Professional Documents

Culture Documents

KSA Benchmarking Report q2 2021

Uploaded by

Mohammed ShebinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KSA Benchmarking Report q2 2021

Uploaded by

Mohammed ShebinCopyright:

Available Formats

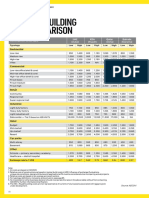

KSA Market Q2 2021

The Saudi construction industry has felt the Currently, essential infrastructure networks Basis/assumptions/exclusions

impact of the Covid-19 pandemic perhaps are being procured, and the construction

more acutely than other regions. The industry anticipates that significant tenders in 1. All costs derived from Currie & Brown's in-house database

Hospitality Healthcare (Abacus) and project experience.

implementation of restrictions in the Kingdom the residential and commercial sectors will be

led to targeted government cost-saving floated in the last quarter of 2021 and through 2. Rates have been calculated based on the GIFA measurement as

measures, including reduced expenditure on to the first half of 2022. Asset description Low High Asset description Low High defined by the RICS Code of Measuring Practice 6th Edition.

(SAR/m2) (SAR/m2) (SAR/m2) (SAR/m2)

giga-project investment. 3. Rates include for hard construction costs only.

As international travel opens up, the Upper-midscale 7,000 8,900 Hospital 10,000 14,000

4. Rates are current as of Q2 2021.

Positive outlook Kingdom’s tourism sector will need to be

Upscale 9,500 10,900 Clinic 12,000 14,500

prepared to meet the anticipated high 5. Rates include contractor's general requirements.

To date, more than 17 million vaccine doses

demand arising from the introduction Upper-upscale 11,200 12,400 6. Rates exclude:

have been administered in the Kingdom. By

of tourism visas. The impact will be felt Luxury 12,800 14,500 Contingencies

the end of 2021 a significant proportion of ■

by both existing and new infrastructure Inflation beyond Q2 2021

nationals and expatriates with Iqamas will be Ultra luxury 14,800 18,200 ■

requirements, in addition to demand for hotel Other amenities

fully vaccinated. ■ Material fluctuation beyond Q2 2021

accommodation and facilities.

■ Soft costs, such as, but not limited to, professional fees, local

Despite last year’s drop in construction

contract awards, the feeling in the industry Increasing commodity costs Hotel - Branded/ International school 3,500 6,000

authority fees, legal fees, sales and marketing costs or pre-

opening costs

remains positive. The accepted forecast is Alongside the above, construction commodity

serviced apartments Mosque 5,000 9,000 ■ Land costs

that as the impact of the global pandemic costs are anticipated to increase, continuing

■ Finances costs

crisis passes, the construction sector will the rising prices of building materials,

recover. Encouraging signs include the especially steel, cement and copper that was Branded/serviced 6,000 11,000 ■ Client direct costs

increasing number of contract awards over seen in the first quarter of 2021. apartments ■ White goods, loose FF&E or OS&E as applicable

the past six months. Car parking ■ VAT

Given the progression of the giga-projects

7. Rate assumes a traditional build-only procurement route with

Sector-specific opportunity across the Kingdom, it is anticipated that in

works being undertaken by reputable main works contractors.

Independently of the anticipated tourism,

the near future a shortage of skilled labour Residential - Car parking - basement/ 3,000 3,800 8. The stated rates are indicative and should not be used or relied

wellness and entertainment giga-projects

and raw materials will have an additional Villa underground upon in lieu of a detailed project-specific cost estimate.

impact on construction unit rates, with the

progressing throughout KSA, other key Car parking - above-ground 1,800 3,100

progression of future projects based on

sectors are anticipated to include residential Villa standard 3,000 4,200 structure

supply and demand.

and commercial.

Villa mid-market 3,500 5,300 Car parking - podium with 2,050 3,450

Currie & Brown has been commissioned to

In particular, housing developments are likely

to be an area of focus in the Kingdom.

assess alternatives to traditional construction Villa upper-mid market 4,500 7,500

1.2m exposed above grade Integrated services

methods with the aim of mitigating against Car parking - on grade 500 1,200

It is estimated that more than 65% of the the risks of a labour shortage, while Villa luxury 7,500 10,000 Project and programme management

Saudi workforce is made up of individuals maintaining focus on the Vision 2030 targets. Cost management

aged 25-44. Planned housing programmes, Our benchmarks will be regularly updated to Contract advisory services

including affordable schemes, will need to take into consideration the market, relevant

cope with this demand, independently of the tender returns impact, and/or any shortage of

Landscape Design management

Residential - Apartment

residential schemes planned within the giga- skilled labour and material impact. Project controls and planning

projects. Park (hard landscape) 400 750 Procurement advice

Apartment - low rise 3,500 6,500

Park (soft landscape) 350 650 Facilities management consultancy

Apartment - mid rise 3,950 7,300

Apartment - high rise 4,550 9,000

A world-leading asset management and construction

Commercial property Contacts

consultancy driven by innovation

Retail James Irvine

We are global in our reach, but local in our relationships and Commercial office - 4,900 8,000

Director/Country Manager

standalone - core and shell

delivery. We strive for excellence in everything we do. james.irvine@curriebrown.com

Regional mall 4,500 7,000 Commercial office - 8,400 11,500

District mall 4,000 6,500 standalone - grade A Francisco Batista

Associate Director

Commercial office - 5,200 8,250

2,000+

francisco.batista@curriebrown.com

business park - core and

We have been shell

Committed and operational Commercial office - 8,700 11,750

high-performing in the Middle East www.curriebrown.com

business park - grade A

people for over 30 years Asia Pacific I Americas I Europe I India I Middle East

You might also like

- Manpower Allowances Indirect Total SalaryDocument2 pagesManpower Allowances Indirect Total SalaryMohammed ShebinNo ratings yet

- Wave Project & SAPDocument28 pagesWave Project & SAPMohammed ShebinNo ratings yet

- Master Site DetailsDocument1 pageMaster Site DetailsMohammed ShebinNo ratings yet

- WBS Assignement-Example2 PDFDocument1 pageWBS Assignement-Example2 PDFMohammed ShebinNo ratings yet

- Estimation - Hand BookDocument7 pagesEstimation - Hand BookMohammed ShebinNo ratings yet

- Work Breakdown Structure - Example PDFDocument2 pagesWork Breakdown Structure - Example PDFMohammed Shebin0% (1)

- Project Scope Statement-Example2 PDFDocument2 pagesProject Scope Statement-Example2 PDFMohammed ShebinNo ratings yet

- WBS-Final Will Mont Pharmacy CaseDocument1 pageWBS-Final Will Mont Pharmacy CaseMohammed Shebin100% (1)

- Stakeholder-Register Willmont Pharmacy CaseDocument1 pageStakeholder-Register Willmont Pharmacy CaseMohammed Shebin80% (10)

- O-Chart Wilmont PDFDocument1 pageO-Chart Wilmont PDFMohammed ShebinNo ratings yet

- Project Scope-Statement Willmont Pharmacy CaseDocument6 pagesProject Scope-Statement Willmont Pharmacy CaseMohammed Shebin100% (2)

- Wave-2 Medinah YANBU-196 Villas Wave-2 Medinah YANBU-196 VillasDocument1 pageWave-2 Medinah YANBU-196 Villas Wave-2 Medinah YANBU-196 VillasMohammed ShebinNo ratings yet

- Reducing Friction and Wear of Tribological Systems Through Hybrid Tribofilm Consisting of Coating and LubricantsDocument5 pagesReducing Friction and Wear of Tribological Systems Through Hybrid Tribofilm Consisting of Coating and LubricantsMohammed ShebinNo ratings yet

- Wave-2 Makkah-RABIGH1-306 Villas Wave-2 Makkah-RABIGH1-306 VillasDocument1 pageWave-2 Makkah-RABIGH1-306 Villas Wave-2 Makkah-RABIGH1-306 VillasMohammed ShebinNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Neighborhood Tour (June 2018)Document8 pagesNeighborhood Tour (June 2018)wdt_rpominvilleNo ratings yet

- New Seoul International AirportDocument33 pagesNew Seoul International AirportHoàng ThôngNo ratings yet

- Classified Advertising: More Classified Contd. On Following PagesDocument6 pagesClassified Advertising: More Classified Contd. On Following PagesAlexander PondianNo ratings yet

- Icgt Welcome Packet 2012-13 v.1.0Document27 pagesIcgt Welcome Packet 2012-13 v.1.0SaajanMeenaNo ratings yet

- Heavenly: by Katie MarkeyDocument32 pagesHeavenly: by Katie MarkeyKatie MarkeyNo ratings yet

- Disproportionate Collapse RequirementsDocument1 pageDisproportionate Collapse RequirementsvidrascuNo ratings yet

- ĐỀ THIDocument180 pagesĐỀ THITrần ThơmNo ratings yet

- Passages Through High-Rise Living: July 2014Document16 pagesPassages Through High-Rise Living: July 2014Homam BsoolNo ratings yet

- Ilkom BIDocument104 pagesIlkom BIvega krismonicaNo ratings yet

- Italy Property LawDocument87 pagesItaly Property LawLubomír Luža100% (1)

- Raj Rewal Asia Games HousingDocument8 pagesRaj Rewal Asia Games HousingShubh Cheema60% (5)

- Texas Apartment Association LeaseDocument6 pagesTexas Apartment Association LeaseSami HartsfieldNo ratings yet

- 33cb06ae-8687-40c4-a87d-b80ecf9c5dbdDocument4 pages33cb06ae-8687-40c4-a87d-b80ecf9c5dbdsasikalaNo ratings yet

- Translator Home-Site Test-1Document8 pagesTranslator Home-Site Test-1Kaso MuseNo ratings yet

- X1 The Landmark BrochureDocument26 pagesX1 The Landmark BrochureNaveed QureshiNo ratings yet

- (IELTS Speaking) - Topic: Accommodation (CH ) : 2018 - mt1522604060.htmlDocument2 pages(IELTS Speaking) - Topic: Accommodation (CH ) : 2018 - mt1522604060.htmlNgan TranNo ratings yet

- Winter 2010Document24 pagesWinter 2010AnneBricklayerNo ratings yet

- Design ReportDocument40 pagesDesign ReportAsmita SubediNo ratings yet

- DLF New Town Gurgaon Soicety Handbook RulesDocument38 pagesDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaNo ratings yet

- A. Background of The StudyDocument9 pagesA. Background of The StudyElla BurayagNo ratings yet

- OBZoningBy LawsDCPCRegsDocument80 pagesOBZoningBy LawsDCPCRegsmoliteNo ratings yet

- Taksila GHS Bye LawsDocument53 pagesTaksila GHS Bye LawsMahesh SharmaNo ratings yet

- House RulesDocument2 pagesHouse RulesAI HUEYNo ratings yet

- Att - Villa Cullinan La ZagaletaDocument5 pagesAtt - Villa Cullinan La ZagaletaAndrew I.L IdiNo ratings yet

- Brochure For Diya FinalDocument12 pagesBrochure For Diya Finalanshika040592No ratings yet

- The Effects of Airbnb On The Hotel IndustryDocument8 pagesThe Effects of Airbnb On The Hotel IndustryRead KhanNo ratings yet

- 0ec50bf0-f799-41a4-a042-50fae530ff1aDocument7 pages0ec50bf0-f799-41a4-a042-50fae530ff1asasikalaNo ratings yet

- Profile Archipelago 010323 - CompressedDocument151 pagesProfile Archipelago 010323 - Compressedsarveshsharma1129No ratings yet

- San Clemente VillagesDocument2 pagesSan Clemente VillagesHarichandan PNo ratings yet

- Project Oworonshoki: KingfisherDocument18 pagesProject Oworonshoki: KingfisherAdedolapo Ademola OdunsiNo ratings yet