteeNo ratings yet

- Technology Driven Banking ServicesDocument28 pagesTechnology Driven Banking ServicesThe Cultural CommitteeNo ratings yet

- Rural Finance and Micro FinanceDocument32 pagesRural Finance and Micro FinanceThe Cultural CommitteeNo ratings yet

- Banking Overview and RegulationsDocument70 pagesBanking Overview and RegulationsThe Cultural CommitteeNo ratings yet

- KYC and Anti Money Laundering NormsDocument7 pagesKYC and Anti Money Laundering NormsThe Cultural CommitteeNo ratings yet

- Design and Pricing of Deposit ServicesDocument37 pagesDesign and Pricing of Deposit ServicesThe Cultural CommitteeNo ratings yet

- Panjiva-supplier-Vinyl Tile-Results 1 To 22 of 22Document16 pagesPanjiva-supplier-Vinyl Tile-Results 1 To 22 of 22The Cultural CommitteeNo ratings yet

- Credit Management Process GuideDocument14 pagesCredit Management Process GuideThe Cultural CommitteeNo ratings yet

- Ac-C-H9090 3d Model (Rev A)Document1 pageAc-C-H9090 3d Model (Rev A)The Cultural CommitteeNo ratings yet

- Ford Fiesta Case AnalysisDocument4 pagesFord Fiesta Case AnalysisMukesh Ranjan100% (1)

- Marketing and Operations - Case StudyDocument1 pageMarketing and Operations - Case StudyThe Cultural CommitteeNo ratings yet

- Ac-C-H9060 3d Model (Rev A)Document1 pageAc-C-H9060 3d Model (Rev A)The Cultural CommitteeNo ratings yet

- Vietnam Supplier DetailsDocument542 pagesVietnam Supplier DetailsThe Cultural CommitteeNo ratings yet

- Panjiva-supplier-Vinyl-results 1 To 259 of 259Document172 pagesPanjiva-supplier-Vinyl-results 1 To 259 of 259The Cultural CommitteeNo ratings yet

- 4727 Waterside Cabinets and CountertopsDocument8 pages4727 Waterside Cabinets and CountertopsThe Cultural CommitteeNo ratings yet

- Vietnam SPC - Vinyl Price ListDocument9 pagesVietnam SPC - Vinyl Price ListThe Cultural CommitteeNo ratings yet

- All Month InsightsDocument398 pagesAll Month InsightsThe Cultural CommitteeNo ratings yet

- Country Total Sums and Container DataDocument15 pagesCountry Total Sums and Container DataThe Cultural CommitteeNo ratings yet

- Albania Ceramic Tile Companies TiranaDocument190 pagesAlbania Ceramic Tile Companies TiranaThe Cultural CommitteeNo ratings yet

- Government Budget and The EconomyDocument8 pagesGovernment Budget and The EconomyAryan Rawat100% (1)

- TARC3 RD ReportDocument328 pagesTARC3 RD Reportnewguyat77No ratings yet

- Taxation I Midterm ReviewerDocument16 pagesTaxation I Midterm ReviewerKaren CueNo ratings yet

- Manila Electric Company vs. VeraDocument14 pagesManila Electric Company vs. VeraMrln VloriaNo ratings yet

- Unit - 5: 1 Define E-Way Bill ?Document21 pagesUnit - 5: 1 Define E-Way Bill ?Sara SowjanyaNo ratings yet

- Health Economics With Taxation and Land ReformDocument45 pagesHealth Economics With Taxation and Land Reformkreelala100% (5)

- I.T Unit 1Document9 pagesI.T Unit 1Gowtham R GowthamNo ratings yet

- Chapter I: Introduction of Study: Goods and Service Tax (GST)Document73 pagesChapter I: Introduction of Study: Goods and Service Tax (GST)Prajakta KambleNo ratings yet

- Golden Bell Challenge: Acca F6 Taxation - June 2019Document215 pagesGolden Bell Challenge: Acca F6 Taxation - June 2019Phương NguyễnNo ratings yet

- General Principles of Taxation Part 1-1Document47 pagesGeneral Principles of Taxation Part 1-1Van TisbeNo ratings yet

- Wa0014.Document15 pagesWa0014.No nameNo ratings yet

- Ategory: Details of Possible Complaints Relating To TheaccountDocument45 pagesAtegory: Details of Possible Complaints Relating To TheaccountKen Lati100% (1)

- Chapter 2 - Taxes, Tax Laws and AdministrationDocument3 pagesChapter 2 - Taxes, Tax Laws and AdministrationAEONGHAE RYNo ratings yet

- Direct & Indirect TaxesDocument33 pagesDirect & Indirect Taxesdinanikarim50% (2)

- Principles of Taxation Paper 2.6march 2023Document18 pagesPrinciples of Taxation Paper 2.6march 2023Victory NyamburaNo ratings yet

- Thesis Patern of Hazara University Mansehra M.phil NewDocument51 pagesThesis Patern of Hazara University Mansehra M.phil NewIrfan Ullah100% (1)

- Tax Sample AssignmentDocument7 pagesTax Sample AssignmentAli SiddiqueNo ratings yet

- Tax Suggested Answers (1994-2006) - NoRestrictionDocument143 pagesTax Suggested Answers (1994-2006) - NoRestrictiondenjo bonillaNo ratings yet

- GST QB by CA Pranav ChandakDocument153 pagesGST QB by CA Pranav ChandakPreetam PatidarNo ratings yet

- Tax Assessment and Collection Related Problem (In Case of Sawla Town Revenue Authority)Document31 pagesTax Assessment and Collection Related Problem (In Case of Sawla Town Revenue Authority)ዕንቁ ሥላሴ100% (1)

- ACCT101 - MidtermsDocument15 pagesACCT101 - MidtermsNicole Anne Santiago SibuloNo ratings yet

- Notes Law of TaxationDocument272 pagesNotes Law of TaxationAditya AshokNo ratings yet

- Direct and Indirect TaxDocument3 pagesDirect and Indirect TaxKb AliNo ratings yet

- DSSC Taxation Law Mid Term ModuleDocument77 pagesDSSC Taxation Law Mid Term ModuleJetroy DiazNo ratings yet

- Unit 1 TaxationDocument72 pagesUnit 1 TaxationAnshul SinghNo ratings yet

- BBA.5 (Unit.1 Introduction To Direct Tax, Residential Status and Income Under The Head of SalariesDocument66 pagesBBA.5 (Unit.1 Introduction To Direct Tax, Residential Status and Income Under The Head of SalariesMihir AsnaniNo ratings yet

- Sheniblog-Sslc-Social Science 2 - All - Chapters-EmDocument48 pagesSheniblog-Sslc-Social Science 2 - All - Chapters-Emgm1650045No ratings yet

- Taxation: GlossaryDocument8 pagesTaxation: GlossarySara PattersonNo ratings yet

- Clubbing of Income-10Document7 pagesClubbing of Income-10s4sahithNo ratings yet

- Tax Midterm ReviewerDocument32 pagesTax Midterm ReviewerJunivenReyUmadhayNo ratings yet