Professional Documents

Culture Documents

Prelim-Task - Rosas, John Francis I.

Uploaded by

John Francis RosasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelim-Task - Rosas, John Francis I.

Uploaded by

John Francis RosasCopyright:

Available Formats

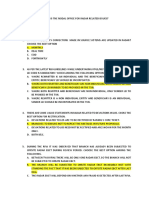

PRELIM EXAMINATION

On April 1, 2019 GB Company had 6,000 units of merchandise on hand that cost

P120 per unit. During the month, GB had the following entries with regard to the

merchandise:

April 5 Purchased on account 15,000 units at P140 per unit

8 Returned 1,000 units from the April 5 purchases-cost flow.

1. What is the cost of goods sold for April 2019?

a. 2,120,000 b. 2,200,000 c. 2,144,000 d. 2,080,000

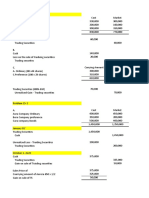

Unit Sold Unit Cost Total Cost

April 1 6,000 120 720,000

April 5 10,000 140 1,400,000

Total Good Sold 16,000 260 2,120,000

Bakun Company began operations late in 2018. For the first quarter ended

March 31, 2019, Bakun made available the following information:

Total merchandise purchased through March 15, recorded at net 4,900,000

Merchandise inventory at December 31, 2018, at selling price 1,500,000

All merchandise was acquired on credit and no payments have been made on

accounts payable since the inception of the company. All merchandise is

marked to sell at 50% above invoice cost before time discounts of 2/10, n/30. No

sales were made in 2019.

2. How much cash is required to eliminate the current balance in accounts

payable?

a. 6,000,000 b. 5,900,000 c. 6,400,000 d. 5,750,000

Purchased through March 15 5,000,000

(4,900,000/98%)

Inventory (1,500,000/150% 1,000,000

Total Gross Amount 6,000,000

The balance in Reed Company’s accounts payable account at December 31,

2019 was P4,900,000 before the following information was considered:

• Goods shipped F.O.B. destinations on December 21, 2019 from a vendor to

Reed were lost in transit. The invoice cost of P180,000 was not recorded by Reed.

On December 28, 2019, Reed notified the vendors of the lost shipment.

• Goods were in transit from a vendor to Reed on December 31, 2019. The

invoice cost was P240,000 and the goods were shipped F.O.B. shipping point on

December 28, 2019. Reed received the goods on January 6, 2020.

3. What amount should Reed report as accounts payable in its December 31,

2019 balance sheet?

a. 5,320,000 b. 5,140,000 c. 5,080,000 d. 4,900,000

Accounts Payable on December 31, 2019 before considering P 4,900,000

additional events

Goods in transit at FOB shipping point basis 240,000

Accounts payable on December 31, 2019 after considering P 5,140,000

additional events

Appari Bank granted a loan to a borrower on January 1, 2016. The interest rate

on the loan is 10% payable annually starting December 31, 2016. The loan

matures in five years on December 31, 2020.

Principal amount 4,000,000

Direct origination cost 61,500

Origination fee received from borrower 350,000

The effective rate on the loan after considering the direct origination cost and

origination fee received is 12%.

4. What is the carrying value of the loan receivable on January 1, 2016?

a. 4,000,000 b. 4,650,000 c. 4,411,500 d. 3,711,500

Principal amount 4,000,000

Direct original cost 61,500

Origination fee received from borrower (350,000)

Total 3,711,500

5. What is the interest income for 2016?

a. 400,000 b. 558,000 c. 529,380 d. 445,380

Interest income (3,711,500*12%) = 445,380

6. Account of the petty cash fund of XYZ Company showed its composition as

follows:

Coins and currency 3,300

Paid vouchers:

Transportation 600

Gasoline 400

Office supplies 500

Postage stamps 300

Due from employees 1,200 3,000

Manager’s check returned by bank marked NSF

1,000

Check drawn by company to the order of petty cash custodian

2,700

What is the amount of the petty cash fund for balance sheet purposes?

a. 10,000 b. 7,000 c. 6,000 d. 9,000

Coins and currency P3,300

Check drawn by company to the order of petty cash custodian 2,700

Amount of petty cash fund 6,000

7. Appari Bank granted a loan to a borrower on January 1, 2019. The interest

rate on the loan is 10% payable annually starting December 31, 2019. The loan

matures in five years on December 31, 2023.

Principal amount 4,000,000

Direct origination cost 61,500

Origination fee received from borrower 350,000

The effective rate on the loan after considering the direct origination cost and

origination fee received is 12%.

What is the carrying value of the loan receivable on January 1, 2019?

a. 4,000,000 b. 4,650,000 c. 4,411,500 d. 3,711,500

Principal amount 4,000,000

Direct original cost 61,500

Origination fee received from borrower (350,000)

Total 3,711,500

The inventory on hand at December 31, 2019 for Fair Company is valued at a

cost of P950,000. The following items were not included in this inventory amount:

Item 1: Purchased goods in transit, shipped FOB destination, invoice price

P30,000 which includes freight charge of P1,500.

Item 2: Goods held on consignment by Fair Company at a sales price of

P28,000, including sales commission of 20% of the sales price.

Item 3: Goods sold to Grace Company, under terms FOB destination, invoiced

for P18,500 which includes P1,000 freight charge to deliver the goods. Goods are

in transit. The company’s selling price is 140% of cost.

Item 4: Purchased goods in transit, terms FOB shipping point, invoice price

P50,000, freight cost, P2,500.

Item 5: Goods out on consignment to Manila Company, sales price P35,000,

shipping cost of P2,000.

8. What is the adjusted cost of the inventory on December 31, 2019

a. 1,042,000 b. 1,043,000 c. 1,040,000 d. 1,073,500

Inventory per books P 950,000

Item 3 (18,500 – 1,000 / 140%) 12,500

Item 4 (50,000 + 2,500) 52,500

Item 5 35,000/ 140% = 25,000 + 2,000) 27,000

Adjusted Inventory P 1,042,000

Kalibo Bank loaned P5,000,000 to Caticlan Company on January 1, 2019. The

terms of the loan require principal payments of P1,000,000 each year for 5 years

plus interest at 8%. The first principal and interest payment is due on January 1,

2020. Caticlan Company made the required payments during 2020 and 2021.

However, during 2021 Caticlan Company began to experience financial

difficulties, requiring Kalibo to reassess the collectibility of the loan. On

December 31, 2021, Kalibo Bank determines that the remaining principal

payment will be collected but the collection of the interest is unlikely. The

present value of 1 at 8% is as follows:

For one period 0.93

For two periods 0.86

For three periods 0.79

9. What is the loan impairment loss on December 31, 2021?

a. 420,000 b. 210,000 c. 630,000 d. 0

January 1, 2022 1,000,000

January 1, 2023 (1,000,000*0.93) 930,000

January 1, 2024 (1,000,000*0.86) 860,000

Total 2,790,000

Less: Loan receivable (3,000,000)

Total 210,000

10. What is the interest income to be reported by Kalibo Bank in 2022?

a. 223,200 b. 143,200 c. 240,000 d. 0

Loan receivable 3,000,000

Collection (1,000,000)

Total 2,000,000

Allowance for loan impairment (210,000)

Total 1,790,000

Interest Income (1,790,000*8%) = 143,200

Hero Company’s inventory at December 31, 2019 was P7,500,000 based on

physical count priced at cost and before any necessary adjustment for the

following:

• Merchandise costing P750,000, shipped FOB shipping point from a vendor on

December 30, 2019, was received and recorded on January 5, 2020.

• Goods in the shipping area were excluded from inventory although shipment

was not made until January 4, 2020. The goods, billed to the customer FOB

shipping point on December 30, 2019, had a cost of P600,000.

1. What amount should Hero report as inventory in its December 31, 2019

balance sheet?

a. 7,500,000 b. 7,950,000 c. 8,100,000 d. 8,850,000

Inventory at December 31, 2019 P 7,500,000

Customer FOB shipping point on December 30, 2019 600,000.

Total inventory in its December 31, 2019 P 8,100,000

The following information applied to Fenn Company for the current year:

Merchandise purchased for resale 4,000,000

Freight in 100,000

Freight out 50,000

Purchase returns 20,000

Interest on inventory loan 200,000

2. Fenn’s inventoriable cost was

a. 4,280,000 b. 4,030,000 c. 4,080,000 d. 4,130,000

Merchandise purchased P 4,000,000

ADD: Freight in 100,000

Total 4,100,000

LESS: Purchase returns (20,000)

Inventory Cost P 4,080,000

3. Burr Company had the following account balance at December 31, 2019:

Cash in bank 2,250,000

Cash on hand 125,000

Cash legally restricted for additions to plant (expected to be disbursed in

2020) 1,600,000

Cash in bank includes P600,000 of compensating balance against short-term

borrowing arrangement. The compensating balance is not legally restricted as

to withdrawal by Burr.

In the current assets section of Burr’s December 31, 2019 balance sheet, total

cash should be reported at

a. 1,775,000 b. 2,250,000 c. 2,375,000 d. 3,975,000

Cash in bank P 2,250,000

Cash on hand 125,000

Total cash be reported P 2,375,000

XYZ Company factored P6,000,000 of accounts receivable to ABC Company on

October 1, 2006. Control was surrendered by XYZ. ABC accepted the

receivables subject to recourse for nonpayment. ABC assessed a fee of 3% and

retains a holdback equal to 5% of the accounts receivable. In addition, ABC

charged 15% interest computed on a weighted-average time to maturity of the

receivables of 54 days. The fair value of the recourse obligation is P90,000.

4. XYZ will receive and record cash of

a. 5,296,850 b. 5,386,850 c. 5,476,850 d. 5,556,850

*6,000,000 – 300,000 – 180,000 – 133,150 = 5,386,850

5. Assuming all receivables are collected, XYZ Company’s cost of factoring the

receivables would be

a. 313,150 b. 180,000 c. 433,150 d. 613,150

* Withheld as fee income 180,000

*Withheld as interest income 133,150

P313,150

You might also like

- ACC 101 - NR Assignment SolutionDocument6 pagesACC 101 - NR Assignment SolutionAdyangNo ratings yet

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- Bleak Company Requirement A Debit Credit Requirement BDocument2 pagesBleak Company Requirement A Debit Credit Requirement BAnonn100% (1)

- Generous Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageGenerous Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Chap14 ProblemsDocument8 pagesChap14 ProblemsYen YenNo ratings yet

- Ia Chapter 11-12Document4 pagesIa Chapter 11-12Marinella LosaNo ratings yet

- Machete Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageMachete Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- Ia - 13Document17 pagesIa - 13Ma. Fatima H. FabayNo ratings yet

- Bedlam Company December Cash Proof ReportDocument2 pagesBedlam Company December Cash Proof ReportChristy HabelNo ratings yet

- Problem 12-2 To 6Document3 pagesProblem 12-2 To 6MYCO PONCE PAQUENo ratings yet

- Quiz 1.02 Cash and Cash Equivalents To Loan ImpairmentDocument13 pagesQuiz 1.02 Cash and Cash Equivalents To Loan ImpairmentJohn Lexter MacalberNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Loans Receivable ProblemsDocument16 pagesLoans Receivable ProblemsPeter Piper33% (3)

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- 6-4 Gullible Company Req 1Document2 pages6-4 Gullible Company Req 1mercyvienhoNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Accounts Receivable Chapter SummaryDocument13 pagesAccounts Receivable Chapter SummaryAndrea FontiverosNo ratings yet

- Computation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditDocument2 pagesComputation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditAnonn100% (1)

- This Study Resource Was: Chapter 18: Accounts ReceivableDocument7 pagesThis Study Resource Was: Chapter 18: Accounts ReceivableXENA LOPEZNo ratings yet

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocument3 pagesMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNo ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Problem 6-5 & 6Document2 pagesProblem 6-5 & 6Micah April SabularseNo ratings yet

- CCEDocument3 pagesCCESofia Nadine100% (1)

- Accounting for Bad Debts MethodsDocument5 pagesAccounting for Bad Debts Methodshoneyjoy salapantanNo ratings yet

- Notes ReceivablesDocument5 pagesNotes ReceivablesDianna DayawonNo ratings yet

- Integrated Review 1 SubmissionsDocument17 pagesIntegrated Review 1 SubmissionsJohn Lexter Macalber100% (1)

- Accounts ReceivableDocument6 pagesAccounts ReceivableNerish PlazaNo ratings yet

- Chapter5 IA Problems1 9Document16 pagesChapter5 IA Problems1 9Anonn100% (1)

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Problem 8-6 & 8-7 ReportDocument3 pagesProblem 8-6 & 8-7 Reportjessamae gundanNo ratings yet

- Activity in E3 - LiabilitiesDocument9 pagesActivity in E3 - LiabilitiesPaupau100% (1)

- IA Activity 3 Chapter 6Document2 pagesIA Activity 3 Chapter 6Sunghoon SsiNo ratings yet

- Dainty Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDainty Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- SHARE BASED PAYMENTS PROBLEMS SOLVEDDocument80 pagesSHARE BASED PAYMENTS PROBLEMS SOLVEDjay1ar1guyena100% (2)

- On June 1 AcctDocument5 pagesOn June 1 AcctMelody Bautista100% (1)

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Module 2d Loan ReceivableDocument24 pagesModule 2d Loan ReceivableChen HaoNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Docile Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDocile Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Practice Notes ReceivableDocument4 pagesPractice Notes ReceivableMartha Nicole Maristela100% (4)

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- IA Activity 2 Chapter 4&5Document9 pagesIA Activity 2 Chapter 4&5Sunghoon SsiNo ratings yet

- Key To CorrectionDocument10 pagesKey To CorrectionSaeym SegoviaNo ratings yet

- Loans Receivable Origination FeesDocument15 pagesLoans Receivable Origination FeesTurksNo ratings yet

- Adjusting Entries for Petty Cash Fund TransactionsDocument29 pagesAdjusting Entries for Petty Cash Fund TransactionsENCARNACION Princess MarieNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- Seatwork 2B ASSIGNDocument5 pagesSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- Omega Finance loan impairmentDocument9 pagesOmega Finance loan impairmentRengeline LucasNo ratings yet

- Walleye Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageWalleye Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Quiz 1 On Mid Term Period - Notes ReceivableDocument3 pagesQuiz 1 On Mid Term Period - Notes ReceivableErille Julianne (Rielianne)No ratings yet

- Estimation of Doubtful Accounts: Problem 12-1 (AICPA Adapted)Document15 pagesEstimation of Doubtful Accounts: Problem 12-1 (AICPA Adapted)Janine Lerum100% (2)

- Bond Interest Income and Discount AmortizationDocument3 pagesBond Interest Income and Discount AmortizationMaria LicuananNo ratings yet

- Intacc1 PrelimDocument5 pagesIntacc1 PrelimSarah Del RosarioNo ratings yet

- Prelim Task De-Vera Angela-KyleDocument6 pagesPrelim Task De-Vera Angela-KyleJohn Francis RosasNo ratings yet

- Second PreboardDocument6 pagesSecond PreboardBella AyabNo ratings yet

- Far FPBDocument16 pagesFar FPBMae Marcos SaguipedNo ratings yet

- Sop - 2 - V3Document3 pagesSop - 2 - V3John Francis RosasNo ratings yet

- Sop - 6 - V3Document4 pagesSop - 6 - V3John Francis RosasNo ratings yet

- Sop - 5 - V3Document2 pagesSop - 5 - V3John Francis RosasNo ratings yet

- VAT Expenses 2020Document24 pagesVAT Expenses 2020John Francis RosasNo ratings yet

- SOP Collection ProcedureDocument3 pagesSOP Collection ProcedureJohn Francis RosasNo ratings yet

- Angelo CompanyDocument3 pagesAngelo CompanyJohn Francis RosasNo ratings yet

- Reviewer in Intermediate Accounting: Problem 169 (IAA)Document106 pagesReviewer in Intermediate Accounting: Problem 169 (IAA)Lester Sanchez75% (67)

- 12345Document3 pages12345John Francis RosasNo ratings yet

- Sales Agreement of CAR VEHICLE Task 1 - Rosas, John Francis I.Document1 pageSales Agreement of CAR VEHICLE Task 1 - Rosas, John Francis I.John Francis RosasNo ratings yet

- Sop - 18 - V3Document9 pagesSop - 18 - V3John Francis RosasNo ratings yet

- Prelim-Task - Rosas, John Francis I.Document7 pagesPrelim-Task - Rosas, John Francis I.John Francis RosasNo ratings yet

- Asynchronous ActivityDocument4 pagesAsynchronous ActivityJohn Francis RosasNo ratings yet

- Asynchronous ActivityDocument4 pagesAsynchronous ActivityJohn Francis RosasNo ratings yet

- Prelim Task De-Vera Angela-KyleDocument6 pagesPrelim Task De-Vera Angela-KyleJohn Francis RosasNo ratings yet

- Midterm Task Angela de VeraDocument3 pagesMidterm Task Angela de VeraJohn Francis RosasNo ratings yet

- Estate Tax CalculationDocument4 pagesEstate Tax CalculationJohn Francis RosasNo ratings yet

- Midterm ExaminationDocument9 pagesMidterm ExaminationJohn Francis RosasNo ratings yet

- Asynchronous ActivityDocument4 pagesAsynchronous ActivityJohn Francis RosasNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Problems 3 Prelim TaskDocument8 pagesProblems 3 Prelim TaskJohn Francis Rosas100% (2)

- Sales Agreement of CAR VEHICLE Task 1 - Rosas, John Francis I.Document1 pageSales Agreement of CAR VEHICLE Task 1 - Rosas, John Francis I.John Francis RosasNo ratings yet

- Prelim-Task - Rosas, John Francis I.Document7 pagesPrelim-Task - Rosas, John Francis I.John Francis RosasNo ratings yet

- Asynchronous ActivityDocument4 pagesAsynchronous ActivityJohn Francis RosasNo ratings yet

- This Study Resource Was: Problem 1Document4 pagesThis Study Resource Was: Problem 1John Francis RosasNo ratings yet

- Prelim-Task - Rosas, John Francis I.Document7 pagesPrelim-Task - Rosas, John Francis I.John Francis RosasNo ratings yet

- Sales Agreement - Task 1 - Rosas, John Francis I.Document6 pagesSales Agreement - Task 1 - Rosas, John Francis I.John Francis RosasNo ratings yet

- Sales Agreement of CAR VEHICLE Task 1 - Rosas, John Francis I.Document1 pageSales Agreement of CAR VEHICLE Task 1 - Rosas, John Francis I.John Francis RosasNo ratings yet

- Midterm Task Angela de VeraDocument3 pagesMidterm Task Angela de VeraJohn Francis RosasNo ratings yet

- Sales Agreement - Task 1 - Rosas, John Francis I.Document6 pagesSales Agreement - Task 1 - Rosas, John Francis I.John Francis RosasNo ratings yet

- FOCE COM MS17836 23-329 (P) (Eng) SBA Opening PLOC in Sharkey County 2023-03-28Document2 pagesFOCE COM MS17836 23-329 (P) (Eng) SBA Opening PLOC in Sharkey County 2023-03-28USA TODAY NetworkNo ratings yet

- Buslaw1 Midterm 01Document14 pagesBuslaw1 Midterm 01Ma. Krecia NicolNo ratings yet

- RgiptulluDocument25 pagesRgiptulluHelloNo ratings yet

- Region Bank StatementDocument4 pagesRegion Bank Statementpolaoapp3044No ratings yet

- Secretary'S Certificate: The Bank, or Third PartiesDocument3 pagesSecretary'S Certificate: The Bank, or Third PartiesJ'ca EdulanNo ratings yet

- CANARA BANK Educationl LoanDocument1 pageCANARA BANK Educationl LoanRahulJotwaniNo ratings yet

- CV EditedDocument2 pagesCV Editedcacious mwewaNo ratings yet

- Module One Introduction To MicrofinanceDocument5 pagesModule One Introduction To MicrofinanceMaimon AhmetNo ratings yet

- Punam ResumeDocument2 pagesPunam ResumeliihaazNo ratings yet

- Internship Project HariharanDocument43 pagesInternship Project HariharanGAMPNo ratings yet

- STAMP DUTY - NewDocument1 pageSTAMP DUTY - Newanshuman khaNo ratings yet

- Year 6 - Practise - 3Document8 pagesYear 6 - Practise - 3falina100% (1)

- TIME VALUE OF MONEY INVESTMENTSDocument83 pagesTIME VALUE OF MONEY INVESTMENTSMustakim Bin Aziz 1610534630No ratings yet

- Marion BoatsDocument3 pagesMarion Boatser.ruchira671No ratings yet

- Project Profile Format For Getting PPR or DPR From Investor ApplicantDocument3 pagesProject Profile Format For Getting PPR or DPR From Investor ApplicantM MNo ratings yet

- CLD - Bao3404 Tutorial GuideDocument7 pagesCLD - Bao3404 Tutorial GuideShi MingNo ratings yet

- "A Study of Agriculture Loan" Vividh Karyakari Seva Sahkari Society Ltd. DingoreDocument34 pages"A Study of Agriculture Loan" Vividh Karyakari Seva Sahkari Society Ltd. Dingorespiritual pfiNo ratings yet

- Understanding RADAR and RFIA integration scoresDocument9 pagesUnderstanding RADAR and RFIA integration scoresER SAABNo ratings yet

- Basic of Accounts Tally Is A Package: AccountingDocument9 pagesBasic of Accounts Tally Is A Package: AccountingArista TechnologiesNo ratings yet

- Commercials: Sr. No. TXN Mode Services Type Vle ShareDocument2 pagesCommercials: Sr. No. TXN Mode Services Type Vle ShareSHASHI KANTNo ratings yet

- Sample of Loan Agreement PhilippinesDocument2 pagesSample of Loan Agreement PhilippinesChristine Angelica Felix50% (4)

- Blank Quiz q2 WK 1 Written WorksDocument4 pagesBlank Quiz q2 WK 1 Written WorksDeanna Kate Balais100% (1)

- How Micro-Loans Help Small Businesses in the PhilippinesDocument10 pagesHow Micro-Loans Help Small Businesses in the PhilippinesTrixie Ros VillerozNo ratings yet

- Nakpil vs. Intermediate Appellate CourtDocument2 pagesNakpil vs. Intermediate Appellate CourtPACNo ratings yet

- Homes and Home Loans Provided To EmployeesDocument8 pagesHomes and Home Loans Provided To EmployeesVidur AggarwalNo ratings yet

- CASEDocument6 pagesCASEmaxinelucero10No ratings yet

- Simple Interest - WSDocument2 pagesSimple Interest - WSKrishnamohanNo ratings yet

- Analyze Financial Records Trial BalanceDocument40 pagesAnalyze Financial Records Trial BalanceJam SurdivillaNo ratings yet

- BEACCTNG.1 Fundamental of Accounting 1 Activity 1 Week 2 Name: - Course: - DateDocument9 pagesBEACCTNG.1 Fundamental of Accounting 1 Activity 1 Week 2 Name: - Course: - DateJD AguilarNo ratings yet

- Info@ks-Legal - In: Rating/Loan Eligibility Across The IndustryDocument2 pagesInfo@ks-Legal - In: Rating/Loan Eligibility Across The IndustryChinmoy DeNo ratings yet