Professional Documents

Culture Documents

Revised Withholding Tax Table: Daily 1 2 3 4 5 6

Uploaded by

Maureen Pascual0 ratings0% found this document useful (0 votes)

9 views2 pagesWITHHOLDING TAX

Original Title

Annex E RR 11-2018

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWITHHOLDING TAX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesRevised Withholding Tax Table: Daily 1 2 3 4 5 6

Uploaded by

Maureen PascualWITHHOLDING TAX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

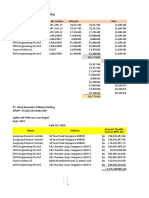

ANNEX “E”

REVISED WITHHOLDING TAX TABLE

Effective January 1, 2023 and onwards

DAILY 1 2 3 4 5 6

P 685 and P 685 – P 1,095 P 1,096 – P 2,191 P 2,192 – P 5,478 P 5,479 – P 21,917 P 21,918 and above

Compensation Range

below

Prescribed 0.00 0.00 P 61.65 P 280.85 P 1,102.60 P 6,034.00.30

Withholding Tax + 15% over P 685 + 20% over P 1,096 + 25% over P2,192 + 30% over P 5,479 + 35% over P 21,918

WEEKLY 1 2 3 4 5 6

P 4,808 P 4,808 – P 7,691 P 7,692 – P 15,384 P 15,385 – P 38,461 P 38,462 – P 153,845 P 153,846 and above

Compensation Range and

below

Prescribed 0.00 0.00 P 432.60 P 1,971.20 P 7,740.45 P 42,355.65

Withholding Tax + 15% over P 4,808 + 20% over P 7,692 + 25% over P 15,385 + 30% over P 38,462 + 35% over P 153,846

SEMI-MONTHLY 1 2 3 4 5 6

P 10,417 P 10,417 – P 16,666 P 16,667 – P 33,332 P 33,333 – P 83,332 P 83,333 – P 333,332 P 333,333 and above

Compensation Range and

below

Prescribed 0.00 0.00 P 937.50 P 4,270.70 P 16,770.70 P 91,770.70

Withholding Tax + 15% over P 10,417 + 20% over P 16,667 + 25% over P 33,333 + 30% over P 83,333 + 35% over P 333,333

MONTHLY 1 2 3 4 5 6

P 20,833 P 20,833 – P 33,332 P 33,333 – P66,666 P 66,667 – P 166,666 P 166,667 – P666,666 P 666,667 and above

Compensation Range and

below

Prescribed 0.00 0.00 P 1,875.00 P 8,541.80 P 33,541.80 P 183,541.80

Withholding Tax + 15% over P 20,833 + 20% over P 33,333 + 25% over P 66,667 + 30% over P 166,667 + 35% over P 666,667

ANNEX “E”

You might also like

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- Taxation - Withholding TaxDocument15 pagesTaxation - Withholding TaxJohn Francis IdananNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- DroneTech Organization Chart PDFDocument1 pageDroneTech Organization Chart PDFPrincess Grace DucaoNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- Income Tax On Employed Taxpayer and Mixed Income EarnerDocument20 pagesIncome Tax On Employed Taxpayer and Mixed Income EarnerFritzie Grace C. FraycoNo ratings yet

- Noeken Und Partner To Demi̇rtürk Ltd. 02.02.2023Document9 pagesNoeken Und Partner To Demi̇rtürk Ltd. 02.02.2023İbrahim Kocak0% (1)

- PRTC TAX-1stPB 0522 220221 091723Document16 pagesPRTC TAX-1stPB 0522 220221 091723MOTC INTERNAL AUDIT SECTIONNo ratings yet

- Train LawDocument23 pagesTrain LawDennis BudanoNo ratings yet

- Law 3 Case DigestDocument3 pagesLaw 3 Case DigestMarianne Dell Oberes100% (1)

- Trimble Precision IQ Application Manuel Utilisateur v2BDocument343 pagesTrimble Precision IQ Application Manuel Utilisateur v2BOlivier LequebinNo ratings yet

- The Nature of The Social Work TaskDocument11 pagesThe Nature of The Social Work Taskronaldzamora100% (1)

- Annex E RR 11-2018Document2 pagesAnnex E RR 11-2018Bernardino PacificAceNo ratings yet

- 2023 WT Table Annex E RR 11-2018Document2 pages2023 WT Table Annex E RR 11-2018Cee MoralesNo ratings yet

- Annex D RR 11-2018Document1 pageAnnex D RR 11-2018Maureen PascualNo ratings yet

- RR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFDocument1 pageRR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFRiña Lizte AlteradoNo ratings yet

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Document1 pageRevised Withholding Tax Table: Daily 1 2 3 4 5 6Renzo Ross Certeza SarteNo ratings yet

- Annex D RR 11-2018-Revised Witholding Tax TableDocument1 pageAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNo ratings yet

- Annex D RR 11-2018 PDFDocument1 pageAnnex D RR 11-2018 PDFKarl Anthony MargateNo ratings yet

- Revised Withholding Tax TableDocument2 pagesRevised Withholding Tax TableNina CastilloNo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Withholding Tax Table 2019Document1 pageWithholding Tax Table 2019Gelie RaelNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Document10 pagesRevised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Raymundo EirahNo ratings yet

- Minimum Wage Earners: (Return To Index)Document11 pagesMinimum Wage Earners: (Return To Index)Shaina Jane LibiranNo ratings yet

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Document9 pagesTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNo ratings yet

- Tax TableDocument9 pagesTax TableRenz VillaramaNo ratings yet

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Document9 pagesTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNo ratings yet

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Document9 pagesTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNo ratings yet

- OCA Circular No. 35-2024Document4 pagesOCA Circular No. 35-2024tpr1nc3ss6No ratings yet

- Daily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022Document2 pagesDaily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022DENR-NCR Legal DivisionNo ratings yet

- Pag-Ibig: Monthly Compensation Employee Share Employer ShareDocument6 pagesPag-Ibig: Monthly Compensation Employee Share Employer ShareJun Wilson MawiratNo ratings yet

- WHT TableDocument2 pagesWHT TableJoneric RamosNo ratings yet

- Witthholding Tax TableDocument2 pagesWitthholding Tax TableFrenzy PopperNo ratings yet

- Tax TablesDocument6 pagesTax TablesGeromil HernandezNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Withholding Taxes & Tax TablesDocument9 pagesWithholding Taxes & Tax Tableslloyd limNo ratings yet

- BIR Withholding Tax Table Effective January 1, 2023Document3 pagesBIR Withholding Tax Table Effective January 1, 2023Gennelyn OdulioNo ratings yet

- PRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressDocument16 pagesPRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressNovemae CollamatNo ratings yet

- I - Problem On PayrollDocument39 pagesI - Problem On PayrollHazel Joy UgatesNo ratings yet

- WITHHOLDING TAX TABLE RenzoDocument1 pageWITHHOLDING TAX TABLE RenzoAshrill DumpNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Planilla Tributaria Form608Document4 pagesPlanilla Tributaria Form608Jose Alvaro Choque MamaniNo ratings yet

- Train by SGV ColorDocument32 pagesTrain by SGV ColorFlorenz AmbasNo ratings yet

- 9S-2B Corporation Forecasted Income StatementDocument5 pages9S-2B Corporation Forecasted Income StatementFlora Fil GutierrezNo ratings yet

- Car AnalysisDocument16 pagesCar AnalysisShaira GimpayanNo ratings yet

- FinMan DLSUD Mid-Term Exam April 11 2019Document4 pagesFinMan DLSUD Mid-Term Exam April 11 2019Raquel ManarpiisNo ratings yet

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Elaine EeDocument1 pageElaine EeMace Jimenez CoNo ratings yet

- Gambar KpaDocument4 pagesGambar KpafazatiaNo ratings yet

- Santiago Villas: Karen House ModelDocument4 pagesSantiago Villas: Karen House ModelJoel ReyesNo ratings yet

- Teste 4 - Geovana Gabriela LettninDocument13 pagesTeste 4 - Geovana Gabriela LettninGeovana LettninNo ratings yet

- Monthly: Old Taxation TablesDocument2 pagesMonthly: Old Taxation TablesBai NiloNo ratings yet

- Terraceincomestatement 16Document3 pagesTerraceincomestatement 16api-354468897No ratings yet

- 1604C 2 MWE TemplateDocument20 pages1604C 2 MWE TemplateJayrick BuencaminoNo ratings yet

- Self Declaration Form Ay 2022-23-ArthisDocument7 pagesSelf Declaration Form Ay 2022-23-ArthisMurugesan JeevaNo ratings yet

- L1f19bsaf0065 Sec B Assign 2 2 1Document7 pagesL1f19bsaf0065 Sec B Assign 2 2 1mistayia brunettaNo ratings yet

- Santiago Villas: Gloria House ModelDocument4 pagesSantiago Villas: Gloria House ModelJoel ReyesNo ratings yet

- Jawaban Tugas Ka RezaDocument15 pagesJawaban Tugas Ka Rezaraja fascalNo ratings yet

- 48451rmc No. 1-2010Document3 pages48451rmc No. 1-2010Maureen PascualNo ratings yet

- Annex C RR 11-2018Document2 pagesAnnex C RR 11-2018Maureen PascualNo ratings yet

- Bureau of Internal RevenueDocument6 pagesBureau of Internal RevenueMaureen PascualNo ratings yet

- Fficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Document1 pageFficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Maureen PascualNo ratings yet

- 2200-T Jan 2020 ENCS Final Annex BDocument3 pages2200-T Jan 2020 ENCS Final Annex BMaureen PascualNo ratings yet

- 2200-AN Jan 2018 ENCS Annex ADocument2 pages2200-AN Jan 2018 ENCS Annex AMaureen PascualNo ratings yet

- Return RMC No. 132-2020 Annex ADocument2 pagesReturn RMC No. 132-2020 Annex AMaureen PascualNo ratings yet

- 2200-A Jan 2020 ENCS Final Annex ADocument3 pages2200-A Jan 2020 ENCS Final Annex AMaureen PascualNo ratings yet

- Excise RMC No. 6-2021 Annex ADocument2 pagesExcise RMC No. 6-2021 Annex AMaureen PascualNo ratings yet

- STFAP Bracket B CertificationDocument1 pageSTFAP Bracket B CertificationlabellejolieNo ratings yet

- Volenti Non Fit Injuria A Critical AnalysisDocument7 pagesVolenti Non Fit Injuria A Critical AnalysisAruna PadalaNo ratings yet

- 10 - Jocson Vs CA, GR L-553322, February 16, 2006Document5 pages10 - Jocson Vs CA, GR L-553322, February 16, 2006romeo stodNo ratings yet

- Civil Procedure Reading AssignmentDocument1 pageCivil Procedure Reading AssignmentJacking1No ratings yet

- Advanced Accounting CHAPTER 1Document20 pagesAdvanced Accounting CHAPTER 1Natsumi T. Viceral0% (2)

- American Government Final Exam Fall 2021Document11 pagesAmerican Government Final Exam Fall 2021Lauren ColeNo ratings yet

- Ruks Konsult and Construction vs. Adworld Sign and Advertising CorporationDocument7 pagesRuks Konsult and Construction vs. Adworld Sign and Advertising Corporationpaul esparagozaNo ratings yet

- Role of Press in IndiaDocument13 pagesRole of Press in IndiaAkash Shrivastava100% (4)

- Lesson 19Document1 pageLesson 19Paul JonesNo ratings yet

- Tort Law Exam Questions and AnswersDocument7 pagesTort Law Exam Questions and AnswersAhmed IbrahimNo ratings yet

- Ramos Case-DigestDocument2 pagesRamos Case-DigestKervy Sanell Salazar100% (1)

- Case Digests - Corporation LawDocument37 pagesCase Digests - Corporation LawFrancis Jan Ax ValerioNo ratings yet

- SAMED v. SEGUTAMBYDocument20 pagesSAMED v. SEGUTAMBYBinendriNo ratings yet

- Evidence Self Mock BarDocument7 pagesEvidence Self Mock BarNeil AntipalaNo ratings yet

- Legal Research What Is Legal Research?Document15 pagesLegal Research What Is Legal Research?SLV LEARNINGNo ratings yet

- Application Form For Ec Arn - 23-2002062178Document3 pagesApplication Form For Ec Arn - 23-2002062178Ricardo GlendaNo ratings yet

- Moot PropositionDocument3 pagesMoot PropositionAradhya HemkeNo ratings yet

- Governing Texas 2nd Edition Champagne Test BankDocument13 pagesGoverning Texas 2nd Edition Champagne Test BankJessicaHardysrbxd100% (12)

- Under 18 Guidance and Consent Form 2020Document6 pagesUnder 18 Guidance and Consent Form 2020sudhansh kumarNo ratings yet

- Remolante vs. TibeDocument8 pagesRemolante vs. TibeEmrys PendragonNo ratings yet

- Iqbal Ismail V State of MaharashtraDocument11 pagesIqbal Ismail V State of Maharashtrasagar jainNo ratings yet

- Fundamental Rules of PleadingDocument12 pagesFundamental Rules of PleadingRahul Tiwari100% (2)

- Legal and Social Controversies in LiveDocument14 pagesLegal and Social Controversies in LiveV.Baskaran VenuNo ratings yet

- New Zealand: Arbitration GuideDocument30 pagesNew Zealand: Arbitration GuideKashaf JunaidNo ratings yet

- Estacode 2019Document1,043 pagesEstacode 2019Abubakar Zubair100% (4)