100% found this document useful (1 vote)

343 views52 pagesProject Risk Management

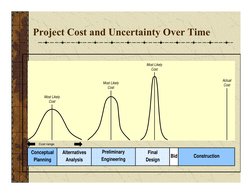

Project costs and the level of uncertainty surrounding them tend to decrease over the course of a project. During conceptual planning and alternatives analysis, the potential costs are most uncertain and have the widest range. As the project progresses through preliminary engineering, final design, bidding, and construction, more details are known and the cost estimates become more accurate and defined, with the actual cost typically falling within the most likely cost estimated during construction. Risk management is an ongoing process throughout the project to identify potential issues and take actions to reduce their likelihood or minimize their impacts.

Uploaded by

Siddarth SinghCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

343 views52 pagesProject Risk Management

Project costs and the level of uncertainty surrounding them tend to decrease over the course of a project. During conceptual planning and alternatives analysis, the potential costs are most uncertain and have the widest range. As the project progresses through preliminary engineering, final design, bidding, and construction, more details are known and the cost estimates become more accurate and defined, with the actual cost typically falling within the most likely cost estimated during construction. Risk management is an ongoing process throughout the project to identify potential issues and take actions to reduce their likelihood or minimize their impacts.

Uploaded by

Siddarth SinghCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Introduction to Project Risk Management: Introduces the concept of project risk management, laying out a broad overview of its importance in project planning and execution.

- Understanding Cost and Uncertainty: Explains how project cost and uncertainty vary over time and introduces basic elements of managing these aspects.

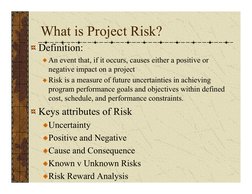

- Defining Project Risk: Provides a definition of project risk and discusses its attributes, including positive and negative impacts.

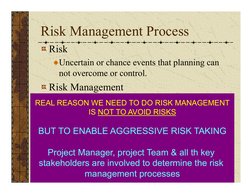

- Risk Management Process Overview: Presents an overview of the risk management process, emphasizing the importance of aggressive risk taking.

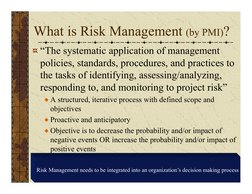

- What is Risk Management?: Describes what constitutes risk management and highlights its systematic approach to identifying and managing risks.

- Phases of Risk Management: Covers the phases of risk management, including selection, planning, implementation, and evaluation, providing a holistic view of the risk management cycle.

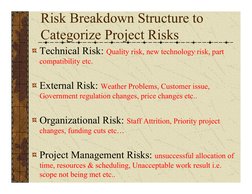

- Risk Breakdown Structure: Uses a risk breakdown structure to categorize different types of project risks, such as technical and external risks.

- Sources of Risk: Identifies both external and internal sources of risks within a project context, providing insight into potential challenges.

- Risk Management Steps by PMI: Lays out the Professional Management Institute's steps for risk management, focusing on planning and assessing risks.

- Risk Management Processes: Details the specific processes involved in risk management, from identification to monitoring and response strategies.

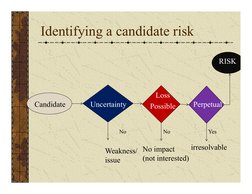

- Risk Identification: Discusses techniques for identifying risk, including formal and informal methods to ensure comprehensive coverage.

- Risk Assessment: Focuses on risk assessment techniques, emphasizing the importance of understanding both the likelihood and impact of risks.

- Risk Analysis Tools: Introduces various tools for analyzing risks, such as scenario analysis, providing strategies to deal with complex risk environments.

- Probability and Impact Analysis: Discusses the probability and impact analysis tool to prioritize risks based on their potential consequences.

- Decision Trees and EMV: Explains the use of decision trees and Expected Monetary Value (EMV) in order to choose appropriate risk responses.

- Risk Response Planning: Covers planning for risk responses and implementing strategies that manage risk effectively.

- Risk Register: Details the creation and utilization of a risk register to document identified risks and manage them systematically.

- Contingency Planning: Explores contingency planning as a method to prepare for unforeseen project risks.

- Final Thoughts on Risk Management: Summarizes key takeaways from risk and contingency planning in project management, emphasizing preparedness.

- Understanding Risk vs. Uncertainty: Discussions on differentiating risk from uncertainty and understanding their respective roles in project management.

- Project Resilience: Concludes with a focus on project resilience, outlining strategies to adapt and respond to disruptive events effectively.