Professional Documents

Culture Documents

San Francisco Q3 2021

Uploaded by

Kevin ParkerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

San Francisco Q3 2021

Uploaded by

Kevin ParkerCopyright:

Available Formats

Q3 2021

SAN FRANCISCO

MARKET

IN

MINUTES

Savills Research

Leasing volume tops one million square feet

for the second quarter post-pandemic KEY STATISTICS

Q3 2020 Q3 2021

y-o-y

Change

The third quarter of 2021 marked the second consecutive quarter since the onset of Inventory 81.2 MSF 83.0 MSF

the pandemic that San Francisco registered more than one million square feet (msf) of

leasing volume. Despite growing concerns and local restrictions due to the COVID-19 Availability Rate 17.7% 26.2%

Delta variant, signs of market resiliency and recovery are evident. Q3 ended with close Asking Rental Rate $75.98 $72.79

to 2.0 msf leased, an increase of 74% over the previous quarter. The majority of leasing

activity occurred within the North and South Financial Districts, with a combined 1.3 Class A Asking Rental Rate $79.55 $75.98

msf leased between those two submarkets alone. San Francisco's overall availability rate

Quarterly Leasing Activity 0.3 MSF 1.9 MSF

dropped slightly, to 26.2%, a 10 basis point drop from Q2 after climbing quickly - and

steadily - since the pandemic began. Class A availability rate fell 10 bps as well, resulting

in a 23.9% rate. ASKING RENT TRENDS

Overall Asking Rent Class A Asking Rent

Despite hybrid work models and murky return-to-work timelines, $100.00

large companies continue to acquire space in San Francisco

The City of San Francisco and the overall Bay Area reinstated some local health $80.00 $75.98

mandates, which have slowed return-to-office timelines, although nowhere near $72.79

as harsh as previous quarters. Many companies have pushed office re-occupancy $60.00

$ / SF

deadlines back towards the end of the year, or early 2022. Although hybrid work

models are sure to be a fixture in the future and return-to-office timelines are sluggish, $40.00

companies still view San Francisco as a key gateway market and are still acquiring

space to keep a physical presence in the city. Charles Schwab, even after moving its $20.00

headquarters to Texas, has renewed its lease for the entire 43,000-sf (square foot)

building at 100 Post. Additionally, Yelp, although downsizing its footprint, has signed a $0.00

Q3 2016 Q3 2017 Q3 2018 Q3 2019 Q3 2020 Q3 2021

sublease for 53,000 sf at 350 Mission Street. Waymo also subleased nearly 50,000 sf of

Uber’s former space at 555 Market Street. Notably, Pinterest signed the largest lease of AVAILABILITY TRENDS

the quarter, renewing 85,0000 sf of space at 651 Brannan Street. Overall Availability Class A Availability

30.0%

Price discovery persists, as premium and trophy-quality space 26.2%

25.0%

compete with discounted sublease rates 23.9%

Overall asking rents dropped a nominal 0.3% over the quarter, resulting in an $72.79 per 20.0%

square foot (psf) rate. Class A asking rents ended the quarter at $75.98 psf, an increase of

15.0%

0.7% from Q2. Sublease inventory remains abundant, but has declined in recent quarters

with over 8.0 msf currently marketed. As owners of prime properties have continued to 10.0%

resist dropping marketed rents, the market is still in a price discovery mode as premium

spaces compete with the plethora of available sublease space on the market and tenants are 5.0%

likely to encounter price reduction in negotiations for certain buildings. 0.0%

Q3 2016 Q3 2017 Q3 2018 Q3 2019 Q3 2020 Q3 2021

Outlook LEASING ACTIVITY

Quarterly Leasing Activity 5-Year Quarterly Average

• Due to concerns regarding the Delta strain, companies have 3.5

pushed return-to-office timelines back until winter or early 3.0

2022; however, market activity is increasing

Square feet (millions)

2.5

• Large companies still see San Francisco as a prime location, 2.0

leasing space in the city, even after relocating headquarters

1.5

or downsizing pre-COVID footprints

1.0

• The market is still in a price discovery mode amidst availability

highs; premium space is still looking to achieve pre-COVID 0.5

rates while sublease blocks are priced at a discount 0.0

Q3 2016 Q3 2017 Q3 2018 Q3 2019 Q3 2020 Q3 2021

San Francisco Market in Minutes - Q3 2021

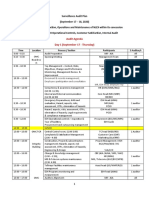

MAJOR TRANSACTIONS

6 of 10 45.4% 84.8%

of major transactions were of major transactions occurred in the Technology sector tenants accounted

new locations Financial District North submarket by for 84.8% of major transactions by

square footage square footage

Tenant Square Feet Address Transaction Type Submarket Industry

Chime 194,440 101 California Street New Location Financial District North Technology

Pinterest 84,355 651 Brannan Street Renewal SOMA Technology

Segment 75,654 100 California Street New Location Financial District North Technology

Amplitude 57,530 201 Third Street New Location Financial District South Technology

Yelp 53,596 350 Mission Street New Location Financial District South Technology

Airtable 48,818 155 5th Street Renewal Yerba Buena Technology

Waymo 48,205 555 Market Street New Location Financial District South Technology

Union Square/Civic For more information,

Charles Schwab 43,340 100 Post Street Renewal Financial Services

Center please contact us:

Royal Bank of Canada 31,217 345 California Street Renewal Financial District North Financial Services

Savills

Generate Capital 26,387 560 Davis Street New Location Jackson Square Financial Services

150 California Street

14th Floor

Source Savills Research San Francisco, CA 94111

+1 415 421 5900

AVAILABILITY RATE COMPARISON RENTAL RATE COMPARISON ($/SF) Steve Barker

San Francisco Submarkets San Francisco Submarkets Vice Chairman, Director,

Branch Manager

sbarker@savills.us

Financial District South 23.0% Jackson Square $78.90

Mission Bay/Showplace Christophe Haeberlin

Financial District North 24.2% $77.39

Square

Research Manager

Union Square/Civic Center 25.7% Financial District North $75.89 chaeberlin@savills.us

San Francisco Overall 26.2% Financial District South $74.13

About Savills Inc.

Savills helps organizations find the

Mission Bay/Showplace right solutions that ensure

26.5% San Francisco Overall $72.79

Square

employee success. Sharply skilled

and fiercely dedicated, the firm’s

Waterfront/North Beach 30.4% Waterfront/North Beach $69.13 integrated teams of consultants and

brokers are experts in better real

Jackson Square 32.9% SOMA $67.75 estate. With services in tenant

representation, workforce and

incentives strategy, workplace

Rincon/South Beach 33.1% Yerba Buena $65.76 strategy and occupant experience,

project management, and capital

markets, Savills has elevated the

SOMA 34.3% Rincon/South Beach $62.27

potential of workplaces around the

corner, and around the world, for

Yerba Buena 37.4% Union Square/Civic Center $58.84 160 years and counting.

0.0% 10.0% 20.0% 30.0% 40.0% $0.00 $20.00 $40.00 $60.00 $80.00 For more information, please visit

Savills.us and follow us on LinkedIn,

Twitter, Instagram and Facebook.

Unless otherwise noted, all rents quoted throughout this report are average asking gross (full service) rents per square foot. Statistics are calculated using both

direct and sublease information. Current and historical availability and rent data are subject to change due to changes in inventory.

The information in this report is obtained from sources deemed reliable, but no representation is made as to the accuracy thereof. Unless otherwise noted,

source for data is Savills Research.

Copyright © 2021 Savills

savills.us

You might also like

- Stelco From Scotia ProductionDocument8 pagesStelco From Scotia ProductionForexliveNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- Presentation On Selling Muffins: Submitted byDocument28 pagesPresentation On Selling Muffins: Submitted byPiyuksha PargalNo ratings yet

- Green Clean Homes Projected Income Statement AnalysisDocument3 pagesGreen Clean Homes Projected Income Statement AnalysisRalph MorganNo ratings yet

- Steel Wire Rack Sams ClubDocument8 pagesSteel Wire Rack Sams ClubJuan Carlos RodriguezNo ratings yet

- Stefanek Family Budget: Author Date PurposeDocument2 pagesStefanek Family Budget: Author Date Purposesalini sasiNo ratings yet

- NorthernNJ Q2 19Document2 pagesNorthernNJ Q2 19Anonymous R6r88UZFNo ratings yet

- Industrial Market Report - 4Q23 - CBREDocument3 pagesIndustrial Market Report - 4Q23 - CBRErbfonseca96No ratings yet

- JLL MX Office Report Mexico City 3q 2022Document4 pagesJLL MX Office Report Mexico City 3q 20221234567qwertzuiNo ratings yet

- Philadelphia Suburban Americas MarketBeat Office Q32019 PDFDocument2 pagesPhiladelphia Suburban Americas MarketBeat Office Q32019 PDFAnonymous kTwAwfnmNo ratings yet

- Washington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsDocument2 pagesWashington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsAnonymous lQgmczOLNo ratings yet

- Q321 Savills Office Market Report - Orange CountyDocument2 pagesQ321 Savills Office Market Report - Orange CountyKevin ParkerNo ratings yet

- Dallas Q2 2019Document2 pagesDallas Q2 2019Anonymous R6r88UZFNo ratings yet

- NCR Off 2q19Document2 pagesNCR Off 2q19Siddharth GulatiNo ratings yet

- SubmarketDocument1 pageSubmarketKevin ParkerNo ratings yet

- CBRE 20vietnam 20ho 20chi 20miDocument8 pagesCBRE 20vietnam 20ho 20chi 20miNguyễn Thị Mỹ TâmNo ratings yet

- Jakarta CBD Office Market OverviewDocument2 pagesJakarta CBD Office Market OverviewIda SetiyaningsihNo ratings yet

- 2023 Q4 Office Houston Report ColliersDocument9 pages2023 Q4 Office Houston Report ColliersKevin ParkerNo ratings yet

- SubmarketDocument1 pageSubmarketKevin ParkerNo ratings yet

- India Delhi NCR Retail Q3 2021Document2 pagesIndia Delhi NCR Retail Q3 2021avinash sharmaNo ratings yet

- Colliers Manila Q3 2022 Retail v1Document4 pagesColliers Manila Q3 2022 Retail v1AlbertNo ratings yet

- India Ahmedabad Retail Q2 2023Document2 pagesIndia Ahmedabad Retail Q2 2023Ishani BathriNo ratings yet

- 4Q19 Boston Life Science MarketDocument4 pages4Q19 Boston Life Science MarketKevin ParkerNo ratings yet

- NGKFDocument6 pagesNGKFdeb breslowNo ratings yet

- CAN Toronto Office Insight Q2 2018 JLL PDFDocument4 pagesCAN Toronto Office Insight Q2 2018 JLL PDFMichaelNo ratings yet

- Quarterly Market Report: Houston Retail - Q3 2020Document5 pagesQuarterly Market Report: Houston Retail - Q3 2020Kevin ParkerNo ratings yet

- India Bengaluru Office Q2 2021 v3Document2 pagesIndia Bengaluru Office Q2 2021 v3KKSNo ratings yet

- Ahead of COVID-19 Outbreak, Market Tightening: Greater Philadelphia Office, Q1 2020Document6 pagesAhead of COVID-19 Outbreak, Market Tightening: Greater Philadelphia Office, Q1 2020Kevin ParkerNo ratings yet

- india---bengaluru---office-q1-2024Document2 pagesindia---bengaluru---office-q1-2024khansahil.1331No ratings yet

- HCMC Brief Q32017 EN - SavillsDocument5 pagesHCMC Brief Q32017 EN - SavillsHung Pham QuocNo ratings yet

- Colliers Frankfurt Buerovermietung Investment 2023-q3Document2 pagesColliers Frankfurt Buerovermietung Investment 2023-q3anustasia789No ratings yet

- US Industrial MarketBeat Q2 2020 PDFDocument7 pagesUS Industrial MarketBeat Q2 2020 PDFRN7 BackupNo ratings yet

- US Industrial MarketBeat Q1 2023Document7 pagesUS Industrial MarketBeat Q1 2023ANUSUA DASNo ratings yet

- Start The Uneven Recovery: Hanoi Real Estate Market OutlookDocument66 pagesStart The Uneven Recovery: Hanoi Real Estate Market OutlookNicholas NguyenNo ratings yet

- CBRE VN Market Outlook 2021 Hanoi enDocument66 pagesCBRE VN Market Outlook 2021 Hanoi enshengchanNo ratings yet

- Graphics q4 2020 Law Firm Activity ReportDocument6 pagesGraphics q4 2020 Law Firm Activity ReportKevin ParkerNo ratings yet

- India Bengaluru Office Q1 2021Document2 pagesIndia Bengaluru Office Q1 2021KrishnaNo ratings yet

- Market Report - Sewa Kantor CBDDocument11 pagesMarket Report - Sewa Kantor CBDdhipie kuronNo ratings yet

- Manhattan Americas MarketBeat Office Q42019Document4 pagesManhattan Americas MarketBeat Office Q42019Zara SabriNo ratings yet

- India Bengaluru Office Q4 2019Document2 pagesIndia Bengaluru Office Q4 2019PranoyCHNo ratings yet

- 19Q1 CBRE Market Insight - HCMC - ENDocument53 pages19Q1 CBRE Market Insight - HCMC - ENChung TranNo ratings yet

- 4Q21 Philadelphia Office Market ReportDocument6 pages4Q21 Philadelphia Office Market ReportKevin ParkerNo ratings yet

- India-Bengaluru-Office-MB-Q4-2022Document2 pagesIndia-Bengaluru-Office-MB-Q4-2022khansahil.1331No ratings yet

- Chennai Off 2q19Document2 pagesChennai Off 2q19Harsh SawhneyNo ratings yet

- Colliers Toronto Office MR 2022 Q2Document5 pagesColliers Toronto Office MR 2022 Q2jihaneNo ratings yet

- 2023 Q4 Industrial Houston Report ColliersDocument6 pages2023 Q4 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- 2023 Q3 Office Houston Report ColliersDocument9 pages2023 Q3 Office Houston Report ColliersKevin ParkerNo ratings yet

- Cushman - Wakefield - MarketBeat - Mumbai Office - Q4 - 2020 - 1634745571430Document2 pagesCushman - Wakefield - MarketBeat - Mumbai Office - Q4 - 2020 - 1634745571430Aditya UdaniNo ratings yet

- Brazil SA OfficeRJ MarketBeat 2021Q4Document4 pagesBrazil SA OfficeRJ MarketBeat 2021Q4Gabriela TámaraNo ratings yet

- Newmark Mexico City CDMX Office 2021 Q2Document5 pagesNewmark Mexico City CDMX Office 2021 Q21234567qwertzuiNo ratings yet

- HoustonDocument1 pageHoustonKevin ParkerNo ratings yet

- India Hyderabad Office Q1 2023Document2 pagesIndia Hyderabad Office Q1 2023jaiat22No ratings yet

- Jakarta Property Market Insight - Q1 2021Document23 pagesJakarta Property Market Insight - Q1 2021Esti SusantiNo ratings yet

- Dallas Fort Worth Americas Marketbeat Industrial Q3 2023Document4 pagesDallas Fort Worth Americas Marketbeat Industrial Q3 2023ANUSUA DASNo ratings yet

- Atlanta Americas MarketBeat Office Q12023 V2Document4 pagesAtlanta Americas MarketBeat Office Q12023 V2Stefan StrongNo ratings yet

- Industrial Market Report - 3Q22 - ColliersDocument6 pagesIndustrial Market Report - 3Q22 - Colliersrbfonseca96No ratings yet

- WiredScore Digital Connectivity Whitepaper 2Document11 pagesWiredScore Digital Connectivity Whitepaper 2abudabeejajaNo ratings yet

- Quarterly Market Report: Houston Retail - Q2 2020Document5 pagesQuarterly Market Report: Houston Retail - Q2 2020Kevin ParkerNo ratings yet

- 435046d4-5191-435f-9312-7243ca0cd2a2-2815194897Document4 pages435046d4-5191-435f-9312-7243ca0cd2a2-2815194897Sirapob ChitmeesilpNo ratings yet

- SewaKantorCBD - Market Report PreviewDocument12 pagesSewaKantorCBD - Market Report Previewiyan karpumNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- LeadershipDocument4 pagesLeadershipKevin ParkerNo ratings yet

- BestConstructionPracticesBUDMWorkshop Midwest FlyerDocument2 pagesBestConstructionPracticesBUDMWorkshop Midwest FlyerKevin ParkerNo ratings yet

- 2024 Real Estate Event InvitationDocument1 page2024 Real Estate Event InvitationKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- Linesight Construction Market Insights Americas - March 2024 1Document36 pagesLinesight Construction Market Insights Americas - March 2024 1Kevin ParkerNo ratings yet

- Manufacturing Update - March 2024Document31 pagesManufacturing Update - March 2024Kevin ParkerNo ratings yet

- FY2023 Results - Transcript WebcastDocument20 pagesFY2023 Results - Transcript WebcastKevin ParkerNo ratings yet

- HO Waterways OK 231108Document2 pagesHO Waterways OK 231108Kevin ParkerNo ratings yet

- 2023 H2 Healthcare Houston Report ColliersDocument2 pages2023 H2 Healthcare Houston Report ColliersKevin ParkerNo ratings yet

- HO Waterways MO 231108Document2 pagesHO Waterways MO 231108Kevin ParkerNo ratings yet

- HO Waterways TN 231108Document2 pagesHO Waterways TN 231108Kevin ParkerNo ratings yet

- GLDT Webinar Agenda APRIL 3 - 2024Document1 pageGLDT Webinar Agenda APRIL 3 - 2024Kevin ParkerNo ratings yet

- HO Waterways WV 231108Document2 pagesHO Waterways WV 231108Kevin ParkerNo ratings yet

- Houston Economic Out LookDocument8 pagesHouston Economic Out LookKevin ParkerNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookKevin ParkerNo ratings yet

- 2024 02 21 Item F2 Surfers-Beach-Staff-ReportDocument5 pages2024 02 21 Item F2 Surfers-Beach-Staff-ReportKevin ParkerNo ratings yet

- Federal Register / Vol. 89, No. 32 / Thursday, February 15, 2024 / Proposed RulesDocument40 pagesFederal Register / Vol. 89, No. 32 / Thursday, February 15, 2024 / Proposed RulesKevin ParkerNo ratings yet

- 2023 Q4 Retail Houston Report ColliersDocument5 pages2023 Q4 Retail Houston Report ColliersKevin ParkerNo ratings yet

- HO Waterways IA 231108Document2 pagesHO Waterways IA 231108Kevin ParkerNo ratings yet

- 3366 ITS D+F Warehouse Index - V6 - Q1 2024Document5 pages3366 ITS D+F Warehouse Index - V6 - Q1 2024Kevin ParkerNo ratings yet

- 2023 Q3 Retail Houston Report ColliersDocument5 pages2023 Q3 Retail Houston Report ColliersKevin ParkerNo ratings yet

- 2023 Q3 Multifamily Houston Report ColliersDocument4 pages2023 Q3 Multifamily Houston Report ColliersKevin ParkerNo ratings yet

- Job Fair Flyer 2023Document1 pageJob Fair Flyer 2023Kevin ParkerNo ratings yet

- Quarterly Houston Office ReportDocument9 pagesQuarterly Houston Office ReportKevin ParkerNo ratings yet

- Counties Q3 2023Document16 pagesCounties Q3 2023Kevin ParkerNo ratings yet

- PileDriver 6 2023Document118 pagesPileDriver 6 2023Kevin ParkerNo ratings yet

- Abell Foundation 2022 Annual ReportDocument48 pagesAbell Foundation 2022 Annual ReportKevin ParkerNo ratings yet

- South Florida OfficeDocument1 pageSouth Florida OfficeKevin ParkerNo ratings yet

- Counties - Keyes Luxury Report Q2 2023Document16 pagesCounties - Keyes Luxury Report Q2 2023Kevin ParkerNo ratings yet

- 9 The Moral Development Stages of The Moral AgentDocument4 pages9 The Moral Development Stages of The Moral AgentChristine Joy VillasisNo ratings yet

- Matigari AssignmentDocument1 pageMatigari AssignmentNoshaba QureshiNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumarNo ratings yet

- Easement of Right of WayDocument2 pagesEasement of Right of WayJeremae Ann CeriacoNo ratings yet

- Samarah - Article Template - 2021Document5 pagesSamarah - Article Template - 2021Nurchaliq MajidNo ratings yet

- BIR Form 17.60Document3 pagesBIR Form 17.60ArtlynNo ratings yet

- 2017 C L C 1736Document5 pages2017 C L C 1736Muhammad ShoaibNo ratings yet

- Dharthi Dredging ResumeDocument2 pagesDharthi Dredging ResumeJ Parameswara RaoNo ratings yet

- The Lady or the Tiger? Summary and ThemesDocument12 pagesThe Lady or the Tiger? Summary and ThemesFarah ElmirNo ratings yet

- Jurnal Pembelajaran Buku Arabiyah Linnasyn Pada Mata Kuliah Qiroah BasithahDocument10 pagesJurnal Pembelajaran Buku Arabiyah Linnasyn Pada Mata Kuliah Qiroah BasithahFatimah Marthalia putriNo ratings yet

- Japrl Vs Security Bank Corporation G.R. No. 190107 June 6, 2011 FactsDocument3 pagesJaprl Vs Security Bank Corporation G.R. No. 190107 June 6, 2011 FactsMythel SolisNo ratings yet

- ACCA AA (F8) Course Notes PDFDocument258 pagesACCA AA (F8) Course Notes PDFayesha najam100% (2)

- Topic-1: Otto Von Bismarck's Foreign Policy: Assignment HSB-675: MODERN WORLD (1871-1992)Document7 pagesTopic-1: Otto Von Bismarck's Foreign Policy: Assignment HSB-675: MODERN WORLD (1871-1992)MOHAMAMD ZIYA ANSARINo ratings yet

- 1868 St. Petersburg Declaration Renouncing The Use, in Time of War, of Certain Explosive ProjectilesDocument1 page1868 St. Petersburg Declaration Renouncing The Use, in Time of War, of Certain Explosive ProjectilesSparrow - A Chronicle of DefianceNo ratings yet

- Ethnicity and Family Therapy Mcgoldrick PDFDocument2 pagesEthnicity and Family Therapy Mcgoldrick PDFJessica0% (4)

- People of The Philippines V. Talay G.R. No. L-66965, June 18, 1987, Sarmiento, J.Document2 pagesPeople of The Philippines V. Talay G.R. No. L-66965, June 18, 1987, Sarmiento, J.ma. vidiaNo ratings yet

- Admission of New States in IndiaDocument4 pagesAdmission of New States in IndiaMahi SrivastavaNo ratings yet

- Synacomex 2000Document5 pagesSynacomex 2000Giurca RaduNo ratings yet

- Surveillance Audit PlanDocument3 pagesSurveillance Audit PlanJessa VillanuevaNo ratings yet

- Withering of Law and State W.S.R To PashukanisDocument9 pagesWithering of Law and State W.S.R To PashukanisShreeram PhuyalNo ratings yet

- Commercial Banking Session 1 IntroductionDocument14 pagesCommercial Banking Session 1 IntroductionDeepika GulatiNo ratings yet

- Criminal Law 1 Reviewer Bar 2021Document58 pagesCriminal Law 1 Reviewer Bar 2021Henrik Tagab Ageas100% (5)

- Skills Framework For Security Technical Skills & Competencies (TSC) Reference DocumentDocument2 pagesSkills Framework For Security Technical Skills & Competencies (TSC) Reference DocumentNicholasFCheongNo ratings yet

- Project Proposal: Saan Aabot Ang BENTE Mo? We Mask, Shield, and Disinfect You From VirusDocument7 pagesProject Proposal: Saan Aabot Ang BENTE Mo? We Mask, Shield, and Disinfect You From Virusmel laguinlinNo ratings yet

- Amy Hall Civil Complaint Against The Brookline Police DepartmentDocument13 pagesAmy Hall Civil Complaint Against The Brookline Police DepartmentAbby PatkinNo ratings yet

- Harjit Singh Uzbekistan VisaDocument1 pageHarjit Singh Uzbekistan Visaparwindersingh9066No ratings yet

- Lecture 3. Theories On Gender - Theoritical PerspectiveDocument17 pagesLecture 3. Theories On Gender - Theoritical Perspectiverafael baesaNo ratings yet

- Vander Nat and Keep - MLM 2002Document13 pagesVander Nat and Keep - MLM 2002Bill KeepNo ratings yet

- Template Dco Manual FinalDocument96 pagesTemplate Dco Manual FinalCaitlin Ann AlonzoNo ratings yet

- Development Communication (Dev Comm) : Unit 2Document3 pagesDevelopment Communication (Dev Comm) : Unit 2Ajith D MawutNo ratings yet