Professional Documents

Culture Documents

SBI STOCK Jaipur Terms

Uploaded by

manish jopatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI STOCK Jaipur Terms

Uploaded by

manish jopatCopyright:

Available Formats

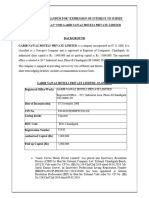

ANNEXURE-1

STATE BANK OF INDIA

LOCAL HEAD OFFICE. JAIPUR-302005

REQUEST FOR EMPANELMENT OF STOCK AUDITORS

CRITERIA AND TERMS & CONDITIONS FOR EMPANELMENT OF

STOCK AND RECEIVABLE AUDITORS (SRAs)

Eligibility Criteria:

i) The Auditors to be from Companies, Firms, Limited Liability Partnership (LLP) of Chartered

Accountants I Cost Accountants registered with Institute of Chartered Accountants of India / Cost

Account~nts of India. Proprietorship Firms shall also be considered for empanelment as SRA

The Auditors should fulfil the following criteria: ·

a) Should have at least two qualified Chartered Accountants/Cost Accountants as Partners /

Directors in case of Companies, Firms and LLP.

b) The Proprietor or at least one Partner/ Director of the Firm / LLP / Company should have

minimum 5 years experience.

c) Preference to entities having personnel with engineering background to assist in conducting

the stock and receivable audit.

d) Preference also to those already empanelled with other Banks/Fis as Stock and Receivable

Auditors.

e) Those who are already empanelled with us/other Banks/Fis and having a good track record of

handling the assignments to be given preference.

ii) Having integrity and character beyond reproach. Unblemished track record, with no unsatisfactory

conduct in the past and should have not been .blacklisted by any Bank / financial institution / other

organizations/any government department, no listing in default/ caution /debarment list of RBI / IBA /

SEBI / their professional institutes etc. Self-attested affidavit on stamp paper in this regard should be

furnished

iii) Having branches/offices in Rajasthan State.

iv)The name of the Companies /Firms/LLP or its director/promoter/partner, Proprietor etc. should not

be in the defaulters/barred/caution list published/displayed at websites of public bodies such as by

RBI/IBA/ECGC/SEBI/CICs/NCLT etc.

Other Terms & Conditions:

i) Application in the prescribed format should be submitted to nearest AGM(SME)RBO/ZO/SME

Intensive Branch on or before 15-03-2021 .

ii) Usual KYC documents revealing Identity and address of Individual/ Corporate/ Firm etc are

mandatory.

iii) PAN Number and GST Registration Number (as applicable) are also mandatory.

iv) In the event of gross negligence/malpractices, if any, noticed by the Bank in S~'s co~duct/scop~

of work, apart from depanelling the Firm/ LLP / Company, the Bank reserves the right to include their

names in the cautionary list for circulation to all the Banks through IBA.

v) Bank reserves the right to reject any or all applications for empanelment without assigning any

reasons thereof.

vi) Auditors against whom complaints have been registered with C~I, Serio_u~ Fraud Investigation Cell

and court(s)/regulatory bodies, and is blacklisted by any banks/Fis 1s not ehg1ble to apply.

************

You might also like

- Buy Bitcoins With Credit CardDocument2 pagesBuy Bitcoins With Credit CardJaySiboNo ratings yet

- Ipo ProcessDocument9 pagesIpo Processrahulkoli25No ratings yet

- E-STATEMENT Emirates Bank International/eStatements/E-STATEMENT 0215827741601 05 MAR 2023 1601 MRETL 05-03-2023 PDFDocument5 pagesE-STATEMENT Emirates Bank International/eStatements/E-STATEMENT 0215827741601 05 MAR 2023 1601 MRETL 05-03-2023 PDFShanish JobNo ratings yet

- CDA AccreditationDocument11 pagesCDA AccreditationAndres Lorenzo III50% (2)

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDSeema BhagatNo ratings yet

- Audit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFDocument113 pagesAudit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFShaheryar Shahid100% (1)

- Documents Required For Registration As Type I - NBFC-NDDocument3 pagesDocuments Required For Registration As Type I - NBFC-NDvignesh ACSNo ratings yet

- Delima ReportDocument16 pagesDelima ReportEstrada Alf100% (7)

- Advertisement 02.05.2023Document6 pagesAdvertisement 02.05.2023Het DoshiNo ratings yet

- Nit 2012-13Document6 pagesNit 2012-13yogesh.b.lokhande9022No ratings yet

- Microsoft Word - Practice Paper Advanced Auditing Mock Test November 2016Document4 pagesMicrosoft Word - Practice Paper Advanced Auditing Mock Test November 2016Asim JavedNo ratings yet

- Allahabad BankDocument4 pagesAllahabad BankBhaskar JanaNo ratings yet

- Who Is A Statutory Auditor PDFDocument3 pagesWho Is A Statutory Auditor PDFSHREYA MNo ratings yet

- Union-bank-Advt Bid Suc AgtDocument2 pagesUnion-bank-Advt Bid Suc Agtbugtestting2No ratings yet

- CA Empanelment-Application FormatDocument12 pagesCA Empanelment-Application FormatJyothi GowdaNo ratings yet

- 8 CMA Rev. CFRDocument18 pages8 CMA Rev. CFRSakshiNo ratings yet

- Suggested Answers Compiler May 2018 To July 2021Document113 pagesSuggested Answers Compiler May 2018 To July 2021rabin067khatriNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document18 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Suryanarayan RajanalaNo ratings yet

- F MauditDocument4 pagesF MauditPaulomee JhaveriNo ratings yet

- NBFC RegistrationDocument25 pagesNBFC RegistrationBirds R AngelsNo ratings yet

- State Bank of India - 16202294849613Document55 pagesState Bank of India - 16202294849613Ramesh gopeNo ratings yet

- Paper 3 - Audit - TP-1Document7 pagesPaper 3 - Audit - TP-1Suprava MishraNo ratings yet

- Union Bank - 1581314273Document12 pagesUnion Bank - 1581314273Subrata PodderNo ratings yet

- Faqs For Intermediaries What Is The Procedure For Registering A Mutual Fund With Sebi? A. How To Get Registered As A Mutual Fund?Document11 pagesFaqs For Intermediaries What Is The Procedure For Registering A Mutual Fund With Sebi? A. How To Get Registered As A Mutual Fund?Raghu selvNo ratings yet

- Narayanmurthy ReportDocument17 pagesNarayanmurthy Reportmeetkamal3No ratings yet

- Corporate Governance-4-3Document4 pagesCorporate Governance-4-3silvernitrate1953No ratings yet

- Mini Case Study - Case Chart & Questions - A DelimaDocument17 pagesMini Case Study - Case Chart & Questions - A Delima930723No ratings yet

- SEBI RegistrationDocument4 pagesSEBI RegistrationpiyushNo ratings yet

- Companies (Auditor's Report) Order, 2020Document17 pagesCompanies (Auditor's Report) Order, 2020Rohit BajajNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- CT AuditReg 2 QPDocument5 pagesCT AuditReg 2 QPKhushi KapurNo ratings yet

- CA Empanelment-Application FormatDocument5 pagesCA Empanelment-Application FormatPV REDDY AssociatesNo ratings yet

- Super Tittle Full MarksDocument14 pagesSuper Tittle Full MarksSriram DammalapatiNo ratings yet

- Companies (Auditor's Report) Order, 2020: Companies Specifically Excluded From Its PurviewDocument4 pagesCompanies (Auditor's Report) Order, 2020: Companies Specifically Excluded From Its PurviewABINASHNo ratings yet

- 1Document8 pages1neelamNo ratings yet

- Code of Corporate Governance For Public Sector OrganisationDocument6 pagesCode of Corporate Governance For Public Sector OrganisationDanish SarwarNo ratings yet

- United Bank Notice Empanelment Stock AuditorDocument15 pagesUnited Bank Notice Empanelment Stock AuditorAlok KhamnotraNo ratings yet

- ch13 - CARODocument8 pagesch13 - CAROTanny KhatriNo ratings yet

- Naresh Chandra Commitee 2002 - Presentation To Be Taken For Class Seminar.Document26 pagesNaresh Chandra Commitee 2002 - Presentation To Be Taken For Class Seminar.sambhu_nNo ratings yet

- Company Law - Test IVDocument5 pagesCompany Law - Test IVArundhati PawarNo ratings yet

- CARO 2020 - Decoding The PerspectiveDocument20 pagesCARO 2020 - Decoding The Perspectivenimisha vermaNo ratings yet

- Companies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CARODocument28 pagesCompanies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROCA Rishabh DaiyaNo ratings yet

- Valuation CirDocument3 pagesValuation Cirmaha33% (6)

- Expressin of Interest - Document PDFDocument12 pagesExpressin of Interest - Document PDFSoumyaranjan SinghNo ratings yet

- Notice 30 July 10 Uco BankDocument7 pagesNotice 30 July 10 Uco BankShivsagar GoyalNo ratings yet

- Application EmpanelmentDocument5 pagesApplication EmpanelmentShubhamAgarwalNo ratings yet

- Bank Audit MPDocument8 pagesBank Audit MPAbhai AgarwalNo ratings yet

- Biodata Format 2011Document4 pagesBiodata Format 2011Mohamed IzwanNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument4 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- UCO BANK Audit and InspectionDocument16 pagesUCO BANK Audit and Inspectionganpati megabuilderNo ratings yet

- Ca Final Audit MCQDocument9 pagesCa Final Audit MCQKarthik Srinivas Narapalle0% (1)

- Assignment No: 03: Name: Samana Zaidi ID #: 7827 Class: Bba 8 Submitted To: Sir Kamran KhanDocument9 pagesAssignment No: 03: Name: Samana Zaidi ID #: 7827 Class: Bba 8 Submitted To: Sir Kamran KhanMohammad UzairNo ratings yet

- Auditing Chapter 2Document127 pagesAuditing Chapter 2Kingsuk BiswasNo ratings yet

- Notice: IDBI Bank Invites Online Applications From Practicing Partnership Firms ofDocument3 pagesNotice: IDBI Bank Invites Online Applications From Practicing Partnership Firms ofzalak jintanwalaNo ratings yet

- Process Memorandum-Garib Nawaz Hotels PVT LTDDocument22 pagesProcess Memorandum-Garib Nawaz Hotels PVT LTDkapil.mantriNo ratings yet

- Wellservices-Globalexpressionofinterest Pre-Qualificationforpetroleumengineering Completion Workoverrequirementsravvacb-Os 2blockDocument2 pagesWellservices-Globalexpressionofinterest Pre-Qualificationforpetroleumengineering Completion Workoverrequirementsravvacb-Os 2blockRavjot Singh BalNo ratings yet

- Question No.1 Is Compulsory. Answer Any Five From The RestDocument4 pagesQuestion No.1 Is Compulsory. Answer Any Five From The RestAsim DasNo ratings yet

- Sbi Stock Receivable Empanelment LetterDocument3 pagesSbi Stock Receivable Empanelment LetterAvinash BaldiNo ratings yet

- Policy For AppointmentDocument16 pagesPolicy For AppointmentPritam NaharNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShivanshu sethiaNo ratings yet

- Procedure Involved To Start A CompanyDocument10 pagesProcedure Involved To Start A CompanyDeepak KohliNo ratings yet

- Chapter 9Document5 pagesChapter 9Divyam sharma Roll no 175No ratings yet

- SBI Stock Jaipur GuidelinesDocument4 pagesSBI Stock Jaipur Guidelinesmanish jopatNo ratings yet

- SBI Jaipur OfficesDocument1 pageSBI Jaipur Officesmanish jopatNo ratings yet

- Kolkata Flat A303 MapDocument2 pagesKolkata Flat A303 Mapmanish jopatNo ratings yet

- Jopat G & Associates Chartered Accountants HO:81, D/A/S-1, Scheme No 78 Indore, Madhya Pradesh-452010Document9 pagesJopat G & Associates Chartered Accountants HO:81, D/A/S-1, Scheme No 78 Indore, Madhya Pradesh-452010manish jopatNo ratings yet

- Company Master Data: ChargesDocument1 pageCompany Master Data: Chargesmanish jopatNo ratings yet

- UNIT IV Material ManagementDocument3 pagesUNIT IV Material ManagementHIMANSHU DARGANNo ratings yet

- Contract - No Yard - Name Yard - City Yard - StateDocument5 pagesContract - No Yard - Name Yard - City Yard - StateGkiniNo ratings yet

- Supplier Creation Form Version Oct17Document2 pagesSupplier Creation Form Version Oct17Fishing FieldNo ratings yet

- Regeneration of The Urban Coastal Area of Scheveningen: PearlDocument14 pagesRegeneration of The Urban Coastal Area of Scheveningen: PearlNevenaTanaskovicNo ratings yet

- Ministry of TourismDocument4 pagesMinistry of TourismVruddhi GalaNo ratings yet

- Supplier Business Plan 1Document10 pagesSupplier Business Plan 1Bipana SapkotaNo ratings yet

- Banking and Insurance Law NotesDocument164 pagesBanking and Insurance Law NotesFaisal KhanNo ratings yet

- Shorcut Tricks MathsDocument102 pagesShorcut Tricks MathsVasanth VSNo ratings yet

- PCG Deployment of Personnel On Seaports FORMATDocument56 pagesPCG Deployment of Personnel On Seaports FORMATcgacNo ratings yet

- Chapter 3. - Budgeting: SECTION 314. Form and Content. - (A) Local Government Budgets ShallDocument8 pagesChapter 3. - Budgeting: SECTION 314. Form and Content. - (A) Local Government Budgets ShallTerele Aeron Maddara OñateNo ratings yet

- Insights Mind Maps: Golden Quadrilateral ProjectDocument2 pagesInsights Mind Maps: Golden Quadrilateral Projectashish kumarNo ratings yet

- Chapter 18 - 3eDocument35 pagesChapter 18 - 3eDJ HoltNo ratings yet

- Waec Econs Theory Ques 11 15Document24 pagesWaec Econs Theory Ques 11 15timothyNo ratings yet

- D1115EquityFund ODDocument86 pagesD1115EquityFund ODLiron MarkmannNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument8 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesramkumar6388No ratings yet

- An Organisation Study At": Internship Report ON by Prajwal A S Submitted ToDocument18 pagesAn Organisation Study At": Internship Report ON by Prajwal A S Submitted ToPRAJWAL A SNo ratings yet

- Almi-Lkt 2008Document48 pagesAlmi-Lkt 2008rizqinstNo ratings yet

- AoC Re Respondent - S Share & Reminder Re Answer 1133Document2 pagesAoC Re Respondent - S Share & Reminder Re Answer 1133cohadarNo ratings yet

- Pemenang Lomba Karya Ilmiah Stabilitas Sistem Keuangan 2021Document2 pagesPemenang Lomba Karya Ilmiah Stabilitas Sistem Keuangan 2021Rezha Nursina YuniNo ratings yet

- BRGY IndigencyDocument3 pagesBRGY IndigencysharraNo ratings yet

- International Production: A Decade of Transformation AheadDocument60 pagesInternational Production: A Decade of Transformation AheadSunil ChoudhuryNo ratings yet

- 1 2 3 Please Fill in Answers Below: 1a 1b 2a 2B Eagle 2b GLORY Installment Amount / Payment Per PeriodDocument4 pages1 2 3 Please Fill in Answers Below: 1a 1b 2a 2B Eagle 2b GLORY Installment Amount / Payment Per PeriodVarun GawarikarNo ratings yet

- G EJy BNK IXYJry 9 W VDocument1 pageG EJy BNK IXYJry 9 W Vdurga workspotNo ratings yet

- Memphis Style - PPTMONDocument26 pagesMemphis Style - PPTMONNanda Desi LarasatiNo ratings yet

- Business PlanDocument5 pagesBusiness Planetio basseyNo ratings yet

- SunTrust StatDocument1 pageSunTrust StatIrakli IrakliNo ratings yet

- Lecture 8Document12 pagesLecture 8youssef hossamNo ratings yet