Professional Documents

Culture Documents

Diagnostic Test Lpu

Diagnostic Test Lpu

Uploaded by

FLOYD MORPHEUSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diagnostic Test Lpu

Diagnostic Test Lpu

Uploaded by

FLOYD MORPHEUSCopyright:

Available Formats

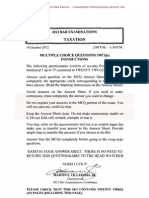

DIAGNOSTIC TEST

TRAIN LAW

1. What is the highest tax rate for individuals receiving purely compensation income?

2. Who can avail of the 8% final tax?

3. What is the tax on sale of an apartment building being rented out?

4. Are Filipino nurses working abroad subject to Philippine income tax?

5. Is there an optional standard deduction for income tax purposes for both individual and

corporate?

6. Will an estate have an optional standard deduction, if the decedent died in 2018?

7. If donor’s and estate tax rates are the same at 6%, will there be any difference in the tax

payable? Under what circumstances?

8. What are the three groups of taxpayers in terms of VAT rates?

9. What is the difference between input VAT and output VAT?

10. What are the applicable taxes in case of sale of shares of stock?

CREATE LAW

11. Give a provision in the NIRC that was repealed by CREATE.

12. What is now the tax rate of nonprofit, nonstock educational institutions?

13. What are the new corporate income tax rates?

14. When did the CREATE Law become effective?

15. What is the change in the net operating loss carry-over (NOLCO) under CREATE?

16. Give two corporate taxpayers which are now taxed at a higher income tax rate.

17. What is now the VAT threshold for sale of land that is not a capital asset?

18. What are the changes effected by CREATE on VAT? Give 2.

19. Cite two provisions under CREATE that are time bound.

20. How did the passing of CREATE affect Section 40(C) of the NIRC?

You might also like

- The Book on Advanced Tax Strategies: Cracking the Code for Savvy Real Estate InvestorsFrom EverandThe Book on Advanced Tax Strategies: Cracking the Code for Savvy Real Estate InvestorsRating: 4.5 out of 5 stars4.5/5 (3)

- CHAPTER5Document16 pagesCHAPTER5Bisag Asa88% (8)

- TEST I: MCQ - THEORY: (1 Point Each) : B. Resident Citizen D. C. Tax Laws Shall Prevail Over GAAPDocument1 pageTEST I: MCQ - THEORY: (1 Point Each) : B. Resident Citizen D. C. Tax Laws Shall Prevail Over GAAPJoe Mari100% (1)

- Chapter 7 Introduction To Regular Income TaxDocument76 pagesChapter 7 Introduction To Regular Income TaxANGELU RANE BAGARES INTOLNo ratings yet

- Income-Tax-Banggawan 2019-cr7 Compress Income-Tax-Banggawan 2019-cr7 CompressDocument11 pagesIncome-Tax-Banggawan 2019-cr7 Compress Income-Tax-Banggawan 2019-cr7 CompressEarth PirapatNo ratings yet

- Tax Banggawan2019 Ch15BDocument17 pagesTax Banggawan2019 Ch15BNoreen Ledda100% (1)

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- Trinidad & Tobago TaxDocument26 pagesTrinidad & Tobago TaxHaydn Dunn100% (4)

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Dy - 2017 Tax 2 RecitsDocument6 pagesDy - 2017 Tax 2 RecitsJAIRA MANAOISNo ratings yet

- General Principles of Taxation - Sample CasesDocument2 pagesGeneral Principles of Taxation - Sample CasesJace Tanaya100% (1)

- Special Exam. Income Taxation 1Document2 pagesSpecial Exam. Income Taxation 1Joyce Amara VosotrosNo ratings yet

- Tax 1 Summative 1 Multiple ChoiceDocument3 pagesTax 1 Summative 1 Multiple ChoiceVon Andrei MedinaNo ratings yet

- Income Tax ExamDocument4 pagesIncome Tax ExamErwin Labayog Medina0% (1)

- Direct & Indirect Tax QuestionsDocument6 pagesDirect & Indirect Tax QuestionsSaiful FaisalNo ratings yet

- Taxprelimsf ADocument4 pagesTaxprelimsf AKierr Lanea RaliNo ratings yet

- Tax Answers at A Glance 2015 - 16 - H M Williams Chartered AccountaDocument265 pagesTax Answers at A Glance 2015 - 16 - H M Williams Chartered AccountaAnonymous IZJqiRv0oKNo ratings yet

- Theories On TaxationDocument3 pagesTheories On TaxationYamateNo ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- 2012 TaxDocument20 pages2012 TaxvenickeeNo ratings yet

- Taxation UK ACCA F6Document9 pagesTaxation UK ACCA F6Ankit DubeyNo ratings yet

- 5 6253255697580950335Document7 pages5 6253255697580950335Kathleen LucasNo ratings yet

- Summative Assessment 01Document5 pagesSummative Assessment 01cpabirreplyNo ratings yet

- TAX 1 AssignmentDocument3 pagesTAX 1 AssignmentSamae RuantoNo ratings yet

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesNo ratings yet

- Changes in New Direct Tax Cod1Document10 pagesChanges in New Direct Tax Cod1Somit ParNo ratings yet

- Chapter5-Self-Test ExercisesDocument10 pagesChapter5-Self-Test ExercisesNeighvestNo ratings yet

- Faqs - Create LawDocument13 pagesFaqs - Create LawMichy De GuzmanNo ratings yet

- 2023-Exercises Law 1Document9 pages2023-Exercises Law 1abelonalysa0No ratings yet

- TIF Problems 11 21 2019 PDFDocument360 pagesTIF Problems 11 21 2019 PDFomar mcintoshNo ratings yet

- A 3 - Taxation-LawDocument53 pagesA 3 - Taxation-LawRei Clarence De AsisNo ratings yet

- Vito, Activity 7Document5 pagesVito, Activity 7Steph AnieNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- VAT - MCQ Test Questions by Mahbub SirDocument16 pagesVAT - MCQ Test Questions by Mahbub SirAysha Alam100% (1)

- Quiz SummaryDocument13 pagesQuiz SummarydancinhomerNo ratings yet

- Taxation ReviewerDocument14 pagesTaxation Reviewerralfgerwin inesaNo ratings yet

- Assessment 2 Tax 1Document5 pagesAssessment 2 Tax 1Judy Ann GacetaNo ratings yet

- A and B Are IncorrectDocument6 pagesA and B Are IncorrectdgdeguzmanNo ratings yet

- Tax2 Dy Recit QsDocument9 pagesTax2 Dy Recit QsNoypi TayooNo ratings yet

- Comprehensive Income Taxation Somera (4!29!14)Document200 pagesComprehensive Income Taxation Somera (4!29!14)Moi Warhead0% (1)

- Chapter 11 - International TaxationDocument11 pagesChapter 11 - International TaxationlinaelinaaaNo ratings yet

- SCS 0975 - Module 1 SMB2018Document13 pagesSCS 0975 - Module 1 SMB2018Deion BalakumarNo ratings yet

- Quiz 7 - Tax On CorporationsDocument14 pagesQuiz 7 - Tax On CorporationsJoyce Anne GarduqueNo ratings yet

- Lesson 1 Tax Administration Tutorial NotesDocument8 pagesLesson 1 Tax Administration Tutorial Notes4mggxj68cyNo ratings yet

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- Take Home Quiz On Taxation Law Prepared By: Prof. AGN Concepts To StudyDocument3 pagesTake Home Quiz On Taxation Law Prepared By: Prof. AGN Concepts To StudyJImlan Sahipa IsmaelNo ratings yet

- PROBLEM EXERCISES in TAXATION Patterned PDFDocument62 pagesPROBLEM EXERCISES in TAXATION Patterned PDFCA DTNo ratings yet

- Yes, Because Goccs Are Essentially Commercial in NatureDocument19 pagesYes, Because Goccs Are Essentially Commercial in NatureAdah Micah PlarisanNo ratings yet

- Test Bank For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida ChenDocument37 pagesTest Bank For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida Chenleggierodoziness.dpupb100% (28)

- Tutorial 7Document6 pagesTutorial 7Lebron BryantNo ratings yet

- The Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketFrom EverandThe Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Financial Crime TrainingDocument264 pagesFinancial Crime TrainingFLOYD MORPHEUS100% (2)

- GQ Best Answers - WRTHDocument33 pagesGQ Best Answers - WRTHFLOYD MORPHEUSNo ratings yet

- Up LB MercantileDocument193 pagesUp LB MercantileFLOYD MORPHEUSNo ratings yet

- Rule 44 - Crispino v. Tansay - ManaloARHSRYJNDocument3 pagesRule 44 - Crispino v. Tansay - ManaloARHSRYJNFLOYD MORPHEUSNo ratings yet

- GQ Best Answers.Document34 pagesGQ Best Answers.FLOYD MORPHEUSNo ratings yet

- CurriculumDocument5 pagesCurriculumFLOYD MORPHEUSNo ratings yet

- RULE 25 - NG Meng Tam V China Bank - MANALO5UE5JE5JE5Document1 pageRULE 25 - NG Meng Tam V China Bank - MANALO5UE5JE5JE5FLOYD MORPHEUSNo ratings yet

- Best Answers RTHRHDocument26 pagesBest Answers RTHRHFLOYD MORPHEUSNo ratings yet

- VOL. 361, JULY 19, 2001 395: Caoibes, Jr. vs. OmbudsmanDocument9 pagesVOL. 361, JULY 19, 2001 395: Caoibes, Jr. vs. OmbudsmanFLOYD MORPHEUSNo ratings yet

- Notes. Because An Order of Expropriation Merely: vs. Phil-Ville Development Housing Corporation, 525 SCRADocument17 pagesNotes. Because An Order of Expropriation Merely: vs. Phil-Ville Development Housing Corporation, 525 SCRAFLOYD MORPHEUS100% (1)

- Civil Law Review Ii Syllabus: Book Iv. Obligations and ContractsDocument4 pagesCivil Law Review Ii Syllabus: Book Iv. Obligations and ContractsFLOYD MORPHEUSNo ratings yet

- EVIDENCE OUTLINE BronceDocument7 pagesEVIDENCE OUTLINE BronceFLOYD MORPHEUSNo ratings yet

- Outline Corp LawDocument22 pagesOutline Corp LawFLOYD MORPHEUSNo ratings yet

- Silot v. de La RosaDocument9 pagesSilot v. de La RosaFLOYD MORPHEUSNo ratings yet

- Casent V PhilbankingDocument13 pagesCasent V PhilbankingFLOYD MORPHEUSNo ratings yet

- Agbayani v. Lupa Realty Holding Corp.20210510-11-1lrs7uaDocument15 pagesAgbayani v. Lupa Realty Holding Corp.20210510-11-1lrs7uaFLOYD MORPHEUSNo ratings yet