Professional Documents

Culture Documents

09 - Income Tax

Uploaded by

Raveendran P MOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09 - Income Tax

Uploaded by

Raveendran P MCopyright:

Available Formats

taxsutra All rights reserved

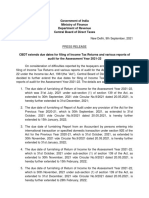

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 9th September, 2021

PRESS RELEASE

CBDT extends due dates for filing of Income Tax Returns and various reports of

audit for the Assessment Year 2021-22

On consideration of difficulties reported by the taxpayers and other stakeholders in

filing of Income Tax Returns and various reports of audit for the Assessment Year 2021-

22 under the Income-tax Act, 1961(the “Act”), Central Board of Direct Taxes (CBDT) has

decided to further extend the due dates for filing of Income Tax Returns and various

reports of audit for the Assessment Year 2021-22. The details are as under:

1. The due date of furnishing of Return of Income for the Assessment Year 2021-22,

which was 31st July, 2021 under sub-section (1) of section 139 of the Act, as

extended to 30th September, 2021 vide Circular No.9/2021 dated 20.05.2021, is

hereby further extended to 31st December, 2021;

2. The due date of furnishing of Report of Audit under any provision of the Act for the

Previous Year 2020-21, which is 30th September, 2021, as extended to 31st

October, 2021 vide Circular No.9/2021 dated 20.05.2021, is hereby further

extended to 15th January, 2022;

3. The due date of furnishing Report from an Accountant by persons entering into

international transaction or specified domestic transaction under section 92E of the

Act for the Previous Year 2020-21, which is 31st October, 2021, as extended to

30th November, 2021 vide Circular No.9/2021 dated 20.05.2021, is hereby further

extended to 31st January, 2022;

4. The due date of furnishing of Return of Income for the Assessment Year 2021-22,

which is 31st October, 2021 under sub-section (1) of section 139 of the Act, as

extended to 30th November, 2021 vide Circular No.9/2021 dated 20.05.2021, is

hereby further extended to 15th February, 2022;

5. The due date of furnishing of Return of Income for the Assessment Year 2021-22,

which is 30th November, 2021 under sub-section (1) of section 139 of the Act, as

extended to 31st December, 2021 vide Circular No.9/2021 dated 20.05.2021, is

hereby further extended to 28th February, 2022;

Downloaded by Pinesh.Bhandari@piramal.com at 09/09/21 07:34pm

taxsutra All rights reserved

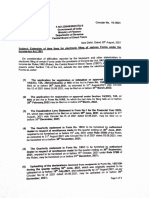

6. The due date of furnishing of belated/revised Return of Income for the Assessment

Year 2021-22, which is 31st December, 2021 under sub-section (4)/sub-section (5)

of section 139 of the Act, as extended to 31st January, 2022, vide Circular

No.9/2021 dated 20.05.2021, is hereby further extended to 31st March, 2022;

It is also clarified that the extension of the dates as referred to in clauses (9), (12)

and (13) of Circular No.9/2021 dated 20.05.2021 and in clauses (1), (4) and (5) above

shall not apply to Explanation 1 to section 234A of the Act, in cases where the amount of

tax on the total income as reduced by the amount as specified in clauses (i) to (vi) of sub-

section (1) of that section exceeds rupees one lakh. Further, in case of an individual

resident in India referred to in sub-section (2) of section 207 of the Act, the tax paid by him

under section 140A of the Act within the due date (without extension under Circular

No.9/2021 dated 20.05.2021 and as above) provided in that Act, shall be deemed to be

the advance tax.

CBDT Circular No.17/2021 in F.No.225/49/2021/ITA-II dated 09.09.2021 issued.

The said Circular is available on www.incometaxindia.gov.in.

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT

Downloaded by Pinesh.Bhandari@piramal.com at 09/09/21 07:34pm

Powered by TCPDF (www.tcpdf.org)

You might also like

- Atul Agarwal IDT Question BankDocument490 pagesAtul Agarwal IDT Question BankSavya Sachi100% (8)

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument2 pagesGovernment of India Ministry of Finance Department of Revenue Central Board of Direct Taxeslakshmi kasthuriNo ratings yet

- CBDT Extends Due Dates For Filing of Income Tax Returns and Various Reports of Audit For Assessment Year 2021-22Document2 pagesCBDT Extends Due Dates For Filing of Income Tax Returns and Various Reports of Audit For Assessment Year 2021-22Raveendran P MNo ratings yet

- Circular 9 2021Document3 pagesCircular 9 2021Camp Asst. to ADGP AdministrationNo ratings yet

- Taxguru - In-Extended Due Dates of Income Tax Return Tax Audit TP AuditDocument5 pagesTaxguru - In-Extended Due Dates of Income Tax Return Tax Audit TP AuditJessica NulphNo ratings yet

- Time For The Income-Tax Act, 1961: Subiect: Extension of Lines Electronic Filing of Various Fomms UnderDocument3 pagesTime For The Income-Tax Act, 1961: Subiect: Extension of Lines Electronic Filing of Various Fomms UnderRambabu TatikondaNo ratings yet

- Cir 2810 2021 9Document2 pagesCir 2810 2021 9vamshiNo ratings yet

- Itr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesDocument1 pageItr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesVittal TalwarNo ratings yet

- Compliance Calendar NovDocument23 pagesCompliance Calendar NovDsp VarmaNo ratings yet

- Circular 1 2023Document1 pageCircular 1 2023KunalKumarNo ratings yet

- Professional Programme (New Syllabus) Supplement FOR Advanced Tax LawsDocument4 pagesProfessional Programme (New Syllabus) Supplement FOR Advanced Tax LawsPriyanga TNo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- Circular 1 2021Document2 pagesCircular 1 2021NESL WebsiteNo ratings yet

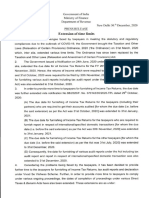

- Press Release Extension of Time Limits - 30 12 2020Document2 pagesPress Release Extension of Time Limits - 30 12 2020Sarang BondeNo ratings yet

- Annexure 1. Extension of Various Key Tax Compliance Under Direct TaxesDocument6 pagesAnnexure 1. Extension of Various Key Tax Compliance Under Direct TaxesJosef AnthonyNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateNaveen kumar MedishettyNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Nov 2021-97th EditionDocument13 pagesNov 2021-97th EditionSwathi JainNo ratings yet

- Tax Laws - Direct TaxDocument45 pagesTax Laws - Direct TaxAnubha PriyaNo ratings yet

- Executive Programme (New Syllabus) Supplement FOR Tax Laws (Part I - Direct Tax)Document21 pagesExecutive Programme (New Syllabus) Supplement FOR Tax Laws (Part I - Direct Tax)Vishnu MotaNo ratings yet

- PressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFDocument2 pagesPressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFSaBoNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument10 pagesSupplement Executive Programme: For June, 2021 ExaminationSP CONTRACTORNo ratings yet

- 25 - MCQ Late Filing Fees and PenaltyDocument11 pages25 - MCQ Late Filing Fees and PenaltyRohit KumarNo ratings yet

- Circular No. 160 - 14 - 2021 - GSTDocument5 pagesCircular No. 160 - 14 - 2021 - GSTCA Ramajayam JayachandranNo ratings yet

- Ey HK Tax Alert 31 Mar 2022 Issue 02 enDocument4 pagesEy HK Tax Alert 31 Mar 2022 Issue 02 en6zt6f6tkxxNo ratings yet

- Press Release CBDT Allows Taxpayers An Opportunity To File Application For Settlement Dated 08 09 2021Document2 pagesPress Release CBDT Allows Taxpayers An Opportunity To File Application For Settlement Dated 08 09 2021lakshmi kasthuriNo ratings yet

- Aino Communique-109EditionDocument12 pagesAino Communique-109EditionSwathi JainNo ratings yet

- Changes in GST Relevant For GST Audit of FY 21-22 - YS - RKSDocument13 pagesChanges in GST Relevant For GST Audit of FY 21-22 - YS - RKSkabathulla shaikNo ratings yet

- Optotax Newletter - March - 2021Document6 pagesOptotax Newletter - March - 2021Atmiya DasNo ratings yet

- Income Tax Amendments by Finance Act, 2021 Relevant For JUNE 2022Document30 pagesIncome Tax Amendments by Finance Act, 2021 Relevant For JUNE 2022yashNo ratings yet

- Circular 20 2022Document1 pageCircular 20 2022Shaikh Mohd HuzaifaNo ratings yet

- CBDT Income Tax Circular 20 2022Document1 pageCBDT Income Tax Circular 20 2022sandeepNo ratings yet

- (2021 Tax Memo) Year-End Tax Compliance RemindersDocument2 pages(2021 Tax Memo) Year-End Tax Compliance RemindersMary Joy BautistaNo ratings yet

- 220303-Circular - Exgratia-Eot - 33 DaysDocument3 pages220303-Circular - Exgratia-Eot - 33 DaysstevenNo ratings yet

- Partial Relaxation With Respect To Electronic Submission of Form 10FDocument2 pagesPartial Relaxation With Respect To Electronic Submission of Form 10FFinance KRIPPLNo ratings yet

- Executive Programme (New Syllabus) Supplement FOR Tax LawsDocument14 pagesExecutive Programme (New Syllabus) Supplement FOR Tax Lawsgopika mundraNo ratings yet

- Aino Communique 110th Dec EditionDocument12 pagesAino Communique 110th Dec EditionSwathi JainNo ratings yet

- Cs Ins 05 2021Document2 pagesCs Ins 05 2021Sri CharanNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Section 168A of CGST Act, 2017 - Invokable or Not?Document16 pagesSection 168A of CGST Act, 2017 - Invokable or Not?CA Sangram K MohantyNo ratings yet

- 2022 Bir Tax CalendarDocument40 pages2022 Bir Tax CalendarRose Ann FrancoNo ratings yet

- Circular On Ex Gratia Extension of Time (Eot) Due To Covid 19 Events For January June 2021 in Public Sector Construction ContractsDocument4 pagesCircular On Ex Gratia Extension of Time (Eot) Due To Covid 19 Events For January June 2021 in Public Sector Construction ContractsProject DirectorNo ratings yet

- GST Update125 PDFDocument6 pagesGST Update125 PDFTharun RajNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Trade Notice No 10-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Document6 pagesTrade Notice No 10-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Gautam jainNo ratings yet

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDocument9 pagesPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNo ratings yet

- Withholding On Other TaxesDocument22 pagesWithholding On Other Taxesdea34.drNo ratings yet

- Circular 14 2022Document3 pagesCircular 14 2022shantXNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- Hansard Report - Tuesday, 5th April 2022 (P)Document58 pagesHansard Report - Tuesday, 5th April 2022 (P)Victor OpiyoNo ratings yet

- Notifications Gist Upto 30.09.2020Document2 pagesNotifications Gist Upto 30.09.2020NishthaNo ratings yet

- 2021NOTICE - Extended Deadlines 2021 31 March 2021Document3 pages2021NOTICE - Extended Deadlines 2021 31 March 2021Eunice SagunNo ratings yet

- MoF IT Extension PR 24.10.2020Document2 pagesMoF IT Extension PR 24.10.2020CA Poonam WaghNo ratings yet

- HedDocument3 pagesHedWajid AliNo ratings yet

- Per 19 BC 2018 VS Per 9 BC 2021Document8 pagesPer 19 BC 2018 VS Per 9 BC 2021yuliaNo ratings yet

- I T, DT: 5 All Secretar Es/csl CBDocument1 pageI T, DT: 5 All Secretar Es/csl CBVijayakumar PonnambalamNo ratings yet

- Aino Communique 108th EditionDocument12 pagesAino Communique 108th EditionSwathi JainNo ratings yet

- Circular No. 162 - 18 - 2021 - GSTDocument4 pagesCircular No. 162 - 18 - 2021 - GSTRamesh GoddumariNo ratings yet

- Do You Know GST - August 2021Document11 pagesDo You Know GST - August 2021CA Ranjan MehtaNo ratings yet

- (CIN: L15202DL1959PLC003786) Nestlé House Jacaranda Marg M'Block, DLF City, Phase - II Gurugram - 122002, Haryana Phone 0124 - 3940000 Website WWW - Nestle.inDocument149 pages(CIN: L15202DL1959PLC003786) Nestlé House Jacaranda Marg M'Block, DLF City, Phase - II Gurugram - 122002, Haryana Phone 0124 - 3940000 Website WWW - Nestle.inPrachiNo ratings yet

- GST Sem 2 Parth Final Assignment 1Document15 pagesGST Sem 2 Parth Final Assignment 1ParthNo ratings yet

- Circular 13 2019Document2 pagesCircular 13 2019Tejindar SinghNo ratings yet

- Faculty of Law: Jamia Millia IslamiaDocument15 pagesFaculty of Law: Jamia Millia IslamiaTaiyaba100% (1)

- P15 - New - CmaDocument640 pagesP15 - New - Cmaideal100% (1)

- Salary Chart W.E.F. 1-1-2013Document1 pageSalary Chart W.E.F. 1-1-2013mohan1403No ratings yet

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Income Tax: - Manntript KaurDocument46 pagesIncome Tax: - Manntript KaurGaurav JangidNo ratings yet

- Income Tax - DEA-1Document83 pagesIncome Tax - DEA-1Crick CompactNo ratings yet

- First Report TARCDocument594 pagesFirst Report TARCnewguyat77No ratings yet

- Tax Term PaperDocument26 pagesTax Term PaperManu Gupta100% (1)

- Circular No. 681 Dated 8-3-94Document41 pagesCircular No. 681 Dated 8-3-94ArshadNo ratings yet

- CBDT Clarifies Doubts On Account of New TCS Provisions - Taxguru - inDocument2 pagesCBDT Clarifies Doubts On Account of New TCS Provisions - Taxguru - inVivek AgarwalNo ratings yet

- Corporate Tax PlanningDocument18 pagesCorporate Tax PlanningSANDEEP KUMARNo ratings yet

- Goods & Service Tax: Dual GST StructureDocument11 pagesGoods & Service Tax: Dual GST StructurePurvi SehgalNo ratings yet

- Assessment Unit 4 of TaxDocument45 pagesAssessment Unit 4 of TaxanuNo ratings yet

- Taxation LawDocument67 pagesTaxation LawAdv Sheetal SaylekarNo ratings yet

- Direct TaxDocument674 pagesDirect TaxVenkatesh ChavanNo ratings yet

- 09 - Income TaxDocument2 pages09 - Income TaxRaveendran P MNo ratings yet

- Faceless AssessmentDocument61 pagesFaceless AssessmentRa VanaNo ratings yet

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- GST and Its Impacts 4Document16 pagesGST and Its Impacts 4anushka kashyapNo ratings yet

- Paper-II Customs With Answer (21.06.2016) PDFDocument12 pagesPaper-II Customs With Answer (21.06.2016) PDFMoud Khalfani100% (1)

- DT Full MCQ BookDocument209 pagesDT Full MCQ BookPanth BaggaNo ratings yet

- Problems in Collection of Tax in IndiaDocument10 pagesProblems in Collection of Tax in Indiamedha shuklaNo ratings yet

- Business TaxationDocument1 pageBusiness TaxationOPTIMA ConsultingNo ratings yet

- Alternative Investment Funds A Robust Platform For Alternative AssetsDocument21 pagesAlternative Investment Funds A Robust Platform For Alternative AssetsBhaskar ShanmugamNo ratings yet

- Course Outline For Direct Taxation 2022-2Document7 pagesCourse Outline For Direct Taxation 2022-2JiaNo ratings yet

- Idt 1Document10 pagesIdt 1manan agrawalNo ratings yet

- India New Tax Regime FY20-21: A Guide To Understanding The Options On The Allsec Payroll PortalDocument20 pagesIndia New Tax Regime FY20-21: A Guide To Understanding The Options On The Allsec Payroll PortalPraveen NairNo ratings yet