Professional Documents

Culture Documents

Problems Rectification of Errors Unsolved 1 5

Uploaded by

Racquel ReyesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems Rectification of Errors Unsolved 1 5

Uploaded by

Racquel ReyesCopyright:

Available Formats

10

Accounting

PROBLEMS RECTIFICATION OF ERRORS (1-5)

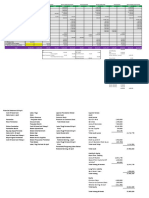

Problem # 10.1: The following Trial Balance has been drafted by a book keeper for the preparation of final accounts of a

Noman Ltd as on December, 2016. Re-draft the correctly

S No. Heads of Account Ref Dr (Rs) Cr (Rs)

st

1 Stock on 31 December, 2016 1,92,100

2 Capital A/c 13,450

3 Cash in hand 1,400

4 Bank overdraft 9,320

5 Sales 2,36,400

6 Purchases 1,06,400

7 Returns inward 13,400

8 Returns outward 2,960

9 Carriage outward 2,360

10 Carriage inward 14,260

11 Salaries 9,600

12 Wages 3,660

13 Sundry Debtors 16,300

14 Sundry creditors 37,360

15 Stock on 1st January 2016 94,120

16 Land & buildings 15,000

17 Plant & Machinery 20,900

18 Trade Expenses 2,090

Total Rs. 395,540 Rs. 395,540

Solution:

S No. Heads of Account Ref Dr (Rs) Cr (Rs)

1 Capital A/c

2 Cash in hand

3 Bank overdraft

4 Sales

5 Purchases

6 Returns inward

7 Returns outward

8 Carriage outward

9 Carriage inward

10 Salaries

11 Wages

12 Sundry Debtors

13 Sundry creditors

14 Stock on 1st January 2016

15 Land & buildings

16 Plant & Machinery

17 Trade Expenses

Total Rs. 299,490 Rs. 299,490

www.accountancyKnowledge.com 1 Rectification of Errors

10

Accounting

Problem # 10.2: Make corrected Trial Balance after anticipating hidden errors for Star Ltd. Financial year for this

company is July 1st, 2015 to June 30th, 20116

Abid Siddique

Trial Balance

As on 30th June, 2016

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

1 Purchases 35,000

2 Factory Overhead (Applied) 1,000

3 Octri and Taxes 100

4 Rebate received 500

5 Trade Mark 55,000

6 Sales 80,000

7 Share Capital 50,000

8 Return Outward 1,600

9 Bills Owed 6,500

10 Carriage Outward 3,700

11 Inventory (1.07.2015) 10,500

12 Motor Van 25,000

13 Claims Receivables 1,500

14 Sundry Debtors 9,000

15 Return Inward 2,000

16 Leasehold Premises 3,000

17 Discount on Sales 2,000

18 Petty Cash 800

19 Stock (30-06-2016) 33,300

20 Sundry Creditors 10,000

21 Suspense Account 19,700

Total Rs. 175,100 Rs. 175,100

Errors in Trial Balance:

(i) Machinery bought Rs. 3,000 posted to as Trade Mark account

(ii) Credit sales of worth Rs. 1,200 was omitted to record in the book of original entry

(iii) Repairs to Motor Van Rs. 1,500 have been debited to Motor Van account

(iv) Unearned Sales of Rs. 15,000 was incorrectly credited to Sales Account

Following accounts are used for correction and adjusting the transactions.

Sales; Unearned Sales, Motor Van; Sundry Debtors; Motor Van Expense; Machinery; Trade Mark

www.accountancyKnowledge.com 2 Rectification of Errors

10

Accounting

Abid Siddique

Trial Balance

As on 31st December, 2012

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

Total

www.accountancyKnowledge.com 3 Rectification of Errors

10

Accounting

Problem # 10.3: Rectify the following errors which are located in the books of Mr. Ahmed at end March, 2017

i. Sale of old furniture for Rs. 2,000 treated as sale of goods

ii. Rs. 12,000 paid of salary to cashier Mr. Naeem, stands debited to his personal account

iii. An amount of Rs. 5,000 withdrawn by the proprietor for his personal use has been debited to trade expenses a/c

iv. Cash received from Mr. Bilal Rs. 300 was credited to Mr. Baber

v. Repairs made were debited to building account Rs. 100

vi. Rs. 1,000 received as interest was credited to commission account

vii. Rs. 5,200 paid for the purchase of typewriter was charged to office expenses account

S. No Wrong Entry / Transaction Correct Entry Rectifying Entry

Cash 2,000 Cash 2,000

i

Sales 2,000 Furniture 2,000

Mr. Naeem 12,000 Salary 12,000

ii

Cash 12,000 Cash 12,000

Trade expenses 5,000 Drawing 5,000

iii

Cash 5,000 Cash 5,000

Cash 300 Cash 300

iv

A/R_ Baber 300 A/R_ Bilal 300

Building 100 Repairs 100

v

Cash 100 Cash 100

Cash 1,000 Cash 1,000

vi

Commission 1,000 Interest 1,000

Office expenses 5,200 Typewriter 5,200

vii

Cash 5,200 Cash 5,200

www.accountancyKnowledge.com 4 Rectification of Errors

10

Accounting

Problem # 10.4: Give journal entries to rectify the following errors

i. Purchase of goods from Mr. Raees amounting to Rs. 25,000 has been wrongly passed through the sales book

ii. Credit sale of goods Rs. 30,000 to Mr. Anees has been wrongly passed through the purchases book

iii. Sold old furniture for Rs. 3,500 passed through the sales book

iv. Paid wages for the construction of Building debited to wages account Rs. 100,000

v. The sales book is undercast by Rs. 2,000

vi. Paid Rs. 10,000 for the installation of Machinery debited to wages account

vii. The purchases book is undercast by Rs. 1,500

S. No Wrong Entry / Transaction Correct Entry Rectifying Entry

i A/R_ Raees 25,000

Sales 25,000

ii Purchases 30,000

A/P_ Anees 30,000

iii Cash 3,500

Sales 3,500

iv Wages 100,000

Cash 100,000

v ----

Wages 10,000

vi Cash 10,000

----

vii

www.accountancyKnowledge.com 5 Rectification of Errors

10

Accounting

Problem # 10.5: Pass Rectification entries for the following transactions at end January, 2017

1. Purchase of furniture for Rs. 615 passed through Purchase Book

2. The motor car had been purchased for Rs. 3.400. Cash had been correctly credited but Motor Car account had

been debited with Rs. 3,140 only

3. Interest on deposits received Rs. 60 had been debited in cash account, but had been not credited to the interest

account

4. The balance in the Account Receivable_ Ali Rs. 100 had been written off as bad but no other account had been

debited

5. Rs. 7,700 paid for wages to workman for making showcases had been charged to wages account

6. Bill Payable Book overcast by Rs. 500

7. Goods purchased for proprietor’s use for Rs. 1,000 was debited to purchase account

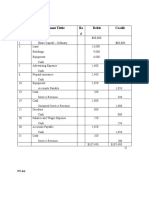

General Journal

Amount (Rs)

Date Account Title and Explanations Ref Debit Credit

2017

Jan 1

Total Rs. 10,235 Rs. 10,235

www.accountancyKnowledge.com 6 Rectification of Errors

You might also like

- Rectification of Errors Accounting Workbooks Zaheer SwatiDocument6 pagesRectification of Errors Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- S. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BDocument3 pagesS. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BALI ZAFAR� LIAQAT UnknownNo ratings yet

- Adjustment Trial Balance UnsolvedDocument3 pagesAdjustment Trial Balance Unsolvedmarvin fajardo100% (1)

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- QuestionDocument1 pageQuestionDana SpencerNo ratings yet

- Null PDFDocument10 pagesNull PDFDhaval SharmaNo ratings yet

- LLP SolutionDocument22 pagesLLP SolutionOm JogiNo ratings yet

- Rectification of Error1Document4 pagesRectification of Error1Typical GamerNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Problems Trial BalanceDocument5 pagesProblems Trial BalanceMUHAMMED RABIHNo ratings yet

- June 2016Document27 pagesJune 2016subham8555No ratings yet

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- Trial Balance and Final Accounts ProblemsDocument6 pagesTrial Balance and Final Accounts Problemsbhanu.chandu100% (1)

- Unit 2Document15 pagesUnit 2neharajt06061No ratings yet

- Partnership PQ SolDocument18 pagesPartnership PQ SolvedthkNo ratings yet

- Accounts Test (Class Xi) (Set - 1) : Particular Rs. RsDocument2 pagesAccounts Test (Class Xi) (Set - 1) : Particular Rs. RsDiya KumariNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- NKT/KS/17/4468: NXO-21328 1 (Contd.)Document3 pagesNKT/KS/17/4468: NXO-21328 1 (Contd.)Namrata RamgadeNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- BUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Document2 pagesBUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Y KNo ratings yet

- Partnership Worksheet 7Document4 pagesPartnership Worksheet 7Timo wernereNo ratings yet

- Finance ReportsDocument2 pagesFinance ReportsCristian MiunsipNo ratings yet

- Adobe Scan 07-Jul-2022Document2 pagesAdobe Scan 07-Jul-2022Accounting HelpNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsSoumendra RoyNo ratings yet

- Ak - 111219Document3 pagesAk - 111219lisa filiNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Assignment Bballb BDocument4 pagesAssignment Bballb BTavnish SinghNo ratings yet

- Rac 101 - Trial Balance - An ExampleDocument1 pageRac 101 - Trial Balance - An ExampleMiko MananiNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- B Printer Limited Prepare Income Statement As Per The Schedule IV ofDocument1 pageB Printer Limited Prepare Income Statement As Per The Schedule IV ofYashi710100% (1)

- Problem 1-1Document3 pagesProblem 1-1Frencess Mae MayolaNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsBhuvaneshwari Palani0% (2)

- Financial Statement2 (Work Sheet)Document6 pagesFinancial Statement2 (Work Sheet)Arham RajpootNo ratings yet

- 1.4 Trial BalanceDocument10 pages1.4 Trial BalancemanasaavvaruNo ratings yet

- Ac 101 Nov 2013 - 1Document5 pagesAc 101 Nov 2013 - 1Sahid Afrid AnwahNo ratings yet

- Suggested Answer CAP I June 2011Document83 pagesSuggested Answer CAP I June 2011alchemistNo ratings yet

- Adobe Scan 01-Nov-2022Document5 pagesAdobe Scan 01-Nov-2022Suthersan SoundarrajNo ratings yet

- ASSIGNMENT OF ACCOUNTING II JJJJDocument5 pagesASSIGNMENT OF ACCOUNTING II JJJJJunaid AhmedNo ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Review Questions Volume 1 - Chapter 7Document3 pagesReview Questions Volume 1 - Chapter 7YelenochkaNo ratings yet

- MT2 Ch13Document7 pagesMT2 Ch13api-3725162100% (1)

- ACP314 Competency PracticeDocument1 pageACP314 Competency PracticeJastine Rose CañeteNo ratings yet

- MRSM 2018 - JawapanDocument14 pagesMRSM 2018 - JawapanbeaveralterNo ratings yet

- Adam's Learning Centre, Lahore: Company AccountsDocument6 pagesAdam's Learning Centre, Lahore: Company AccountsMasood Ahmad AadamNo ratings yet

- Module II AfmDocument27 pagesModule II Afmshuklayuvaan22No ratings yet

- Project Corporate AccountingDocument2 pagesProject Corporate AccountingARATFTAFTNo ratings yet

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- Practice 1Document4 pagesPractice 1talalbashir001No ratings yet

- Practice Questions DM112 No 22Document13 pagesPractice Questions DM112 No 22Bianca BenNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Problems Cash Book II 1 4Document4 pagesProblems Cash Book II 1 4Racquel ReyesNo ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- 2a. Job Order Costing CRDocument17 pages2a. Job Order Costing CRAnaly Omandac PelayoNo ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- Problems Trial BalanceDocument5 pagesProblems Trial BalanceMUHAMMED RABIHNo ratings yet

- Definition of Break-Even AnalysisDocument3 pagesDefinition of Break-Even AnalysisRacquel ReyesNo ratings yet

- Ia Vol 1 Valix 2019 Answer KeyDocument232 pagesIa Vol 1 Valix 2019 Answer KeyRacquel ReyesNo ratings yet

- FM ReviewerDocument2 pagesFM ReviewerRacquel ReyesNo ratings yet

- PAS 33-Earnings Per ShareDocument26 pagesPAS 33-Earnings Per ShareGeoff MacarateNo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Easy NoFap EbookDocument37 pagesEasy NoFap Ebookசரஸ்வதி சுவாமிநாதன்No ratings yet

- Victaulic-FP-FireLock Fire-Pac Series 745 PreactionDocument9 pagesVictaulic-FP-FireLock Fire-Pac Series 745 PreactionTấn ĐạtNo ratings yet

- Job Sheet 1Document5 pagesJob Sheet 1Sue AzizNo ratings yet

- Drill Bit Classifier 2004 PDFDocument15 pagesDrill Bit Classifier 2004 PDFgustavoemir0% (2)

- Cinnamon RollDocument1 pageCinnamon RollMaria Manoa GantalaNo ratings yet

- Introductions and Basic Personal Information (In/Formal Communication)Document6 pagesIntroductions and Basic Personal Information (In/Formal Communication)juan morenoNo ratings yet

- p1632 eDocument4 pagesp1632 ejohn saenzNo ratings yet

- Mech VibrationDocument14 pagesMech VibrationSquakx BescilNo ratings yet

- Combat Storm - Shipping ContainerDocument6 pagesCombat Storm - Shipping ContainermoiNo ratings yet

- QLD Plan Draft Review Raw DataDocument242 pagesQLD Plan Draft Review Raw DataRohit Jain100% (1)

- Digital ThermometerDocument12 pagesDigital Thermometershahpatel19No ratings yet

- Professional Development Objectives Related To Modalities Specific TopicsDocument3 pagesProfessional Development Objectives Related To Modalities Specific TopicsCris100% (1)

- AC AMMETER / Moving Iron: Model AECDocument33 pagesAC AMMETER / Moving Iron: Model AECRoonar Aponte NoaNo ratings yet

- Moinho Disco PKM PDFDocument6 pagesMoinho Disco PKM PDFPaulo WilkerNo ratings yet

- A Dessertation Report Submitted in Partial Fulfillment of Requirements For The Award of The Degree ofDocument65 pagesA Dessertation Report Submitted in Partial Fulfillment of Requirements For The Award of The Degree ofMadhavpokale100% (1)

- Faculty Vitae 1. Name: C.TamilselviDocument2 pagesFaculty Vitae 1. Name: C.Tamilselvisadeeskumar.dNo ratings yet

- 234567890Document37 pages234567890erppibuNo ratings yet

- Department of Labor: BC Retaining Wall CodeDocument2 pagesDepartment of Labor: BC Retaining Wall CodeUSA_DepartmentOfLaborNo ratings yet

- Musk Founded Space Exploration Technologies Corporation, or Spacex, in 2002 With TheDocument4 pagesMusk Founded Space Exploration Technologies Corporation, or Spacex, in 2002 With TheLauren Harris0% (1)

- Edug 899 - Grade 2 Forces and Motion Unit - CompletedDocument37 pagesEdug 899 - Grade 2 Forces and Motion Unit - Completedapi-241358660No ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- Bubble Deck SlabDocument29 pagesBubble Deck SlabJhimy Rusbel Gutierrez YanapaNo ratings yet

- Portfolio Eelco Maan - 06-2017Document25 pagesPortfolio Eelco Maan - 06-2017tungaas20011No ratings yet

- Articles About Social Issues - Whiter SkinDocument9 pagesArticles About Social Issues - Whiter Skinf aNo ratings yet

- CA-idms Ads Alive User Guide 15.0Document142 pagesCA-idms Ads Alive User Guide 15.0svdonthaNo ratings yet

- Memo ALS Literacy MappingDocument4 pagesMemo ALS Literacy MappingJEPH BACULINANo ratings yet

- I - Pronunciation Choose The Word Whose Stress Pattern Is Different From The Other Three in The Following QuestionsDocument6 pagesI - Pronunciation Choose The Word Whose Stress Pattern Is Different From The Other Three in The Following QuestionsHaNo ratings yet

- Impeller Velocity TrianglesDocument2 pagesImpeller Velocity TrianglesLorettaMayNo ratings yet

- Trend Trading StocksDocument64 pagesTrend Trading Stockssasi717100% (1)

- January 11, 2019 Grade 1Document3 pagesJanuary 11, 2019 Grade 1Eda Concepcion PalenNo ratings yet