Professional Documents

Culture Documents

Revised Depreciation Estimates Impact Financial Statement Usefulness

Uploaded by

Donna Mae Singson0 ratings0% found this document useful (0 votes)

13 views5 pagesOriginal Title

CASE STUDY ON RDE-

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views5 pagesRevised Depreciation Estimates Impact Financial Statement Usefulness

Uploaded by

Donna Mae SingsonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

CASE STUDY ON REVISING DEPRECIATION ESTIMATES

ACCTG 14

CN 3004

SUBMITTED BY: DONNA MAE A. SINGSON

REVISING DEPRECIATION ESTIMATES

Typically, a shift in an asset's anticipated useful life or its projected salvage

value. The depreciation expense for the current year and following years is frequently

affected by the modification. Depreciation expense is calculated by estimating a number

of factors that may vary or require adjustment over the asset's lifetime owing to internal

or external influences. As a result of a change in any of these estimates, the business

will be required to incorporate the change in a prospective manner beginning on the

date of revision and continuing forth. Previous periods are not adjusted for change in

estimates.

Estimates that may need revision are:

Useful life of asset: the period for which asset is expected to stay operational

may change

Depreciation rate: if the rate of cashflows (benefits) from the asset has increased

or decreased, entity may have to adjust depreciation rate to match up.

Residual value of asset: the value entity is expecting to recover at the end of

useful life by scrapping or recycling the asset may be different than expected.

This will change the depreciable value of asset.

Factors that may invoke revision of above estimates can be internal to entity or

external.

Internal factors include:

Change in use and application of asset working for longer hours, used by

untrained workers.

New information obtained that is different from previous estimates and

expectations

Damage resulting in shorter useful life

External factors include:

Market value has reduced significantly that will eventually change salvage value of

asset. Technological advancement as new equipment is available or restrictions by

government may force entity to abandon the asset sooner than expected.

Accounting for change in depreciation related estimates

Because it is a change in estimate, it will be accounted for prospectively, from the

date of modification through the end of the asset's useful life. In previous years'

computations, no changes were performed. The procedure is straightforward. Calculate

the depreciation charge based on revised estimates and the starting net book value of

the asset (carried forward value of the asset from the previous year prior to

modification).

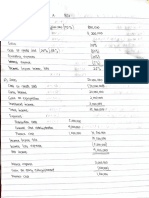

Final Output (problem)

Revising depreciation estimates

Hard Bodies Co. is a fitness chain that has just completed its second year of

operations. At the beginning of its first fiscal year, the company purchased fitness

equipment at a cost of $600,000 and estimated that the equipment would have a useful

life of five years and no residual value. The company uses the straight-line depreciation

method. The company reported net income for the first two years of operations as

follows:

Year Net Income (Loss)

1 $50,000

2 (2,000)

Mike Gambit, the company's chief financial officer (CFO), has recently run

financial models to predict future net income, and he expects net losses to continue at

per year for the next three years. James Steed, the president of Hard Bodies, is

concerned about these predictions, as he is under pressure from the company's owner

to return the company to Year 1 net income levels, If the company does not meet these

goals, both he and Mike will likely be fired. Mike suggests that the company change the

estimated useful life of the fitness equipment to 10 years and increase the equipment's

estimated residual value to $50,000. This will reduce depreciation expense and

increase net income.

QUESTIONS:

1.Evaluate the decision Co change the equipment's estimated useful life and

estimated residua! Value to improve earnings. How does this change impact the

usefulness of the company's net income for external decision makers?

ANSWERS

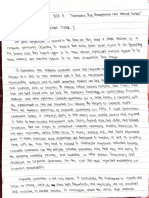

It is very important to apply the fundamental qualitative characteristics of financial

statements which are verifiability, timeliness, understandability, comparability.

And most especially it should be faithfully presented. Financial reports must have

faithful depiction as a basic feature in order to be relevant for economic decision-

making. Good financial reports assist in making educated economic decisions

that improve resource allocation efficiency. In words and numbers, general

purpose financial reports depict economic occurrences. Financial data must not

only be relevant, but it must also accurately represent the phenomena it purports

to describe in order to be valuable. faithful representation refers to the depiction

of an economic phenomenon's substance rather than only its legal form.

The expense is minimized, while the net revenue is inflated, thus deceiving

financial statement users into making incorrect decisions. The financial statement

that shows net income does not accurately reflect what happened. It professes to

represent and is misleading in the sense that it encourages decision-makers to

invest in the company business. The company's usefulness will be questioned

because management's calculations do not accurately reflect the economic

benefits and liabilities of the asset used to boost the company's net income.

QUESTION

2.If Mike and James make the change, are they acting in an ethical manner?

Explain.

ANSWERS

Accepting a position in a corporation, they must not only meet the needs of their

clients, but also act in the public interest. A professional accountant should

observe and follow the ethical obligations of their profession when operating in

the public good. Accounting professionals must follow the rules and regulations

that govern their domains and bodies of work as a matter of ethics. Avoiding

behaviors that could harm the profession's reputation is a legitimate expectation

that business partners and others should have. However, in this case Mike and

James make the change and they are obviously not acting in an ethical manner.

They should follow the core values of integrity, objectivity, professional

competence and due care, confidentiality, and professional behavior to be

ethically compliant. They are directly breaking Integrity and Objectivity by

making the adjustments. Integrity was shattered because they were not honest

and forthright in their professional and business dealings by attempting to

manipulate net income and costs. Objectivity is also important. They were

infringed upon in the sense that they permitted bias to overcome their business

judgments in order to present greater numbers. a higher net income and lower

expenditure.

Recommendations

Depreciation moves the asset's costs from the balance sheet to the income

statement's expenses throughout the asset's useful life. Depreciation is a method of

allocating resources to achieve the matching principle. It is not a method for determining

an asset's fair market value. And professionals should always consider and remember

to act on an ethical manner because it is very important not just in the company but for

yourself as well. James and Mike should make their research more about the

company’s problem and make decision that would fix the problem. Also, they could

collect the past data of company in order for them to compare and can get some

information that would help them not to make an impulsive decision.

Depreciation allows businesses to recoup the cost of an asset they purchased.

Instead of collecting the purchase price immediately, the technique allows corporations

to cover the whole cost of an asset over its lifetime. This enables businesses to replace

future assets with the right amount of revenue.

You might also like

- How Business Impacts SocietyDocument9 pagesHow Business Impacts SocietyDonna Mae SingsonNo ratings yet

- Chapter 3 FS SINGSONDocument7 pagesChapter 3 FS SINGSONDonna Mae SingsonNo ratings yet

- Chapter 8 - Ethical Dilemma Exercise 1Document1 pageChapter 8 - Ethical Dilemma Exercise 1Donna Mae SingsonNo ratings yet

- Financial Analysis of a Proposed Pet Grooming BusinessDocument16 pagesFinancial Analysis of a Proposed Pet Grooming BusinessDonna Mae SingsonNo ratings yet

- Chapter 4 FS SINGSONDocument31 pagesChapter 4 FS SINGSONDonna Mae SingsonNo ratings yet

- Market Analysis and Demand ProjectionDocument13 pagesMarket Analysis and Demand ProjectionDonna Mae SingsonNo ratings yet

- Starting a Pet Grooming Business in General Santos CityDocument14 pagesStarting a Pet Grooming Business in General Santos CityDonna Mae SingsonNo ratings yet

- Singson Reaction PaperDocument2 pagesSingson Reaction PaperDonna Mae SingsonNo ratings yet

- Lec2 Ass Ia3 - SingsonDocument3 pagesLec2 Ass Ia3 - SingsonDonna Mae SingsonNo ratings yet

- Ramon Magsaysay Memrorial Colleges College of Accountancy Pioneer Avenue, General Santos CityDocument16 pagesRamon Magsaysay Memrorial Colleges College of Accountancy Pioneer Avenue, General Santos CityDonna Mae SingsonNo ratings yet

- SinGLO Dotya naE A BSA Income StatementDocument4 pagesSinGLO Dotya naE A BSA Income StatementDonna Mae SingsonNo ratings yet

- Reviewer in CORPORATE GOVERNANCE-singsonDocument5 pagesReviewer in CORPORATE GOVERNANCE-singsonDonna Mae SingsonNo ratings yet

- Cost Accounting Ass SingsonDocument4 pagesCost Accounting Ass SingsonDonna Mae SingsonNo ratings yet

- SINGSON1Document1 pageSINGSON1Donna Mae SingsonNo ratings yet

- Reaction Paper 2 - SingsonDocument2 pagesReaction Paper 2 - SingsonDonna Mae SingsonNo ratings yet

- Financial Management With Feasibility: Prelim Project BSA CN:3014Document6 pagesFinancial Management With Feasibility: Prelim Project BSA CN:3014Donna Mae SingsonNo ratings yet

- Tax 1st Quiz Answer KeyDocument2 pagesTax 1st Quiz Answer KeyDonna Mae SingsonNo ratings yet

- Corporate Governance Risk Management and AccountabilityDocument2 pagesCorporate Governance Risk Management and AccountabilityDonna Mae SingsonNo ratings yet

- Assignment 3Document1 pageAssignment 3Donna Mae SingsonNo ratings yet

- Acctg26 Intermediate Accounting Prelim Accounting Case CN: 3016 BSA - 2Document4 pagesAcctg26 Intermediate Accounting Prelim Accounting Case CN: 3016 BSA - 2Donna Mae SingsonNo ratings yet

- Tax Ass2 - Singson, DM BsaDocument2 pagesTax Ass2 - Singson, DM BsaDonna Mae SingsonNo ratings yet

- Gee 141 - 1ST AssignmentDocument22 pagesGee 141 - 1ST AssignmentDonna Mae SingsonNo ratings yet

- MSME OUTPUT 2 and 3 Prelim - SingsonDocument15 pagesMSME OUTPUT 2 and 3 Prelim - SingsonDonna Mae SingsonNo ratings yet

- Case Analysis 2Document5 pagesCase Analysis 2Donna Mae SingsonNo ratings yet

- CD 2 Midterm SingsonDocument2 pagesCD 2 Midterm SingsonDonna Mae SingsonNo ratings yet

- Case Study On Revising Depreciation Estimates Acctg 14 CN 3004Document4 pagesCase Study On Revising Depreciation Estimates Acctg 14 CN 3004Donna Mae SingsonNo ratings yet

- Law2 Ass Midterm - Singson 1Document1 pageLaw2 Ass Midterm - Singson 1Donna Mae SingsonNo ratings yet

- SINGSON REVIEWER CHAPTER 5 BOND ISSUANCE QUESTIONSDocument3 pagesSINGSON REVIEWER CHAPTER 5 BOND ISSUANCE QUESTIONSDonna Mae SingsonNo ratings yet

- Prolblen 4: S.p00 1,1, So0 DDocument1 pageProlblen 4: S.p00 1,1, So0 DDonna Mae SingsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDocument34 pagesRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNo ratings yet

- How To Make A Business PlanDocument17 pagesHow To Make A Business PlanlibaboyNo ratings yet

- REED FileDocument4 pagesREED FileJake VargasNo ratings yet

- Fin Ac Robles Empleo CH 5 Vol 1 Answers2012Document18 pagesFin Ac Robles Empleo CH 5 Vol 1 Answers2012Engel Ken Castro71% (7)

- IPRO Mock Exam - 2021 - QDocument21 pagesIPRO Mock Exam - 2021 - QKevin Ch Li100% (1)

- Chapter 09Document12 pagesChapter 09Dan ChuaNo ratings yet

- Majestic Mulch and Compost Co. Capital Budgeting AnalysisDocument68 pagesMajestic Mulch and Compost Co. Capital Budgeting AnalysisMnar Abu-ShliebaNo ratings yet

- INCOMPLETEDocument13 pagesINCOMPLETEOwen Bawlor ManozNo ratings yet

- Statement of Comprehensive Income AnalysisDocument43 pagesStatement of Comprehensive Income AnalysisCzanelle Nicole EnriquezNo ratings yet

- Case 4 - Ratio Analysis - Micro TilesDocument18 pagesCase 4 - Ratio Analysis - Micro TilesAimee ChantengcoNo ratings yet

- Grade 11 Controlled Test March 2024 QP 2Document8 pagesGrade 11 Controlled Test March 2024 QP 2ZenzeleNo ratings yet

- NSSCH Examiners Report 2020Document257 pagesNSSCH Examiners Report 2020kamatigranny36No ratings yet

- 3310-Ch 9-End of Chapter solutions-STDocument29 pages3310-Ch 9-End of Chapter solutions-STArvind ManoNo ratings yet

- Sub Accountancy: Class XIDocument3 pagesSub Accountancy: Class XIJanvi Singh RajputNo ratings yet

- Test: 1 Topic: Fundamental, Goodwill, Change in Profit Sharing RatioDocument4 pagesTest: 1 Topic: Fundamental, Goodwill, Change in Profit Sharing RatioHigreeve SrudhiNo ratings yet

- Pisa Pizza healthier pizza sales projectionsDocument6 pagesPisa Pizza healthier pizza sales projectionskarol nicole valero melo100% (1)

- Stars Produces Stars For Elementary Teachers To Reward Their StudentsDocument14 pagesStars Produces Stars For Elementary Teachers To Reward Their StudentsJalaj GuptaNo ratings yet

- 1-Law Cover Print - Combine634642971062050292 PDFDocument274 pages1-Law Cover Print - Combine634642971062050292 PDFRaj Kunal100% (1)

- BASTDocument6 pagesBASTsyamsir nurNo ratings yet

- DEFERRED TAXES: Calculating Expense, Assets & LiabilitiesDocument5 pagesDEFERRED TAXES: Calculating Expense, Assets & LiabilitiesCris Joy BiabasNo ratings yet

- Software Engineering Economics FundamentalsDocument7 pagesSoftware Engineering Economics FundamentalsSaba TanveerNo ratings yet

- Full Answers For Level 2 Accounting Learning Work BookDocument80 pagesFull Answers For Level 2 Accounting Learning Work BookSerki Love Setki LiveNo ratings yet

- Chapter 6: Accounting For Plant Assets and Depreciation. ContentsDocument46 pagesChapter 6: Accounting For Plant Assets and Depreciation. ContentsSimon MollaNo ratings yet

- ACCOUNTING P1 GR11 QP NOV 2023 - EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOV 2023 - EnglishChantelle IsaksNo ratings yet

- CBLM - JournalizingDocument78 pagesCBLM - JournalizingCary Jaucian0% (1)

- ACC 107 Exam ReviewDocument2 pagesACC 107 Exam Reviewhoneyjoy salapantanNo ratings yet

- Master Budget Preparation and ComponentsDocument13 pagesMaster Budget Preparation and ComponentsJames CantorneNo ratings yet

- SAP Transaction and Command Codes for GFEBSDocument84 pagesSAP Transaction and Command Codes for GFEBSmofibhaiNo ratings yet

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalDocument5 pagesCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoNo ratings yet