Professional Documents

Culture Documents

Case Analysis 2

Uploaded by

Donna Mae Singson0 ratings0% found this document useful (0 votes)

69 views5 pagesOriginal Title

case analysis 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

69 views5 pagesCase Analysis 2

Uploaded by

Donna Mae SingsonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

SHORT CASE ANALYSIS ON

ESTIMATION OF DOUBTFUL ACCOUNTS

ACCTG 14

CN 2004

SUBMITTED BY: DONNA MAE A. SINGSON

ACCOUNTING CASE: ESTIMATION OF DOUBTFUL ACCOUNTS

Allowance for doubtful accounts

For several years, Xtreme Co.'s sales have been on a "cash only" basis. On January 1,

20Y4, however, Xtreme Co. began offering credit on terms of n/30. The amount of the

adjusting entry to record the estimated uncollectible receivables at the end of each year

has been ½ of 1% of credit sales, which is the rate reported as the average for the

industry. Credit sales and the year-end credit balances in Allowance for Doubtful

Accounts for the past four years are as follows:

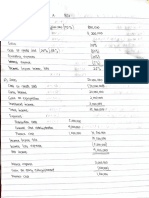

Year Credit Sales Allowance for doubtful

accounts

20Y4 4,000,000 5,000

20Y5 4,400,000 8,250

20Y6 4,800,000 10,200

20Y7 5,100,000 14,400

Laurie Jones, president of Xtreme Co., is concerned that the method used to account

for and write off uncollectible receivables is unsatisfactory. She has asked for your

advice

in the analysis of past operations in this area and for recommendations for change.

1. Determine the amount of (a) the addition to Allowance for Doubtful Accounts and

(b) the accounts written off for each of the four years. Support your answer.

A) Addition to Allowance for Doubtful Accounts

= 20Y4 Credit Sales x % of Estimated Uncollectible Receivables

= 4,000,000 x (1/2 x 1%)

= 4,000,000 x 0.5%

= 20,000

To solve the 20Y4 addition to the allowance for doubtful accounts: multiply the

credit sales by the percentage of estimated uncollectible receivables.

= 20Y5 Credit Sales x % of Estimated Uncollectible Receivables

= 4,400,000 x (1/2 x 1%)

= 4,400,000 x 0.5%

= 22,000

To solve for the 20Y5 addition to the allowance for doubtful accounts: multiply the

credit sales by the percentage of estimated uncollectible receivables.

= 20Y6 Credit Sales x % of Estimated Uncollectible Receivables

= 4,800,000 x (1/2x 1%)

= 4,800,000 x 0.5%

= 24,000

To solve for the 20Y6 addition to the allowance for doubtful accounts: Multiply the

credit sales by the percentage of estimated uncollectible receivables.

= 20Y7 Credit Sales x % of Estimated Uncollectible Receivables

= 5,100,000 x (1/2 x 1%)

= 5,100,000 x 0.5%

= 25,500

To solve for the 20Y7 addition to the allowance for doubtful accounts: multiply the

credit sales by the percentage of estimated uncollectible receivables.

The addition to Allowance for Doubtful Accounts for each year

20Y4 - 20,000

20Y5 - 22,000

20Y6 - 24,000

20Y7 - 25,500

B) The accounts written off for each of the four years.

20Y4 Accounts Written Off

= 20Y4 Beginning Balance of Allowance for Doubtful Accounts + Addition to Allowance

for Doubtful Accounts - 20Y4 Ending Balance of Allowance for Doubtful Accounts

= 0 + 20,000 - 5,000

= 15,000

To solve for the accounts written off for the year 20Y4: add the beginning balance of

doubtful accounts and the calculated addition to allowance for doubtful accounts from

part 1, then subtract the ending balance of allowance for doubtful accounts.

2. A) Advise Laurie Jones as to whether the estimate of 1/2 of 1% of credit sales

appears reasonable.

Laurie should estimate the number of bad loans on the basis of the loan percentage

sales tend to result in an excessive or greater quantity of predicted bad with debts. This

ultra-conservative outcome of the current methodology might not be relevant, as it does

not reflect or at least closely estimate the actual value of the receivable accounts which

have been written off.

As shown in the previous calculation, the amount of additional doubtful accounts based

on the percentage of credit sales is higher than the actual accounts receivable. And it

was resulted to the current method of estimating the amount of bad debts on the basis

of the percentage sales of credit sales shows to be inadequate. However, the current

method appears to be resulted in an excessive estimate of bad debts. In addition, the

estimated bad debt should at least approximate the actual amount written off.

Compared to the increase total sales, the allowance for doubtful accounts also

increases but sharply. It should be at least in close proportion to the increase in sales.

B.) Assume that after discussing (a) with Laurie Jones, she asked you what

action might be taken to determine what the balance of Allowance for

Doubtful Accounts should be at December 31, 20Y7, and what possible

changes, if any, you might recommend in accounting for uncollectible

receivables. How would you respond?

Past information may provide some information and sources that may help and allow

the company to estimate the amount of the doubtful accounts with reasonable accuracy.

However, it is normally use different methods to estimate the potential bad debts or the

allowance for uncollectible accounts, no matter how it is accurate or how the method

selected because there is no absolute assurance to the accuracy of the results that can

be obtained from using the one method than other.

There are steps that can be taken to properly know the reasonable accuracy. The

allowance for doubtful accounts as of December 31 2017, an analysis of the actual

historical write-offs of receivables that may provide reasonable indications of the

reasonable balance of the allowance in doubtful accounts. The estimated percentage of

uncollectible accounts based on the aging of receivables may can also give a more

accurate of accounts receivable. However, it is based on the actual write-off results, the

estimated bad debts expense is can be possible to have changes in the estimation of

bad debts that may recommend.

You might also like

- Virtues, Vices and Values - The Master List - 2016Document24 pagesVirtues, Vices and Values - The Master List - 2016Lion Goodman100% (1)

- How To Judge DiseasesDocument2 pagesHow To Judge Diseasesmaharajkumar100% (1)

- Essential Question and Enduring Understanding TutorialDocument28 pagesEssential Question and Enduring Understanding TutorialAureliano BuendiaNo ratings yet

- Budgeted Balance Sheet For Skulas As of January 31Document2 pagesBudgeted Balance Sheet For Skulas As of January 31Elliot RichardNo ratings yet

- The Imamis Between Rationalism and TraditionalismDocument12 pagesThe Imamis Between Rationalism and Traditionalismmontazerm100% (1)

- Characteristics of Charismatic LeadershipDocument3 pagesCharacteristics of Charismatic LeadershipMuhammad Hashim Memon100% (1)

- Akmen AbcDocument3 pagesAkmen AbcSUKMA PUTRI GANDAARUMNo ratings yet

- Easystart, Marcel and The Mona Lisa AWDocument2 pagesEasystart, Marcel and The Mona Lisa AWVlad-NicolaeAchimNo ratings yet

- Indian Proverbs - WikiquoteDocument5 pagesIndian Proverbs - WikiquoteRahul7LMNo ratings yet

- Richard Coudenhove-Kalergi - Pan-Europa (2019)Document150 pagesRichard Coudenhove-Kalergi - Pan-Europa (2019)Eduardo AntónioNo ratings yet

- Russel Vs Vestil DigestedDocument1 pageRussel Vs Vestil DigestedAzrael CassielNo ratings yet

- TOS For EIM Grade 9 & 10Document2 pagesTOS For EIM Grade 9 & 10Sanja Shishin100% (4)

- Chapter 2Document24 pagesChapter 2gerry hormatiNo ratings yet

- Soal Sia RomneyDocument8 pagesSoal Sia RomneyChoi MinriNo ratings yet

- Instructional Supervisory Plan For ED 22Document12 pagesInstructional Supervisory Plan For ED 22Rodel Namayan100% (2)

- Prelim Task De-Vera Angela-KyleDocument6 pagesPrelim Task De-Vera Angela-KyleJohn Francis RosasNo ratings yet

- Soal Akm1Document2 pagesSoal Akm1putri50% (2)

- CH 8 Prob 3Document2 pagesCH 8 Prob 3Wan ZahroNo ratings yet

- Akm P21-1, P21-2Document5 pagesAkm P21-1, P21-2nandya rizkyNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- MUH - SYUKUR (A031191077) AKUNTANSI KEUANGAN Problem P11-9 (Buku Kieso Chapter 11)Document2 pagesMUH - SYUKUR (A031191077) AKUNTANSI KEUANGAN Problem P11-9 (Buku Kieso Chapter 11)Rismayanti100% (1)

- Pertemuan 12 Chapter 19 KiesoDocument90 pagesPertemuan 12 Chapter 19 KiesoJordan SiahaanNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinancejahidkhanNo ratings yet

- Resume Kieso CHAPTER 17Document7 pagesResume Kieso CHAPTER 17A RahmaNo ratings yet

- Kieso - Inter - ch10 - Ifrs Psak Ppe RevDocument59 pagesKieso - Inter - ch10 - Ifrs Psak Ppe RevJhoNo ratings yet

- Daftar Isi ISADocument4 pagesDaftar Isi ISADedi PramonoNo ratings yet

- Tugas P17-8 - AKLDocument15 pagesTugas P17-8 - AKLNovie AriyantiNo ratings yet

- ACCT550 Exercises Week 1Document6 pagesACCT550 Exercises Week 1Natasha DeclanNo ratings yet

- Activity 2Document7 pagesActivity 2Mae FerrerNo ratings yet

- Exercises: Managerial Accounting Concepts and PrinciplesDocument8 pagesExercises: Managerial Accounting Concepts and PrinciplesJosh MorrisNo ratings yet

- Soal UTS GANJIL 2018-2019 B'Rita FathiahDocument5 pagesSoal UTS GANJIL 2018-2019 B'Rita FathiahDaeng Buana SaputraNo ratings yet

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- IFA-I Assignment PDFDocument3 pagesIFA-I Assignment PDFNatnael AsfawNo ratings yet

- PR 14-4A Accounting QuestionsDocument2 pagesPR 14-4A Accounting QuestionsLegnaNo ratings yet

- Basic Pension WorksheetDocument1 pageBasic Pension WorksheetIbnu GamingNo ratings yet

- Bab 8 Costing by Product and Joint ProductDocument5 pagesBab 8 Costing by Product and Joint ProductAntonius Sugi Suhartono100% (1)

- Book Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanDocument2 pagesBook Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanRynaldo xf100% (1)

- CH5 Accounting QuizDocument7 pagesCH5 Accounting QuizTarun ImandiNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- HMPSA TALE (Tutoring and Learning Ease) : Accounting For Merchandising OperationsDocument53 pagesHMPSA TALE (Tutoring and Learning Ease) : Accounting For Merchandising OperationsKevin Chandra100% (1)

- Ilovepdf MergedDocument9 pagesIlovepdf MergedGARTMiawNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- AkuntansiDocument4 pagesAkuntansiNadilla NurNo ratings yet

- 1.kieso 2020-1118-1183Document66 pages1.kieso 2020-1118-1183dindaNo ratings yet

- For The Barista at The Walk-In-Only Store, They Should Consider The Ethical BehaviorDocument2 pagesFor The Barista at The Walk-In-Only Store, They Should Consider The Ethical BehaviorThư VõNo ratings yet

- Activity Preparing Journal EntriesDocument5 pagesActivity Preparing Journal EntriesJomir Kimberly DomingoNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklMelati SepsaNo ratings yet

- Mikro Ekonomi 2Document2 pagesMikro Ekonomi 2Arfini LestariNo ratings yet

- Proces CostingDocument14 pagesProces CostingKenDedesNo ratings yet

- PT Mega Restorasi General Journal OCTOBER, 31 2016Document5 pagesPT Mega Restorasi General Journal OCTOBER, 31 2016Mas AbiNo ratings yet

- 645873Document3 pages645873mohitgaba19No ratings yet

- Jawaban Soal 2 Variabel CostingDocument1 pageJawaban Soal 2 Variabel CostingFitriNo ratings yet

- Case 6-49 - MaDocument4 pagesCase 6-49 - MaAFIFAH KHAIRUNNISA SUBIYANTORO 1No ratings yet

- Intermediate Financial Accounting Chapter 7 SolutionDocument12 pagesIntermediate Financial Accounting Chapter 7 SolutionDrm BluNo ratings yet

- E21 16Document2 pagesE21 16Warmthx0% (1)

- Kementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisDocument2 pagesKementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisAntique NariswariNo ratings yet

- Asistensi Akmen Ch.8Document12 pagesAsistensi Akmen Ch.8Irham SistiasyaNo ratings yet

- Tugas Ifrs Chapter 7.2Document4 pagesTugas Ifrs Chapter 7.2Nabilla salsaNo ratings yet

- Latihan Bank Reconciliation Akuntansi Dasar 1Document2 pagesLatihan Bank Reconciliation Akuntansi Dasar 1Amelia LarasatiNo ratings yet

- Solution:: Step: 1 of 14: Job Costing, Normal and Actual Costing. Anderson Construction Assembles ResidentialDocument6 pagesSolution:: Step: 1 of 14: Job Costing, Normal and Actual Costing. Anderson Construction Assembles ResidentialHerry SugiantoNo ratings yet

- Pert 11 Tugas Dividend and Retained Earnings PDFDocument1 pagePert 11 Tugas Dividend and Retained Earnings PDFAini NS100% (1)

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFDocument17 pagesPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiNo ratings yet

- Modul Lab AD I 2019 - 2020 - 1337415165 PDFDocument52 pagesModul Lab AD I 2019 - 2020 - 1337415165 PDFClarissa Aurella ChecyalettaNo ratings yet

- Networking 1Document31 pagesNetworking 1Anh Tô MaiNo ratings yet

- Accounting For Pensions and Postretirement BenefitsDocument3 pagesAccounting For Pensions and Postretirement BenefitsdwitaNo ratings yet

- Budjet and PlannigDocument10 pagesBudjet and Plannigprakash009kNo ratings yet

- Chapter 5 Estimation of Doubtful Accounts 5 PDF FreeDocument8 pagesChapter 5 Estimation of Doubtful Accounts 5 PDF FreeryseNo ratings yet

- 08 Notes Accounts ReceivableDocument3 pages08 Notes Accounts ReceivablePeter KoprdaNo ratings yet

- Chapter 5 Fs SingsonDocument16 pagesChapter 5 Fs SingsonDonna Mae SingsonNo ratings yet

- Chapter 2 FS SingsonDocument13 pagesChapter 2 FS SingsonDonna Mae SingsonNo ratings yet

- Cost Accounting Ass SingsonDocument4 pagesCost Accounting Ass SingsonDonna Mae SingsonNo ratings yet

- Chapter 1 FS SINGSON FinalDocument14 pagesChapter 1 FS SINGSON FinalDonna Mae SingsonNo ratings yet

- Chapter 8 - Ethical Dilemma Exercise 1Document1 pageChapter 8 - Ethical Dilemma Exercise 1Donna Mae SingsonNo ratings yet

- Chapter 4 FS SINGSONDocument31 pagesChapter 4 FS SINGSONDonna Mae SingsonNo ratings yet

- Chapter 6 Fs SingsonDocument9 pagesChapter 6 Fs SingsonDonna Mae SingsonNo ratings yet

- Chapter 3 FS SINGSONDocument7 pagesChapter 3 FS SINGSONDonna Mae SingsonNo ratings yet

- Singson Reaction PaperDocument2 pagesSingson Reaction PaperDonna Mae SingsonNo ratings yet

- Ramon Magsaysay Memrorial Colleges College of Accountancy Pioneer Avenue, General Santos CityDocument16 pagesRamon Magsaysay Memrorial Colleges College of Accountancy Pioneer Avenue, General Santos CityDonna Mae SingsonNo ratings yet

- SINGSON1Document1 pageSINGSON1Donna Mae SingsonNo ratings yet

- Tax 1st Quiz Answer KeyDocument2 pagesTax 1st Quiz Answer KeyDonna Mae SingsonNo ratings yet

- Financial Management With Feasibility: Prelim Project BSA CN:3014Document6 pagesFinancial Management With Feasibility: Prelim Project BSA CN:3014Donna Mae SingsonNo ratings yet

- Lec2 Ass Ia3 - SingsonDocument3 pagesLec2 Ass Ia3 - SingsonDonna Mae SingsonNo ratings yet

- Reviewer in CORPORATE GOVERNANCE-singsonDocument5 pagesReviewer in CORPORATE GOVERNANCE-singsonDonna Mae SingsonNo ratings yet

- Singson prelimAss1.IA3Document4 pagesSingson prelimAss1.IA3Donna Mae SingsonNo ratings yet

- Tax Ass2 - Singson, DM BsaDocument2 pagesTax Ass2 - Singson, DM BsaDonna Mae SingsonNo ratings yet

- Assignment 3Document1 pageAssignment 3Donna Mae SingsonNo ratings yet

- CD 2 Midterm SingsonDocument2 pagesCD 2 Midterm SingsonDonna Mae SingsonNo ratings yet

- Reaction Paper 2 - SingsonDocument2 pagesReaction Paper 2 - SingsonDonna Mae SingsonNo ratings yet

- Acctg26 Intermediate Accounting Prelim Accounting Case CN: 3016 BSA - 2Document4 pagesAcctg26 Intermediate Accounting Prelim Accounting Case CN: 3016 BSA - 2Donna Mae SingsonNo ratings yet

- Reaction Paper 1 - SingsonDocument2 pagesReaction Paper 1 - SingsonDonna Mae SingsonNo ratings yet

- Law2 Ass Midterm - Singson 1Document1 pageLaw2 Ass Midterm - Singson 1Donna Mae SingsonNo ratings yet

- Case Study On Revising Depreciation Estimates Acctg 14 CN 3004Document4 pagesCase Study On Revising Depreciation Estimates Acctg 14 CN 3004Donna Mae SingsonNo ratings yet

- Prolblen 4: S.p00 1,1, So0 DDocument1 pageProlblen 4: S.p00 1,1, So0 DDonna Mae SingsonNo ratings yet

- Singson Reviewer Chapter 5 Ia 2Document3 pagesSingson Reviewer Chapter 5 Ia 2Donna Mae SingsonNo ratings yet

- MSME OUTPUT 2 and 3 Prelim - SingsonDocument15 pagesMSME OUTPUT 2 and 3 Prelim - SingsonDonna Mae SingsonNo ratings yet

- Gee 141 - 1ST AssignmentDocument22 pagesGee 141 - 1ST AssignmentDonna Mae SingsonNo ratings yet

- Case Study On RdeDocument5 pagesCase Study On RdeDonna Mae SingsonNo ratings yet

- MC Script For The Birthday Company 2021Document7 pagesMC Script For The Birthday Company 2021HR CLVNo ratings yet

- Fundamentals IKS SyllabusDocument2 pagesFundamentals IKS Syllabuspurushotampandit1No ratings yet

- Filosofi Pengakuan Dan Penghormatan Negara Terhadap Masyarakat Hukum Adat Di IndonesiaDocument13 pagesFilosofi Pengakuan Dan Penghormatan Negara Terhadap Masyarakat Hukum Adat Di Indonesialisken hNo ratings yet

- Recurrences 2Document59 pagesRecurrences 2Eman KhanNo ratings yet

- Improving Students' Speaking Proficiency in EFL Classes Through Oral Presentation TechniqueDocument132 pagesImproving Students' Speaking Proficiency in EFL Classes Through Oral Presentation TechniqueYasmine Hacini100% (1)

- The Cave of Snakes: T D E RPG O: Exotic VistasDocument1 pageThe Cave of Snakes: T D E RPG O: Exotic VistasFabien WeissgerberNo ratings yet

- Chapter 5 Greece Sec 1Document32 pagesChapter 5 Greece Sec 1missseesNo ratings yet

- Generics - The Swift Programming Language (Swift 5.7)Document28 pagesGenerics - The Swift Programming Language (Swift 5.7)jomi86No ratings yet

- Health-9 Q3 3b V2Document17 pagesHealth-9 Q3 3b V2Solrac LeunamNo ratings yet

- The Role of Significance Tests1: D. R. CoxDocument22 pagesThe Role of Significance Tests1: D. R. CoxMusiur Raza AbidiNo ratings yet

- Rorschach Audio: Ghost Voices and Perceptual Creativity by Joe BanksDocument8 pagesRorschach Audio: Ghost Voices and Perceptual Creativity by Joe BanksyoutreauNo ratings yet

- Amores vs. CSCDocument4 pagesAmores vs. CSCIzobelle PulgoNo ratings yet

- Cue Card English International WeddingDocument2 pagesCue Card English International WeddingTA Kab JombangNo ratings yet

- Ifa Tourneeausstellungen 2021 ENDocument112 pagesIfa Tourneeausstellungen 2021 ENsextoNo ratings yet

- Graham V Blissworld, LLCDocument16 pagesGraham V Blissworld, LLCcityfileNo ratings yet

- Whats The Weather LikeDocument3 pagesWhats The Weather Likechristian sosaNo ratings yet

- 24941-100-30R-G01-00073 Tunra 6299 Report FinalDocument96 pages24941-100-30R-G01-00073 Tunra 6299 Report FinalcmahendrNo ratings yet

- Outpatient Appointment Systems in Healthcare - A Review of Optimization StudiesDocument32 pagesOutpatient Appointment Systems in Healthcare - A Review of Optimization Studiesgabrieelcrazy100% (1)