Professional Documents

Culture Documents

MODULE 3 - Discussion

MODULE 3 - Discussion

Uploaded by

Albert Sean LocsinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MODULE 3 - Discussion

MODULE 3 - Discussion

Uploaded by

Albert Sean LocsinCopyright:

Available Formats

Flexible Learning A.Y.

2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

DISCUSSION

We are done with financial assets at fair value. In this Module, we will focus our discussion on

the last type of financial assets, which are financial assets at amortized cost. A very common

example of this type of financial assets is Investment in Bonds.

Before we study this new topic, recall these important concepts on measurement, as it will be

very helpful if you are already familiar with these:

CLASSIFICATION INCLUSION INITIAL MEASUREMENT

Financial assets at fair value through Equity securities

Fair value

profit or loss (FA@FVPL) Debt securities

Financial assets at fair value through

Equity securities Fair value plus transaction

other comprehensive income

Debt securities costs

(FA@FVOCI)

Financial assets at amortized cost Fair value plus transaction

(FA@AC) Debt securities

costs

Remember, the subsequent measurement of FA@AC is at its amortized cost. Meaning, it is not

affected by changes in fair value. Just focus on the computation of amortized cost. How? Find

out in this Module and by reading Chapters 19 and 20 of Valix’s Intermediate Accounting 2019

Volume 1.

Below is a summary of the things that you need to remember:

1. Investment in bonds can be classified as: a.) Financial asset held for trading b.)

Financial asset at amortized cost c.) Financial asset at FVOCI; or d.) Financial asset at

FVPL (by irrevocable designation or by fair value option).

2. It can either be a term bond or a serial bond. Term bonds are bonds having single

maturity date, whereas, serial bonds have series of maturity dates. With regards serial

bonds, take note that principal payments doesn’t need to be of equal amounts and of

regular interval. It totally depends upon the agreement of the issuer (borrower) and the

investor (creditor).

3. The investment can be done on interest date or between interest dates. If it is made

between interest dates, don’t forget to debit the account Interest Income for the number

of months not covered by the investment. Also, remember to adjust the term of the

bonds when investment is made between interest dates.

4. In computing for present value factors, PV of 1 is used for term bonds and serial bonds

having unequal installments or irregular timing of cash flows; while PV of ordinary

annuity for serial bonds having equal, annual installments.

To give more details of each class of investment in bonds, check the images on the next page:

This document is a property of the University of St. La Salle Module 3 | Page 1

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

Investment(in(Bonds(

CLASSIFICATION:(Financial(asset(at(amortized(cost(

! Initial(measurement:(Fair(value((Cost)(

! Transactions(costs:(Added/Included(to(the(cost(

! Subsequent(measurement:(Amortized(cost!

! Amortize(any(premium(or(discount(

" Straight(line(method((term(bonds)(

" Bond(outstanding(method((serial(bonds)(

" Effective(interest(method((term(and(serial(bonds)(

! Journal(entry(upon(recognition(–(on(interest(dates:(

( (Investment(in(bonds(face!value!x!purchase!price) (XX(

( ( (Cash ( ( ( ( ( ( ( ( ( ( (XX(

! Journal(entry(upon(recognition(–(between(interest(dates:(

( (Investment(in(bonds(face!value!x!purchase!price) !XX(

( (Interest(income((face!value!x!nominal!rate)( ( (XX ( ( (

( ( (Cash ( ( ( ( ( ( ( ( ( ( (XX(

Investment(in(Bonds(

CLASSIFICATION:(Financial(asset(at(FVOCI(

! Initial(measurement:(Fair(value(

! Transactions(costs:(Added/Included(to(the(cost(

! Subsequent(measurement:(FVOCI((recognizes+changes+in+FV)+

! Amortize(any(premium(or(discount:(Effective(interest(method(

! Journal(entry(upon(recognition(–(on(interest(dates:(

( (Financial(asset(–(FVOCI(face+value+x+purchase+price) (XX(

( ( (Cash ( ( ( ( ( ( ( ( ( ( (XX(

! Journal(entry(upon(recognition(–(between(interest(dates:(

( (Financial(asset(–(FVOCI(face+value+x+purchase+price)+XX(

( (Interest(income((face+value+x+nominal+rate)( ( (XX ( ( (

( ( (Cash ( ( ( ( ( ( ( ( ( ( (XX(

This document is a property of the University of St. La Salle Module 3 | Page 2

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

Investment(in(Bonds(

CLASSIFICATION:(Financial(asset(at(FVPL(

! Initial(measurement:(Fair(value(

! Transactions(costs:(Expensed(immediately(

! Subsequent(measurement:(FVPL((recognizes+changes+in+FV)+

! Does(not(amortize(any(premium(or(discount(

! Journal(entry(upon(recognition(–(on(interest(dates:(

( (Financial(asset(–(FVPL(face+value+x+purchase+price) (XX(

( (Expenses ( ( ( ( ( ( ( ( (XX(

( ( (Cash ( ( ( ( ( ( ( ( ( ( (XX(

! Journal(entry(upon(recognition(–(between(interest(dates:(

( (Financial(asset(–(FVPL(face+value+x+purchase+price) +XX(

( (Interest(income((face+value+x+nominal+rate)( ( (XX(

( (Expenses ( ( ( ( ( ( ( ( (XX(

( ( (Cash ( ( ( ( ( ( ( ( ( ( (XX(

Don’t get overwhelmed with the concepts and principles underlying investment in bonds. Below

are sample problems which can help you understand this topic better. Solutions are also

provided at the end of this section. Just a tip, be able to identify what are the given financial

assets as these exercises include FA@FVPL and FA@FVOCI. Answer the problems diligently

before looking at the solutions. Furthermore, we will use four decimal places for PV factors,

except when such is given; example, 0.3333 or 1.2555; and we round off final answers to whole

number. As much as possible, recall the necessary journal entries we have discussed.

SAMPLE PROBLEM #1

At the beginning of the current year, Icon Company acquired bonds with face amount of P4,000,000

at a cost of P3,761,000. The bonds are held for trading. Bonds pay interest of 12% semiannually on

January 1 and July 1 and mature on January 1, 2023. The bonds have an effective yield of 14% and

are quoted at 105 at year-end. Prepare journal entries for the current year.

SAMPLE PROBLEM #2

Mature Company carried out the following transactions in bond investments held for trading

during the current year:

Aug. 1 Purchased 5,000, P1,000, 12% bonds of Acme Company at 104 plus accrued interest of

P150,000. The bonds pay interest semiannually on May 1 and November 1.

31 Purchased 2,000, P1,000, 12% bonds of Avco Company at 98 plus accrued interest.

Semiannual payment of interest, June 30 and December 31.

Dec. 1 Sold 2,000 of the Acme bonds at 102 plus accrued interest. Brokerage fee, P160,000.

31 The following quotations were obtained: Acme bonds, 98; Avco bonds, 99.

REQUIRED:

a.) Prepare journal entries to record the transactions.

b.) Carrying amount of the investments on December 31.

SAMPLE PROBLEM #3

On July 1, 2019, Bearish Company purchased as trading investment a P2,000,000 face amount,

8% bond for P2,200,000 plus accrued interest and commission of P50,000. The bond pays

interest annually on December 31. On December 31, 2019, the bond investment was quoted at

95. On March 31, 2020, the entity sold the bond investment for P2,100,000 plus accrued

interest. Prepare journal entries for 2019 and 2020.

This document is a property of the University of St. La Salle Module 3 | Page 3

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

SAMPLE PROBLEM #4

On October 1, 2019, Yost Company purchased 4,000 of the P1,000 face amount, 10% bonds of

Pell Company for P4,400,000 which included accrued interest of P100,000. The bonds, which

mature on January 1, 2026, pay interest semiannually on January 1 and July 1. The entity used

the straight line method of amortization and appropriately recorded bonds as financial asset at

amortized cost. Prepare journal entries for 2019 and 2020.

SAMPLE PROBLEM #5

On January 1, 2019, Flexible Company acquired for P1,150,000 the entire P1,000,000, 12%

bond issue of another entity to be held as financial asset at amortized cost. Bonds of P200,000

mature at annual interval beginning December 31, 2019. Interest is payable semiannually on

June 30 and December 31.

REQUIRED:

a.) Prepare a schedule of amortization following the bond outstanding method.

b.) Prepare journal entries for the current year.

SAMPLE PROBLEM #6

On January 1, 2019, Demeanor Company purchased bonds with face value of P5,000,000 to

held as financial assets at amortized cost. the entity paid P4,600,000 plus transaction costs of

P142,000. The bonds mature on December 31, 2021 and pay 6% interest annually on

December 31 of each year with 8% effective yield. The bonds are quoted at 105 on December

31, 2019. The bonds are sold at 110 on December 31, 2020.

REQUIRED:

a.) Prepare a table of amortization.

b.) Prepare journal entries for 2019 and 2020.

SAMPLE PROBLEM #7

On January 1, 2019, a company acquired for P5,241,500 the entire P5,000,000, 12% bond

issue of another entity to be held as financial assets at amortized cost. Bonds of P1,000,000

mature at annual interval beginning December 31, 2019. Interest is payable annually on

December 31. The bonds have a 10% effective rate. Prepare journal entries for 2019 and 2020

using the effective interest method.

SAMPLE PROBLEM #8

Durable Company purchased P3,000,000 face amount bonds for P3,111,510 on January 1,

2019 to be held as financial assets at amortized cost. The bonds carry a nominal rate of 8%

payable semiannually on June 30 and December 31. The bonds mature on January 1, 2021

with an effective rate of 6%.

REQUIRED:

a.) Prepare a table of amortization following the effective interest method.

b.) Prepare journal entries for 2019.

SAMPLE PROBLEM #9

On January 1, 2019, Agusan Company purchased bonds with face amount of P5,000,000. The

business model of the entity in managing the financial asset is not only to collect contractual

cash flows that are solely payment of principal and interest but also to sell the bonds in the open

market. The entity has not elected the fair value option of measuring financial asset. The entity

paid P4,600,000 plus transaction cost of P142,000 for the bond investment. The bonds mature

on December 31, 2021 and pay 6% interest annually on December 31 each year with 8%

effective yield. In addition, the bonds are quoted at 105 on December 31, 2019 and 110 on

December 31, 2020. The bonds are redeemed at face amount on December 31, 2021.

REQUIRED:

a.) Prepare a table of amortization.

b.) Prepare journal entries for 2019, 2020, and 2021.

SAMPLE PROBLEM #10

On January 1, 2019, Reign Company purchased 12% bonds with face amount of P5,000,000 for

P5,380,000. The bonds provide an effective yield of 10%. The bonds are dated January 1,

2019, mature on January 1, 2024 and pay interest annually on December 31 each year. the

bonds are quoted at 120 on December 31, 2019 and 115 on December 31, 2020. The entity has

elected the fair value option for the bond investment. Prepare journal entries for 2019 and 2020.

This document is a property of the University of St. La Salle Module 3 | Page 4

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

SAMPLE PROBLEM #11

At the beginning of the current year, Havoc Company purchased ten-year bonds with a face

amount of P5,000,000 and a stated interest rate of 8% per year payable semiannually June 30

and December 31. The bonds were acquired to yield 10%. Present value factors are as follows:

Present value of 1 for 10 periods at 10% 0.386

Present value of 1 for 20 periods at 5% 0.377

Present value of an annuity of 1 for 10 periods at 10% 6.145

Present value of an annuity for 1 for 20 periods at 5% 12.462

REQUIRED:

a.) Compute for the purchase price of the bonds.

b.) Prepare journal entries to record transactions for the current year.

SAMPLE PROBLEM #12

On January 1, 2019, Labyrinth Company purchased serial bonds with face amount of

P3,000,000 and stated 12% interest payable annually every December 31. The bonds are to be

held as financial assets at amortized cost with a 10% effective yield. The bonds mature at an

annual installment of P1,000,000 every December 31.

Present value of 1 at 10% for one period 0.91

Present value of 1 at 10% for two periods 0.83

Present value of 1 at 10% for three periods 0.75

REQUIRED:

a.) Compute for the purchase price of the bonds.

b.) Prepare journal entries for 2019. The effective interest method of amortization is used.

c.) Compute the carrying amount of the bond investment on December 31, 2019.

Done? How are you doing so far? Here are the SOLUTIONS to the given sample problems.

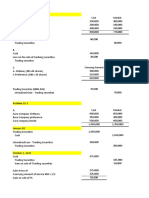

SAMPLE PROBLEM #1

1/1 Trading securities 3,761,000

Cash 3,761,000

7/1 Cash (4,000,000x12%x6/12) 240,000

Interest income 240,000

12/31 Interest receivable 240,000

Interest income 240,000

FMV (4,000,000x105%) 4,200,000

Carrying amount 3,761,000

Unrealized gain- P/L 439,000

Trading securities 439,000

Unrealized gain - P/L 439,000

SAMPLE PROBLEM #2

a.) 8/1 Trading securities - Acme (5,000,000x104%) 5,200,000

Interest income (5,000,000x12%x3/12) 150,000

Cash 5,350,000

8/31 Trading securities - Avco (2,000,000x98%) 1,960,000

Interest income (2,000,000x12%x2/12) 40,000

Cash 2,000,000

11/1 Cash (5,000,000x12%x6/12) 300,000

Interest income 300,000

12/1 Cash 1,900,000

Loss on sale of trading securities (squeeze) 200,000

Trading securities - Acme (2,000/5,000x5,200,000) 2,080,000

Interest income (2,000,000x12%x1/12) 20,000

Selling price ([2,000x1,000]x102%) 2,040,000

Interest income 20,000

Total cash received 2,060,000

Less: Brokerage fee 160,000

Net cash received 1,900,000

This document is a property of the University of St. La Salle Module 3 | Page 5

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

12/31 Interest receivable 60,000

Interest income (3,000,000x12%x2/12) 60,000

Cash (2,000,000x12%x6/12) 120,000

Interest income 120,000

Face amount - Acme 3,000,000

Multiply by (%) 98

FMV, 12/31 2,940,000

Carrying amount 3,120,000

Unrealized loss -180,000

Unrealized loss - P/L 180,000

Trading securities - Acme 180,000

Face amount - Avco 2,000,000

Multiply by (%) 99

FMV, 12/31 1,980,000

Carrying amount 1,960,000

Unrealized gain 20,000

Trading securities - Avco 20,000

Unrealized gain 20,000

b.) Trading securities - Acme 2,940,000

Trading securities - Avco 1,980,000

4,920,000

SAMPLE PROBLEM #3

2019 7/1 Trading securities 2,200,000

Interest income (2,000,000x8%x6/12) 80,000

Commission expense 50,000

Cash 2,330,000

12/31 Cash (2,000,000x8%) 160,000

Interest income 160,000

Face amount 2,000,000

Multiply by (%) 95

FMV, 12/31 1,900,000

Carrying amount 2,200,000

Unrealized loss -300,000

Unrealized loss 300,000

Trading securities 300,000

2020 3/31 Cash 2,140,000

Gain on sale of trading securities (squeeze) 200,000

Trading securities (2,200,000-300,000) 1,900,000

Interest income (2,000,000x8%x3/12) 40,000

Selling price 2,100,000

Interest income 40,000

Total cash received 2,140,000

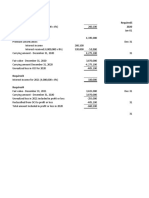

SAMPLE PROBLEM #4

2019 10/1 Investment in bonds 4,300,000

Interest income (4,000,000x10%x3/12) 100,000

Cash 4,400,000

12/31 Interest receivable (4,000,000x10%x6/12) 200,000

Interest income 200,000

Term of the bonds (months):

2019 (October 1 to December 31) 3

2020 - 2025 (January 1 to December 31) 72

Total (months) 75

This document is a property of the University of St. La Salle Module 3 | Page 6

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

Purchase price 4,300,000

Face value of the bonds 4,000,000

Premium on bonds 300,000

Divided by 75

Monthly amortization 4,000

Interest income (4,000x3) 12,000

Investment in bonds 12,000

2020 1/1 Interest income 200,000

Interest receivable 200,000

Cash 200,000

Interest income 200,000

7/1 Cash 200,000

Interest income 200,000

12/31 Interest income (4,000x12) 48,000

Investment in bonds 48,000

Interest receivable (4,000,000x10%x6/12) 200,000

Interest income 200,000

SAMPLE PROBLEM #5

1.) Bond

Year Fraction Amortization

Outstanding

2019 1,000,000 1,000/3,000 50,000

2020 800,000 800/3,000 40,000

2021 600,000 600/3,000 30,000

2022 400,000 400/3,000 20,000

2023 200,000 200/3,000 10,000

3,000,000 150,000

Purchase price 1,150,000

Less: Face value 1,000,000

Premium 150,000

2.) 1/1 Investment in bonds 1,150,000

Cash 1,150,000

6/30 Cash 60,000

Interest income (1,000,000x12%x6/12) 60,000

12/31 Cash 60,000

Interest income (1,000,000x12%x6/12) 60,000

Interest income 50,000

Investment in bonds 50,000

Cash 200,000

Investment in bonds 200,000

SAMPLE PROBLEM #6

1.) Interest Interest Discount Carrying

Date

received (6%) income (8%) amortization amount

1/1/19 4,742,000

12/31/19 300,000 379,360 79,360 4,821,360

12/31/20 300,000 385,709 85,709 4,907,069

12/31/21 300,000 392,931 92,931 5,000,000

Purchase price 4,742,000

Less: Face value 5,000,000

Discount 258,000

This document is a property of the University of St. La Salle Module 3 | Page 7

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

2.) 2019 1/1 Investment in bonds 4,742,000

Cash 4,742,000

12/31 Cash 300,000

Investment in bonds 79,360

Interest income 379,360

2020 12/31 Cash 300,000

Investment in bonds 85,709

Interest income 385,709

Selling price (5,000,000x110%) 5,500,000

Carrying amount 4,907,069

Gain on sale of bonds 592,931

Cash 5,500,000

Gain on sale of bonds 592,931

Investment in bonds 4,907,069

SAMPLE PROBLEM #7

Interest Interest Premium Principal Carrying

Date

received (12%) income (10%) amortization payment amount

1/1/19 5,241,500

12/31/19 600,000 524,150 75,850 1,000,000 4,165,650

12/31/20 480,000 416,565 63,435 1,000,000 3,102,215

12/31/21 360,000 310,222 49,779 1,000,000 2,052,437

12/31/22 240,000 205,244 34,756 1,000,000 1,017,680

12/31/23 120,000 102,320 17,680 1,000,000 -

Purchase price 5,241,500

Less: Face value 5,000,000

Premium 241,500

2019 1/1 Investment in bonds 5,241,500

Cash 5,241,500

12/31 Cash 600,000

Investment in bonds 75,850

Interest income 524,150

Cash 1,000,000

Investment in bonds 1,000,000

2020 12/31 Cash 480,000

Investment in bonds 63,435

Interest income 416,565

Cash 1,000,000

Investment in bonds 1,000,000

SAMPLE PROBLEM #8

1.) Interest Interest Premium Carrying

Date

received (4%) income (3%) amortization amount

1/1/19 3,111,510

6/30/19 120,000 93,345 26,655 3,084,855

12/31/19 120,000 92,546 27,454 3,057,401

6/30/20 120,000 91,722 28,278 3,029,123

12/31/20 120,000 90,877 29,123 3,000,000

Purchase price 3,111,510

Less: Face value 3,000,000

Premium 111,510

This document is a property of the University of St. La Salle Module 3 | Page 8

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

2.) 2019 1/1 Investment in bonds 3,111,510

Cash 3,111,510

6/30 Cash 120,000

Investment in bonds 26,655

Interest income 93,345

12/31 Cash 120,000

Investment in bonds 27,454

Interest income 92,546

SAMPLE PROBLEM #9

1.) Interest Interest Discount Carrying

Date

received (6%) income (8%) amortization amount

1/1/19 4,742,000

12/31/19 300,000 379,360 79,360 4,821,360

12/31/20 300,000 385,709 85,709 4,907,069

12/31/21 300,000 392,931 92,931 5,000,000

Purchase price 4,742,000

Less: Face value 5,000,000

Discount 258,000

2.) 2019 1/1 Financial asset - FVOCI 4,742,000

Cash 4,742,000

12/31 Cash 300,000

Financial asset - FVOCI 79,360

Interest income 379,360

FMV (5,000,000x105%) 5,250,000

Carrying amount, 12/31/19 4,821,360

Unrealized gain 428,640

Financial asset - FVOCI 428,640

Unrealized gain 428,640

2020 12/31 Cash 300,000

Financial asset - FVOCI 85,709

Interest income 385,709

FMV (5,000,000x110%) 5,500,000

Carrying amount, 12/31/20 5,335,709

Unrealized gain 164,291

Financial asset - FVOCI 164,291

Unrealized gain 164,291

2021 12/31 Cash 300,000

Financial asset - FVOCI 92,931

Interest income 392,931

Cash (face value) 5,000,000

Unrealized gain - OCI (cumulative) 592,931

Financial asset - FVOCI 5,592,931

Financial asset - FVOCI

1/1 4,742,000

12/31 79,360

428,640

2019, 12/31 5,250,000

12/31 85,709

5,335,709

164,291

2020, 12/31 5,500,000

12/31 92,931

2021,12/31 5,592,931

This document is a property of the University of St. La Salle Module 3 | Page 9

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

SAMPLE PROBLEM #10

2019 1/1 Financial asset - FVPL 5,380,000

Cash 5,380,000

12/31 Cash (5,000,000x12%) 600,000

Interest income 600,000

FMV (5,000,000x120%) 6,000,000

Carrying amount, 12/31/19 5,380,000

Gain 620,000

Financial asset - FVPL 620,000

Gain from change in fair value 620,000

2020 12/31 Cash (5,000,000x12%) 600,000

Interest income 600,000

FMV (5,000,000x115%) 5,750,000

Carrying amount, 12/31/20 6,000,000

Loss -250,000

Loss from change in fair value 250,000

Financial asset - FVPL 250,000

Financial asset - FVPL

1/1 5,380,000

12/31 620,000

2019, 12/31 6,000,000

250,000 12/31

2020, 12/31 5,750,000

SAMPLE PROBLEM #11

1.) PV of principal (5,000,000 x 0.377) 1,885,000

PV of interest (5,000,000x4%x12.462) 2,492,400

Purchase price 4,377,400

Purchase price 4,377,400

Less: Face value 5,000,000

Discount 622,600

2.) Interest Interest Discount Carrying

Date

received (4%) income (5%) amortization amount

1/1/19 4,377,400

6/30/19 200,000 218,870 18,870 4,396,270

12/31/19 200,000 219,814 19,814 4,416,084

1/1 Investment in bonds 4,377,400

Cash 4,377,400

6/30 Cash 200,000

Investment in bonds 18,870

Interest income 218,870

12/31 Cash 200,000

Investment in bonds 19,814

Interest income 219,814

SAMPLE PROBLEM #12

1.) PV of principal and interest, 2019:

Principal (1,000,000 x 0.91) 910,000

Interest (3,000,000x12%x0.91) 327,600 1,237,600

PV of principal and interest, 2020:

Principal (1,000,000 x 0.83) 830,000

Interest (2,000,000x12%x0.83) 199,200 1,029,200

This document is a property of the University of St. La Salle Module 3 | Page 10

Unauthorized copying and / or editing is prohibited.

Flexible Learning A.Y. 2021-2022

DISTANCE EDUCATION COURSE GUIDE USING OBTL DESIGN v1

PV of principal and interest, 2021:

Principal (1,000,000 x 0.75) 750,000

Interest (1,000,000x12%x0.75) 90,000 840,000

Purchase price 3,106,800

Purchase price 3,106,800

Less: Face value 3,000,000

Premium 106,800

2.) Interest Interest Premium Principal Carrying

Date

received (12%) income (10%) amortization payment amount

1/1/19 3,106,800

12/31/19 360,000 310,680 49,320 1,000,000 2,057,480

12/31/20 240,000 205,748 34,252 1,000,000 1,023,228

12/31/21 120,000 143,228 23,228 1,000,000 -

1/1 Investment in bonds 3,106,800

Cash 3,106,800

12/31 Cash 360,000

Investment in bonds 49,320

Interest income 310,680

Cash 1,000,000

Investment in bonds 1,000,000

This document is a property of the University of St. La Salle Module 3 | Page 11

Unauthorized copying and / or editing is prohibited.

You might also like

- AmortizationDocument20 pagesAmortizationJudith Gabutero100% (2)

- Investment in Associate Complex Problems: Problem 38-1 (AICPA Adapted)Document32 pagesInvestment in Associate Complex Problems: Problem 38-1 (AICPA Adapted)Kimberly Claire Atienza90% (20)

- AC 1201 - Financial Assets at Fair ValueDocument14 pagesAC 1201 - Financial Assets at Fair ValueCarmelou Gavril Garcia Climaco100% (5)

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- FINAL-Investment in AssociateDocument16 pagesFINAL-Investment in AssociateJessa75% (4)

- Chapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Document5 pagesChapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Reinalyn Mendoza75% (4)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho100% (2)

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- Solutions (Quiz1 &2)Document8 pagesSolutions (Quiz1 &2)Aaron Arellano50% (2)

- A Simplified Guide To Crime Scene InvestigationDocument16 pagesA Simplified Guide To Crime Scene Investigationokoro matthewNo ratings yet

- Quiz 1.03 FVPL FVOCI FAACDocument13 pagesQuiz 1.03 FVPL FVOCI FAACJohn Lexter MacalberNo ratings yet

- Activity 2 Investments in Equity SecuritiesDocument4 pagesActivity 2 Investments in Equity SecuritiesVi Vid100% (5)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho50% (2)

- Chapter16 Equity Investments PDFDocument69 pagesChapter16 Equity Investments PDFRomuell BanaresNo ratings yet

- A Comparison of The Sunni Caliphate and The Shii Imamate PDFDocument14 pagesA Comparison of The Sunni Caliphate and The Shii Imamate PDFvalentin24No ratings yet

- Verdadero Cjezerei Borrowing CostsDocument11 pagesVerdadero Cjezerei Borrowing CostsPeter PiperNo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- INVESTMENTS ReviewerDocument35 pagesINVESTMENTS ReviewerRyze100% (1)

- Prelim-Task - Rosas, John Francis I.Document7 pagesPrelim-Task - Rosas, John Francis I.John Francis RosasNo ratings yet

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAngelo Payawal100% (1)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Requirement A.: Acquisation of The BondsDocument3 pagesRequirement A.: Acquisation of The BondsMaria LicuananNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Chapter16 BuenaventuraDocument11 pagesChapter16 BuenaventuraAnonn100% (1)

- CHapter 25 Financial Accounting Vol1Document8 pagesCHapter 25 Financial Accounting Vol1Judith GabuteroNo ratings yet

- Problem 22-1, Page 610 Classic Company: GivenDocument3 pagesProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNo ratings yet

- 06 Diman v. Alumbres (Solis)Document2 pages06 Diman v. Alumbres (Solis)Rafael Alejandro Solis100% (1)

- Receivable FinancingDocument80 pagesReceivable Financingjay1ar1guyena100% (2)

- Chapter 19 20Document11 pagesChapter 19 20Kyle Francine BoloNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- 13 Equity Investment Talusan UsmanDocument18 pages13 Equity Investment Talusan UsmanTakuriNo ratings yet

- Understanding Balance SheetsDocument26 pagesUnderstanding Balance SheetsAli AhmedNo ratings yet

- BSA 3202 Topic 1 - Investment in AssociatesDocument15 pagesBSA 3202 Topic 1 - Investment in AssociatesFrancis Abuyuan100% (1)

- IA 2 Quiz#2 - Reclassification of FA - Investment Property - Answer KeyDocument7 pagesIA 2 Quiz#2 - Reclassification of FA - Investment Property - Answer KeychingchongNo ratings yet

- FAR Practical Exercises InvestmentDocument5 pagesFAR Practical Exercises InvestmentAB CloydNo ratings yet

- Exercise ProblemsDocument6 pagesExercise ProblemsDianna Rose Vico100% (1)

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocument3 pagesMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNo ratings yet

- Impairment of AssetDocument54 pagesImpairment of AssetX50% (2)

- Debt Investments: Lecture Notes What Is A Debt Instrument?Document17 pagesDebt Investments: Lecture Notes What Is A Debt Instrument?moNo ratings yet

- Effective Interest MethodDocument2 pagesEffective Interest MethodKurt Del RosarioNo ratings yet

- Financial Asset at Amortized CostDocument20 pagesFinancial Asset at Amortized CostJudith Gabutero0% (1)

- Answer Key Assignment in Equity Investments - VALIX 2017Document3 pagesAnswer Key Assignment in Equity Investments - VALIX 2017Shinny Jewel VingnoNo ratings yet

- Acc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - CainDocument3 pagesAcc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - Cainslow dancer50% (4)

- Investment PropertyDocument9 pagesInvestment PropertyNathalie GetinoNo ratings yet

- Financial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CDocument15 pagesFinancial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CLiana100% (2)

- Investment in AssociateDocument7 pagesInvestment in AssociatenenzzmariaNo ratings yet

- Quiz 1 On Mid Term Period - Notes ReceivableDocument3 pagesQuiz 1 On Mid Term Period - Notes ReceivableErille Julianne (Rielianne)No ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- ACC421 Chapter 18 Questions and AnswersDocument11 pagesACC421 Chapter 18 Questions and AnswersNhel AlvaroNo ratings yet

- Soledad Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesSoledad Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Chapter 26 - Inventory Cost Flow: Question 26-1Document11 pagesChapter 26 - Inventory Cost Flow: Question 26-1Cyrus IsanaNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodNo ratings yet

- Lecture Slides - Week 1 - Introduction and Short Term Financial ManagementDocument51 pagesLecture Slides - Week 1 - Introduction and Short Term Financial ManagementSelin AkbabaNo ratings yet

- P7 - Investment in Debt Securities & Other Non-Current Financial AssetsDocument46 pagesP7 - Investment in Debt Securities & Other Non-Current Financial AssetsNashiel AnneNo ratings yet

- Financial Asset at Fair Value: Intermediate Accounting 1 Ray Patrick S. Guangco, CPADocument17 pagesFinancial Asset at Fair Value: Intermediate Accounting 1 Ray Patrick S. Guangco, CPAClaire Magbunag AntidoNo ratings yet

- FABM2 Module 5 Cash Flow StatementDocument12 pagesFABM2 Module 5 Cash Flow StatementLoriely De GuzmanNo ratings yet

- FIN 201 Chapter 02Document27 pagesFIN 201 Chapter 02ImraanHossainAyaanNo ratings yet

- READING 8 Free Cashflow (Equity Valuation)Document25 pagesREADING 8 Free Cashflow (Equity Valuation)DandyNo ratings yet

- حضور ﷺکی زندگی کا ازدواجی پہلوDocument14 pagesحضور ﷺکی زندگی کا ازدواجی پہلوMuhammad NabeelNo ratings yet

- ABC Advance Accounting Inter 1Document4 pagesABC Advance Accounting Inter 1Chirag GadiaNo ratings yet

- Đề thi thử Deloitte-ACE Intern 2021Document60 pagesĐề thi thử Deloitte-ACE Intern 2021Tung HoangNo ratings yet

- Chapter 14 SolutionDocument9 pagesChapter 14 Solutionbellohales0% (1)

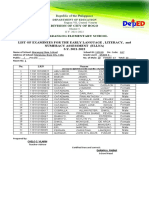

- List of Examinees For The Early Language, Literacy, and Numeracy Assessment (Ellna) S.Y. 2021-2022Document2 pagesList of Examinees For The Early Language, Literacy, and Numeracy Assessment (Ellna) S.Y. 2021-2022April Catadman QuitonNo ratings yet

- Banaras Hindu University: 7 Mahamana MalaviyaDocument23 pagesBanaras Hindu University: 7 Mahamana MalaviyaRaghavendra SinghNo ratings yet

- Sílabo de Family, Children and Teenagers LawDocument5 pagesSílabo de Family, Children and Teenagers Lawedwarsh1504No ratings yet

- UK Visas & Immigration: Personal InformationDocument3 pagesUK Visas & Immigration: Personal InformationАлександрNo ratings yet

- Assignment Drafting (Malaysian Issues)Document3 pagesAssignment Drafting (Malaysian Issues)Kelvin ChiamNo ratings yet

- HVN - Annual Report 2019Document150 pagesHVN - Annual Report 2019Krithik RajNo ratings yet

- Agent Name: M/S. Policy Bazaar Insurance B Private Limited TB (869196), PH NO.: 18002585970, ADDRESS: Plot No. 119, Sector-44, GurgaonDocument60 pagesAgent Name: M/S. Policy Bazaar Insurance B Private Limited TB (869196), PH NO.: 18002585970, ADDRESS: Plot No. 119, Sector-44, GurgaonLovekesh KasanaNo ratings yet

- NRSAP 2021-30 Draft Final 14apr22 1658832893Document159 pagesNRSAP 2021-30 Draft Final 14apr22 1658832893black webNo ratings yet

- Case Study - Ben & Jerry'sDocument7 pagesCase Study - Ben & Jerry'sLinh Phan Thị MỹNo ratings yet

- Presentation FormatDocument9 pagesPresentation FormatHassan MohsinNo ratings yet

- Jeena Jeena Guitar Chords - Badlapur With Strumming PatternDocument3 pagesJeena Jeena Guitar Chords - Badlapur With Strumming PatternnfsNo ratings yet

- Harrison OPRA Form Request FormDocument4 pagesHarrison OPRA Form Request FormThe Citizens CampaignNo ratings yet

- Speakout Adv A Key Units 1 5 Lookback ReviewDocument3 pagesSpeakout Adv A Key Units 1 5 Lookback ReviewSadokat100% (1)

- Ibm Totalstorage San140M: Designed For Easy-To-Manage, Highly Scalable, High-Performance Enterprise San SolutionsDocument8 pagesIbm Totalstorage San140M: Designed For Easy-To-Manage, Highly Scalable, High-Performance Enterprise San SolutionsrakeshNo ratings yet

- Strangeness and The StrangersDocument5 pagesStrangeness and The StrangersabdesssaNo ratings yet

- Fol500 006 14Document3 pagesFol500 006 14Franco DeottoNo ratings yet

- Moot Court Tutorial 1Document8 pagesMoot Court Tutorial 1rushi sreedharNo ratings yet

- Bhikkhuni Vinaya Studies5.1 PDFDocument256 pagesBhikkhuni Vinaya Studies5.1 PDFNed BranchiNo ratings yet

- CHAPTER II. CICM in The WorldDocument9 pagesCHAPTER II. CICM in The WorldJocelyn TabudlongNo ratings yet

- ETHICAL CODE OR CODE OF ETHICS Are Principles Adopted by An Organization To Assist Those inDocument2 pagesETHICAL CODE OR CODE OF ETHICS Are Principles Adopted by An Organization To Assist Those inEve Rose Tacadao IINo ratings yet

- Judy Austin Affidavit 200906 in Supreme Court of BC Action No. S-085280 Vancouver RegistryDocument36 pagesJudy Austin Affidavit 200906 in Supreme Court of BC Action No. S-085280 Vancouver RegistryWesley KenzieNo ratings yet

- Financing Card Based On Murabahah Contract: The Legal Implications On A Credit CardDocument15 pagesFinancing Card Based On Murabahah Contract: The Legal Implications On A Credit CardIJELS Research JournalNo ratings yet

- ACC9805 - Chapter 10Document19 pagesACC9805 - Chapter 10Shakuli YesrNo ratings yet