Professional Documents

Culture Documents

Ac101 Prelim Exam

Uploaded by

Mariam� AmilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ac101 Prelim Exam

Uploaded by

Mariam� AmilCopyright:

Available Formats

College of Business and Accountancy

AC101

From the following given data, prepare adjusting journal entries for the year ended December 31,

2019:

1. Of the P 4,800 office supplies inventory, P 1,600 cost of the supplies were on hand.

Asset account was debited upon purchase.

Office Supplies Expense 3,200

Office Supplies 3,200

2. Paid insurance premium on March 1, 2019 amounting to P 9,600 for a 2-year policy

contract. Expense account was debited upon payment.

Insurance Expense 4,000

Prepaid Insurance 4,000

3. Received cash of P 144,000 for a 3-year advance rental to commence September 20,

2019. Unearned rental account was credited upon receipt of cash.

Unearned Rent Revenue 16,000

Rent Revenue 16,000

4. Salaries from the period December 27, 2019 to January 3, 2020 at P450/day were unpaid.

Salaries Expense 3,600

Salaries Payable 3,600

5. Of the recorded interest income account of P10,000, P 6,000 was unearned at the end of

the period.

Interest Receivable 4,000

Interest Revenue 4,000

6. Purchase of supplies for P 6,000. At the end of the year, P 2,000 cost of the supplies

were actually used. Expense method used in payment of supplies.

Supplies Expense 4,000

Supplies 4,000

7. A P96,000 12%, 120-day note was received from a client dated November 1, 2019. The

interest was not yet collected at the end of the accounting period.

Interest Receivable 2880

Interest Revenue 2880

8. Before adjustment, the balance of the laundry supplies inventory was P70,000. Physical

count of supplies inventory was P 30,000.

Laundry Supplies Expense 40,000

Laundry supplies 40,000

9. An office equipment was acquired on May 31, 2019 for P 300,000. The office equipment

has an estimated life of 5 years without salvage value.

Depreciation Expense - Office Equipment 60,000

Accumulated Depreciation - Office Equipment 60,000

10. The 1% of the outstanding account receivable of P500,000 was proved to be

uncollectible.

Allowance for Uncollectible Accounts 5,000

Accounts Receivable 5,000

You might also like

- INTACC2 Liabilities Questions ARALJPIADocument3 pagesINTACC2 Liabilities Questions ARALJPIAKiba YuutoNo ratings yet

- Exercise. AdjustmentsDocument6 pagesExercise. AdjustmentsDavid Con Rivero79% (14)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Variations and Claims Procedure: Practical Issues: A Paper Given at The SCL (Gulf) Conference in Dubai On 20th March 2011Document14 pagesVariations and Claims Procedure: Practical Issues: A Paper Given at The SCL (Gulf) Conference in Dubai On 20th March 2011Mohamed El AbanyNo ratings yet

- Assignment Accounting AJE GUIANGDocument14 pagesAssignment Accounting AJE GUIANGIce Voltaire B. GuiangNo ratings yet

- Adjusting Entries Exercises LandscapeDocument3 pagesAdjusting Entries Exercises LandscapeTatyanna Kaliah100% (3)

- Test I Journalizing of Adjusting Entries (22 Points)Document4 pagesTest I Journalizing of Adjusting Entries (22 Points)Jonathan Dela CruzNo ratings yet

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDocument3 pagesMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)

- Adjusting Entries Christine Gamba CargoDocument5 pagesAdjusting Entries Christine Gamba Cargoelma wagwag100% (2)

- Midterm Quiz No. 2 - PreparationDocument2 pagesMidterm Quiz No. 2 - PreparationRonel CaagbayNo ratings yet

- Adjusting Entries & Adjusted Trial Balance-1 - 94Document9 pagesAdjusting Entries & Adjusted Trial Balance-1 - 94Zubair Jutt100% (1)

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzNo ratings yet

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANNo ratings yet

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Review of The Accounting Process Straight Problems Problem 1Document13 pagesReview of The Accounting Process Straight Problems Problem 1angielynNo ratings yet

- HW AjeDocument5 pagesHW AjeBenicel Lane M. D. V.No ratings yet

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- Cash To InventoryDocument6 pagesCash To InventoryEdmar HalogNo ratings yet

- Mocule1 Quiz 202Document4 pagesMocule1 Quiz 202yowatdafrickNo ratings yet

- 112 Seatwork1 ForStudentsDocument5 pages112 Seatwork1 ForStudentsJoventino NebresNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Auditing Practice Problem 4Document4 pagesAuditing Practice Problem 4Jessa Gay Cartagena TorresNo ratings yet

- ACC111 - Activity 15Document5 pagesACC111 - Activity 15Triquesha Marriette Romero RabiNo ratings yet

- Coactg1 Common Exam ReviewerDocument7 pagesCoactg1 Common Exam ReviewerIvy Rose BorasNo ratings yet

- Auditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Document16 pagesAuditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Moira C. Vilog100% (1)

- Cheating Is Strictly Prohibited. If Cheating Is Confirmed, The Student(s) Involved Will Automatically FAIL in This ExamDocument2 pagesCheating Is Strictly Prohibited. If Cheating Is Confirmed, The Student(s) Involved Will Automatically FAIL in This ExamHANNAH CHARIS CANOYNo ratings yet

- Pamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2Document4 pagesPamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2suruth242No ratings yet

- Accounting QuestionsDocument6 pagesAccounting QuestionsJohn Ace Dela RamaNo ratings yet

- Adjusting Entry ProblemsDocument5 pagesAdjusting Entry ProblemsRize Takatsuki100% (1)

- Basic Accounting Review Self Assessment TestDocument4 pagesBasic Accounting Review Self Assessment TestAether SkywardNo ratings yet

- FABM ActivityDocument3 pagesFABM ActivityRey VillaNo ratings yet

- Cash and Cash Equivalents SsDocument12 pagesCash and Cash Equivalents SsCINDY BALANONNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- AFAR MOD 4 HO Branch PDFDocument5 pagesAFAR MOD 4 HO Branch PDFelaine piliNo ratings yet

- Adjustments Quiz 1 - Answer KeyDocument7 pagesAdjustments Quiz 1 - Answer KeyAngelie JalandoniNo ratings yet

- Quiz Module 1 FINALDocument4 pagesQuiz Module 1 FINALeia aieNo ratings yet

- Adjustments Quiz 1Document7 pagesAdjustments Quiz 1Sheena GaborNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Cfas Exam3 ProblemsDocument8 pagesCfas Exam3 ProblemspolxrixNo ratings yet

- AE-O-A - Quiz QuestionnaireDocument1 pageAE-O-A - Quiz QuestionnaireUSD 654No ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument2 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs Joovho0% (1)

- 1.6.1 Quiz 3 Problems Accounting ProcessDocument4 pages1.6.1 Quiz 3 Problems Accounting ProcessyelenaNo ratings yet

- Intacc1 PrelimDocument5 pagesIntacc1 PrelimSarah Del RosarioNo ratings yet

- Far 103 - Accounting For Receivables and Notes ReceivableDocument4 pagesFar 103 - Accounting For Receivables and Notes ReceivablePatrishaNo ratings yet

- Practice Porblems CashDocument8 pagesPractice Porblems CashDonna Zandueta-TumalaNo ratings yet

- Accounting ProcessDocument6 pagesAccounting ProcessJen NerNo ratings yet

- 221 REQUIREMENT For Summer Class 1Document2 pages221 REQUIREMENT For Summer Class 1Lealyn CuestaNo ratings yet

- Multiple Choice Questions: Questions 1 Through 5 Are Based On The Following InformationDocument2 pagesMultiple Choice Questions: Questions 1 Through 5 Are Based On The Following InformationXXXXXXXXXXXXXXXXXXNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- 06 Correction of Errors PDFDocument5 pages06 Correction of Errors PDFRoxanneNo ratings yet

- Wedding R UsDocument5 pagesWedding R UsAnnie Clado San JuanNo ratings yet

- Prelim-Task - Rosas, John Francis I.Document7 pagesPrelim-Task - Rosas, John Francis I.John Francis RosasNo ratings yet

- AE17 Quiz No. 1Document2 pagesAE17 Quiz No. 1nglc srzNo ratings yet

- Problems 1 - Accounting Cycle PDFDocument17 pagesProblems 1 - Accounting Cycle PDFEliyah JhonsonNo ratings yet

- Accounting CycleDocument17 pagesAccounting CycleAnonymous 1P4Me8680% (1)

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- 3A Accounting Cycle Journal TBDocument1 page3A Accounting Cycle Journal TBDUDUNG dudongNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Siemens Dr. Surachai Presentation Energy4.0Document24 pagesSiemens Dr. Surachai Presentation Energy4.0Sittiporn KulsapsakNo ratings yet

- Types of Residential PropertyDocument32 pagesTypes of Residential PropertyAlex CruzNo ratings yet

- EPC E Procurement Vijayawada SWD EPC DocumentDocument171 pagesEPC E Procurement Vijayawada SWD EPC DocumentdkhpkNo ratings yet

- AA Bot Insight v2.1 User GuideDocument63 pagesAA Bot Insight v2.1 User GuideAmitesh PandeyNo ratings yet

- 2 International Conference On Innovative Trends in Information Technology (ICITIIT'21)Document2 pages2 International Conference On Innovative Trends in Information Technology (ICITIIT'21)sidhushellyNo ratings yet

- File Formats AssignmentDocument16 pagesFile Formats AssignmentmoregauravNo ratings yet

- Profile SRC Projects PDFDocument52 pagesProfile SRC Projects PDFrengarajan82No ratings yet

- 8th Sem - Assignment - MD II (2962108)Document5 pages8th Sem - Assignment - MD II (2962108)rishabhk28995No ratings yet

- Austria Oracle LocalizationDocument8 pagesAustria Oracle LocalizationGanesh VenugopalNo ratings yet

- Microprocessors and Microcontrollers: Unit I The 8086 Microprocessor Unit I The 8086 MicroprocessorDocument133 pagesMicroprocessors and Microcontrollers: Unit I The 8086 Microprocessor Unit I The 8086 MicroprocessornivasiniNo ratings yet

- Defect Analysis and Prevention For Software Process Quality ImprovementDocument6 pagesDefect Analysis and Prevention For Software Process Quality ImprovementSrinivas Rg KNo ratings yet

- Technical Data: 1. DescriptionDocument6 pagesTechnical Data: 1. DescriptionRIGOBERTO PONCENo ratings yet

- Kuwait Anti Money Laundering (2013/106)Document21 pagesKuwait Anti Money Laundering (2013/106)Social Media Exchange Association100% (1)

- Logic GatesDocument11 pagesLogic GatesXharmei ThereseNo ratings yet

- Chapter 2 SynthesisDocument2 pagesChapter 2 SynthesisjonaNo ratings yet

- CWTSDocument2 pagesCWTSShakira Isabel ArtuzNo ratings yet

- Performance Based Navigation (PBN)Document40 pagesPerformance Based Navigation (PBN)Bayu Chandra100% (2)

- Project Estmate (Final)Document65 pagesProject Estmate (Final)Bilal Ahmed BarbhuiyaNo ratings yet

- Full Download Solution Manual For Principles of Corporate Finance 13th by Brealey PDF Full ChapterDocument36 pagesFull Download Solution Manual For Principles of Corporate Finance 13th by Brealey PDF Full Chaptercucumisinitial87qlh100% (18)

- GRANTA Selector 2021 R1 Installation GuideDocument6 pagesGRANTA Selector 2021 R1 Installation Guidesuch.86899357No ratings yet

- Release Notes For Altium Designer Version 14.3 - 2014-05-29Document7 pagesRelease Notes For Altium Designer Version 14.3 - 2014-05-29Luiz Ricardo PradoNo ratings yet

- BRODIE RESUME UpdatedDocument3 pagesBRODIE RESUME UpdatedB SmithNo ratings yet

- Grade 10 12 Revision Notes Kitwe District Education Board Civic Education 2030Document119 pagesGrade 10 12 Revision Notes Kitwe District Education Board Civic Education 2030Betsheba Mwila67% (3)

- Xwatermark GuideDocument25 pagesXwatermark GuideKingsukNo ratings yet

- Chapter - 5 Organic MaterialsDocument36 pagesChapter - 5 Organic MaterialsJayvin PrajapatiNo ratings yet

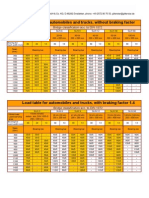

- 9 Gitterstar LoadTable Autom TrucksDocument1 page9 Gitterstar LoadTable Autom TrucksSnaz_nedainNo ratings yet

- Ten Common SQL Server Reporting Services Challenges and SolutionsDocument25 pagesTen Common SQL Server Reporting Services Challenges and Solutionssrisrinivas76No ratings yet

- RedBOOK On Dimensional Modelling IBMDocument668 pagesRedBOOK On Dimensional Modelling IBMapi-3701383100% (3)

- Nature of ObDocument3 pagesNature of ObLords PorseenaNo ratings yet