Professional Documents

Culture Documents

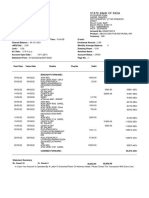

Journal Entries for Cleaning Business Transactions

Uploaded by

Donabelle Marimon0 ratings0% found this document useful (0 votes)

184 views4 pagesOriginal Title

ACC111(412)_EXERCISE1_MARIMON

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

184 views4 pagesJournal Entries for Cleaning Business Transactions

Uploaded by

Donabelle MarimonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Transaction Type of Effect Journal Entry

Transaction

Feb 1 – Deposited SA Inc. in Asset (Cash) Cash P162,000

P162,000 cash in bank L, Capital P162,000

account in the name Inc. in OE (L, Capital) Initial investment

of the business

Feb 3 – Purchased SA (asset Inc. in Asset (Cleaning Cleaning Supplies P21,400

cleaning supplies on approach) Supplies) Accounts Payable P21,400

account P21, 400 Bought cleaning supplies on credit

Inc. in Liab (A/P)

EC (expense Dec. in OE (Cleaning Cleaning Supplies Exp P21,400

approach) Supplies Expense) Accoounts Payable P21,400

Bought cleaning supplies on credit

Inc. in Liab (A/P)

Feb 5 – Acquired SA Inc. in Asset (Cleaning Cleaning Equipment P15,600

cleaning equipment Equipment) Accounts Payable P15,600

on account P15,600 Bought cleaning equipment on credit

Inc. in Liab (A/P)

Feb 5 – Paid P10,000 EA Inc. in Asset Advances of Employees P10,000

to an employee who (Advances of Cash P10,000

made a cash advance Employee) Cash advance of employee

to be repaid in 4 equal

installments from Dec. in Asset (Cash)

salaries of the

employee

Feb 6 – Acquired a SA Inc. in Asset (Service Service Vehicle P80,000

second hand service Vehicle) Cash P30,000

vehicle costing Notes Payable P50,000

P80,000 for the Dec. in Asset (Cash) Bought 2nd hand service vehicle w/

business paying downpayment of P30,000, balance

P30,000 cash and Inc. in Liab (A/P) issued a note

issued a note for the

balance

Feb 7 – Paid the UA Dec. in Asset (Cash) Taxes & Licenses P10,500

registration to BIR and Cash P10,500

business permit Dec. in OE (Taxes & Paid BIR registration and business

P10,5000 Licenses) permit

Feb 8 – Paid rent of EC Dec. in OE (Rent Rent Expense P10,000

the space for the Expense) Withholding Tax Payable P500

month amounting to Cash P9,500

P10,000 less: 5% Inc. in Liab Payment of rent expense and

Withholding tax (Withholding Tax withholding tax

Payable)

Dec. in Asset (Cash)

Feb 9 – Received SA Inc. in Asset (Cash) Cash P51,800

P51,800 cash for Cleaning Revenue P51,800

cleaning services Inc. in OE (Cleaning Received cash for services rendered

rendered Revenue)

Feb 10 – Paid for a UA Dec. in Asset (Cash) Advertising Expense P2,000

newspaper Cash P2,000

advertisement P2,000 Dec. in OE Payment of newspaper

(Advertising Expense) advertisement

Feb 12 – Paid for a EA Dec. in Asset (Cash) Prepaid Insurance P12,000

one-year insurance Cash P12,000

premium P12,000 Inc. in Asset (Prepaid Payment of one-year insurance

Insurance) expense

Feb 13 – Paid partial UA Dec. in Liab (A/P) Accounts Payable P10,000

for the account on Cash P10,000

Feb. 3 P10,000 Dec. in Asset (Cash)

Feb 14 – Paid UA Dec. in Asset (Cash) Miscellaneous Expense P2,200

miscellaneous Cash P2,200

expenses amounting Dec. in OE Payment of miscellaneous expense

to P2,200 (Miscellaneous

Expense)

Feb 15 – Paid first half UA Dec. in OE (Salaries Salaries Expense P15,000

salaries of workers Expense) Advances of Employees P2,500

P15,000; less: Cash P12,500

advances of Dec. in Asset First half payment of salaries

employees P2,500 (Advances of expense less advances of employees

Employees)

Dec. in Asset (Cash)

Feb 16 – Billed SA Inc. in Asset (Accounts Accounts Receivable P28,600

customers P28,600 Receivable) Cleaning Revenues P28,600

for cleaning services Billed customers for services

Inc. in OE (Cleaning rendered

Revenues)

Feb 20 – Received EA Dec. in Asset Cleaning Revenues P10,000

P10,000 from (Accounts Receivable) Salaries Income P10,000

customers billed on Received income for services

Feb. 16 Inc. in OE (Salaries rendered

Income)

Feb 22 – Paid in full UA Dec. in Liab (Notes Notes Payable P50,000

the notes issued on Payable) Cash P50,000

Feb. 6 Full payment of notes payable issued

Dec. in Asset (Cash) on Feb 6

Feb 25 – Paid UA Dec. in Asset (Cash) Communication Expense P900

telephone bills P900 Cash P900

Dec. in OE Payment of communication expense

(Communication

Expense)

Feb 28 – Paid second EC Dec. in OE (Salaries Salaries Expense P15,000

half salaries of Expense) SSS/PHIC/ HDMF Payable P2,800

workers P15,000; less: Withholding Tax Payable P300

SSS P1,500; PHIC Inc. in Liab (SSS/PHIC/ Cash P11,900

P800; HDMF P500; HDMF premium Second half payment of salaries

and Withholding tax payable) expense less SSS/PHIC/HDMF

P300 premium payable and Withholding

Inc. in Liab Tax Payable

(Withholding Tax

Payable)

Dec. in Asset (Cash)

Feb 28 – Billed SA Inc. in Asset (Accounts Accounts Receivable P22,500

customers for Receivable) Cleaning services P22,500

cleaning services Billed customers for services

rendered P22,500 Inc. in OE (Cleaning rendered

services)

Feb 28 – The owner SA Inc. in OE (L, Cash P5,000

withdrew cash from Withdrawals) L, Withdrawals P5,000

the business for Withdraw cash for personal use

personal use P5,000 Inc. in Asset (Cash)

Feb 28 – Received bill EC Dec. in OE (Utilities Utilities Expense P5,500

from Davao Light and Expense) Notes Payable P5,500

DCWD for light and Received bill for utilities expense

water consumption to Inc. in Liab (Notes

be paid next month Payable)

amounting to P5,500

CHART OF ACCOUNTS

Cash Cleaning Revenues

Accounts Receivable Salaries Income

Cleaning Supplies Rent Expense

Prepaid Insurance Advertising Expense

Advances of Employees Insurance Expense

Cleaning Equipment Cleaning Supplies Expense

Service Vehicle Communication Expense

Notes Payable Miscellaneous Expense

Accounts Payable Taxes and Licenses

SSS/PHIC/HDMF Premium Payable

Withholding Tax Payable

Laurente Capital

Laurente Withdrawals

You might also like

- Accounting and its EnvironmentDocument11 pagesAccounting and its EnvironmentJeva, Marrian Jane Nool100% (2)

- Laundry Shop Transactions August 2020Document11 pagesLaundry Shop Transactions August 2020Donabelle Marimon0% (1)

- Activity 10: We All Know That The Purpose of Accounting Is To Provide Quantitative InformationDocument16 pagesActivity 10: We All Know That The Purpose of Accounting Is To Provide Quantitative InformationDonabelle MarimonNo ratings yet

- HEDGING ACCOUNTINGDocument46 pagesHEDGING ACCOUNTINGJune KooNo ratings yet

- Intermediate Accounting 1 - Cash and Cash EquivalentsDocument14 pagesIntermediate Accounting 1 - Cash and Cash EquivalentsKristine Jewel MirandaNo ratings yet

- Module 6 Part 1 Internal ControlDocument21 pagesModule 6 Part 1 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- Front Office CashDocument4 pagesFront Office CashpranithNo ratings yet

- Sample Problem Case 2Document54 pagesSample Problem Case 2MAKI100% (1)

- Accounting quiz answersDocument10 pagesAccounting quiz answersGab IgnacioNo ratings yet

- Statement of Account: State Bank of IndiaDocument6 pagesStatement of Account: State Bank of Indiashinde rushiNo ratings yet

- AB Bank LimitedDocument1 pageAB Bank Limitedshahid2opu100% (1)

- Cash and Cash Equivalents: Problem 1Document4 pagesCash and Cash Equivalents: Problem 1Hannah SalcedoNo ratings yet

- FF7A Cash PositionDocument9 pagesFF7A Cash PositionloanltkNo ratings yet

- Calculate Depreciation and Net Book Value of BuildingDocument5 pagesCalculate Depreciation and Net Book Value of Buildingangela flores100% (1)

- Kelly Pitney Began Her Consulting Business Kelly Consulting On AprilDocument3 pagesKelly Pitney Began Her Consulting Business Kelly Consulting On AprilMiroslav GegoskiNo ratings yet

- Print Cash JournalDocument4 pagesPrint Cash JournalmoorthykemNo ratings yet

- E Time Value of Money AutosavedDocument56 pagesE Time Value of Money AutosavedChariz AudreyNo ratings yet

- Mathematics in the Modern World: Simple InterestDocument2 pagesMathematics in the Modern World: Simple InterestPeter EcleviaNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- Total: Nancy Mulles Data Encoders May 15 2018Document6 pagesTotal: Nancy Mulles Data Encoders May 15 2018Tashnim AreejNo ratings yet

- Problem I - SolutionsDocument10 pagesProblem I - SolutionsDing CostaNo ratings yet

- JKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyDocument2 pagesJKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyHazel Gumapon100% (1)

- Activities KeyDocument7 pagesActivities KeyCassandra Dianne Ferolino MacadoNo ratings yet

- Bookkeeping Records for Cleaning BusinessDocument17 pagesBookkeeping Records for Cleaning BusinessJenne Santiago BabantoNo ratings yet

- Accounting 1 Review Series Worksheet ExercisesDocument14 pagesAccounting 1 Review Series Worksheet ExercisesKayle Mallillin100% (2)

- Journalize The Following Transactions in General Journal FormDocument1 pageJournalize The Following Transactions in General Journal FormShiela Mae Gabrielle AladoNo ratings yet

- Recording Transactions in Financial Transaction WorksheetDocument4 pagesRecording Transactions in Financial Transaction WorksheetAngel MayNo ratings yet

- Merchandising Business Chart of AccountsDocument10 pagesMerchandising Business Chart of AccountsMary Jane PalermoNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- AssignmentDocument16 pagesAssignmentSABORDO, MA. KRISTINA COLEENNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Adjusting Entries for Uncollectible AccountsDocument6 pagesAdjusting Entries for Uncollectible AccountsKristine IvyNo ratings yet

- Cindy Lota - Activity No. 3 - Statement of Financial PositionDocument6 pagesCindy Lota - Activity No. 3 - Statement of Financial PositionCindy LotaNo ratings yet

- Special Journals Cherry Lopez Wear Ever Store BSA13Document12 pagesSpecial Journals Cherry Lopez Wear Ever Store BSA13Erika RepedroNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- CHAPTER 6 (Payroll)Document9 pagesCHAPTER 6 (Payroll)lc100% (1)

- JDC Merchanndising ActivityDocument6 pagesJDC Merchanndising ActivityShaira Sahibad100% (1)

- Post Quiz Chapter 10Document1 pagePost Quiz Chapter 10joanna supresenciaNo ratings yet

- ACCCOUNTING EQUATION With Answers by AlagangWencyDocument7 pagesACCCOUNTING EQUATION With Answers by AlagangWencyHello KittyNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Business Transactions AnalysisDocument4 pagesBusiness Transactions AnalysisHello KittyNo ratings yet

- Chapter 3 Basic AccountingDocument35 pagesChapter 3 Basic AccountingDeanna LuiseNo ratings yet

- AE 112-AE 112-: Partnership Operations)Document32 pagesAE 112-AE 112-: Partnership Operations)Hazel CababatNo ratings yet

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- Journal, T Accounts, Worksheet and PostingDocument29 pagesJournal, T Accounts, Worksheet and Postingkenneth coronelNo ratings yet

- Adjusting Journal EntriesDocument23 pagesAdjusting Journal EntriesAlliyah Manzano CalvoNo ratings yet

- Accounting For Training Merchandising BusinessDocument109 pagesAccounting For Training Merchandising BusinessIsa NgNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Chap 6 Notes AFMDocument30 pagesChap 6 Notes AFMAngel RubiosNo ratings yet

- Resultay T-AccountsDocument1 pageResultay T-AccountsMackenzie Heart ObienNo ratings yet

- CFAS - Lec. 5 PAS 7, PAS8, PAS10Document28 pagesCFAS - Lec. 5 PAS 7, PAS8, PAS10latte aeriNo ratings yet

- Problem 22222Document3 pagesProblem 22222Isabelle CandelariaNo ratings yet

- Name of Examinee: - : Prepare The FollowingDocument15 pagesName of Examinee: - : Prepare The FollowingNoel CarpioNo ratings yet

- Accounting For Business Organization: Partnership FormationDocument14 pagesAccounting For Business Organization: Partnership FormationKate Jezel SantoniaNo ratings yet

- Year 1Document15 pagesYear 1James De TorresNo ratings yet

- BMSH2003 Business Transactions and Adjusting EntriesDocument2 pagesBMSH2003 Business Transactions and Adjusting EntriesLaisan SantosNo ratings yet

- Assignment Chapter 1Document5 pagesAssignment Chapter 1Mark CalimlimNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Accounting Theory ReviewerDocument4 pagesAccounting Theory ReviewerAlbert Sean LocsinNo ratings yet

- Accounting 2Document4 pagesAccounting 2Jocelyn Delacruz50% (2)

- CF04 Part 3 - Petty Cash FundDocument51 pagesCF04 Part 3 - Petty Cash FundABMAYALADANO ,ErvinNo ratings yet

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- Module 9 - Accounting For Treasury SharesDocument7 pagesModule 9 - Accounting For Treasury SharesMariel Ann RebancosNo ratings yet

- Resuento - Ulob ActivitiesDocument16 pagesResuento - Ulob Activitiesemem resuentoNo ratings yet

- Financial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesDocument5 pagesFinancial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesShilla Mae BalanceNo ratings yet

- Week 011 - Module Analysis and Interpretation of Financial StatementsDocument7 pagesWeek 011 - Module Analysis and Interpretation of Financial StatementsJoana Marie100% (1)

- FAR Chapter 3 RevisedDocument36 pagesFAR Chapter 3 RevisedDanica TorresNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Accounting For Sole Proprietorship Problem3-6Document3 pagesAccounting For Sole Proprietorship Problem3-6Rocel Domingo100% (1)

- Accounting Review: Key Financial ConceptsDocument23 pagesAccounting Review: Key Financial Conceptsjoyce KimNo ratings yet

- Application 2.7Document1 pageApplication 2.7Donabelle MarimonNo ratings yet

- Business Process Re-EngineeringDocument2 pagesBusiness Process Re-EngineeringDonabelle MarimonNo ratings yet

- CBM321 Week4-5 ReviewerDocument2 pagesCBM321 Week4-5 ReviewerDonabelle MarimonNo ratings yet

- Acc223-Standard Costing-ApplicationsDocument4 pagesAcc223-Standard Costing-ApplicationsDonabelle MarimonNo ratings yet

- CBM 321 Final Exam ReviewerDocument12 pagesCBM 321 Final Exam ReviewerDonabelle MarimonNo ratings yet

- Acc224 (8315) - Week 5 AssignmentDocument1 pageAcc224 (8315) - Week 5 AssignmentDonabelle MarimonNo ratings yet

- Task 2.4Document2 pagesTask 2.4Donabelle MarimonNo ratings yet

- Acc224-2nd Exam ReviewerDocument2 pagesAcc224-2nd Exam ReviewerDonabelle MarimonNo ratings yet

- In A Nutshell: Name: Donabelle C. Marimon Subject & Time: GE5 (8:00-9:00AM) Code: 6214Document2 pagesIn A Nutshell: Name: Donabelle C. Marimon Subject & Time: GE5 (8:00-9:00AM) Code: 6214Donabelle MarimonNo ratings yet

- ULOcI MARIMONDocument1 pageULOcI MARIMONDonabelle MarimonNo ratings yet

- In A Nutshell Activity 3Document1 pageIn A Nutshell Activity 3Donabelle MarimonNo ratings yet

- Acc111 (412) Activity29 MarimonDocument1 pageAcc111 (412) Activity29 MarimonDonabelle MarimonNo ratings yet

- Let's Check: Name: Donabelle C. Marimon Subject & Time: GE5 (8:00-9:00AM) Code: 6214Document1 pageLet's Check: Name: Donabelle C. Marimon Subject & Time: GE5 (8:00-9:00AM) Code: 6214Donabelle MarimonNo ratings yet

- ULOcI5 MARIMONDocument1 pageULOcI5 MARIMONDonabelle MarimonNo ratings yet

- ULOcI4 MARIMONDocument1 pageULOcI4 MARIMONDonabelle MarimonNo ratings yet

- ULOcI6 MARIMONDocument1 pageULOcI6 MARIMONDonabelle MarimonNo ratings yet

- Journal Entries for Cleaning Business TransactionsDocument4 pagesJournal Entries for Cleaning Business TransactionsDonabelle MarimonNo ratings yet

- ACTIVITY 5. Now That You Are Acquainted With The Account Titles and Its Classification, Let UsDocument3 pagesACTIVITY 5. Now That You Are Acquainted With The Account Titles and Its Classification, Let UsDonabelle MarimonNo ratings yet

- Acc111 (412) Activity28 MarimonDocument2 pagesAcc111 (412) Activity28 MarimonDonabelle MarimonNo ratings yet

- Acc111 (412) Activity30 MarimonDocument1 pageAcc111 (412) Activity30 MarimonDonabelle MarimonNo ratings yet

- Acc111 (412) Activity27 MarimonDocument2 pagesAcc111 (412) Activity27 MarimonDonabelle MarimonNo ratings yet

- Activity 6. The Study of The Elements of The Financial Statements and Its Accounts Is ADocument6 pagesActivity 6. The Study of The Elements of The Financial Statements and Its Accounts Is ADonabelle MarimonNo ratings yet

- Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDocument4 pagesActivity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDonabelle MarimonNo ratings yet

- Let'S Check: Activity 12. in This Activity Let Us Check Your Understanding On TheDocument2 pagesLet'S Check: Activity 12. in This Activity Let Us Check Your Understanding On TheDonabelle MarimonNo ratings yet

- Activity 8. Knowing The Elements and Its Classification Is Not Enough You Have To UnderstandDocument2 pagesActivity 8. Knowing The Elements and Its Classification Is Not Enough You Have To UnderstandDonabelle MarimonNo ratings yet

- Activity 7Document2 pagesActivity 7Donabelle MarimonNo ratings yet

- Donabelle C. Marimon ACC111 (412) Forum4Document2 pagesDonabelle C. Marimon ACC111 (412) Forum4Donabelle MarimonNo ratings yet

- CENG4130 - Spring 21-22Document4 pagesCENG4130 - Spring 21-22kere evaNo ratings yet

- Chapter 17: The Management of Cash and Marketable SecuritiesDocument21 pagesChapter 17: The Management of Cash and Marketable SecuritiesArven FrancoNo ratings yet

- Chart of Account - Manufactur IndustryDocument3 pagesChart of Account - Manufactur IndustryBenedicto Nunzio75% (4)

- CONFIDENTIAL - Klinik Ratulangi Medical Center - January 2023Document20 pagesCONFIDENTIAL - Klinik Ratulangi Medical Center - January 2023Ratulangi Medical CentreNo ratings yet

- CASH Module Q N ADocument20 pagesCASH Module Q N AAndrea Gwen ArapocNo ratings yet

- Case - Augusta Training Shop Snowflakes SolDocument13 pagesCase - Augusta Training Shop Snowflakes SolAscharya DebasishNo ratings yet

- EBITDADocument2 pagesEBITDAMihaela DumitruNo ratings yet

- Unit 2 Supply Chain in Cash Transfer ProgrammingDocument20 pagesUnit 2 Supply Chain in Cash Transfer ProgrammingPMU Chimhanda District HospitalNo ratings yet

- A Comparative Study of Urban and Rural Customers On Perception Towards Online Payment System at Anantapur DistrictDocument4 pagesA Comparative Study of Urban and Rural Customers On Perception Towards Online Payment System at Anantapur DistrictEditor IJTSRDNo ratings yet

- CASH AND CASH EQUIVALENTS BALANCESDocument8 pagesCASH AND CASH EQUIVALENTS BALANCESRonel CaagbayNo ratings yet

- Report on Demonetisation effects on Indian Economy sectorsDocument5 pagesReport on Demonetisation effects on Indian Economy sectorsKumar AbhishekNo ratings yet

- Top performing masternodes in 1H 2020Document23 pagesTop performing masternodes in 1H 2020B latedNo ratings yet

- BSBFIM501 Manage Budgets and Financial Plans: Assessment Cover SheetDocument19 pagesBSBFIM501 Manage Budgets and Financial Plans: Assessment Cover SheetKimberly Dyanne100% (1)

- Bank Collection Sales System JuneDocument44 pagesBank Collection Sales System Juneaktaruzzaman bethuNo ratings yet

- DownloadInstallmentChallan PDFDocument1 pageDownloadInstallmentChallan PDFImran Afzal50% (2)

- Quiz Audit of CashDocument3 pagesQuiz Audit of CashwesNo ratings yet

- Oil and Gas KT Sessions 50 Sessions Knowledge Transfer PlanDocument72 pagesOil and Gas KT Sessions 50 Sessions Knowledge Transfer PlanSudhakar MvnNo ratings yet

- Literature Review Cash Flow ManagementDocument6 pagesLiterature Review Cash Flow Managementafmzitaaoxahvp100% (2)

- Should Company Lease or Buy Asset Based on IRRDocument6 pagesShould Company Lease or Buy Asset Based on IRRMuntazir HussainNo ratings yet

- Petty Cash Bank ReconcilationDocument13 pagesPetty Cash Bank ReconcilationXS3 GamingNo ratings yet